How Does Having Fewer Big Property Agencies Affect Homebuyers?

October 23, 2021

It was just in 2017 that OrangeTee and Edmund Tie & Company announced a new joint venture called Orange Tee and Tie (OTT) to form the third biggest property agency in Singapore with more than 4,400 agents.

How things have changed though.

With a recent big exodus from Orange Tee and Tie (OTT) toward other real estate agencies, there’s a real possibility that the “big four” will soon become the “big three”. Singapore’s real estate firms now resemble an oligopoly, with possibly just three “power players” dominating the market. But is this a healthy situation for homebuyers?

The state of Singapore realtors today

If you’re looking to buy or sell a home, you’ll notice there seem to be just four agency names: Propnex, ERA, OrangeTee & Tie (OTT), and Huttons.

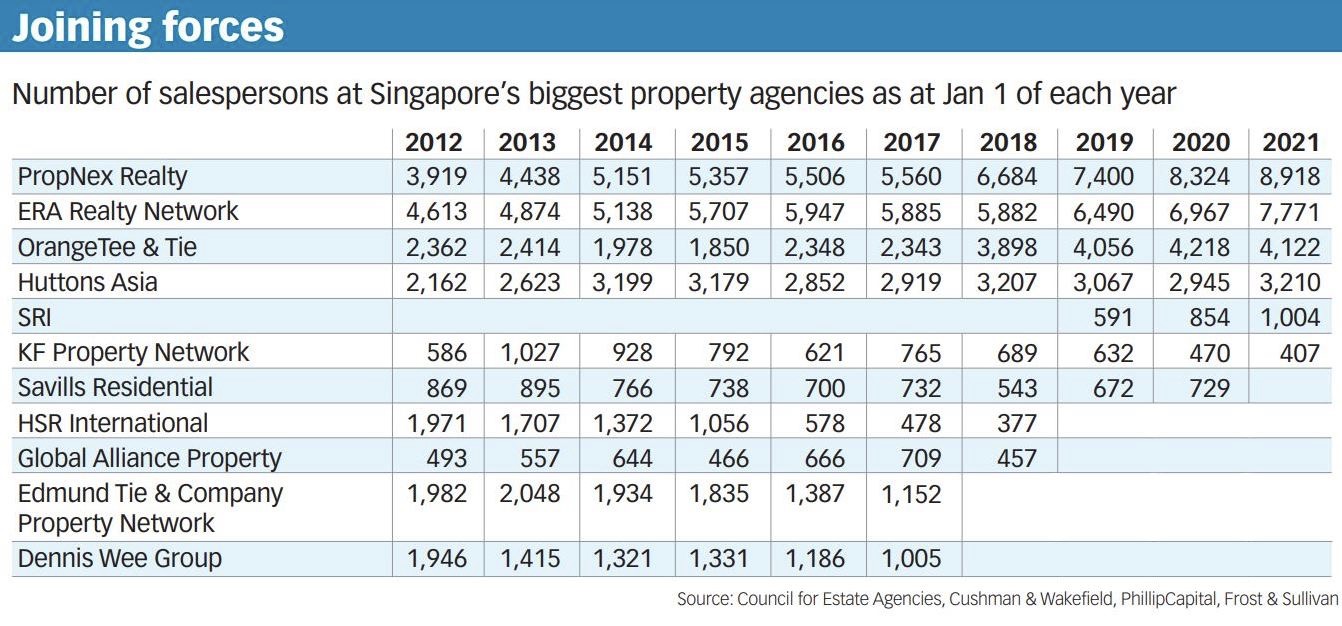

These are the numbers reported by The Business Times:

It’s estimated that the “big four” account for at least 80 per cent of active realtors in the market.

In 2021, the agencies have become increasingly aggressive in their recruitment tactics; and are quite eager to lure agents away from each other. In May this year, for instance, Propnex rolled out a “Rescue & Grow” package, where they would subsidise up to $3,000 of an agent’s penalty, for leaving to join Propnex. In June, ERA followed up with a similar offer.

(Most real estate firms have a clawback clause, where agents need to pay back training fees or marketing expenses, should they leave for another agency).

Although it’s not widely publicised, there was also a large exodus from OTT a few months back; individual agents, as well as some large groups, moved to other agencies like Huttons and Propnex.

If you see your former agent with a new name card, this may be the reason.

Consolidation into just three large agencies may not be too healthy

To explain how all these matters, we need to touch on property developers, and their existing margins (check out our previous article on this).

As we mentioned in the earlier article, about five per cent of the selling price can be attributed to the developers having to pay commissions alone (of course, this is dependant on the project, but it is a common thread we are seeing). They don’t really have a way around this, because developers are almost wholly reliant on property firms to market their projects.

Since around the ‘90s, this has been how “the system” works: the developer focuses just on getting the project built, and maybe providing the 3D images and other marketing materials. Beyond that, it’s left to agencies to:

- Man the show flats

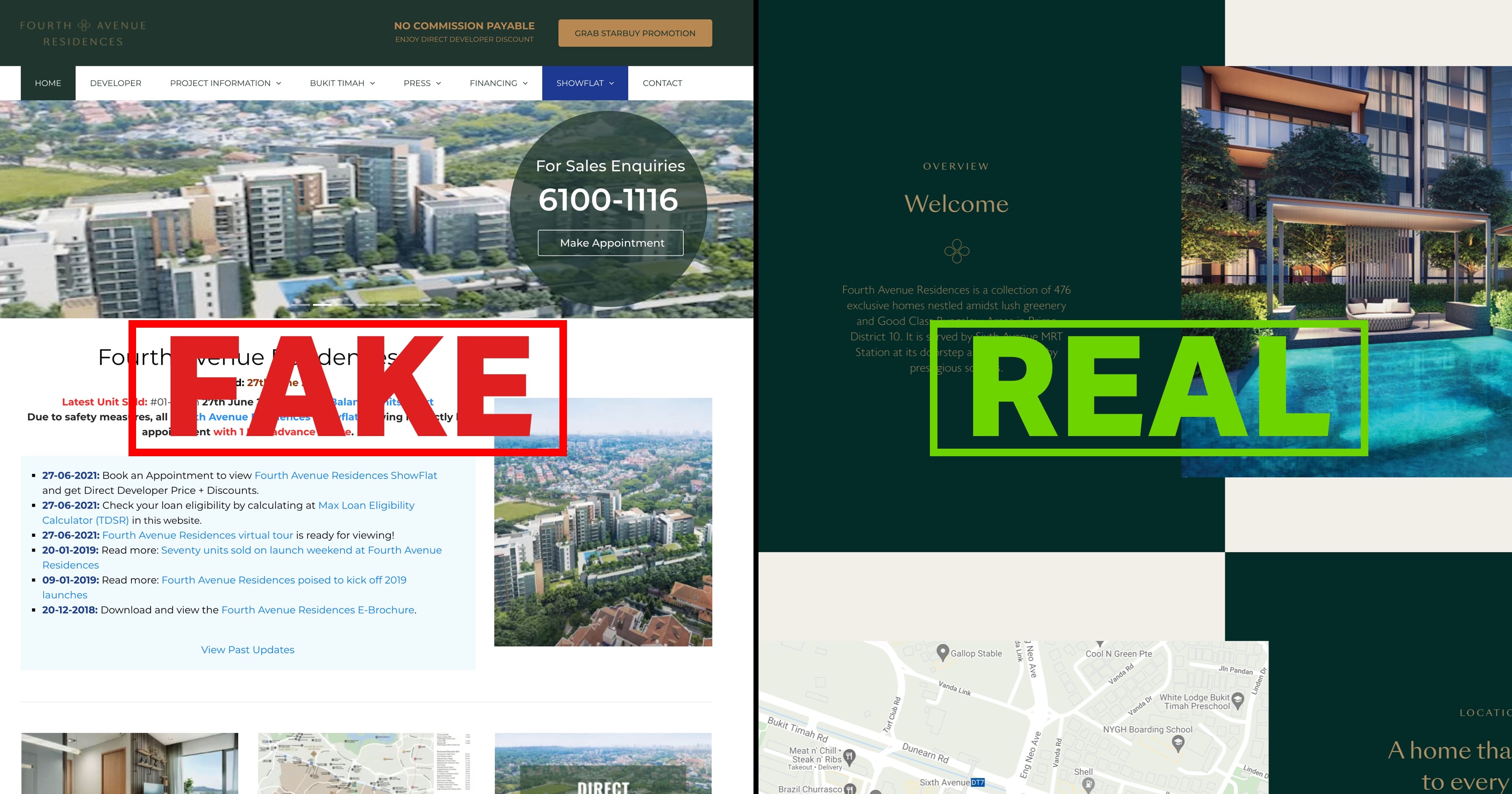

- Set up websites about the project (if you Google any development, you’ll see hundreds of web pages about the project, almost all of which are owned by agents. Some of them even call their sites the “official” developer page, when it’s not).

- Pay property portals like PropertyGuru, 99.co, etc. to put up listings

- Create advertisements, ranging from videos to social media content (sometimes with disastrous results, like this Midwood condo ad that sparked outrage for its apparent snobbery)

- Engage and negotiate with the buyers

If you’re a home buyer, try to think of the last time you spoke directly to a developer. Chances are, the answer is never. All your queries are filtered through agents.

Property AdviceDon’t Be Fooled By “Official” Developer Sites: 7 Tell-Tale Signs To Uncover The Knock-Offs

by Ryan J. OngThis has gotten to the point where, in some cases, buyers can’t even contact the developer to raise issues about defects, or dates of the first general meeting. In some of these cases, it ends up being the property agent who has to put them in touch.

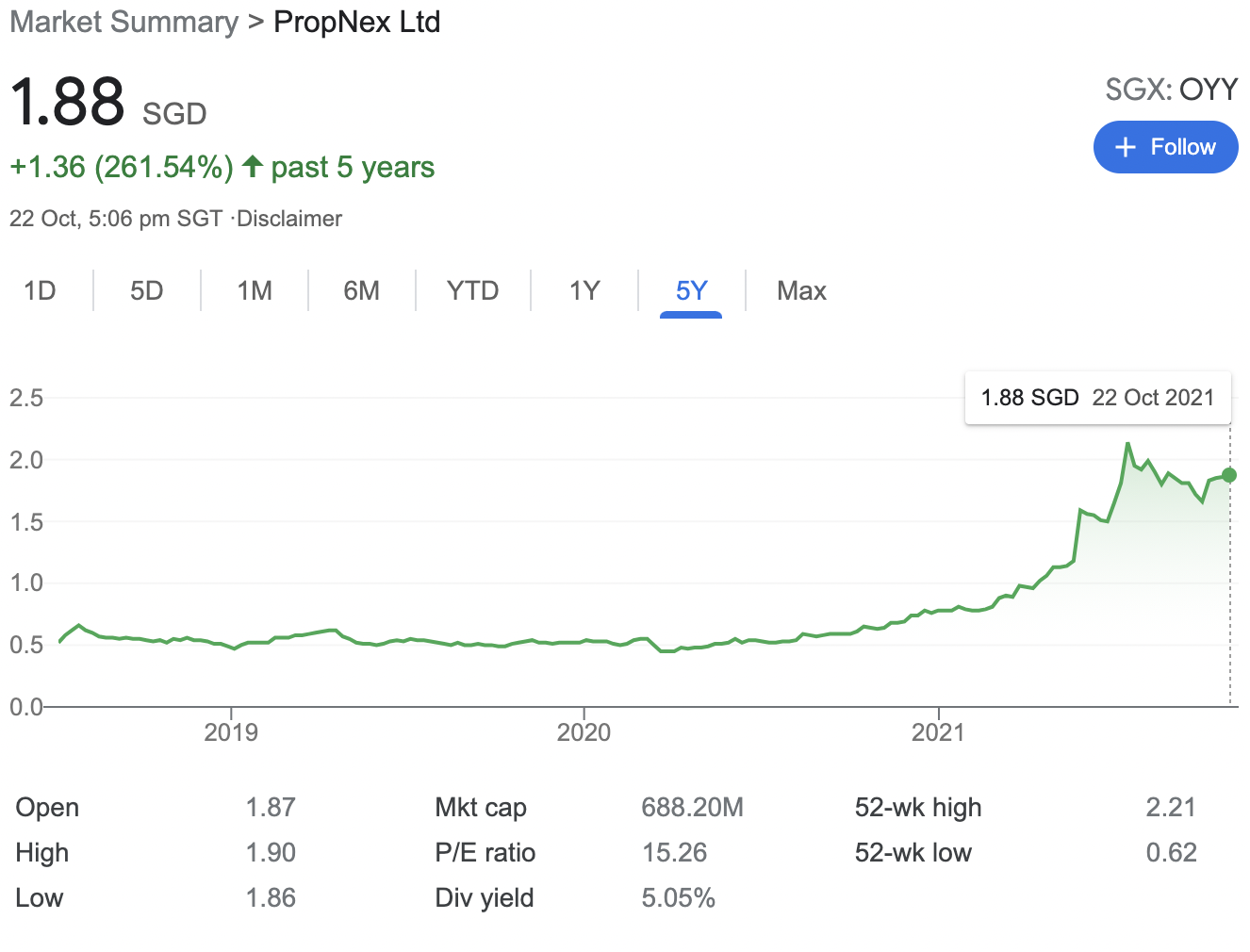

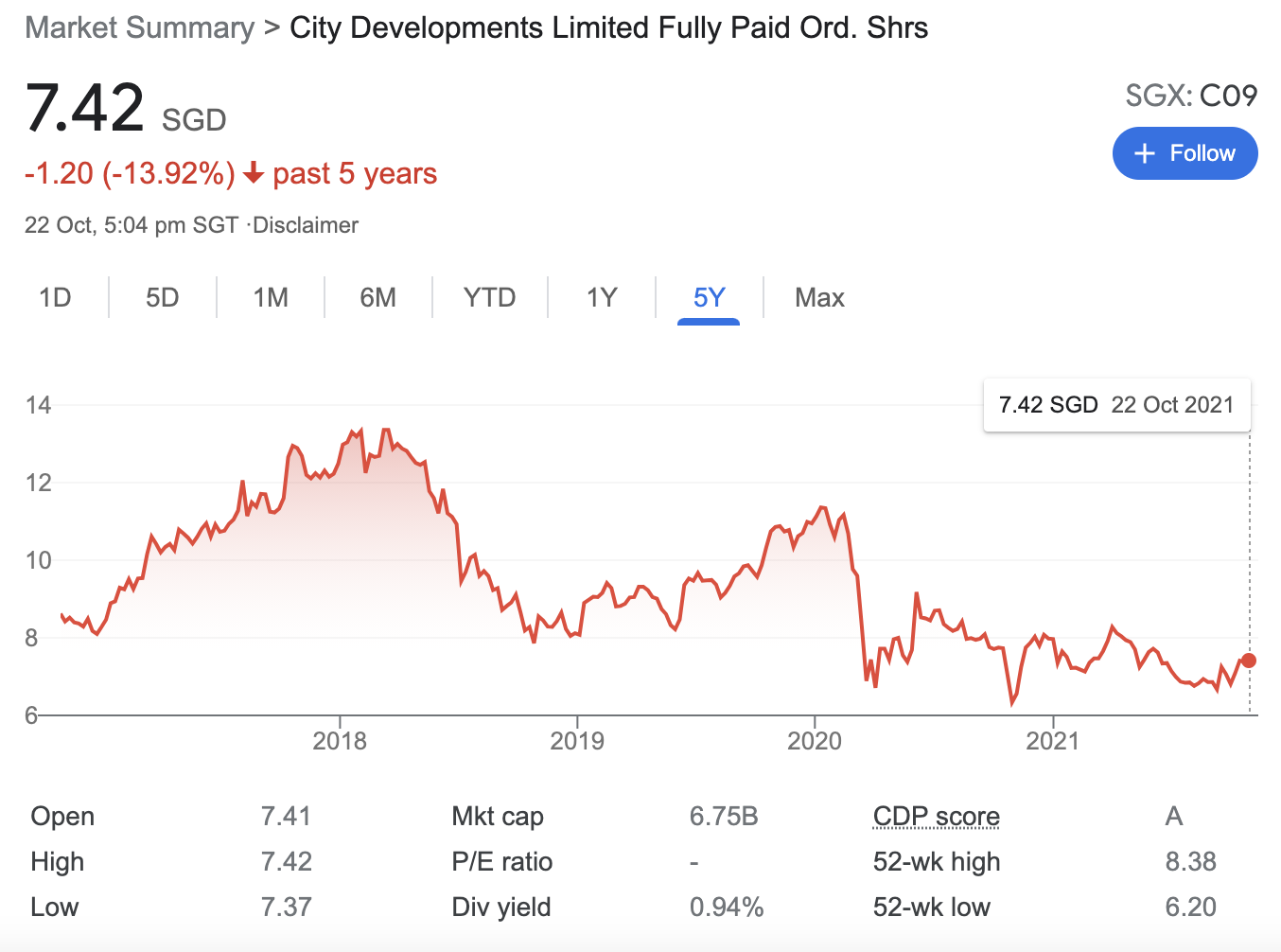

In fact, it’s been noted that around the time of writing (mid-October 2021), stocks of property agencies such as Propnex have an inverse relationship to developers. At the time of writing, Propnex is up 137.2 per cent year-to-date, while developers like CDL are down 7.3 per cent, and Frasers Property is down 6.5 per cent.

Of course, share prices move for a multitude of reasons; but the correlation between the two is hard to ignore.

This excessive reliance on property agencies is why developers struggle to negotiate commissions

At this point, developers absolutely need property agents to market their units. They don’t have the database of potential buyers, or the numerical reach required to push their projects.

This is majorly aggravated by the tight timelines that developers work with – they need to complete and sell every unit in a project within five years, lest they end up paying 30 per cent of the land price as Additional Buyers Stamp Duty (ABSD).

Being able to move units in time demands large numbers of agents, which forces developers to bend to the will of the largest agencies. Those who can’t – or won’t – pay higher commissions will attract fewer agents, and run the multi-million-dollar risk of missing the five-year deadline.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Is This New ABSD Rule A Sign?

When we started seeing runaway prices after Covid, there was a sense of “not this again,” and most market watchers…

This results in a one-sided situation, where agencies could demand increasingly higher commissions; and developers have very little leverage in the negotiations.

All of this ends up having an indirect impact on home buyers

Some of the concerns here would be:

- You end up paying more, just because of commissions

- Squeezed-out developers make compromises

- There is a potential for price-fixing

- In the long run, it discourages improvement and innovation

1. Raised prices, and the unhealthy trend of kickbacks

As we mentioned in our earlier article, around five per cent of the selling price can account to pay out to these property agencies. By way of contrast, consider that in the resale market, sellers typically pay a commission of just two per cent.

If the big four (or big three at the rate things are going) all decide they want to raise their commissions, there isn’t too much that developers can do. Given that developer margins are already quite squeezed, these could end up having an effect on the final price of the property.

We’ve talked about this extensively before, but the ripple effect here is the trend of commission cash backs to the buyer. While on the surface it may seem like a win-win, it may often be more harmful than not.

2. Squeezed-out developers make compromises

In our earlier article, we mentioned that developers could see margins as slim as 10 per cent (in some cases, it can be even lower). If the big agencies want to raise their commissions, developers could choose to absorb the cost.

But then, what happens to the quality of projects built with such slim budgets? We saw the effects of squeezed budgets back in 2015, with the problems inherent in many Design, Build, and Sell Scheme (DBSS) flats.

Due to lean budgets, many DBSS flats ended up with issues ranging from unreasonably narrow corridors, to plumbing issues and leaks/stains from the very first year.

So far, it’s been rare for developers to cut corners; but we wouldn’t want to threaten the quality of our projects, just to service the coffers of the real estate oligopoly.

3. There is a potential for price-fixing

When you have many different agencies in the market, price-fixing becomes much harder. Some might try to undercut the competition, or offer a better deal to developers. But when you have just the big four, it’s quite easy for all of them to decide on a certain level of commissions as the norm; or to come to an agreement to collectively raise commissions.

Needless to say, shrinking it to the big three will make this even easier.

To be clear, we’re not claiming the big agencies have formed any such cartel or price-fixing approaches – simply that they’re in a good position to do so, if they want to.

Hopefully, authorities will intervene if anything like that happens. But it would be healthier if we removed the potential for such a scenario anyway.

4. In the long run, it discourages improvement and innovation

The “big four” have emphasised digital marketing in recent years. But as a matter of opinion, we don’t think that was out of a need to compete with each other. It was probably from a need to compete with property portals, which sell listings to agents.

Because a few giant agencies dominate the space, it’s hard for small agencies to break in. This stifles innovation somewhat, and there’s less urgency in trying to improve service quality.

Now, this is partially offset by internal competition – even within the same agency, each realtor is competing with the others. This sometimes results in better service from some agents, more innovative approaches, and perhaps even lower commissions (but we wouldn’t count on that).

Nonetheless, it would be healthy if we had a larger number of agencies, all of which pushed their agents to compete harder based on service quality, and creative (but legal) approaches to transactions.

While we’ve yet to see a serious negative impact from this oligopolistic situation, we shouldn’t be too dismissive of it either. Hopefully, authorities will create a more competitive environment, by supporting small, upcoming agencies trying to break into the real estate space.

For more on the situation as it unfolds, follow us on Stacked. We’ll also provide you with updates on new and resale condos alike, in the Singapore private property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How does the concentration of major property agencies affect home prices in Singapore?

What impact does having fewer big property agencies have on competition among real estate firms?

Does the dominance of a few property agencies benefit homebuyers in Singapore?

How might the reduction in the number of big property agencies influence property developer negotiations?

Could the dominance of a few agencies lead to price-fixing or other unfair practices?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

0 Comments