Buying A Home In 2022? Here’s An 8 Step Preparation List

January 2, 2022

In light of new cooling measures, and an ever-changing property market, we’ve put together a new preparation list. Whether you’ve already shortlisted properties, or are just beginning to look, the following will help create a smooth transaction. Above all, look out for timing issues, option dates, and pre-approved loans, to minimise the risk of costly mistakes:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Start paying down your existing loans

It’s ideal to start paying down your debts 12 months before making home loan applications. Even if you’re a bit late, however, it makes sense to quickly get started (at least you can show the bank proof that you’re discharging prior loans).

The December 2021 cooling measures lowered the Total Debt Servicing Ratio (TDSR) to 55 per cent. This means your home loan repayment, plus all other debts like credit cards and education loans, cannot cost more than 55 per cent of your declared income. Note that this is slightly tighter than the earlier limit of 60 per cent.

The lower your debt load, the more easily you can qualify for most home loans.

2. Find the cheapest bank, and get Approval In Principle

Use a mortgage broker to find the cheapest bank for property loans (it seldom costs you anything, as most mortgage brokers work on commissions from the bank).

At any given time, there are usually just two or three banks that have the lowest rates. These are the banks you want to approach for Approval In Principle (AIP).

The is the amount the bank will loan you if you purchase a property. For HDB properties, the equivalent would be getting your HLE letter. You need pre-approval for two reasons:

First, it ensures you have the financing for the loan, and can safely put down the Option To Purchase (OTP) deposit, or booking fee (these deposits are non-refundable).

Second, it clarifies how much you can borrow if you use the cheapest bank; this helps to determine your maximum budget.

3. Shortlist and view the properties you’re interested in

Once you have the list of properties, your realtor (or the seller’s realtor if you’re not using one) can arrange for viewings. Remember to:

- Ensure you meet eligibility requirements before shortlisting units. If you and your spouse are both Permanent Residents, for example, you’ll need to have resided here for at least three years before you can buy a flat.

- View each property more than once; try to view it at different times of the day

- Take note of the payment schemes available, such as whether it’s Progressive Payment (for new launches).

- Verify figures using the URA transaction records, and not by comparing listing prices on portals.

- Check for defects or issues in resale units, and get written agreement by the seller to fix them, as a condition of sale (unless you’re willing to receive it “as is”, perhaps in return for a discount)

Stacked provides detailed consultations for home buyers, and can guide you through this important preparation step.

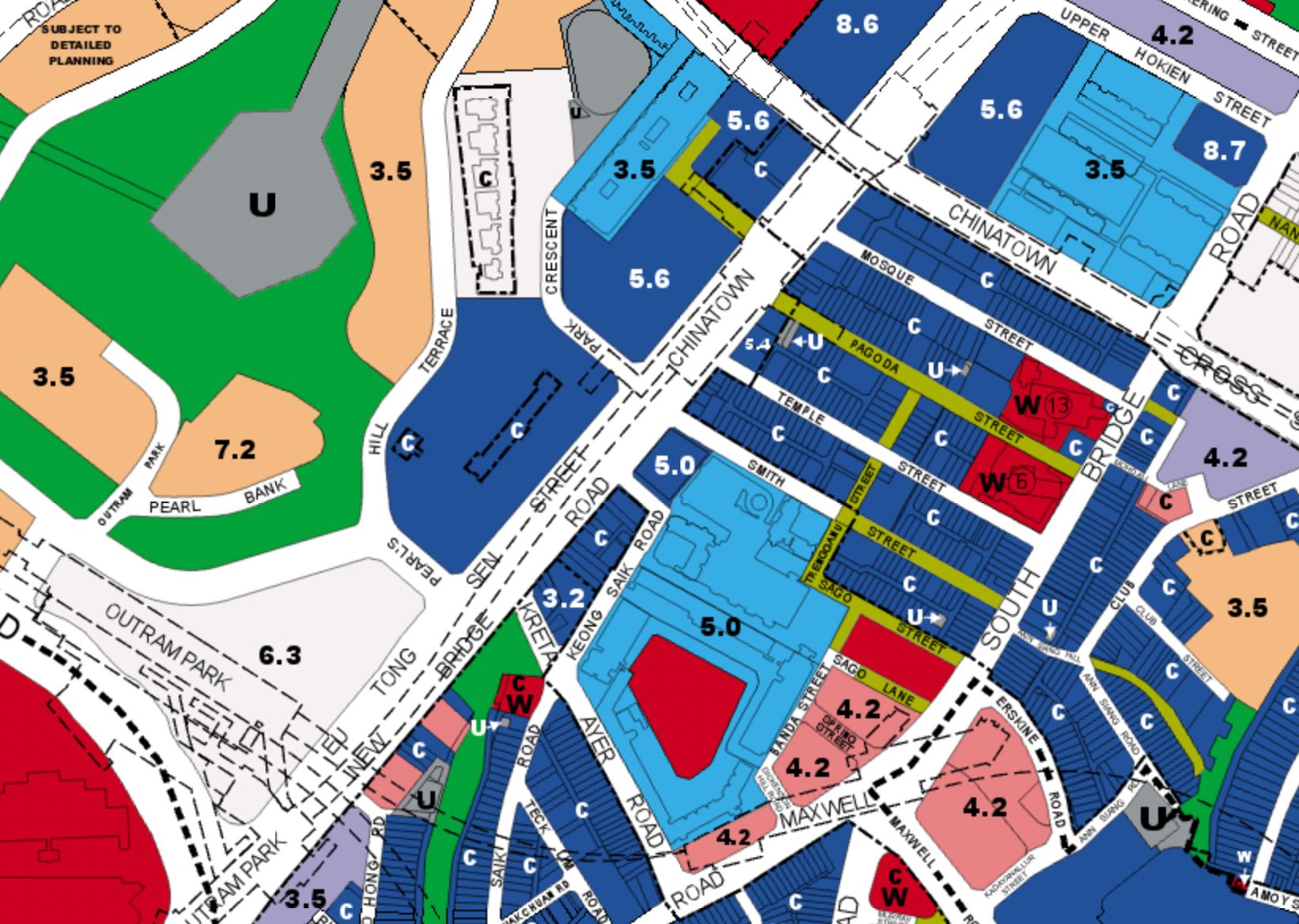

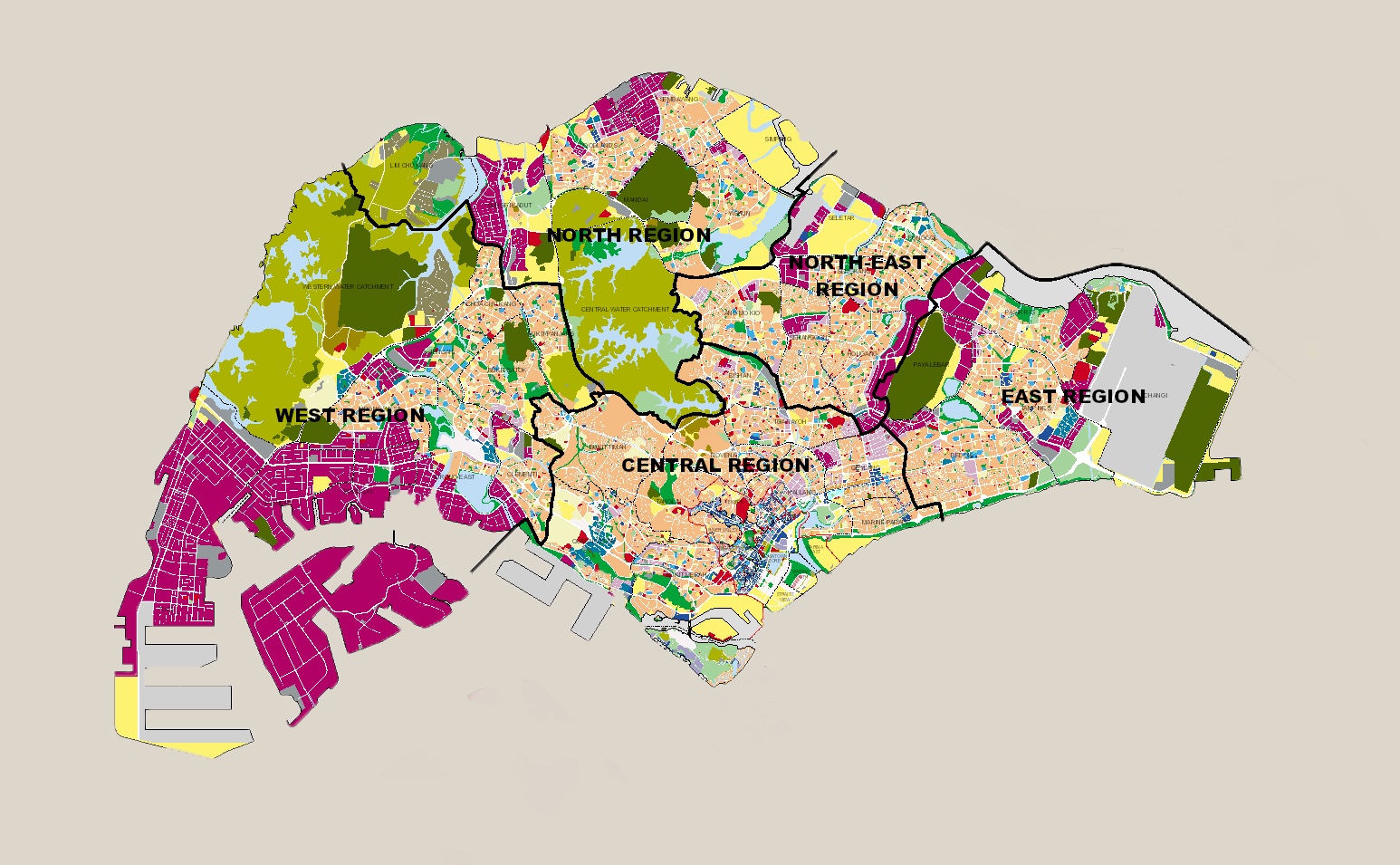

4. Check the URA Master Plan

Here’s a guide on how to use the URA Master Plan. Take note of future developments on nearby plots, which might impede your view, or create competition. You really don’t want to be in a situation where you are caught by surprise by a new development that blocks the view you paid for or have to deal with construction noise or traffic diversions all because you didn’t do your homework.

Owner-investors should also check on overall plans for the neighbourhood. Ideally, you want your home to be near a major future amenity, such as a new mall nearby, or a future MRT station.

The URA Master Plan is also a good tie-breaker when you’re down to just two or three property choices.

5. Ensure you can cover the down payment and stamp duties

The available total must be sufficient to cover the down payment on your property, as well as the Buyers Stamp Duty (BSD) and Additional Buyers Stamp Duty (ABSD) if applicable.

Under the December 2021 cooling measures, you must be able to pay at least 15 per cent of your flat price, before the loan covers the rest. This can be in any combination of cash or CPF.

For example, if your flat costs $500,000, you must have any combination of $75,000 in cash or CPF, for the down payment.

For banks, you must pay the first five per cent of the property in cash. The next 20 per cent can come from any combination of cash or CPF.

So for the same $500,000 flat, you would need $25,000 in cash and $100,000 in any combination of cash or CPF.

Stamp duties like the BSD and ABSD must be paid within two weeks of your property purchase. You can check the rates of stamp duties in the Stacked guide.

For resale properties, bear in mind that the loan percentage applies to the valuation, not the seller’s price. So if the property costs $500,000, but is valued at $470,000, the extra $30,000 will have to be covered in cash.

As a general guideline, it’s recommended you save up sufficient funds to pay for 30 per cent of the property, before initiating the purchase.

6. Discuss the manner of holding, with any co-borrowers

You can own the property under a joint tenancy (all co-borrowers count as a single legal entity), or under tenancy-in-common (each co-borrower owns a designated percentage of the property).

We have a more detailed explanation of this in an earlier article.

At the same time, there should be a common agreement on how the property will be used; such as whether there will be tenants, how to decide when to sell, and so forth.

You should talk to a conveyancing lawyer regarding the implications, before making your choice.

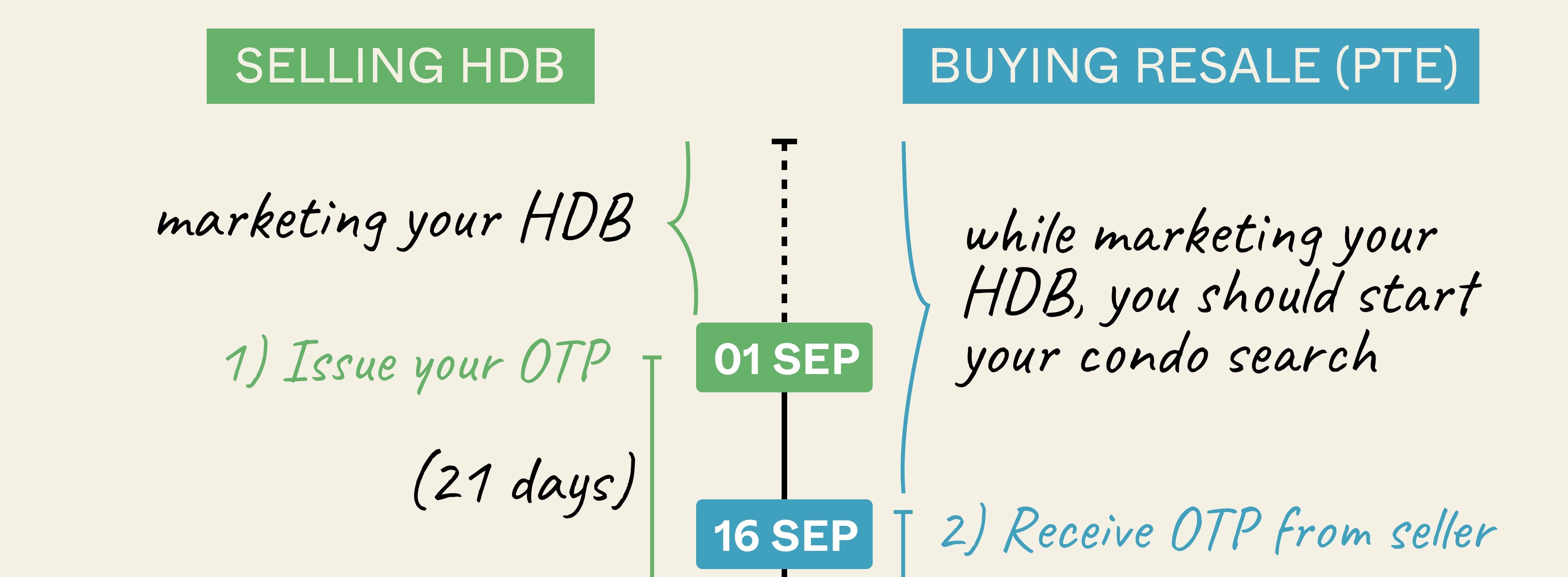

7. Plan the timeline of your move

If you are upgrading, it’s advisable to approach a realtor for help. The issue of whether to sell your flat before buying the condo (or vice versa) is a complex one.

For example, you will have to pay ABSD if you buy a condo before selling your flat; and you’ll only have six months to sell your flat and claim ABSD remission.

This has gotten even more delicate with the December 2021 cooling measures; even Singapore Citizens will now pay 17 per cent ABSD on the second property.

Also bear in mind that, in some instances, you could end up servicing two separate home loans at once; this can happen if you buy before discharging the property loan on your previous flat.

At the same time, do settle temporary accommodation and storage. An upgrader may have to move twice (e.g., once to a rental property, and then once more later when their new condo is built).

Ideally, you really want to be able to move homes without having to fork out money to rent (it also doesn’t help that a minimum lease is three months). So from getting the sale proceeds of your flat, to being able to move in on the right date – it’s crucial to plan properly to get it correct.

8. Plan for renovation costs and delays

When agreeing on the final price for your home, remember you still have renovation costs after that. This typically ranges between $30,000 to 50,000 for most three-bedder units, and that’s if you’re conservative.

Besides the price, the labour and manpower shortage is slowing down contractors. This might mean renovation delays, which can lead to a need for temporary accommodation.

Also note that most renovation loans are capped at six months of your income, or $30,000, whichever is lower. Interest rates can be between three to four per cent per annum.

You may have to save up more than just the down payment if you also want renovations without using a loan.

Finally, if you’re still uncertain after all this – or have issues meeting one of the criteria – do reach out to us on Stacked. We can put you in touch with experts, to help you find solutions.

In the meantime, you can check out in-depth reviews of new and resale condos alike on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

1 Comments

Thank you for the very useful article! Just a small comment, the line “the extra $300,000 will have to be covered in cash” I believe the number should be $30,000 instead. Keep up the good work guys!