An In-depth Update Of 88 New Launch Condos: Have Prices Risen Or Fallen?

February 13, 2021

“You’ll make instant profit”, the sales team will tell you, “if you buy at a discount now, and then the prices rise in a few months”. It’s a familiar sales pitch in many show flats; and to Singapore’s property investors and home buyers, early-bird discounts are expected at launch. But is it true?

The most honest answer would be “Sometimes, and to varying degrees”. Assuming prices really do rise later, some new launch condos might net you a double-digit percentage increase…and some might net you a few hundred dollars. Here’s a comprehensive look at how prices can change (both positively and negatively) for 88 new launch condos so far.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

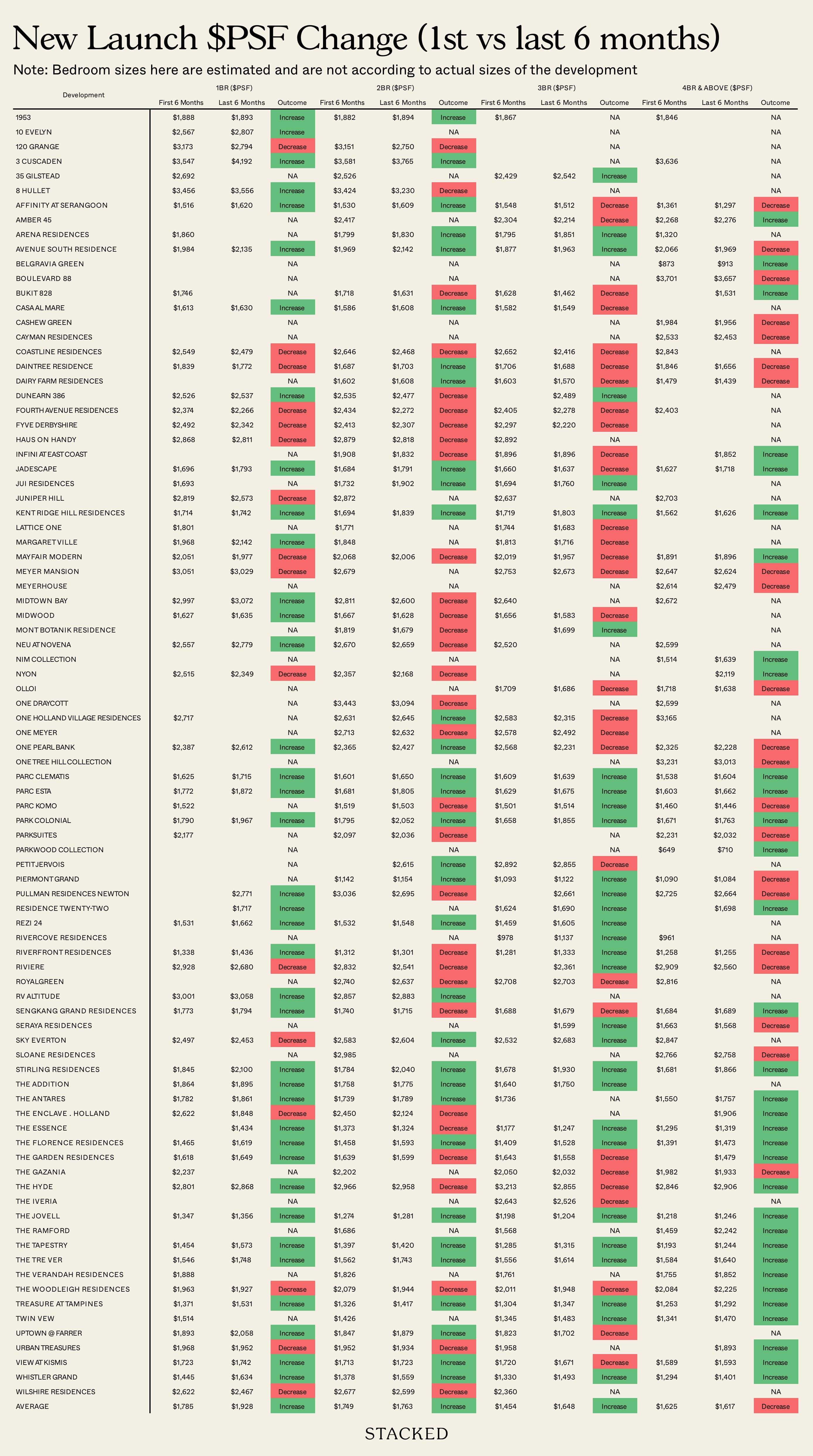

88 new launch condo gains at a glance:

First off, there are two things to note:

We are showing a snapshot of the selling performance of a new launch condo 6 months after it has launched, and comparing it to 6 months before today. Which is why many of the newer condo launches in 2020/2021 will not be featured due to the minimum 1 year timeline the new launch condo would need to have.

Second, we divided it down into categories: 1 bedroom, 2 bedroom, 3 bedroom, and 4 bedroom and above as that would give you a more accurate overview of how the development is actually doing. Note that the bedroom sizes are based on a typical range, and not according to the actual sizes of the development.

The division of the different units is as such:

1 Bedroom Units: Less than 600 sqft

2 Bedroom Units: 600 – 850 sqft

3 Bedroom Units: 850 – 1,200 sqft

4 Bedroom Units and above: More than 1,200 sqft

So these were the results:

How does the unit size matter?

If we compare average prices between the first and last six months of the year, we can see that most – but not all – developments really do start raising prices later.

Note that, in a loose sense, it’s the smallest, or largest units that tend to see a quick pick-up:

| Increased Prices | Decreased Prices | No Data | |

| 1BR | 39 | 16 | 34 |

| 2BR | 33 | 31 | 25 |

| 3BR | 31 | 30 | 28 |

| 4BR & Above | 33 | 22 | 34 |

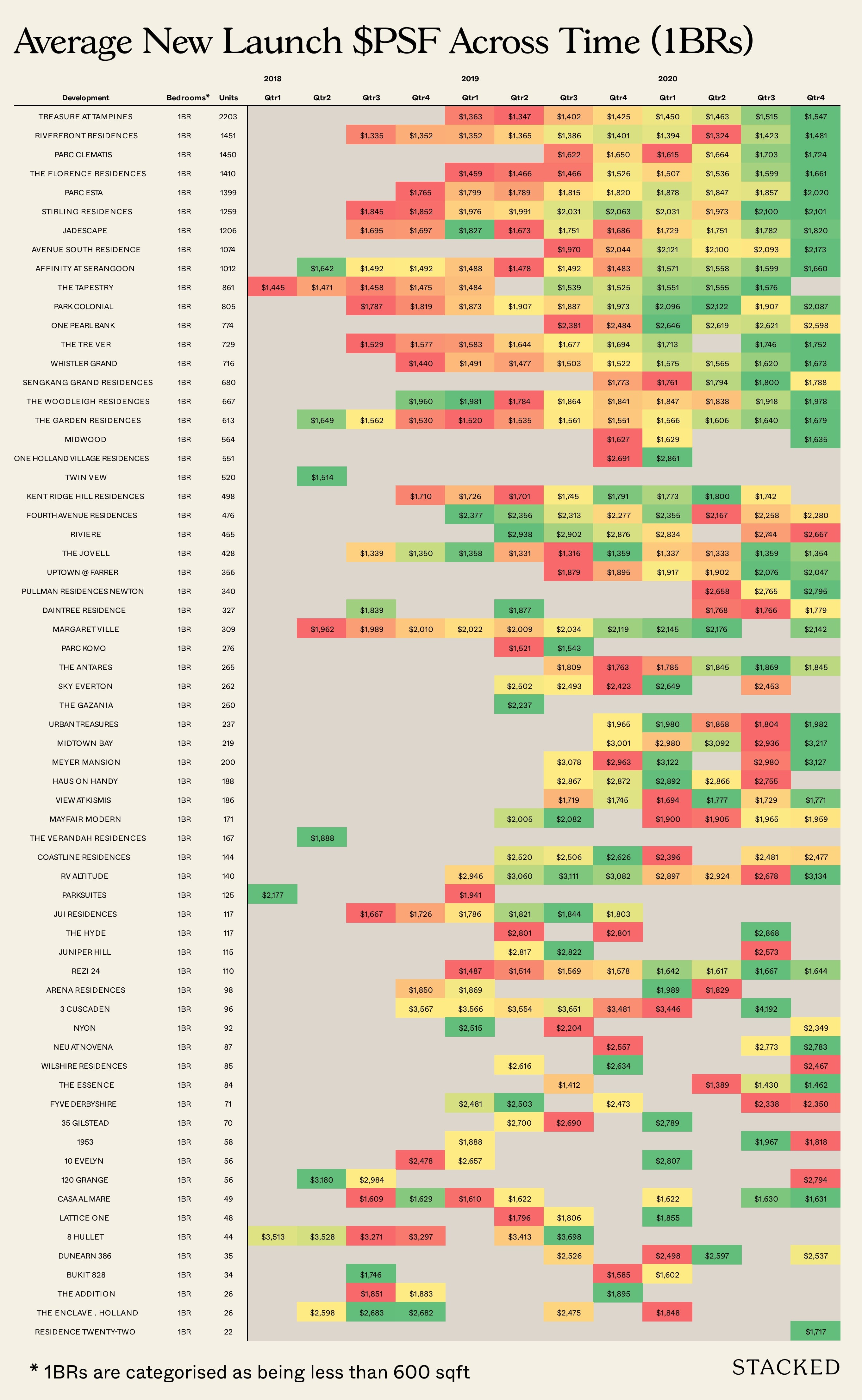

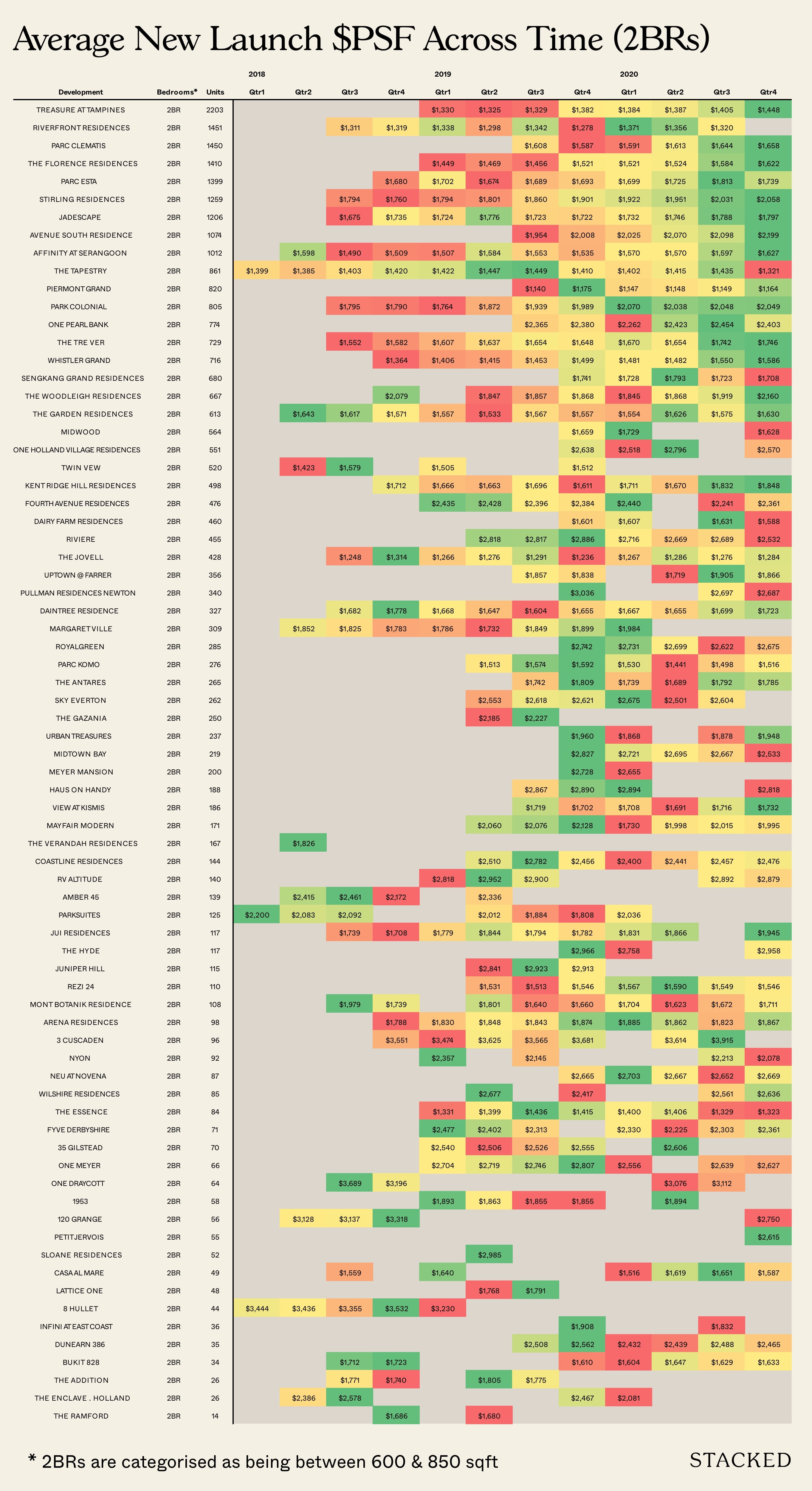

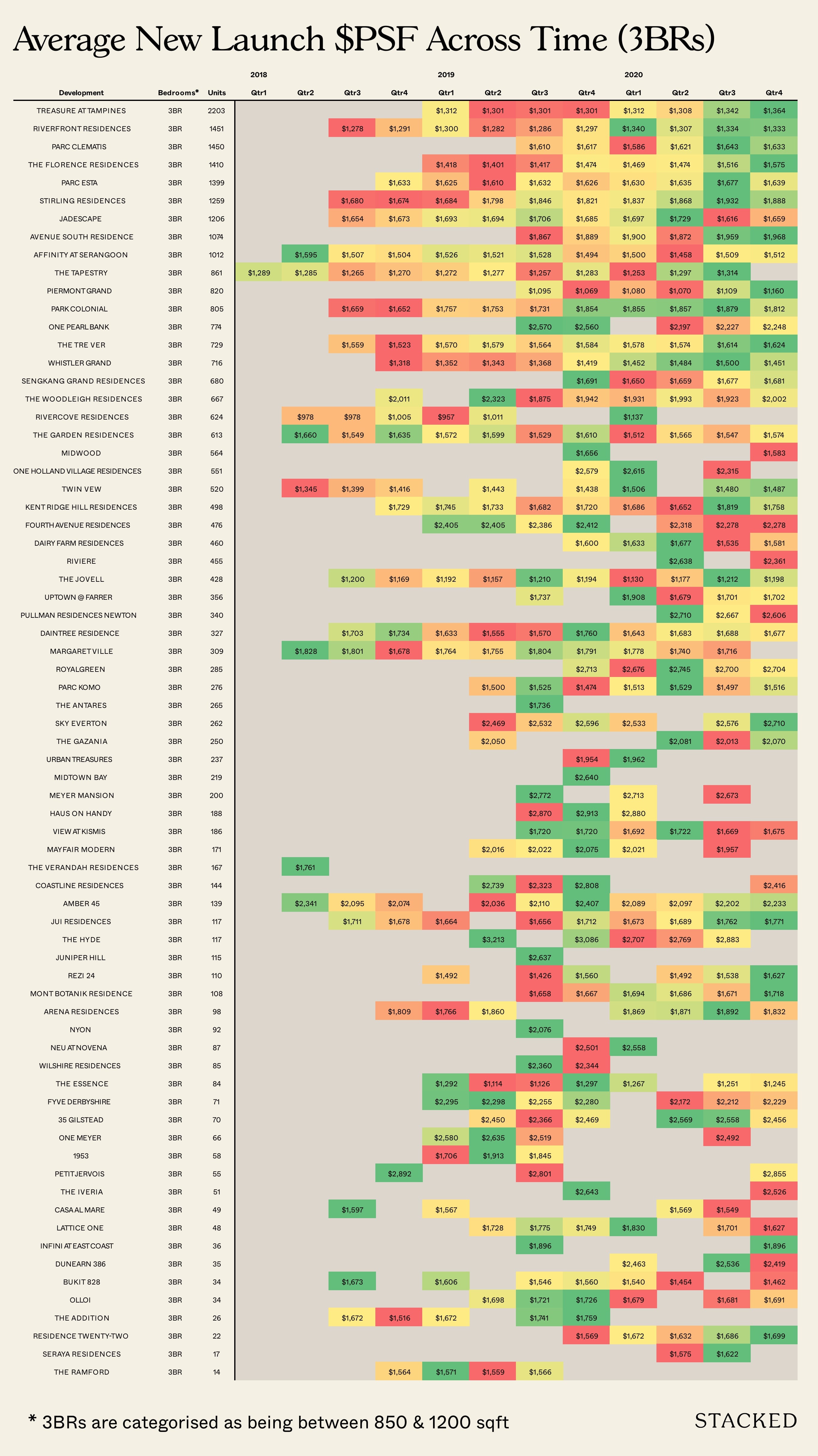

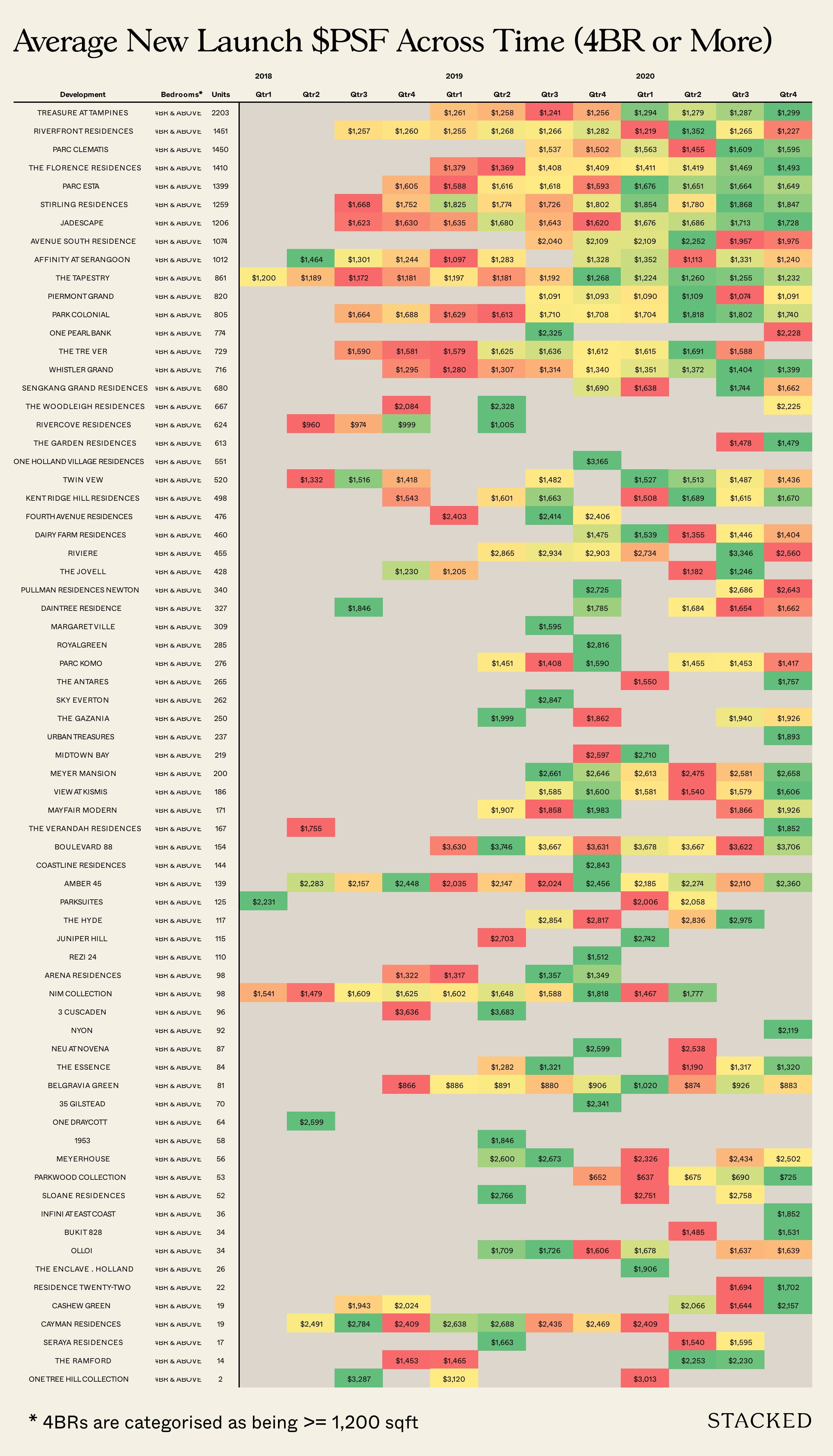

The following charts detail the quarterly average $PSF by development and unit size, and they are sorted by the number of units in the development.

With regard to single-bedders, for example, 39 developments saw gains, while only 16 saw decreases in price. For units that are four-room or larger, 33 developments on the list saw increases, while only 22 saw a decrease.

For the mid-sized two and three-bedder units, it’s almost a 50-50 split as to whether they’ll appreciate.

33 of the developments saw gains for two-bedders, while 31 saw decreases. Similarly, 31 developments saw gains for three-bedders, while 30 saw decreases.

(That said, some developments – such as Treasure at Tampines and Parc Esta – see increases across the board, regardless of the unit size).

Why do the smallest and largest units tend to do better?

One-bedders are, to be direct, the low-hanging fruit for the sales teams. These units tend to be loss leaders, and developers want to move them in volume early on.

These help with initial sales figures. while also pushing up the perceived price per square foot for the development. This works because one-bedders, or shoebox units, are characterised by a low quantum, but a high price per square foot.

Midtown Bay is a good example of this; despite being in the heart of Bugis, the one-bedders started from just $1.3 million (although as you’ll see from above, the units push past $3,000 psf at present).

Larger units have the opposite issue – they tend to be lower in terms of price per square foot, but cost more overall and are a tougher sell. This is most obvious with regard to landed developments.

For example, Belgravia Green is a landed development averaging $913 psf. But being a landed development, unit sizes range from 3,595 to 4,004 sq.ft., and the overall quantum is within the $2.7 million to $3.8 million range.

Due to the high quantum, these larger units – be they landed, penthouses, or just unusually big premium layouts – may be slow to move. As such, they may see more generous discounts.

Which developments have been rewarding for those who have bought in early?

To answer this question, we focused on three and four-bedder units across different developments. These constitute the bulk of units in most projects (they’re also the typical unit size chosen by families / HDB upgraders).

You can use the colour codes above to get a summary view of the better developments. In general, you’re looking for developments that start red, and end green:

Next we’ll look at the four-bedders, but you’ll notice the better developments are still the same ones:

Notice that there’s a general trend among the top developments

The same names tend to be repeated at the top; these are:

- Parc Esta (99.9% sold)

- Parc Clematis (75% sold)

- Riverfront Residences (93.2% sold)

- Stirling Residences (95.9% sold)

- The Florence Residences (69.2% sold)

- Treasure at Tampines (79.7% sold)

In addition, note that apart from Riverfront Residences, the above projects saw prices rise across all unit types; from one-bedders all the way to four-bedders. Unsurprisingly as well, these have all sold well thus far too.

1. Parc Esta

Location: Sims Avenue (District 14)

Developer: MCL Land

Lease: 99-years from 2018

Estimated TOP: 31 Dec. 2022

Number of units: 1,399 units

We have a full review of Parc Esta on Stacked.

Parc Esta is arguably one of the best located condos in its district, and we’d expect prices to keep rising for a long time yet. This condo is just across the road from the Eunos MRT station – but more importantly, it’s one train stop away from Paya Lebar.

Paya Lebar Quarter (PLQ) is a new commercial district; apart from the malls and eateries, it also has grade A office space. This makes nearby properties – including Parc Esta – well-positioned for both investors and home owners.

This one was also easy to see coming: Parc Esta sold 329 of its 450 released units on the first day of sales alone, so we’re not surprised that the price continued to climb after that.

2. Parc Clematis

Location: Jalan Lempeng (District 5)

Developer: Sing Haiyi Gold Pte. Ltd.

Lease: 99-years

Estimated TOP: 2023

Number of units: 1,468 units

We have a full review of Parc Clematis on Stacked.

If you see the linked review, you’ll see we rated Parc Clematis a 4/5 for pricing earlier in its launch. Units in this development – of all sizes and configurations – were competitively priced; and like Treasure at Tampines, the low initial price points were a major draw.

It was easy for the price to consistently rise, given the location. Clementi is gold at the moment, thanks to the growing development of the nearby One-North tech and media hub, as well as Buona Vista.

It also helps that the development is decently close to Clementi Mall and the accompanying MRT station.

3. Riverfront Residences

Location: Hougang Avenue 7 (District 19)

Developer: Oxley Holdings Ltd, KSH Holdings Ltd, SLB Development Ltd., Apricot Capital

Lease: 99-years

Estimated TOP: 2024

Number of units: 1,472 units (21 units are landed)

Prices started low for Riverfront Residences, particularly with regard to the one-bedders and landed units.

Without discounts, some of the one-bedders here (463 to 581 sq.ft.) had asking prices of around $650,000. Note that as of 2020, average rental rates for one-room units in Hougang averaged $4.11 pdf, or $1,755 per month. This would imply a potential gross rental yield of about 3.2 per cent, which quickly drew investor attention.

Also before discounts, the landed units, which are four-roomed terrace houses, were priced at around $2.42 million; this was an affordable option for those who wanted landed living, but not at the more typical $3.5 million price range.

At $1,200 to $1,300+ psf at the time of writing, prices are still attractively low here.

4. Stirling Residences

Location: Stirling Road (District 3)

Developer: Nanshan Group & Logan Property Holdings

Lease: 99-years

Estimated TOP: 2022

Number of units: 1,259 units

We have a full review of Stirling Residences on Stacked.

This was another development that we rated 4/5 for price earlier on. Stirling Residences was bound to see its price creep up fast, as this project is located in Queenstown. The HDB flats nearby already hint at demand for the location – the nearby Mei Ling Street is famous for producing a slew of million-dollar resale flats, despite the advanced lease decay.

It also helps that Stirling Residences is just 450 metres, or about a four-minute walk, from the Queenstown MRT station. As this is a city fringe location, residents are just around 10 minutes from the CBD.

5. The Florence Residences

Location: Hougang Avenue 2 (District 19)

Developer: Nanshan Group & Logan Property Holdings

Lease: 99-years from 2018

Estimated TOP: 31 March 2023

Number of units: 1,410 units

We have a full review of The Florence Residences on Stacked.

This development provides an alternative to Riverfront Residences (see above). The Florence Residences was one of the top sellers during the Covid-19 period, with 78 units sold in July 2020 at $1,559 psf.

The Florence Residences isn’t exactly close to the Hougang MRT station – it’s about 900 metres, or an 11 to 12-minute walk; but some home owners would consider it acceptable. The main advantages to the location are the upcoming Cross Island Line expansion, as well as Kovan being a bit of a foodie haven.

If prices at Riverfront Residences are rising, The Florence Residences will likely rise in tandem – the two are both mega-developments, with broadly comparable locations.

6. Treasure at Tampines

Location: Tampines Street 11 (District 18)

Developer: Sim Lian Group

Lease: 99-years

Estimated TOP: 2023

Number of units: 2,203 units

We have a full review of Treasure at Tampines on Stacked.

This is currently the largest private residential development in Singapore, with 2,203 units.

Since its inception, Treasure at Tampines has been regarded as one of the best priced condos in District 18. Near the initial launch, total prices for two-bedders started from just around $880,000, while the four-bedders were in the $1.5 million range.

Treasure at Tampines is also reasonably close to Tampines Hub, at a distance of around 750 metres (about nine minutes’ walk); the MRT station is also here. Bear in mind that Tampines is the regional centre of the east, making this project very well priced for its location.

The only worry, of course, is future competition – there are so many units in the development – and this is the first development in Singapore to have crossed the 2,000 unit mark.

You may notice that these developments all share a common trait: they’re mega-developments

All of the above projects have 1,000+ units. This gives a good hint as to why they’re priced low at the start, allowing for quick appreciation.

Developers in Singapore have a five-year time limit, to complete and sell everything in a project. The size of the project is immaterial – whether it has 18 units or 2,000+ units, the time limit is still five years. Failure to meet the deadline means paying a tax of 30 per cent on the land price.

This means that, for mega-projects, developers will emphasise a high volume of sales from the beginning. That makes it easier to find a value buy at the start, compared to exclusive or boutique developments.

But that being said, don’t assume mega-developments always translate to good investments. These projects have their own drawbacks – such as price-wars between competing landlords, and lower chances of en-bloc success. Even for pure home owners, you have to consider factors such as lack of privacy, or blocks that are more “closed in” due to lack of space.

Needless to say, there are many other developments that have dropped their prices since the initial launch. You might notice as well that many of these are located in the central areas, some of which include: Fourth Avenue Residences, Riviere, and Pullman Residences, just to name a few. We will definitely be exploring these in an upcoming article so stay tuned!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Do property prices in Singapore's new condos tend to go up or down after launch?

Which types of units in new launch condos are more likely to see price increases?

What are some of the top developments that have seen price increases after launch?

How does the size of a condo unit affect its resale price and appreciation potential?

Are mega-developments in Singapore good investment options?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

4 Comments

I see Piermont Grand, is there an $PSF Across Time from OLA too?

Great Infographics!