The New Norms Of Singapore’s Property Market In 2020

September 22, 2020

In the past two decades, Singapore’s property market has gone through a series of ups-and-downs; from a slew of new cooling measures, to worries about falling resale flat prices.

If the last time you bought a home was in the early 2000’s or before, you might find the Singapore private property market so alien, it’s practically Mars. So whether you’re upgrading or giving advice to your children, here are the new norms of Singapore property that you need to know:

What’s different from the early 2000’s in Singapore real estate?

- Higher income requirements for home loans

- You’re faced with bigger down payments today

- Loan tenure and age restrictions have been tightened

- New stamp duty rules

- Buying a property through a company no longer helps

- A struggling resale flat market

- More concern over quantum than price per square foot

1. Higher income requirements for home loans

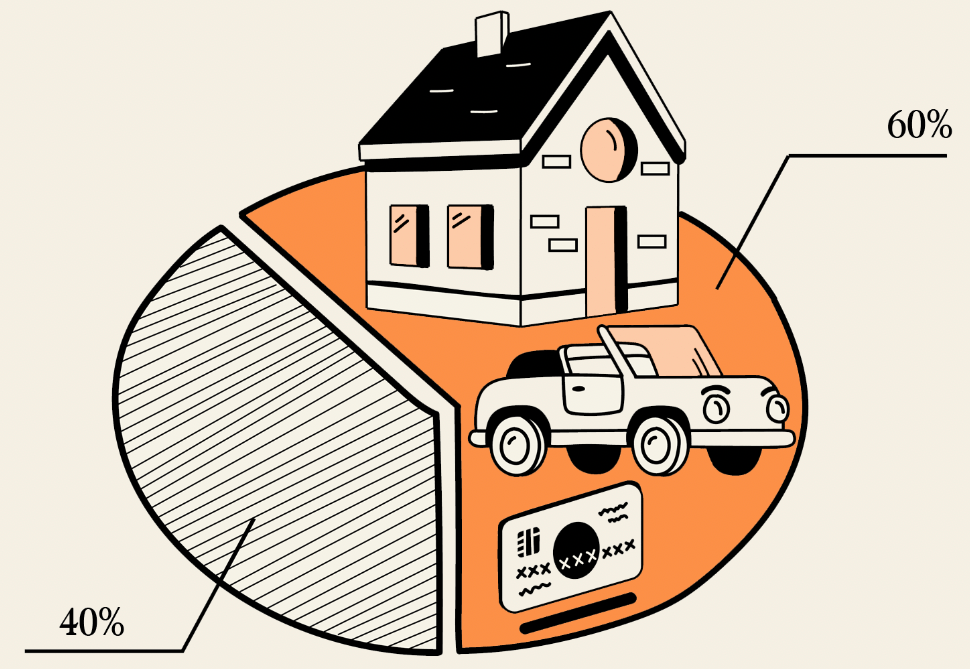

One of the biggest changes to Singapore’s property market came in June 2013, when the government introduced the Total Debt Servicing Ratio (TDSR).

The TDSR restricts the size of your home loan, based on your income. Under the TDSR framework, your monthly home loan repayment, plus other outstanding debts, cannot exceed 60 per cent of your monthly income.

For example, if your monthly income is $10,000, then your monthly home loan repayment – plus any car loans, personal loans, or credit card debts* – cannot exceed $6,000.

On top of this, banks do not use the actual home loan rates to work out your monthly repayment. For the purposes of meeting TDSR, the bank must use an interest rate of 3.5 per cent (even though the real rate is about 1.3 per cent at present).

For example: if you were to borrow $1 million over 25 years, your monthly home loan repayment – at today’s real rate of about 1.3 per cent – is just around $3,900.

However, because the bank must use 3.5 per cent as the interest rate for TDSR purposes, your monthly home loan repayment will count as being over $5,000.

So even if you qualified for a home loan before 2013, the TDSR could mean you won’t qualify in 2020.

This is important to bear in mind before you try to upgrade!

If you fail to meet the TDSR, the usual solutions are to extend the loan tenure, make a bigger down payment, or pay off existing debts. You should always seek pre-approval for your home loan before putting down the deposit on a home, to ensure you qualify.

(Drop us a message if you want to get pre-approval from a bank).

Also, note that TDSR is often mistakenly called a cooling measure. It isn’t; TDSR was never meant to be temporary, and it’s here to stay.

*For loans with variable repayment rates, the minimum required monthly repayment is used to calculate your TDSR.

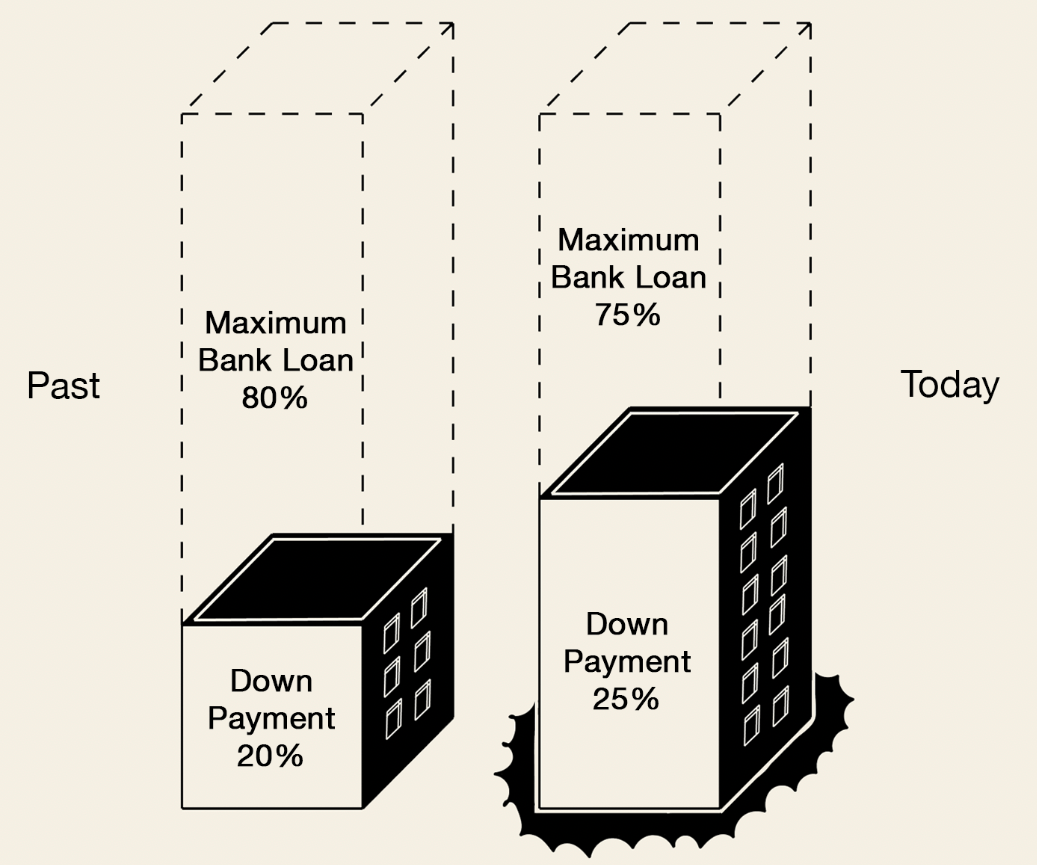

2. You’re faced with bigger down payments today

This is relevant to bank loans, not HDB loans.

The maximum Loan To Value (LTV) requirements are not 80 per cent, as is commonly stated in older articles. It has now been reduced to 75 per cent.

This means the most you can borrow is 75 per cent of the property’s price or official valuation, whichever is lower.

For the typical condo priced at around $1.5 million, this means you’ll need about $75,000 more for the down payment than before.

Property AdviceDownpayment for condo in 2020: How much do you have to save exactly?

by Stanley Goh3. Loan tenure and age restrictions have been tightened

As of July 2018, the government has placed new restrictions on loan tenure, and new age limits.

The maximum loan tenure for HDB properties is now 30 years, and the maximum loan tenure for private housing is 35 years.

However, taking the actual full loan tenure will lower the amount you can borrow.

The LTV ratio (see point 2) decreases to 55 per cent if your loan tenure exceeds 25 years (for HDB), or exceeds 30 years (for private property).

The LTV also decreases if your age, plus the loan tenure, would go beyond the retirement age of 65.

If you’re an older upgrader, take special note of the age limit.

If you are 45 when you upgrade, for example, you would only be able to take a 20-year loan tenure to get the full LTV. The problem is that a shorter loan tenure also raises your monthly home loan repayment.

Going back to the earlier example, let’s say you take a $1 million loan at an interest rate of 3.5 per cent, as mandated by the TDSR (see point 1).

As we mentioned earlier, this is around $5,000 a month for 25 years.

But when you shorten the loan tenure to 20 years, the monthly loan repayment becomes $5,800. Bear in mind you still need to meet the TDSR, so $5,800 plus your outstanding loans can’t exceed 60 per cent of your monthly income.

As such, older upgraders must usually count on the sale proceeds of their former home, to cover a much larger down payment today.

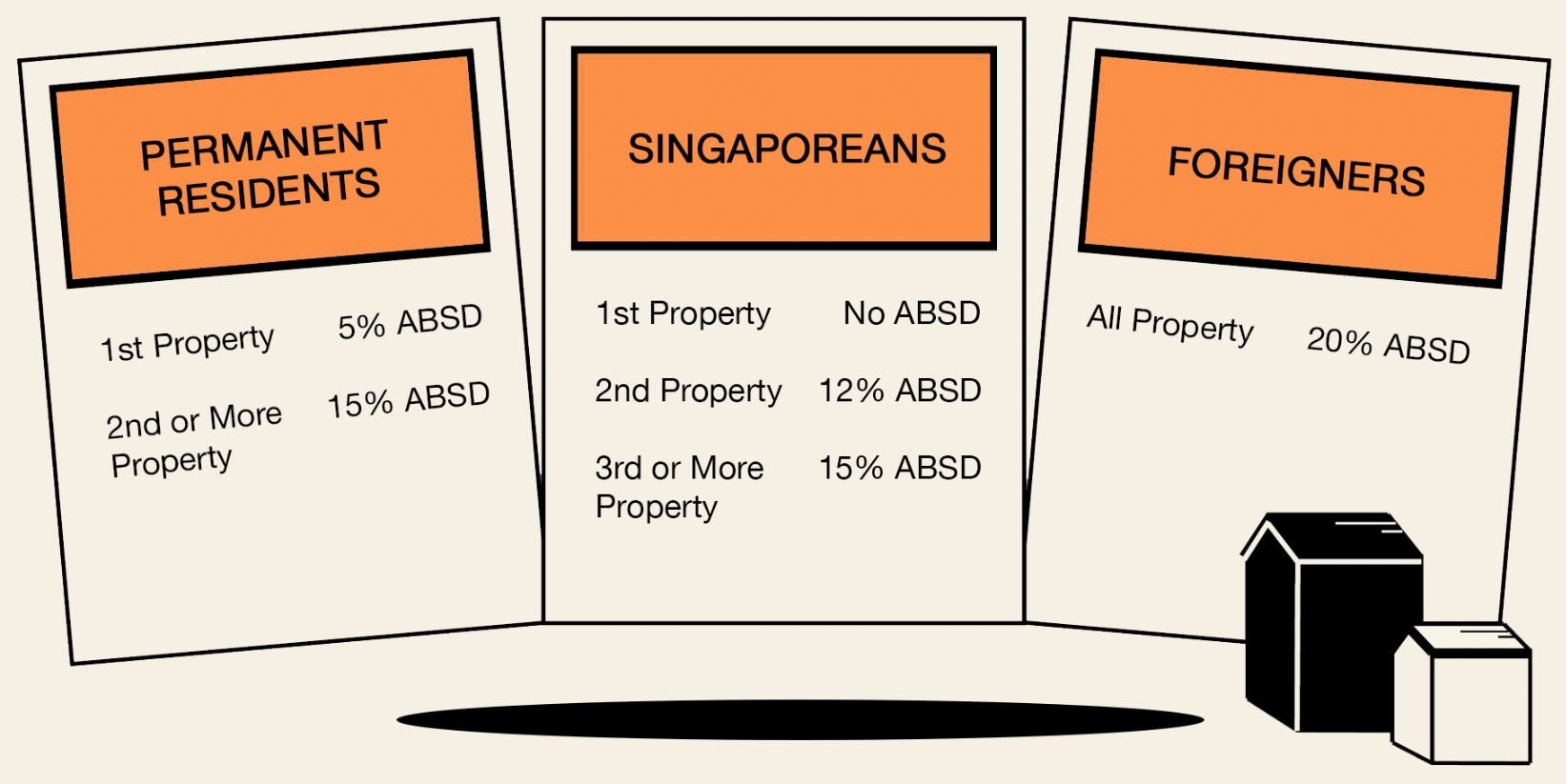

4. New stamp duty rules

The Additional Buyers Stamp Duty (ABSD) was implemented in December 2011. However, it has been revised to go higher multiple times, with the last round being in July 2018.

The ABSD is based on the higher of your property price or valuation.

The ABSD rates are now as follows for Singaporeans:

- No ABSD on the first property

- 12 per cent ABSD on the second property

- 15 per cent on the third or subsequent property

The ABSD for Permanent Residents is:

- Five per cent ABSD on the first property

- 15 percent ABSD on the second and subsequent property

Note that the highest ABSD rate applies, if co-borrowers have different profiles. So if you are a Singapore Citizen, but your co-borrower is a PR, then the ABSD rate of 15 per cent will apply on your second home, instead of 12 per cent.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A Couple’s $60k Renovation Transformation: From A 17-Year-Old HDB To A Bohemian-Scandi Home

Like many other couples during the pandemic, Alex and Cheryl's (@tiongbahru.crib) search for a BTO flat proved to be an…

However, you can apply for ABSD remission on your first marital home, if your co-borrower is your wife. One of our experts can help advise you on this.

The ABSD for foreigners is a flat 20 per cent on all properties purchased, while the ABSD for entities (e.g. companies) is raised to 25 per cent.

Besides the ABSD, the Sellers Stamp Duty (SSD) has also been tweaked

The SSD was introduced in 2010. This is a tax on the sale proceeds of your home, and applies to the higher of the sale price or valuation.

SSD rates have now been relaxed. The SSD applies only in the first three years of acquiring the property, instead of four. The SSD rates are also reduced across the board – they are 12 per cent for selling in the first year, eight per cent in the second year, and four per cent in the third year.

5. Buying a property through a company no longer helps

If you’re thinking of setting up a shell company to buy a residential property, stop right there.

This method used to work, but it’s almost meaningless now as an ABSD rate of 25 per cent would apply (See point 4). Furthermore, the LTV limit on a residential property, purchased by entities, is a mere 15 per cent.

In most situations, you’re better off buying residential property as an individual.

6. A struggling resale flat market

A long time ago, when you bought a resale flat, it was a norm to haggle over the Cash Over Valuation (COV). This was the amount of money you had to pay, over HDB’s official valuation.

Due to COV, resale flat prices were soaring, reaching around $38,000 by 2011.

In 2014 however, the rules changed. HDB no longer reveals the actual value of the flat, until after you agree on the price, and put down the deposit. So if you agree on a price that’s way above the value, you might be in trouble – the bank or HDB loan won’t cover any amount above the valuation.

COV rates are also no longer published, so no one (except major real estate firms) really knows what they are.

All of this has resulted in more cautious buyers, and an overall downward trend in prices. On top of that, Singaporeans are increasingly aware of lease decay issues; we now know that only five per cent of HDB estates are eligible for Selective En-Bloc Redevelopment Schemes (SERS).

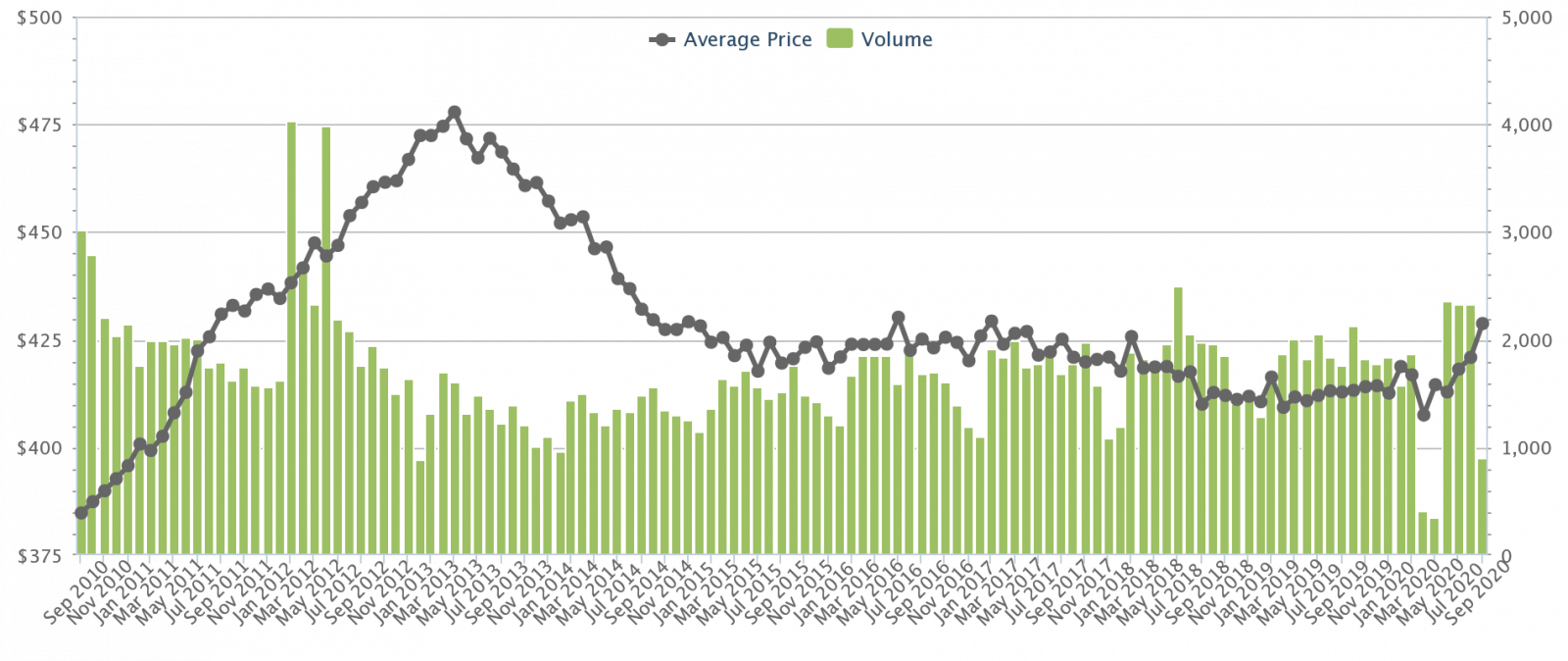

As such, HDB prices have done this:

HDB prices went into a downward trend following 2013, although there has been a slight recovery of late. At present, flat prices average $429 psf, down from $478 psf in the property peak of 2013.

This is the reason you hear so much talk about upgrading in the Singapore property market today; there’s a general sense that HDB resale flats are no longer the surety they used to be (barring special cases like Pinnacle @ Duxton).

7. More concern over quantum than price per square foot

The recent highlights of this would be The M Condo, which had units at below $1 million and Midtown Bay, which had units starting from just $1.3 million.

Such a low quantum, for properties in the Core Central Region (CCR), were almost unheard of in previous years. However, some of these units also averaged around $2,900 to just over $3,000 per square foot.

In essence, the trend is toward luxury or centrally located units, that are made affordable by being much smaller. Buyers are still enthusiastic about this, and compact single-bedders are among the first to sell out in developments.

It’s an unsurprising turn, given that the quantum – and not the price per square foot – is the big factor in securing a home loan (see our points above). As such, you may be taken aback at how much smaller condo units have gotten compared to the early 2000’s. It’s no longer unusual for a three-bedder to be as small as 900 square feet.

The upside is that you may find small, but much more affordable, condo options in central or mature areas. For more details on this, you can check out our reviews on Stacked, where we also consider the floor plans of the smallest units.

What should you make of all this?

The key takeaways, for those re-joining the property market after a long time, are:

- Securing a home loan is much tougher; you could fail to get a loan even if you succeeded before, and your income hasn’t changed.

- The longer you wait, the tougher it can be to upgrade. This is due to the age restrictions on the loan tenure.

- The resale flat market has been lagging, and simply holding on to your flat may not be the guaranteed success it once was.

- Luxury or centrally located developments have some surprisingly affordable units, in terms of overall cost; but these are very small by early 2000 standards, and even the new three-bedders may seem small to you.

Illustrations by: Xiu Ying

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the new rules for getting a home loan in Singapore?

How have down payment requirements changed for property buyers in Singapore?

What are the recent changes to stamp duty for property purchases in Singapore?

Is it still beneficial to buy property through a company in Singapore?

How has the resale flat market in Singapore changed recently?

Are small, affordable condos in central areas more common now?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

0 Comments