GuocoLand Developer Review: A Detailed Look And Analysis

May 25, 2020

Sections

- Developer Profile

- History

- GuocoLand Vs Singapore

- List of GuocoLand Projects

- Top 10 Past Projects

- Key Upcoming Projects

Founded: 1976

CEO Rating: Raymond Choong Yee How – Appointed Sept 2015

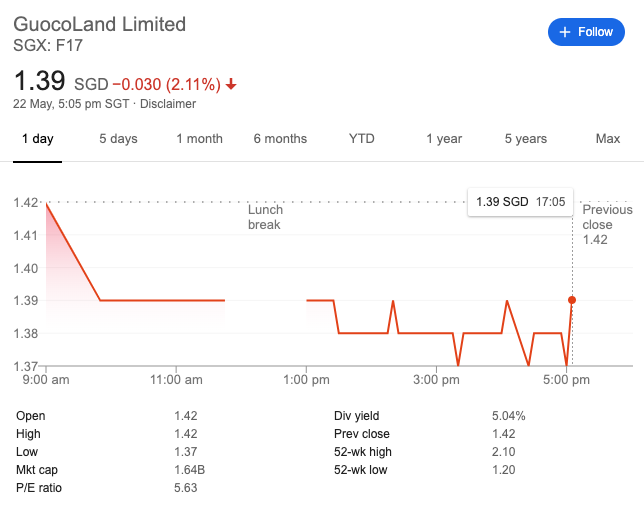

Current P/E ratio: 5.76

Number of Employees: ~5000

GuocoLand Share Price:

Key En Bloc Clinch

| Acquisition | Transacted Price | To Be Developed Into |

| Pacific Mansion (2018) | S$980 million | The Avenir |

| Casa Meyfort (2018) | S$319.88 million | Meyer Mansion |

A daughter company of the Guoco Group, GuocoLand Ltd has been a major player in the Asian real estate development scene for some time now.

The company is Singapore-based, but their range of operations extend beyond our borders to neighbouring countries like Malaysia, Vietnam and China.

In 2017, GuocoLand joined forces with fellow developer, Eco World International Berhad, and further expanded into the markets of the United Kingdom and Australia. A true testament of their fiscal strength and ambitious (yet wholly credible) nature.

Look a little closer to home, and I’m sure that most (if not all) of you would have heard of Singapore’s Guoco Tower.

Situated by the Singapore river, it is a hotel, shopping centre, luxury condominium and office sprawl stacked into one development – a feat second only to the fact that the Guoco Tower is also the tallest building in the country!

Besides achieving great heights (forgive me), GuocoLand has also been a prominent figure on the Main Board of the Singapore Exchange for years.

It was listed almost immediately on the Singapore Exchange Securities Trading Ltd back in 1978 – barely two years after the company was founded on 31 March 1976.

As for GuocoLand’s mighty growth in assets post 20th century, well, that would mostly be attributed to its Former-CEO, Mr Quek Chee Hoon.

From his takeover in 1999 till his retirement in early 2014, he spearheaded a bulk of ventures that resulted in the company’s asset base growing from just under $2.9 billion to an astounding $9.2 billion.

Things are also looking good under the leadership of current-CEO, Mr Raymond Choong Yee How.

Just last year, the company’s revenue increased from S178.5 million (2018) to $323.5 million, an impressive growth of 81%!

With that in mind, I believe that Guocoland does have a bright future going forward.

GuocoLand vs Singapore (Value of Projects)

Let’s now take a look at GuocoLand’s property values versus that of Singapore’s over the past decades.

As you’d observe, the company’s projects had been lagging behind in average property valuation from the get-go.

That was, up till 2012 when GuocoLand’s prices eventually caught up – and gradually surpassed the market average.

How did that happen?

Cooling measures, Wallich Residences and Luxury condos.

Let me break it down for you.

(For those who are familiar with the following scenario that played out, please feel free to skip ahead!)

The Cooling Measures that Slowed Property Price Growth

Back in 2010, the Global Metro Monitor Report revealed Singapore to be the fourth fastest recovering city from the ‘08 and ‘09 Global Recession, with our GDP rising 17.9% (H1 2010) from 2009.

In short, economic growth meant better employment rates and bigger wages (IRAS reported a 13% increase in income tax collected from individual taxpayers in fiscal year 2009/2010).

Adding to that, the foreign growth of Singaporeans PRs and non-residents between 2004 and 2009 far exceeded that of local citizen growth.

From Q1 2009 to Q2 2010 alone, the percentage of foreigners purchasing private homes increased from 15.5% to 23.7%. This rose to 19% in the second half of 2011!

In essence, our growing population, with an ever-increasing demand for foreign talent – coupled with limited land space and a ‘booming/safe’ economy led to massive pent-up demand for property.

This demand then fueled the rise in property prices which had been dulled in previous quarters post 2006/2007 price peaks.

Soon after, the government stepped in with cooling measures to prevent further price surges (in fear of a housing bubble and a subsequent price crash).

One of them would be the introduction of Additional Buyers’ Stamp Duty (ABSD). Effective Dec 2011, ABSD essentially discouraged property investment opportunities by setting a hefty fee for every additional property one would own in Singapore, encouraging both locals and foreigners to focus on ownstay purchases.

This, along with an accumulation of other factors like restricted home-loan maturities that ultimately contributed to slowdown in property-price growth.

Yes, just at that point when cooling measures were pouring in, this CBD-based residential (part of Guoco Tower) had just commenced construction, and was a massive hit amongst the elite in Singapore.

With units starting on the 41st level, and a location that smacked it right in the middle of Singapore’s key financial district, it was no surprise that prices here were going for at least $3000 psf per unit.

Naturally, this drove up Guocoland’s total project valuation.

But how did Guocoland manage to maintain its ‘value-form’ and exceed the national average even till today?

Following the measures, we saw a period of weakened property market sentiment from 2013 to 2017 (and hence a gradual dip in prices).

While GuocoLand suffered a relatively similar fate, the company’s ever-growing ventures into Luxury Condominiums (some of them in key central locations) allowed it to climb ahead of the pack.

In fact, some of their top upcoming projects, namely Midtown Bay, Meyer Mansion and The Avenir, all exceed prices of $2,700 psf and beyond!

In the meantime, Wallich Residence continues to pull its weight.

Unit sales in its launch year (2013) averaged $3,052 psf, and have since risen by 22.6% ($691 psf) to $3,743 psf, based on the averaged prices of units sold this year.

In total, GuocoLand has exceeded the market average consistently in project values for the last 8 years of the 26 shown above.

You can check out the entire list of its projects, further appreciation trends as well as the details of its upcoming projects which have yet to be completed below.

List of GuocoLand Projects (Profitable/Unprofitable Transactions)

| Project | District | TOP | Tenure | No. of Profitable Transactions | Average profit | No. of Unprofitable Transactions | Average loss |

| Elias Terrace | 18 | 1994 | 999-Year | 23 | 528,087 | 11 | -289,182 |

| Harbour View Towers | 4 | 1994 | 99-Year | 65 | 416,403 | 20 | -201,246 |

| Kew Bungalows | 16 | 1994 | 99-Year | 44 | 523,142 | 27 | -342,239 |

| The Tanamera | 16 | 1994 | 99-Year | 90 | 288,411 | 44 | -207,495 |

| Chiltern Park | 19 | 1995 | 99-Year | 229 | 310,621 | 77 | -205,927 |

| Cavendish Park | 21 | 1996 | 99-Year | 109 | 333,933 | 53 | -231,509 |

| Melville Park | 18 | 1996 | 99-Year | 680 | 166,959 | 332 | -152,220 |

| Loyang Villas | 17 | 1997 | 99-Year | 208 | 369,836 | 162 | -265,774 |

| Maysprings | 23 | 1998 | 99-Year | 409 | 201,378 | 350 | -145,371 |

| Tanglin Regency | 10 | 1998 | 99-Year | 235 | 232,098 | 75 | -201,567 |

| Westville | 22 | 1998 | 99-Year | 179 | 398,729 | 92 | -149,894 |

| Stratford Court | 16 | 2000 | 99-Year | 163 | 257,874 | 69 | -108,277 |

| Aquarius By The Park | 16 | 2000 | 99-Year | 483 | 243,850 | 143 | -79,266 |

| Sanctuary Green | 15 | 2003 | 99-Year | 392 | 390,604 | 38 | -110,919 |

| The Gardens At Bishan | 20 | 2004 | 99-Year | 604 | 275,926 | 26 | -44,312 |

| Bishan Point | 20 | 2005 | 99-Year | 160 | 299,999 | 11 | -35,747 |

| D’Elias | 18 | 2005 | 999-Year | 15 | 244,133 | 0 | – |

| Le Crescendo | 14 | 2006 | Freehold | 112 | 371,987 | 2 | -72,750 |

| Leonie Suites | 9 | 2006 | 99-Year | 17 | 183,765 | 9 | -67,556 |

| Nathan Place | 10 | 2006 | Freehold | 37 | 506,446 | 2 | -19,000 |

| Paterson Residence | 9 | 2008 | Freehold | 87 | 733,735 | 12 | -309,993 |

| The Stellar | 5 | 2008 | Freehold | 129 | 382,806 | 2 | -60,190 |

| The View @ Meyer | 15 | 2010 | Freehold | 30 | 327,305 | 6 | -203,100 |

| The Quartz | 19 | 2010 | 99-Year | 392 | 299,596 | 15 | -50,161 |

| Elliot @ The East Coast | 15 | 2013 | Freehold | 32 | 371,679 | 1 | -26,980 |

| Goodwood Residence | 10 | 2013 | Freehold | 25 | 574,740 | 7 | -318,571 |

| The Waterline | 19 | 2013 | Freehold | 8 | 131,503 | 5 | -146,878 |

| Sophia Residence | 9 | 2014 | Freehold | 56 | 202,711 | 13 | -119,639 |

| Leedon Residence | 10 | 2015 | Freehold | 15 | 781,212 | 5 | -364,977 |

| Wallich Residence | 2 | 2016 | 99-Year | – | – | – | – |

| Sims Urban Oasis | 14 | 2020 | 99-Year | 30 | 125,032 | 0 | – |

| Martin Modern | 9 | 2021 | 99-Year | – | – | – | – |

| Midtown Bay | 7 | 2022 | 99-Year | – | – | – | – |

| Meyer Mansion | 15 | 2024 | Freehold | – | – | – | – |

| The Avenir | 9 | 2025 | Freehold | – | – | – |

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What I Regret Most After Buying My First Home: We Share 7 Most Common Regrets From Readers

The first time buying a home is an unforgettable experience. It’s a mix of anxiety and excitement, and almost always…

As a whole, the average transaction for a GuocoLand project made a profit of $349,150. The biggest average profits goes to Leedon Residence, at $781,212, but that’s also because it has one of the higher quantum per unit on this list.

Other standouts include the Quartz – 392 profitable transactions with only 15 unprofitable transactions thus far. Bishan Point with 160 profitable and 11 unprofitable transactions. Le Crescendo with 112 profitable and only 2 unprofitable transactions. The Gardens at Bishan with 604 profitable and 26 unprofitable transactions.

On the losses front, the average loss making transaction for a GuocoLand projects currently stands at -$161,812. The biggest number of unprofitable transactions goes to Maysprings with 350 total unprofitable transactions at an average loss of $145,371.

(Note: For more information/the full list of GuocoLand Projects – both residential & commercial; as well as sale prices/in-depth appreciation trends of individual units, feel free to reach out to us at stories@stackedhomes.com!)

#10 – Goodwood Residence (Freehold)

Built in 2013, the Goodwood Residence condominium is situated along Bukit Timah Road in District 10. Its residential makeup totals 210 units.

Unit sales in its launch year averaged $2800 psf, and have since dipped by 13.1% ($368 psf) to $2432 psf, based on the averaged prices of units sold this year.

Condo ReviewsGoodwood Residence Review: Private With Exclusive Greenery Views

by Reuben Dhanaraj#9 – The Waterline (Freehold)

Built in 2013, The Waterline condominium is situated along Poh Hua Road in District 19. Its residential makeup totals 103 units.

Unit sales in its launch year averaged $1051 psf, and have since risen by 8.7% ($91 psf) to $1142 psf, based on the averaged prices of units sold last year.

#8 – The View @ Meyer (Freehold)

Built in 2010, The View @ Meyer is situated along Meyer Road in District 15. Its residential makeup totals a mere 45 units.

Unit sales in its launch year averaged $1219 psf, and have since risen by 21.7% ($265 psf) to $1484 psf, based on the averaged prices of units sold in 2017.

#7 – Harbour View Towers (99-Year Leasehold)

Built in 1994, Harbour View Towers are situated along Telok Blangah Drive in District 4. Its residential makeup totals 154 units.

Unit sales in its launch year averaged $749 psf, and have since risen by 68.5% ($514 psf) to $1263 psf, based on the averaged prices of units sold last year.

#6 – Elliot @ The East Coast (Freehold)

Built in 2013, the Elliot @ The East Coast condominium is situated along Elliot Road in District 15. Its residential makeup totals 119 units.

Unit sales in its launch year averaged $913 psf, and have since risen by 71.5% ($653 psf) to $1566 psf, based on the averaged prices of units sold last year.

#5 – Le Crescendo (Freehold)

Built in 2006, Le Crescendo condominium is situated along Paya Lebar Road in District 14. Its residential makeup totals 228 units.

Unit sales in its launch year averaged $630 psf, and have since risen by 74.9% ($472 psf) to $1102 psf, based on the averaged prices of units sold last year.

#4 – The Gardens At Bishan (99-Year Leasehold)

Built in 2004, The Gardens At Bishan condominium is situated along Sin Ming Walk in District 20. Its residential makeup totals an astounding 756 units.

Unit sales in its launch year averaged $606 psf, and have since risen by 80.5% ($488 psf) to $1094 psf, based on the averaged prices of units sold this year.

#3 – The Stellar (Freehold)

Built in 2008, The Stellar condominium is situated along West Coast Road in District 5. Its residential makeup totals units.

Unit sales in its launch year averaged $584 psf, and have since risen by 95.4% ($557 psf) to $1141 psf, based on the averaged prices of units sold last year.

#2 – Leonie Suites (99-Year Leasehold)

Built in 2006, the Leonie Suites are situated at Leonie Hill in District 9. Its residential makeup totals 87 units.

Unit sales in its launch year averaged $914 psf, and have since risen by 96.6% ($883 psf) to $1797 psf, based on the averaged prices of units sold last year.

#1 – Nathan Place (Freehold)

Built in 2006, Nathan Place condominium is situated along Nathan Road in District 10. Its residential makeup totals a mere 45 units.

And yet, unit sales in its launch year averaging $759 psf, have since risen by an astounding 114.6% ($870 psf) to $1629 psf, based on the averaged prices of units sold last year.

Details

Launched: July 2017

| Expected TOP | Dec 2021 |

| Address / District | 8 Martin Place (D9) |

| Tenure | 99-Year Leasehold |

| Total Units | 450 |

| Land Area | 171,535 sqft |

| Average PSF (Based on 1st year transactions) | $2,066 (2017) |

| Distance to MRT | ~ 1.2km, 15-min walk (Fort Canning MRT)~ 600m, 7-min walk (Great World City MRT, opening 2021) |

Unit Mix

| Unit Type | No. of Units | Size of Units (sqft) |

| 2-Bedroom | 150 | 820 |

| 2-Bedroom + Study | 90 | 880 |

| 3-Bedroom | 90 | 1050 |

| 3-Bedroom Premium | 60 | 1300 |

| 4-Bedroom | 60 | 1800 |

Details

Launching: Oct 2019

| Expected TOP | Dec 2022 |

| Address / District | 120 Beach Road (D7) |

| Tenure | 99-Year Leasehold |

| Total Units | 219 |

| Land Area | 226,249 sqft |

| Average PSF (Based on 1st year transactions) | $2,820 (2019) |

| Distance to MRT | ~ 150m, 2-min walk (Bugis MRT) |

Unit Mix

| Unit Type | No. of Units | Size of Units (sqft) |

| 1-Bedroom | 107 | 409 to 527 |

| 2-Bedroom | 72 | 732 to 775 |

| 3-Bedroom | 32 | 990 to 1152 |

| 3-Bedroom Duplex | 8 | 1324 |

Meyer Mansion (Formerly Casa Meyfort)

Details

Launched: Sept 2019

| Expected TOP | 1st half of 2024 |

| Address / District | 79 Meyer Road (D15) |

| Tenure | Freehold |

| Total Units | 200 |

| Land Area | 85,250 sqft |

| Average PSF (Based on 1st year transactions) | $2,765 (2019) |

| Distance to MRT | ~500m, 6-min walk (Katong Park MRT, opening 2023) |

Unit Mix

| Unit Type | No. of Units | Size of Units (sqft) |

| 1-Bedroom | 25 | 484 |

| 2-Bedroom | 25 | 689 to 883 |

| 3-Bedroom | 50 | 1109 to 1389 |

| 3-Bedroom Premium | 50 | 1399 to 1830 |

| 4-Bedroom Premium | 50 | 1722 to 2142 |

The Avenir (Formerly Pacific Mansion)

Details

Launched: Jan 2020

| Expected TOP | Aug 2025 |

| Address / District | 8 & 10 River Valley Close (D9) |

| Tenure | Freehold |

| Total Units | 376 |

| Land Area | 129,648 sqft |

| Average PSF (Based on 1st year transactions) | $3,255 (2020) |

| Distance to MRT | ~ 700m, 8-min walk (Somerset MRT)~ 450m, 5-min walk (Great World MRT, opening 2021) |

Unit Mix

| Unit Type | No. of Units | Size of Units (sqft) |

| 1-Bedroom | 69 | 527 to 539 |

| 2-Bedroom | 69 | 807 to 829 |

| 3-Bedroom | 69 | 1141 |

| 3-Bedroom with Private Lift | 68 | 1529 to 1572 |

| 4-Bedroom with Private Lift | 67 | 2056 to 2067 |

| 4-Bedroom + Family with Private Lift | 34 | 2411 |

(For more information on the various unit-types/availabilities of GuocoLand projects, feel free to drop us an email at stories@stackedhomes.com – PS: no hard sales, just genuine advice to suit your needs/wants!)

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the history of GuocoLand and its main operations?

How has GuocoLand performed in the Singapore property market compared to the national average?

What are some of GuocoLand’s most profitable projects?

Can you give examples of GuocoLand’s past projects and their investment performance?

What upcoming projects does GuocoLand have in development?

Reuben Dhanaraj

Reuben is a digital nomad gone rogue. An avid traveler, photographer and public speaker, he now resides in Singapore where he has since found a new passion in generating creative and enriching content for Stacked. Outside of work, you’ll find him either relaxing in nature or retreated to his cozy man-cave in quiet contemplation.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

0 Comments