Coronavirus and SARS: How It Might Affect The Singapore Property Market

February 24, 2020

Wuhan Virus, Coronavirus, 2019-nCoV, COVID-19, Coronavirus 2019.

Call it whatever we want, but there’s no denying that it’s already wreaked havoc across our tiny island.

Empty grocery shelves and over-priced masks have been lining the news bulletins these past weeks, fueling all sorts of reactions amongst the good citizens of Singapore.

Tourism has fallen..

The Singapore Dollar is slowly dropping.

And to make matters worse, the UK, Qatar, Kuwait, and Israel (amongst a bunch of other countries) are dishing out travel advisories to their citizens to avoid Singapore as a travel destination (at all costs) for the foreseeable period.

This, after the recent string of infected cases this CNY plunged our DORSON level straight into that auspicious orange range (coincidence? I think not).

And as if all that isn’t enough, everywhere I go, I hear people saying –

‘Aiya, economy die already la like that – confirm recession liao’

Now I can’t deny the impact the Coronavirus has, and will continue to have on the stock market.

But what about the property market in Singapore?

Could we be on the verge of another massive downward spiral?

Let’s have a look!

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Key Coronavirus Social Talking Points

The Media

It’s no secret that the media plays a massive role in gatekeeping the information that we consume.

And while I’m not about to launch into a massive charade on it, I’ve actually been following articles from the Straits Times regularly since the start of the Coronavirus (as I’m sure many of you have).

We’ve seen the switch from the initial ‘New Foreign Virus’ stage to the ‘OMG it’s in Singapore’ articles.

Quickly followed by the ‘Public Panic’ phase, and then the ‘Righteous Keyboard Warrior’ phase (basically the period where cynics took to Social Media with memes and posts criticising the ‘hoard mentalities’).

And as for those who are wondering, we’re at the ‘Media wants to help’ stage now.

Which is basically the stage where the issue is downplayed (or just covered with less sensationalism) to avoid unnecessary wide-spread public panic.

This, in line with the authorities strict view on urging calm amongst the people.

With all that in mind, as well as the increased coverage on Singapore’s ‘incredible’ medical prowess in fighting the virus, we can therefore expect more ‘censored’ articles from the media to help in allaying the public’s fears.

And in doing so, preventing rash public movements that could further the economic slowdown, or in this case, cause panic selling/buying in the property market.

A New Normal & The Psychological Factor of ‘Death-counts’

It’s a fact that people will eventually find a way to get back to their daily lives and commitments.

As face masks quickly become a common sight, the public will naturally adapt to the situation and quite simply, ‘carry on’.

Now due to the widespread coverage of the issue, nearly everyone is aware (and keeping track) of the situation.

And while the government’s latest POFMA ruling will help keep most ‘fake news’ pieces in check to an extent, we should understand the volatility of the situation (despite this supposed ‘calm’ that we are now riding on).

A single certified death could spark off a gradual chain of socio and economic impacts, leading to more dire outlooks (depending on the case of death amidst the global virus scene at that time).

That said, it would then take an unprecedentedly high fatality-rate/death toll to throw the otherwise stable property market into a frenzy.

Key Coronavirus Economical Talking Points

Our Diversified Economy

Some of you might have read about Australia’s impending dollar drop due to their lack of economic diversification (sorry mates, had to throw in an example here).

Now one thing that the 2020 version of Singapore has, that the Aussie economy (or the 2003 version of itself) unfortunately doesn’t/didn’t is a well-diversified economy.

It’s a no brainer that the retail industry will take a hit (especially for companies who aren’t currently operating with online/delivery services), but according to head researchers at JLL, ‘technology and business-service firms, as well as traditional finance and insurance companies, will help to counter any further (economic) headwind.’

Basically, the unfortunate few from the retail/business sectors will take a noticeable hit for a sustained period as they observe lesser ‘on-ground’ customers. Depending on how long the virus drags on, we might possibly observe a dip in commercial rental rates/demands.

In lieu of this, we will most likely see a surge in ‘on-ground’ businesses porting to online services/deliveries during and post Coronavirus as owners begin to realise the importance of providing buying versatility to its customers.

As for property purchases, we could very well see consultations going online, and possibly even an improvement in virtual home-viewing (360-pictures, live tour videos etc.).

Foreign Impact (Decreased Investments & Expat Population Fall)

That being said, it isn’t all sunshine and rainbows on our end – as some of you might point out.

We know that a large number of Singapore’s investors have major investment dealings with China.

Naturally, this demographic would be harder hit by the virus from both social and economical standpoints given the current state of the country (without even including current US-China trade tensions).

As a result, we could see a sizable portion of investors pulling out of the market, or simply threading more carefully for the time being.

And depending on how long this COVID-19 war rages both locally and abroad, we could expect subdued property market sentiment/movement in the near future.

What’s more, a handful of expats from foreign countries have decided to avoid weathering the storm by either 1.) Moving back home or 2.) Halting/Postponing plans on an initial work-move to Singapore.

A factor, which could result in reduced rental demand/yield in the short-term, and on a smaller scale, reduced new launch/resale demand.

What did we observe from SARS?

SARS 2003 Trend

Now Mark Twain (he’s the guy who wrote Huckleberry Finn) said this.

‘History doesn’t repeat itself, but it often rhymes.’

Based on that, let’s see what kind of impact the SARS virus had on Singapore’s economy back in 2003.

If you understand a typical property cycle, you’ll know that there are 4 stages.

There’s the Recovery phase, followed by the Mid-cycle dip, the Explosive phase, and the Recession phase.

More from Stacked

6 Key Steps To Take When Right-sizing Your Property

So the children have moved out, and you’re sick of cleaning up your huge 1980’s five-room flat / three-storey bungalow…

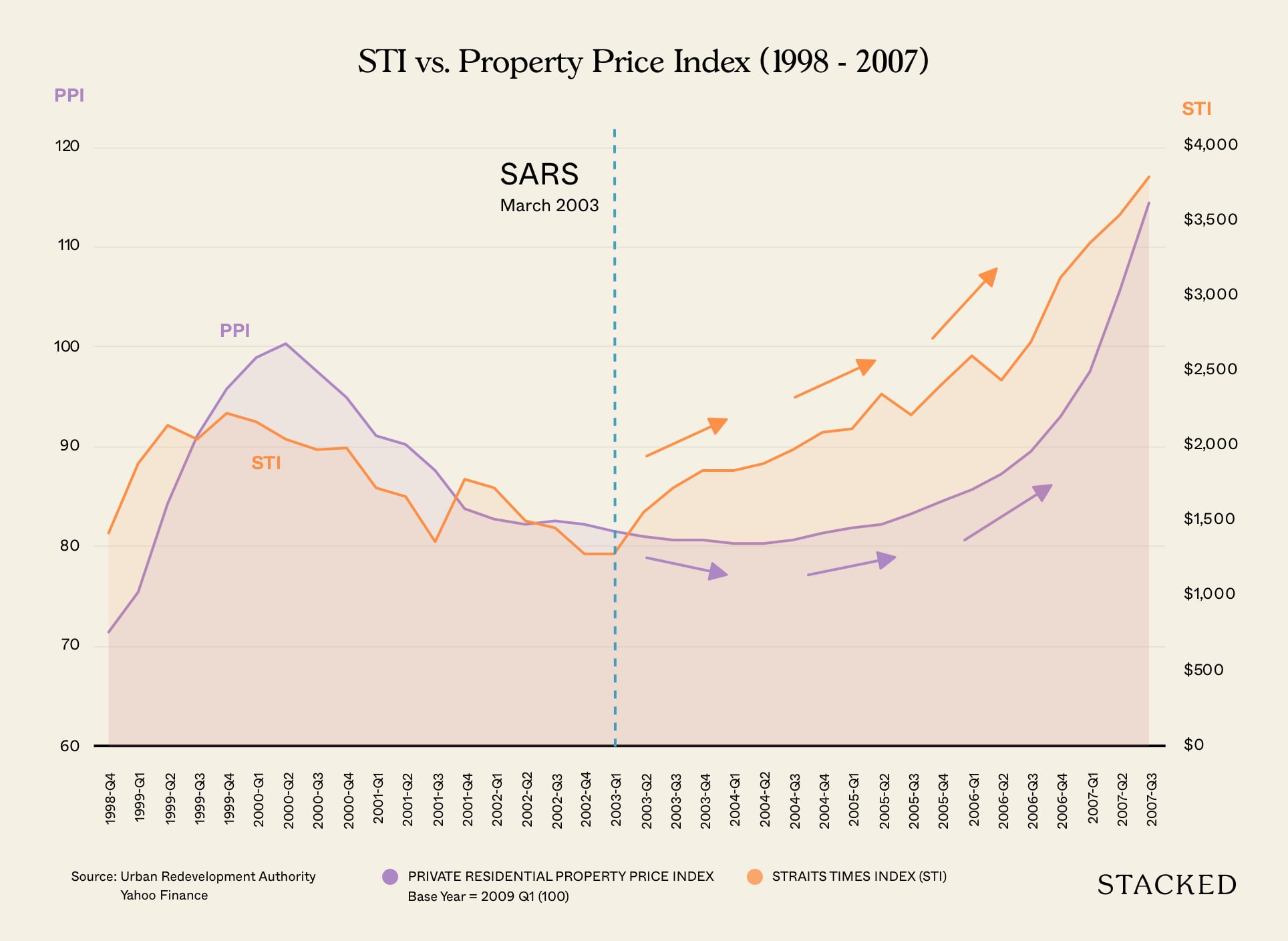

At the point when SARS hit, the Property Market was going just about going through the mid-cycle dip on its way through to the Expansion phase right off the back of the Recession/Correction phase (Dot.com crash and 9/11).

(If you think about it, it does parallel the poor market sentiment between 2013-2017 in some ways.)

And according to the price index, it does seem like the virus had almost no major impact on the cycle whatsoever.

If anything, it looks as if it might have even contributed to a faster-than-expected ‘Peak’ phase.

Which leads me to my next point.

Pent-up Demand/Savvy Buyers

As we’ve seen through the years (SARS, Wall Street/Lehman Brothers Crash, ABSD), a sudden subdued property demand is often channeled as pent-up property demand (in the case of Singapore’s ever-growing economy at least) – often leading to heightened sales in post.

For the science geeks, think of it as potential kinetic energy. Press the spring down on a hard surface (diversified/strong economy) and it doesn’t move or disappear.

Release the spring and it flies into the air (and then drops somewhere under your 100-kilo sofa).

Once the virus cleared back in 2003, people came out of their shells, and so begin the ramp-up of the explosive phase of the property cycle right up till 2007.

Sales Have Not Evaporated Completely

Yes, showflat visit numbers may have dropped, and some developers are even ‘postponing’ launch dates. But if you have been seeing the news on The M which managed to sell 70% of its 522 units on its launch weekend, you’d realise that the issue of the Coronavirus isn’t an all encompassing cripple.

Singaporeans are still willing to venture out and make purchases IF they deem that the development holds good value for their future.

If you also factor in the lack of easy-access (investment/media) information available back in 2003 as there is now (along with the ‘novelty’ of the entire issue at that time and the ‘boldness’ of our younger generation) – it quickly becomes evident that people are more willing to make educated purchases this time around.

And unlike the fear that reigned in 2003 which saw lower property transactions and resulted in pent-up demands, this ‘willingness’ to continue participating in the property market would, in my opinion, reduce the extremities of the dips in this current expansion phase and the rises in the upcoming peaking phase.

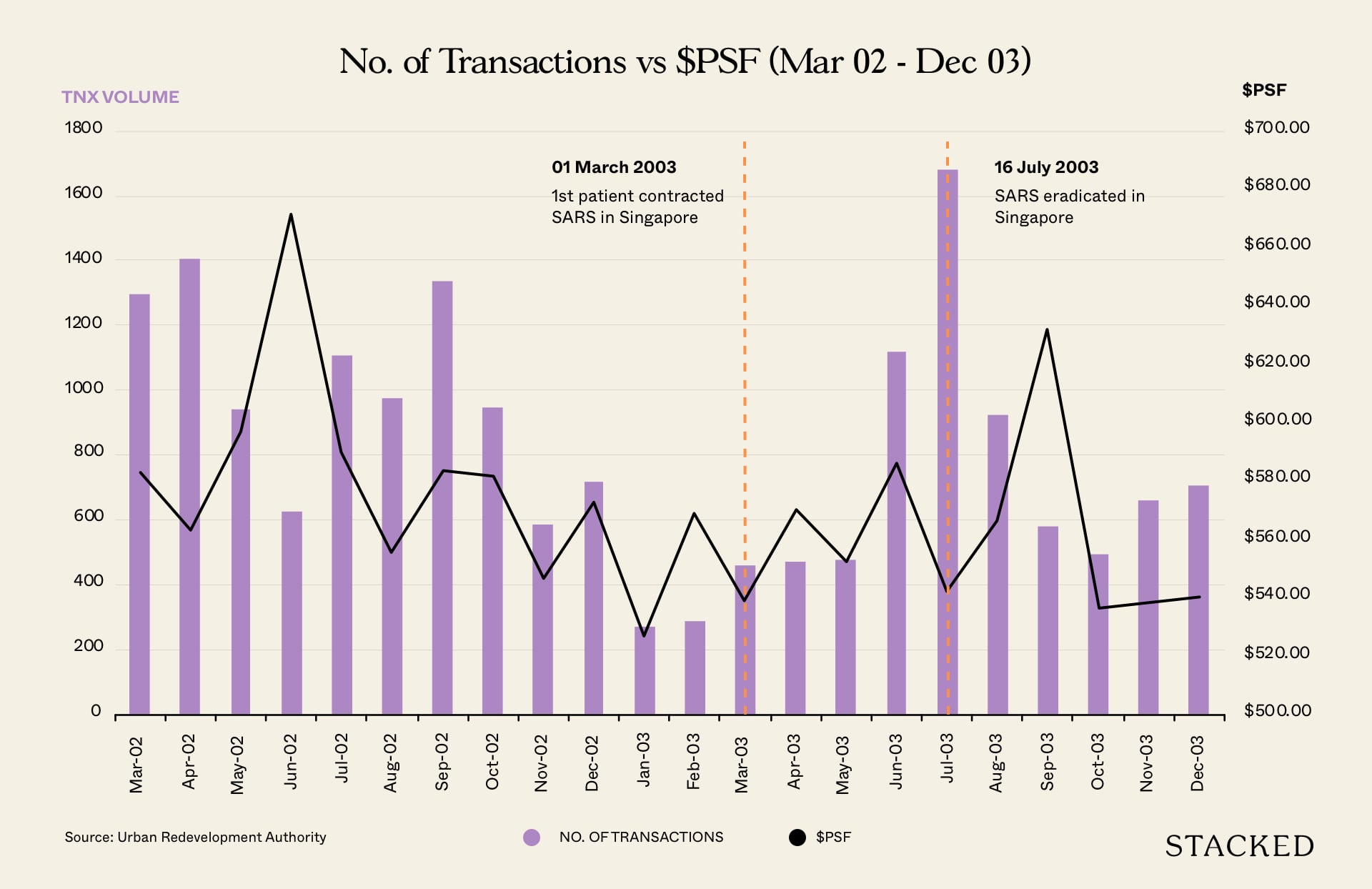

Looking at the number of transactions during the SARS period, we can see that it was pretty much stagnant in the few months following March. But considering the impact of SARS on the market then, while it did not grow, the fact that it didn’t fall either does show some resilience.

| Date | No. Transactions | Avg Psf |

| 03-02 | 1294 | $ 583.21 |

| 04-02 | 1408 | $ 563.00 |

| 05-02 | 941 | $ 597.23 |

| 06-02 | 629 | $ 671.72 |

| 07-02 | 1106 | $ 589.91 |

| 08-02 | 976 | $ 555.83 |

| 09-02 | 1334 | $ 583.83 |

| 10-02 | 947 | $ 581.53 |

| 11-02 | 589 | $ 546.96 |

| 12-02 | 716 | $ 572.49 |

| 01-03 | 271 | $ 527.16 |

| 02-03 | 288 | $ 568.92 |

| 03-03 | 461 | $ 539.15 |

| 04-03 | 470 | $ 570.49 |

| 05-03 | 476 | $ 552.73 |

| 06-03 | 1121 | $ 586.37 |

| 07-03 | 1681 | $ 542.49 |

| 08-03 | 924 | $ 566.36 |

| 09-03 | 583 | $ 631.97 |

| 10-03 | 493 | $ 536.49 |

| 11-03 | 660 | $ 538.22 |

| 12-03 | 707 | $ 540.58 |

Now that we’ve established that the number of transactions was barely affected, let’s take a look at the average PSF prices during the same period. I’m sure most people would naturally assume that prices would definitely have fallen – but the data shows otherwise.

While more detailed analysis could be done, on the surface, the data does show that by and large, prices did not change for the worse.

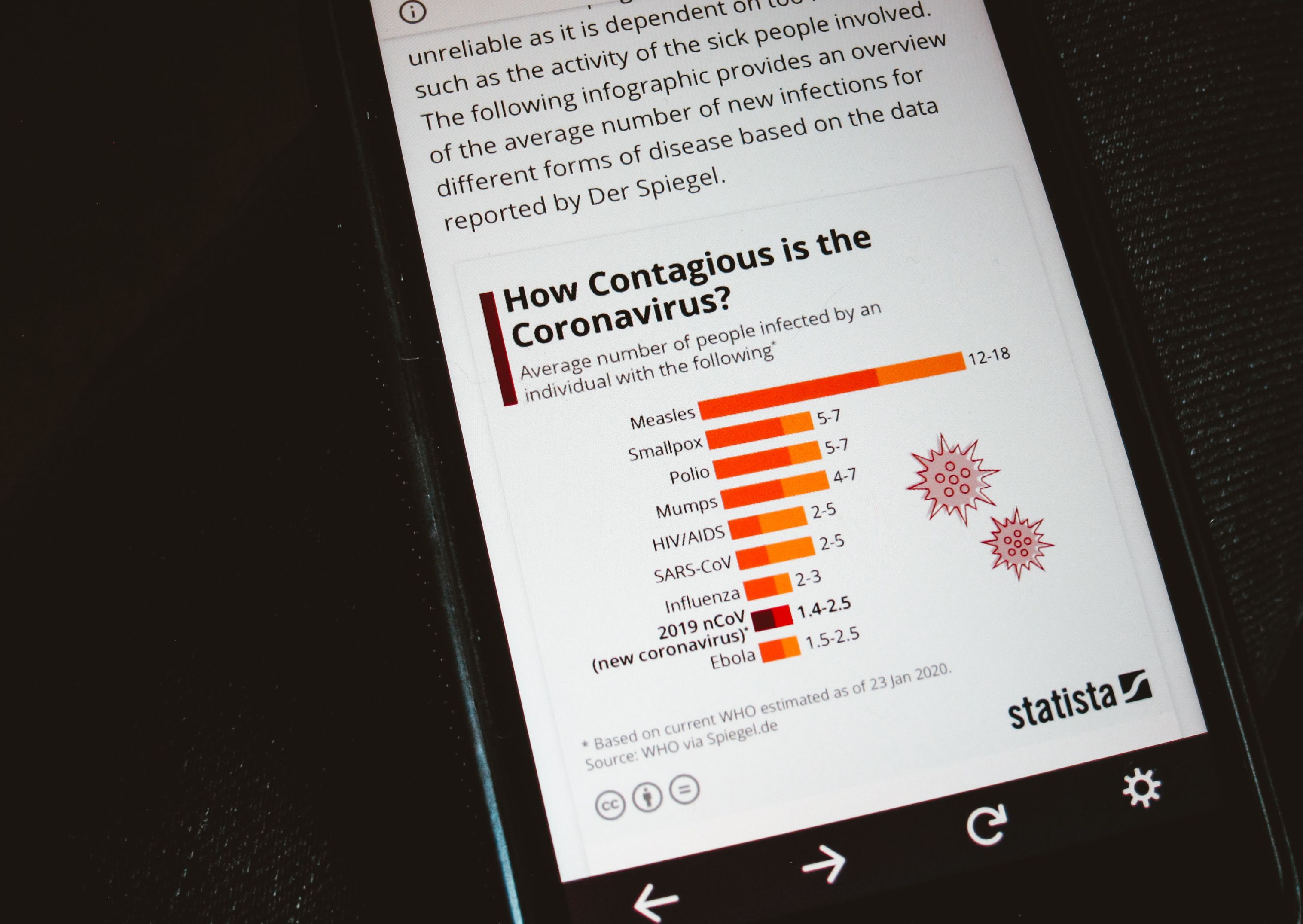

That said, it is also important to note that due to the difference in economical landscape, policies and ‘virus-contagiousness’ then and now, we should not predict that the same trends will apply for the current Coronavirus situation.

Conclusion (And a Word of Encouragement)

To conclude, it’s easy to think a pandemic like SARS would have adversely affected the property market. But the numbers don’t lie, and while transaction numbers and prices were stagnant, it really wasn’t as bad as people assumed.

While we cannot speak for how far-reaching or how much more serious the Coronavirus can be (as of 24 Feb 20′), if it does follow in the same footsteps of SARS, we can more or less predict the same thing to happen in the Singapore property market today.

If, however, the virus is as contagious (and deadly to certain demographics) as we fear it is, and it isn’t curbed in its infancy, then that could mean more serious implications in the short-mid term for both global and local economies.

That being said, let’s also not forget that with all the cooling measures implemented in 2013, the property market is quite strictly controlled – making it unlikely for a sharp fall in property prices if the economy suffers more than expected from this outbreak.

And if things do get truly bleak, it will undoubtedly serve as a tool for the government to re-stabilise property prices.

Now SARS was really the first pandemic to hit Singapore and we’ve learned a lot since then.

With measures like the Disease Outbreak Response System (DORS) and the swiftness with which the multi-ministry taskforce (amongst a number of other teams) has been set up, I have faith that the systems and procedures we have in place will help combat and control our current/potential situation – thus preventing the property market from spiraling out of control (barring extreme viral-fatality escalations).

If, in the unlikely event that those steps were to fail however, it is important that we should already have individual (worse-case scenario) plans in place to safeguard our personal interests (both investments and welfare-wise).

At the end of the day, the battle is as much a mental one as it is a physical one.

Regardless of the situation that will transpire, we should all take heart in knowing that all bad things must and do eventually come to an end.

So with that, let us remain firm and unwavering in this time of uncertainty as we brave the coming headwind for both ourselves and our loved ones.

Wishing you the very best of health in these coming months.

Sincerely Yours,

Reuben D.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How has the COVID-19 pandemic affected Singapore's property market so far?

Will the COVID-19 pandemic cause a major drop in property prices in Singapore?

How did SARS impact Singapore's property market, and can we expect a similar effect from COVID-19?

Could the COVID-19 pandemic lead to a decrease in foreign investments and expat population in Singapore?

What measures does Singapore have in place to prevent a property market crash during the pandemic?

Reuben Dhanaraj

Reuben is a digital nomad gone rogue. An avid traveler, photographer and public speaker, he now resides in Singapore where he has since found a new passion in generating creative and enriching content for Stacked. Outside of work, you’ll find him either relaxing in nature or retreated to his cozy man-cave in quiet contemplation.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

5 Comments

The Singapore property market is too resilient to be affected by such an outbreak. A crash really only happens when it wasn’t predicted, and too sudden like the US housing market crash.

Now people are so cautious, waiting for ‘the next recession’ to happen, eagerly waiting on the sidelines with hoards of cash to invest, saying perhaps the virus will cause this crash, or the Trump trade wars would.

Nonsense!

When it happens, you wouldn’t have known the reason till the fact!

The situation has changed so much since this was written. We can expect march data and maybe april to be worse than months prior. I pray for everyone to remain healthy and hope crisis comes to an end soon

This not not like SARS, the spread is fast and deadly and it affects the middle and older folks who have the cash to invest. Surely it will affect the property market as Covid-19 unless SARS does not closed companies down and restrict foreign buyers. Foreign buyers and expats have diminish and common sense will speak for itself. Property Developers and Marketing Agencies are trying to talk up the market demand. Don’t be fooled by them. Got the money, wait. You will be rewarded by the end of the year, when the economy is in full recession.