Can We Expect Cash Over Valuation (COV) To Keep Climbing For HDB Flats?

February 4, 2021

Late last year, property agents already alerted us to the issue of rising Cash Over Valuation (COV) in resale flat transactions. As of last week, news reports seem to affirm that COV is, indeed, creeping its way back into the market. This is enough to put a scowl on most buyers’ faces; the monster of higher cash outlays is back, and we don’t know if it’s going to stick around.

Here’s what you need to know, if a resale flat is part of your housing plan this year:

What is Cash Over Valuation, and why does it matter?

For full details, see our previous article. As a quick summary, COV refers to any amount above the valuation of the resale flat. For example, if the resale flat is valued at $500,000, but the price is $525,000, then the COV is $25,000.

COV can seriously impact resale flat buyers, because it is never covered by an HDB or bank loan. If you need to pay COV, it has to be in cash. This can result in properties requiring a higher cash outlay than initially expected.

How much COV can we expect to pay?

There is, unfortunately, no source of data other than hearsay or word-on-the-ground. This is because, as far back as 2014, HDB decided to stop publishing COV rates; this was done expressly to discourage COV.

If anyone out there knows the real COV numbers, it’s probably a government body; and there’s no chance they’ll reveal it.

However, our conversations with agents suggest amounts of between $15,000 to $20,000 for 3-room and 4-room flats. For non-standard flats such as jumbo HDB flats, maisonettes, and DBSS flats, we were told the amount can be much higher; somewhere between $40,000 and $50,000.

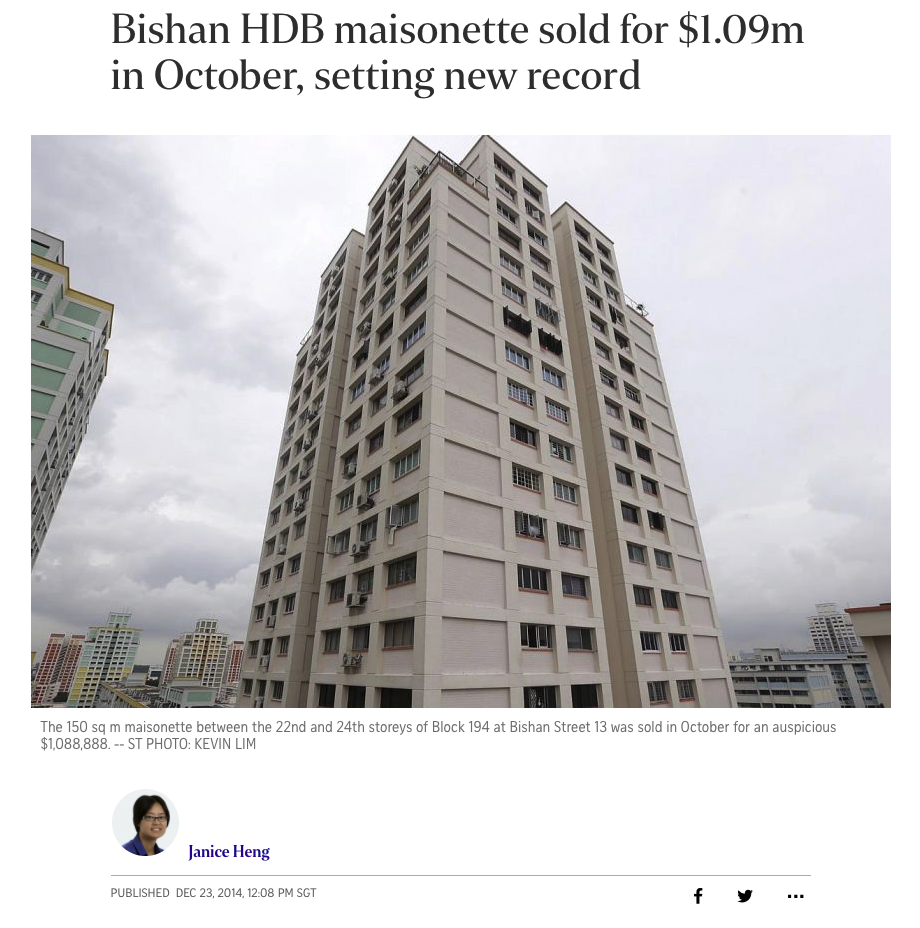

For notable HDB properties, such as Pinnacle @ Duxton, COV rates of even above $100,000 are not unheard of; but we should point out that even long ago in 2012, we were already seeing COV rates of as high as $195,000 for such “special” properties (we believe the record holder is still a maisonette that sold in 2014, with a COV of around $250,000).

For a time, COV was subdued – after the end of published COV prices in 2014, zero COV was becoming a norm (see our linked article above).

So why would COV be creeping back into the scene now?

There are a number of possible reasons, of which the following are most likely:

- A greater number of newer (five-years old) resale flats

- The drive to upgrade results in higher asking prices too

- Grants and schemes that support prices for older resale flats

- The buyers tend to be in more urgent need than the sellers

1. A greater number of newer (five-years old) resale flats

For more details on this, see our previous article. Among the bumper crop of flats reaching Minimum Occupation Period (MOP), there are many new units that are just in their fifth year.

A five-year old resale flat has strong appeal: the lease decay is negligible, unlike a 20+ year-old counterpart; and unlike a BTO flat, there’s no three to four-year wait time for their construction. Coupled with this, a five-year old flat probably has recent renovations, which will be seen as adding value (in the eyes of the seller, at least).

Sellers of these “young” resale flats are quite aware of their advantages; and if they’re not, the sellers’ agents will soon inform them. The appeal of these newer units, with their higher asking prices, may contribute to rising COV.

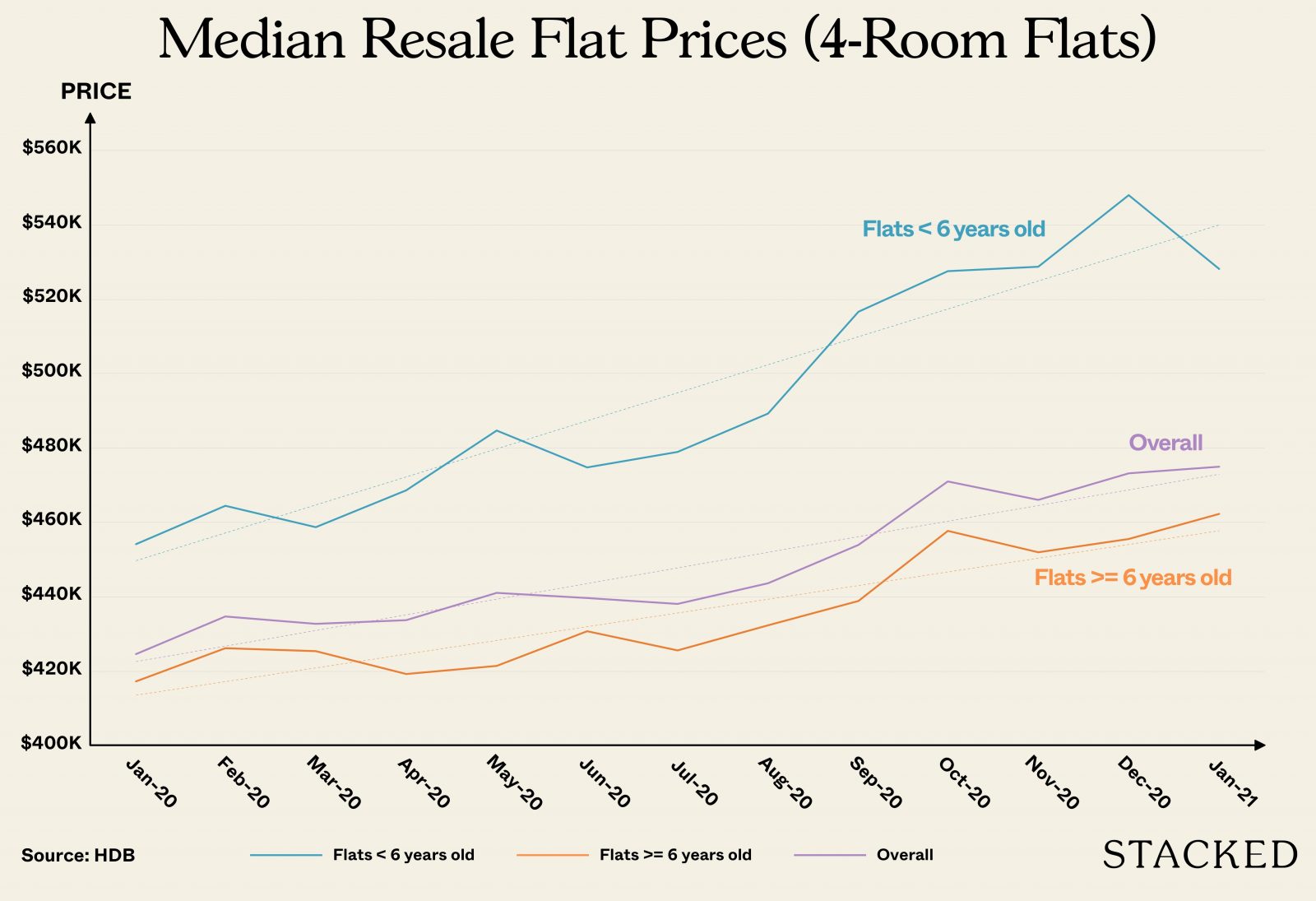

As an aside, we decided to look at the median resale flat prices to see if there is any difference when HDB flats that are less than 6 years old are taken out of the equation.

So while newly MOP-ed flats (< 6 years old) did see a jump in price (namely due to the larger volume from new Punggol and Queenstown HDBs), the overall volume compared to the entire resale market is still considered small – hence the “overall” price trend mimics that of flats >= 6 years old than those that are < 6 years old.

Property TrendsShould You Buy A Newly MOP-ed Resale HDB Or BTO If You Plan To Upgrade In 5 Years? (We Analyse 14 Years Of Transactions)

by Reuben Dhanaraj2. The drive to upgrade results in higher asking prices too

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The No-Nonsense Guide To The “Sell One, Buy Two” Property Investment Strategy

You’re no doubt seen this by now: SELL ONE, BUY TWO, the advertisement yells - HOW TO OWN TWO PRIVATE…

We would think that, with resale flat supply increasing, the COV has little chance to rise. However, some agents have pointed out that it may be less contradictory than it seems.

More flats reaching MOP also means a greater percentage of upgraders. Now ever since 2018, loan curbs have increased the minimum down payment required to purchase a condo unit. The minimum down payment is now 25 per cent (five per cent from cash, and 20 per cent from CPF).

In addition to the loan curbs, sellers of resale flats have to refund their used CPF monies, inclusive of the accrued 2.5 per cent interest. This raises the possibility that, after the sale of their flat, the seller will not have enough to cover the minimum cash down on their new condo.

As such, the sellers aim for a higher asking price to cover the difference, and this may result in COV. Given the bigger pool of upgraders, we would then chalk up more transactions with COV.

3. Grants and schemes that support prices for older resale flats

In May of 2019, the government introduced several policy changes that are supportive of older resale flat prices.

These include more liberal use of CPF monies to purchase resale flats (provided the lease lasts until the youngest buyer turns 95), and full financing (up to 90 per cent of the flat price or value, whichever is lower), so long as the minimum remaining lease is met.

Note that many high-value flats, such as jumbo flats are maisonettes, are older units; it’s not uncommon for some to be 40-years or older. The policy changes, coupled with the high asking prices that already come with these rare properties, may be helping to maintain their high COV rates.

In addition, some agents expressed the opinion that the measures passed in 2019 were always expected to push up resale flat prices; and that it’s simply taken close to a year for the full effect to sink in. They point out that resale flat prices have now changed course after almost seven years of consecutive decline, which reflects the impact of policy measures.

This is in tandem with the surge of newer resale flats (see point 1), resulting in a general uptick across the property segment.

4. The buyers tend to be in more urgent need than the sellers

Few of Singapore’s flat owners are in any urgent need to sell. Even at the height of the pandemic in 2020, government schemes such as mortgage relief ensured there were few fire sales.

Buyers, however, tend to be in more urgent need. With Covid-19 raging, fewer buyers want to take on the risk of construction or renovation delays. There’s also greater difficulty in viewing properties and picking homes, and even show flats are tightly regulated.

Agents have expressed that more often, it’s buyers who are banging on the doors of sellers, not the other way around. The recent slew of oversubscribed flats, such as in Toa Payoh and Bishan in the last BTO exercise, are simply contributing to this; disappointed buyers are giving up on balloting to get desired mature estate locations, and simply picking resale.

How likely is the situation to continue?

The general consensus we received is that – barring any new cooling measures – cash over valuation for resale flats are likely to rise by the end of the year.

This was, again, attributed to the strong desire to upgrade – the dominant mentality among many Singaporeans is that, when we sell our flats, we should make enough to buy private, or seriously pad our retirement fund. And Covid-19 or not, most Singaporeans are seemingly doing well enough that they’re not desperate to sell.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is Cash Over Valuation (COV) in HDB resale flats?

How much COV do buyers typically pay for resale flats now?

Why is COV increasing again in the resale flat market?

Are government policies influencing resale flat prices and COV rates?

Will COV continue to rise in the near future?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

0 Comments