Should You Keep Your HDB Flat To Rent Out After Buying A Condo?

December 30, 2020

We recently received this particularly interesting question:

Do you think it is worth to pay ABSD for second property (condo) and keep the first property (HDB) for a rental income?

While that does mean incurring Additional Buyers Stamp Duty (ABSD), there are merits to doing so. Some would argue, for instance, that the rental income from their HDB flat could offset the mortgage interest on their condo. Here’s a look at this alternative approach:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How can you keep your flat while still owning a condo?

If you’re a Singapore Citizen, you can keep your flat after buying a private property, so long as you live in the flat for the five-year Minimum Occupation Period (MOP) first.

So for this strategy to work, you must buy an HDB flat as your first property, and hold it till MOP (if you buy a private property first, you can’t buy an HDB flat unless you dispose of the private property).

Permanent Residents (PRs) cannot buy a private property and still retain their flat, regardless of whether they’ve met the MOP.

How much will you need to buy a condo, if you don’t sell your flat?

The maximum Loan To Value (LTV) ratio of a home loan, assuming your flat is fully paid-up, is 75 per cent. The first five per cent of your condo must be paid in cash, and the next 20 per cent in cash or CPF.

Using a $1.5 million condo as an example, this would mean a minimum of $75,000 in cash, and $300,000 in your CPF Ordinary Account (CPF OA).

Besides this, we also need to consider the Buyers Stamp Duty (BSD), and Additional Buyers Stamp Duty (ABSD).

The BSD for the condo would be $44,600*, while the ABSD – assuming you’re a Singapore Citizen – would be 12 per cent or $180,000*. This comes to a total of $224,600, which can be paid through your CPF.

As there is no sale of your flat, you must be able to pay – at minimum – $75,000 in cash, and $524,600 in CPF.

*For a complete explanation of how stamp duties are calculated, please refer to our complete guide on the topic.

This example assumes your flat is fully paid-up; otherwise, the down payment will be higher

If you still have one outstanding home loan, such as for your flat, then your maximum LTV ratio will fall to 45 per cent. This will also mandate a minimum cash down payment of 25 per cent, with the remainder payable from CPF.

As such, it’s not viable for most buyers to contemplate keeping their flat, unless it’s fully paid by the time they purchase private property; and those who want to keep their flat for rental income should plan further than the usual five-year period (most upgraders, who don’t keep their flats, plan to sell soon after the Minimum Occupation Period).

This may require considerations that other upgraders don’t have, such as:

- Speeding up home loan repayments for your flat (not a move usually favoured by property investors, as it locks up capital in an illiquid asset)

- Planning as far as 10 to 15 years down the road, as you need to save substantially more for the down payment while fully paying off the flat. Bear in mind that is likely to shorten your available loan tenure; some buyers will be too old to qualify for a full 25-year loan tenure at that point.

- Greater emphasis on rentability and rental yield, rather than shorter-term resale gains

Why is this strategy still favoured by investors, despite the high upfront costs?

This approach is slower and tougher, but with potentially higher rewards and greater peace of mind. The key benefits are:

- Considered less risky by some investors

- Offsetting interest repayments and maintenance fees

- You can switch residences as needed

- Non-financial reasons

1. Considered less risky by some investors

This is a matter of opinion, but some investors feel secure knowing that – no matter what happens – they have a fully paid-up flat they can move back into.

Consider the risks posed by alternative strategies: “sell one, buy two” requires both spouses to have separate mortgages. Upgrading to a bigger condo, with a new bank loan, could mean another two decades of repayments.

In a worst-case scenario, if you have to sell the private property, there will be less disruption: you can simply move back into your old home, while selling off the condo. You won’t end up needing temporary accommodations, face the risk of higher home prices at the point where you downgrade, etc.

So while this strategy is often slow to pull off (unless you’ve had some kind of windfall or inheritance), it has strong appeal in the “peace of mind” department.

readthisnext

Some financial planners and property agents may disagree with this perspective

In the eyes of some financial planners, locking up your capital in two properties – especially if it means having no other investments – is risky as you’ll lack diversification. This is a matter of retirement planning / portfolio management that will require more thought, so you should speak to a qualified financial expert on this.

Some property agents may also point out that an old resale flat (e.g. those approaching the 40-year mark) could be more of a liability than an asset. If the flat proves difficult to rent out, or rental yields decline, you may face a challenge trying to offload it. It’s not always wise to keep holding on to an old flat.

This will come down to an assessment of both properties, and the financial targets you set for your portfolio. This has to be considered on a case-by-case basis; so if your plan is to keep the flat, do reach out to us and we can help provide some clarity.

2. Offsetting interest repayments and maintenance fees

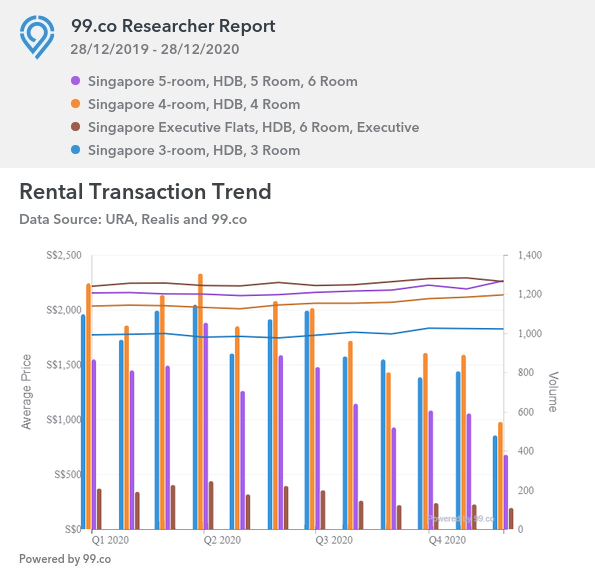

The following are the average rental rates as of end-December 2020, for HDB flats:

- 3-room flats average $1,824 per month

- 4-room flats average $2,136 per month

- 5- room flats average $2,264 per month

- Executive flats average $2,256 per month

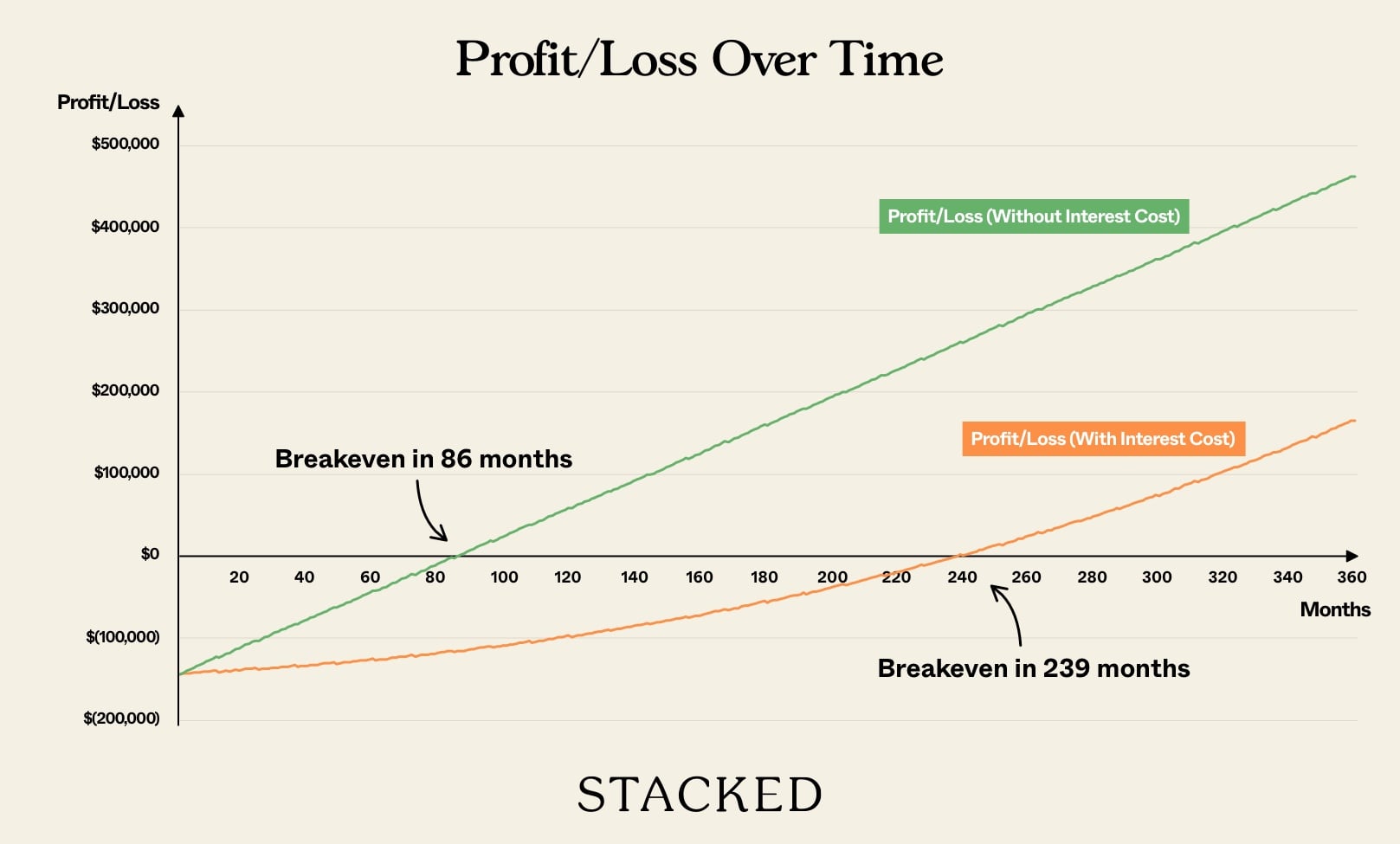

The repayment on a loan of $1.125 million for 25 years (for a $1.5 million condo), at 1.3 per cent interest, comes to about $4,394 per month. Of this amount, about $1,219 make up the interest portion.

The typical maintenance fee for a condo unit (excepting luxury condos) is around $300 to $400 per month.

As such, even the average rental income from a 3-room flat is sufficient to cover the mortgage interest, plus the maintenance fees of a condo.

Here’s how long it could potentially take you to breakeven for a $1.2 million condo, with an assumed rental rate of $2,083 per month (5% rental yield from a $500,000 HDB).

3. You can switch residences as needed

You can live in the condo unit while renting out the flat, or live in the flat while renting out the condo. If things don’t go as planned (e.g you keep experiencing vacancies or poor rental rates from one of the properties), you can simply live in it while renting out the better performing unit.

This is, of course, contingent on the size of the property you buy; a shoebox unit won’t fit your whole family, so you may not have an option to switch if you buy such a property.

Being able to switch can also help with changing life circumstances. Some retirees, for instance, switch from living in their bigger flat to living in a shoebox unit, once their children have moved out (and still get rental income from their flat to pay for the condo maintenance).

4. Non-financial reasons

This approach may suit your family for reasons other than money. You could, for instance, plan to give the flat or condo to your children when they get married; or you may have exposure to the property market, without having to leave the neighbourhood you’re used to.

It can even be as simple as wanting to avoid timeline complications. Switching from a flat to a condo – as opposed to just owning both – means you need to work out considerations like where you’ll live while the condo is being built, periods when you may be servicing two home loans, the timing of your sale, etc. This can be disruptive to schooling children, or to your work.

There’s no way to quantify these benefits to say if they’re right or wrong. But to some home buyers, these issues trump the financial aspects.

Before doing this, be sure to understand the risks involved with keeping the flat

There’s no guarantee regarding any flat’s rental prospects. We have no way of knowing what the rental market will be like five or 10 years down the road; so you should never rely heavily on the flat’s rental income to pay for the condo.

Also, you should bear in mind that stamp duties like the ABSD are non-recoverable costs. Assuming you pay $180,000 for the ABSD (as described above), and you rent out a 5-room flat at the average rate, it would take over 6.5 years just to cover the cost of the ABSD. While this doesn’t immediately rule it out as a bad investment, it is something that has to be considered in the wider context of your portfolio (your age, retirement targets, etc.)

For some buyers, it might make sense to just sell the flat, and invest the proceeds somewhere else rather than chase rent.

As always, let us know if you’re in doubt, and we can help review your situation. You can also find out more about Singapore’s private and HDB markets by following us on Stacked, and see in-depth reviews on new and resale developments.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

0 Comments