How Much Must You Earn To Pay Off Your Property By 50?

October 6, 2020

Here’s a thought that will make any Singaporean heart turn cold: working past 50 to pay off a housing mortgage. Could you really still be attending 10 am presentations, and typing mind-numbing reports in your mid-50’s, all because of that hefty housing mortgage?

It’s enough to make some of us wonder if downgrading to a two-room might be a better option.

Sure, we can have a loan tenure that stretches till our very retirement at 65…but imagine if our home – be it a flat or a condo – is fully paid long before then. The good news is, it may not just be a fantasy.

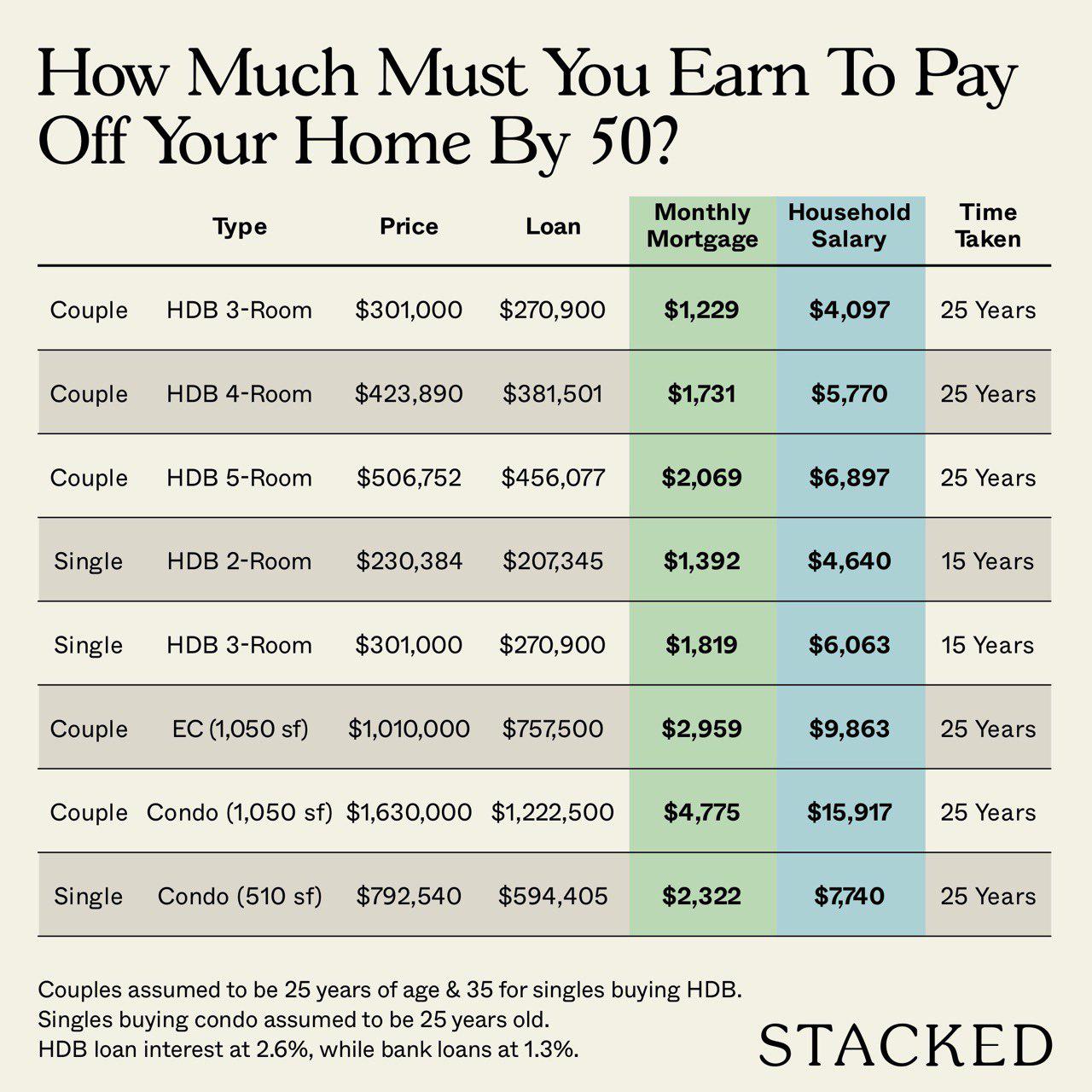

Here’s an estimate of whether you might pay off that housing mortgage by age 50, based on your property and situation:

For HDB flats:

- Dual-income couple aged 25, to pay off a 3-room flat

- Dual-income couple aged 25, to pay off a 4-room flat

- Dual-income couple aged 25, to pay off a 5-room flat

- 35-year old single borrower, to pay off a 2-room flat

- 35-year old single borrower, to pay off a 3-room flat

For dual-income families with condos

- Dual income coupled aged 25, to pay off a 1,050 sq.ft. Executive Condominium

- Dual income couple aged 25, to pay off a 1,050 sq.ft. private condo

- 25-year old single borrower, to pay off a 510 sq. ft. compact unit

Note:

As the situation varies greatly between individual buyers, we have to rely on some generalisations.

For the sake of simplicity, we have excluded the consideration of any grants for HDB flats in our example (as they vary greatly for different cases). We are also assuming that, for examples involving couples, they are both roughly at the age of 25.

We have also assumed that all the buyers will use the maximum loan quantum (90 per cent financing for HDB, and 75 per cent financing for ECs and private condos). By definition, this assumes buyers of HDB flats will use HDB loans. Note that the ideal earnings level can decrease significantly, if a larger initial down payment is made.

We have also applied the current interest rate for bank loans, which is at a historical low point. Rising interest rates in future may change the calculations for bank loans (the condo and EC examples). In addition, we have simplified the estimated repayment, by excluding factors such as the lower initial repayments for progressive payment schemes, or methods such as Deferred Payment Schemes.

1. Dual-income couple aged 25, to pay off a 3-room flat

The average price of a 3-room flat, as of Sept. 2020, is $430 psf across Singapore. The average size of a 3-room flat today is around 700 sq.ft. As such, we can estimate that the average quantum for a 3-room flat is about $301,000.

Maximum HDB loan amount: $270,900

Loan tenure: 25 years (to complete repayment by age 50)

Loan repayment at 2.6% per annum: $1,229 per month

To ensure sustainability, we will cap the monthly loan repayment at 30 per cent of the couple’s collective monthly income.

As such, a combined monthly income of at least $4,097 is ideal, to comfortably pay off the 3-room flat by age 50.

2. Dual-income couple aged 25, to pay off a 4-room flat

The average price of a 4-room flat, as of Sept. 2020, is $437 psf across Singapore. The average size of a 4-room flat today is around 970 sq.ft. As such, the average quantum for a 4-room flat is about $423,890.

Maximum HDB loan amount: $381,501

Loan tenure: 25 years (to complete repayment by age 50)

Loan repayment at 2.6% per annum: $1,731 per month

To ensure sustainability, we will cap the monthly loan repayment at 30 per cent of the couple’s collective monthly income.

As such, a combined monthly income of at least $5,770 is ideal, to comfortably pay off the 4-room flat by age 50.

3. Dual-income couple aged 25, to pay off a 5-room flat

The average price of a 5-room flat, as of Sept. 2020, is $428 psf across Singapore. The average size of a 5-room flat today is around 1,184 sq.ft. As such, the average quantum for a 5-room flat is about $506,752.

Maximum HDB loan amount: $456,077

Loan tenure: 25 years (to complete repayment by age 50)

Loan repayment at 2.6% per annum: $2,069 per month

To ensure sustainability, we will cap the monthly loan repayment at 30 per cent of the couple’s collective monthly income.

As such, a combined monthly income of at least $6,897 is ideal, to comfortably pay off the 5-room flat by age 50.

4. 35-year old single borrower, to pay off a 2-room flat

The average price of a 2-room flat, as of Sept. 2020, is $476 psf across Singapore. 2-room flats come in two main sizes: around 387 sq.ft., and 484 sq.ft.. We will use the larger 2-room flat in this example.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Should You Pay For A Buyer Agent?

You know those guides that say you should bang pots and pans, to scare off a bear?

The average quantum for the such a flat is about $230,384.

Maximum HDB loan amount: $207,345

Loan tenure: 15 years (to complete repayment by age 50)

Loan repayment at 2.6% per annum: $1,392 per month

To ensure sustainability, we will cap the monthly loan repayment at 30 per cent of the couple’s collective monthly income.

A monthly income of at least $4,640 is ideal, to comfortably pay off the 2-room flat by age 50.

Property Advice10 Things a First Time Condo Buyer Should Look Out For To Avoid Regret

by Druce Teo5. 35-year old single borrower, to pay off a 3-room flat

The average price of a 3-room flat is about $301,000 (see above).

Maximum HDB loan amount: $270,900

Loan tenure: 15 years (to complete repayment by age 50)

Loan repayment at 2.6% per annum: $1,819 per month

To ensure sustainability, we will cap the monthly loan repayment at 30 per cent of the couple’s collective monthly income.

A monthly income of at least $6,063 is ideal, to comfortably pay off the 3-room flat by age 50.

Next, we’ll take a look at dual-income families with condos:

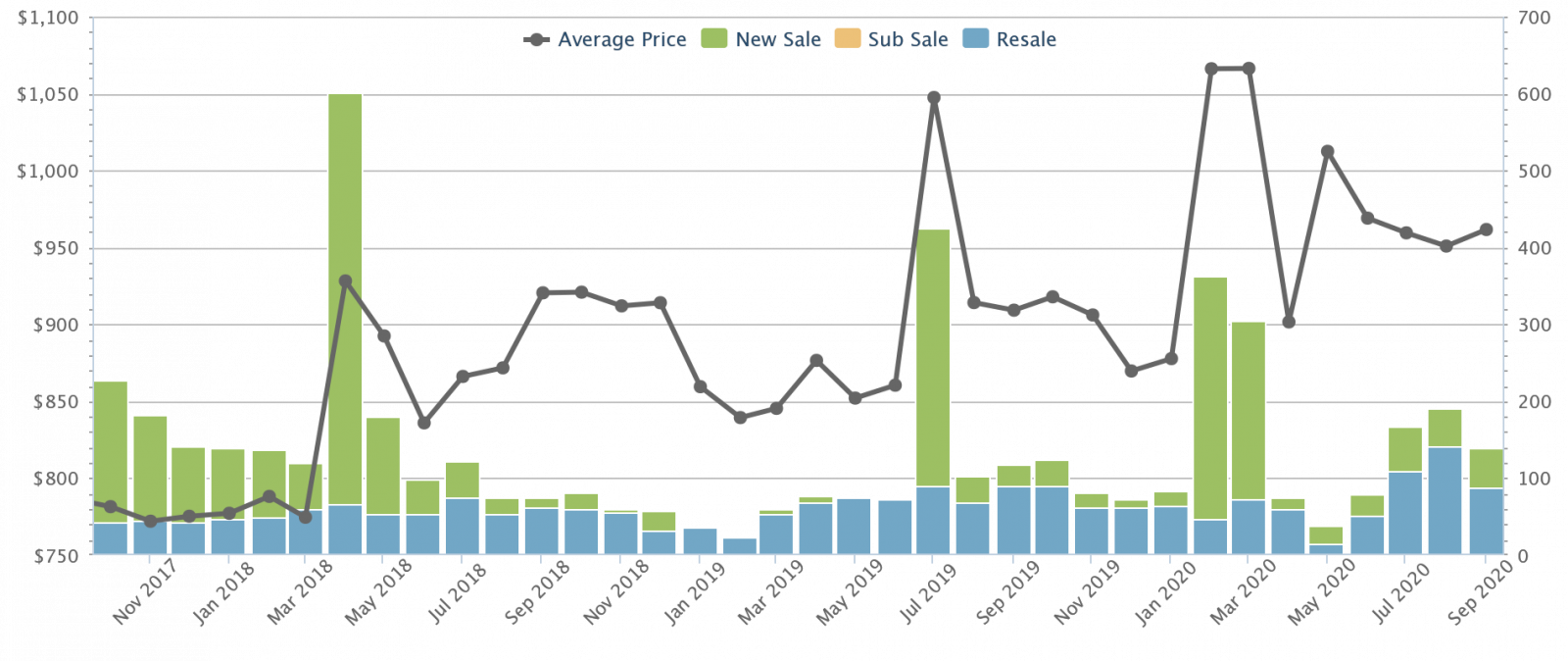

1. Dual income coupled aged 25, to pay off a 1,050 sq.ft. Executive Condominium (EC)

The average price of an EC unit, as of Sept. 2020, is $962 psf across Singapore. The typical size of an EC unit is about 1,050 sq.ft. As such, the average quantum for such an EC unit is about $1.01 million.

Maximum bank loan: $757,500

Loan tenure: 25 years (to complete repayment by age 50)

Loan repayment at 1.3% per annum: $2,959 per month

To ensure sustainability, we will cap the monthly loan repayment at 30 per cent of the couple’s collective monthly income.

As such, a combined monthly income of at least $9,863 is ideal, to comfortably pay off the EC by age 50.

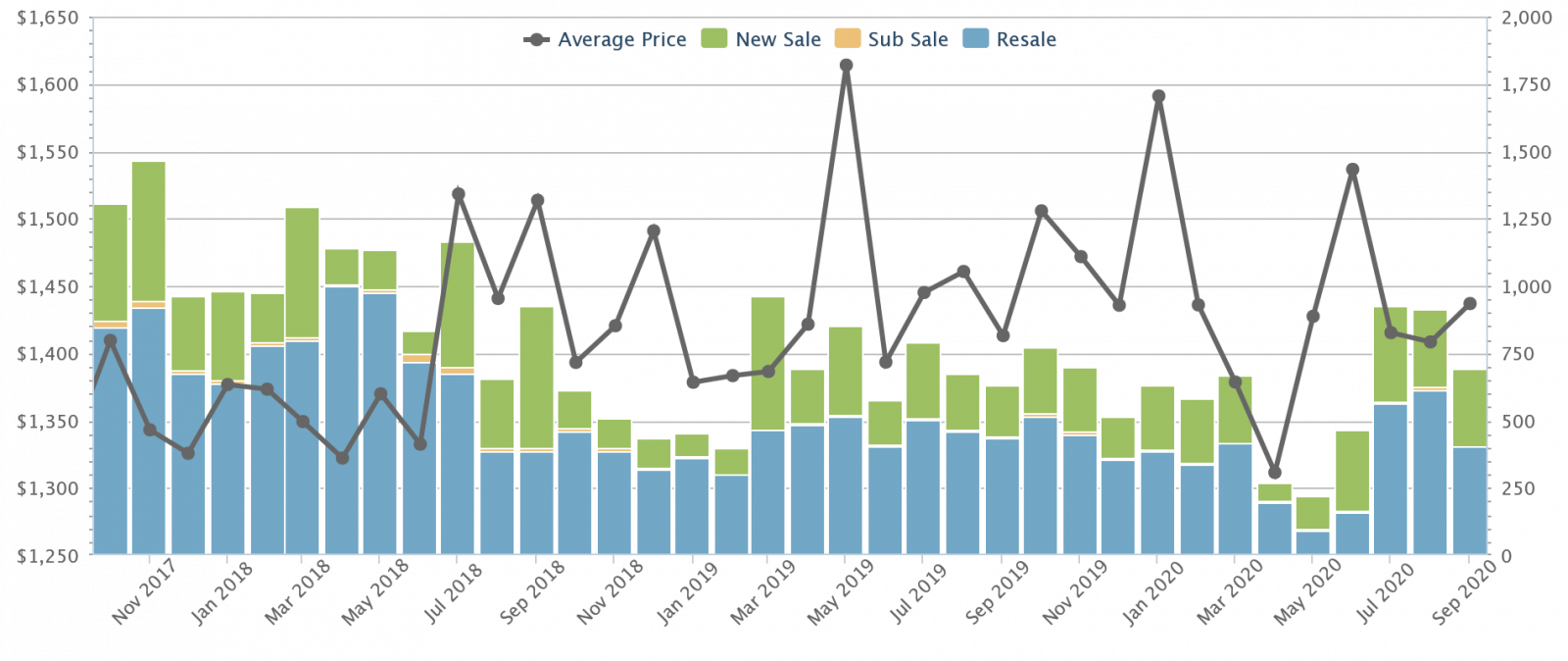

2. Dual income couple aged 25, to pay off a 1,050 sq.ft. private condo

The average price of a condo unit, as of Sept. 2020, is $1,554 psf across Singapore. We will compare this to an equivalent-sized EC unit (as in the above example), of 1,050 sq.ft. A private condo of the same size would thus average $1.63 million.

Maximum bank loan: $1,222,500

Loan tenure: 25 years (to complete repayment by age 50)

Loan repayment at 1.3% per annum: $4,775 per month

To ensure sustainability, we will cap the monthly loan repayment at 30 per cent of the couple’s monthly income.

As such, a combined monthly income of at least $15,917 is ideal, to comfortably pay off the private condo by age 50.

Next, we’ll look at condos with a single borrower:

1. 25-year old single borrower, to pay off a 510 sq. ft. compact unit

The average price of a private condo today is $1,554 psf (see above). A compact unit is, by convention, anything of 510 sq.ft. or below. For this example, we will use the biggest compact units.

The average quantum for such a unit would be $792,540.

Maximum bank loan: $594,405

Loan tenure: 25 years (to complete repayment by age 50)

Loan repayment at 1.3% per annum: $2,322 per month

To ensure sustainability, we will cap the monthly loan repayment at 30 per cent of the borrower’s monthly income.

As such, a monthly income of at least $7,740 is ideal, to comfortably pay off the compact unit by age 50.

If the numbers seem high, don’t be too discouraged by this; remember there are ways to make things easier.

We haven’t factored in benefits like grants (for HDB flats), or the possibility of renting out rooms or even the whole unit for a while (e.g. some compact unit owners stay with their parents for a few years, and generate pure rental income with the condo; this can significantly quicken the pace at which they pay off the loan).

If you’re worried about your specific situation, drop us a message on Facebook. If we can know the exact details of your property and loan, we can help you work out an appropriate strategy.

Finally, don’t forget to consult a qualified financial planner, even if you see that one of the above is within your grasp.

It’s may not always be the best move to rush and pay off the mortgage by 50, even if you could. There could be other reasons – such as a need to build up more savings – that should be settled before rushing your home loan.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How much income do I need to pay off a 3-room flat by age 50?

What is the estimated salary required to pay off a private condo by age 50?

Can a single person pay off a 2-room flat by age 50, and what income is needed?

What factors could help reduce the income needed to pay off a property early?

Is it always advisable to pay off a mortgage by age 50?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

0 Comments