What Is Cash Over Valuation (COV) And Why Would You Pay It?

November 9, 2020

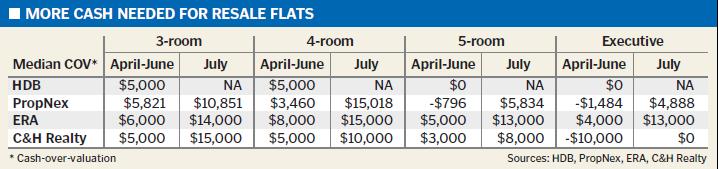

We’re seeing a resale flat revolution. As of Q3, resale prices are rising at their fastest pace since around 2012, and transaction volumes are at a 10-year high. We have a more detailed discussion of this in our previous article.

Now, our guys on the ground have commented that they have been seeing higher Cash Over Valuation (COV) as of recent times. More specifically, even in further out regions, such as Yishun and Woodlands, we are seeing more people willing to pay this.

As a quick recap, back in the day, the valuation was done before the OTP was signed, so people could negotiate the COV. Today, the valuation is done only after the OTP is signed. Given the slow market for years, prices have never really gone far beyond the valuation, but given the recent exuberance, we’re now observing more of this.

If you’re thinking of getting a resale flat soon – or selling yours – here’s what you should know about it:

What is COV?

Simply put, it’s the discrepancy between the sale price of the flat, and the actual valuation of the flat.

For example, say the seller wants $450,000 for their flat, but the HDB valuation is $440,000. This would mean a COV of $10,000.

The main problem with COV is that it isn’t covered by your housing loan or CPF, and it affects the Buyers Stamp Duty (BSD)

The maximum loan quantum for your flat – be it from the bank or HDB – is always based on the lower of the price or valuation.

Using the example of a bank loan, the cap is 75 per cent of the lower of price or value. So if you purchase a resale flat for $400,000, but the valuation is $380,000, then your maximum loan is only $285,000.

The extra $20,000 in (your COV, basically) has to be in cash, aside from your deposit for the flat. Also, remember that this comes after you’ve agreed on the price, and secured the OTP. Backing out, if you can’t cover the COV, it means losing your Option monies.

Stamp duties, unlike home loans, are always based on the higher of the price or valuation.

With regard to the same flat in our example, the BSD would apply on the price of $400,000, and not $380,000.

This would mean paying a BSD of $6,600, instead of $6000. It’s not a huge amount, but it is an added, non-recoverable cost.

COV is only an added risk when it comes to resale flats, not new flats

With BTO flats, the price is considered the same as the valuation. As such, new flat buyers never need to worry about COV.

Resale flat buyers, however, need to be on their guard. Before securing the OTP, for instance, it’s best to have extra cash saved up; just in case you need to pay COV that your home loan won’t cover.

It’s usually possible – from checking price histories – to know when you’re paying too much and could incur COV. Contact us on Stacked, and we can help take a deeper look for you.

We have seen more buyers willing to pay COV of late

This is particularly true in areas like Woodlands and Yishun, where we have met more buyers willing to fork out the COV. In one instance, the COV was as high as $40,000 from an HDB unit in Sembawang.

Here are some potential ways that COV might be involved:

- Supply in the desired area

- Fallout from the recent BTO launch exercises

- Urgency in the transaction

- Buyers using resale flats as an alternative to a condo

- Emphasis on pure home ownership

- Rare or DBSS flats

1. Supply in the desired area

By now, it’s much repeated news that a record number of resale flats are entering the market, with an estimated 50,000 flats reaching the Minimum Occupation Period (MOP) in 2020 and 2021.

However, there’s little data on which specific HDB towns are seeing more resale flats enter the market. It’s possible that, whatever the number of new flats reaching MOP, you just can’t find one where you need it.

You may find, for instance, that there’s few resale flats within range of your office, or within range of a desired school for your children (for self-explanatory reasons, flats near prestigious schools, or near business parks, tend to be snapped up almost as soon as they enter the market).

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

6 Possible Cross Island Line MRT Stations (Phase 2) + Condos That Might Benefit

The Cross Island Line (CRL), once completed, will span a whopping 58 kilometres. It’s a huge boon to the Singapore…

Lacking a choice, you may have to concede to higher prices, and end up paying COV.

2. Fallout from the recent BTO launch exercises

The BTO launch exercise in August 2020 was the largest one to date; and they included some highly desirable mature towns. In particular:

- Bishan Towers

- Dakota One (Geylang)

- Kebun Baru Edge (Ang Mo Kio)

- Tampines GreenCrest, GreenGlade, and GreenOpal

On the ground, we’ve encountered plenty of BTO applicants who rushed for these units, failed to secure one, and gave up on the idea of balloting.

Some are more receptive to the idea of paying more, if it means securing the home they want. It also helps that they can move in without waiting for construction (which may sometimes be delayed due to Covid-19).

Property AdviceCouldn’t Get Your BTO Flat Of Choice? Here Are 5 Alternative Steps To Take

by Ryan J. Ong3. Urgency in the transaction

There are some buyers who absolutely need a flat right away – they can’t wait three to five years for construction, and they can’t wait 30 months to apply for a new flat (if they’ve just sold their private property).

These buyers also tend to rush the sale process – they may know they’re accepting a price on the high side, but would rather pay the COV than be kept without a roof.

4. Buyers using resale flats as an alternative to a condo

As we’ve mentioned in our previously linked article, some buyers may have opted for resale instead of an Executive Condominium (EC) or fully private condo.

(Note that there is no income ceiling for resale flats)

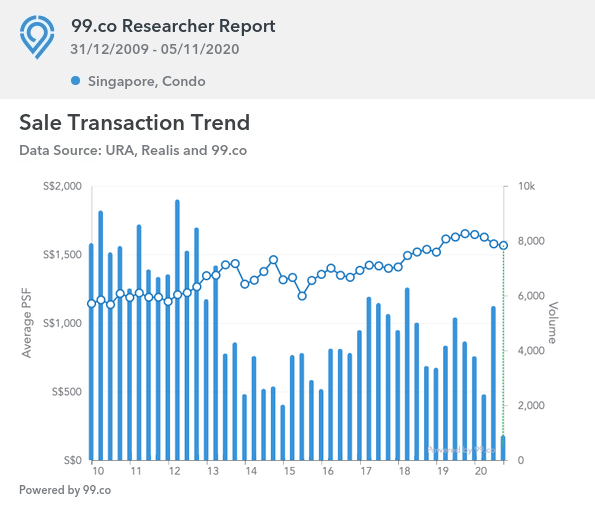

Now if a condo was even an option in the first place, these buyers aren’t going to flinch at the concept of COV. The average condo price right now, is $1,565 psf:

The typical 1,000 sq. ft. family condo would thus be around $1.5 million, with a minimum cash down payment of $75,000.

They were already in a financial position to handle anything but the most outrageous COV prices. As such, these buyers may be willing to go for the most highly prized resale flats as an alternative to a condo (e.g. flats in the most mature districts, blocks closest to the MRT station, and so forth).

It’s still the more affordable choice to them.

5. Emphasis on pure home ownership

Not everyone is interested in resale gains or rental yields. If your flat is simply a home – or you plan to stay there for the rest of your life – then personal comfort is more important.

You may be willing to pay the COV for a flat that’s near your friends and family, in your favourite neighbourhood, etc. It may not matter that you’re technically overpaying, as you’re not expecting any profit anyway.

6. Rare or DBSS flats

In October, 13 flats were sold at or above the $1 million mark. In many million-dollar transactions, COV might play a major role.

We don’t know the COV for these units, as HDB no longer publishes the figures; but we can take a hint from the past. According to the Straits Times, million-dollar flats in the past (dating back to 2016) have had COV of $195,000 to as high as $250,000.

However, almost all of these flats are not “regular” HDB flats. Many are double-storey maisonettes, which are no longer built by HDB.

Many others are also Design, Build, and Sell Scheme (DBSS) flats – such as the five-room unit at Natura Loft (Bishan), that sold for $1.2 million in October. DBSS flats, while lacking condo facilities, were nonetheless built by private developers and have higher quality finishing.

As COV data remains hidden, do get an informed expert who knows the right price levels. Do this before you secure the OTP, and would incur a loss by backing out. We can put you in touch with the right professionals if you need.

You can also follow Stacked for the latest insights into the Singapore property market, and in-depth reviews of the local private property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is Cash Over Valuation (COV) in property transactions?

Why is COV important when buying resale flats?

Can I negotiate COV when purchasing a resale flat?

Why are some buyers willing to pay high COVs for resale flats?

Are COVs relevant for new flats or BTOs?

What types of flats tend to have higher COVs?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

0 Comments