How Much Does En Bloc Sales Or GLS Affect Nearby Prices? We Analyse 163 Sites To See

April 16, 2022

Did you know? If you own a piece of land (i.e. non-strata such as landed property), you actually own 30m of the subterranean space below your land too. For context, you could build a 10-storeys building underground! And even better, the government will have to compensate you if they were to acquire this subterranean space from your land.

As such, common law defines “land” to include intangible structures (e.g. air space and pathways) besides tangible structures that are permanently affixed to the earth (e.g. buildings, fixtures, subterranean space and trees). This facilitates the transfer of land titles under the Land Titles Act, especially for integrated/mixed developments (for example, Pasir Ris 8 comprises different land titles for its residential/commercial components, bus/MRT interchanges and overhead bridges).

If anything, it was easier to own land in the past as our population density was still low then. In fact, during a visit by the Minister for National Development, Mr Desmond Lee to Dover Forest back in Jan 2021, it was discovered that the estate of the late merchant, Mr Tan Kim Seng, was so vast that it stretches east to west from Queenstown to Clementi and north to east from Dover Forest to Southern Kent Ridge Park. For context, this spans the area of 5 MRT stations (imagine the number of BTO projects that you can build on this piece of land).

Today, land comes at a premium in our land-scarce country, as land prices from government land sales (GLS) programme and en-blocs continue their inexorable march to record levels time and time again. We ought to be content if we can own enough space for making babies building a family.

And this is why it’s also not uncommon for agents to use a successful bid in a Government Land Sales (GLS) site or en bloc sales to justify higher prices of surrounding developments, thereby pushing you to purchase now or perhaps using it to justify paying for higher prices today because eventually, prices of the developments surrounding these sites will catch up anyway.

So does a successful GLS sale or en bloc really lead to an increase in the prices of condominiums around? Let’s find out from the recent en-blocs and Government Land Sales (GLS) programme!

Table Of Contents

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Notes on this review

Before we present our findings, we wish to highlight a couple of points on how we conducted this review –

- Land prices from 163 en-blocs and GLS between 2013 and 2021 from URA were used for this study. These were referenced from Squarefoot Research.

- Prices of properties in the vicinity (i.e. up to around 500m radius) and the district’s average PSF of these en-bloc sites and GLS were then compared 1 year before and 1 year after the land sales/en-bloc took place.

- For this review, we did not go in-depth to examine other possible factors (e.g. announcement of new urban transformation, supply in the area) that may result in the change in prices after the land sales.

- New sales were excluded from this study to eliminate drastic changes in $PSF between one year and another which is not a true reflection of price changes in the immediate area.

Key findings

Our findings are summarised as follows –

- There’s no clear pattern that GLS or en bloc sales raise the prices of surrounding developments based on transaction data.

- The timing of the land sales impacts the eventual land prices and surrounding properties’ prices (e.g. land sold at the peak of the property market in 2013 led to higher land prices and also more bullish resale/subsale prices of surrounding properties).

- There is no conclusive evidence that new land price/successful en-bloc sales are the sole catalyst for affecting the prices of their surrounding properties.

1) There’s no clear pattern that GLS or en bloc sales raise the prices of surrounding developments

Based on our findings, you’ll see that most of the en-blocs and GLS have positive spillover effects in terms of price appreciation in the surrounding properties. This is shown in Tables 1 and 2 below (note: a negative change in PSF does not necessarily mean that the nearby developments are not profitable. It only shows the trend of the properties PSF 1 year before and 1 year after the en-bloc/GLS sale).

This should be unsurprising, as news of higher land prices provides confidence to aspiring homebuyers/investors, who are likely to pay a slight premium than to purchase a brand-new unit to be built on the redeveloped en-bloc site/GLS, which are typically pricier (e.g. Park Colonialnew vs 8@Woodleigh; Amber Parknewvs The Esta).

| Category | No. of Developments Within 500m Radius |

| Positive Change in Average PSF (%) | 2,390 (68.5%) |

| Negative Change in Average PSF (%) | 1,097 (31.5%) |

| Category | No. of Developments Within 500m Radius |

| Positive Change in Average PSF (%) | 1,452 (72.2%) |

| Negative Change in Average PSF (%) | 560 (27.8%) |

Despite this, however, it’s observed that prices in the district, on average, also tend to appreciate – and in some cases, more so than developments surrounding the GLS/en-bloc sites. This could be due to a myriad of factors (e.g. gentrification/urban transformation) or just inflation in general as shown in Figures 1 and 2 below.

As such, it is difficult to say that prices strictly increase as a result of the GLS sites or en-bloc sales. Based on the table, there is no clear and obvious winner between condos around these sites versus the district $PSF changes.

More from Stacked

Canberra Crescent Residences Pricing Breakdown: A Price Comparison With Nearby Condos

Canberra Crescent Residences presents some challenges when it comes to a pricing review. At Stacked, our goal is always to…

While condos around GLS sites won 6 out of 9 years, this is too slim a margin to observe any pattern. The extent to which it edges the district average also varies greatly. The same can be said for en bloc sales.

When looking at the years, those within 500m of the en bloc sites won just 3 out of 5 of the years.

When looking at the district, those within 500m of en bloc sales sites won just 3 out of 9 districts with en bloc sales.

This is certainly not enough to conclude that surrounding condos had a direct benefit from these GLS or en bloc sales.

2) Timing of land sales matters

Looking through the past en-bloc sites and GLS, we noticed that the capital appreciation of properties near these land sales was time-sensitive. Specifically, the highest average gains were recorded when the market was at its peak (e.g. 2013, 2021) and/or when the supply of available/new units are low (i.e. a sellers’ market) as shown in Tables 3 and 4 below.

| Year | 2016 | 2017 | 2018 | 2019 | 2021 |

| PSF Change (%) (Within 500m) | -0.6% | 7.4% | 7.2% | -5.4% | 2.3% |

| PSF Change (%) (District Average) | 2.2% | 5.0% | 4.4% | -6.2% | 6.5% |

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Change_PSF (%)_500M | 1.9% | -4.2% | 1.1% | 0.0% | 3.5% | 5.1% | -0.6% | 2.5% | 5.2% |

| Change_PSF (%)_District | 1.8% | -5.4% | -2.2% | 1.6% | 7.5% | 2.7% | -0.8% | 2.3% | 7.0% |

| Last peak of property market before TDSR rolled out | Price levels going south as market sentiment waned after the cooling measures in 2013 | Easing of sellers’ stamp duties rates which fueled speculation | High supply of new launches and effect of post cooling measures rolled out in 2018 | Market displayed resilience despite COVID-19 | Strong sentiment persisted strongly due to supply crunch caused by Covid-19 | ||||

3) Land prices alone do not determine the profitability of nearby developments

We’ve seen that there are sites where, due to a GLS or en-bloc sales, prices surrounding the site went up – but we’ve also seen that it’s not the sole factor considering how district prices as a whole can even outperform the condos surrounding these sites of interest.

Moreover, some neighbouring developments could even stand to lose if the en bloc or GLS site could pose future competition to them, particularly if the site is in a more strategic location or has better potential to offer more to buyers. To further illustrate this, let’s take a look at some developments in our study that clearly did not benefit from the redevelopment of their neighbouring land parcels (pls see examples in Table 5 below), as other factors impact consumers’ buying behaviour as well.

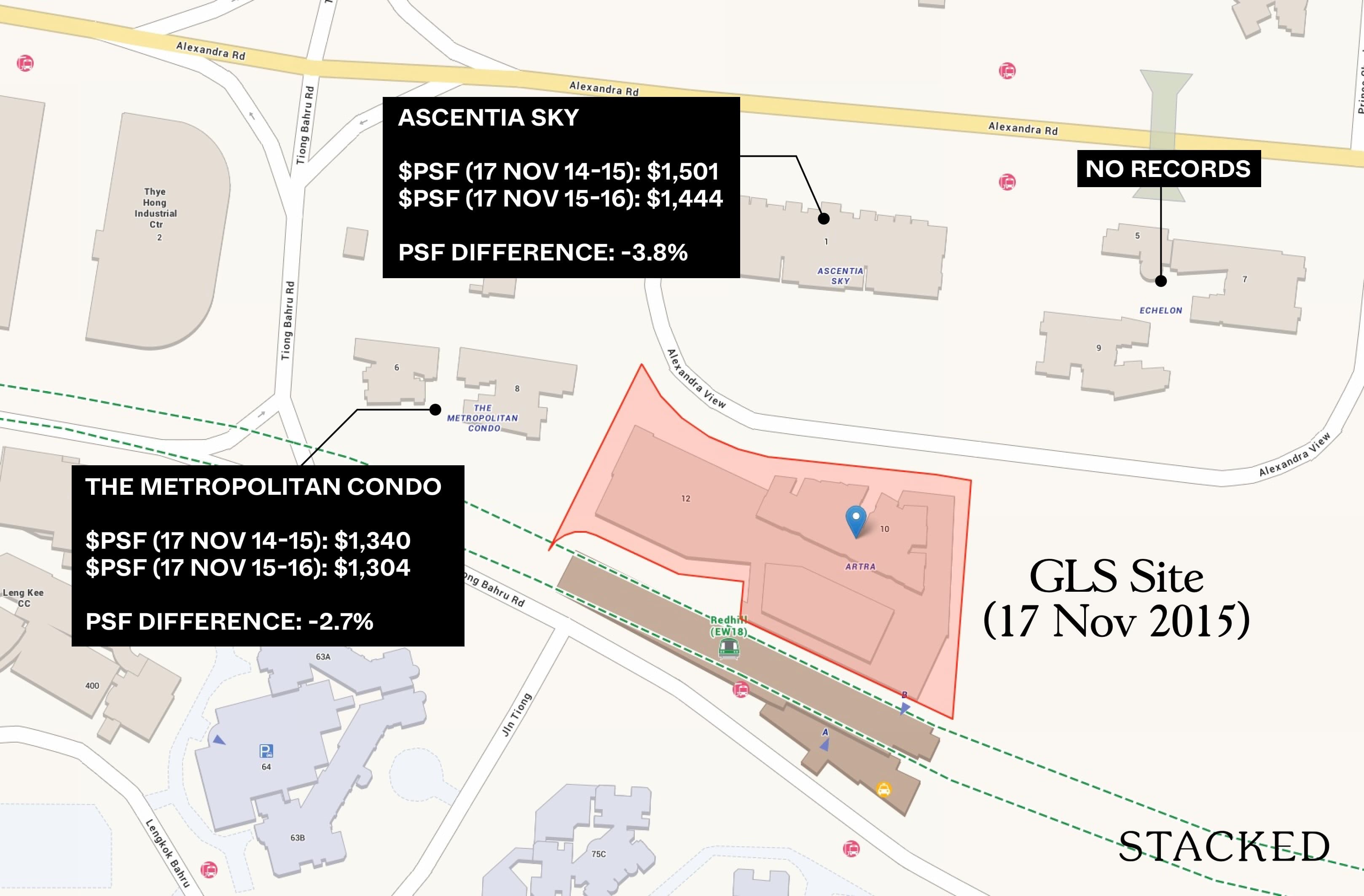

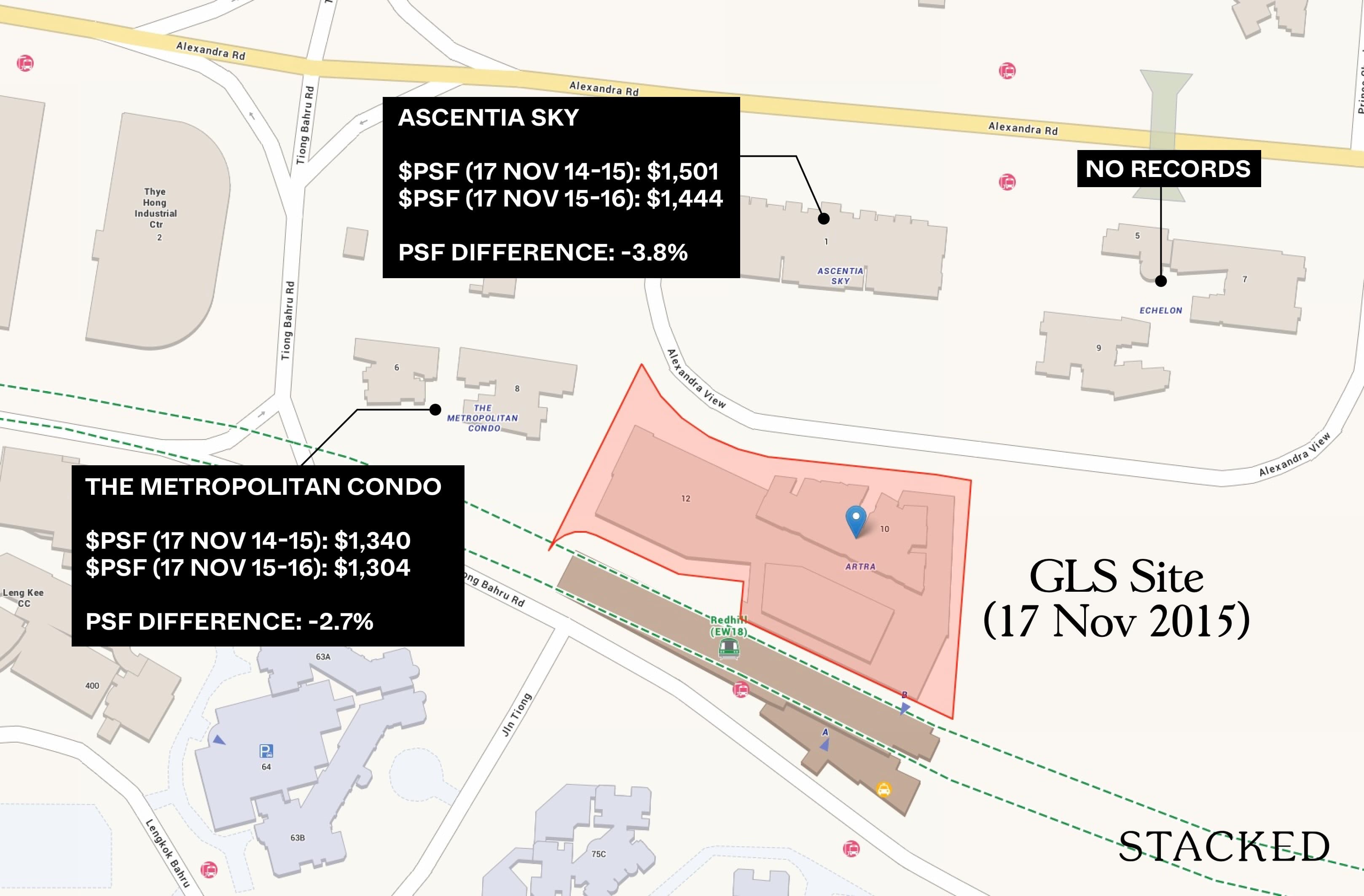

| Redeveloped En-Bloc / GLS Site(s) | Neighbouring Developments | Average Change in $PSF ($) | Comments |

| Artra (GLS awarded on 17 Nov 2015) | 1) Ascentia Sky | -3.80% |

Oversupply of private homes is the main issue at Redhill, which has suppressed healthy price appreciation. Like the example above, the market was moribund for a few years after 2013. |

| 2) The Metropolitan Condominium | -2.70% |

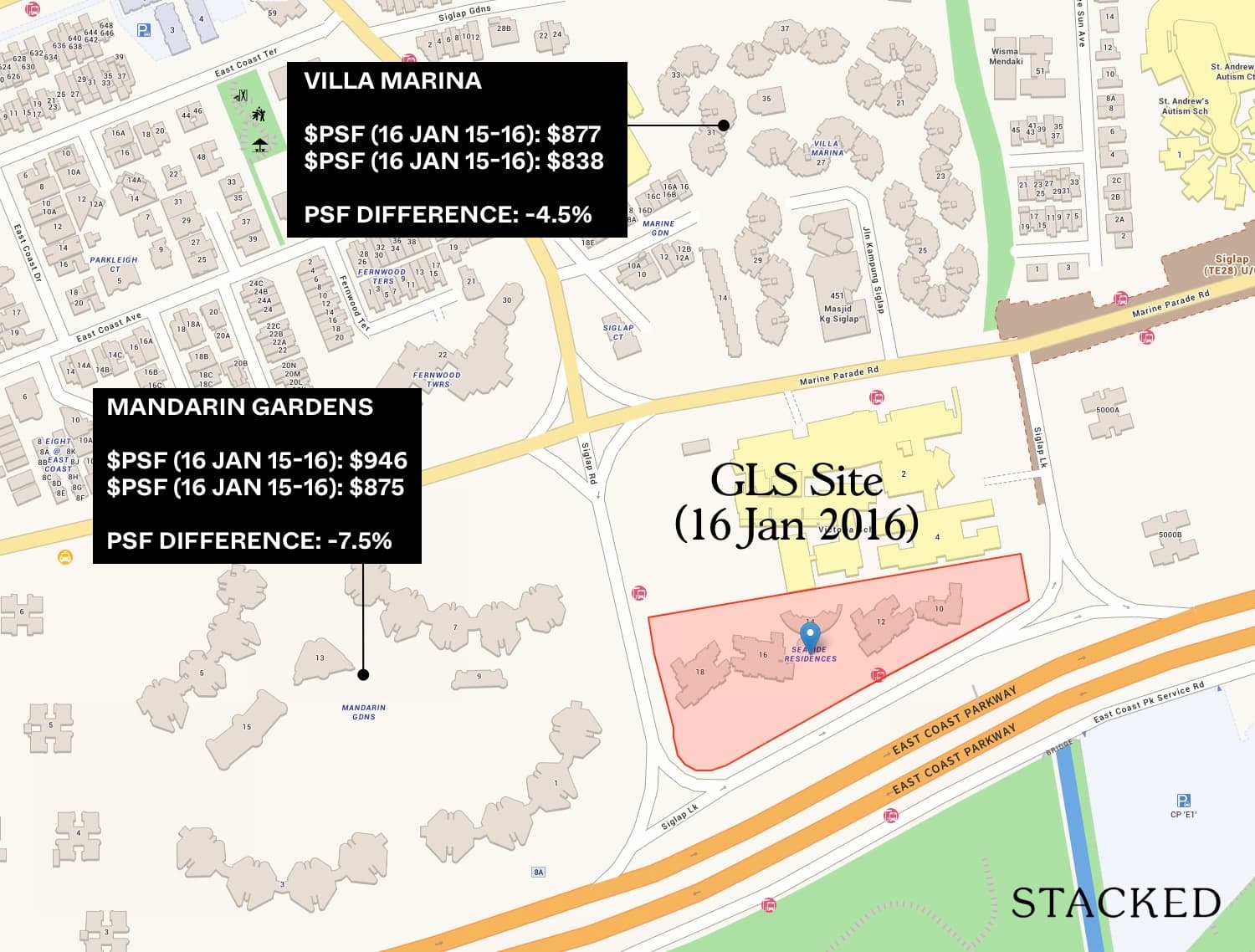

| Redeveloped En-Bloc / GLS Site(s) | Neighbouring Developments | Average Change in $PSF ($) | Comments |

| Seaside Residences (GLS awarded on 18 Jan 2016) | 1) Mandarin Gardens | -7.50% |

Both are very old leasehold (Villa marina was built in 1999 while Mandarin Gardens was built in 1986). On top of that, 1 year before the GLS was awarded, the overall property market was still correcting from the 2013 highs and the year after the GLS was awarded saw the market continue through to hit the bottom in Q2 of 2017. Combined with its age and tenure, the GLS seemed to have no positive effect on their prices. |

| 2) Villa Marina | -4.50% |

Conclusion

Based on our study, I think it’s safe to say that while GLS sales and en-blocs do pave the way for property prices to rise in the long run (after all, developers have to sell higher to make a profit), I find it hard to justify a short-term appreciation for developments surrounding these sites of interest.

While it may occur for some sites, there’s a sizeable number that does not seem to benefit from this at all, of which two sites were specifically mentioned above. There are many factors (such as entry price, surrounding competition, layout etc) that lead to a property’s performance and this study further shows that one such factor cannot necessarily be applied to all properties.

To be sure, this is a study on the impact of the announcement of GLS or successful en bloc sites, and not whether the new development that succeeds it has an impact. Perhaps, knowing the sale of the land price isn’t really enough to move the needle. And it’s only with the tangible launch, with proper unit prices and visuals, are sellers/homebuyers able to make a distinct comparison.

Aligning our purchase intention with these key factors would help pave the way toward an enjoyable and fulfilling property investment journey, that has become increasingly arduous due to more stringent regulations. For prudence, you might want to have a checklist on whether the development that you are eyeing fulfils the key factors that we have been emphasising, which could help you focus better on your next property purchase while providing the bang for your buck.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Does a successful en bloc sale or GLS always increase nearby property prices?

How does the timing of land sales affect property prices around the site?

Can land prices alone predict the profitability of nearby developments?

What factors should I consider besides land sale prices when investing in nearby properties?

Is there a short-term benefit for properties surrounding GLS or en bloc sites?

Ian Tan

Ian is a property enthusiast who finds himself constantly learning about this art and uses data to educate himself on property investment. When not analysing property data, Ian can be found shooting hoops, eating healthily and reflecting on himself, so that he can continue pursuing his aspirations for as long as his mind and body allow.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments