Most Affordable Resale HDB Flats You Can Buy For Those Aged Under 30

May 5, 2021

If you want a BTO flat these days, it can feel like there are flaming hoops to jump through. Coupled with oversubscribed flats and recent Covid-19 construction delays, you may be better off looking for a resale flat instead.

“But wait,” you might say, “Resale flat prices are more expensive, and are at an eight-year high!”

Okay, that’s true.

And let’s not forget, while it seems like a no-brainer to look at the absolute cheapest resale HDB there is, you do have limits on how old a flat you can actually buy based on your age.

As of 10 May 2019, the remaining lease of the flat has to be at least 20 years (naturally) and can cover the youngest buyer up till the age of 95 – as long as you want to fully utilise your CPF.

For buyers who do not meet this criteria, the amount of CPF that can be used is pro-rated based on the extent the remaining lease of the flat can cover the youngest buyer up to the age of 95 (more info here).

So in a bid to help younger home buyers looking for house options at this point, we’ve combed through listings and HDB towns, to pick out the most affordable resale flats as of end-April 2021. To be safe, we looked for HDB flats that had at least 66 years lease remaining and onwards.

(Correction: The previous version of this article showed a “Completed Year” column which is incorrect as it is supposed to be the lease remaining. We apologise for any inconvenience this has caused you.)

Here’s where to look, and how much you’ll need:

Most affordable resale HDB 3-room flats

| Address | 3-Room | Lease Remaining (Yrs) | Estate |

| 19 Marsiling Lane | $223,000 | 66 | Woodlands |

| 284 Yishun Ave 6 | $238,000 | 66 | Yishun |

| 641 Yishun St 61 | $242,000 | 70 | Yishun |

| 409 Bt Batok West Ave 4 | $243,000 | 66 | Bukit Batok |

| 415 Bt Batok West Ave 4 | $245,000 | 67 | Bukit Batok |

| 523 Bt Batok St 52 | $245,000 | 66 | Bukit Batok |

| 722 Yishun St 71 | $249,000 | 66 | Yishun |

| 286 Yishun Ave 6 | $250,000 | 66 | Yishun |

| 333 Bt Batok St 32 | $250,000 | 66 | Bukit Batok |

| 505 Bt Batok St 52 | $250,000 | 66 | Bukit Batok |

Average town prices for comparison

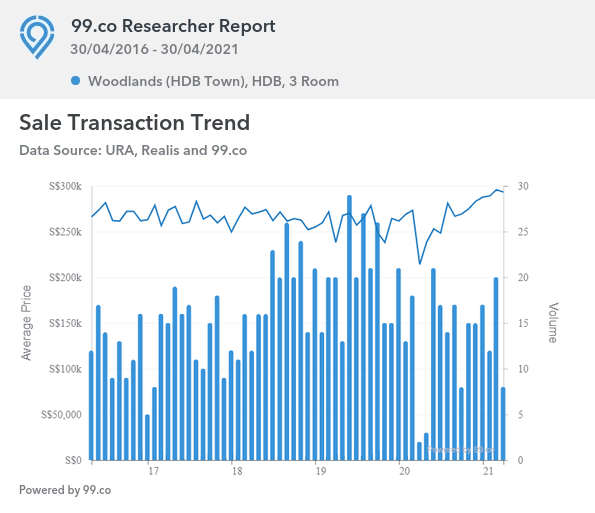

Woodlands:

As of end-April 2021, average prices of 3-room flats in Woodlands are at $293,250.

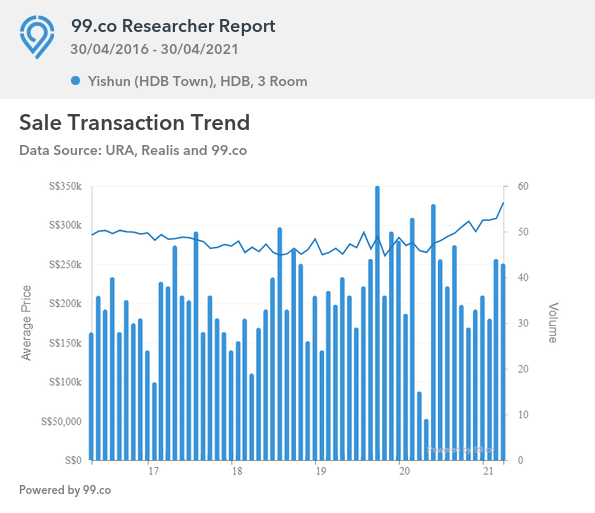

Yishun

As of end-April 2021, average prices of 3-room flats in Yishun are at $328,786.

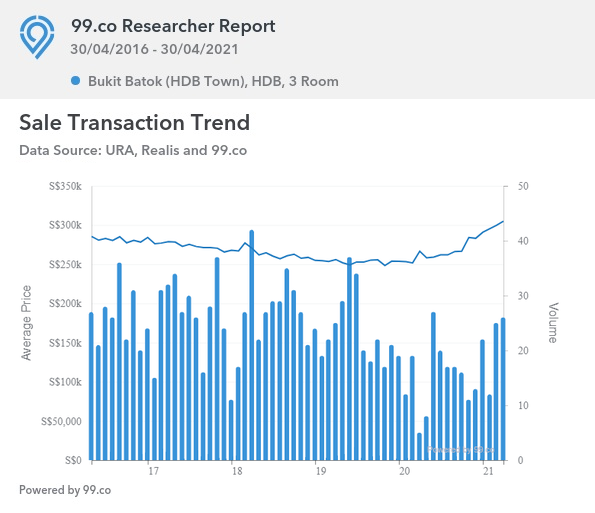

Bukit Batok

As of end-April 2021, average prices of 3-room flats in Bukit Batok are at $304,846.

How much would you need using an HDB loan?

Important: Note that the remaining lease of the flat must last until the youngest buyer reaches 95 years of age. If this age requirement is not met, you may not receive full financing from the HDB loan.

We will use the median price of $245,000 as an estimate:

Down payment:

Assuming full financing, this is 10 per cent of the price or value, whichever is lower. This must be paid in any combination of cash or CPF. We will assume, for this example, that the price and valuation are almost similar.

This comes to a down payment of about $24,500.

Buyers Stamp Duty (BSD):

This is $3,100, payable in any combination of cash or CPF (see the IRAS website for details on how BSD is calculated)

Loan repayments:

We will assume the maximum loan quantum of $220,500, for 25 years. The HDB loan has an interest rate of 2.6 per cent per annum. This comes to about $1,000.34 per month.

The total repayment over 25 years will come to about $300,102.38, with total interest repayments of close to $79,602.38.

Income requirement:

To meet the Mortgage Servicing Ratio (MSR), the loan repayment must not exceed 30 per cent of your monthly income. Based on the above loan repayment, your minimum income should be around $3,000.

How much would you need using a bank loan?

Important: For older properties there may be greater difficulty getting a bank loan. Banks may not provide maximum financing (i.e., you need a bigger down payment). Contact us if you experience difficulties here.

Down payment:

Assuming full financing, this is 25 per cent of the price or value, whichever is lower. The first five per cent of any property purchase must always be paid in cash, while the next 20 per cent can be paid with cash or CPF.

We will assume, for this example, that the price and valuation are almost similar.

This comes to a minimum cash down payment of $12,250. The next part of the down payment comes to $49,000, payable in any combination of cash or CPF.

BSD:

As above: $3,100, payable in any combination of cash or CPF

Loan repayments:

Unlike HDB loans, bank loan rates will fluctuate. The rate is also determined by the loan package you choose (contact us and we can help you to pick the cheapest right now).

Nonetheless, we will use the current average interest rate of 1.3 per cent, over a loan tenure of 25 years. Assuming full financing, the maximum loan amount is $188,750.

This comes to a monthly loan repayment of about $737.27. Over 25 years you would repay $221,181.68, with total interest repayments of $32,431.68.

Income requirement:

Note that, for the purposes of calculating your servicing ratio, the bank will use an assumed interest rate of 3.5 per cent; even if the actual rate is much lower. So to meet the MSR using the loan above, you would need a monthly income of around $3,150.

Most affordable resale HDB 4-room flats

| Address | 4-Room | Lease Remaining (Yrs) | Estate |

| 360 Tampines St 34 | $250,000 | 74 | Tampines |

| 314 Sembawang Dr | $280,000 | 77 | Sembawang |

| 236 Bt Panjang Ring Rd | $285,000 | 66 | Bukit Panjang |

| 437 Yishun Ave 6 | $287,667 | 67 | Yishun |

| 639 Yishun St 61 | $288,000 | 66 | Yishun |

| 658 Yishun Ave 4 | $288,055 | 66 | Yishun |

| 423 Bt Batok West Ave 2 | $290,000 | 66 | Bukit Batok |

| 119 Pending Rd | $290,000 | 67 | Bukit Panjang |

| 166 Yishun Ring Rd | $290,000 | 66 | Yishun |

| 401 Choa Chu Kang Ave 3 | $290,000 | 71 | Choa Chu Kang |

Average town prices for comparison:

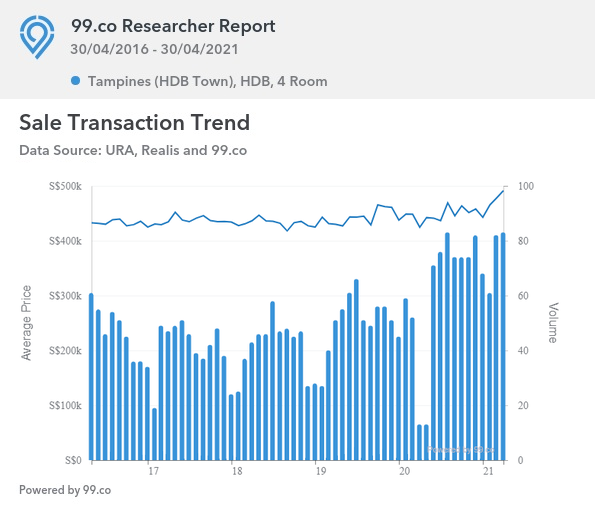

Tampines

As of end-April 2021, average prices of 4-room flats in Tampines are at $491,287.

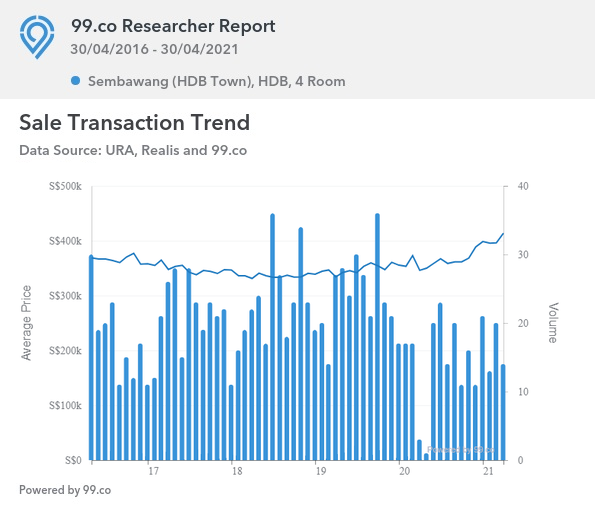

Sembawang

As of end-April 2021, average prices of 4-room flats in Sembawang are at $413,716.

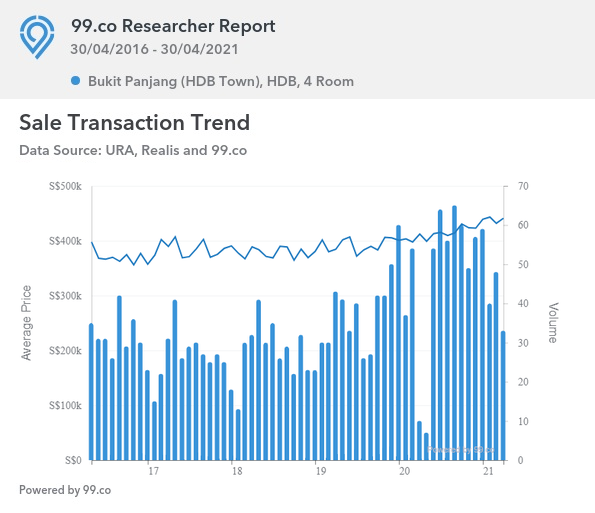

Bukit Panjang

As of end-April 2021, average prices of 4-room flats in Bukit Panjang are at $440,954.

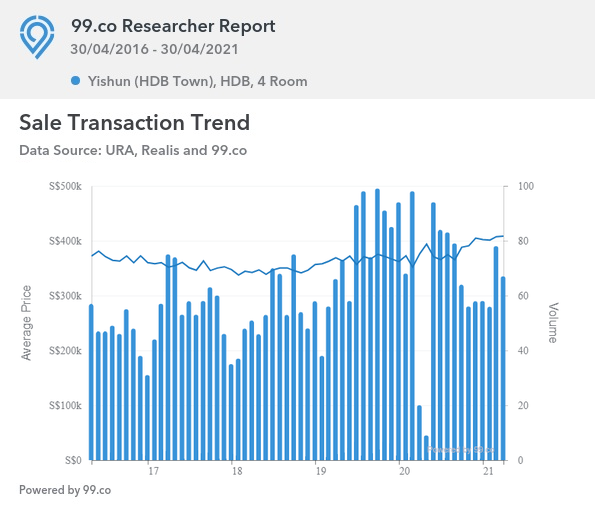

Yishun

As of end-April 2021, average prices of 4-room flats in Yishun are at $408,223.

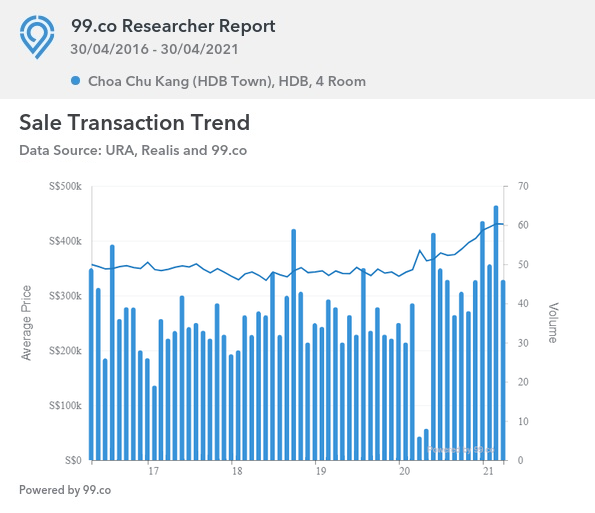

Choa Chu Kang

As of end-April 2021, average prices of 4-room flats in Choa Chu Kang are at $430,099.

How much would you need using an HDB loan?

We will use the median of around $288,000 as an estimate:

Down payment:

Assuming full financing, this is 10 per cent of the price or value, whichever is lower. This must be paid in any combination of cash or CPF. We will assume, for this example, that the price and valuation are almost similar.

This comes to a down payment of about $28,800.

Buyers Stamp Duty (BSD):

This is $3,960, payable in any combination of cash or CPF (see the IRAS website for details on how BSD is calculated)

Loan repayments:

We will assume the maximum loan quantum of $259,200, for 25 years. The HDB loan has an interest rate of 2.6 per cent per annum. This comes to about $1,175.91 per month.

The total repayment over 25 years will come to about $352,773.41, with total interest repayments of close to $93,573.41.

Income requirement:

To meet the Mortgage Servicing Ratio (MSR), the loan repayment must not exceed 30 per cent of your monthly income. Based on the above loan repayment, your minimum income should be at least $3,920.

How much would you need using a bank loan?

Down payment:

Assuming full financing, this is 25 per cent of the price or value, whichever is lower. The first five per cent of any property purchase must always be paid in cash, while the next 20 per cent can be paid with cash or CPF.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

5 Biggest Jumbo HDB Units Above 1,700 Sqft For Families Who Need More Space

In our ongoing quest to discover spacious HDB flats, this week we spotlight properties boasting over 1,700 square feet. Impressively,…

We will assume, for this example, that the price and valuation are almost similar.

This comes to a minimum cash down payment of $14,400. The next part of the down payment comes to $57,600, payable in any combination of cash or CPF.

BSD:

As above: $3,960, payable in any combination of cash or CPF

Loan repayments:

As before, we will use the current average interest rate of 1.3 per cent, over a loan tenure of 25 years. Assuming full financing, the maximum loan amount is $216,000.

This comes to a monthly loan repayment of about $843.71. Over 25 years you would repay $253,113.87 with total interest repayments of $37,113.87.

Income requirement:

Note that, for the purposes of calculating your servicing ratio, the bank will use an assumed interest rate of 3.5 per cent; even if the actual rate is much lower. So to meet the MSR using the loan above, you would need a monthly income of around $3,605.

Property Market CommentaryHow Does 2020’s Low Interest Rates Impact Your Property Purchase?

by Ryan J. OngMost affordable resale HDB 5-room flats

| Address | 5-Room | Lease Remaining (Yrs) | Estate |

| 683B Choa Chu Kang Cres | $340,000 | 80 | Choa Chu Kang |

| 812 Jurong West St 81 | $340,000 | 68 | Jurong West |

| 851 Jurong West St 81 | $340,000 | 74 | Jurong West |

| 690F Woodlands Dr 75 | $344,000 | 81 | Woodlands |

| 948 Jurong West St 91 | $345,000 | 67 | Jurong West |

| 840 Jurong West St 81 | $348,000 | 71 | Jurong West |

| 481 Sembawang Dr | $350,000 | 78 | Sembawang |

| 813 Jurong West St 81 | $350,000 | 68 | Jurong West |

| 396 Yishun Ave 6 | $351,000 | 67 | Yishun |

| 814 Jurong West St 81 | $356,000 | 68 | Jurong West |

Average town prices for comparison

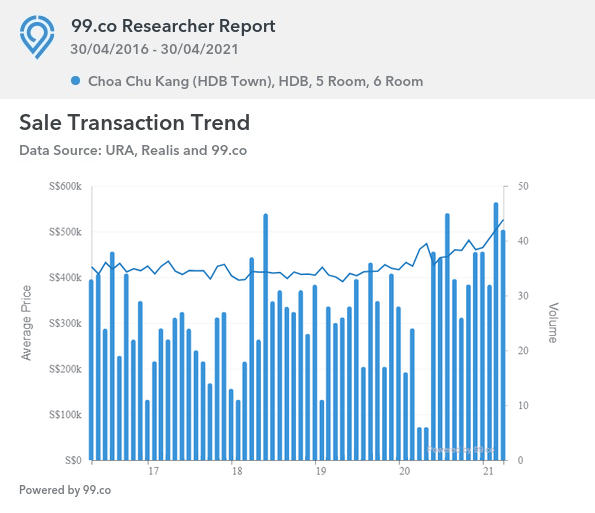

Choa Chu Kang

As of end-April 2021, average prices of 5-room flats in Choa Chu Kang are at $526,225.

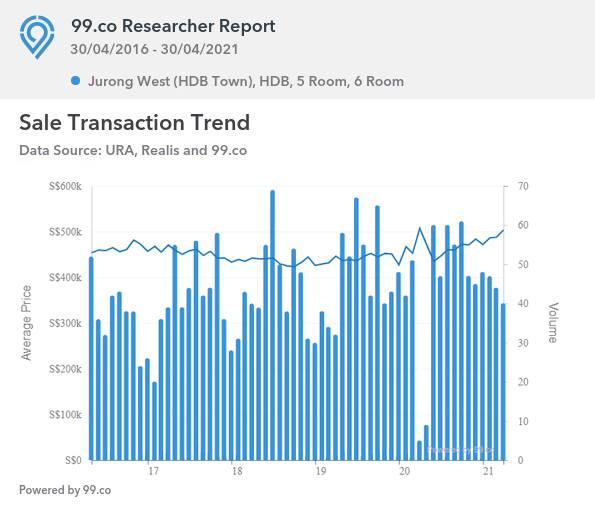

Jurong West

As of end-April 2021, average prices of 5-room flats in Jurong West are at $503,262.

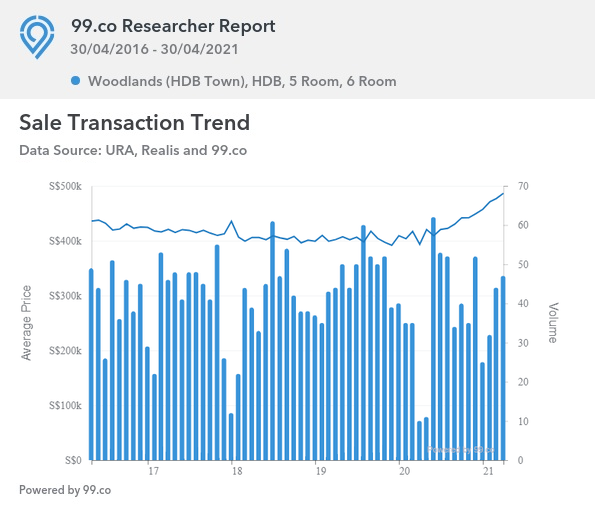

Woodlands

As of end-April 2021, average prices of 5-room flats in Woodlands are at $486,490.

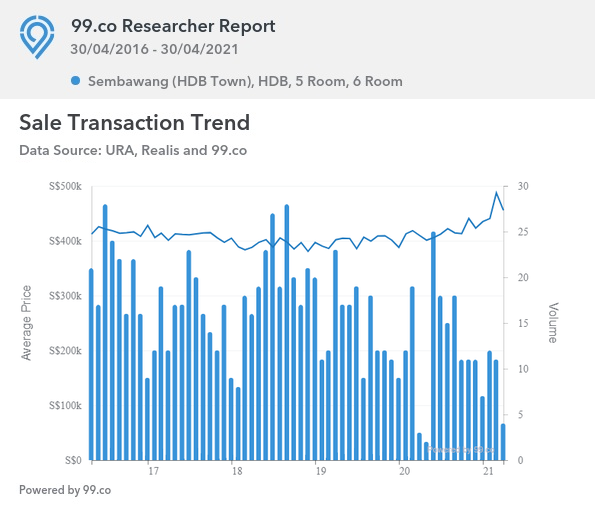

Sembawang

As of end-April 2021, average prices of 5-room flats in Sembawang are at $455,472.

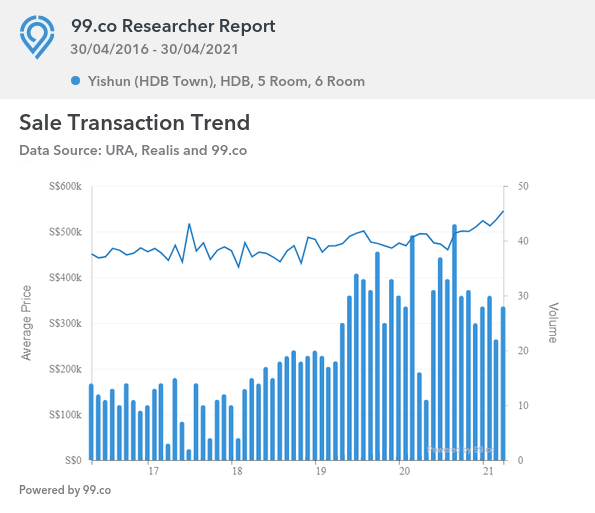

Yishun

As of end-April 2021, average prices of 5-room flats in Yishun are at $545,032.

How much would you need using an HDB loan?

We will use the median of around $345,000 as an estimate:

Down payment:

Assuming full financing, this is 10 per cent of the price or value, whichever is lower. This must be paid in any combination of cash or CPF. We will assume, for this example, that the price and valuation are almost similar.

This comes to a down payment of about $34,500.

Buyers Stamp Duty (BSD):

This is $5,100, payable in any combination of cash or CPF (see the IRAS website for details on how BSD is calculated)

Loan repayments:

We will assume the maximum loan quantum of $310,500, for 25 years. The HDB loan has an interest rate of 2.6 per cent per annum. This comes to about $1,408.64 per month.

The total repayment over 25 years will come to about $422,593.15, with total interest repayments of close to $112,093.15.

Income requirement:

To meet the Mortgage Servicing Ratio (MSR), the loan repayment must not exceed 30 per cent of your monthly income. Based on the above loan repayment, your minimum income should be at least $4,695.

How much would you need using a bank loan?

Down payment:

Assuming full financing, this is 25 per cent of the price or value, whichever is lower. The first five per cent of any property purchase must always be paid in cash, while the next 20 per cent can be paid with cash or CPF.

We will assume, for this example, that the price and valuation are almost similar.

This comes to a minimum cash down payment of $17,250. The next part of the down payment comes to $69,000, payable in any combination of cash or CPF.

BSD:

As above: $5,100, payable in any combination of cash or CPF

Loan repayments:

As before, we will use the current average interest rate of 1.3 per cent, over a loan tenure of 25 years. Assuming full financing, the maximum loan amount is $258,750.

This comes to a monthly loan repayment of about $1,010.70. Over 25 years you would repay $303,209.32 with total interest repayments of $44,459.32.

Income requirement:

Note that, for the purposes of calculating your servicing ratio, the bank will use an assumed interest rate of 3.5 per cent; even if the actual rate is much lower. So to meet the MSR using the loan above, you would need a monthly income of around $4,318.

Most affordable Resale HDB Executive Flats

| Address | Executive | Lease Remaining (Yrs) | Estate |

| 274B Jurong West St 25 | $426,714 | 80 | Jurong West |

| 470 Segar Rd | $430,000 | 80 | Bukit Panjang |

| 274A Jurong West Ave 3 | $430,000 | 80 | Jurong West |

| 682 Choa Chu Kang Cres | $445,500 | 78 | Choa Chu Kang |

| 274C Jurong West St 25 | $448,000 | 80 | Jurong West |

| 468C Admiralty Dr | $450,000 | 79 | Sembawang |

| 275 Choa Chu Kang Ave 2 | $450,000 | 72 | Choa Chu Kang |

| 529 Choa Chu Kang St 51 | $450,000 | 73 | Choa Chu Kang |

| 472 Sembawang Dr | $452,500 | 79 | Sembawang |

| 408 Sembawang Dr | $454,000 | 79 | Sembawang |

Unfortunately, average town prices are not available for comparison for Executive Flats

This is due to a lower volume of transactions. The above is based on the lowest transactions we’ve found overall, as of end-April 2021.

How much would you need using an HDB loan?

Important: Due to the higher income of most Executive Flat buyers, you may be asked to take a bank loan instead. Do prepare for the possibility.

We will use the median of around $448,000 as an estimate:

Down payment:

Assuming full financing, this is 10 per cent of the price or value, whichever is lower. This must be paid in any combination of cash or CPF. We will assume, for this example, that the price and valuation are almost similar.

This comes to a down payment of about $44,800.

Buyers Stamp Duty (BSD):

This is $8,040, payable in any combination of cash or CPF (see the IRAS website for details on how BSD is calculated)

Loan repayments:

We will assume the maximum loan quantum of $403,200, for 25 years. The HDB loan has an interest rate of 2.6 per cent per annum. This comes to about $1,829.20 per month.

The total repayment over 25 years will come to about $548,758.64, with total interest repayments of close to $145,558.64.

Income requirement:

To meet the Mortgage Servicing Ratio (MSR), the loan repayment must not exceed 30 per cent of your monthly income. Based on the above loan repayment, your minimum income should be at least $6,097.30.

How much would you need using a bank loan?

Down payment:

Assuming full financing, this is 25 per cent of the price or value, whichever is lower. The first five per cent of any property purchase must always be paid in cash, while the next 20 per cent can be paid with cash or CPF.

We will assume, for this example, that the price and valuation are almost similar.

This comes to a minimum cash down payment of $22,400. The next part of the down payment comes to $89,600, payable in any combination of cash or CPF.

BSD:

As above: $8,040, payable in any combination of cash or CPF

Loan repayments:

As before, we will use the current average interest rate of 1.3 per cent, over a loan tenure of 25 years. Assuming full financing, the maximum loan amount is $336,000.

This comes to a monthly loan repayment of about $1,312.44. Over 25 years you would repay $393,732.68 with total interest repayments of $57,732.68.

Income requirement:

Note that, for the purposes of calculating your servicing ratio, the bank will use an assumed interest rate of 3.5 per cent; even if the actual rate is much lower. So to meet the MSR using the loan above, you would need a monthly income of around $5,606.98.

Finally, do keep in mind the potential for Cash Over Valuation (COV).

It’s possible that the seller’s asking price will exceed the actual valuation; such as if the asking price is $488,000, but the valuation by HDB comes to $460,000. The $28,000 difference would be the COV.

Also note that the valuation is only revealed after you have already agreed on the price. As such, we advise against any assumptions that you won’t have to pay cash; even if you’re eligible for an HDB loan.

As bank and HDB loans are based on the lower of the price or valuation, the COV amount has to be paid in cash. COV can be unpredictable, as HDB does not publish the data for COV.

For more information on the Singapore property market, and in-depth reviews of new and resale developments alike, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the minimum remaining lease for resale HDB flats for young buyers?

How much does a typical affordable 3-room resale HDB flat cost in Yishun?

What is the estimated monthly repayment for a $245,000 HDB flat loan over 25 years?

How much is the down payment for a $288,000 resale HDB flat with a bank loan?

What is the income requirement to qualify for a bank loan for a 4-room resale HDB flat?

Are resale HDB flats more affordable than BTO flats for under-30 buyers?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Picks

Property Picks Where to Find Singapore’s Oldest HDB Flats (And What They Cost In 2025)

Property Picks Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

0 Comments