How ABSD Deadlines Can Negate Your New Launch Discounts

July 19, 2020

It’s practically a guaranteed profit. That’s what you’ll often hear at a VIP preview or the first phase of a new launch. Buy the unit now at a seven to 10 per cent discount, and when the “normal” price is applied, you’ve made your returns.

These early bird new launch discounts are a big part of Singapore’s private property scene, and draw much of the initial crowd. It’s a normal scheme that you’ll probably have seen utilised everywhere else. From concerts to exhibition tickets, early bird discounts are used to attract more adventurous buyers – and slowly increasing prices by using social proof and FOMO (fear of missing out) marketing to push the rest of the sales.

In essence, almost everybody wins – developers are happy, early buyers are happy they managed to get in at a discount, and later buyers are happy they secured their units.

However, incidents such as the fire sale at 38 Jervois have made buyers more cautious.

Many are now wising up to the risk of last-minute new launch discounts due to the ABSD deadline; or some have started seeing these as potential opportunities. Here’s a rundown on how they work, and on recent developments near the deadline:

A summary of the ABSD deadline and how it matters

Developers pay an Additional Buyers Stamp Duty (ABSD) of 30 per cent on the land price, such as when buying in an en-bloc purchase. This applies to all developments consisting of five or more units.

Developers can later apply for ABSD remission of 25 per cent, if they complete the entire development and sell every unit within five years.

The purpose of this policy is to prevent land hoarding – a practice where developers, or a cartel of developers, purposely buy and hold the land to create scarcity and drive up prices.

However, the ABSD deadline has a side-effect: it can also prompt developers to slash prices to clear out a handful or remaining units, as it makes no sense to pay the 30 per cent tax over them.

Note that as of 6th May 2020, an exception has been made. Existing ABSD deadlines have been extended by six months for all developers, to account for the Circuit Breaker period (construction was forced to stop during the CB).

When might ABSD-related discounts happen?

This tends to happen when there are a small number of units unsold (e.g. around the last 10 units), and the ABSD deadline is close.

A developer that has a large number of outstanding units is actually less likely to slash prices. For example, if the development has over 200 units still unsold, and the ABSD deadline is a month away, there may be no point in last minute discounts. They’d likely still miss the deadline, given the number of units to move.

A discount due to the ABSD deadline can negatively impact earlier buyers

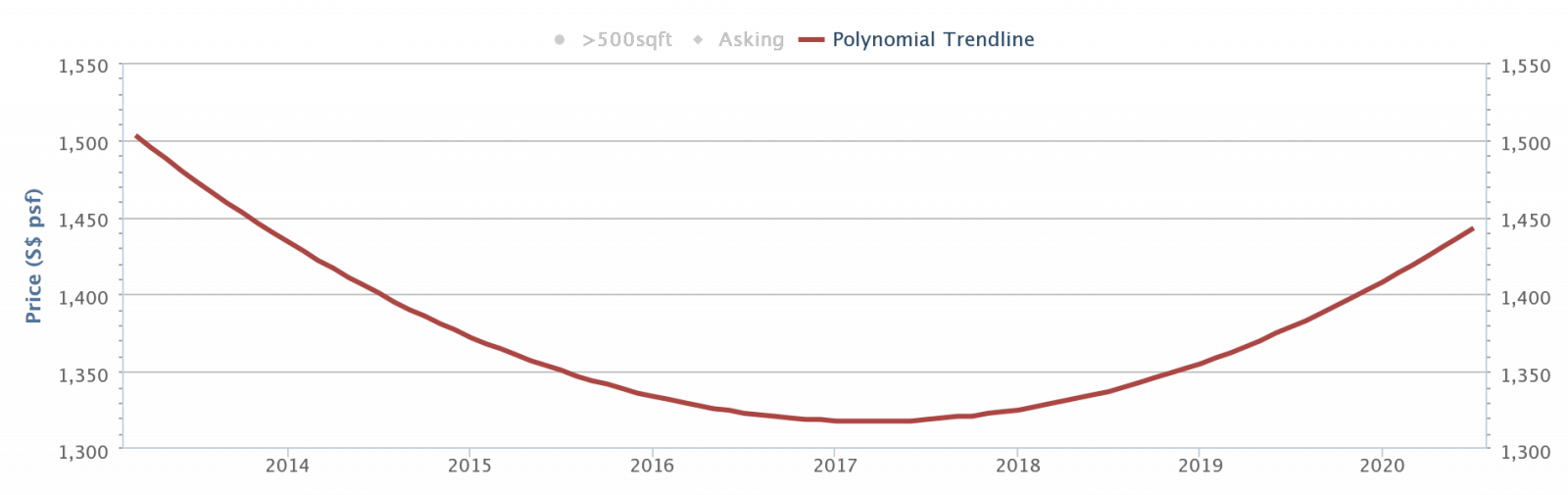

One example of this would be the Trilinq. The median developer’s selling price was around $1,380 psf in 2016 (launch was around $1,545). But by January 2017 – around the time of Trilinq’s ABSD deadline – some prices were down to $1,139 psf – a decrease of 14.46 per cent.

If you were one of the early buyers of the Trilinq, I can’t imagine that you’d be a happy camper at all.

In these cases, there can be 3 possible scenarios that might follow:

- Market moves up and prices increase across the board such that everyone is happy

- Price adjusts to the initial selling price – early buyers stay status quo while later entrants make that upside

- Price adjusts to the new normal – if a big enough number have bought in at the slashed prices and market conditions does not improve – your “cheaper” entry price becomes the new valuation

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

6 Potential Money Wasters To Avoid When Buying Property

Property is one of those purchases where “small extra costs” do matter. Even a few extra square feet can run…

In the more recent case of 38 Jervois, a total of 16 units were sold on discount. The Straits Times (see the above link) reported that discounts on the various units ranged from 13 to 24 per cent.

As with the Trilinq, I’m sure earlier buyers will not be happy at all.

Thankfully, cases like this didn’t result in unrest in Singapore – just look at what happened in a similar situation in China.

So from cases such as this, you can understand why it is important to look at a developers track record – it’s certainly not ideal to be stuck in a similar situation.

For comparison, check out our previously compiled list of discounts at new launches. If you look through these, you’ll see that the bigger discounts are around seven to eight per cent only.

Property PicksNew Condo Launch Price list 2020 + Discounts/Price Drops (Updated)

by StackedSo you can see how these early buyers would be frustrated, when they realise the extent of the later ABSD-related discounts.

You can try waiting for an ABSD-deadline discount yourself of course; but don’t get your hopes too high

Most developers are reluctant to slash prices this way, for the aforementioned reasons. Also, the developer needs to ensure every unit is sold; if they give a discount and then units are still left over, the situation is even worse for them.

As such, the discounted units are often sold en-bloc to an entity, such as a holding company, investment firm, etc, rather than to the public.

But you can keep a close eye on properties nearing the ABSD deadline, if you’re feeling lucky:

| Development | Remaining units at present | Approx. ABSD deadline |

| Forest Woods | 2 of 519 | 2020 |

| Cayman Residences | 1 of 19 | 2020 |

| Seaside Residences | 38 of 841 | 2021 |

| Kandis Residences | 24 of 130 | 2021 |

| Le Quest | 24 of 516 | 2021 |

| Grandeur Park Residence | 10 of 720 | 2021 |

| The Tapestry | 60 of 861 | 2021 |

| 120 Grange | 10 of 56 | 2021 |

| Martin Modern | 50 of 450 | 2021 |

| 38 Carpmael | 1 of 16 | 2021 |

| 8 Hullet | 7 of 44 | 2021 |

How can you avoid being “conned” by later discounts like this?

There are some warning signs to note.

One example would be developments hit by a “No Sale License”. This means the developer cannot sell any units, until after the development is completed (the new Normanton Park is currently facing this issue). This means the developer has a much shorter time to sell, so there’s a greater risk of missing the ABSD deadline.

Also, be cautious with regard to high-quantum, boutique developments. Examples are developments with 50 or fewer units, where each unit has a quantum in the range of $2.5 million or above. High quantum units are usually harder to move; and if the ABSD deadline encroaches with just three or four unsold units, the developer may be more inclined to bundle them off at a discount.

If you’re in doubt about any new launch discounts, drop us a message before buying; we can help you get an expert opinion before you put down the cheque. You can also check out our latest in-depth reviews on new developments.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the ABSD deadline and why does it matter for property buyers?

When do developers typically offer discounts related to the ABSD deadline?

How can ABSD-related discounts impact early buyers of new property launches?

What signs should buyers watch for to avoid falling for last-minute discounts?

Are discounts at new launches usually large, and how do they compare to the discounts near the ABSD deadline?

Can waiting for an ABSD deadline discount be a good strategy for buyers?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

2 Comments

Thanks for the great article Ryan, very useful in educating buyers like me as well as informing us of the options in securing the best deal possible. I am actually torn between buying an older resale HDB unit with little to none loan taken or a new launch with a longer loan repayment but possibility of growing capital investment. I am 46 years old and I have a steady income ($10K a month). I recently sold my condo at a negative sales and while all the proceedings were returned to my CPF, i actually bled cash due to the 2% commission paid to the property agent which was all paid in cash. So now, I have a choice of buying a resale HDB fully paid with CPF and cash (the good ones come with a hefty COV) or buy a new launch with again a big loan to my name. While my inclination is to go with the former, I am also not closed to the option of exploring newer launches or even resale condo (as mentioned above) with good potential or discounted due to the ABSD deadline. I am just worried about carrying a big loan as I am planning to take it easy and slow down with work.

Do you have any advice for me? I have about $500K in CPF and about $50K in cash that I can use for home right now.

Rani