Why Developer Discounts Doesn’t Always Mean A Good Deal

June 10, 2020

Everybody loves a good deal – even the rich.

why do people look at me like I’m crazy when i use coupons at grocery or try bargaining at retail, IM FROM NEW YORK WHERE IS THE SALE RACK

— Lady Gaga (@ladygaga) December 21, 2012

Lady Gaga has an estimated net worth of USD $275 million, and yet she still cannot resist the allure of a good deal.

On a more relatable note, I’m sure many of you reading would have been to Daiso before – the land of buying things you never knew you needed.

It is, after all, human nature to love exclusive deals.

If you have been on the lookout for a property recently, you would have probably come across this advertisement.

With the attractive 6-figure number plastered across the flyer, its District 10 location, and its freehold status – it’s easy to see why this garnered such widespread attention.

Admittedly, for those who are more in tune with the property market, you’d know that the average $400,000 discount is a bit of a misnomer.

The early launch price was close to $1.81 million in 2016, so while the discount is still a 6-figure one, it isn’t actually as great a discount as advertised.

To be fair, it is a tactic that is commonly used in the retail environment – set a higher price to make the discount seem bigger.

Nevertheless, 38 Jervois managed to sell all 16 of its firesale units in just 3 days.

It’s quite an impressive feat, isn’t it?

By all accounts, selling this many units in this Covid-19 environment is certainly a “win” in the developer’s books.

And again, it’s easy to see the appeal here.

By entering at a lower price than the earlier buyers, it seemingly gives you a safety net – you definitely feel better knowing that you aren’t buying at a high.

After all, with that margin in place, the hope is that prices could possibly go back to its initial launch price in the future.

So does a big discount necessarily mean it is a good buy?

Let me show you an example.

Kingsford Hillview Peak is a condominium launched in the Hillview area in 2013.

But perhaps it is more famously known for being fined $130,000 for repeated safety lapses during its construction.

And to make matters worse, its poor construction quality continued to plague the residents even after it was completed.

But that’s really besides the point here – so let’s talk about its launch.

Sentiments on the ground weren’t great when it was first announced, more so from the fact that it was a foreign developer embarking on its maiden project in Singapore.

So after its launch in April 2013, it only sold 137 out of a total of 512 units (32.6%) in the development for the rest of the year – this was at an average $1,349 psf.

And those poor sales meant that in 2015, Kingsford Development had to push out discounts to lure in buyers – to a new selling price of around $1,200 psf.

While that did push some sales, there were further marketing efforts required in 2016 to tie up sales of the project.

Fun fact: this was with a 250k Property Tycoon Challenge, which was modeled after the game show Who Wants To Be A Millionaire.

No prizes for guessing the top prize here – it was a $250,000 cash rebate.

So if you had bought a unit in 2016 (with added discount incentives) – you were buying at a lower price point than those who bought during the launch.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

10 Free Property Research Tools To Boost Your Chances Of Buying The Right Property

For such a small country, Singapore sure has a lot of property options and nuances - which can certainly be…

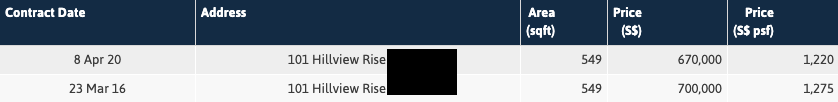

This particular unit was bought in early 2016, when the first round of discounts were dangled to push sales at the development.

It was then sold just two months back in April 2020, at a loss of $30,000.

Remember, this doesn’t take into account commissions, taxes, fees, and interest – so actual losses are likely to be even more.

To be completely transparent, there haven’t been that many loss making transactions at the Kingsford Hillview Peak thus far.

And you might be surprised to find a healthy number of “profitable” transactions.

| SOLD | AREA(SQFT) | SALE PRICE(S$ PSF) | BOUGHT | PURCHASE PRICE(S$ PSF) | PROFIT(S$) |

| 26 FEB 2020 | 678 | 1,130 | 15 JAN 2016 | 1,071 | 40,000 |

| 5 DEC 2019 | 829 | 1,397 | 4 JUN 2013 | 1,293 | 86,000 |

| 16 OCT 2019 | 517 | 1,403 | 22 APR 2013 | 1,372 | 16,000 |

| 22 MAR 2019 | 1,249 | 1,345 | 31 JAN 2016 | 1,298 | 58,798 |

| 25 JAN 2019 | 775 | 1,355 | 10 MAY 2013 | 1,300 | 42,500 |

| 10 JAN 2019 | 786 | 1,425 | 27 JUL 2015 | 1,322 | 81,000 |

| 10 OCT 2018 | 517 | 1,461 | 21 MAY 2013 | 1,417 | 22,962 |

| 9 JUL 2018 | 829 | 1,448 | 10 MAY 2013 | 1,312 | 112,575 |

| 25 JUN 2018 | 1,044 | 1,167 | 25 APR 2013 | 1,101 | 68,000 |

| 1 JUN 2018 | 517 | 1,432 | 15 MAY 2013 | 1,301 | 67,900 |

| 16 MAY 2018 | 1,044 | 1,319 | 19 JUN 2013 | 1,317 | 1,500 |

| 28 MAR 2018 | 549 | 1,439 | 23 APR 2013 | 1,328 | 61,000 |

| 28 NOV 2017 | 635 | 1,272 | 24 APR 2013 | 1,211 | 39,000 |

| 8 MAY 2017 | 775 | 1,355 | 3 MAY 2013 | 1,351 | 3,000 |

| 26 APR 2017 | 1,378 | 1,198 | 25 APR 2013 | 1,085 | 155,000 |

| 28 FEB 2017 | 1,097 | 1,310 | 5 JUL 2016 | 1,275 | 38,000 |

But if you look closer at the profits, you’ll find that it tells a similar story.

Other than the $112,575 profits from the one transaction, the rest all have very marginal profits.

So if you were to calculate proper returns, you’ll find that the majority have actually lost money on their units as well.

That’s not to say that Hillview Peak would never appreciate in the future, things could change depending on the market and further redevelopment to the area.

But the fact remains that if you had purchased it with an investment horizon of 5 years (and persuaded by the discounts), you would have made a loss.

Let’s say you had held your horses to do a little more research, things could have turned out very differently.

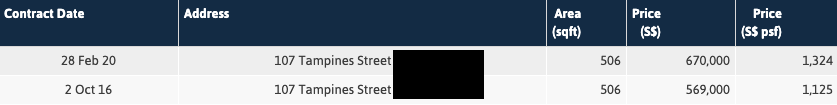

For example, take a look at this unit at the Alps Residences.

Purchasing this unit at a slightly later date, and an even lower quantum would have netted you a gross profit of $101,000.

Even after taking away all your relevant costs – you are still left in a better position than you were before.

Final Words

Let me just be clear, I am not saying that 38 Jervois would have been a bad purchase for everyone.

At that price point, it could make sense for some people who are looking at an own-stay situation in District 10.

But if you were considering a purchase purely because of the discount, then all I’m saying is stop and really consider what you are buying the property for.

Don’t follow and rush blindly like everyone else.

Understand and research on the surrounding projects and their transaction prices.

Know your secondary market demographics in the area – will there be a demand for that type of product at the future price point that you are looking to exit.

Ensure that you cover all bases before committing, for making a wrong decision could set you back for many years.

Any questions or feedback, feel free to reach out at stories@stackedhomes.com

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Does a big discount on property always mean it's a good deal?

Why might a property with a significant discount still result in a loss for the buyer?

What should I consider before buying a property just because it’s discounted?

Can buying later at a lower price be more profitable than buying at launch?

Is it better to wait and do more research before purchasing property during a sale or discount period?

Ryan Ong

Ryan is part property consultant, part wordsmith, and a true numbers aficionado. Ryan's balanced approach to every transaction is as diverse as it is effective. Since starting his real estate journey in 2016, he has personally brokered over $250 million of properties. Beyond the professional sphere, you'll often find him cherishing moments with his beloved cats: Mia, Holly, Percy and Toto.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

2 Comments

Is there a place to get notified of developer discounts instantly?