Don’t Leave Money On The Table: 7 Money-Saving Tips When Upgrading/Downgrading Your Property

June 24, 2021

Whether your goal is asset progression or right-sizing, switching homes is a bit of a minefield. Every now and then, someone switching homes will balk at a five-digit stamp duty they didn’t see coming (ABSD even when I won’t be owning two homes?) or the sudden need for another six months of renting. In this article, we’ll look at some of the common culprits, and ways to minimise these costs:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What costs should home owners upgrading/downgrading aim to minimise?

- Not negotiating to stay longer, if you have to

- Prepayment penalties on the existing home loan

- Jumping straight to resale flats when downgrading

- Renovation delays

- Being within the Sellers Stamp Duty (SSD) period

- Inspect the unit again, even after the OTP is signed

- Outstanding fees by previous owners

1. Not negotiating to stay longer, if you have to

Sometimes, having to move out immediately forces you to find temporary accommodation. But before you do this, don’t forget that your buyer may be open to negotiations.

For HDB flats, sellers can stay in flats for up to three months, if buyers agree (this was previously not allowed, but the law was tweaked in 2014). For private properties, arrangements are quite flexible. For example, some sellers agree to pay rent to the buyer to stay on longer; this might be cheaper than having to rent elsewhere.

Conversely, if you’re buying a resale unit, remember you can negotiate with your sellers too. You might make a little money by allowing your sellers to stay on longer, if it’s no inconvenience to you.

2. Prepayment penalties on the existing home loan

This only matters to private property owners. HDB loans never include prepayment penalties.

When you sell your existing property, you’ll almost always pay off the existing home loan with the sale proceeds. However, some banks will impose a prepayment penalty, typically 1.5 per cent of the amount redeemed.

Prepayment penalties usually don’t last the entire loan tenure, and often apply in the first three to five years of a loan. As such, it’s not always the best idea to reprice / refinance into a fresh loan package, if you’re intending to sell and pay off the loan shortly.

If you are intending to upgrade or downgrade soon, but still want to refinance, drop us a note. We can help you find loan packages that won’t charge a prepayment penalty, in the event of a sale.

(In general, we would suggest you don’t refinance if you’re intending to sell within the year. It costs about $2,500 to $3,000 to refinance; and you’re unlikely to recoup the cost, even with savings from lower monthly repayments).

3. Jumping straight to resale flats when downgrading

If you’re downgrading from a private property, chances are you’ll jump straight for a resale flat. That’s because you need to wait 30 months after selling a private property, before you can apply for a BTO flat.

However, if you have somewhere else to stay in that time, we suggest you crunch the numbers first.

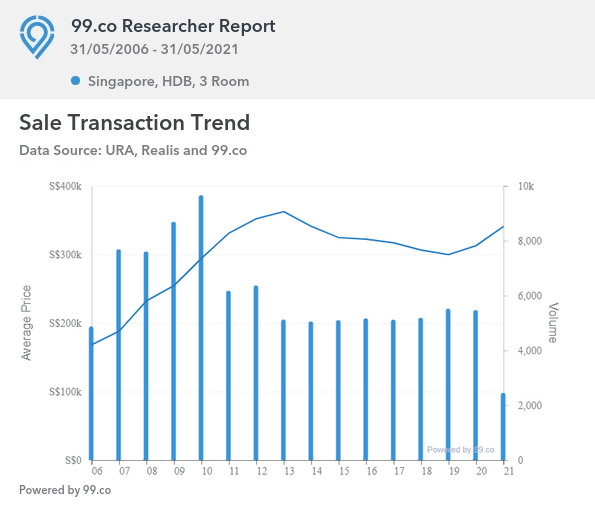

At the time of writing the average price of a 3-room resale flat, island-wide, is $340,618.

In comparison, how much can a 3-room BTO flat cost? Well in May 2021, they were as low as $184,000 before grants, in Woodlands. We’re sure you see the point – if you can wait out the 30 months with no problem, getting a BTO flat could mean a significant boost to retirement funds, paying off existing debts, etc.

This is especially true in 2021, when resale flat prices have been rising for 11 straight months.

How much you save will, of course, vary based on location; and this assumes you don’t need to rent in the meantime. However, it’s worth working out the numbers before you decide. You can also consult one of our experts, to figure out the optimal solution for your situation.

4. Renovation delays

Renovation delays have become a norm during this pandemic. This incurs extra costs, in the form of needing longer temporary accommodation, or having to pay more for on-time completion (e.g., allowing your contractor to get more expensive supplies or manpower, in the current shortage).

If a delay is inevitable talk to your contractor about making the next home as liveable as possible for now; and completing other works later. For example, you might renovate just the toilets and bedrooms first, so you can move into a functional home. You can worry about other areas, like the living room, later on.

It may not be the most pretty or comfortable situation, but it’s likely cheaper than having to rent for another six months.

5. Being within the Sellers Stamp Duty (SSD) period

This only applies to private property (you can’t sell an HDB flat within the five-year Minimum Occupancy Period anyway).

If you sell a property within the first three years of buying it, you’ll be subject to SSD. This is 12 per cent of the purchase price on the first year, eight per cent on the second year, and four per cent on the third year.

As such only buy property if you’re sure you won’t need to sell in the SSD period. We should stress that this isn’t a purely financial concern. For example, if you and your spouse move in with your parents, and later find you all can’t live together, you may not be able to bear it for three whole years.

Another common complaint is that the SSD applies even during en-bloc sales. In these cases, don’t be too quick to swallow the costs.

If you would suffer a financial loss at the end of the transaction, authorities can order that a greater share of the sale proceeds be apportioned to you. Should the sum paid out from the other owners exceed 0.25 per cent of the proceeds from each unit (or $2,000, whichever is higher), the en-bloc sale could be blocked.

So in cases where the SSD and en-bloc sale would cause you a financial loss, do speak to a conveyancing lawyer.

Besides this, upgraders and downgraders alike should be wary, when buying units in a project that’s come close to an en-bloc. The worst-case scenario is having the development go en-bloc, within the same year that you bought it.

Property Advice5 Handy Ways To Use Your Property For Retirement Planning

by Ryan J. Ong6. Inspect the unit again, even after the OTP is signed

Many buyers get lax after the OTP is secured, and never view the unit until it’s time to move in. But bear in mind that the condition of the property can change, between the time of the transaction and your moving in.

A typical example would be damaged walls or flooring, as the previous owners move out. Most OTPs state that the seller has to hand you the property in the same state and condition as when it was signed. This means your seller may be obliged to fix those damages, and not you. But if you don’t spot it on time, it’s hard to make your claims later.

Also, you may have signed the OTP with the understanding that the seller will perform maintenance work (e.g., fixing broken sockets, sagging doors, and so forth). You should check that the work has actually been done.

7. Outstanding fees by previous owners

If you’re moving into a resale unit, ensure that the previous owners have settled outstanding maintenance fees, fines, and utility bills.

At the very least, you’ll waste weeks trying to clear up the situation; often with creditors who are less than understanding. We have come across cases where the sellers leave Singapore right after the transaction, leaving behind several months of unpaid maintenance fees (they quickly became uncontactable, as you might expect).

Some buyers, who don’t have the time to clear up the mess, give in and just pay the previous owners’ bills.

If you have a qualified realtor this shouldn’t happen, as it’s routine for them to check; but buyers making DIY transactions often overlook this.

For more on navigating the Singapore private property market, follow us on Stacked. We’ll also provide you with the most in-depth reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

0 Comments