Is Lentor Central Residences Worth A Look With 3 Bedders Priced From $1.813m?

February 22, 2025

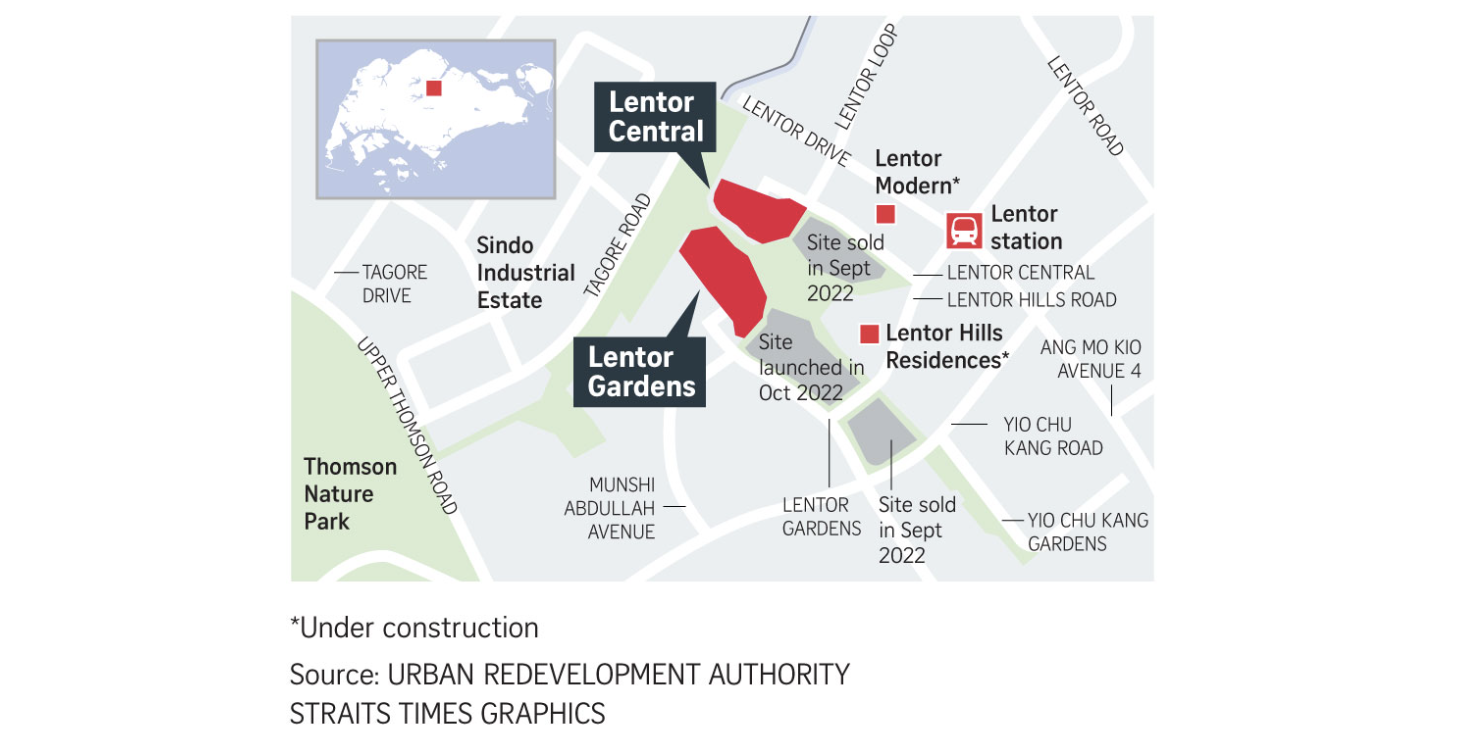

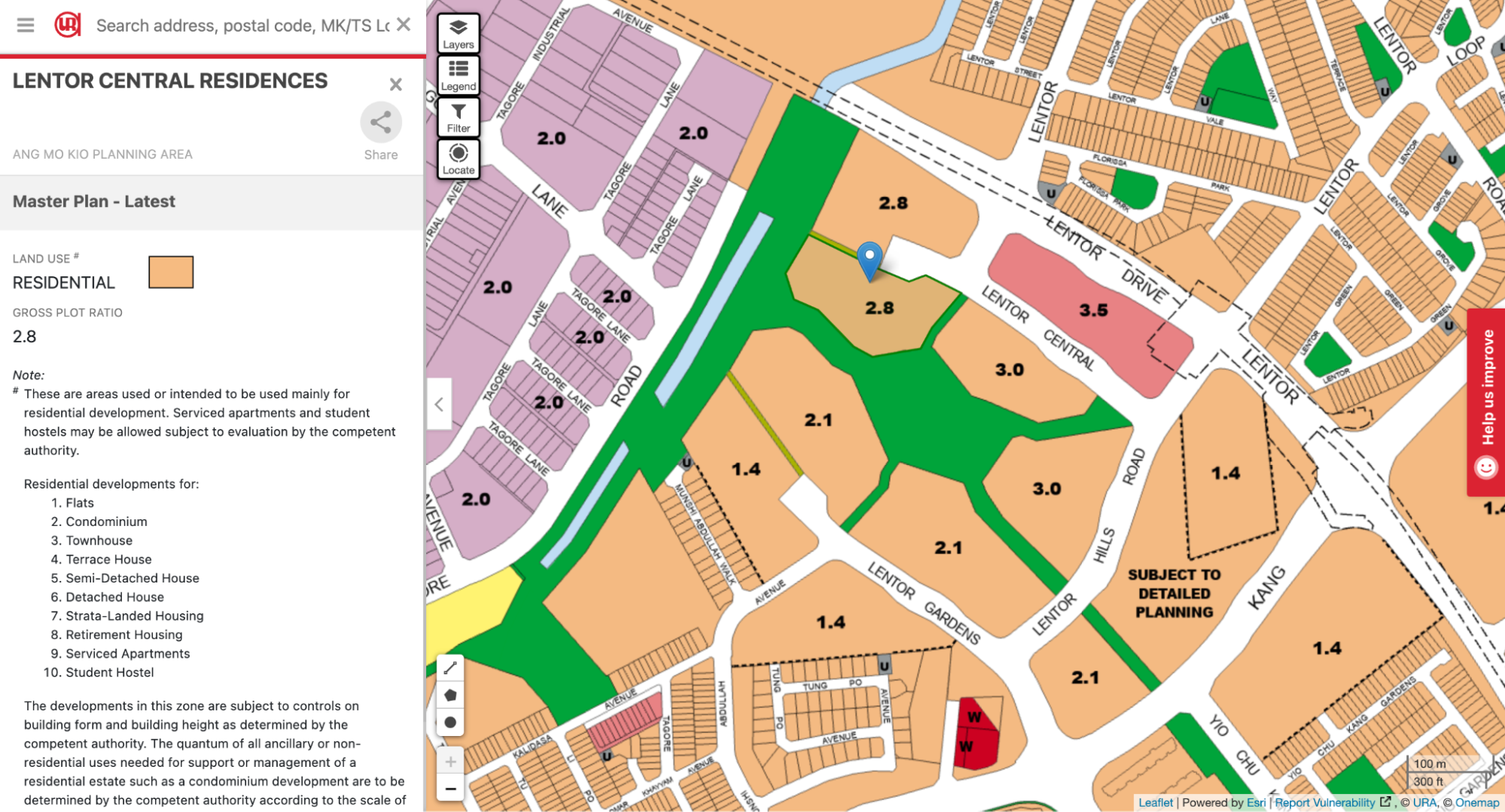

Once a quiet forested enclave, the URA has strategically mapped out Lentor for 11 residential plots. Seven plots have been launched so far, and today’s launch in question, Lentor Central Residences is the latest entrant to this much-evolved area.

Most buyers who haven’t kept in touch with the market may be wondering if there’s an oversupply in the area, but the reality is that most of the projects here have seen strong take-up rates. Here’s how they’ve performed so far:

- Lentor Modern – Fully sold

- Lentor Hills Residences – 99% sold

- Hillock Green – 86% sold

- Lentoria – Around 70% sold

- Lentor Mansion – Fully sold

So while there’s been a steady stream of new launches, the truth is that available options in Lentor are already thinning out. In any case, Lentor Central Residences is set to launch with an indicative starting price of $975,000 (around $2,105 psf). Which all things considered, is an attractive price point in today’s new launch market in 2025.

Let’s take a look at what sets Lentor Central Residences apart from the other launches in the area so far.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Overview of Lentor Central Residences

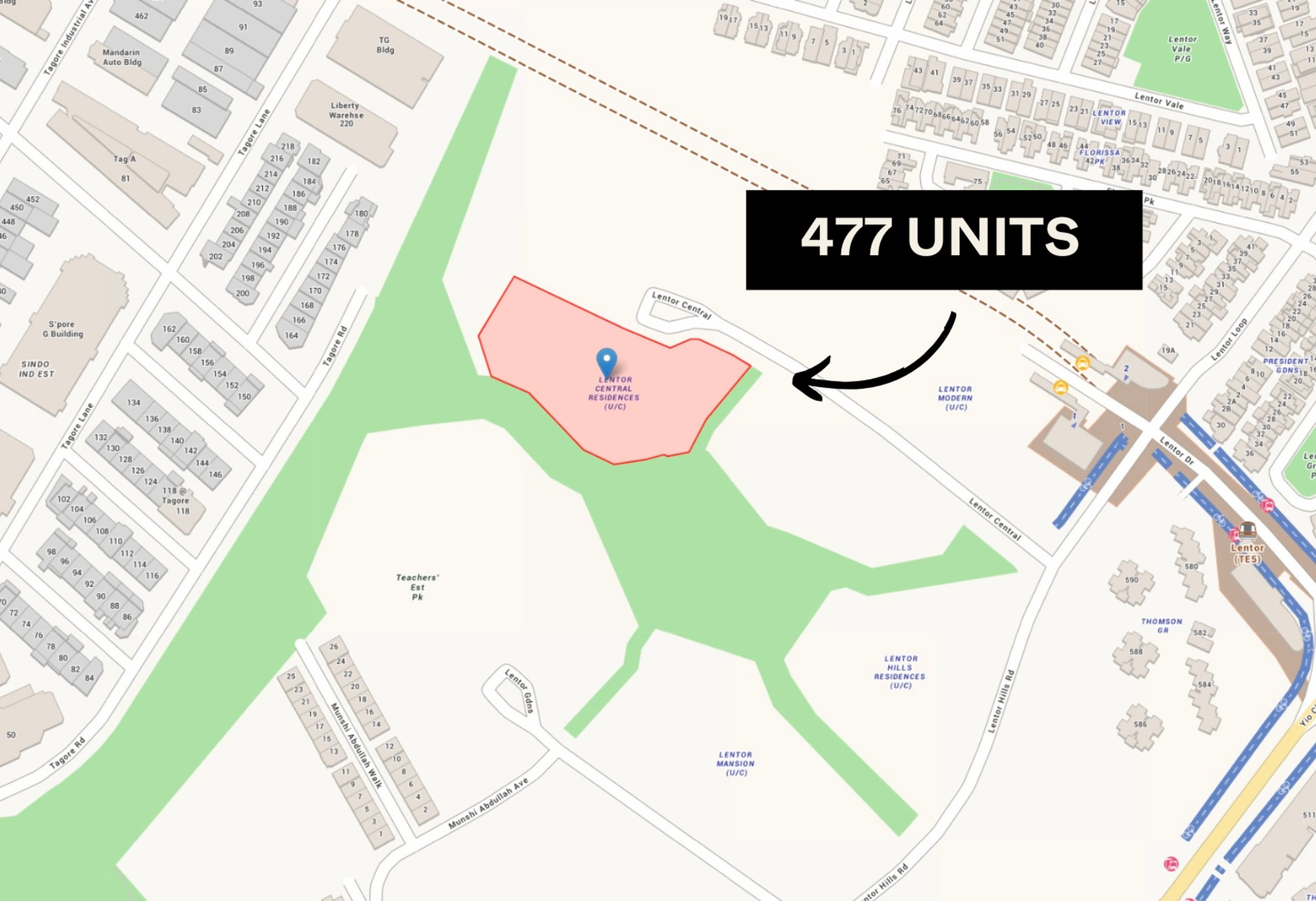

Lentor Central Residences is the sixth new launch in Lentor (District 26)—a 477-unit leasehold condominium developed by Hong Leong, GuocoLand, and CSC Land.

The development consists of two blocks—one at 28 storeys and the other at 27 storeys—spanning a total of 158,263 square feet of land.

It’s positioned along Lentor Central, overlooking the upcoming Hillock Park. It is flanked by Hillock Green (a non-GuocoLand project) and an undeveloped site yet to be launched. Across from it is the seventh GLS site (Lentor Gardens) which is still open for tender.

Notably, it is one of the closest projects to Lentor Modern, the only integrated development in the estate. It goes without saying that this will be an added advantage, given that Lentor is still in its early growth phase with limited amenities.

For now, Lentor Modern’s retail podium will serve as the estate’s primary mall and lifestyle hub. Also, while it’s not an integrated project, residents of Lentor Central Residences would still enjoy a similar level of convenience to these amenities by walking across the road – and potentially save up on the integrated premium that Lentor Modern’s residents had to pay upfront.

The unit offerings at Lentor Central Residences range from 1- to 4-bedroom configurations, fairly standard across its neighbours. Here’s a quick breakdown:

| Unit Type | Size (sq ft) | Total Units | Unit Breakdown |

| 1 Bedroom | 463 | 53 | 11.6% |

| 1 Bedroom + Study | 581 | 2 | |

| 2 Bedroom | 678/689 | 79 | 44% |

| 2 Bedroom + Study | 786/797 | 131 | |

| 3 Bedroom | 915 | 53 | 22.2% |

| 3 Bedroom Premium | 1,076 | 53 | |

| 4 Bedroom | 1,184 | 53 | 22.2% |

| 4 Bedroom Premium | 1,399 | 53 |

Lentor Central Residences is also the second project under the new GFA harmonisation guidelines (after Lentor Mansion, which has since fully sold out). This means AC ledges are no longer counted in the unit’s square footage, resulting in more efficient layouts—a key selling point in this particularly competitive landscape.

Another interesting observation is the higher proportion of two-bedders in what is largely considered a family-oriented neighbourhood—where most would expect a stronger focus on three-bedders and above. At first glance, this might seem at odds with the area’s demographic, but the larger share of 2+ study units suggests a more strategic approach.

For families who want to enter the Lentor market but find a three-bedder out of reach, a 2+Study could serve as a more affordable alternative—offering just enough flexibility for a compact workspace, nursery, or even a small bedroom for a young child. It’s a compromise on space, but not necessarily on functionality.

In comparison, here’s how the unit mix stacks up against its neighbours:

- Lentor Modern: 1- to 4-bedrooms (527 – 1,432 sq ft)

- Lentor Hills Residences: 1- to 4-bedrooms (452 – 1,399 sq ft)

- Hillock Green: 1- to 5-bedrooms (500 – 1,572 sq ft)

- Lentoria: 1- to 4-bedrooms (538 – 1,345 sq ft)

- Lentor Mansion: 2- to 5-bedrooms (520 – 1,507 sq ft)

From what we hear on the ground, Lentor Central Residences may have an edge over its neighbours due to its more efficient floorplans, a direct result of both the GFA harmonisation guidelines and the developer’s iterative design improvements based on feedback from previous buyers.

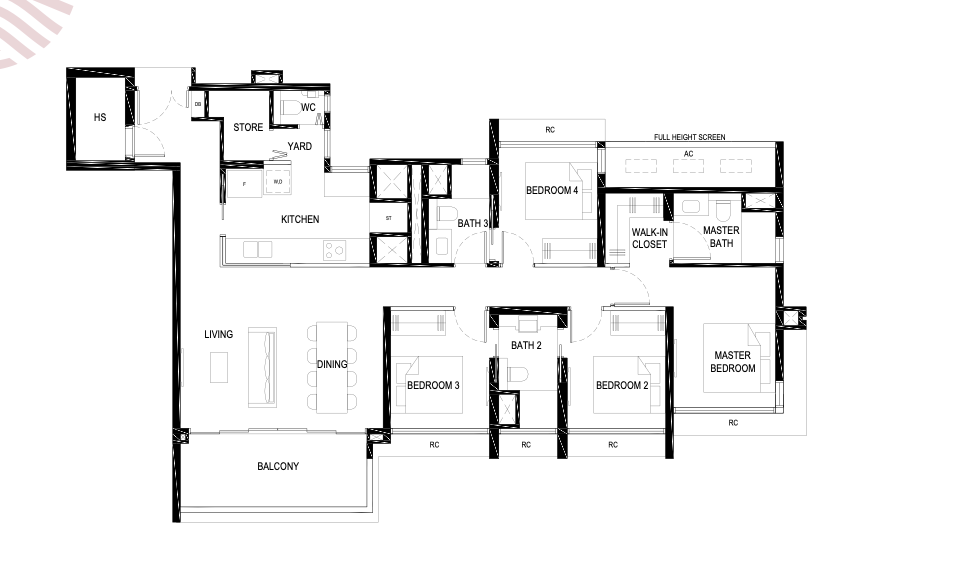

Take, for example, the 4-bedroom premium unit, which comes in at 1,399 square feet:

One common complaint about older layouts is the lack of storage space. At this size, though, the unit includes a household shelter, a dedicated storage space, and an enclosable yard—a first for most projects in the Lentor area.

The layout also features three bathrooms and a wide frontage in the living area which many buyers appreciate. Meanwhile, the master bedroom is sized quite generously, with enough room for a walk-in closet.

It’s evident that the developer is taking buyer feedback into account by refining the layouts of newer projects to offer something more efficient and functional for the typical family in Singapore. And if this is the new benchmark for Lentor, it’s certainly a step in the right direction (at least, for the other unreleased projects in the pipeline).

In terms of facilities, Lentor Central Residences offers a full suite, including:

- 50m lap pool

- Tennis court

- Clubhouse and gym

- Landscaped gardens and relaxation decks

One noteworthy feature is the inclusion of Sky Facilities, allowing even residents on lower floors to enjoy elevated views of the surroundings. There will also be a childcare centre located within the residence.

While this is a thoughtful touch, it’s worth noting that the unblocked skyline may not remain that way for long. The adjacent site facing the landed enclave is also zoned for high-rise development, meaning future projects could eventually obstruct some views. Buyers who prioritise an unblocked outlook should factor this into their decision-making.

The project also offers a 1:1 carpark lot ratio, which is uncommon in newer developments, especially given its close proximity to Lentor MRT (TEL). There are also two EV charging lots, though this will be confirmed closer to its official launch.

The expected TOP for Lentor Central Residences is in Q3 2028.

The Location of Lentor Central Residences

For those familiar with Lentor, its biggest appeal has always been its low-density, green surroundings. But with 11 new residential plots in the pipeline, the question is: how much of this tranquillity will remain in the years to come?

While the official renders for Lentor Central Residences showcase unblocked greenery, buyers should temper expectations—what’s visible today may not be the final landscape once all developments are completed over the next decade.

Neighbouring landed enclaves like Teachers’ Estate offer a sense of exclusivity, but this comes at the cost of accessibility.

More from Stacked

One Pearl Bank Review: Impressive Architecture, Great Location, But Could Be Impractical For Some

One cannot begin to talk about One Pearl Bank without a short history of its predecessor, Pearl Bank Apartments. Dominating…

While shopping malls like Thomson Plaza and AMK Hub are nearby, they aren’t within walking distance. That gap will be partially bridged once Lentor Modern is completed, bringing a supermarket, and retail options to the doorstep of future residents. That said, as the only commercial hub in the estate, footfall at the mall is expected to be high.

One major advantage of Lentor Central Residences is that residents won’t have to wait to enjoy these conveniences. With Lentor MRT (TEL) already operational and Lentor Modern expected to TOP in 2026, much of the groundwork for a self-sufficient estate will already be in motion by the time residents of Lentor Central Residences move in.

For families prioritising school access, CHIJ St. Nicholas Girls’ School is a key draw.

However, whether Lentor Central Residences falls within its 1km radius remains unconfirmed, as Onemap has yet to provide a definitive answer. If school proximity is a deal-breaker, it’s worth verifying whether your preferred unit stack sits within the boundary.

For reference, Lentor Hills Residences is within 1 km of both Anderson Primary and CHIJ St. Nicholas, making it a potential alternative for those who want to secure a place for their children in these sought-after schools.

Lentor Central Residences Indicative Pricing

For those keen on pricing, here’s a look at the indicative starting prices for Lentor Central Residences:

- 1-Bedroom: From $975,000 (~$2,110 psf)

- 2-Bedroom: From $1.388M (~$2,050 psf)

- 3-Bedroom: From $1.813M (~$1,984 psf)

- 4-Bedroom: From $2.368M (~$2,000 psf)

Notably, Lentor Central Residences secured the lowest land price ($PSF PPR) among the six Lentor sites at $982 psf ppr —which might come as a surprise to some – but do note that as a GFA harmonisation project this was expected to be lower, and in line with what GuocoLand paid for Lentor Mansion.

This GLS exercise had just two bidders, with the winning bid only 5.9 per cent higher than the second—suggesting a measured but steady demand.

Of course, this doesn’t necessarily translate into lower launch prices. With most of the Lentor projects controlled by the same developers, undercutting each other on price is unlikely.

To put things into perspective, here’s how Lentor Central Residences stacks up against its neighbours:

| Project | Launched | Developer | $PSF PPR | Starting Prices ($psf) | No. of Bidders |

| Lentor Central Residences | 2025 | GuocoLand and Hong Leong Group | $982 | $1,984 | 2 |

| Lentor Modern (Integrated Project) | 2022 | GuocoLand | $1,204 | $1,880 | 9 |

| Lentor Hills Residences | 2023 | GuocoLand, Hong Leong & TID | $1,060 | $1,834 | 4 |

| Hillock Green | 2023 | CCCC, Soilbuild Holdings & United Engineers | $1,108 | $2,108 | 3 |

| Lentor Mansion | 2024 | GuocoLand and Hong Leong Group | $985 | $2,082 | 1 |

| Lentoria | 2024 | TID | $1,130 | $1,965 | 2 |

Lentor Modern set a record when it was sold at $1,204 psf ppr—the highest GLS price for an OCR project at the time. To put this into perspective, it outpriced the recent Park Town Residences—Tampines’ first integrated project—where the site was sold at $885 psf ppr.

And let’s not forget: every single Lentor site is within a short walk of Lentor Modern, meaning buyers here will still benefit from proximity to an integrated development—without necessarily paying the premium that comes with buying directly within one. This proximity could help sustain demand, particularly for those who prioritise accessibility to amenities but prefer a lower entry price.

What About the Current Resale Market?

Resale activity in Lentor has been fairly robust. Here’s a look at Lentor Modern’s recent transactions – though keep in mind that this is the sole integrated project within this estate.

| Contract Date | Address | Unit area (SQFT) | Price ($PSF) | Price ($) |

| 19 Jan 2025 | 3 Lentor Central #2X-XX | 1,130 | 2,126 | 2,403,000 |

| 9 Oct 2024 | 3 Lentor Central #2X-XX | 1,109 | 2,384 | 2,643,000 |

| 21 Sep 2024 | 7 Lentor Central #2X-XX | 527 | 2,468 | 1,301,460 |

| 30 Aug 2024 | 3 Lentor Central #2X-XX | 1,130 | 2,220 | 2,509,000 |

| 26 Jul 2024 | 3 Lentor Central #2X-XX | 969 | 2,313 | 2,241,000 |

| 1 Jul 2024 | 7 Lentor Central #2X-XX | 1,109 | 2,436 | 2,701,000 |

| 18 May 2024 | 3 Lentor Central #2X-XX | 1,130 | 2,194 | 2,480,000 |

| 2 May 2024 | 3 Lentor Central #2X-XX | 1,130 | 2,157 | 2,438,000 |

| 24 Apr 2024 | 5 Lentor Central #2X-XX | 1,130 | 2,178 | 2,462,000 |

And here’s how Lentor Hills Residences is performing in the resale market:

| Contract Date | Address | Unit area (SQFT) | Price ($PSF) | Price ($) |

| 19 Jan 2025 | 31 Lentor Hills Road #01-XX | 1,346 | 2,071 | 2,787,000 |

| 12 Jan 2025 | 37 Lentor Hills Road #18-XX | 581 | 2,407 | 1,399,000 |

| 11 Jan 2025 | 39 Lentor Hills Road #08-XX | 1,302 | 2,146 | 2,795,000 |

| 22 Dec 2024 | 31 Lentor Hills Road #01-XX | 603 | 2,213 | 1,334,000 |

| 10 Dec 2024 | 39 Lentor Hills Road #02-XX | 1,399 | 2,087 | 2,920,000 |

| 3 Dec 2024 | 37 Lentor Hills Road #17-XX | 581 | 2,395 | 1,392,000 |

| 23 Nov 2024 | 37 Lentor Hills Road #14-XX | 1,356 | 2,168 | 2,941,000 |

| 16 Nov 2024 | 35 Lentor Hills Road #14-XX | 1,098 | 2,208 | 2,424,000 |

| 15 Nov 2024 | 37 Lentor Hills Road #15-XX | 1,356 | 2,176 | 2,951,000 |

| 14 Nov 2024 | 37 Lentor Hills Road #21-XX | 1,356 | 2,222 | 3,013,000 |

| 10 Nov 2024 | 35 Lentor Hills Road #17-XX | 1,098 | 2,239 | 2,458,000 |

| 9 Nov 2024 | 33 Lentor Hills Road #17-XX | 1,356 | 2,196 | 2,979,000 |

| 4 Nov 2024 | 35 Lentor Hills Road #18-XX | 1,098 | 2,249 | 2,469,000 |

| 1 Nov 2024 | 37 Lentor Hills Road #01-XX | 1,356 | 2,071 | 2,809,000 |

| 31 Oct 2024 | 35 Lentor Hills Road #19-XX | 1,098 | 2,260 | 2,481,000 |

| 30 Oct 2024 | 37 Lentor Hills Road #16-XX | 1,356 | 2,183 | 2,961,000 |

| 26 Oct 2024 | 37 Lentor Hills Road #17-XX | 1,356 | 2,191 | 2,972,000 |

| 22 Oct 2024 | 37 Lentor Hills Road #18-XX | 1,356 | 2,199 | 2,982,000 |

| 4 Oct 2024 | 35 Lentor Hills Road #15-XX | 1,098 | 2,209 | 2,425,000 |

| 2 Oct 2024 | 35 Lentor Hills Road #16-XX | 1,098 | 2,219 | 2,436,000 |

From here, it seems that the market has largely accepted Lentor’s pricing trajectory, with transactions suggesting that prices in the area have stabilised. Given the consistent demand seen across recent launches, it seems the $2,100 – $2,200 psf range has been normalised.

Considering the number of projects introduced here in such rapid succession, there’s quite a bit of competition: future gains boil down to better layouts, premium-facing stacks, or more attractive finishing and facilities.

The Flip Side: Pricing Power

With four out of six confirmed launches under its belt—including today’s focus, Lentor Central Residences—GuocoLand’s presence in the area is hard to miss.

GuocoLand has long positioned itself as a “placemaker”, taking a long-term stake in shaping precincts—much like it did with Midtown Modern and Midtown Bay in the Beach Road area. From that perspective, their dominance in Lentor is part of a broader strategy rather than a one-off play.

Naturally, controlling most of the supply also gives GuocoLand significant pricing power. With limited competition, there’s no pressure to undercut previous projects—meaning prices will likely remain stable (if not inch upwards).

So, while Lentor Central Residences secured the lowest GLS land price, it doesn’t automatically translate to a more affordable launch. Instead, pricing will depend on overall market sentiment and demand.

Looking ahead, the seventh Lentor site closes for tender on 13 April 2025, but with so many launches already in play, analysts expect cautious bidding for this particular site.

As for Lentor Central Residences, it is in an interesting position—not the first project in the area, but also not the last. Holding one of the lowest $PSF PPR land prices in Lentor is an advantage, though whether that translates into more attractive pricing for buyers is still open to question.

What does stand out, however, is the more efficient layouts compared to some of its neighbours, and as the second project with the new GFA harmonisation rules applied, it could offer even better space optimisation (and edge).

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Cheryl Teo

Cheryl has been writing about international property investments for the past two years since she has graduated from NUS with a bachelors in Real Estate. As an avid investor herself, she mainly invests in cryptocurrency and stocks, with goals to include real estate, virtual and physical, into her portfolio in the future. Her aim as a writer at Stacked is to guide readers when it comes to real estate investments through her insights.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

2 Comments

Very informative read! Can you also do a new launch rating review for Lentor Central?