Looking To Invest In Property In 2022? Here Are 5 Property Investment Trends That Have Changed

January 30, 2022

With a slew of policy tweaks over the past decade, the property market in 2022 is almost unrecognisable to those who bought in 2012 or earlier. One common gripe we hear is that long-term plans, laid out over 10 or 15 years, have now been derailed by factors such as ABSD and TDSR. Whether you’re returning to the property market this year – or are just worried about having outdated advice – here are some recent ways that property investment has changed:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Buying shoebox units for rental is less attractive

Way back in 2012, the most popular strategy – or rather the most heavily marketed – was for HDB owners to buy and rent out shoebox condo units. It reached the point that, in Q1 of 2012, an amazing 52 per cent of all the transactions were shoebox units.

Shoebox units are aimed at investors who want higher rental yields. Due to the low quantum of a shoebox (510 sq. ft. or under) unit, gross rental yields topping five per cent were expected; and a decade ago, we even heard claims of eight per cent yields. This was also made better by the number of expats coming into Singapore back then, with good pay packages to attract them to Singapore.

Note that as of 2022, this is no longer the case. Due to the higher Additional Buyer Stamp Duty (ABSD) on second or third properties, the cost of a shoebox unit is not as low as it was before. A Singapore citizen buying a shoebox unit as a second property, for instance, would pay the ABSD of 17 per cent.

Once you add in the stamp duties, many shoebox units end up with a gross rental yield that’s comparable to a larger, mass-market condo. Investors should consider if it’s worth the cost, as shoebox units tend to be harder to resell.

This brings us to the second issue: since around 2019, most home buyers have been HDB upgraders. This dominant group of buyers are not often attracted to shoebox units, as they’re families; a shoebox unit is too small for them. This leaves a more limited pool of buyers, such as empty-nesters or lifelong singles, when it comes time to sell.

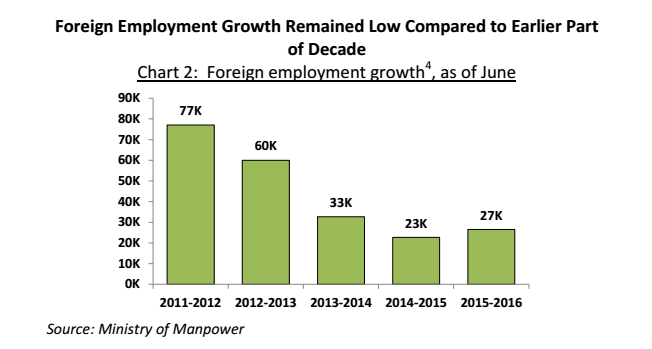

Likewise, the rise of shoebox units coincided with the growth of the foreign population in Singapore. In 2013, a Government policy paper showed there were plans for the population to increase 30 per cent by 2030, with nearly half of that planned 6.9 million to be foreigners. This was met with a lot of resistance, and the stricter requirements for foreigners to come into Singapore in the past few years have also played a part in less demand for shoebox units ever since.

This isn’t to say shoebox units are necessarily bad, and the low capital does mean less risk for a new investor, but they’re not the investment darlings they were in the past.

2. Cash-flow positive properties are less of an expectation

In the property heydays of 2012 to 2013, it was more common for investors to seek out cash-flow positive properties. That is, investors expected that they would still have rental income left over, once they’d covered the home loan repayments and maintenance fees.

Such situations are far less common in recent years:

Across the board, the average rental rate for a condo in 2022 is about $3.65 psf. This is down by more than 10 per cent from a decade ago when landlords could expect around $3.90 psf. Do keep in mind that this is even with recent rental rates at a six-year high.

This isn’t to say you can’t find cash-flow positive properties; they’re definitely still out there. It’s just that such finds are rare these days; most investors now see rental income as just a way to hopefully cover mortgage interest and maintenance fees, rather than expecting it to cover the entire home loan repayment, plus more.

As such, you may find that the latest property investment strategies tend to emphasise resale gains over rental.

3. No more OTP shenanigans and flipping

In the past, it was possible to avoid the Sellers Stamp Duty (SSD) by transferring the Option To Purchase (OTP). In effect, you’d secure the OTP, and then transfer the OTP for a profit, instead of transferring any actual property.

This can no longer be done, and sub sale (fast house flipping) strategies are mostly dead. As of 2022, the SSD is now 12 per cent on the first year, eight per cent on the second year, and four per cent on the third year.

If you do see sub sales, or homes being sold within a year of purchase, it’s more often a result of the seller cutting losses or facing a crisis; not so much an “investment strategy”.

Another much-loved form of OTP shenanigans – dragging out the validity period – ended in September 2020. In the past, developers could promise to automatically renew your OTP whenever it lapsed, for a small fee; this could result in the extra time given to exercise the OTP (in some cases, dragging it out for as long as two years).

This meant that investors could “chope” the unit by securing the OTP, even before they had secured the money to buy. They could then wait while they secured a loan, sold their existing home, etc., before exercising the OTP.

As this can no longer be done, investors are more often forced to sell before they buy a new unit. This may require more in-depth consideration of the timeline, and may even cause you to reconsider investing right now.

4. Cash Over Valuation (COV) is back

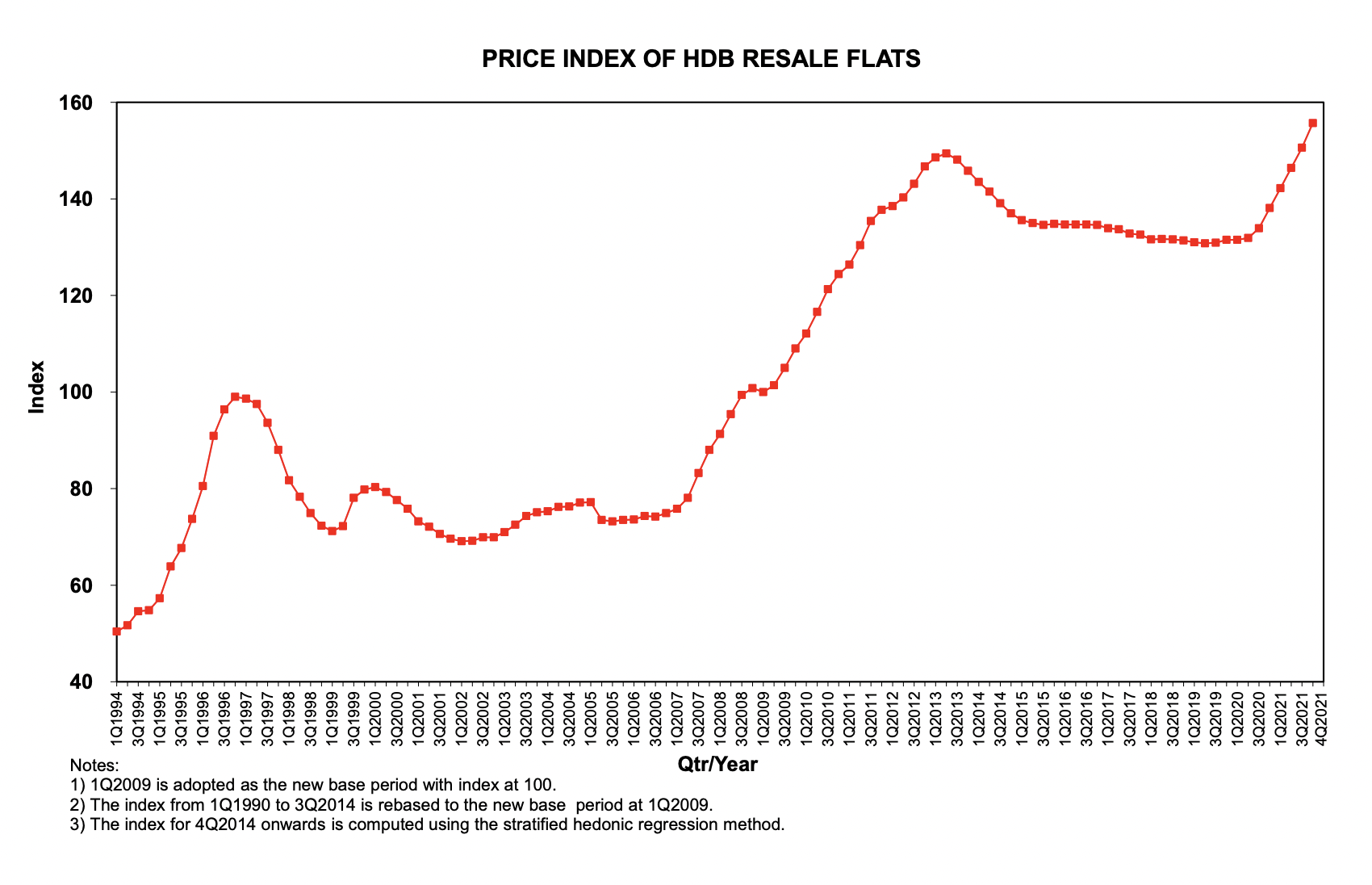

Around 2014, HDB stopped publishing COV rates. Coupled with a new Mortgage Servicing Ratio (MSR), it resulted in steadily falling resale flat prices – and this continued for around seven straight years.

As of 2020, however, resale flat prices began to show a turnaround; and by the end of 2021, resale flat prices were at their highest in around eight years. For most of the past decade, HDB flats have been seen as a stepping stone, to be quickly disposed of after five years – but the perspective is changing.

One of the reasons is the return of COV. While the numbers aren’t publicly known, it’s reported that one-third of all resale flats were sold with COV in 2021; up from one-fifth in 2020. It’s partly what explains the current record of 259 flats, which managed to transact at $1 million or more.

So if you’ve been warned to quickly sell and upgrade in the past, it may be time to re-evaluate that notion (especially since if you sell right now, you’ll be buying in one of the priciest markets since 2013).

Owner-investors may now have a better reason to hang on to their flats, or have more confidence in it as an appreciating asset at least in 2022.

Of course, it’s important to note that the rise in prices has been a result of Covid-19 putting pressure on the supply and demand of property in Singapore. Due to a combination of Work From Home changes, construction delays, and low-interest rates, the demand for homes that you can move into immediately has been through the roof. Once the planned upcoming supply increases, however, this situation will change.

5. Buying just ahead of an en-bloc is now more hazardous

In the past, investors would invade older resale properties like Vikings, setting up pro-sale committees and pushing for fast en-bloc sales. You’ll notice that in 2022, however, there’s far less enthusiasm for this strategy.

The main reason is rising costs on developers – ranging from land prices to Development Charges, to the ABSD on developers. With the December 2021 cooling measures, developers now pay 35 per cent ABSD on land prices. Five per cent of this is unremissible – the rest of it they can get back, provided they complete and sell the entire project in five years.

This has thrown a spanner in the works for some older developments; particularly large ones hoping for an en-bloc sale. Large land plots now represent a much bigger risk and are less likely to get snapped up or see generous sale proceeds.

In 2022, the tendency is now to look for new developments nearing the end of their five-year ABSD deadline. Some investors hope that nearing the deadline, developers will sell off the few remaining units at a discount, rather than pay the full ABSD.

Some investors still bank on en-bloc sales as a strategy – but they tend to focus on smaller condos, such as those with 300 or fewer units, or a smaller land plot. Developers tend to be more confident about redeveloping such projects.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How has the appeal of shoebox units changed for property investors in Singapore?

Are cash-flow positive properties still common among property investors today?

What are the recent changes in property flipping and purchase strategies in Singapore?

Is it still a good idea to sell HDB flats quickly to upgrade, given current market conditions?

How have recent government policies affected en-bloc redevelopment strategies?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Singapore Property News Taking Questions: On Resale Levies and Buying Dilemmas

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

3 Comments

Hi Ryan,

Appreciate your article. Thanks for sharing the market trend. This answered to some of my doubts that I had. Always learning a lot here. Thanks.