How We Made $270k From A $960k Condo Bought During COVID: A Buyer’s Case Study

April 16, 2025

Project Case Study: Penrose

Client Details

- Early 30s

- Works in medical sales

Buyer’s Brief

- Solo investor with a budget under S$1M.

- Purchasing purely for investment, with no specific location or lifestyle preferences

- Open to both resale and new launch projects

Challenges they faced

- Bought shortly after the COVID-19 pandemic, amid market uncertainty

- Limited to the 2-bedroom, 1-bathroom layout due to budget constraints, adding uncertainty to the choice

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

First Consultation: A Breakdown

Everyone loves to say, “Buy when the market is down.” It’s the golden rule of investing, the advice everyone claims they’d follow. But in reality? Few actually do it.

That was the exact dilemma Z faced in 2020, at the height of COVID-19. The property market was in a strange limbo—transactions were still happening, but buying was anything but easy.

In hindsight, now in 2025, this seemed like such an obvious time to buy. But the truth was that on the ground, buyers were still cautious.

Viewings were restricted, sellers were hesitant, and no one knew what the future held. Would prices drop further? Would the economy bounce back or take a turn for the worse?

With her husband already holding the title to their matrimonial home, this second property was meant to be an investment. But making the right call wasn’t easy.

With a budget of S$1M, she had two clear options:

- A resale unit, where prices were slightly more negotiable but market confidence was low.

- A new launch, with future upside potential but more unknowns in the short term.

More importantly, how could she protect herself from downside risks if things didn’t go as planned?

These were the questions we tackled together during our first consultation.

From there, we mapped out two strategic approaches—each designed to help her make a confident, calculated investment, even in a market clouded by uncertainty.

After analysing the trade-offs, Z leaned towards the new launch route. As such, with her $1m budget, we narrowed it down to Penrose – as the project that had strong appreciation potential, but more importantly, it was the less risky proposition in an uncertain environment.

Exploring Penrose

Penrose: Central Connectivity with a Caveat

Located in the Rest of Central Region (RCR), Penrose offers excellent connectivity, particularly for drivers. With direct access to the PIE, it’s less than 15 minutes to the CBD and under 20 minutes to Orchard. For investors, this positions it well for rental demand from professionals working in the city.

However, there was a trade-off: its immediate surroundings. The area is flanked by older industrial estates, which don’t exactly scream prime residential appeal. That said, daily conveniences are well within reach. Sims Vista Food Centre is nearby, and Aljunied MRT (EWL) is within walking distance, ensuring accessibility for tenants reliant on public transport.

For Z, this wasn’t a dealbreaker. Her focus was purely on investment returns, not lifestyle considerations. The real question was whether the numbers added up. After a detailed financial analysis, Penrose checked that box.

A Deeper Dive into Penrose

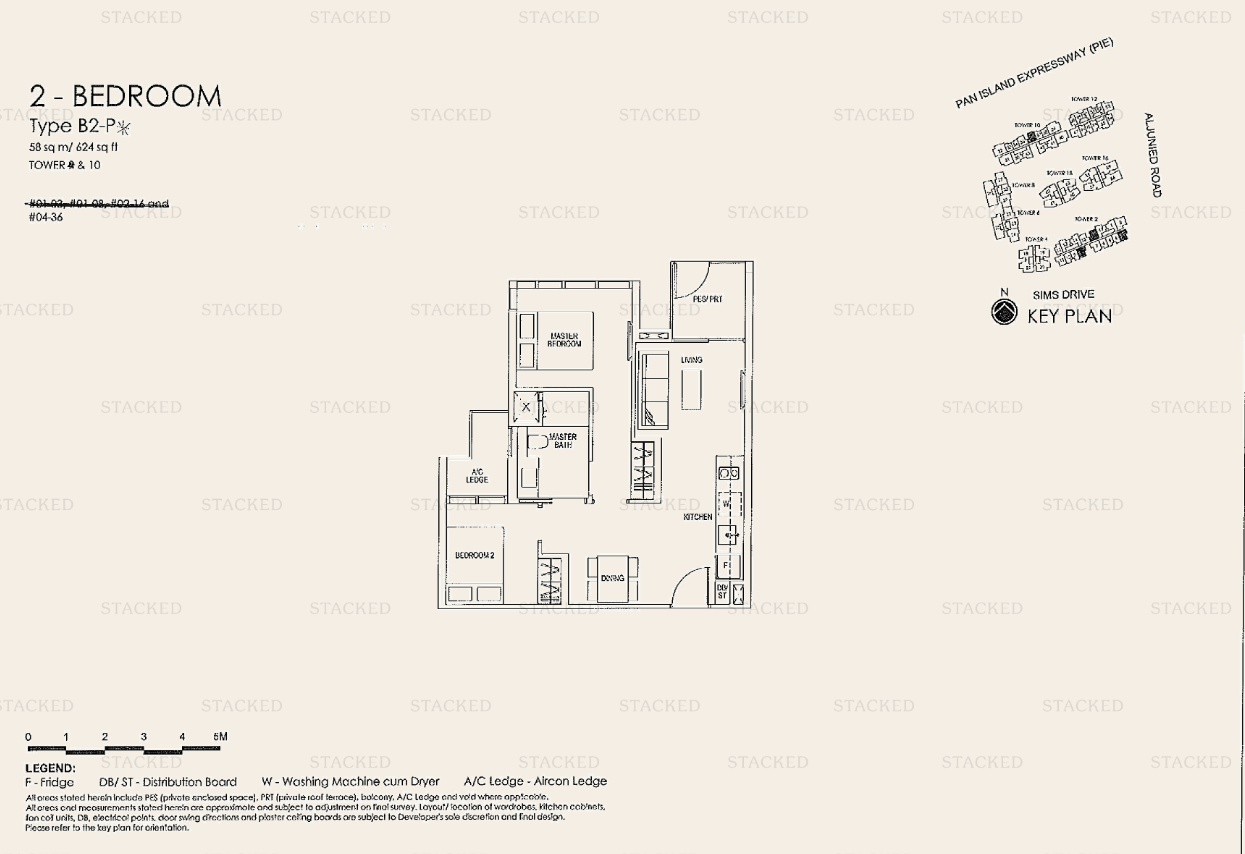

Penrose’s 2-Bedroom, 1-Bath Layout

Market sentiment and early demand strongly favoured Penrose’s 646 sq. ft. 2-Bedroom, 1-Bath unit, and for good reason. Its dumbbell layout maximised space efficiency, making it an attractive choice for both homeowners and tenants. The enclosed kitchen was another standout feature, a rarity for units of this type.

That said, opting for a 2b1b layout wasn’t without its risks. At the time, most buyers gravitated towards the more conventional 2b1b configuration, making Z understandably concerned about its resale potential.

But when we broke down the numbers, the truth was that 2b1b units were not any worse off in terms of investment returns. So given the budget she had in mind, this was the most well-suited configuration.

Benchmarking Against Sims Urban Oasis

The most important part of this equation was that Z had to feel confident about her decision in this investment. While you could point out that there may be other projects that could offer a stronger investment, the key thing to note about Penrose was that it offered the least risk because of the pricing of Sims Urban Oasis. This was a comparable project launched in 2015, just 200m away. The numbers were telling:

- Sims Urban Oasis GLS site transacted at S$383.5M (S$732 psf ppr).

- Penrose’s GLS site was secured at the same S$732 psf ppr—despite a five-year gap.

This pricing parity was significant.

Penrose launched during the uncertainty of COVID-19, prompting developers to adopt a more flexible, investor-friendly pricing strategy. At launch, its 2-bedroom units were priced around S$1,500 psf, mirroring resale transactions at Sims Urban Oasis at that time.

More from Stacked

Inside 2023’s Biggest Condo Launch: Everything You Need to Know About Grand Dunman

It's been a while since we've had two new condos launching on the very same weekend - Grand Dunman (near…

We also noted that Sims Urban Oasis, although older and similarly priced, continued to see robust transaction volumes – reinforcing the likelihood of Penrose achieving strong resale demand. It was newer, featured a competitive layout, and had no other direct competitors in the area.

Considering these factors, Penrose ultimately presented a more compelling match for Z’s investment criteria.

Balloting for Penrose

With Penrose emerging as Z’s top pick, we now had to pick the right unit.

With how new launch sales are structured, you would admittedly need to have some “good fortune” to get a good ballot number. Simply put, the lower the number, the higher the opportunity to select the right unit.

After putting in her cheque for the unit, she secured a ballot number under 100 – a strong position given the high demand for the 69 available 2b1b units. Competition was fierce; by the time ballots hit the 200th mark, the likelihood of securing one of these units would have been slim.

Fortunately, her early ballot number meant she had a real shot at her ideal stack.

Penrose’s Site Plan

As we worked with Z to refine her unit selection, her first choice was a unit in Block 28—the only inward-facing stack that didn’t front the PIE highway.

Given that it was priced identically to highway-facing units, we advised that it offered the best value in the development.

From a pricing standpoint, we highlighted that the increment per floor was under $4,000, representing less than 1% of the total quantum. This minimal premium gave her the flexibility to consider a higher-floor unit for better views, though she remained open to lower-floor options as well.

That said, while her queue number was a good one, it was likely that all of these units would be taken up by then – so we had to highlight a few contingencies.

Reassessing her Options on Booking Day

When booking day arrived, Z finally had full visibility of the remaining units.

As expected, Block 28 was fully taken, leaving only four available stacks, all facing the highway. We had two key strategies to mitigate road noise:

- Selecting a higher-floor unit to increase distance from the highway.

- Choosing a block with a larger setback to minimise direct exposure.

With limited choices, we guided Z towards a mid-floor unit in the stack furthest from the highway that remained within her budget and below the $1,500 PSF target, which would have been the safest choice given the resale pricing at Sims Urban Oasis.

Guiding Z Through Her Exit Strategy

Since the Seller’s Stamp Duty (SSD) was over, we’ve continued advising Z on the optimal timing and pricing for her sale.

We approach this strategically by addressing two core questions:

- What’s the primary motivation for selling? Is she looking to reallocate funds into another investment, or is the goal simply to lock in capital gains?

- How important is timing versus profit? Would she be willing to hold out for an additional S$20,000–S$30,000 in appreciation, or does a quicker exit align better with her goals?

As such, she decided to sell earlier, and we secured a deal for Z’s 2-Bed 1-Bath unit at $1.23x ($1,9xx PSF) in 2024. For context, a similar unit on a much higher floor had just transacted at $1.25x ($1,9xx PSF), so it was an easy decision given the circumstances.

Z originally bought the unit for $960k+, with $23k+ in stamp duty, bringing her total cost to $990k+.

Fast forward four years, and she clocked an estimated $270k profit before stamp duty, with an annualised return of 6.9%. After deducting the initial stamp duty, her net gain stood at $240k+ – not a bad outcome for a relatively low-risk investment.

If you have similar considerations, reach out to us at Stacked. For a more in-depth consultation, you can get in touch here.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How did the buyer choose between a resale unit and a new launch during COVID-19?

What makes Penrose a good investment despite its surroundings?

How did the buyer secure a good unit at Penrose during the launch?

What was the buyer's exit strategy for her property investment?

What was the return on investment for the buyer after selling the property?

Cheryl Teo

Cheryl has been writing about international property investments for the past two years since she has graduated from NUS with a bachelors in Real Estate. As an avid investor herself, she mainly invests in cryptocurrency and stocks, with goals to include real estate, virtual and physical, into her portfolio in the future. Her aim as a writer at Stacked is to guide readers when it comes to real estate investments through her insights.Need help with a property decision?

Speak to our team →Read next from Investor Case Studies

Investor Case Studies Why We Chose A $1.23 Million 2-Bedroom Unit At Parc Vista Over An HDB: A Buyer’s Case Study

Investor Case Studies Why We Bought A 3-Bedder Condo At Penrose: A Buyer’s Case Study

Editor's Pick Why I Bought A 2-Bedder Investment Property At Leedon Green In District 10: A Buyer’s Case Study

Editor's Pick Why We Bought A $1.9xm Unit At The Continuum: A Buyer’s Case Study With Stacked

Latest Posts

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

0 Comments