I’m A Retiree With $700k Looking To Settle Down: Is A Dual-Key Condo Or HDB Better?

July 29, 2022

Hello, Stacked!

I’m an avid reader of your site and I really enjoy the in-depth articles. Kudos to you all.

Even though I have left several comments on different articles over the years, none have ever appeared under the discussion. I don’t know why my comments are blocked.

Hence I decided to email instead…

I hope to consult you on the best strategy for my property purchase. I am unable to decide and stuck in decision paralysis as I have a plan in mind but it doesn’t seem feasible in the midst of rising property prices and due to my personal circumstances.

Okay, a bit of context before I launched into the issue at hand. I am single and left my job last year due to a toxic work environment. I will be 53 this year.

Financially speaking – I am quite comfortable at the moment.

I have a few income streams – including a fixed income/equities portfolio generating 5-6% which is more than enough for my expenses annually. I have emergency funds of over S$200k to cover 5 years of expenses. 150K USD in a US broker for investment purposes which I can liquidate quite quickly.

My CPF is on target to 1M55.

With inflation likely to erode my passive income in years to come I would like to hedge it by getting a property where I can stay with the flexibility to generate passive income by renting it out. The logic is if inflation is high then the rental should be in tandem. If inflation is low then I don’t have to rent it out.

I would like to stay comfortably and rent out in a way that will not disrupt my daily living. I also foresee myself traveling much of the time, leaving the place empty for months at times. But when I do return I would like to have a place to call home.

This would likely be my last property purchase in Singapore. I intend to sell my current property to fund this purchase. Based on the latest transacted price I think I should be left with $700k cash after deducting the loan. CPF monies is not used.

So let’s say I have a budget of $700k cash at hand,

1. Should I go for HDB? At my age and without a salary slip, it would be difficult for me to get a loan unless I top up with CPF or cash to pay it off in full.

If I use only my CPF OA it might be possible to stretch the budget to 1.2 million.

(700k + 500k)

2. HDB jumbo or multi-gen flats seemed to fit the bill as offering the flexibility I am looking for.

But I want to have a good living environment and with older HDB estates the surrounding might not be ideal for me. Some of these flats are also asking for above $900k.

Would you be able to recommend such flats that offer good value? Am I constraining my options by not being willing to fork out more cash?

3. Apply for HDB Flexi 2 room BTO with the short lease of 45 years old when I reach 55 y/o? That is going to be my last resort if I really cannot find a suitable option. But that means I do not have the option to rent out if I need to.

4. Buy an older resale condo with the dual key feature? It may cost more but at least there are some amenities with landscaping. Do you have recommendations for resales that meet my requirement? But would I be burdening myself by overstretching my finances at this stage in my life?

5. Stick to my current home and rent out one bedroom (not ideal).

Apologies for such a long email.

I look forward to having an objective party taking a look at my situation and telling me straight. I might have missed out on some key information or was blind to some risks.

Hi there,

Thanks for your trust in us to provide objective views. We apologise for your earlier comments being deleted and would like to assure you that this wasn’t done on purpose as we definitely do not delete comments on our site. We only recently discovered this technical issue that comments were being sent to trash without our knowledge (some, not all), and our developers are looking into this issue at the moment.

Nevertheless, we do appreciate that you’ve taken the time to detail everything. It’s quite a difficult topic to approach, as this essentially involves your retirement plans and affects your future. But we’d try our best to explore the pros and cons of each option, along with our opinion as well.

Some things that we will take into consideration here:

As mentioned, the property may be vacant from time to time due to extensive traveling. And you’d like to be able to rent it out without disrupting your daily living. It’s going to be your last purchase, so capital appreciation isn’t quite the focus as compared to the quality of life and a stress-free way to manage and finance the property is a bigger priority given the stage of life you are at.

Let’s work our way down the list.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Should you go for HDB?

So first things first, is the HDB option viable?

On that front, we are more inclined to recommend an HDB given the circumstances. While you did mention condo amenities and landscaping, this wasn’t brought up from the get-go and so it’s likely that this isn’t really something that you prioritise. As such with HDBs, you can get a greater bang for your buck in terms of living space compared to a condo. So if having more living space is needed, then you can enjoy a higher quality of life with an HDB. Given you will be traveling a lot, having to pay minimal maintenance each month is also definitely preferable, which you won’t be able to do with a condo.

The monthly maintenance can certainly add up too. Let’s take a reasonable number of $280 for monthly maintenance – multiply that by 30 years and you’ll be paying out a total of $100,800. It’s a big sum that can be saved if you truly don’t have much use for the facilities. In contrast, HDB conservancy charges are less than half that amount.

Moreover, we believe that at this age, exercising prudence would be better. And so keeping your investments to earn passive income is even more important now that you are 53. So if you have to liquidate anything that helps you earn passive income is not recommended especially since it also goes towards supporting your lifestyle today.

Perhaps, it’s also good to continue just keeping your CPF instead of putting it into a more expensive property at this point. It can help you to earn higher payouts later on, which can also go towards funding further travel. As you rightly mentioned, taking a loan at this age is likely to be difficult. And even if you could, it’s better to avoid any further loans at this juncture which can add unnecessary stress at this point in your life.

Of course, this might not be suitable if you are concerned about future capital appreciation. And while we can’t be sure of your exact future goals, what we infer is that a comfortable home takes precedence at this point.

Should you go for a Jumbo/Multi-Gen flat?

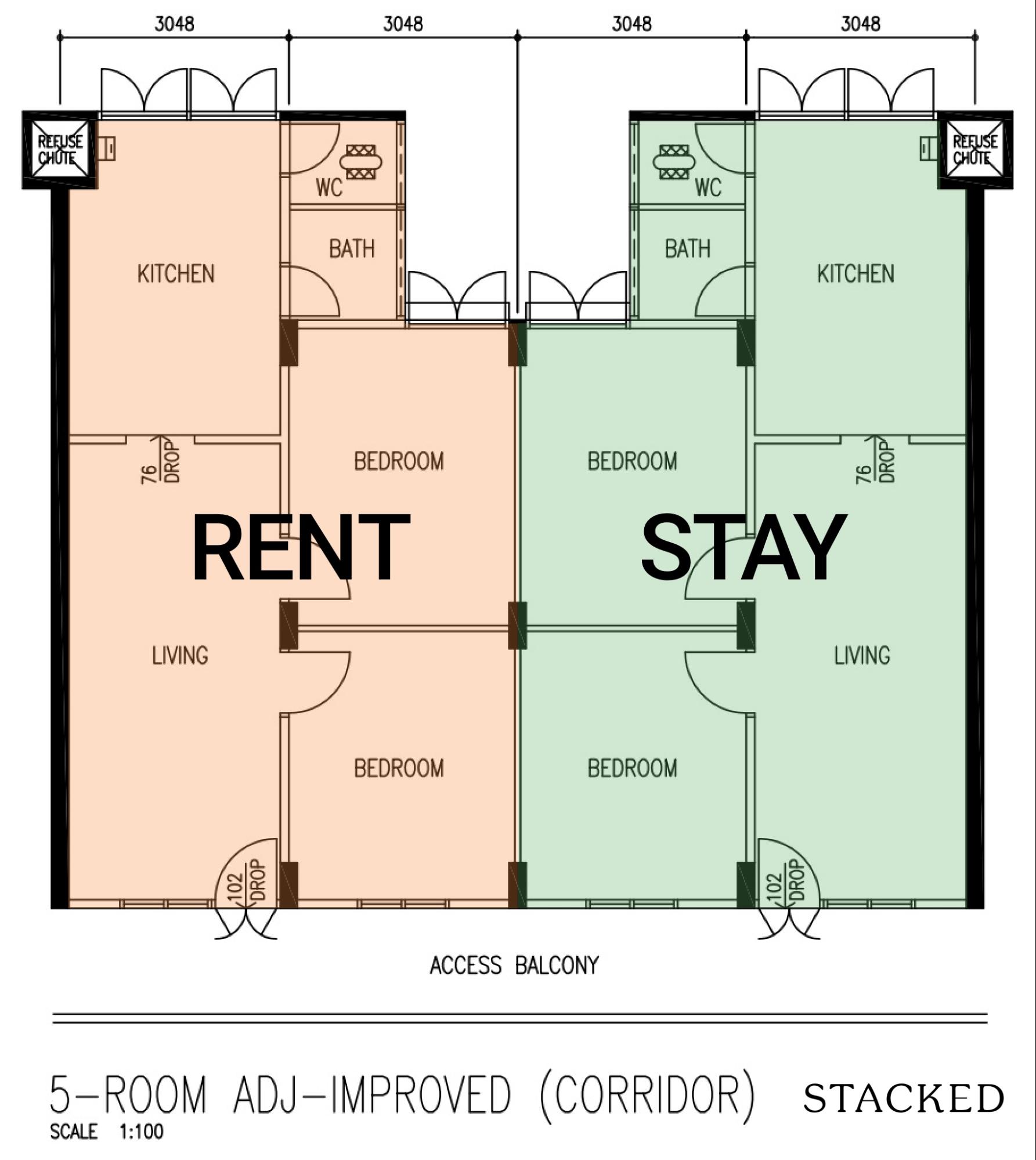

On the surface, this seems like quite a suitable option.

Jumbo and multi-gen HDB flats are large and there are even some layouts that have a dual-key function (one entrance that shares a foyer space leading into two separate units within one unit).

Just so you know, some of these flats are also listed as “adjoined flats” according to HDB. Sometimes finding the prices of jumbo flats can be difficult as they are not officially categorised by HDB, but you can search for them on the usual property portals. These jumbo flats are a combination of 3 and 4-room flats in the past, and their layout may be of a dual-key nature.

So dual-key HDBs or adjoined flats would be ideal here since you can enjoy the space with privacy while having the option to rent out the other unit. Bear in mind that you must occupy the unit and not be overseas for too long as this could violate the rental policy that HDB has (although probably hard to enforce).

We’ve pulled out some of the adjoined flats that have transacted in the past 6 months:

| Month | Town | Type | Address | Storey | Size (sqm) | Lease Started | Lease Remaining | Price |

| 2022-06 | Geylang | 4 Room | 43 Circuit Rd | 01 TO 03 | 92 | 1971 | 47 years 08 months | $450,000 |

| 2022-06 | Bukit Merah | 4 Room | 37 Jln Rumah Tinggi | 04 TO 06 | 106 | 1969 | 46 years 02 months | $510,000 |

| 2022-05 | Bukit Merah | 4 Room | 28 Jln Klinik | 07 TO 09 | 107 | 1969 | 46 years 03 months | $535,000 |

| 2022-06 | Bukit Merah | 4 Room | 38 Beo Cres | 07 TO 09 | 110 | 1971 | 47 years 08 months | $620,000 |

| 2022-02 | Yishun | 5 Room | 703 Yishun Ave 5 | 04 TO 06 | 136 | 1984 | 60 years 11 months | $620,800 |

| 2022-07 | Toa Payoh | 5 Room | 235 Lor 8 Toa Payoh | 01 TO 03 | 130 | 1976 | 52 years 11 months | $640,000 |

| 2022-05 | Toa Payoh | 5 Room | 174 Lor 1 Toa Payoh | 10 TO 12 | 130 | 1972 | 49 years 03 months | $655,000 |

| 2022-02 | Bukit Merah | 5 Room | 2 Jln Bt Merah | 10 TO 12 | 126 | 1975 | 52 years 05 months | $668,888 |

| 2022-05 | Jurong East | Executive | 329 Jurong East Ave 1 | 07 TO 09 | 148 | 1983 | 60 years 02 months | $680,000 |

| 2022-07 | Kallang/Whampoa | 5 Room | 76 Lor Limau | 01 TO 03 | 130 | 1973 | 50 years 01 month | $690,000 |

| 2022-04 | Ang Mo Kio | 5 Room | 457 Ang Mo Kio Ave 10 | 10 TO 12 | 150 | 1980 | 56 years 10 months | $700,000 |

| 2022-01 | Toa Payoh | 5 Room | 85C Lor 4 Toa Payoh | 19 TO 21 | 136 | 1972 | 49 years 01 month | $760,000 |

| 2022-07 | Bukit Merah | 5 Room | 119 Bt Merah View | 10 TO 12 | 130 | 1983 | 59 years 07 months | $786,000 |

| 2022-04 | Ang Mo Kio | Executive | 471 Ang Mo Kio Ave 10 | 01 TO 03 | 162 | 1979 | 56 years 03 months | $880,000 |

| 2022-04 | Bedok | Executive | 410 Bedok Nth Ave 2 | 04 TO 06 | 163 | 1980 | 57 years 01 month | $880,000 |

| 2022-07 | Bedok | Executive | 519 Bedok Nth Ave 1 | 10 TO 12 | 162 | 1979 | 56 years 01 month | $908,000 |

| 2022-07 | Ang Mo Kio | Executive | 474 Ang Mo Kio Ave 10 | 13 TO 15 | 148 | 1984 | 60 years 08 months | $918,000 |

| 2022-01 | Ang Mo Kio | Executive | 433 Ang Mo Kio Ave 10 | 04 TO 06 | 162 | 1979 | 56 years 01 month | $935,000 |

| 2022-07 | Clementi | Executive | 377 Clementi Ave 5 | 10 TO 12 | 163 | 1980 | 57 years 04 months | $935,000 |

| 2022-04 | Ang Mo Kio | Executive | 504 Ang Mo Kio Ave 8 | 07 TO 09 | 163 | 1980 | 57 years 05 months | $938,000 |

| 2022-07 | Bedok | Executive | 510 Bedok Nth St 3 | 04 TO 06 | 163 | 1979 | 56 years 03 months | $960,000 |

As you can see from the past transacted prices, you can get such units from as low as $450,000 to more sizeable options for around $600,000+ but bear in mind that you’ll have to factor in other costs like buyer stamp duty and possible renovations.

As a result, you may have to dip a little into your CPF, but not its entirety.

Of course, all these units are old (hence the price), but considering capital appreciation isn’t the priority here, these are suitable for your needs. In fact, the executive flats here are probably too big for what you’re looking for, so moving into the $800k + mark is unnecessary.

Here’s an example of one that could work for you: 2 Jalan Bukit Merah $668,888. It’s close to eateries such as ABC Brickworks (there’s even an ice cream joint). There’s an NTUC Fairprice located here too, and if you walk further down, an eatery that opens in the wee hours. Just behind, you have IKEA Alexandra which is also opposite neighbourhood mall Anchorpoint, where there is a Cold Storage as well. Alexandra Central Mall is here too, but beyond food options, nail spas, and the like, it definitely isn’t a huge draw. For more affordable food options, Alexandra Village Food Centre is just a 7-minute walk away. If you’re into sneakers and McDonald’s, Queensway Shopping Centre is another option.

For nature aspects, you are about a 6-minute walk to the Rail Corridor, and also within walking distance to Alexandra Hill East Neighbourhood Park. We’d say that this qualifies for a pretty ideal surrounding environment.

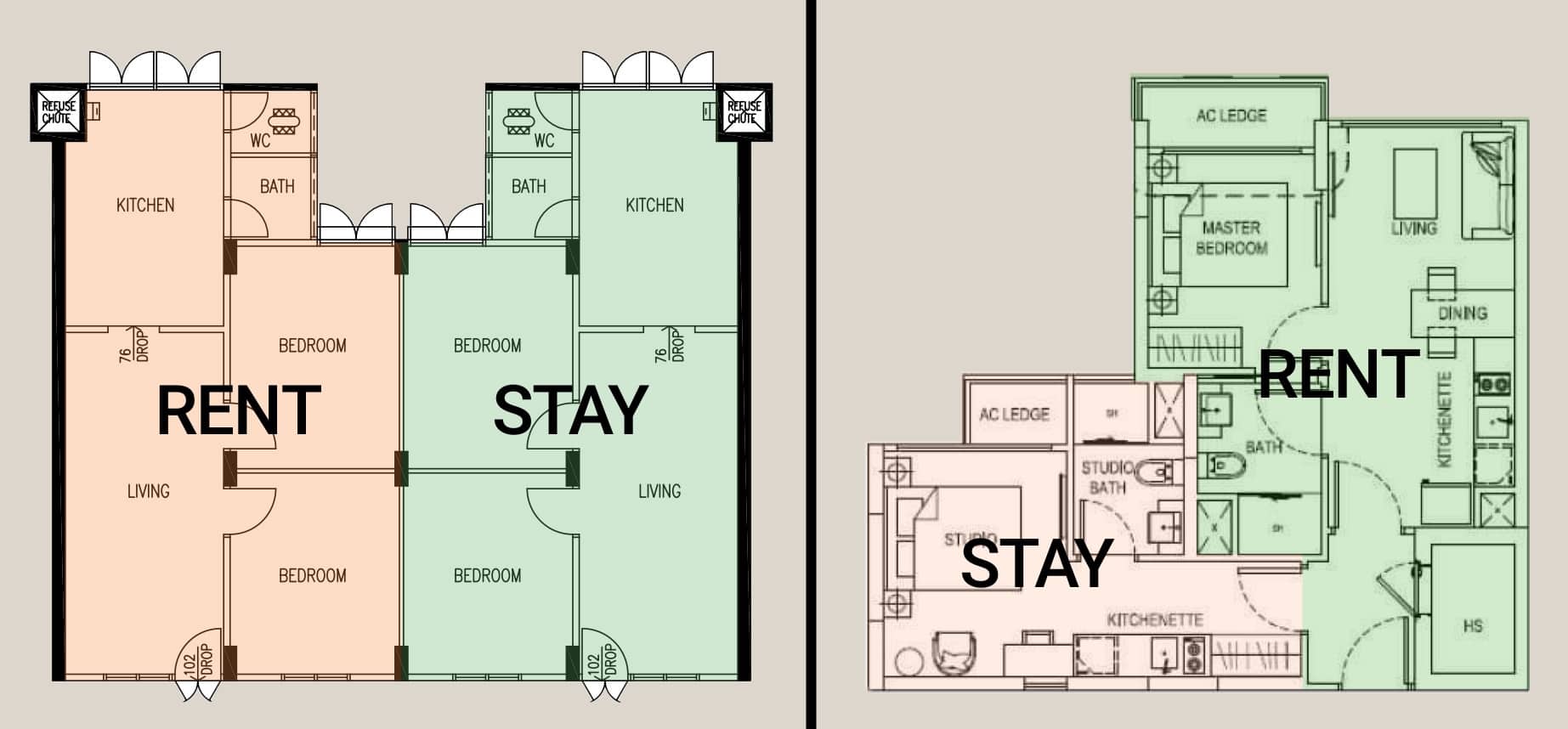

Now here’s what the floor plan looks like:

As we mentioned, it’s really two units combined into one. You can live in one unit and hack down the walls for a more open concept while renting out the other as a 3-room flat. Here’s what the 3-room rental rates in Bukit Merah are currently going for:

Currently, the median 3-room rental in Bukit Merah is $2,100 (bearing in mind that rental rates are good now). Assuming your cost is $700,000, you’re earning a 3.6% rental return (unleveraged) which is really good considering you are living in it too.

That said, there are other layouts that may make more sense such as jumbo flats that are listed as an Executive flat which could come in configurations like a 4 and 3-room flat, but these would cost more or are found in non-mature estates.

It’s worth noting SERS or VERS options here too. As the estate grows older, you may find yourself forcefully evicted and perhaps asked to top-up for the lease, or if given a shorter-lease option, will find yourself having to uproot yourself at an old age (like what happened at Ang Mo Kio).

Should you apply for a 2-room Flexi BTO?

To be sure, this is definitely the most affordable option. However, you are going to miss out on the rental income that you could earn when you are traveling. But is that necessarily a bad thing?

Let’s explore this further.

With the excess cash, you could also be investing it. How does it fair against the rental highlighted earlier?

A 2-room Flexi in Toa Payoh in the May 2022 BTO exercise went from $162,000. Assuming you purchased it at that price (plus other costs incurred) let’s assume you spend $200k in total.

This leaves you with remaining cash of $500k. Assuming you are able to achieve 5.5% returns, this gives you $27,500 per year.

The rental you could make from a $2,100/mo 3-room flat is $25,200. This is less than what you could earn from your 5.5% returns.

However, we must also account for the fact that the 5.5% return is an average – is this purely dividend-paying? Or would you also be accounting for capital appreciation here? Because while the rental is cash, the 5-6% return may not be entirely cash. So you need to weigh your options here and look deep into your portfolio to decide.

Also, buying an old HDB in Bukit Merah will likely see depreciation given how old it is already, even if the property market were to appreciate it. Your stocks, however, are likely to go up in the longer term (assuming you’re well diversified) unlike a depreciating HDB.

Another thing to consider is also the possibility of SERS with an old jumbo/multi-gen/adjoined flat, but obviously not with the BTO. There’s no SERS for stocks – it’ll be there so long as you’re well diversified.

The easy upside is that you’ll also get to enjoy a new flat. It could also probably be a nicer environment given it’s newer, but however, not necessarily better amenities.

The downside? You’d have to wait (obviously). It’s hard to say what your housing needs are for the next 3 – 4 years time, but if you have alternative housing plans that you can use in the meantime, then this can be a viable option.

Buy an older resale condo with a dual key feature?

We probably will infer from your queries that facilities aren’t as important to you. But if you do happen to change your mind on this, let’s see how this option would hold up.

Unquestionably, older resale condos with dual key features will surely cost a lot more than what you can get with an HDB. As always, the added advantage to a condo is that you get a gated compound plus facilities, but as we mentioned in the beginning, the maintenance fees can really add up, especially if you don’t use them. Remember, this varies based on the type of condo – mass market or boutique. If you want to explore further, we have a list of dual-key condos here.

The first dual-key unit came with the launch of the Caspian in 2009. The last we checked, dual-key units are all north of a million dollars, even for the smallest 2-bedroom dual-key units. And the article was written in 2020 – it can only be worse now.

This would be stretching your finances, something we cannot recommend considering the lack of added benefits.

Moreover, since dual-key units only came about in 2009, these developments are still relatively new. So you’d be paying for newness here (modern facilities), which wasn’t a point you mentioned. Even if it’s over 10 years old, it’s still relatively young compared to an HDB with just 50 years left, so you can get a lot more space with an HDB at probably a much more convenient location than spending on a condo that’s younger, smaller and perhaps less convenient.

But if you really want to explore the private option, the most affordable choice would probably be The Hillford (which we’ve written about extensively here). Bear in mind, that this is a 60-year leasehold property which is why it could fit into your budget. The last of such a dual-key unit at 657 sq ft was sold at $760,000 in June 2022.

Here’s a look at the transactions so far this year:

| Project Name | Transacted Price ($) | Area (SQFT) | Unit Price ($ PSF) | Sale Date |

| THE HILLFORD | $760,000 | 657 | 1,157 | 28 Jun 2022 |

| THE HILLFORD | $820,000 | 657 | 1,249 | 06 May 2022 |

| THE HILLFORD | $725,000 | 657 | 1,104 | 04 May 2022 |

| THE HILLFORD | $800,088 | 657 | 1,219 | 26 Apr 2022 |

Here are the rental transactions in June 2022:

| Project Name | No of Bedroom | Monthly Rent ($) | Floor Area (SQFT) | Lease Commencement Date |

| THE HILLFORD | 1 | 3,000 | 300 – 400 | Jun 2022 |

| THE HILLFORD | 1 | 2,350 | 300 – 400 | Jun 2022 |

| THE HILLFORD | 1 | 3,000 | 300 – 400 | Jun 2022 |

| THE HILLFORD | 1 | 2,700 | 300 – 400 | Jun 2022 |

| THE HILLFORD | 1 | 2,150 | 300 – 400 | Jun 2022 |

| THE HILLFORD | 1 | 2,200 | 300 – 400 | Jun 2022 |

| THE HILLFORD | 1 | 2,500 | 300 – 400 | Jun 2022 |

| THE HILLFORD | 1 | 1,900 | 300 – 400 | Jun 2022 |

| THE HILLFORD | 1 | 2,200 | 300 – 400 | Jun 2022 |

| THE HILLFORD | 1 | 2,700 | 300 – 400 | Jun 2022 |

| THE HILLFORD | 1 | 2,400 | 300 – 400 | Jun 2022 |

The median rental here is $2,400 for a 1-bedroom unit. For a $760,000 unit, that’s about a 3.8% yield which is about the same as your adjoined HDB. Here’s what your investment looks like until the lease runs to zero, assuming a consistent property tax tier, maintenance cost, and rental income:

| Year | Lease Left (Years) | Price | Property Tax | Maintenance Cost | Buyer Stamp Duty + Legal Fees | Rental Income | Net Income | Quantum Gains |

| 2022 | 51 | $760,000 | $2,880 | $ 3,600 | $20,400 | $28,800 | $18,144 | $36,469 |

| 2023 | 50 | $754,435 | $2,880 | $ 3,600 | $28,800 | $17,956 | $54,425 | |

| 2024 | 49 | $748,676 | $3,168 | $ 3,600 | $28,800 | $17,473 | $71,898 | |

| 2025 | 48 | $742,716 | $3,168 | $ 3,600 | $28,800 | $17,271 | $89,169 | |

| 2026 | 47 | $736,546 | $3,168 | $ 3,600 | $28,800 | $17,063 | $106,232 | |

| 2027 | 46 | $730,161 | $3,168 | $ 3,600 | $28,800 | $16,847 | $123,079 | |

| 2028 | 45 | $723,552 | $3,168 | $ 3,600 | $28,800 | $16,623 | $139,702 | |

| 2029 | 44 | $716,712 | $3,168 | $ 3,600 | $28,800 | $16,392 | $156,094 | |

| 2030 | 43 | $709,633 | $3,168 | $ 3,600 | $28,800 | $16,153 | $172,246 | |

| 2031 | 42 | $702,306 | $3,168 | $ 3,600 | $28,800 | $15,905 | $188,151 | |

| 2032 | 41 | $694,722 | $3,168 | $ 3,600 | $28,800 | $15,648 | $203,799 | |

| 2033 | 40 | $686,873 | $3,168 | $ 3,600 | $28,800 | $15,383 | $219,182 | |

| 2034 | 39 | $678,749 | $3,168 | $ 3,600 | $28,800 | $15,108 | $234,290 | |

| 2035 | 38 | $670,341 | $3,168 | $ 3,600 | $28,800 | $14,824 | $249,114 | |

| 2036 | 37 | $661,638 | $3,168 | $ 3,600 | $28,800 | $14,530 | $263,644 | |

| 2037 | 36 | $652,631 | $3,168 | $ 3,600 | $28,800 | $14,225 | $277,869 | |

| 2038 | 35 | $643,309 | $3,168 | $ 3,600 | $28,800 | $13,910 | $291,778 | |

| 2039 | 34 | $633,660 | $3,168 | $ 3,600 | $28,800 | $13,583 | $305,362 | |

| 2040 | 33 | $623,674 | $3,168 | $ 3,600 | $28,800 | $13,246 | $318,608 | |

| 2041 | 32 | $613,338 | $3,168 | $ 3,600 | $28,800 | $12,896 | $331,504 | |

| 2042 | 31 | $602,641 | $3,168 | $ 3,600 | $28,800 | $12,534 | $344,038 | |

| 2043 | 30 | $591,569 | $3,168 | $ 3,600 | $28,800 | $12,160 | $356,198 | |

| 2044 | 29 | $580,109 | $3,168 | $ 3,600 | $28,800 | $11,773 | $367,971 | |

| 2045 | 28 | $568,249 | $3,168 | $ 3,600 | $28,800 | $11,371 | $379,342 | |

| 2046 | 27 | $555,973 | $3,168 | $ 3,600 | $28,800 | $10,956 | $390,299 | |

| 2047 | 26 | $543,268 | $3,168 | $ 3,600 | $28,800 | $10,527 | $400,825 | |

| 2048 | 25 | $530,118 | $3,168 | $ 3,600 | $28,800 | $10,082 | $410,907 | |

| 2049 | 24 | $516,507 | $3,168 | $ 3,600 | $28,800 | $9,622 | $420,529 | |

| 2050 | 23 | $502,421 | $3,168 | $ 3,600 | $28,800 | $9,145 | $429,674 | |

| 2051 | 22 | $487,841 | $3,168 | $ 3,600 | $28,800 | $8,652 | $438,327 | |

| 2052 | 21 | $472,751 | $3,168 | $ 3,600 | $28,800 | $8,142 | $446,469 | |

| 2053 | 20 | $457,133 | $3,168 | $ 3,600 | $28,800 | $7,614 | $454,083 | |

| 2054 | 19 | $440,968 | $3,168 | $ 3,600 | $28,800 | $7,067 | $461,150 | |

| 2055 | 18 | $424,238 | $3,168 | $ 3,600 | $28,800 | $6,502 | $467,651 | |

| 2056 | 17 | $406,922 | $3,168 | $ 3,600 | $28,800 | $5,916 | $473,567 | |

| 2057 | 16 | $389,000 | $3,168 | $ 3,600 | $28,800 | $5,310 | $478,877 | |

| 2058 | 15 | $370,450 | $3,168 | $ 3,600 | $28,800 | $4,683 | $483,560 | |

| 2059 | 14 | $351,252 | $3,168 | $ 3,600 | $28,800 | $4,033 | $487,593 | |

| 2060 | 13 | $331,381 | $3,168 | $ 3,600 | $28,800 | $3,361 | $490,955 | |

| 2061 | 12 | $310,815 | $3,168 | $ 3,600 | $28,800 | $2,666 | $493,621 | |

| 2062 | 11 | $289,529 | $3,168 | $ 3,600 | $28,800 | $1,946 | $495,567 | |

| 2063 | 10 | $267,498 | $3,168 | $ 3,600 | $28,800 | $1,201 | $496,768 | |

| 2064 | 9 | $244,697 | $3,168 | $ 3,600 | $28,800 | $430 | $497,198 | |

| 2065 | 8 | $221,097 | $3,168 | $ 3,600 | $28,800 | -$368 | $496,830 | |

| 2066 | 7 | $196,671 | $3,168 | $ 3,600 | $28,800 | -$1,194 | $495,636 | |

| 2067 | 6 | $171,390 | $3,168 | $ 3,600 | $28,800 | -$2,049 | $493,587 | |

| 2068 | 5 | $145,224 | $3,168 | $ 3,600 | $28,800 | -$2,934 | $490,653 | |

| 2069 | 4 | $118,142 | $3,168 | $ 3,600 | $28,800 | -$3,850 | $486,804 | |

| 2070 | 3 | $90,113 | $3,168 | $ 3,600 | $28,800 | -$4,797 | $482,006 | |

| 2071 | 2 | $61,102 | $3,168 | $ 3,600 | $28,800 | -$5,778 | $476,228 | |

| 2072 | 1 | $31,077 | $3,168 | $ 3,600 | $28,800 | -$6,794 | $469,434 | |

| 2073 | 0 | $ – | $3,168 | $ 3,600 | $28,800 | -$7,845 | $461,589 |

The main difference here is that you get to enjoy facilities if you buy a 2-bedroom dual key unit and rent out one part of it compared to the HDB. You’ll also have a say when it comes to en bloc, although the odds are not very high for this development, to begin with.

However, the size you can get with the HDB is larger, to begin with – two 3-room flats mean you can stay in a home with 2 bedrooms instead of 1. Moreover, Hillford isn’t exactly in the most convenient of places, although you can take a straight bus down to Beauty World MRT and the strata malls around it.

As such, you’ll need to weigh between this and the HDB option.

Stick to your current home and rent out 1-bedroom?

It’s hard to really comment much on this given we don’t know the details about your current home.

But in a nutshell, we think it makes more sense to shift to an adjoined/jumbo flat as highlighted earlier so that your rental would not disrupt your lifestyle. Moreover, you can collect more cash over time with that option.

Otherwise, buying a smaller unit and generating more returns from your excess cash would also be better since you do not even have to deal with tenants, agents, and repairs. You may also not get along with your tenant at some point which may have an impact on your quality of life. Unit or room vacancies could also be stressful which goes against your objectives.

Conclusion

Ultimately, what’s important is understanding the investment value from your excess cash, or if you are able to find a suitable jumbo/adjoined unit to support your objectives. As of now, supply is definitely low, and we’d advise working with an agent to keep a lookout for such units and negotiate on your behalf.

We hope that our insights into these developments will help you in your decision-making.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

0 Comments