Is $525k For The New Mount Pleasant BTO Site Worth It? Here’s A Quick Review

March 7, 2025

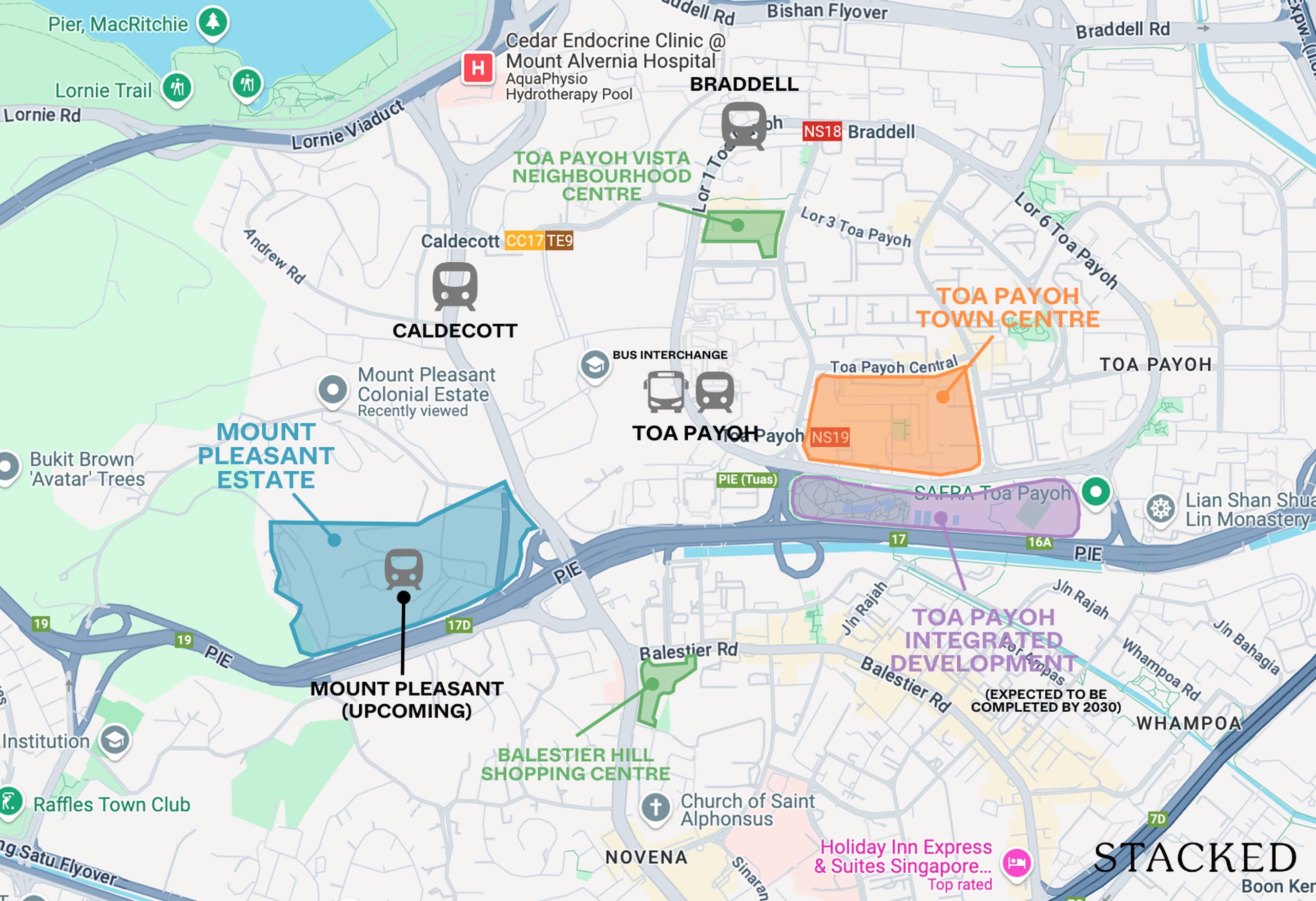

The first BTO flats in the new Mount Pleasant estate are launching in October 2025. Consisting of around 1,500 new flats, it’s part of six planned BTO projects for this estate. Once all the projects are complete, Mount Pleasant will be a town with about 5,000 homes. But for now, what can we tell about the first 1,500 flats? Could this be the big launch of 2025, and a windfall in the future?

Details of the Mount Pleasant Launch in October 2025

The October launch will include about 1,500 flats, including 2-room, 3-room, and 4-room units. Several public rental flats will also be available, although the number of these has not yet been disclosed. Most notably, this project will have residential blocks exceeding 40 storeys.

Speculatively, units on the higher floors facing south may get panoramic views towards Marina Bay or the Central Business District (CBD). This could make the view comparable to high-rise units in nearby Toa Payoh and Novena, where city-facing flats command a premium.

Some blocks may also overlook MacRitchie Reservoir and the Central Catchment Reserve, offering an excellent greenery view.

We would hope, however, that the project avoids facings toward the PIE. Highway facings are busy and noisy, unless you’re on a high-enough floor.

Mount Pleasant township – of which the October launch is just the first part – consists of a 33-hectare estate, with six planned BTO projects that will total around 5,000 homes.

The October BTO project is expected to be in the Plus or Prime category. Plus and Prime flats come with tighter resale and rental restrictions, such as a 10-year Minimum Occupation Period (MOP) and subsidy clawback upon resale.

This new estate will also include heritage conservation efforts, with six conserved buildings including the Old Police Academy.

A quick review of the location

Let’s start with the double-edged swords of this location: Thomson Road and the PIE. The BTO land parcel appears to be situated between these two major roads; so on the one hand, this project has excellent road connectivity to Novena, Toa Payoh, and Orchard Road. On the other hand, some buyers may not appreciate the noise and congestion. It could drive demand for high-floor units that are spared the noise, both during initial sales and at relaunch.

Besides this, the area offers mainly positives:

1. Access to the TEL via Mount Pleasant MRT station

Mount Pleasant MRT station is between Stevens and Caldecott stations (TEL 10). This is significant as Stevens provides access to the DTL, while Caldecott provides access to the CCL. As such, some might consider the residents to have access to three different lines.

It’s also important to note that from Mount Pleasant, it’s only four stops to Orchard. This would make Mount Pleasant one of the closest HDB estates to Singapore’s main shopping belt.

More from Stacked

A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

Veteran property investors, as well as industry professionals, tend to know what to expect from a developer’s name. This is…

The opening of the Mount Pleasant station is slated to coincide with the launch of the new township.

2. Proximity to Toa Payoh Integrated Development and HDB hub

The HDB Hub/Toa Payoh Hub probably needs no introduction. This serves as a major commercial and transport hub in the heart of Toa Payoh, and houses offices, retail shops, eateries, and banking services. Because it’s so close to Mount Pleasant, the residents have access to good amenities from the very start of the new township.

In addition to this, the Toa Payoh Integrated Development (this may not be the final name of the project) is set to launch in 2030. This integrated development is a major community hub and will include a new polyclinic, library, and sports facilities, as well as the usual retail and dining.

3. Unusual blend of urban centrality and MacRitchie’s greenery

This is probably the most unique aspect of Mount Pleasant. The estate is near MacRitchie Reservoir and the Central Catchment Reserve, where residents have access to outdoor activities (hiking, kayaking, etc.) To our knowledge, this is the only centrally located HDB township that provides so much outdoor space nearby.

This can be seen as a best-of-both-worlds arrangement, as you’re usually forced to choose between “ulu” areas with green spaces, or densely packed but convenient urban areas. Mount Pleasant strikes a good balance between the two.

4. First-mover advantage for the new township, even with the extended MOP

Mount Pleasant seems bound to be a highly desirable location; so securing the first BTO project in this area is getting in on the ground floor. It’s likely that, as more of the six projects launch – and more nearby amenities are completed – we’ll see increasingly higher prices in future.

This advantage is muted by Prime/Plus property restraints: a 10-year MOP, Subsidy Recovery, and eligibility restrictions on resale buyers (including the income ceiling) prevent this from being the windfall it would otherwise be. That Plus/Prime housing lacks 5-room flats is also a notable drawback. However, given the strength and uniqueness of the location, Mount Pleasant flats could see strong gains despite the limitations.

Overall, we expect very strong demand for this project come October. We would be surprised if the 1,500 units aren’t oversubscribed several times over, and grabbing a unit here will require a lot of luck.

For more on the Singapore property market and its upcoming changes, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

When will the first Mount Pleasant BTO flats be available for sale?

What types of flats will be available in the Mount Pleasant BTO launch?

What are the potential views from the new Mount Pleasant flats?

What are the main advantages of the Mount Pleasant location?

Are there any restrictions on resale or rental for the new flats in Mount Pleasant?

Why might the Mount Pleasant flats be highly sought after despite some drawbacks?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

0 Comments