How We Ended Up Buying 2 Units At Reserve Residences: A Buyer’s Case Study

June 29, 2023

Project Case Study: The Reserve Residences

Client Details

- In his 50s

- Businessman

Buyer’s Brief

- Looking for a home that can double as an investment

- 4 bedroom

Challenges they faced

- Concerns on ABSD

- Timeline issues with financing

- How to evaluate which was the right new launch unit

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

First consultation

Our first interaction with J unfolded more as a casual inquiry rather than a formal consultation. J, already immersed in discussions with another property agent, approached us on 17th January 2021. He sought an alternate viewpoint and additional insights on two projects: Pasir Ris 8 and The Ryse Residences.

True to our approach with most case studies, our exploratory conversation stretched beyond mere details of the condos. We attempted to probe J’s primary considerations to assess the suitability of these projects for his needs. Perhaps it was a bit early though, as J didn’t share too much at this point – his interest seemed to be focused on the analysis of these two condos.

Following this initial discourse, the urgency to purchase only begin again nearly half a year later.

Delving Deeper: The Second Consultation

When we reconnected for the second call, J’s concerns centred around the Additional Buyer’s Stamp Duty (ABSD). He was trying to understand whether it was levied upon transaction completion or at the Temporary Occupation Permit (TOP) stage. This provided an opportunity for us to guide him through the costs involved, presenting a comprehensive financial breakdown and explaining the transaction timeline.

(Just for clarity, stamp duties are payable within 14 days upon signing the Sale & Purchase Agreement, thus completing the transaction).

While we slightly deviated from our typical process (where we explore the buyer’s profile first), discussing financial intricacies often reveals important aspects of the client’s circumstances. Apart from clarifying things for J, it also helped us identify which projects could be financially viable for him post-stamp duties.

An interesting revelation was J’s interest in acquiring a second property. He already owned a fully paid-up condo on Singapore’s west side and was contemplating the prospect of maintaining it while investing in another.

Although this would usually involve having to pay the ABSD, we identified a possible workaround for J. By decoupling his current property ownership, either he or his co-borrower could transfer their share to the other, allowing one of them to buy a second property without incurring an ABSD.

We also worked out that J met the definition of an owner-investor. While his intention was to reside in the property, he was also interested in reaping investment returns. Plus, owning two properties presented an additional advantage: J wouldn’t need to rent a place while waiting for the construction of the new property.

However, at the age range in the 50s, we had to consider the impact of loan tenure. The sum of the loan tenure and the borrower’s age must not exceed 65; otherwise, the required down payment could rise to 45 per cent. Therefore, the amount of J’s CPF reserves he could use became a crucial factor.

(Note that you can still use your CPF to pay for properties even at 55 or beyond – but there are housing limits and eligibility requirements).

With these financial and logistical considerations in mind, we arranged a visit to the Pasir Ris 8 show flat with J. He was open to all options, from two to four-bedroom units, mainly concerned about the lift’s positioning and layout dimensions.

Despite our planning, we encountered a few obstacles. While preparing the final calculations for the booking day, J’s timeline had to be pushed back and reorganised. This was due to issues over the immediate availability of funds.

The issue would have been less challenging before 2020 when the Option To Purchase (OTP) could be extended. However, new rules since September 2020 have ended this practice, making developers more rigid and less likely to grant extensions.

Given the potential complications of rushing the process, we advised J to be patient and wait for a more opportune time as there weren’t suitable units at that time that we felt were suitable.

Exploring new options: The Third Consultation

We reconnected with J in the early days of 2022, reaching out to him with updates on the latest new launches. Our conversations led to his interest in The Reserve Residences, referred to back then as the generic Jalan Anak Bukit land sales site.

J was interested in our opinion on the location, but as details were scarce, we had few comparisons or hard data points. As such, we decided to give updates over time, and as more information became available. At the same time, we also brought up again that he should consider a part sale/purchase of his existing west-side property.

J was contemplating this decoupling process sometime in the following February when he would return from his overseas travel. As a businessman, his itinerary often involved significant travelling.

However, there wasn’t much communication with J again, until he became available in September. On the 8th of September J reached out again; and after going over the details, we agreed to have a look at Lentor Modern.

New Launch Condo Analysis6 Reasons Why Lentor Modern Sold 84% Of Its 605 Units During Launch

by Ryan J. OngDuring the viewing of the show flat, it was obvious that J had a high attention to detail. While he appreciated that Lentor Modern had a good location, he was clear that the property had to be good for own-stay use as well as investment.

This meant a good kitchen and living room for his wife, and a need for greenery. Where he currently lived, J liked to get lost in the nature reserve for an hour a day after work, for peace of mind. Also, as a businessman, the home was sometimes a meeting point with prospective clients, associates, etc., so a good experience was a must for visitors.

With these considerations in mind, we were able to develop a systematic process for subsequent house hunting, aiming to circumvent the financial obstacles experienced previously:

- First, we checked in with the conveyancing firm to kickstart the decoupling. Based on the time taken, we were able to work out a timing when a September 18th purchase was doable.

- Second, we ensured that the loan package, down payment, loan tenure, etc., were practical and manageable for J.

- We contacted the bank, to go over the terms and conditions (e.g., we wanted a loan package where, if J paid off the loan partially or in full before the loan tenure was up, he wouldn’t be penalised). We also double-checked to ensure affordability parameters, like the Total Debt Servicing Ratio (TDSR), could all be passed.

Refining the Search: The Final Leg of the House Hunting Journey

Once we had the financials in place, the search for the perfect property rapidly accelerated.

Unfortunately, Lentor Modern fell off the list upon closer inspection. Although we had initially recommended the four-bedders at this location, the parking situation was a deal breaker – paid parking for visitors was far from ideal for a businessman regularly hosting clients and associates.

(We had recommended the bigger four-bedders, because all other units in the area were smaller; and with good schools in the area, families seeking to move into the area would want the larger units)

Regardless, the financials and decoupling were already squared away, so it was easy to push ahead. On November 17th, we briefed J on The Reserve Residences, discussing unit sizes ranging from 400 to 3,500 sq. ft. We also weighed the pros and cons of it being an integrated development and proposed alternatives like Terra Hill and The Continuum.

The market buzz around these three properties was as follows:

- The Reserve Residences – being a Far East development, there were rumours that it would cost $3,000 psf.

- Terra Hill – Despite an irregular plot shape, it was a more luxurious freehold own stay alternative

- The Continuum – Hailed as an impressive full-sized development near Paya Lebar and freehold, the price point was a potential stumbling block.

Terra Hill was suitable for J in terms of proximity to Mount Faber and a long-term hold. Seeing the relevancy of bigger units in projects like The Peak, Pepys Hill and Island View, it made sense for looking at bigger units.

More from Stacked

I Reviewed A New Launch 4-Bedroom Penthouse At Beauty World

Bukit Timah recorded a 53% take-up rate during its first sales weekend. It was an impressive showing and placed the…

Also, the lack of smaller more affordable units could help demand in that area.

The Continuum was a somewhat similar bigger development and bigger units did very well in the last few years. And because there was a lack of big developments in the East, plus the population of boutique developments were really high. When the cooling measures of Sellers Stamp Duty (SSD) were implemented, the transaction volume of these 30-odd unit developments suffered quite a bit.

In contrast, The Reserve Residences, an integrated development within one kilometre of Methodist Girls School and Pei Hwa, offered larger units and seemed a unique proposition.

Our first visit was to Terra Hill. Though pricing for larger units was steep, the premium blocks boasted superb layouts. However, J wasn’t impressed by the smaller four-bedder options.

We then turned our attention to The Continuum, amid a wave of hype in March 2023. While J acknowledged its potential as a suitable investment in the long run, his West side preference and frequent travel led to his decision to bypass this option.

By now The Reserve Residences launch was around the corner, and we were able to obtain some new details every couple of days. There were a few issues that we had to work out:

First, was the toilet that was not naturally ventilated – how would it work? We identified that Creekside had a good layout in the three-bedders but its back was facing PIE. The tower blocks had a few pool-facing units that were good such as the four-bedders in stacks 115 and 116 and the three-bedders in stacks 92 or 97.

Here were some of our main concerns that we put forward to the sales team:

Q1. Bathroom Ventilation

– For Mechanical Ventilated bathrooms, is the ventilation in a common shaft or is separate for each unit?

– Is the Mechanical Ventilation always ON or controlled individually?

– Any provision to prevent back drafts?

The responses to this came back as:

1. Ventilators are separate for each unit

2. The Mechanical vent air will be let outwards. Likely no backdraft.

Besides this, we looked at other issues like:

- Location of rubbish chute

- Location of Genset

- Location of BBQ pits

- Internal length/width of rooms for above units.

- Identification of quietest stacks/units

We had a few issues to iron out because, when you’re getting a new development, a lot of these could be hard to see without looking at the actual product. As an example regarding the potential noise, we went up to Sherwood Towers car park to have a feel of the sound.

We then made a call to J informing him the noise levels were in fact bad, and 78 decibels at the window; we would need convincing details from the developer of expected noise levels to make any real conclusions.

We did the financial breakdown of the stacks, including the intended floors. It was also difficult to predict because no pricing was out yet; but we based our own predictions of the upper limit. Certain developments, we advised A, are worth the extra cost, if you’re aware of the competition and their respective price points.

Reserve Residences Showflat Viewing and Selection

The time had come to visit the show flat at the Reserve Residences.

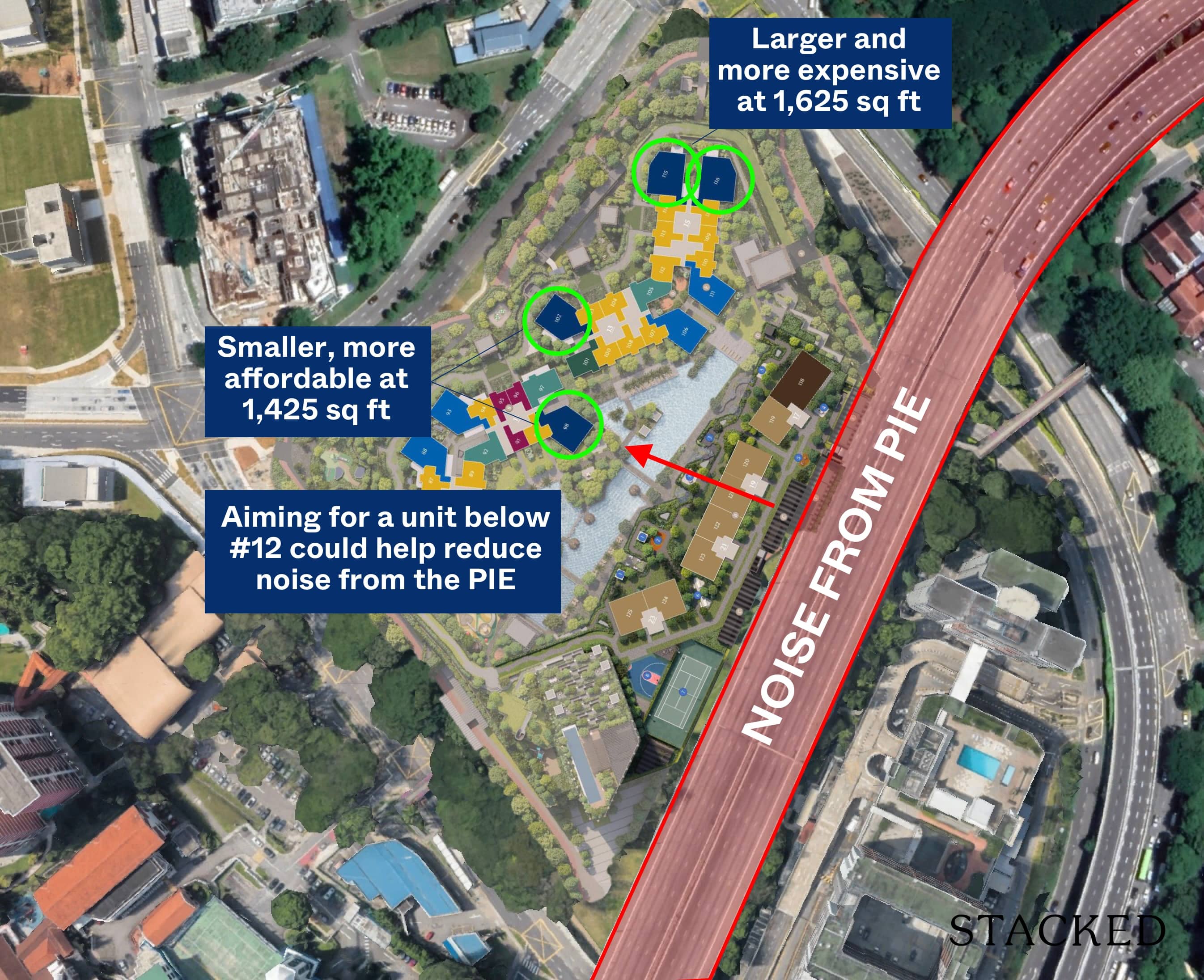

We first examined the model of the building, gaining an understanding of the location of existing roads, the Pan Island Expressway (PIE), the height of the building, and the general orientation of the various stacks. Within the Creekside collection at Reserve Residences, we found appealing three-bedroom units; however, we remained wary of potential road noise from the PIE.

The attractive indicative price of $2,300 psf was our starting point, but given our past experiences, we knew that factors like facing, floor level increments, and price adjustments at certain levels, like the 10th and 20th, could vary significantly.

We estimated that the launch price for the three-bedroom units in the Creekside collection would be around $3.1 million. We further projected that for $3.3 million, we could secure a higher floor, possibly in the corner blocks which were more distanced from the PIE.

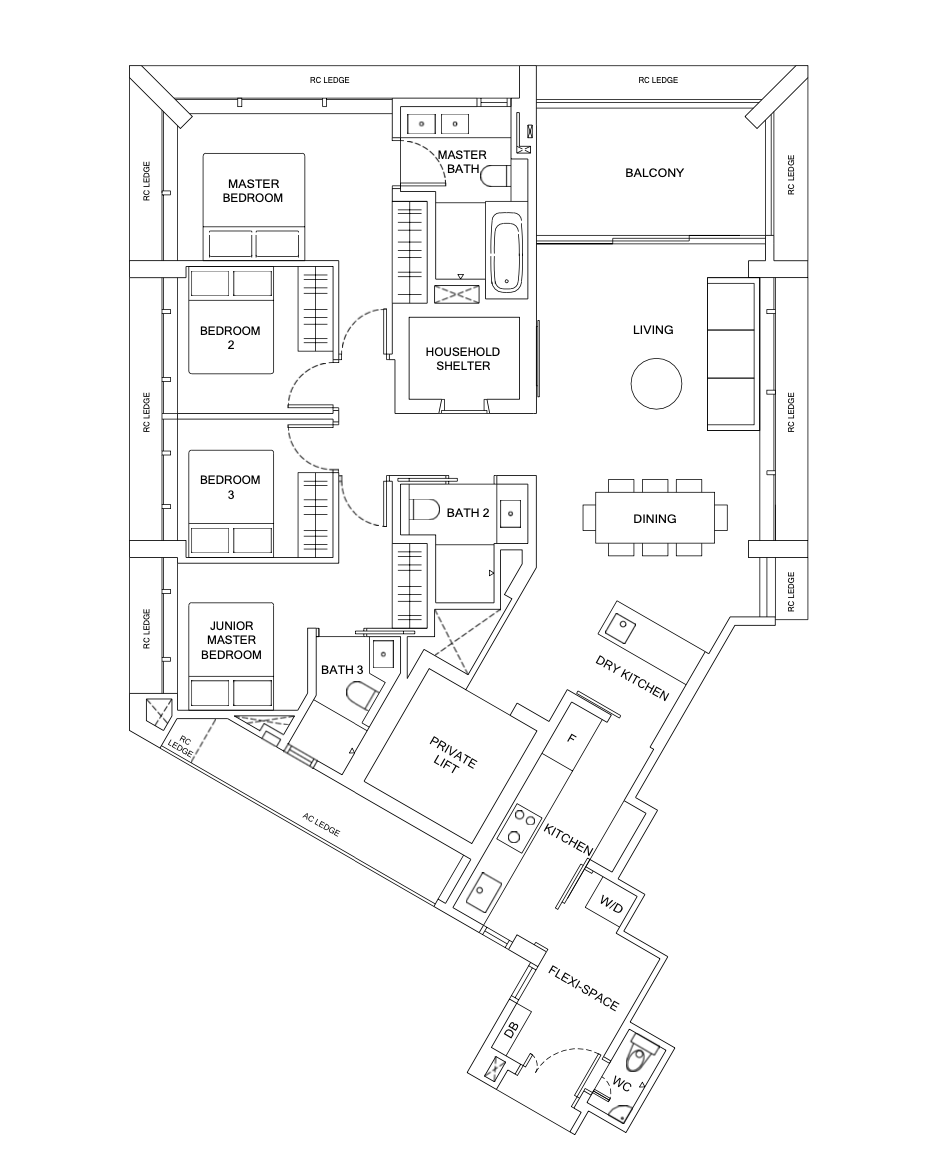

Our attention then turned to other options within the development. We found the four-bedroom units in the Horizon Collection, another part of Reserve Residences, were priced considerably higher due to their size, spanning 1,625 sq. ft.

To find a more feasible option, we compared these to the four-bedroom unit at stack 98. Although there could be some road noise, choosing a unit below the 12th floor could mitigate the impact of noise from the PIE. The unit’s position, with its distance from the pool and a Cabana in the common area, made it an attractive option.

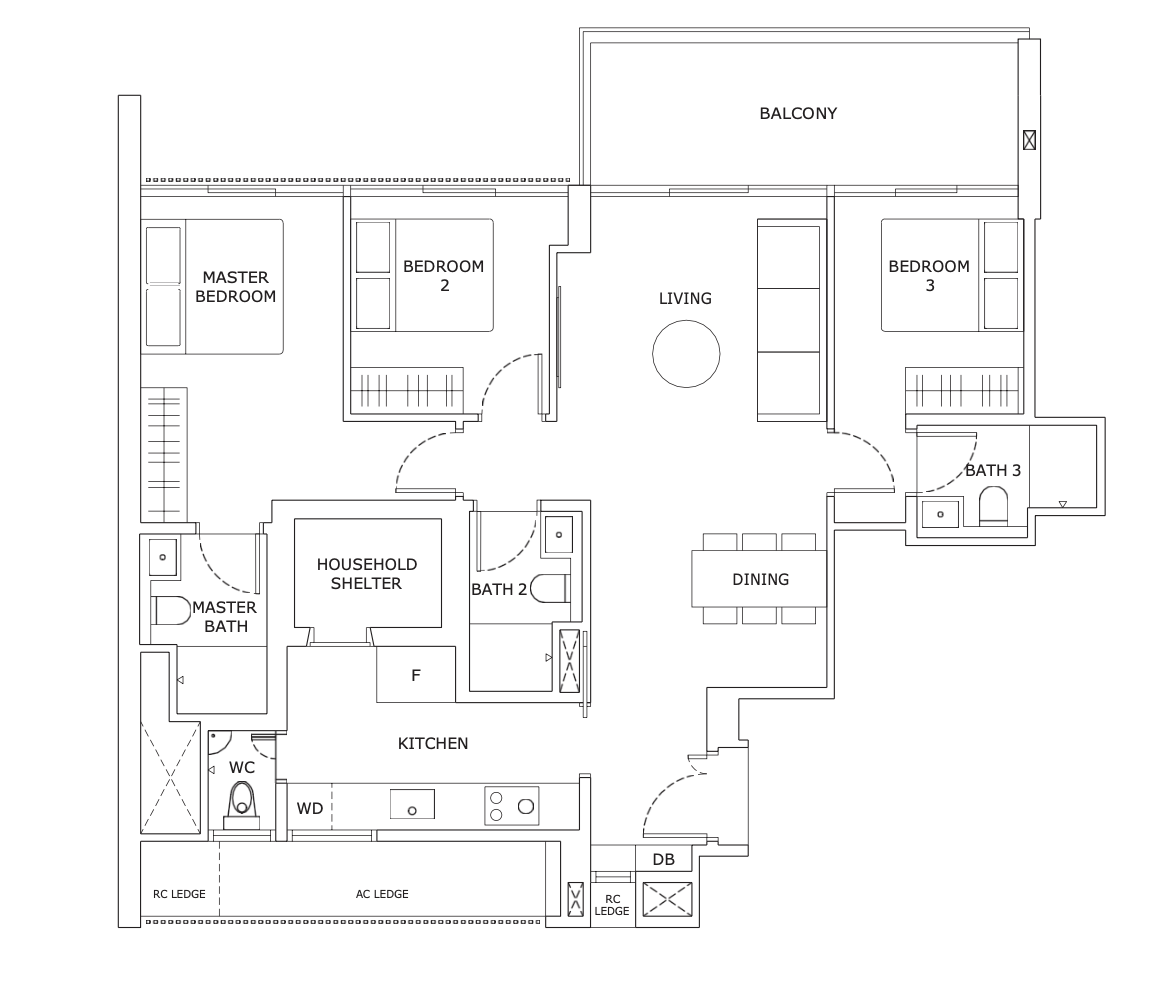

This four-bedroom layout seemed perfect for A, boasting a regular-shaped living room and well-located bedrooms that offered privacy. The spacious kitchen came with a flexible space that could be converted into a maid’s room or storage area. Thus, XX-98 became our top choice.

Since we were at the mercy of the ballot though (judging from the response of the cheque collections), we decided to also consider and do the math for a second unit.

Because the interest and the price were really good, and also the timeline for payments was right – we could potentially select two better units by going in for bulk purchase (as you usually get to pick a day before everyone else).

While a one-bedroom unit was least desirable for J’s situation, a two-bedroom unit at stack 99 seemed possible and could be registered under his daughter’s name.

Between the two and three-bedders, if affordability permitted, a three-bedder would do better as we expect more families in the future to be looking at Reserve Residences. The average quantum of the area for school proximity would probably be in the higher band of $2.8 million to $3 million for the surrounding resale.

After weighing our options, we suggested a three-bedroom unit between stacks 97 and 92 as a potential alternative to our first choice. Stack 92 offered a slightly better view, while stack 97 had a superior layout.

Before we went to the ballot we had a last call before the booking, to make sure we were making the right choice. We again checked that J liked the development and that the 4-bedder would suit his lifestyle.

Upon the release of the ballot results, we were delighted to find both units, on our preferred floor levels, were available. This was a fortunate outcome given the high demand. As expected, smaller units were popular among multiple purchasers.

The buying process takes patience and isn’t always clear-cut

As this transaction shows, picking a home can be an involved and lengthy process. Many seem to think it’s a case of shortlisting what’s on the market right now and making a choice – but it can be many months, with projects coming and going, before the right unit can be found.

The key is to stay up to date, and be open-minded and flexible. Sometimes, the most obvious answers are simply not viable at the time.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What challenges did the buyer face when purchasing a property at Reserve Residences?

How did the buyer's financial considerations influence the property selection process?

Why did the buyer decide against certain properties like Lentor Modern and The Continuum?

What factors were considered when choosing the units at Reserve Residences?

What was the significance of the decoupling process in the buyer's property purchase plan?

Ryan Ong

Ryan is part property consultant, part wordsmith, and a true numbers aficionado. Ryan's balanced approach to every transaction is as diverse as it is effective. Since starting his real estate journey in 2016, he has personally brokered over $250 million of properties. Beyond the professional sphere, you'll often find him cherishing moments with his beloved cats: Mia, Holly, Percy and Toto.Need help with a property decision?

Speak to our team →Read next from Investor Case Studies

Investor Case Studies Why We Chose A $1.23 Million 2-Bedroom Unit At Parc Vista Over An HDB: A Buyer’s Case Study

Investor Case Studies How We Made $270k From A $960k Condo Bought During COVID: A Buyer’s Case Study

Investor Case Studies Why We Bought A 3-Bedder Condo At Penrose: A Buyer’s Case Study

Editor's Pick Why I Bought A 2-Bedder Investment Property At Leedon Green In District 10: A Buyer’s Case Study

Latest Posts

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

1 Comments

Have viewed Reserve too and was wondering why stackedhomes hasn’t done a more detailed review of the launch so far given its popularity! Some questions:

– the stack 98/102 units should be 1475 sq ft and not 1425 sq ft as shown in one of the article’s diagrams

– was a reason J did not go with the 1625 sq ft units because the developer did not provide convincing replies on dealing with the expected noise due to the road-facing

– not sure it’s accurate to say 98 has ‘well-located bedrooms that offered privacy’, as an agent did point out that the full-glass windows means the other pool-facing units can look into your bedrooms, or even people on the pool-floor if the unit is on a lower floor