Is The Upcoming 1,193-Unit Parktown Residence In Tampines Worth A Look? Here’s All You Need To Know

January 23, 2025

Singapore property buyers have an ever-growing appetite for integrated projects—and if there’s another thing they can’t resist, it’s mega-developments.

As such with 1,193 units, Parktown Residence is poised to be Singapore’s largest integrated development to date. While its 545,511-square-foot footprint is smaller than Treasure at Tampines (648,880 square feet), the inclusion of a substantial commercial component sets Parktown Residence apart. More than just sheer size, it’s a milestone for Tampines North: the first integrated development in the district, laying the groundwork for its transformation.

However, for those less familiar with Tampines, let’s be clear about the location. This isn’t at the bustling central hub, which is anchored by the trio of malls—Tampines Mall, Tampines 1, and Century Square. In contrast, Tampines North remains a work in progress, shaped by a mix of HDB estates and industrial sites. While recent launches like Tenet hint at what’s on the horizon, the area isn’t yet the hotspot that Tampines Central has become.

If anything, current residents in the area are probably happy with the announcement of Parktown Residence. As a large-scale integrated development, it will be the focal point of Tampines North. Residents will enjoy direct access to the upcoming Tampines North MRT (Cross Island Line), plus a new bus interchange, retail mall, hawker centre, and community hub.

Although many specifics are still under wraps, here’s a closer look at what we know so far—and why Parktown Residence could be an interesting project to keep your eye on.

| Project Name | Parktown Residence |

| Location | 1, 3, 5, 7, 9, 11, 13, 15, 17, 19, 21, 23 Tampines St 62 |

| District | 18 |

| No. of Units | 1,193 |

| Tenure | 99-year Leasehold |

| Site Area | 545,511.8 SQFT |

| Gross Plot Ratio | 2.5 |

| Developer | JV Between CapitaLand Development, UOL Group Limited, and Singapore Land Group Limited |

| Est. TOP | Est. June 2033 |

CapitaLand, UOL, and Singapore Land Group acquired the Parktown Residence site for $1.21 billion ($885 psf ppr), beating the runner-up by an impressive 14%. That premium initially raised a few eyebrows, but it pales in comparison to the subsequent GLS site at Tampines West, which fetched $668.28 million at a higher land rate of $1,004 psf ppr. The developer there will likely have to price units higher to recoup costs, which could give Parktown Residence a relative edge with its lower entry price—although we remain cautiously optimistic.

That said, integrated projects like Parktown Residence typically come with higher construction costs than standard residential developments. As a result, industry estimates suggest final pricing could start around $2,1XX–$2,2XX psf. While that aligns with other integrated launches, it might stretch budgets for an area still finding its identity. Tampines North remains primarily an HDB and industrial zone, with many amenities on the horizon rather than fully established.

Compounding matters is the lack of direct benchmarks for pricing. The closest neighbour, Tenet, is an executive condominium (EC) and thus not a true comparison. Beyond that, the immediate vicinity is dominated by HDB blocks. In other words, Parktown Residence is in largely uncharted territory—and this dynamic may split potential buyers into two camps. Some may be reluctant to pay a premium in an emerging locale, while others might embrace the first-mover opportunity in a district with long-term upside.

Keep in mind again, that this isn’t the Tampines Central that most people visualise, with its bustling malls and established amenities. Whether or not Parktown Residence’s promise is worth the wait depends on how bullish you are about Tampines North’s eventual transformation.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A sticking point for risk-averse buyers: still an industrial enclave

One potential drawback is the immediate surroundings.

Tampines North still bears a heavy industrial feel, sitting close to Pasir Ris and lacking the built-up nature of Tampines Central.

And so as captured from the July 2024 Google Street View, it’s clear that Tampines North differs significantly from Tampines Central. Buyers will need to focus on the estate’s future potential rather than its current state.

However, that future, as mapped out in the URA Master Plan, looks promising.

Plans for widespread green spaces, pedestrian-friendly infrastructure, and a central hub are all in place, alongside the upcoming Cross Island Line (CRL) station that will connect Tampines North to major areas like the Jurong Lake District, Punggol Digital District, and the broader Changi region.

With that said, these enhancements will take time to materialise, so early residents can expect some growing pains.

CapitaLand’s involvement: it’s an important one

CapitaLand is a familiar name for most Singaporeans, largely thanks to its extensive presence in some of the country’s most iconic malls—ION Orchard, Jewel Changi Airport, and Tampines Mall, to name a few.

This reputation makes CapitaLand’s involvement in Parktown Residence particularly noteworthy. Today’s buyers aren’t just looking for a development with a commercial element; they want that commercial space to be functional and useful —think supermarkets, pharmacies, and notable retail brands, and not some random travel agent, bike parts shop or scented candle shop.

With CapitaLand’s track record in retail management, buyers are likely to have more confidence in the mall’s relevance and appeal.

Given that the new retail mall will serve as a central feature for Tampines North, the reassurance of a reputable developer behind it could provide much-needed peace of mind for buyers. These features are clearly designed to support the growing population in the area (more on that below).

Design and facilities: a family-focused approach

The residential component comprises 12 blocks, each ranging between six and 12 storeys, with an emphasis on family-friendly facilities.

Parktown Residence will have six swimming pools, several dedicated children’s spaces, and a single tennis court.

While some might find having just one court underwhelming for a development of this scale, it’s become increasingly common among larger projects like Avenue South Residence and Chuan Park.

Parktown Residence also offers a relatively generous 457 sq ft of common space per unit—well above comparables such as Treasure at Tampines (295 sq ft) and Normanton Park (358 sq ft).

That said, the presence of a retail mall on-site means portions of the project will likely see higher foot traffic, so it remains to be seen whether the additional space adequately offsets this.

Unit mix and layouts

| Bedroom Type | Unit Type | No. of Units | Size (sq ft) | Unit Breakdown | Maintenance Fee (Est) |

| 1-Bedroom + Study | AS1/ AS2/ AS3/ AS4 | 73 | 463 / 506 sq ft | 6.1% | $362 |

| 2-Bedroom | B1/ B2/ B2(p)/ B3 | 160 | 592 sq ft | 49.1% | $442 |

| 2-Bedroom Premium | BP1/ BP1(p)/ BP2/ BP2 (p)/ BP3 / BP3 (p)/ BP4 / BP4(p)/ BP5 | 292 | 678 / 721 sq ft | ||

| 2-Bedroom + Study | BPS1 / BPS1 (p) / BPS2 | 134 | 764 sq ft | ||

| 3-Bedroom | C1/ C2/ C3/ C4/ C5 | 135 | 926 / 936 / 947 sq ft | 34.2% | |

| 3-Bedroom Premium | CP1 / CP1 (p) / | 158 | 1,055 / 1,066 / 1,076 sq ft | ||

| 3-Bedroom Premium + Study | CPS1/ CPS1(p) / CPS2 / CPS2 (p) / CPS3 / CPS3 (p) / CPS4 / CPS5 | 115 | 1,163 / 1,173 / 1,184 sq ft | $514 | |

| 4-Bedroom | D1 / D1(p) / D2 / D2(p) / D3 / D3(p) / D4 / D4(p) | 57 | 1,335 / 1,345 / 1,356 sq ft | 8.7% | |

| 4-Bedroom Premium | DP1 / DP1 (p) / DP2 / D2P (p) | 47 | 1,485 / 1,496 sq ft | ||

| 5-Bedroom | E1 / E1 (p) | 22 | 1,679 sq ft | 1.8% | $587 |

More from Stacked

Orchard Towers Review – Interesting apartment at the doorstep of Orchard

Orchard Towers is infamous for its nightlife and vice activities for decades. Every now and then, this 43-year old development…

Looking at the current unit breakdown for Parktown Residence, it’s clear that the development is heavily skewed towards smaller units. With 2-bedroom units comprising 49.1 per cent of the mix, that’s a sizeable number to cater to young couples or potentially even investors.

This is a bit surprising, especially given the family-oriented facilities and the project’s location within a residential heartland. One might have expected a larger proportion of family-sized units, particularly considering the increasing demand for spacious layouts, which has driven up prices for larger units in recent years.

As for unit sizes, a comparison between Treasure at Tampines and Parktown Residences seems comparable on paper; but note that Parktown Residence falls under the new GFA harmonisation guidelines, while Treasure at Tampines does not (i.e., the square footage of Parktown units doesn’t count air-con ledges or other such unlivable areas.)

With projected launch prices from approximately $2,1XX to $2,2XX PSF—and larger-than-average unit sizes for the bigger unit types—the resulting higher quantum may exceed the budgets of some buyers, particularly in the OCR. This could pose a challenge when it comes to moving the bigger units, which will inevitably command a steeper overall price tag.

In any case, we will have a comprehensive pricing review once Parktown Residence launches, so do keep a lookout for that.

A look at the show flat units

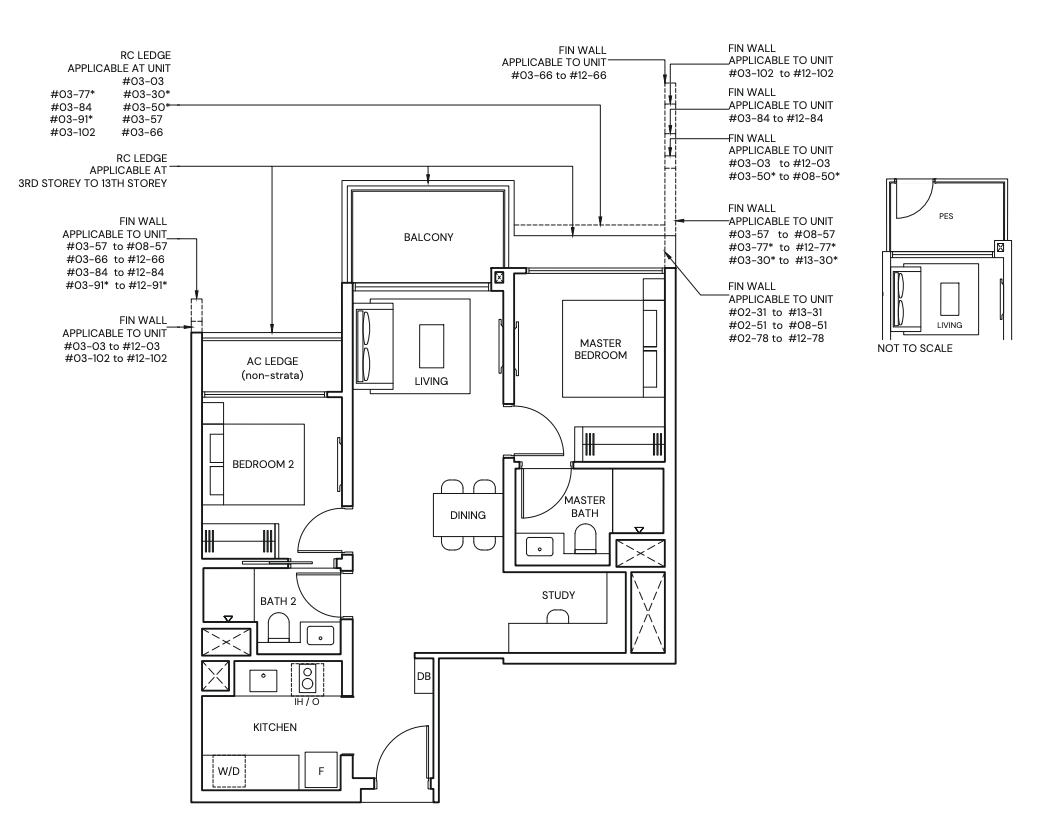

2-Bedroom Premium + Study – 764 square feet

The 2-bedroom Premium + Study units here come in two different layouts, both measuring 764 square feet. The dumbbell layout, shown here, is often favoured for its efficient use of space. Beyond that, it’s fairly standard for what you’d expect at most showflats—though the overall unit size is notably generous.

Bear in mind, that this is one of the projects governed by the new GFA harmonisation guidelines. For context, comparable layouts at newer launches typically run smaller: The Orie, for example, offers a 2+Study at 700 square feet, while Emerald of Katong ranges from 678 to 700 square feet.

In light of this, these 2+ study units here could be a good fit for those seeking a more compact unit type option without sacrificing the overall space.

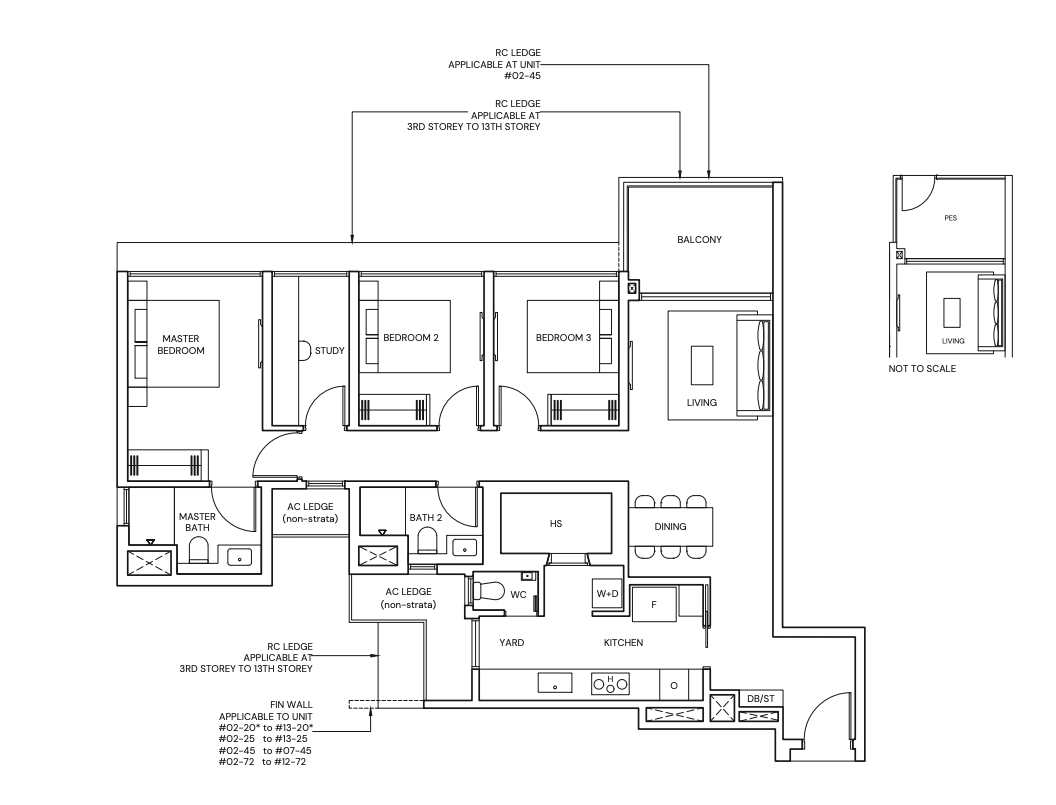

3-Bedroom Premium + Study – 1,163 square feet

The show flat highlights the 1,163-square-foot variant, notable for its elongated entry hallway. Overall, it’s a fairly standard layout for a three-bedder in new launches today.

We would have liked a wider frontage for the living area to provide a more expansive feel—though to be fair, narrower layouts aren’t uncommon in newer launches. The study is tucked beside the master bedroom, effectively off the living room. From the floor plan, a structural wall separates the two, so any hopes of merging them for an open concept would likely involve some professional ID work.

Much like the 2+Study units, these 3+Study layouts are generously sized. For perspective, Emerald of Katong’s 3+Study ranges from 969 to 1,001 square feet, while The Orie’s 3 Bedroom Premium Dual Key (they don’t have a +Study) spans 1,130 square feet. At 1,163 square feet, Parktown’s offering is relatively spacious—though again bear in mind that the added square footage can push up the overall price point.

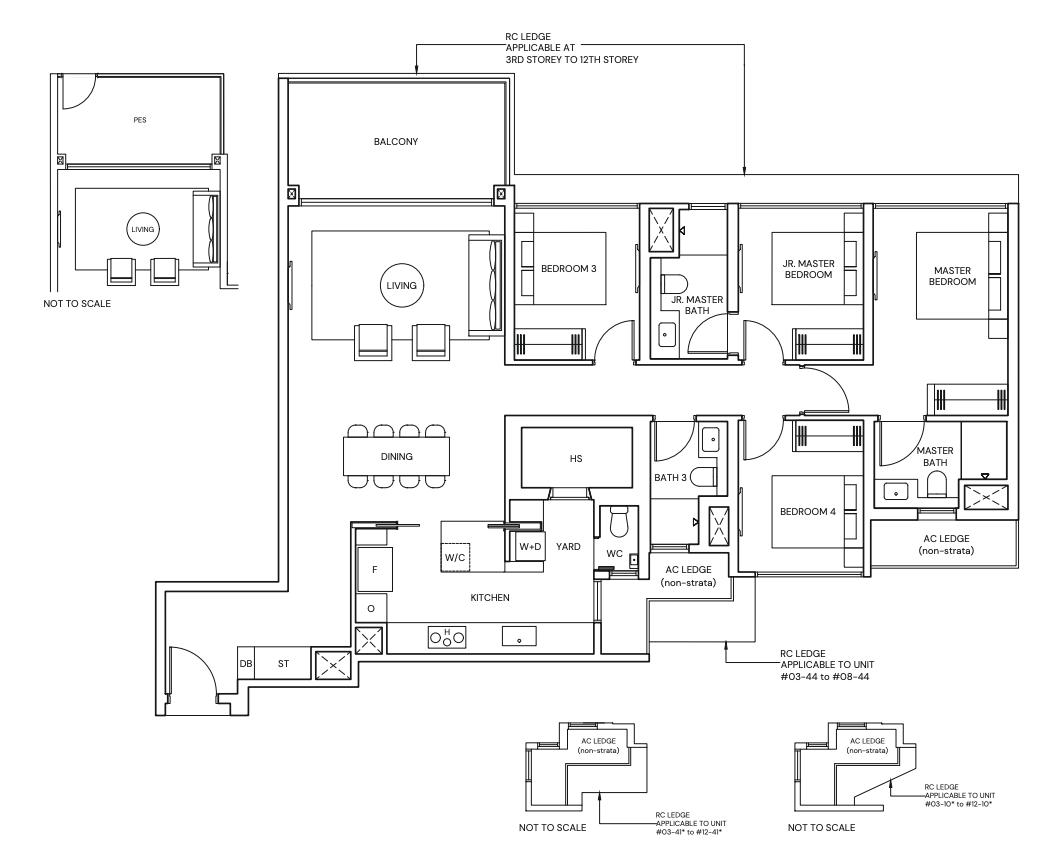

4-Bedroom Premium – 1,496 square feet

For those seeking more breathing room, here’s a look at the 4-Bedroom Premium, which is the biggest layout on display at the show flat. It is sized at 1,496 square feet.

As previously mentioned, it’s surprising that there are not more larger units offered at Parktown Residence, despite the project seemingly geared towards families. Even so, this layout is impressively spacious, even overshadowing the 5-Bedder options at The Orie and some 5-Bedroom Luxe layouts at Emerald of Katong.

Naturally, a bigger layout size would also mean a heftier price tag, and it’s worth noting that even the entry-level 4-bedroom options here start at 1,335 square feet. So, if budget is a concern, that may be an issue.

Overall, the design feels fairly standard, but one can appreciate the wider frontage in the living area—it adds a sense of openness that’s sometimes lacking in new projects.

One trade-off, however, is the master bedroom’s modest two-panel wardrobe, which might not satisfy those craving extra storage. Still, this sort of compromise has become quite typical in recent launches.

Future Mass Supply in the Area

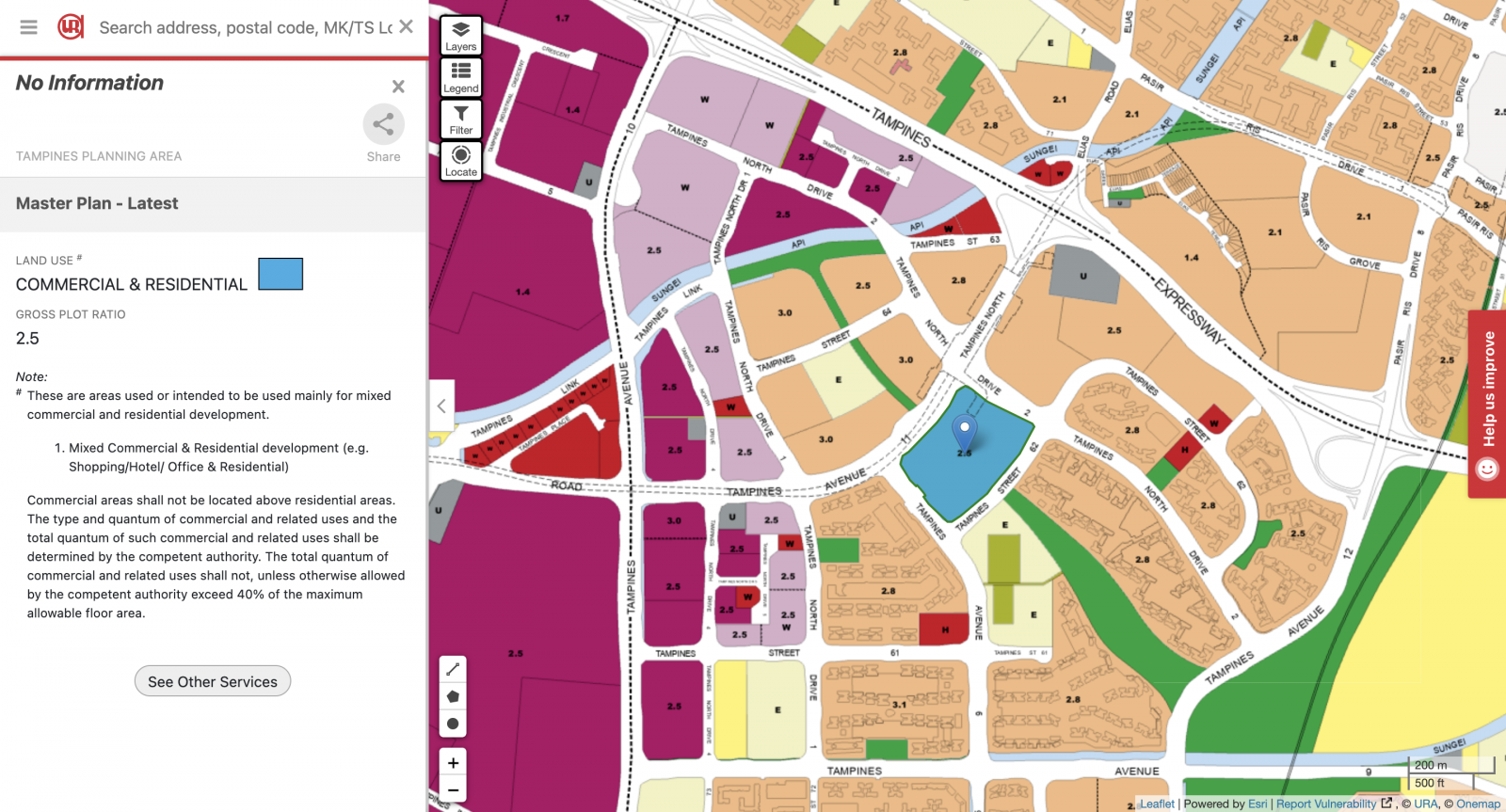

A quick glance at the URA Master Plan reveals that Parktown Residence sits on one of the largest plots of residential-zoned land in the heart of the Tampines North estate.

With a growing population anticipated in this area, it’s clear that Parktown’s mall component is poised to become a key amenity to service the vicinity.

Currently, Tenet stands as the only confirmed (and fully sold) project in this emerging precinct, but it’s likely just the first of many upcoming developments. While it remains uncertain whether future residential sites will be zoned for HDBs or private condos, the broader outlook points to continued growth in Tampines North.

What truly distinguishes Parktown Residence is its status as an integrated development. According to the latest Master Plan, it could remain the only project of its kind here for some time. Nonetheless, future developments may still fall within walking distance of Tampines North MRT, granting convenient access to the station and the on-site mall.

Ultimately, the key question is whether buyers will find it worth paying a premium for the convenience of living directly above a mall, bus interchange, and other amenities—and, crucially, how steep that premium might be.

So, is Parktown Residence worth a look?

Tampines as a whole has seen significant price growth in recent years, but for those seeking a more budget-friendly entry into the district, Tampines North may present a viable alternative. Still, it remains very much a work in progress, lacking the extensive amenities and established neighbourhood appeal that define Tampines Central—features that some buyers are willing to pay a premium for.

On the other hand, a quieter environment might be exactly what some people want. However, if you’re set on living near Tampines’s well-known mall cluster, Tampines North likely won’t fit the bill just yet.

As an integrated development, Parktown Residence will almost certainly command a premium over any future neighbouring projects—provided those turn out to be private launches, which is still unconfirmed. That raises a key question for buyers: How much are you willing to pay for direct, on-site access to amenities such as a mall, hawker centre, and bus interchange? Future developments may offer comparable proximity, but they won’t replicate the convenience of having everything right beneath your home.

For some, the potential cost savings of a non-integrated project could outweigh the benefit of built-in amenities. For others, the seamless convenience of integrated living justifies the higher cost. Ultimately, details like pricing, unit layouts, and the overall execution of Parktown Residence’s ‘convenience promise’ will determine whether it meets buyers’ expectations—and whether Tampines North truly lives up to its potential as the next key residential hub.

When Parktown Residence launches (it’ll be in February, after 2025’s Chinese New Year lull period), all eyes will be on its prices. So, follow us on Stacked for a more thorough review of it when more details are made available.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Cheryl Teo

Cheryl has been writing about international property investments for the past two years since she has graduated from NUS with a bachelors in Real Estate. As an avid investor herself, she mainly invests in cryptocurrency and stocks, with goals to include real estate, virtual and physical, into her portfolio in the future. Her aim as a writer at Stacked is to guide readers when it comes to real estate investments through her insights.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

0 Comments