Executive Condos Singapore: Key Differences Between An EC And Private Condominiums

June 6, 2020

This is Part 7 of our 18-part first-time home buyer series. You may refer to the full table below:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

First Time Home Buyer Guide

Financing

- Approval-in-Principle: Why It’s Your First Step for a Home Loan/Mortgage

- How Much Can You Borrow For A Home Loan / Mortgage?

- How Much Income Do You Need To Get A Home Loan / Mortgage?

- How To Read Your Credit Report For Your Home Loan / Mortgage

- Understanding SIBOR, Board Rate, And Fixed Deposit Home Loans

- How You Can Compare Home Loans And Get The Best Deal

Choosing The Right Condo

- Executive Condo Versus Private Condo

- Freehold Versus Leasehold Condos

- New Versus Resale Condos

- Large Versus Small Condo Developments

Choosing The Best Condo Unit In A Development

- How To Pick The Best Stack In A Development

- Key Questions To Ask About Condo Facilities

- Key Factors To Note About A Condo’s Location

- How To Read And Compare Floor Plans

- What To Look For In Condo Shoebox Units

- When Should You Consider A Dual-Key Unit?

- Key Questions To Ask At A Showflat

- Condo Purchase Timeline

One of the big decisions among first time home buyers is choosing between a private condominium or executive condominium. On the surface, there are few real differences – both are full suite condos (there’s a pool, BBQ pit, gym, etc.), and both are built and marketed by private developers.

However, there’s a big difference in terms of housing policy between the two; and even in the actual price:

So what is an EC?

Executive condos are a form of hybrid housing, partway between a private condo and public housing. It was introduced in 1996, with Eastvale being the first EC completed in January 1999, in Pasir Ris.

Executive condos count as HDB properties for the first 10 years, but are fully privatised afterward. This means the rules regarding HDB properties, such as the Minimum Occupancy Period (MOP), only apply for the first decade. Notably, this means that the Family Grant and Half-Housing Grant are available for executive condos during this period.

| Average gross monthly household income | Singapore Citizen Household | SC/ Singapore Permanent Resident Household | Half-Housing Grant |

| $10,000 or lower | $30,000 | $20,000 | $15,000 |

| $10,001 to $11,000 | $20,000 | $10,000 | $10,000 |

| $11,001 to $12,000 | $10,000 | Nil | $5,000 |

| $12,001 to $14,000 | Nil | Nil | Nil |

This is currently the only way to get government grants for (what will eventually be) private housing.

Note that there are no HDB loans available for executive condos, even if they’re still HDB properties. You must use a private bank loan for an EC.

Here is all the EC eligibility criteria you need to know:

- Only Singaporean couples, or Singaporean + Permanent Resident couples, can buy HDB properties

- You must be eligible under the Public Scheme, Fiance / Fiancee Scheme, Orphans Scheme, or the Joint Singles Scheme (please see the HDB website for details on each scheme)

- The EC income ceiling is $16,000 per month

- Buyers must not have owned or disposed of any private property within the past 30 months

As with any HDB properties, remember that you can buy only HDB properties twice (BTO flats, resale flats, etc.) For more information on this, visit the HDB website.

We’ve already compiled a comprehensive list of ECs and their prices for you.

Other key differences between Executive Condos and Condos

- Five-year MOP period

- No ABSD for upgraders

- Income qualifications

- Selling restrictions until full privatisation

- Pricing differences

- No freehold option

1. Five-year MOP period

There is a five-year Minimum Occupancy Period when you buy an HDB property, including ECs. During these five years, you cannot rent out the entire unit, or sell it on the open market. You must also reside within the unit (if you need to live somewhere else for any reason, such as working abroad, your time spent away will not count toward the MOP).

For ECs, the MOP begins from the time of the development’s Temporary Occupancy Permit (TOP). For example, if your EC takes three years to complete, you’ll need to wait another five years after that – a total of eight years – before you can resell it on the open market.

The MOP also applies to resale executive condos that haven’t been fully privatised. This is of particular importance to aspiring landlords – you won’t be able to rent out a whole EC unit immediately, even if it’s already complete. That’s a big difference from a private condo, where you can rent out the unit as soon as you get it.

Also with a private condo, you can choose to sell anytime you like (although bear in mind the Sellers Stamp Duty (SSD) applies during the first three years).

2. No ABSD for upgraders

It’s less stressful to upgrade from a flat to an EC.

For example, say you decide to sell your flat and upgrade to a condo. To avoid an interim period without a home, you decide to purchase the condo first, and then sell the flat after you’ve moved in.

This means you would have to pay the Additional Buyers Stamp Duty (ABSD) on your condo, as it would be your second property at the time of purchase. This would be payable within 14 days of completing the transaction.

You can apply for ABSD remission later, provided you sell your flat within six months of buying the condo.

This can be problematic. For Singapore citizens, the ABSD would be 12 per cent of your condo price or value (whichever is higher), so you need quite a lot in cash or CPF to pay for this initially.

Later, there is a risk that something can go wrong in selling your flat, and cause you to miss the deadline for ABSD remission.

However, if you choose to upgrade to an EC instead, you don’t need to pay the ABSD; even if you buy the EC before you’re done selling your previous flat.

Do also note that you will have to pay a resale levy if you are selling a subsidised flat (even resale flats bought with a CPF housing grant) and then buy a new EC.

| First Subsidised Housing Type | Households | Single Grant recipients |

| 2-room flat | $15,000 | $7,500 |

| 3-room flat | $30,000 | $15,000 |

| 4-room flat | $40,000 | $20,000 |

| 5-room flat | $45,000 | $22,500 |

| Executive flat | $50,000 | $25,000 |

| Executive Condominium | $55,000 | Not applicable |

3. Income qualifications

For private properties, you need to meet the Total Debt Servicing Ratio (TDSR) to secure a home loan. This caps your monthly repayments to 60 per cent of your monthly income, inclusive of all other loans (car loans, personal loans, etc.)

For HDB properties, you need to meet the Mortgage Servicing Ratio (MSR). This caps your monthly loan repayments to 30 per cent of your monthly income, excluding other loans.

For ECs, you need to meet both requirements. For example, if your monthly income is $10,000 then your maximum home loan repayment (excluding other debts) is $3,000 a month.

Your maximum monthly loan repayment, inclusive of other debts like car loans, cannot exceed $6,000 a month.

4. Selling restrictions until full privatisation

HDB properties can’t be sold to foreigners or entities. The same would apply to ECs that are not yet fully privatised (after 10 years, anything goes; sell it to a foreigner or even a company if you like).

Many property agents will tell you, quite correctly, that this doesn’t make a big difference nowadays. That’s because the 25 per cent ABSD on foreigners rules out all but the wealthiest foreign buyers (who tend to stick to the luxury market), and it’s rare that anyone sells to a company or other such entity anyway.

As such, the MOP is considered the bigger factor.

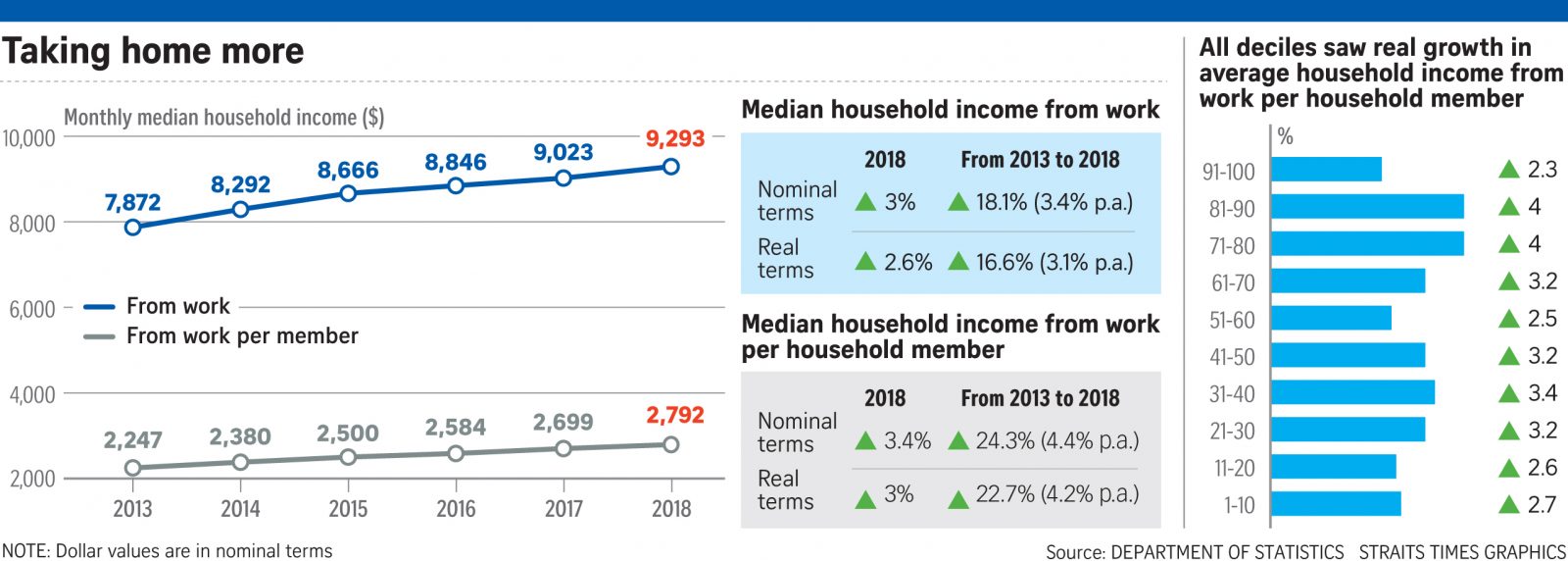

5. Pricing differences

As a general rule of thumb, a leasehold private condo will cost about 20 per cent more than an EC of similar size and location.

As an aside, this may partly be due to location. ECs tend to be further away from MRT stations, due to the plots the government earmarks for them. This is not always the case (e.g. Parc Canberra is right across from the MRT station), but it’s true for many ECs.

(Most ECs have a shuttle service to the MRT station to mitigate this)

Regardless, for buyers seeking a quantum of below $1 million, executive condos are a more sensible place to start looking.

6. No freehold option

It’s an eternal debate whether freehold is better than leasehold, but we know some of you swear by it. Sadly, there are no freehold ECs, nor are there likely to be.

For some buyers the combination of MOP restrictions, and a 10-year wait for privatisation, may not be acceptable given the leasehold nature of the property.

The big question of capital gains

So which will give you better returns, a condo or an EC?

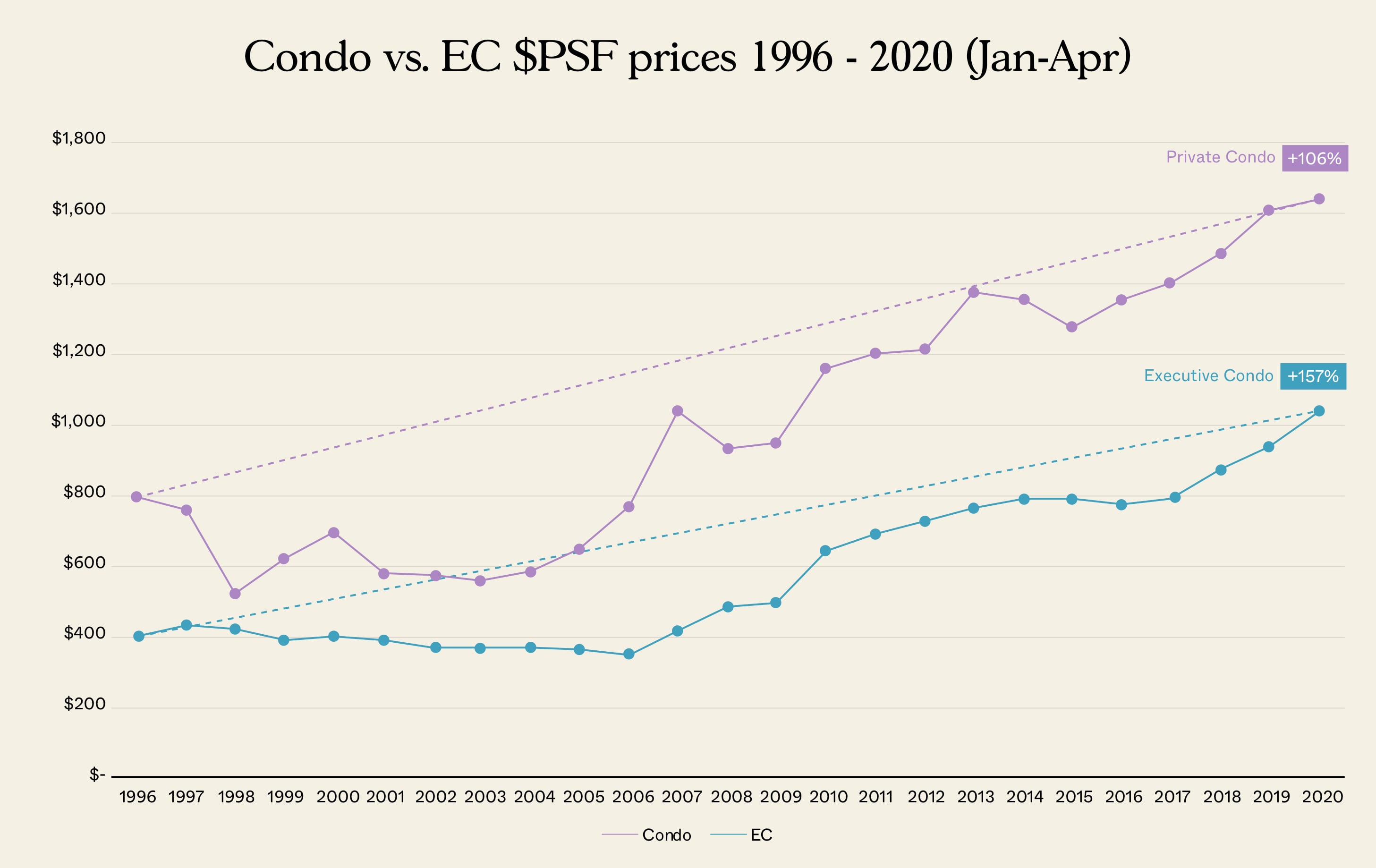

Here’s how the real estate market looks for the two of them:

As you can see, from 1996 executive condos have appreciated an average of 157% as compared to 106% from private condos.

While it seems that that puts ECs ahead in terms of appreciation, that isn’t quite the full picture.

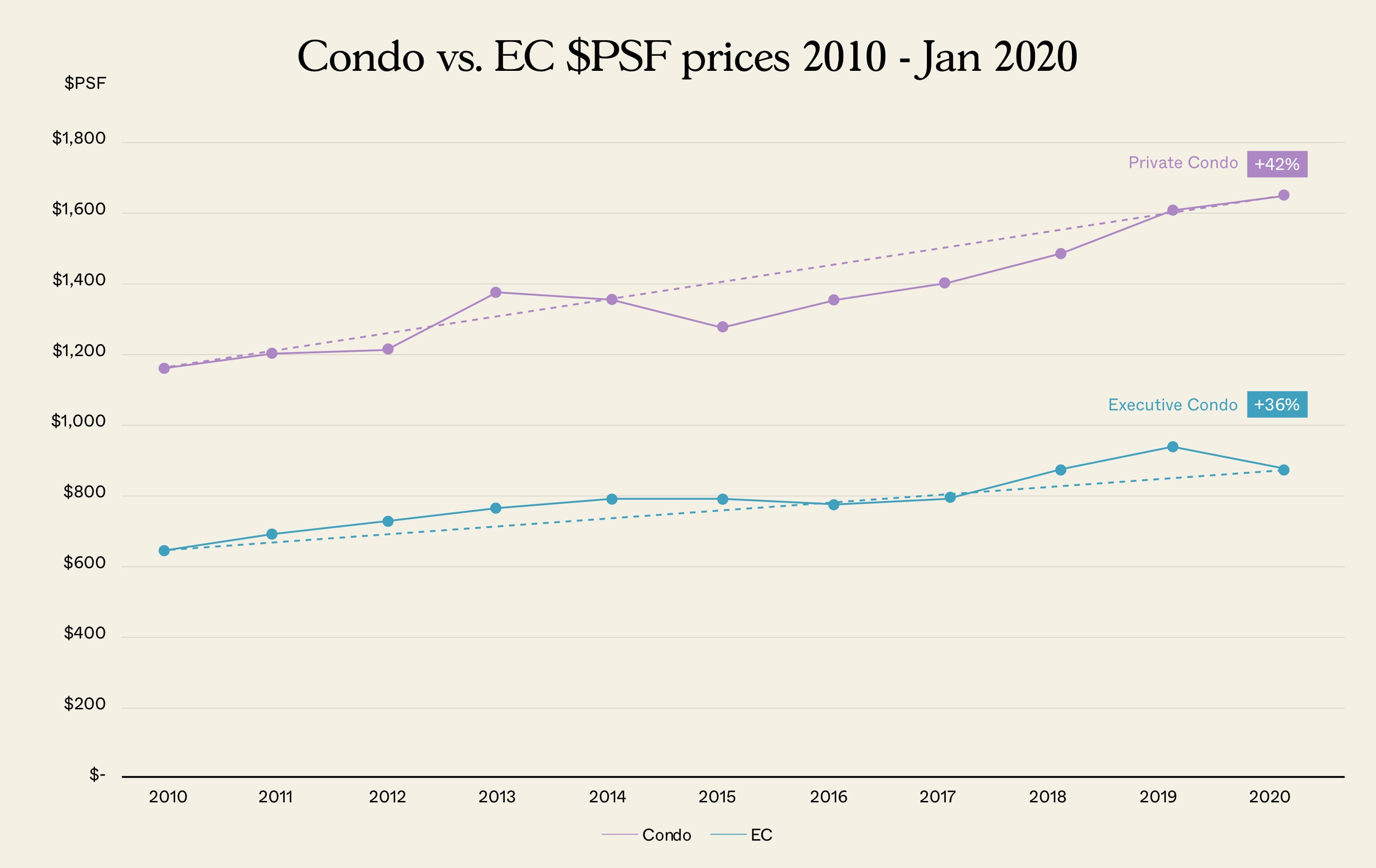

If we were to select different dates, you can see the outcome is quite different.

In this case, private condominiums come out on top, at an average appreciation of 42% as compared to the executive condo at 36%.

Like what we found in our freehold vs leasehold study, the period of comparison has a huge impact on the outcome of which is the “better” type of condo.

So while everyone has their own opinion on which is better: condo vs EC, the truth is that it really depends. There are just way too many factors that come into play.

So remember to look at individual developments and not just the overall market

Things can be quite different when you start comparing individual ECs and condos; and there are many exceptions to the average prices in the market. It’s best to create a checklist of the different plus points in any development, of which being an EC or condo is just one of your criteria.

If you are interested in knowing more about an EC, we’ve done a comprehensive study here on the EC prices and gaps with a private condo. For now, you can take a closer look at this pricing table that we’ve put together.

| EC Name | District | Launch Price | New Launch Price | Gap | Gap Margin |

| Ola | 19 | $1,137 | $1,548.00 | $411.00 | 36.15% |

| Parc Canberra | 27 | $1,104 | $1,262.10 | $158.10 | 14.32% |

| Piermont Grand | 19 | $1,101 | $1,559.00 | $458.00 | 41.60% |

| Rivercove | 25 | $971 | – | – | – |

| Hundred Palms Residences | 22 | $842 | $1,305.40 | $463.40 | 55.04% |

| iNz Residence | 19 | $774 | $1,393.87 | $619.87 | 80.09% |

| Northwave | 18 | $746 | $1,057.89 | $311.89 | 41.81% |

| Treasure Crest | 19 | $747 | $1,349.55 | $602.55 | 80.66% |

| The Visionaire | 27 | $815 | $1,050.73 | $235.73 | 28.92% |

| Sol Acres | 28 | $787 | $992.35 | $205.35 | 26.09% |

| Parc Life | 25 | $785 | – | – | – |

| Wandervale | 28 | $765 | $983.14 | $218.14 | 28.51% |

| The Criterion | 25 | $796 | – | – | – |

| The Brownstone | 18 | $814 | $1,020.49 | $206.49 | 25.37% |

| Westwood Residences | 19 | $803 | $1,260.21 | $457.21 | 56.94% |

| Signature At Yishun | 19 | $772 | $1,260.21 | $488.21 | 63.24% |

| The Terrace | 19 | $812 | $1,142.21 | $330.21 | 40.67% |

| Bellewaters | 19 | $817 | $1,142.21 | $325.21 | 39.81% |

| The Vales | 19 | $789 | $1,260.21 | $471.21 | 59.72% |

| Bellewoods | 25 | $799 | – | – | – |

| Lake Life | 22 | $872 | $1,325.31 | $453.31 | 51.98% |

| The Amore | 19 | $800 | $1,260.21 | $460.21 | 57.53% |

| Sea Horizon | 18 | $813 | $999.31 | $186.31 | 22.92% |

| Ecopolitan | 19 | $792 | $1,082.40 | $290.40 | 36.67% |

| SkyPark Residences | 27 | $796 | $951.32 | $155.32 | 19.51% |

| Lush Acres | 28 | $792 | $1,016.82 | $224.82 | 28.39% |

| Forestville | 25 | $729 | $1,031.33 | $302.33 | 41.47% |

| The Topiary | 28 | $735 | $1,136.30 | $401.30 | 54.60% |

| Twin Fountains | 25 | $743 | $1,031.33 | $288.33 | 38.81% |

| Citylife@Tampines | 18 | $796 | $999.31 | $203.31 | 25.54% |

| Waterbay | 19 | $755 | $939.95 | $184.95 | 24.50% |

| Waterwoods | 19 | $800 | $1,082.40 | $282.40 | 35.30% |

| Heron Bay | 19 | $736 | $939.95 | $203.95 | 27.71% |

| 1 Canberra | 27 | $705 | $933.15 | $228.15 | 32.36% |

| Twin Waterfalls | 19 | $730 | $939.95 | $209.95 | 28.76% |

| The Rainforest | 23 | $745 | $1,098.50 | $353.50 | 47.45% |

| The Tampines Trilliant | 18 | $781 | $924.49 | $143.49 | 18.37% |

| WaterColours | 18 | $728 | $924.49 | $196.49 | 26.99% |

| Blossom Residences | 23 | $685 | $1,109.04 | $424.04 | 61.90% |

| Arc at Tampines | 18 | $736 | $923.33 | $187.33 | 25.45% |

| RiverParc Residence | 19 | $681 | $934.69 | $253.69 | 37.25% |

| Belysa | 18 | $661 | $923.33 | $262.33 | 39.69% |

| Austville Residences | 19 | $728 | $934.69 | $206.69 | 28.39% |

| The Canopy | 27 | $651 | $763.13 | $112.13 | 17.22% |

| Esparina Residences | 19 | $767 | $859.90 | $92.90 | 12.11% |

| Privé | 19 | $691 | $934.69 | $243.69 | 35.27% |

| La Casa | 25 | $382 | $462.95 | $80.95 | 21.19% |

| The Quintet | 23 | $370 | $469.44 | $99.44 | 26.88% |

| The Esparis | 18 | $393 | $484.26 | $91.26 | 23.22% |

| Whitewater | 18 | $364 | $484.26 | $120.26 | 33.04% |

| Park Green | 19 | $388 | $473.02 | $85.02 | 21.91% |

| Nuovo | 20 | $394 | $572.74 | $178.74 | 45.37% |

| Lilydale | 27 | $353 | $463.19 | $110.19 | 31.22% |

| Bishan Loft | 20 | $408 | $572.74 | $164.74 | 40.38% |

| The Dew | 23 | $377 | $518.09 | $141.09 | 37.42% |

| The Eden | 18 | $428 | $504.15 | $76.15 | 17.79% |

| The Floravale | 22 | $359 | $483.67 | $124.67 | 34.73% |

| Woodsvale | 25 | $354 | $457.27 | $103.27 | 29.17% |

| Northoaks | 25 | $360 | $457.27 | $97.27 | 27.02% |

| The Florida | 19 | $441 | $502.01 | $61.01 | 13.84% |

| The Rivervale | 19 | $472 | $502.01 | $30.01 | 6.36% |

| Summerdale | 22 | $441 | $419.58 | -$21.42 | -4.86% |

| Yew Mei Green | 23 | $427 | $433.59 | $6.59 | 1.54% |

| Pinevale | 18 | $459 | $653.49 | $194.49 | 42.37% |

| Chestervale | 23 | $455 | $609.61 | $154.61 | 33.98% |

| Windermere | 23 | $357 | $609.61 | $252.61 | 70.76% |

| Simei Green | 18 | $402 | $653.49 | $251.49 | 62.56% |

| Westmere | 22 | $401 | $643.26 | $242.26 | 60.42% |

| Eastvale | 18 | $406 | $590.80 | $184.80 | 45.52% |

Ultimately, you want a home that’s comfortable and affordable; and whether it’s an EC or private should be secondary to those concerns.

If affordability is your main concern, it’s easy to see why buying an EC would make sense for a first time home buyer that wants a balance between lifestyle and being practical with finances.

On the other hand, if you are looser on the purse strings, buying a condo as a first home could also make sense – especially if you have earlier upgrading plans down the road.

For more details on buying your first home, check out the rest of our Ultimate guide on Stacked Homes. You can also follow us for in-depth reviews on condos in Singapore.

This is Part 7 of our Ultimate Guide to buying your first home. If you haven’t read Part 6, you can do so at the link!

Next up: Part 8 – Freehold versus leasehold condos: which are better?

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments