“Lease decay” is the buzzword that never seems to go away. On the HDB end of things, it leads to constant complaints that you “don’t really own your flat”. In Singapore’s private property market, it leads to comments like “99-year lease and so old? You may as well buy HDB”.

And yet, even a brief glance at URA records will reveal there are buyers; there’s interest even in condos dating back to the ‘70s and ‘80s. Perhaps more surprisingly, some of the buyers aren’t’ always owner-occupiers. This leads to the question of why: what investment value is there, in older condos?

Older condos are probably not as “dead” as many of us imagine

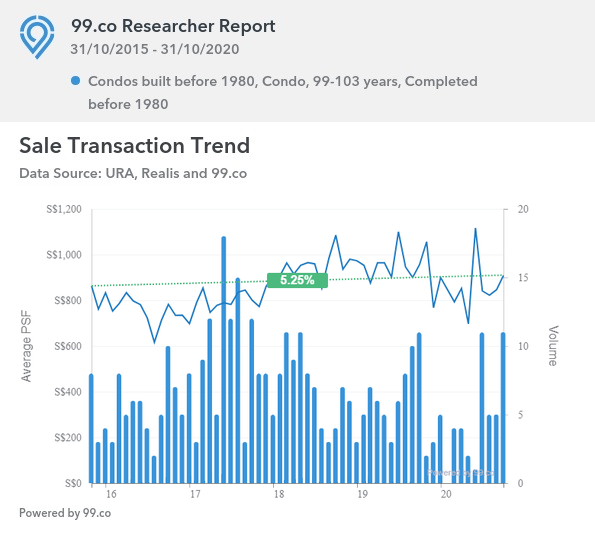

The way internet ads / sales pitches explain lease decay, you may be given the impression older condos start declining fast at 40 years of age. In reality, this is what prices look like for leasehold developments completed before 1980:

Some of the condos completed before 1980 include developments such as People’s Park Complex, Neptune Court, Laguna Park, etc., which are still valued for their location.

There’s no longer huge appreciation in prices, as you’d expect; but they still managed to rise from an average of $761 psf in 2015, versus $908 psf today.

What about the difference between freehold and leasehold for older condos?

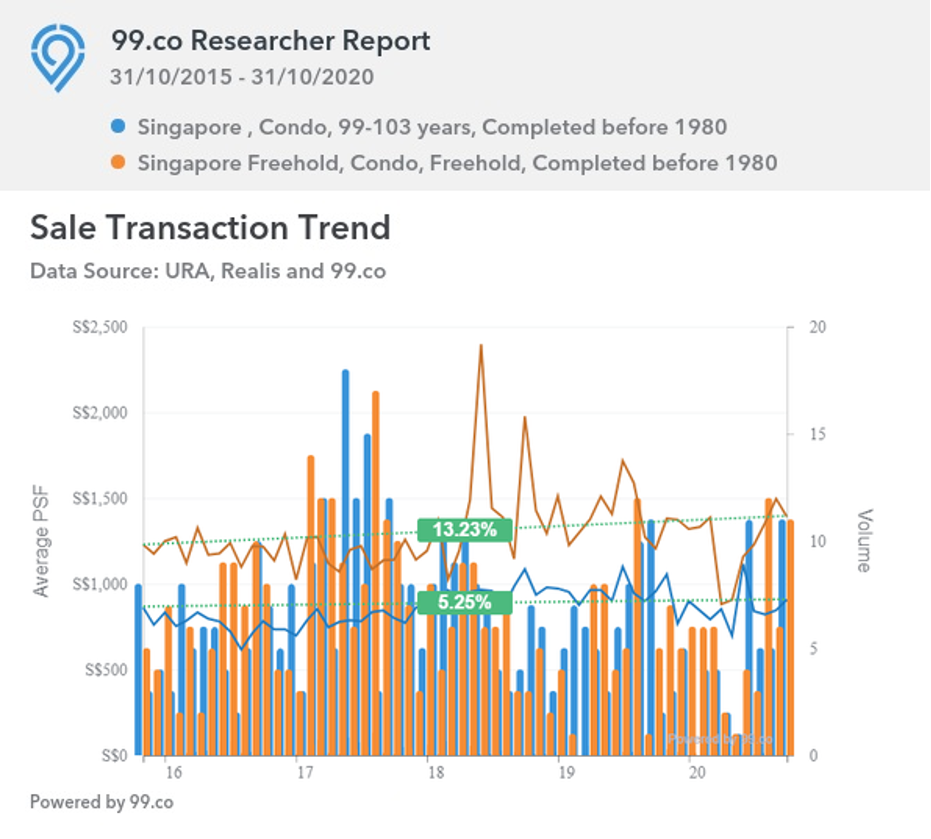

We’ve had a lengthier discussion about leasehold versus freehold; however, here’s how the two compare (for developments completed before 1980):

Unsurprisingly, freehold properties outperform their leasehold counterparts as age sets in. Freehold condos completed before 1980 continue to average $1,391 psf, whereas their leasehold counterparts average $908 psf.

In either case, gains are not spectacular; why would investors be interested?

We’ll leave out the obvious, that older condos tend to be cheaper, and are hence more affordable; especially in light of a higher Additional Buyers Stamp Duty (ABSD).

Besides that, investors may still see value in older condos because:

- They could have higher rentability

- Rental yields tend to be on the high side

- Freehold condos mitigate some of the worst aspects of age

- They can seize on recent upgrades to the area

- They believe an en-bloc sale is a good possibility

1. They could have higher rentability

Some of these older condos may look run-down, but there’s no end of willing tenants. Ideally, they combine a central location, with a rental rate slightly lower than that of surrounding new properties.

For example, People’s Park Complex is a two-minute walk to the Chinatown MRT station, with an average rental rate of just $3.22 psf. Peace Mansions is under 10 minutes’ walk to Dhoby Ghaut MRT station, and about as far from Plaza Singapura mall; average rental is just $1.60 psf.

Even without extensive new facilities, these older developments tend to be the only “cheap” options for staying in central areas. As such, there’s usually a good line of waiting tenants.

Note that this means higher rentability, not necessarily higher rental income; the units are quicker and easier to rent out, but rental income does tend to be a bit lower due to age. However, some investors will accept that, in return for having almost zero vacancies.

2. Rental yields tend to be on the high side

Older developments tend to cost less, but rental income is not always equally affected. In general, tenants don’t care about the remaining lease so long as the development is well maintained.

In effect, older condos mean you could pay a lower quantum, while retaining more or less the same rental income. The best-known example is People’s Park Complex (opened in 1973), which consistently tops the charts for rental yield.

Here are two of the recent transactions at People’s Park Complex, both in 2020 (all data from Square Foot Research):

| Date | Unit Size | Initial Price (PSF) | Sale Price (PSF) | Annualised Return |

| 3 Apr 2020 | 1,119 sq. ft. | $329 | $794 | 6.6% |

| 23 Jan 2020 | 409 sq. ft. | $1,100 | $1,100 | 0.7% |

At the same time, these are the five most recent leases in 2020:

| Date | Unit Size | Rental Per Month | Est. Rental PSF |

| Oct 2020 | 400 – 500 sq. ft. | $1,700 | $3.80 |

| Oct 2020 | 400 – 500 sq. ft. | $1,750 | $3.90 |

| Oct 2020 | 400 – 500 sq. ft. | $1,800 | $4 |

| Oct 2020 | 400 – 500 sq. ft. | $1,600 | $3.60 |

| Oct 2020 | 400 – 500 sq. ft. | $1,850 | $41.0 |

The average monthly rent for a 400-500 sq. ft. unit (for the past six months) is $1,643, while the average quantum for such a unit is $466,500. The estimated average rental yield is 4.2 per cent, as compared to an average of two to three per cent for most condos today.

3. Freehold condos mitigate some of the worst aspects of age

Investors tend to be more confident about buying older condos, when lease decay is not in the picture. As we’ve shown above, freehold condos are expected to show appreciation even 30 or 40 years down the road; they’re also theorised to be better for en-bloc gains.

Perhaps the most important factor here is financing: with leasehold condos, banks typically don’t provide loans when there are 30 years or less on the lease. The maximum loan quantum may also be reduced, for condos with 40 years or fewer on the lease.

More from Stacked

Canberra Crescent Residences Pricing Breakdown: A Price Comparison With Nearby Condos

Canberra Crescent Residences presents some challenges when it comes to a pricing review. At Stacked, our goal is always to…

This means freehold condos still have resale prospects at such an advanced age, whereas leasehold condos typically don’t.

As such, some investors may see older freehold condos as an ideal asset: they pay a lower price, can potentially get higher rental yield, and can still sell the unit later on. Mind you, this makes a lot of assumptions – such as the condo still being a good state of repair, after so many decades.

Property Investment InsightsFreehold vs Leasehold: 3 Tests To Determine Which Is Better (Part 2)

by Sean Goh4. They can seize on recent upgrades to the area

The most common example of this is an MRT station appearing nearby. Investors are quick to seize on older condos with a lower quantum, that happen to be near these amenities.

Some recent interest has fallen on Spottiswoode Park (completion date is unknown, but lease is 92 years from 1989). This ageing development is across the road from the planned Cantonment MRT station, coming up in 2025. Another is Bayshore Park (completed 1986), which is just down the road from Bayshore MRT station, upcoming in 2023.

It doesn’t take much to realise that “low price + nearby MRT station” is a good recipe for rental yields, or en-bloc prospects.

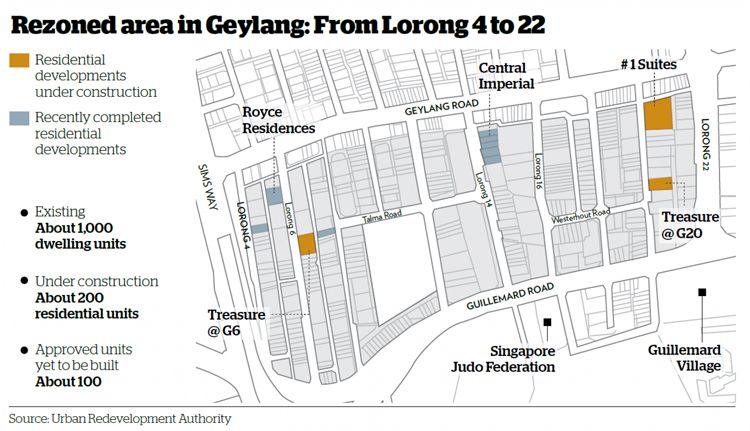

Rezoning can also have an impact on the area. In 2015, for instance, the area between Geylang Lorong 4 and Lorong 22 was re-zoned to prevent further residential development. This helped to support condo prices in the area, by reducing the available supply. Moves like this can also draw investor attention to older condos in the area.

While gentrification can raise the value of older properties – such as in Tiong Bahru and the Joo Chiat stretch – there’s no way to predict this will happen. As such, we can’t claim investors are drawn to old properties because they have a crystal ball for this; if any do, they haven’t revealed their method.

5. They believe than an en-bloc sale is a good possibility

This is purely speculative, and you should never rely on an en-bloc sale happening. Even if developers are interested, you may not secure the majority needed to push the sale through.

Nonetheless, some investors may feel that condos near upcoming MRT stations, new malls, etc. are good prospects for an en-bloc sale. If so, the amount they pay for an older unit could be a bargain.

It’s hard to recommend this degree of speculation, but it does happen.

PS: Some investors like to buy old condos in which there have been repeated, near-successful en-bloc attempts.

Note that if you buy a condo and it goes en-bloc within the first three years, you’re still liable to pay the Sellers Stamp Duty (SSD). This is 12 per cent of the sale proceeds in the first year, eight per cent in the second year, and four per cent in the third year. Mis-timing your purchase can be an expensive mistake.

Does all this make older condos a better investment?

To summarise, a certain number of traits need to align to make older condos an investment-worthy property:

- A location good enough to make up for its age; ideally in a central location or close to an MRT station

- It has to be in a good-enough state of repair, even if it’s freehold

- It’s ideally freehold

- There are coming changes in the location, which you can capitalise on by getting an older property there for cheap

Some older condos can be a viable investment as compared to a shiny new-launch, or an Executive Condominium (EC) that only just reached its Minimum Occupation Period; but it’s not for everyone.

In general, buying older condos is a risky proposition for new investors

It’s a viable strategy for more seasoned – and well-capitalised – property investors. Remember that old leasehold condos are not easily sold; so if things don’t work out as planned; you’ll find a hard time looking for buyers to offload a 40+ year old condo.

This goes double for leasehold properties.

It also requires experience, to know whether an older, more-run down property can still attract tenants; along with the likely renovation costs and higher potential maintenance.

However, it’s also a good reminder to keep an open mind: not every property is at a dead-end just because it’s getting older. If you do happen to get your hands on one – such as through an inheritance – work out the numbers before rushing to offload it. It may pay off better than it looks on the outside.

For reviews of new launches and old condos alike, follow us on Stacked Homes. We can provide you with in-depth reviews of the properties in question. Or if you’re thinking of buying an old condo, drop us a message on Facebook; we can give you a more specific analysis of its prospects.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are older condos still a good investment in Singapore?

Why might investors prefer freehold older condos over leasehold ones?

Can older condos offer high rental yields?

What should I consider before buying an older condo as an investment?

Is lease decay a real concern for older condos?

Are older condos suitable for first-time property buyers?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights We Compared Lease Decay Across HDB Towns — The Differences Are Significant

Property Investment Insights This Singapore Condo Skipped 1-Bedders And Focused On Space — Here’s What Happened 8 Years Later

Property Investment Insights Why Buyers in the Same Condo Ended Up With Very Different Results

Property Investment Insights What Happens When a “Well-Priced” Condo Hits the Resale Market

Latest Posts

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

On The Market Here Are The Cheapest 4-Room HDB Flats Near An MRT You Can Still Buy From $450K

2 Comments

Wish to know whether it is good option to invest in old Executive condo for enbloc is this viable if the GPR is yet to be maximized like Summerdale condo.