Do We Really Need 35,251 Property Agents In Singapore?

January 21, 2024

All hail the digital generation (of property agents)

As of this year, we have around 35,251 property agents, up from 34,427 last year; which when we consider how much they like flyers, makes it amazing there are any trees left.

But this is despite the fact that the property market is starting to cool, and we may even be headed for a correction. This is the opposite of what you might expect, as it’s during the boom market that most people start thinking it’s easy money.

I then wondered if there was a correlation between how well the property market is doing, and how many agents are there.

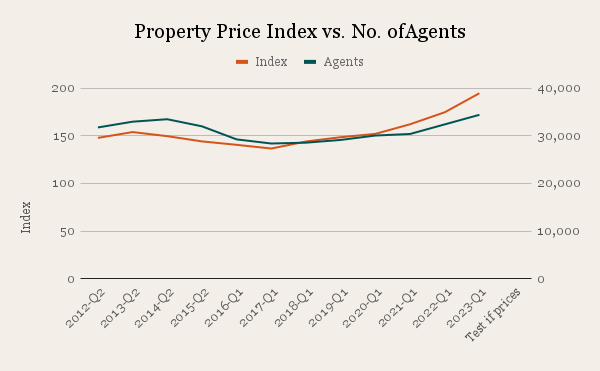

Here’s what I found:

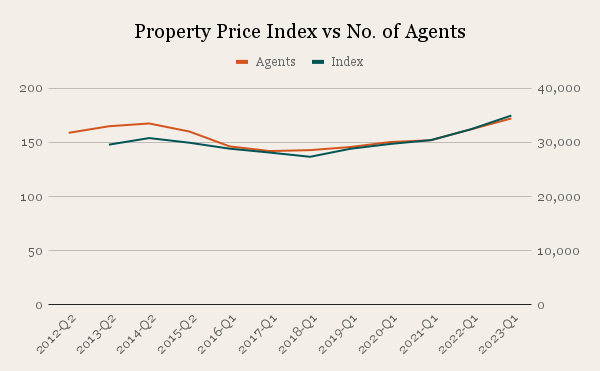

As you can see, it is quite correlated in terms of the peaks and troughs. But given there could be a delay in terms of price moving before people start to act (and as the new agents need to pass their exams, get their licenses, etc.) – here’s how it looks when we add in a year delay in terms of prices:

So if we look at how prices move, there’s now an even closer correlation with the number of property agents entering the market. Now that we’ve incorporated the one-year delay, we can see that property prices and the number of property agents in Singapore are much more in sync.

Now as of 2024, some of these new agents are late to the party. They noticed the post-Covid property goldmine in 2023; but it’s too bad that, just as they got their licenses at the start of this year, the market is beginning to cool.

But market conditions aside, I think there’s another reason for the eagerness to join the industry. I’ve seen an increasing number of younger agents, who cite property videos on YouTube, or interior tours on Instagram, as the thing that sparked their interest.

Consider how properties today are marketed: we’ve gone from classified ads, to property portals, to digital content with video and Instagrammable interiors.

The skills of a YouTuber or Instagram model are arguably more relevant to property marketing than ever before. And among the younger crowd (who don’t seem too happy with the conventional job market by the way), this is something that they get. I think it’s starting to dawn on them that, when it comes to digital property marketing, main character syndrome isn’t frowned upon. Behaving like that is an advantage.

The younger generation of agents are more exposed to online content, and have a better sense of what works. They know what sort of posts attract clicks, they know how to present themselves on social media; and when they create content, it comes off as less pretentious than my generation’s attempts.

But that leads to the question of how many property agents we need

The number of agents has hovered around 30,000 to 35,000 for many years; and even around a decade ago, many asked if so many agents are necessary.

We have an increasing number of avenues for people to buy or even list properties without agents; the HDB resale portal will also come about soon. Fewer tenants like to use leasing agents, and some buyers these days even shun the use of a buyer’s agent.

Now I’m not saying the age of property agents is at an end; far from it (in fact, here’s a long explanation as to why agents are still important).

More from Stacked

The Allure Of Older Properties: Who Are Buying These Places?

“LEASE DECAY”, the ad screams, “DID YOU KNOW YOUR HDB VALUE IS $0 IN THE END, OMG”. It’s probably one…

But I worry that some property agencies have given up on nurturing better agents, and instead just gone for casting the widest net possible (e.g., if one in 10 agents are actual talents, they don’t try turning that ratio into five or six out of 10; instead they just get 10,000 new recruits, and leave the less talented ones are left to perish Lord-of-the-Flies style).

When agencies just start going for numbers like that, service quality sinks like a brick in a bathtub. Buyers and sellers are forced to sift through multiple bad agents, to get to the genuinely good ones.

Still, on the plus side, taking on younger and more tech-savvy agents might make up for this. It improves the odds of a quicker transaction; and some clients are more satisfied at seeing nice promotional videos, Instagram pics, etc. Quite a few have told me that it simply feels like they’re getting their money’s worth.

This may even be sufficient to convince buyers and sellers to work with agents again, despite the increasing avenues for DIY property transactions.

Meanwhile in other property news:

- So you want to live near a landed enclave for peace and quiet, but you don’t want a mortgage that your great-grandchildren will be paying off. Okay, here are the most affordable options.

- What’s more magical than seeing a unicorn? A three-bedder priced below $1.2 million in Singapore. Experience the magic here.

- Dual-key units: when you buy one, it feels like you fought IRAS and won. Here’s what it’s like to live in one at Whistler Grand.

- While I think property agents get a bad rep sometimes, some of them may deserve it.

- What’s it like being a homeowner as early as your mid-twenties? One of them explains it all

Weekly Sales Roundup (08 January – 14 January)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WATTEN HOUSE | $12,236,000 | 3412 | $3,576 | FH |

| THE RESERVE RESIDENCES | $8,098,520 | 2809 | $2,883 | 99 yrs (2021) |

| LEEDON GREEN | $4,708,000 | 1356 | $3,471 | FH |

| THE CONTINUUM | $2,688,000 | 947 | $2,838 | FH |

| PINETREE HILL | $2,567,000 | 969 | $2,650 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PINETREE HILL | $1,349,000 | 538 | $2,507 | 99 yrs (2022) |

| RIVERFRONT RESIDENCES | $1,490,550 | 872 | $1,710 | 99 yrs (2018) |

| THE MYST | $1,507,000 | 678 | $2,222 | 99 yrs (2023) |

| LENTOR HILLS RESIDENCES | $1,777,000 | 753 | $2,358 | 99 yrs (2022) |

| SCENECA RESIDENCE | $1,860,000 | 904 | $2,057 | 99 yrs (2021) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE RITZ-CARLTON RESIDENCES CAIRNHILL | $16,500,000 | 3057 | $5,397 | FH |

| THE ARCADIA | $4,600,000 | 3735 | $1,232 | 99 yrs (1979) |

| CYAN | $3,550,000 | 1528 | $2,323 | FH |

| THE ARC AT DRAYCOTT | $3,500,000 | 1270 | $2,756 | FH |

| NEWEST | $2,800,000 | 2519 | $1,112 | 956 yrs (1928) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| VETRO | $658,000 | 474 | $1,389 | 999 yrs (1882) |

| VENTURA VIEW | $700,000 | 441 | $1,586 | FH |

| PRESTIGE HEIGHTS | $730,000 | 409 | $1,785 | FH |

| SIMS URBAN OASIS | $785,000 | 409 | $1,919 | 99 yrs (2014) |

| ALEXIS | $800,000 | 398 | $2,009 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE RITZ-CARLTON RESIDENCES CAIRNHILL | $16,500,000 | 3057 | $5,397 | $4,900,000 | 8 Years |

| WARNER COURT | $2,800,000 | 1270 | $2,204 | $2,062,000 | 22 Years |

| THE WATERINA | $2,500,000 | 1313 | $1,904 | $1,733,263 | 22 Years |

| HILLINGTON GREEN | $2,375,000 | 1528 | $1,554 | $1,600,000 | 19 Years |

| VARSITY PARK CONDOMINIUM | $2,295,888 | 1572 | $1,461 | $1,476,857 | 17 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE ROCHESTER RESIDENCES | $1,638,000 | 1281 | $1,279 | -$181,020 | 16 Year |

| STARLIGHT SUITES | $1,890,000 | 850 | $2,223 | $26,644 | 14 Years |

| KINGSFORD WATERBAY | $1,168,000 | 850 | $1,374 | $31,000 | 6 Years |

| VETRO | $658,000 | 474 | $1,389 | $38,000 | 12 Years |

| RV POINT | $945,000 | 484 | $1,951 | $68,960 | 13 Years |

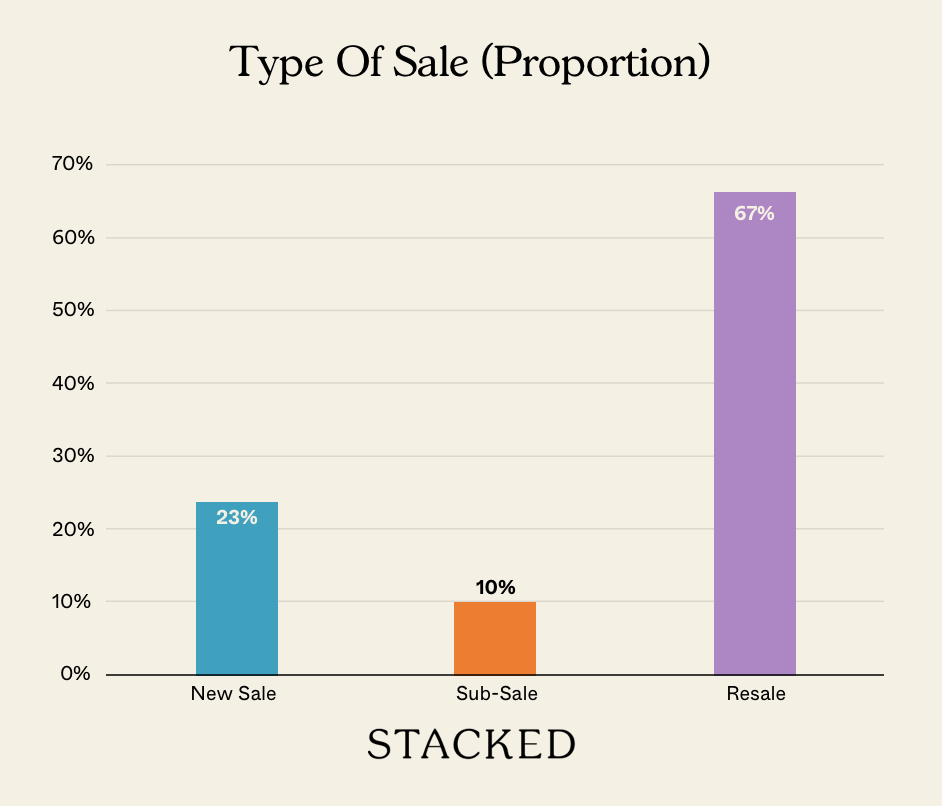

Transaction Breakdown

For news and homeowner experiences, as well as my endless complaining about balconies in unit layouts, follow us on Stacked Homes.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are there so many property agents in Singapore despite a cooling market?

How does the number of property agents relate to property prices in Singapore?

Are younger, digital-savvy agents changing the property industry in Singapore?

Is the large number of property agents necessary for Singapore's property market?

What are some challenges faced by the property agent industry in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Latest Posts

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

0 Comments