Buying Your First Property After 40 In Singapore: Hidden Risks To Look Out For

December 12, 2024

Not everyone has the ability to buy their first home at 35 or younger. Circumstances force some to start late, perhaps from their 40s or even after. Whatever the reasons, these buyers may face some additional hazards. It’s not just about making sure the lease lasts until you’re 95; you also need to consider financing issues, as well as the shorter holding period. Here are some of the issues that might pose a problem:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Underestimating the risk of lease decay

A common mistake among older buyers is to handwave lease decay. It’s easy to understand why: in theory, being older means you need fewer years on the remaining lease. On top of that, advanced lease decay tends to significantly lower the price of a property: a tempting proposition, if you’re already faced with higher down payments and monthly loan repayments (see below).

Another source of temptation: there are fewer restrictions on CPF usage when buying an older home, when you yourself are older.

To use your CPF when buying a home, the remaining lease only has to last until the youngest buyer is 95 years old (otherwise, the amount of CPF you can use is pro-rated, based on the extent of the remaining lease.)

So if you’re 45 years old, you can go ahead and buy a property with just 50 years left on the lease*. This is a partial reason why older buyers are less averse to “vintage” properties.

*But note there must be a minimum of 20 years remaining on the lease to use your CPF, regardless of your age.

The problem is when the unexpected happens, and you need to sell and move again.

Medical emergencies require you to move closer to your children, a change in finances requires you to move back into HDB from your condo, etc. It’s not an uncommon situation. And when this happens, a property with advanced lease decay is certainly more difficult to sell, especially if you have time constraints.

For properties with advanced lease decay, such as just 40 to 50 years remaining, a bank may lower financing to just 55 per cent of the value. For properties with 30 years or less remaining, a bank loan may be impossible. The end result: you may find yourself stuck with a property that you can’t offload; not without significant losses.

So in this sense, lease decay still matters. It’s not about being greedy for gains, or worrying about what your children will inherit; it’s a safety buffer just in case you need to sell and move again. Life events can be unpredictable, and growing older doesn’t always change that.

2. The Loan To Value (LTV) ratio and loan tenure might require a bigger cash outlay

If your age plus the loan tenure exceeds 65 years, the LTV ratio will fall to 55 per cent, instead of the usual 75 per cent. So if you’re 45 years old but want a 25 year loan tenure, the down payment on a $1.6 million property would be $720,000.

(The minimum cash down is 10 per cent if the LTV is 55 per cent. See the MAS guidelines here for full details).

Because of this, most older buyers will take a shorter loan tenure. However, this in turn impacts the monthly loan repayment.

For example, to get the full 75 per cent LTV on a $1.6 million property, the loan amount would be $1.2 million. Let’s assume an interest rate of three per cent per annum.

With a full 25-year loan tenure, you would pay about $5,691 per month. But if you’re 45 when you buy, you need to drop the loan tenure to just 20 years. This raises monthly repayments to around $6,655 per month.

(Although you will end up paying less interest overall, as the one silver lining).

For these reasons, you may need to save more or have higher income sources, if you start your home ownership journey later.

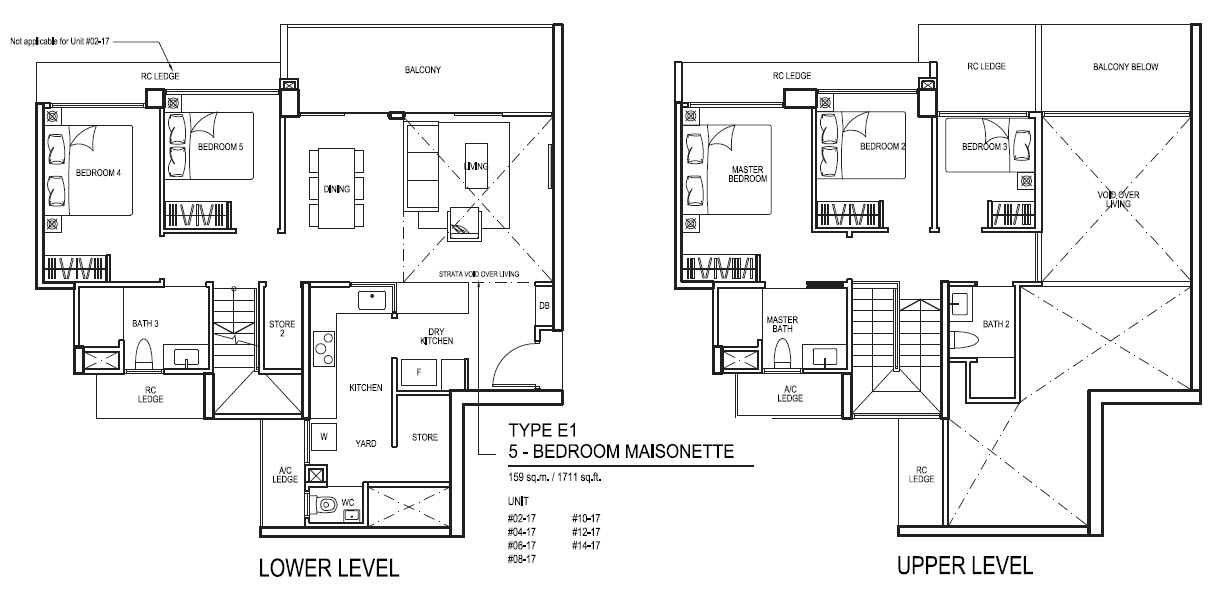

3. There are more practical constraints on layouts and property types

If you buy when younger, you can handle most layouts and property types. You’re still fit enough to hike up the stairs of a walk-up apartment or maisonette; and you’re fit enough to handle difficult-to-clean features, such as a high ceiling or a very large, condo-terrace style balcony. Chances are, you’ll have lots of time to save up and move to something more practical, over the next two or three decades.

If you’re buying when you’re in your 40s, 50s, or older, you need to consider that physical demands will creep up on you much sooner. You may possess the home for as short as a single decade, before it’s too risky to handle the stairs, the high ceilings, and so forth.

(As an aside, many older home buyers regret overlooking the need for a bigger bathroom. A big master bathroom makes all the difference if you develop mobility issues later; such as when the time comes that you need a walker or other such device. Tiny bathrooms can pose a hazard under those circumstances).

There are variables at play here, such as how well your health keeps up, and whether you have the means to hire help. But for the most part, older home buyers do tend to end up with more practical restrictions.

4. Described distances to amenities may not be applicable to older buyers

When a property is said to be “within walking distance” of a mall, MRT station, supermarket, etc., the assumption is usually toward a young person. But as an older buyer, you may find that the alleged “short walk” to an MRT station involves an exhausting uphill trek.

Also, while we don’t want to be presumptuous, it’s worth at least considering this: If the walk is merely tiring when you’re in your 40s or 50s, it may become intolerable in the decade to come.

For this reason, we suggest increasing your standards of what’s considered “walking distance” or “nearby.” Be more picky about whether the walk is sheltered, whether it’s uphill or involves crossing pedestrian bridges, and how many wide, busy roads you’ll need to rush across. You may also want to consider five minutes to be walking distance, instead of 10 minutes (remember you’re walking there and back, so 10 minutes really means 20 minutes to and from the market, MRT station, etc.)

5. Unexpected en-bloc sales can be problematic when you’re older

This is yet another reason to be wary of older properties, even if they’re freehold. For a 35 to 45-year old homebuyer, an en-bloc sale shortly after they buy could be a windfall. For a 50 to 60 year-old homebuyer, it can be a major headache.

The sale proceeds for an en-bloc, even if profitable, don’t come right away. This may necessitate the use of loans in the interim, when getting your replacement property; and it’s much harder to get said loans when you’re older.

There’s also the physical demands of having to move. An ill-timed en-bloc could mean moving twice, once to an interim rental unit, and then once more to the replacement unit. Manageable for a younger homeowner perhaps, but a serious strain on their older counterparts.

This marks yet another possible restriction on buying when you’re older: you may want to avoid buying properties that are close to an en-bloc (e.g., a near- successful recent attempt, within the past two years).

It’s not all doom and gloom though

There can be an upside to buying your first home a bit later; especially if it’s because you’re just being prudent, and spending more time saving up. You may also be buying at a stage where you no longer need to worry about the children’s primary school being nearby, still changing jobs and potentially ending up quite far away, etc. The only difference is being a little more picky about some of the details, and planning ahead.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice Should I Pay $500K More For A New Launch — Or Buy A Resale Condo Instead?

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Latest Posts

Singapore Property News A Rare Freehold CBD Office Unit Is Up For Sale At $20.5M — And Foreigners Can Buy It

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

0 Comments