CapitaLand Developer Review: A Detailed Look And Analysis

May 13, 2020

Sections

1) Preface

2) Developer Profile

3) History

4) Capitaland Vs Singapore

5) List of Capitaland Projects

6) Top 10 Past Projects

7) Key Upcoming Projects

An Introduction to Developer Reviews

Over the past few years, we’ve been working hard to get you the most detailed and unbiased condo reviews as possible – simply because we feel that every new/existing buyer in Singapore should have a grasp on what they are dealing with before they enter the market.

In actual fact, however, that’s just the tip of the iceberg.

Very often, we’re stuck comparing the price trends of a property as well as its convenience factor (amongst other things) that we sometimes fail to look at the actual figure behind the actual project…

The developers!

And as we’ve seen on many an occasion, the developer can actually make or break both the popularity and short-long term quality of a project.

Now the aim of this series as a whole is to help buyers like ourselves learn more about the organisations and people behind the construction of our projects.

Just because we don’t usually observe them in action doesn’t mean that we should pay them any less attention to their various success rates and dependability as a whole.

From land acquisition to layouts, pricings to incentives, these guys are in charge, every single step of the way, and I think that highlights some manner of importance in the least.

To kick-off the series, we’re going to have a look at a real estate powerhouse today – and that is none other than CapitaLand.

Join us as we delve into the developer’s mighty beginnings, appreciation statistics of its past projects, and any upcoming developments we can look out for – as well as a couple of fun titbits along the way to keep this review both enriching and entertaining.

Let’s get to it!

Developer Profile (Dated 11 May 2020)

Founded: 2000

CEO Rating: Lee Chee Koon – Appointed 2018 (92% GlassDoor rating)

Current P/E ratio: 6.71

Number of Employees: ~10509

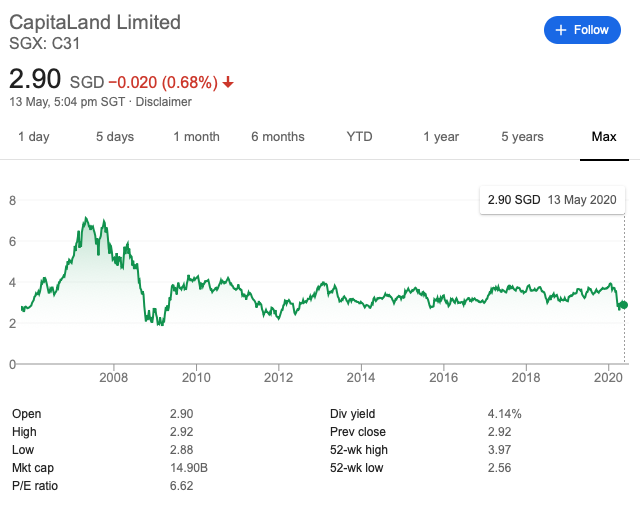

CapitaLand Share Price:

Key En Bloc Clinches:

| Acquisition | To Be Developed Into |

| Liang Court (2019) | Integrated development |

| Pearl bank Apartments (2018) | One Pearl Bank |

Not many of you might know this, but CapitaLand was actually formed when two top companies (DBS Land and Pidemco Land) decided to join forces nearly 30 years ago.

I won’t go into the numbers, but let’s just say that their single merger made their brainchild (CapitaLand) the largest listed property company in the whole of SouthEast Asia.

So yes, this isn’t your typical rags-to-riches story.

But what astounds me, is its growth.

5 years after it’s initiation, CapitaLand’s assets rose to a blinding $28 billion globally (up from $18 billion), recording annual earnings of up to $750 million.

10 years later, that figure rose to $50 billion, and today, it’s already way past that prized $100 billion mark.

Now I’m not about to drop a ridiculous pun about how these guys capitalized on their opportunities (ok I just did), but really it was the quality and diversity of their projects that have set them as a driving force in today’s market.

As many of you might be familiar, CapitaLand has more than just condominiums to its name.

Renowned art pieces, Mega malls (Ion Orchard/The Jewel come to mind), and a dive into the hospitality sector has given them the edge of stability and promising long-term growth.

For today’s piece however we’re looking solely at some of CapitaLand’s past and current residential development projects (that is, after all, the main reason for this series) – as well as their appreciation stats, and how these projects have fared against the rest of Singapore through the years.

Let’s dive in.

(Note: For more information/the full list of CapitaLand’s Projects – both residential & commercial; as well as sale prices/indepth appreciation trends of individual units, feel free to reach out to us at stories@stackedhomes.com!)

CapitaLand Vs Singapore (Value of Projects)

What you see here is the increase of CapitaLand’s property values (in PSF) against the rest of Singapore over the years.

Unsurprisingly, the first few years didn’t bode extremely well for CapitaLand in the appreciation department when compared to the market average.

This owes to its relative infancy in the initial years – both in the internal (newly merged) organisation and the public’s eye.

As the years go by however, they have proven themselves with fine projects and we begin to see periods (2003, 2010, 2016 and most recently, 2019) where the appreciation of CapitaLand’s projects greatly outshines the rest of the Singapore property market.

Apart from the ‘household brand’-related confidence that people have in their projects, it is also likely that CapitaLand Projects in these past years have been based more in central regions (ie. CCR & RCR) and offer more quality finishes and layouts that help fuel its average project price points.

The esteemed developer is also known for constructing two of Singapore’s ‘largest’ condos in the Interlace and D’Leedon as well as some key integrated developments like both Bedok and Orchard Residences.

Finally, the graph shows us how CapitaLand’s project valuation trends have been able to weather both major downturns/stagnation, performing above market value during the financial crisis of 07/08 and the weakened property market sentiment between 13’ and 17’, post-cooling measures.

In total, CapitaLand has outshone the market average for project values, no less than 15 years out of the 26 years shown here.

| Project | Address | District | Top | Tenure |

| Leonie Gardens | 23 Leonie Hill | 9 | 1993 | 99-year |

| Ashley Green | Bukit Sedap Road | 10 | 1995 | 999-year |

| Chestervale | 31 Bangkit Road | 23 | 1997 | 99-year |

| Northvale | 61 Choa Chu Kang Loop | 23 | 1998 | 99-year |

| Pebble Bay | 130 Tanjong Rhu Road | 15 | 1998 | 99-year |

| Eastvale | 31 Pasir Ris Drive 3 | 18 | 1998 | 99-year |

| Burgundy Hill | Burgundy Crescent | 23 | 1999 | 99-year |

| Hillbrooks | 88 Hillview Avenue | 23 | 1999 | Freehold |

| Westmere | 71 Jurong East Street 13 | 22 | 1999 | 99-year |

| Casafina | 211 Bedok South Ave 1 | 16 | 2000 | 99-year |

| The Floravale | 218 Westwood Avenue | 22 | 2000 | 99-year |

| The Woodsvale | 1 Woodlands Drive 72 | 25 | 2000 | 99-year |

| Windermere | 20 Choa Chu Kang Street 64 | 23 | 2000 | 99-year |

| Pinevale | 2 Tampines Street 73 | 18 | 2000 | 99-year |

| The Rivervale | 1 Rivervale Link | 19 | 2001 | 99-year |

| Central Grove | 1 Geylang East Avenue 1 | 14 | 2001 | 99-year |

| Palm Grove Condo | 19 Palm Grove Avenue | 19 | 2002 | 999-year |

| The Loft | 22 Nassim Hill | 10 | 2002 | 99-year |

| Palm Haven | 18 Palm Grove Avenue | 19 | 2003 | 999-year |

| Sunglade | 1 Serangoon Avenue 2 | 19 | 2003 | 99-year |

| Sunhaven | 781 Upper Changi Road East | 16 | 2003 | Freehold |

| Belmond Green | 15 Balmoral Road | 10 | 2004 | Freehold |

| The Levelz | 38 Farrer Road | 10 | 2004 | Freehold |

| Tanamera Crest | 6 Pari Dedap Walk | 16 | 2004 | 99-year |

| Glentrees | 11 Mount Sinai Lane | 10 | 2005 | 999-Year |

| Tanglin Residences | 23 – 43 St Martin’S Drive | 10 | 2005 | Freehold |

| Shelford Condominium | 11G Shelford Road | 11 | 2005 | Freehold |

| The Shelford | 1 Shelford Road | 11 | 2005 | Freehold |

| The Waterina | 71 Lorong 40 Geylang | 14 | 2005 | Freehold |

| The Imperial | 3 Jalan Rumbia | 9 | 2006 | Freehold |

| The Botanic On Lloyd | 23 Lloyd Road | 9 | 2006 | Freehold |

| Casabella | 174 Duchess Avenue | 10 | 2006 | Freehold |

| Citylights | 80 Jellicoe Road | 8 | 2007 | 99-year |

| Visioncrest Residence | 33 Oxley Rise | 9 | 2007 | Freehold |

| Riveredge | 21 Sampan Place | 15 | 2008 | 99-year |

| Varsity Park Condominium | 34 West Coast Road | 5 | 2008 | 99-year |

| The Beacon | 130 Cantonment Road | 2 | 2008 | 99-year |

| Rivergate | 99 Robertson Quay | 9 | 2009 | Freehold |

| The Metropolitan Condominium | 8 Alexandra View | 3 | 2009 | 99-year |

| Scotts Highpark | 45 Scotts Road | 9 | 2009 | Freehold |

| Botannia | 27A West Coast Park | 5 | 2009 | 956-year |

| The Orchard Residences | 238 Orchard Boulevard | 9 | 2010 | 99-year |

| The Seafront On Meyer | 55 Meyer Road | 15 | 2011 | Freehold |

| Latitude | 31 Jalan Mutiara | 10 | 2011 | Freehold |

| Urban Resort Condominium | 32 Cairnhill Road | 9 | 2012 | Freehold |

| The Interlace | 180 Depot Road | 4 | 2013 | 99-year |

| The Wharf Residence | 7 Tong Watt Road | 9 | 2013 | 999-year |

| Urban Suites | 1 Hullet Road | 9 | 2013 | Freehold |

| D’Leedon (Former Farrer Court) | 1 Leedon Heights | 10 | 2014 | 99-year |

| Sky Habitat | 7 Bishan Street 15 | 20 | 2015 | 99-year |

| Bedok Residences | 24 Bedok North Drive | 16 | 2015 | 99-year |

| The Nassim | 18 Nassim Hill | 10 | 2015 | Freehold |

| Sky Vue | Bishan Street 14 | 20 | 2017 | 99-year |

| Cairnhill Nine | 9 Cairnhill Road | 9 | 2017 | 99-year |

| Marine Blue | 91 Marine Parade Road | 15 | 2017 | Freehold |

| Victoria Park Villas | Coronation Road | 10 | 2018 | 99-year |

| One Pearl Bank | 1 Pearl Bank | 3 | 2023 | 99-year |

| Sengkang Grand Residences | 84 Compassvale Bow | 19 | 2024 | 99-year |

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

This Man Created A Nice Community Corner In An HDB Void Deck, And It Was Shut Down. Why?

HDB projects becoming the “elevator music” of residential properties.

Let’s now take a more in depth look at the actual appreciation figures of some of CapitaLand’s bigger/more famous projects.

(Note: We were unable to trace any unit transactions for both Orchard Residences and Belmond Green this year, and have therefore substituted last year’s averaged transactions in their respective places.)

Top 10 Past Project List – Most Recent Unit Sale Price/History Included

#10 – Urban Resort (Freehold)

Built in 2012, the Urban Resort Condo is situated along Cairnhill Road in District 9. Its residential make-up totals a mere 64 units.

Unit sales in its launch year averaged $2,904 psf, and has since dipped by 22.4% ($532 psf) to $2,372 psf, based on the averaged prices of units sold this year.

#9 – Sky Habitat (99-Year Leasehold)

Built in 2015 by renowned architect Moshe Safdie, Sky Habitat is situated along Bishan Street 15 in District 20. It boasts a total of 509 units and a peak of 38-storeys high.

Unit sales in its launch year averaged $1,604 psf, and has since dipped by 11.4% ($183 psf) to $1421 psf, based on the averaged prices of units sold this year.

#8 – Orchard Residences (99-Year Leasehold)

Built in 2010, Orchard Residences is situated along Orchard Boulevard in District 9. You will find 175 units here, boasting a magnificent 54-storeyed peak.

Unit sales in its launch year averaged $3,316 psf, and has since dipped 4.5% ($148 psf) to $3,168 psf, based on the averaged prices of units sold *last year.

#7 – D’Leedon (99-Year Leasehold)

Built in 2014, D’Leedon is a massive condo situated along Leedon Heights in District 10. You will find 1715 units here, with blocks rising up to 36-storeys high.

Unit sales in its launch year averaged $1,547 psf, and has since risen 4% ($61 psf) to $1,608 psf, based on the averaged prices of units sold this year.

#6 – Bedok Residences (99-Year Leasehold)

Built in 2015, Bedok Residences is situated along Bedok North Drive in District 16. You will find 583 units here.

Unit sales in its launch year averaged $1,346 psf, and has since risen 9% ($122 psf) to $1,468 psf, based on the averaged prices of units sold this year.

#5 – Interlace (99-Year Leasehold)

Built in 2013, the Interlace is another massive condo situated along Depot Road in District 4. You will find 1040 units here, with blocks rising up to 24-storeys high.

Unit sales in its launch year averaged $1,031 psf, and has since risen 24.1% ($249 psf) to $1,280 psf, based on the averaged prices of units sold this year.

#4 – The Wharf Residences (999-Year Leasehold)

Built in 2013, The Wharf Residences is situated along Tong Watt Road in District 9. You will find 186 exclusive units here.

Unit sales in its launch year averaged $1,515 psf, and has since risen 38% ($576 psf) to $2,091 psf, based on the averaged prices of units sold this year.

#3 – Belmond Green (Freehold)

Built in 2004, Belmond Green is situated along Balmoral Road in District 10. You will find 211 units here, with a conservative 12-storey peak.

Unit sales in its launch year averaged $981 psf, and has since risen 94.5% ($928 psf) to $1,909 psf, based on the averaged prices of units sold *last year.

#2 – Rivergate (Freehold)

Built in 2009, the Rivergate condo is situated along Robertson Quay in District 9. It boasts a total of 545 units and a peak of 43-storeys high.

Unit sales in its launch year averaged $1,102 psf, and has since risen by a whopping 101% ($1,120 psf) to $2,222 psf, based on the averaged prices of units sold this year.

#1 – Varsity Park Condominium (Freehold)

Built in 2008, Varsity Park Condominium is a 99-year leasehold condo situated along West Coast Road in District 5. You will find 530 units here.

Unit sales in its launch year averaged $466 psf, and has since risen 99% ($463 psf) to $929 psf, based on the averaged prices of units sold this year.

Upcoming Projects (Updated 11 May 2020)

As for upcoming projects, these are the developments that have been given the greenlight, but are yet to achieve TOP status/completion.

Sengkang Grand Residence (In depth review here!)

Details

| Launched: | 2019 |

| Expected TOP: | 2023 |

| Address/District: | Sengkang Central (D19) |

| Tenure: | 99-Year Leasehold |

| Total Units: | 680 |

| Land Area: | 401,012 square feet |

| Average PSF (Based on 1st year transactions): | $1,746psf |

| Distance to MRT: | Immediate (Buangkok MRT) |

Unit mix

| Unit Type | No. Of Units | Size of Units (sqft) |

| 1-Bedroom + Study | 131 | 474 – 506 sqft |

| 2-Bedroom | 95 | 624 – 678 sqft |

| 2-Bedroom + Study | 10 | 624 sqft |

| 2-Bedroom Premium + Study | 136 | 732 – 764 sqft |

| 3-Bedroom | 148 | 936 – 947 sqft |

| 3-Bedroom Premium | 56 | 1023 – 1055 sqft |

| 3-Bedroom Premium + Flexi | 55 | 1012 sqft |

| 4-Bedroom Premium + Flexi | 49 | 1313 – 1324 sqft |

One Pearl Bank

Details

| Launched: | 2019 |

| Expected TOP: | 2023 |

| Address/District: | 1 Pearl Bank (D3) |

| Total Units: | 774 |

| Land Area: | 82,374 square feet |

| Average PSF (Based on 1st year transactions): | $2,385psf |

| Distance to MRT: | ~ 600m, 7-min walk (Chinatown/Outram Park MRT) |

Unit mix

| Unit Type | No. Of Units | Size of Units (sqft) |

| Studio | 140 | 431 sqft |

| 1-Bedroom/1-Bedroom + Study | 175 | 538 – 570 sqft |

| 2-Bedroom | 280 | 689 – 893 sqft |

| 3-Bedroom | 140 | 1,141 – 1,281 sqft |

| 4-Bedroom | 35 | 1,432 sqft |

| Penthouse | 4 | 2,691 – 2,777 sqft |

(For more information on the various unit-types/availabilities of CapitaLand’s projects, feel free to drop us an email at stories@stackedhomes.com – PS: no hard sales, just genuine advice to suit your needs/wants!)

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is CapitaLand and when was it founded?

How has CapitaLand's property value growth compared to Singapore's market?

What are some of CapitaLand's notable past residential projects?

What upcoming projects does CapitaLand have in Singapore?

How have some of CapitaLand’s past projects appreciated in value?

Reuben Dhanaraj

Reuben is a digital nomad gone rogue. An avid traveler, photographer and public speaker, he now resides in Singapore where he has since found a new passion in generating creative and enriching content for Stacked. Outside of work, you’ll find him either relaxing in nature or retreated to his cozy man-cave in quiet contemplation.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

2 Comments

best developer in singapore