How Would Old People Affect The Future Master Plan?

April 16, 2023

An update to the Master Plan is in the works again.

As before, the Master Plan Review will be in gear over the next two to three years, and any property investor can tell you why that’s important: so you can spot whether your condo view is about to be blocked, and quickly freak out and sell.

(Do remember that changes can happen in between also, which is why it’s always good to check).

Besides that, the Master Plan details land use over the next 10 to 15 years; and that makes it the property bible. Not just for investors but also realtors, home owners, landlords, and property developers.

A notable detail this time is the mention of age: National Development Minister Desmond Lee pointed out that a quarter of all Singaporeans will be 65 years or older by the year 2030.

Couple that detail with how some 80 per cent of us live in HDB flats, and you’ll see why I’m fond of calling HDB the country’s chief senior citizen care body. While HDB’s prime mandate is to provide housing, that same housing requirement is impacted by the fact that the residents are older.

That means building flats in ways that are amenable to the elderly, which we’ve already seen with HDB programmes like EASE and Community Care Apartments. But as decades wear on, we’re going to see an impact via ownership rules as well. The Lease Buyback Scheme (LBS), for instance, which lets some seniors sell back the unused portion of their lease.

But as Singapore ages, and the old begin to outnumber the young, I do wonder if resale flats can maintain their value.

As I’ve pointed out in many articles, the next generation will at some point pass down their flats. Foreigners can’t inherit these HDB flats, while most Singaporeans would already own a flat by the time their forebears move on (for most it’s impossible to inherit their parents’ flats, as no one can own two HDB properties at once).

That leaves a lot of vacant flats on the market, and not much demand if ownership requirements stay as stringent as they do today.

It is also why HDB can’t just open the floodgates and build as much as possible because of immediate demand today.

This is a difficult thing to conceive in 2023 while there’s still a supply crunch and a general outcry for more flats; but if we take a longer-term view, we do need to consider what’s to be done with our parents and grandparents’ flats when the time comes.

And since ageing is a worry, maybe we can finish some basic HDB amenities while we’re still young. How about that, Jurong West?

2.5 years to construct a resident’s corner in a void deck has got to be some kind of record.

I understand the contractor had some issues during Covid, but just…have you seen a resident’s corner? It’s literally a bunch of tables and chairs, in a corner of a void deck. I get that Covid caused some manpower and supply issues, but two and a half years? The whole Empire State Building was completed in one year and 45 days.

Also, a 78-year-old man buying 10 plastic chairs apparently managed to put together a functional resident’s corner, while waiting. I think the Town Council should just pay him the contractor’s fee.

(Or at least for the chairs).

In other serious property news:

- We looked at some HDB flats with rare layouts, from way back in our housing body’s more experimental phases.

- Next, we cleared up some property misconceptions we’ve been hearing this year, especially about the 99-1 loophole.

- Do take a look at our take on the upcoming HDB launch sites next, to help you decide where to ballot.

- Finally, check out how a couple transformed their old rental unit into a chic new home with no renovation involved.

Weekly Sales Roundup (03 – 09 Apr)

More from Stacked

Resale HDB prices for June 2017!

According to HDB, resale volume for HDB has fallen by 11.6 percent from last month of May. In total, 1,753…

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CANNINGHILL PIERS | $8,744,000 | 2788 | $3,136 | 99 yrs (2021) |

| THE AVENIR | $6,858,000 | 2067 | $3,318 | FH |

| KLIMT CAIRNHILL | $5,650,000 | 1496 | $3,776 | FH |

| MIDTOWN MODERN | $5,458,860 | 1808 | $3,019 | 99 yrs (2019) |

| BOULEVARD 88 | $4,915,500 | 1313 | $3,743 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE BOTANY AT DAIRY FARM | $1,175,000 | 506 | $2,323 | 99 yrs (2022) |

| TEMBUSU GRAND | $1,248,000 | 527 | $2,366 | 99 year (ehold |

| THE LANDMARK | $1,331,510 | 495 | $2,689 | 99 yrs (2020) |

| ONE BERNAM | $1,351,000 | 452 | $2,988 | 99 yrs (2019) |

| LEEDON GREEN | $1,419,000 | 474 | $2,996 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ST REGIS RESIDENCES SINGAPORE | $13,500,000 | 6060 | $2,228 | 999 yrs (1995) |

| YONG AN PARK | $8,100,000 | 3434 | $2,359 | FH |

| THE MORNINGSIDE | $6,280,000 | 3520 | $1,784 | FH |

| AALTO | $4,820,000 | 1959 | $2,460 | FH |

| MARINA COLLECTION | $4,650,000 | 3272 | $1,421 | 99 yrs (2007) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| TREASURES @ G20 | $545,000 | 420 | $1,298 | FH |

| RESIDENCES 88 | $655,000 | 431 | $1,521 | FH |

| HERITAGE EAST | $700,000 | 377 | $1,858 | FH |

| CASPIAN | $703,000 | 463 | $1,519 | 99 yrs (2008) |

| SELETAR PARK RESIDENCE | $718,000 | 527 | $1,361 | 99 yrs (2011) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| YONG AN PARK | $8,100,000 | 3434 | $2,359 | $2,080,000 | 11 YRS |

| KENSINGTON PARK CONDOMINIUM | $2,700,000 | 1668 | $1,618 | $1,765,000 | 24 YRS |

| THE PEAK@BALMEG | $4,150,000 | 2508 | $1,655 | $1,332,000 | 13 YRS |

| GALLERY FIFTEEN | $3,000,000 | 2443 | $1,228 | $1,325,000 | 11 YRS |

| ADAM PARK CONDOMINIUM | $2,320,000 | 1163 | $1,996 | $1,304,000 | 21 YRS |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MARINA COLLECTION | $4,650,000 | 3272 | $1,421 | -$4,645,000 | 15 YRS |

| REFLECTIONS AT KEPPEL BAY | $3,008,888 | 1615 | $1,864 | -$763,912 | 16 YRS |

| ST REGIS RESIDENCES SINGAPORE | $13,500,000 | 6060 | $2,228 | -$741,000 | 13 YRS |

| CAIRNHILL NINE | $1,850,000 | 753 | $2,455 | -$34,000 | 7 YRS |

| SOPHIA HILLS | $1,120,000 | 570 | $1,963 | -$17,000 | 5 YRS |

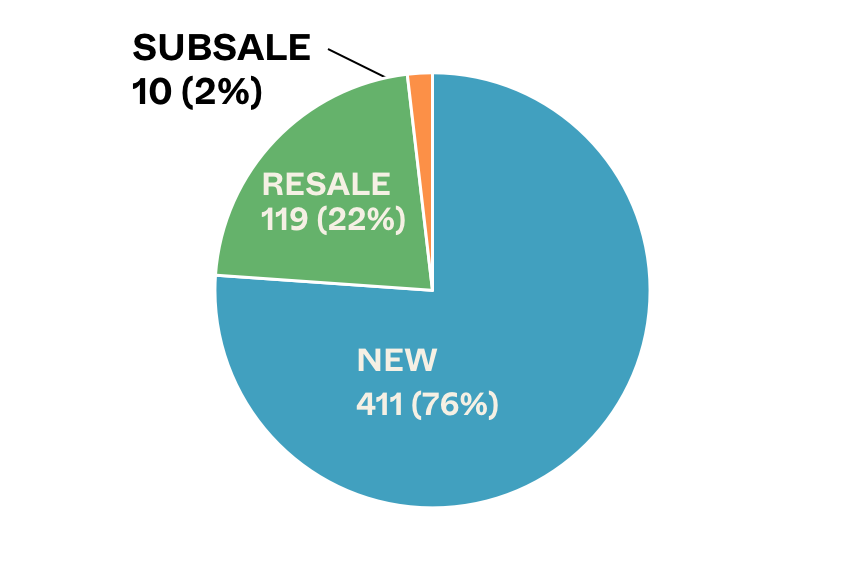

Transaction Breakdown

My interesting links of the week

- Coronavirus changing life on the elevator

This isn’t exactly straight off the press news, but research from Otis Worldwide has found that 138 seconds is the average wait time for a trip on the lift in a 16-floor building. Also, IBM once tallied the cumulative time that office workers spent waiting for lifts in different cities over 12 months – New York topped the list at 16.6 years.

Which got me thinking – how much time do we spend waiting for lifts in our lifetimes in Singapore? It’s why tall office building’s like Guoco Tower (watch this video about the lift system), have a system to assign you a floor upon swiping your access card. This shortens wait times, and possibly at some point we might see such an implementation in high-end high-rise condos in Singapore as another selling point?

- Move over ChatGPT, there’s now AutoGPT

It’s pretty insane how fast technology moves, and this week we have more news on a new ways to utilise AI in our workflows. Now, I don’t mean for the newsletter to be one on AI, but there’s no denying the impact that will come for the real estate industry.

This time, here’s a really interesting thread on how some people have been using AutoGPT (it’s basically like a personal assistant). There are people who have given it tasks to do market research, sales prospecting, read about recent events and prepare podcasts outline, and someone even used it to populate a virtual world.

So what are some uses for real estate? Market research for land for developers, customer enquiries for real estate, social media management for agencies, even possibly as a real estate advisor and advising on property matters. Excited?

Finally, if you’ve noticed fewer new posts or some trip-ups this week, that’s my fault. I’ve got a (non-Covid) flu and I’m coughing my literal soul out of my body every three sentences I type. Please forgive any typos or slip-ups.

May your weekend be better, and do take care as that Covid-wave is coming around again. Stay healthy and happy, and do follow us on Stacked for more property updates.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How will Singapore's aging population impact the housing market in the future?

What are the challenges related to HDB flats as Singapore ages?

Why is the Master Plan review important for property investors and homeowners?

What are some recent developments in HDB amenities and construction delays?

How might technology like AI influence the real estate industry in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments