What Would It Take To See Cooling Measures Lifted In Singapore

October 30, 2023

It’s nice to see somebody is easing off their cooling measures

But sadly it’s not us. This is happening in Hong Kong right now, where the added taxes on properties for foreigners has been halved to 7.5 per cent.

Interestingly, people there call these taxes “spicy measures”, whereas down here we call them cooling measures. Score one for us I think, because if you’re going to freak out your property market, you at least want a synonym for chill, rather than something that implies pain.

Hong Kong is, of course, facing a very different situation from us. China is trying to restore confidence in its property market, and Hong Kong is still recovering from the double whammy of political demonstrations and Covid-19. So in some ways, their bringing back investors is a predictable move.

This has caused some concern over here in Singapore though. For a long time, Singapore, Hong Kong, and Australia have been prime spots for foreign real estate investment. Singapore took the lead in recent years, thanks to Hong Kong’s setback; and Chinese property investors are culturally closer to Hong Kong and Singapore. But let’s consider where we stand now:

At 60 per cent ABSD for foreigners, Singapore now has the most punishing stamp duty rates for non-residents. We’re also likely to see mounting compliance issues, in banks and real estate firms dealing with foreigners (for that, thank the crooks who tried to launder more money than the GDP of a small country through our real estate market).

In light of this, some realtors (and even mortgage bankers) have begun mumbling that we’re “giving away” business to Hong Kong. And it’s certainly plausible that, with a 60 per cent ABSD, we’ll lose a few foreign investors to other regions, Australia included.

But I don’t think it’s as bad as all that.

For starters, Singapore has mostly avoided spats between nations, like US or Australian relations with China – and most people would feel we’re in a magnificently neutral position (barring the occasional coffee shop uncle who turns racist after the fourth beer). We also have a nebulous culture that can sort of connect with both East and West.

We can be kantang enough to sip wine with Americans and Europeans, and at the same time not choke and die from high-spice mala. I really believe that this is our secret sauce to attracting foreign buyers: not simply hard numbers, but a cosmopolitan culture that connects us where the numbers won’t.

Nevertheless, it will be interesting to see how the relaxation of measures in Hong Kong would help their real estate market – and just how much of a difference can that make. More so because measures in Singapore have only gotten stricter, and hardly ever been relaxed (I only remember the SSD getting better).

I wonder what would happen if our ABSD is ever relaxed.

You know what we do have in common with Hong Kong real estate though?

Car park issues. For some time now, you’ve probably heard that car parks in Hong Kong can end up costing more than houses. There’s only that much room for cars (same as in Singapore), and I assume it’s not fun buying a home if the parking spot is going to be 20 minutes away on foot.

In Singapore, we are starting to see issues regarding property and parking spaces too. Case in point: LTA allowing developers to have fewer car park spaces back in 2019. Condos within CBD areas, or within 400 metres of an MRT station, can shrink their allotment of spaces for cars. For some projects, this means there’s no visitor parking. And as for families with more than one car, well, here’s something that makes older resale condos attractive again.

More from Stacked

En bloc Singapore: Here is how much you would have made if you picked the right property to en bloc every time from 1995 to 2017. Hint: It’s HUGE

"En Bloc Singapore" is a hot topic in Singapore right now. The recent en bloc news of the Sun Rosier…

(If you look at projects from the ‘90s or beyond, I’m sure you’ll find many with two lots per unit. Space was abundant back then.)

Perhaps if Singapore really wants to enforce a car-lite society, the answer is in real estate. It would work just as effectively as the COE. I think the government should take a bold step, and provide incentives/support for more developers to build condos or HDB blocks with fewer parking spaces. These can come at a much lower price, as there’s less expense in building underground car parks, multi-storey car parks, etc.

So this may follow in the footsteps of places like Hong Kong and Shanghai, where each unit doesn’t come with a car park space, and you have to purchase your car park lot separately.

But would people buy? I am going to assert the answer is yes. If you could get a unit with an extra room, freehold status, or is in a more central area just by giving up a car, would you? I’m confident an increasing number of Singaporeans might make that trade, given how unaffordable cars have become anyway.

Meanwhile, in other property news…

- Flipping your property in three to four years: is this really a tactic worth trying? Check it out here.

- Think buying at a property market low is the secret? Well you should know that…uh, actually, you’re right and that is a good way to make money. But sometimes it can still fail, just so you know.

- Million-dollar flats are springing up like mushrooms after rain, but you can still find affordable 4-room flats in central areas.

- Some home buyers grumpily shared their property investment regrets. Check it out here, to avoid making the same mistakes.

Weekly Sales Roundup (16 October – 22 October)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ONE PEARL BANK | $7,100,000 | 2788 | $2,547 | 99 yrs (2019) |

| THE RESERVE RESIDENCES | $4,237,839 | 1625 | $2,607 | 99 yrs (2021) |

| PINETREE HILL | $3,704,580 | 1464 | $2,531 | 99 yrs (2022) |

| GRAND DUNMAN | $3,510,000 | 1432 | $2,452 | 99 yrs (2022) |

| ONE BERNAM | $3,380,000 | 1421 | $2,379 | 99 yrs (2019) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE LAKEGARDEN RESIDENCES | $1,259,400 | 592 | $2,127 | 99 yrs (2023) |

| GRAND DUNMAN | $1,364,000 | 581 | $2,347 | 99 yrs (2022) |

| MYRA | $1,395,200 | 872 | $1,600 | FH |

| THE MYST | $1,473,000 | 678 | $2,172 | 99 yrs (2023) |

| LENTOR HILLS RESIDENCES | $1,613,000 | 689 | $2,341 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| BISHOPSGATE RESIDENCES | $22,000,000 | 6082 | $3,617 | FH |

| MARINA BAY RESIDENCES | $6,900,000 | 2368 | $2,914 | 99 yrs (2005) |

| THE SOVEREIGN | $5,800,000 | 2637 | $2,199 | FH |

| ST THOMAS SUITES | $4,930,000 | 2013 | $2,449 | FH |

| JADESCAPE | $4,550,000 | 2099 | $2,168 | 99 yrs (2018) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PARC ROSEWOOD | $640,000 | 431 | $1,486 | 99 yrs (2011) |

| THE INTERWEAVE | $690,000 | 431 | $1,603 | FH |

| NOTTINGHILL SUITES | $710,000 | 398 | $1,783 | FH |

| THE PANORAMA | $855,000 | 452 | $1,891 | 99 yrs (2013) |

| SKY GREEN | $875,000 | 474 | $1,847 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MEYA LODGE | $1,840,000 | 1195 | $1,540 | $1,228,000 | 18 Years |

| JADESCAPE | $4,550,000 | 2099 | $2,168 | $1,122,000 | 3 Years |

| CITYLIGHTS | $1,680,000 | 893 | $1,880 | $1,096,800 | 19 Years |

| CASTLE GREEN | $2,068,888 | 1410 | $1,467 | $1,093,888 | 13 Years |

| SOUTHAVEN II | $2,280,000 | 1485 | $1,535 | $1,080,000 | 28 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MARINA BAY RESIDENCES | $6,900,000 | 2368 | $2,914 | -$2,390,000 | 1 Year |

| REFLECTIONS AT KEPPEL BAY | $2,650,000 | 1518 | $1,746 | -$150,000 | 4 Years |

| PARK INFINIA AT WEE NAM | $3,350,000 | 1464 | $2,288 | -$60,000 | 4 Months |

| MARINE BLUE | $1,580,000 | 689 | $2,294 | $17,000 | 5 Years |

| KINGSFORD . HILLVIEW PEAK | $1,210,000 | 915 | $1,322 | $30,000 | 7 Years |

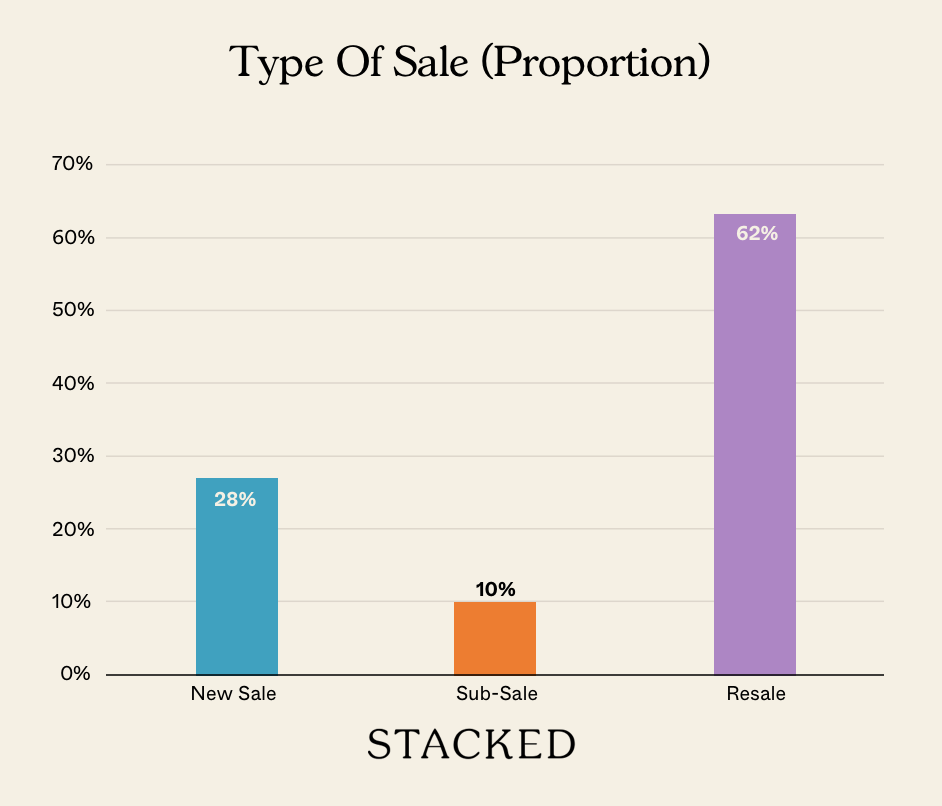

Transaction Breakdown

For more on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are cooling measures in Singapore's property market?

How does Hong Kong's recent property tax change compare to Singapore's cooling measures?

Could relaxing Singapore's property measures attract more foreign investors?

What is the impact of limited parking spaces on Singapore's property market?

Is there a possibility that Singapore will relax its cooling measures in the future?

How might Singapore encourage a car-lite society through real estate development?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Property Market Commentary Singapore’s Tallest HDB Yet: A 60-Storey Project Is Coming To Pearl’s Hill

0 Comments