A few articles back, I mentioned a missed opportunity on a Joo Chiat shophouse

This was back in the 2000s when the family had a restaurant in the area. At the time, we faced a conundrum, one that’s relevant to commercial property even today:

Do you buy your place of business, or do you rent?

The former means a whole different level of risk and investment, while the latter places you at the mercy of the landlord. And for those of you who are wondering, yes, most landlords really do increase your rent as you earn more.

(For some shopping malls, the rent includes a variable component as well as a fixed component, which can be a percentage of revenue).

So why not buy at the time?

Because as I mentioned, Joo Chiat was a mess in the early 2000s.

Where Katong’s i12 mall used to stand, there was a strata-titled mall called Katong Mall (not Katong Shopping Centre). This was across the street from the shophouse; and if I had to count the number of people it brought to the area, I’d say it was any number below one.

I used to go to that mall to sleep while waiting for my next shift.

It was the only mall where the drone of the air-conditioner was louder than the people.

Next to the shophouse was just a row of dark shopfronts; and the one right next to us was a massage parlour with “special services.” Along with all the divey bars, the stretch radiated the vibe of the worst Geylang Lorongs; and it extended right down to where Katong Village stands today.

(Before Katong Village’s redevelopment, by the way, there were bars there which were constantly raided for sexual activities. Today an NTUC supermarket has taken the place of the bars, alongside some upscale enrichment centres).

There is also a problem with parking, and during rainy days the footfall could drop to near zero as customers had to park across the road and walk in the rain.

All of this meant that, at the time, the shophouse was dirt cheap. Prospects seemed limited, and if I had asked a property agent if it was worth buying the answer would have been a voice recording of him laughing.

Then came a swift transformation in the past decade or so, and now Joo Chiat is a big part of the Katong heritage area. It’s full of hipster restaurants, there’s a proper mall, and the only vice activity is adding to your cholesterol count. That “dirt cheap” shophouse would now buy a luxury condo if the current owner were even willing to part with it.

It’s a good reminder of how unpredictable and blindingly fast the Singaporean cityscape is. Whilst other cities tend to see the slow transformation over 50 to 100+ years, Singapore does it in a fraction of the time – just as we once saw with Bugis (also a red-light area before the opening of Bugis Street).

Perhaps people who own Geylang properties have a good game plan in mind…

There’s more than one reason the golf and horses have to go

By now you probably know that several golf courses are headed for extinction, including Marina Bay Golf Course (from 2024) and Orchid Country Club (from 2030). In fact, by 2030, a massive 400 hectares of former golf courses would have been taken back for redevelopment.

Now, joining their ranks is the 180-odd-year-old Singapore Turf Club, with its 120 hectares of land. The last scheduled race will be on 5th October 2024, and the place will be shuttered on March 2027.

More from Stacked

Are We Finally In A Buyer’s Property Market? Why The Recent Price Dip May Not Tell The Full Story

Speak to some agents and sellers, and you may be told the tide has turned: the housing supply crunch is…

I’d have to say it’s fair: Singapore just doesn’t have room for massive golf courses and horse race tracks, when everyone is already bemoaning the lack of available housing. But it’s about more than that:

It’s a matter of optics.

In a much bigger country, you can disguise the wealth divide with distance. The rich can live rather far away from the poor; and while that alone doesn’t change the reality of the situation, it does muffle the effect somewhat.

But Singapore is small. The rich live right next to the poor. Many can see the landed properties and high-end condos from their HDB flat, if not from the parade of luxury cars that drive by them on the street.

And don’t tell me that visibility isn’t one (of many) aspects of the Ridout Road saga. Political leaders being in huge bungalows can spur anger, even if the rentals are perfectly legitimate.

And it’s for that same reason we can’t let certain atas forms of recreation, like golf, be staring the in face of someone struggling to find a 3-room flat right now. It’s yet one more challenge that comes from being a small city-state and a very understated one that we need to contend with.

Meanwhile in other serious property news…

- Want a convenient property without a crazy price tag? Here’s a trick: check out units close to integrated developments, without being integrated projects themselves.

- The 10 most profitable condos to date have been pretty surprising; it must be nice to be rolling in cash even in this economy.

- Are freehold condos worth buying? Here’s what the performance of 1990’s era freehold condos has been like so far.

- Tenants share their biggest regrets over renting in Singapore. Tenants and landlords alike, take note.

Weekly Sales Roundup (29 May – 4 June)

Top 5 Most Expensive New Sales (By Project)

Top 5 Cheapest New Sales (By Project)

Top 5 Most Expensive Resale

Top 5 Cheapest Resale

Top 5 Biggest Winners

Top 5 Biggest Losers

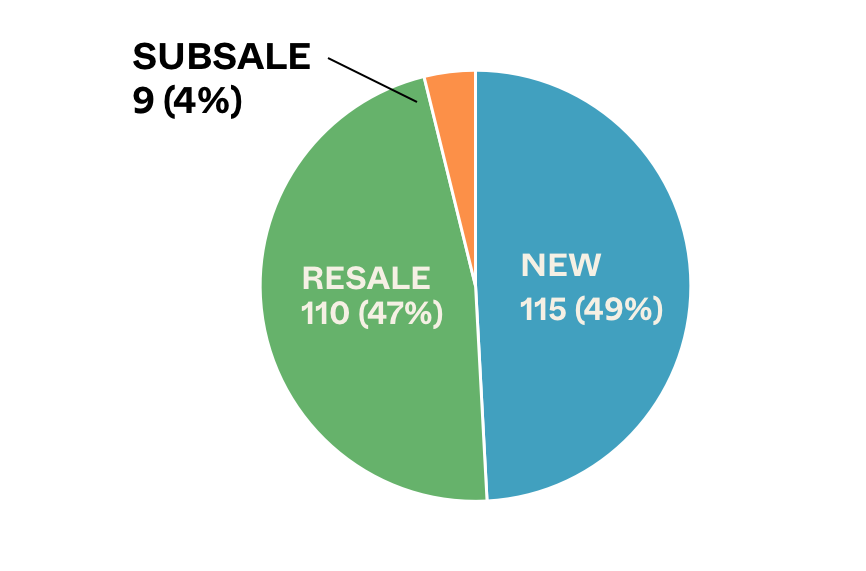

Transaction Breakdown

My most interesting link of the week:

- McDonald’s is a real estate company, not a burger company

This may be a surprise to some people, but while McDonald’s is best known for their fast food restaurants selling burgers, they actually make their money from being an astute real estate business.

In fact, their former CFO has been quoted as saying “We are not technically in the food business. We are in the real estate business.”

It’s a very interesting model, which you can read more about here.

But essentially, besides making money from the usual franchise fees and percentage of sales, the biggest driver of revenue from them is actually the rent that their franchises pay them. Also, as McDonald’s typically buys the land/building at its locations, it is also a real estate portfolio that continues to appreciate.

According to this site, the company apparently owns about 45% of the land and 70% of the buildings at their more than 36,000 locations.

We need a masterclass on McDonald’s and their real estate strategies, pronto.

Follow us on Stacked for news and insights into the Singapore private property market. We provide in-depth reviews of new as well as resale condos and on-the-ground insights from industry players.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did the author miss the opportunity to buy a shophouse in Joo Chiat in the 2000s?

How has Joo Chiat changed since the 2000s?

What is the significance of golf courses and horse race tracks in Singapore’s property landscape?

Why are some people suggesting checking units near integrated developments for property investment?

What is unique about McDonald's business model according to the article?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

0 Comments