My Biggest Miss: A $200k Joo Chiat Shophouse

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

A few articles back, I mentioned a missed opportunity on a Joo Chiat shophouse

This was back in the 2000s when the family had a restaurant in the area. At the time, we faced a conundrum, one that’s relevant to commercial property even today:

Do you buy your place of business, or do you rent?

The former means a whole different level of risk and investment, while the latter places you at the mercy of the landlord. And for those of you who are wondering, yes, most landlords really do increase your rent as you earn more.

(For some shopping malls, the rent includes a variable component as well as a fixed component, which can be a percentage of revenue).

So why not buy at the time?

Because as I mentioned, Joo Chiat was a mess in the early 2000s.

Where Katong’s i12 mall used to stand, there was a strata-titled mall called Katong Mall (not Katong Shopping Centre). This was across the street from the shophouse; and if I had to count the number of people it brought to the area, I’d say it was any number below one.

I used to go to that mall to sleep while waiting for my next shift.

It was the only mall where the drone of the air-conditioner was louder than the people.

Next to the shophouse was just a row of dark shopfronts; and the one right next to us was a massage parlour with “special services.” Along with all the divey bars, the stretch radiated the vibe of the worst Geylang Lorongs; and it extended right down to where Katong Village stands today.

(Before Katong Village’s redevelopment, by the way, there were bars there which were constantly raided for sexual activities. Today an NTUC supermarket has taken the place of the bars, alongside some upscale enrichment centres).

There is also a problem with parking, and during rainy days the footfall could drop to near zero as customers had to park across the road and walk in the rain.

All of this meant that, at the time, the shophouse was dirt cheap. Prospects seemed limited, and if I had asked a property agent if it was worth buying the answer would have been a voice recording of him laughing.

Then came a swift transformation in the past decade or so, and now Joo Chiat is a big part of the Katong heritage area. It’s full of hipster restaurants, there’s a proper mall, and the only vice activity is adding to your cholesterol count. That “dirt cheap” shophouse would now buy a luxury condo if the current owner were even willing to part with it.

It’s a good reminder of how unpredictable and blindingly fast the Singaporean cityscape is. Whilst other cities tend to see the slow transformation over 50 to 100+ years, Singapore does it in a fraction of the time – just as we once saw with Bugis (also a red-light area before the opening of Bugis Street).

Perhaps people who own Geylang properties have a good game plan in mind…

There’s more than one reason the golf and horses have to go

By now you probably know that several golf courses are headed for extinction, including Marina Bay Golf Course (from 2024) and Orchid Country Club (from 2030). In fact, by 2030, a massive 400 hectares of former golf courses would have been taken back for redevelopment.

More from Stacked

Budget 2022 Property Tax: How Much More It’ll Cost You + What It Means For The Market

In the recent budget 2022 announcement, the government said it would raise property taxes starting next year. While the increment…

Now, joining their ranks is the 180-odd-year-old Singapore Turf Club, with its 120 hectares of land. The last scheduled race will be on 5th October 2024, and the place will be shuttered on March 2027.

I’d have to say it’s fair: Singapore just doesn’t have room for massive golf courses and horse race tracks, when everyone is already bemoaning the lack of available housing. But it’s about more than that:

It’s a matter of optics.

In a much bigger country, you can disguise the wealth divide with distance. The rich can live rather far away from the poor; and while that alone doesn’t change the reality of the situation, it does muffle the effect somewhat.

But Singapore is small. The rich live right next to the poor. Many can see the landed properties and high-end condos from their HDB flat, if not from the parade of luxury cars that drive by them on the street.

And don’t tell me that visibility isn’t one (of many) aspects of the Ridout Road saga. Political leaders being in huge bungalows can spur anger, even if the rentals are perfectly legitimate.

And it’s for that same reason we can’t let certain atas forms of recreation, like golf, be staring the in face of someone struggling to find a 3-room flat right now. It’s yet one more challenge that comes from being a small city-state and a very understated one that we need to contend with.

Meanwhile in other serious property news…

- Want a convenient property without a crazy price tag? Here’s a trick: check out units close to integrated developments, without being integrated projects themselves.

- The 10 most profitable condos to date have been pretty surprising; it must be nice to be rolling in cash even in this economy.

- Are freehold condos worth buying? Here’s what the performance of 1990’s era freehold condos has been like so far.

- Tenants share their biggest regrets over renting in Singapore. Tenants and landlords alike, take note.

Weekly Sales Roundup (29 May – 4 June)

Top 5 Most Expensive New Sales (By Project)

Top 5 Cheapest New Sales (By Project)

Top 5 Most Expensive Resale

Top 5 Cheapest Resale

Top 5 Biggest Winners

Top 5 Biggest Losers

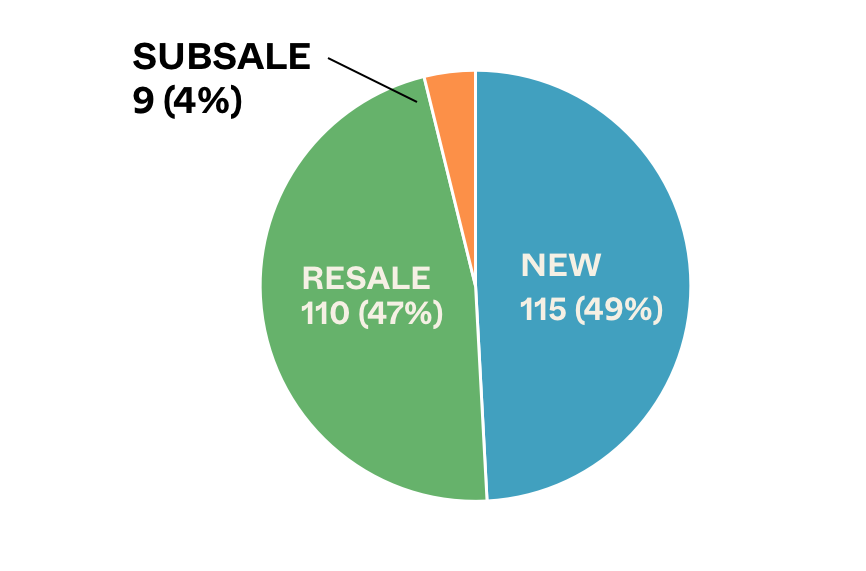

Transaction Breakdown

My most interesting link of the week:

- McDonald’s is a real estate company, not a burger company

This may be a surprise to some people, but while McDonald’s is best known for their fast food restaurants selling burgers, they actually make their money from being an astute real estate business.

In fact, their former CFO has been quoted as saying “We are not technically in the food business. We are in the real estate business.”

It’s a very interesting model, which you can read more about here.

But essentially, besides making money from the usual franchise fees and percentage of sales, the biggest driver of revenue from them is actually the rent that their franchises pay them. Also, as McDonald’s typically buys the land/building at its locations, it is also a real estate portfolio that continues to appreciate.

According to this site, the company apparently owns about 45% of the land and 70% of the buildings at their more than 36,000 locations.

We need a masterclass on McDonald’s and their real estate strategies, pronto.

Follow us on Stacked for news and insights into the Singapore private property market. We provide in-depth reviews of new as well as resale condos and on-the-ground insights from industry players.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Singapore Property News

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

Editor's Pick The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Editor's Pick This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Editor's Pick Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Editor's Pick Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Editor's Pick LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden