You Have Enough To Pay Off Your Home Loan Early; But Should You?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

It is a miracle! For years you’ve slogged away at your home loan, thinking you were never going to get it paid. Then lo and behold, long before even your 55th birthday, you check the mortgage and realise: hey, you can repay the outstanding home loan right now if you want.

And the quicker you repay the loan, the less interest you pay, right? But make a few phone calls, and you’ll probably meet at least one mortgage broker who wags his finger and tells you to reconsider. As it turns out, the issue of whether to repay your home loan early is more complicated than it seems.

This is one of those situations where, sometimes, it can even be less financially prudent to pay off the outstanding loan early. Here’s what to consider before you go ahead:

Why isn’t it always better to pay off the home loan early?

- Locking up the cash in your property is dangerous if you lack savings

- Given the low interest rate, you might be better off investing the money elsewhere

- You have higher interest-rate debts that you should clear first

- Your mortgage can be insured anyway

- It’s not always free to redeem your home loan early

1. Locking up the cash in your property is dangerous if you lack savings

Here’s a typical scenario where early repayment could be dangerous:

Say you owe an outstanding $300,000 on your home loan for your flat, and have little else in the way of cash. By some windfall, you end up getting $300,000 by way of inheritance, winning the lottery, etc.

You decide to use all $300,000 to pay off the flat loan, because that means no more interest repayments.

Great, but now what happens in an emergency such as retrenchment, or high medical bills?

You can’t “undo” the payment you’ve already made for your flat. At the same time, you can’t pay your medical bills or day-to-day expenses with your flat; bill collectors don’t care that you have no outstanding home loan.

This can result in some undesirable alternatives, such as having to downgrade the flat, rent out rooms, or use other forms of credit. And once you resort to methods such as personal loans, you would have cemented a bad decision: your HDB loan interest rate would only be 2.6 per cent per annum, and a private bank home loan is currently around 1.3 per cent. Both are cheaper than unsecured bank loans, which range from six to nine per cent per annum.

As such, it’s usually inadvisable to rush home loan repayment, unless you would still have sufficient savings afterward*.

*This is often defined as six months worth of expenses, but consult a qualified professional with regard to your personal finances.

Private property owners, however, have an option that HDB owners don’t have in these situations

Let’s say you rushed to pay off a private property, instead of your flat. If you run out of cash afterward, you have one option that HDB owners don’t.

You can maybe get cash-out refinancing: this is a bank loan that uses your home as collateral. You might be able to borrow up to 80 per cent of the value of your home (subject to the bank’s approval), at fairly low interest rates – often as low as 1.3 to 1.6 per cent per annum.

However, this does mean you’re back to square one, as you once again have a big property loan to pay (or the bank will foreclose). Also, there’s no guarantee that a bank will grant you such a loan, as you still need to meet parameters like age limits, the Total Debt Servicing Ratio (TDSR), creditworthiness, and others.

(If for some reason you need cash-out refinancing, contact us on Facebook, and we can help you through it. No guarantees though!)

Regardless, even if you have a private property, avoid rushing your home loan repayment if it would leave you too cash-strapped.

2. Given the low interest rate, you might be better off investing the money elsewhere

At present, home loan rates in Singapore are only at 1.3 per cent. This is likely to persist till 2022, given the US commitment to keeping interest rates low.

Financially savvy homeowners – such as those who know how to trade and invest – should take this into consideration before paying off their whole loan. Consider, for example, if you have an outstanding $300,000, with an interest rate of just 1.3 per cent.

Rather than lock up all $300,000 in your property, could you invest it in a way that beats the home loan’s 1.3 per cent interest rate? We won’t be recommending any investment products here as we’re not financial advisors; but we’re confident that most financial professionals can give you a slew of better ways to use the money.

Even without active investing, some homeowners might realise they can beat the home loan just by letting their CPF accumulate (2.5 per cent in the Ordinary Account, and four per cent in the Special Account). So why would they rush repayment and lose liquidity?

3. You have higher interest-rate debts that you should clear first

If you have spare cash, always prioritise other debts over your home loan (e.g. credit card loans accrue at around 26 per cent per annum).

You should never pay off the home loan first, as it’s the debt with the lowest interest.

Property Market CommentaryHDB vs. SIBOR vs. Fixed Deposit: Which Home Loan is Best Right Now?

by Ryan J4. Your mortgage can be insured anyway

One of the concerns among homeowners is that, if they pass on, their family will be saddled with the outstanding home loan. As such, they want to pay off the home loan as soon as possible.

But HDB owners already pay for mandatory mortgage insurance, in the form of the Home Protection Scheme (HPS). The HPS will pay off your outstanding flat loan, if you pass away or suffer a Total Permanent Disability.

Private homeowners can purchase a Mortgage Reducing Term Assurance (MRTA), which if you haven’t you should do right away. The MRTA will also pay off your outstanding home loan, in the event of death or permanent disability.

You don’t need to rush home loan repayment out of fear for this situation, just insure your mortgage.

5. It’s not always free to redeem your home loan early

Do read the terms and conditions of your home loan with care. Some loans impose a prepayment penalty – often in the first three to five years – if you try to pay off the loan early. This is typically 1.5 per cent of the outstanding loan amount.

It’s usually a waste of money; you’d be better off waiting for the period to end, before paying off the rest of your loan.

This isn’t an issue with HDB loans though, which never come with prepayment penalties.

When is it better to pay off your home loan early?

- You want to purchase another property

- The interest rates are high

- Credit reasons

1. You want to purchase another property

Your outstanding home loans affect the maximum loan quantum you can get, on subsequent property purchases.

| Number of outstanding home loans | Maximum financing possible | Minimum down payment that must be made in cash |

| 0 | 75% | 5% |

| 1 | 45% | 25% |

| 2+ | 35% | 25% |

Note that financing may be lowered even further, in the event of poor credit score, exceeding age limits or loan tenures, etc.

The cash outlay may be too large to be viable, if you don’t settle your existing home loan first.

2. The interest rates are high

Home loan interest rates in Singapore were once much higher; around 3.7 to four per cent was a norm.

It is only a series of unusual events – starting from the Global Financial Crisis in 2008 to the Covid-19 situation today – that have kept interest rates at two per cent or below for over a decade.

Someday, however, will come the time when interest rates rise again. That may be many years from now; but when it does, it will be time to consider if early repayment is better given the higher interest.

3. Credit reasons

This may matter for non-property related reasons, such as if you’re a business owner and need to secure working capital loans. Paying off your home loan can improve your creditworthiness, as it’s one of the most substantial long-term debts.

As you can see, it’s not a clear-cut “right or wrong” answer.

This decision really depends on the state of your personal finances, and your near to mid-term goals (e.g. you want to buy another property). However, it’s not as clear-cut as “early repayment = always good”.

If you follow personal finance websites in other countries, bear in mind that their home loans market can be quite different from Singapore. In many other countries, for instance, home loans tend to have a much higher interest rate than ours, and may involve much lower amounts.

Contact us if you’re not sure, and we can get an expert to review your situation. In the meantime, you can find out the latest news, updates, and property investment strategies on Stacked.

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Advice

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Advice Why Punggol Northshore Could Be The Next Hotspot In The HDB Resale Market

Property Advice How Much Is Your Home Really Worth? How Property Valuations Work in Singapore

Property Advice Why I Had Second Thoughts After Buying My Dream Home In Singapore

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

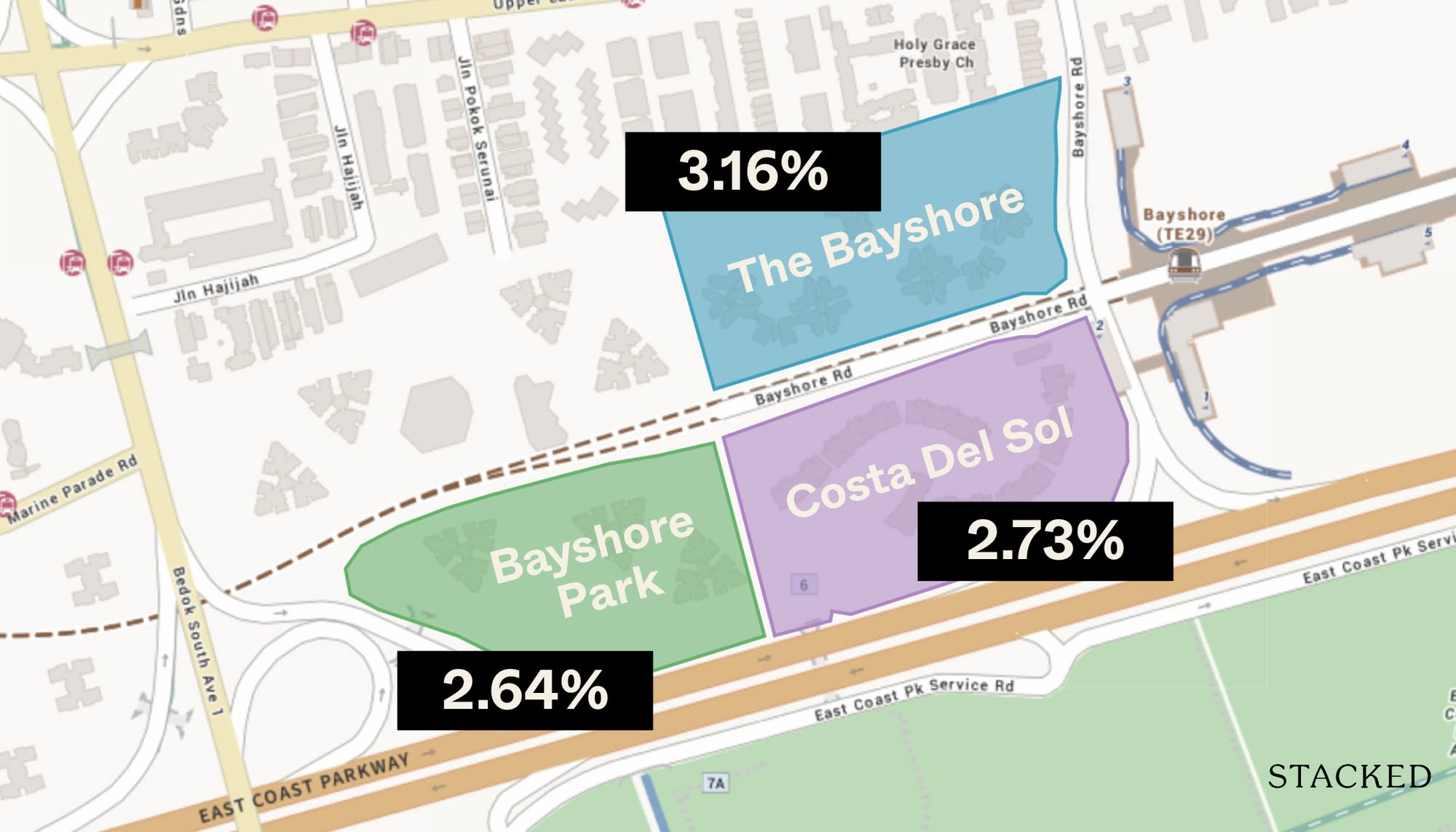

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

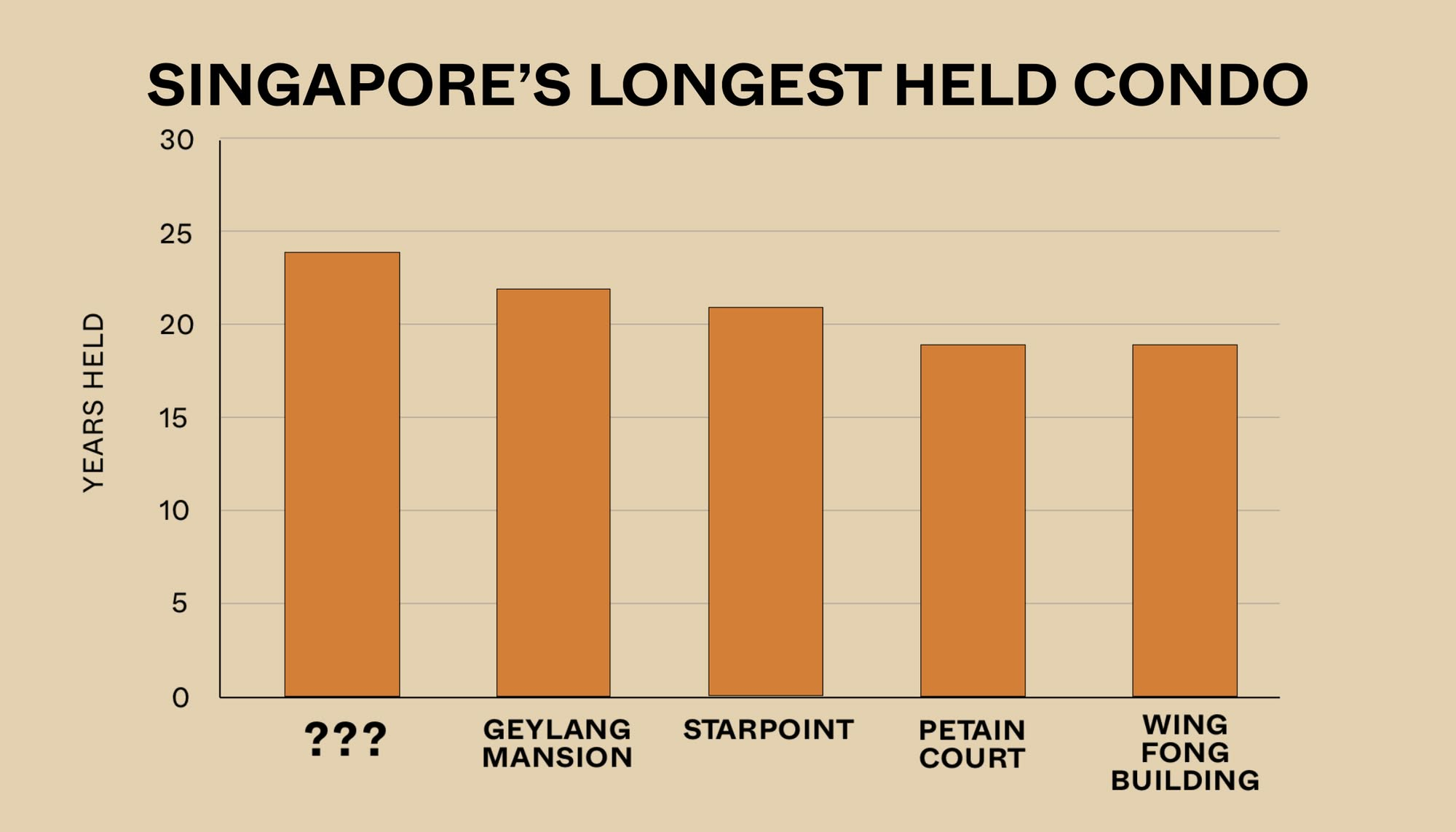

Editor's Pick The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

Editor's Pick This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Editor's Pick Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Editor's Pick Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

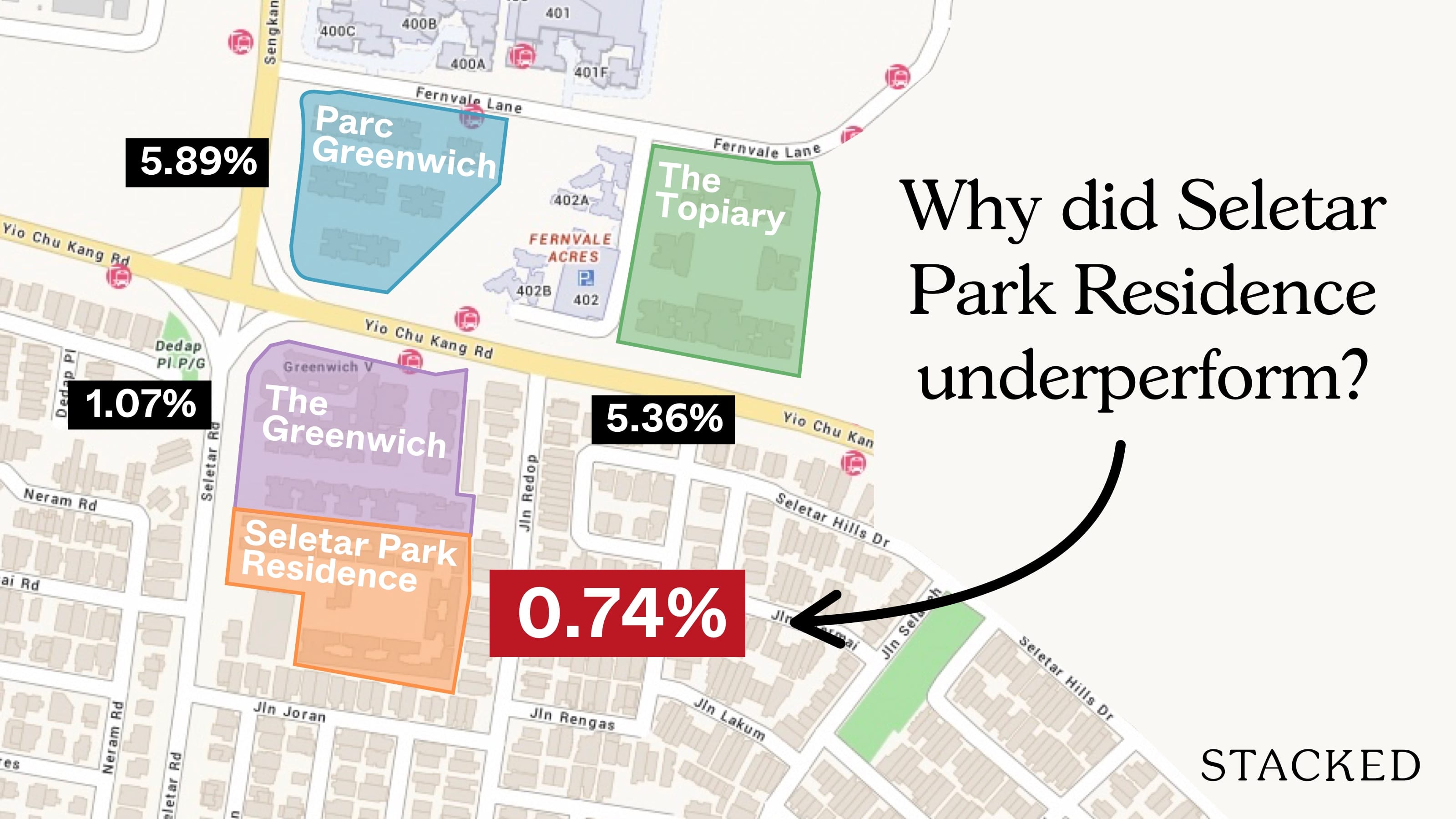

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?