First Time Home Buyer Story: Buying A Condo After The 2007 Financial Crisis And Lessons Learned

March 27, 2021

It’s certainly been some time since our last buyer story, but nonetheless we have quite an interesting feature this week.

This time, we look at the first-home purchase of Andy (not his real name). What’s unusual about this case is the timing of the purchase – Andy bought his condo in 2008, while the wider economy was reeling from the last Global Financial Crisis (GFC). Here’s how he made his unusual home-buying decision:

The best of times, the worst of times

“2008 was tough for a lot of people, but strangely it was kind to me”, Andy says, “Everything about the timing just worked out – I had sold off some important assets the year before, and luckily I had hesitated to reinvest in anything.

I and my girlfriend at the time were thinking of having a place to ourselves, so I held on to the money first.

I was still holding on to the cash when the crisis struck. Had I sunk it into something else, I would not have been in a position to buy. So I took it as a sign of providence.”

Andy decided that fate had it in for him to become a homeowner that year, so he started to look for an appropriate home.

He started by drawing up some “must-have” requirements, such as:

- The location must be somewhere in the east, from Paya Lebar onward. His parents lived in Bedok and he wanted to be nearby, especially since they weren’t in good health.

- It had to be an already-completed unit. The aim was to move in right away.

- The unit had to have at least three rooms, or be large enough that he could rent out a room if necessary. This meant he still had to care about rentability, even though he was mainly an owner-occupier.

- Andy had a large-breed dog, so an HDB flat was unsuitable. The property would also have to be reasonably pet-friendly.

- The price limit was $900,000.

“The reason I’m so adamant about being able to rent out, even though I probably won’t, is that I’ve been self-employed from day one. I intend to be for life. After some dry spells, I know the importance of having an alternative income source if I need it,” Andy says.

Andy initially wanted to buy in the Paya Lebar area, as he felt it was the “best of both worlds”. It was reasonably close to the city centre, but still in the east.

His first choice was actually Paya Lebar Residences, which was in walking distance to Paya Lebar MRT. However, he was unable to find a listing that he liked.

“Although the location was ideal, I didn’t like how enclosed it was. The blocks were packed in very close, and there was a religious building just outside, so I was worried about the noise and traffic.”

He also considered Sims Residences (an apartment and not a condo). However, he couldn’t find a willing seller. “I wasn’t willing to go very high on the price,” Andy says, “I was half-hearted as there was a lack of facilities besides a small pool.”

For a brief moment, Andy even considered buying over his aunt’s flat in Bedok Reservoir, and leaving his dog at his girlfriend’s parents’ place. However, the logistics would have been a nightmare.

“Her family stayed at Pasir Panjang, so we gave up on that idea pretty fast,” he says.

In a lucky stroke, Andy ran into a former business associate who was selling her condo unit.

“She had a unit at Changi Court, and when she mentioned the location something clicked in my mind. It was in the east and near my dad’s workplace at the airport.

But on my first visit I was unimpressed; Changi Court was frankly inaccessible, and it was already past 10 years old. But there were a few things that won me over.”

The biggest factor was price. The seller was willing to accept around $921,000 for a 1,389 sq. ft. unit. This was slightly above Andy’s budget, but it was still palatable to him.

The second factor was the interior.

“There was no need for renovation, as the unit had been renovated three years prior. And the interior design was professionally done, I saw very little that I wanted to change. I would only have to furnish it.”

The third consideration was the condo’s freehold status:

“In those days there were en-blocs left, right, and centre. There were no cooling measures yet, and the prevailing wisdom was that you always bought freehold, even if it cost more. Because you’ll get more during the inevitable en-bloc.”

(Today however, en-bloc attempts have a lower chance of success.)

Property Market CommentaryWhat You Need To Know About En-bloc Sales In 2021

by Ryan J. OngFinally, Andy’s father worked at Changi Airport, which is a four-minute drive from Changi Court. This meant his father could stay over on certain nights, and Andy could drop his father off at work without too much delay.

In addition, Andy’s father had colleagues at the airport who were foreigners; he could recommend tenants, if it became necessary.

About Changi Court

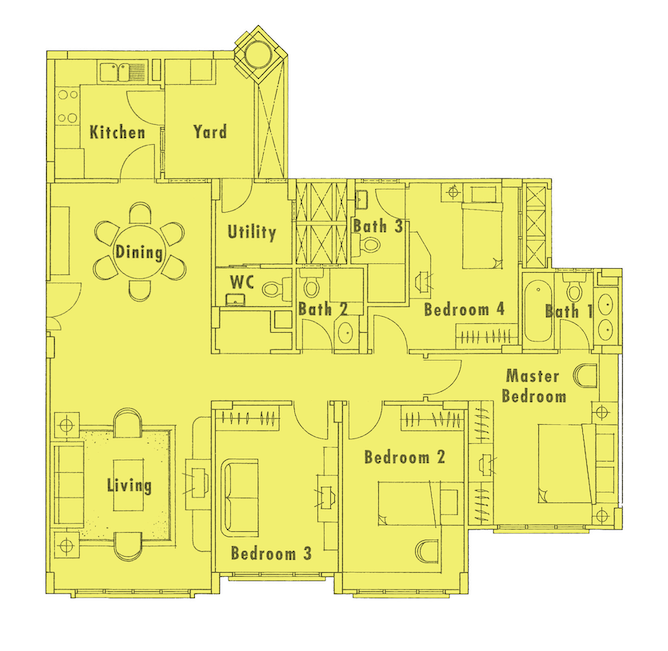

Location: Upper Changi Road East (District 16)

Developer: Allgreen Properties Pte. Ltd.

Lease: Freehold

Completion: 1997

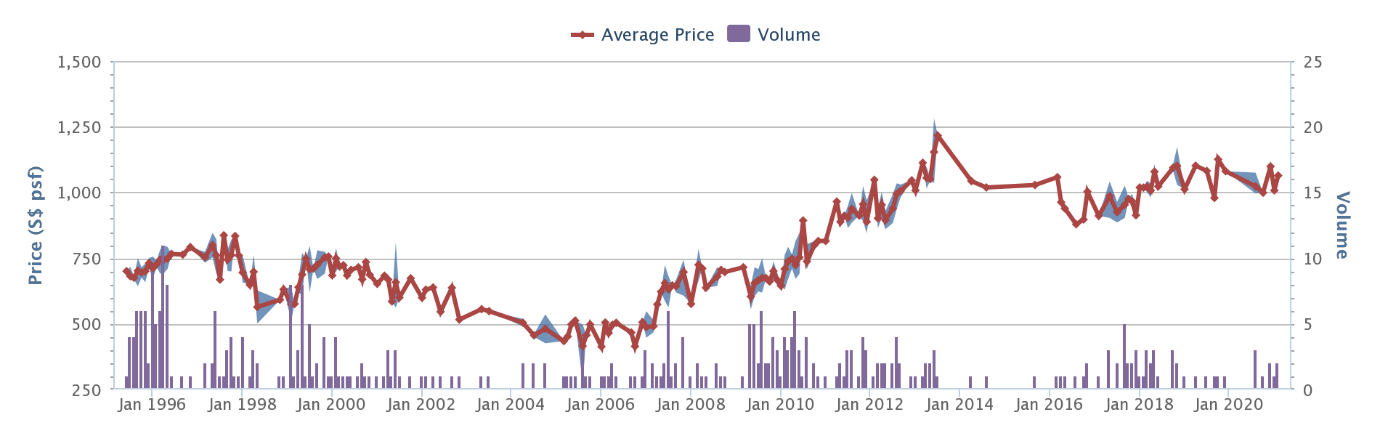

The indicative price range is between $999 to $1,120 psf, with an average price of $1,056 psf.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

We Evaluate The Truths Behind 4 Common Property Sayings

The Singapore property market is awash with sayings and platitudes. Some old favourites include “If you want to see a…

Financing the property

At the time of Andy’s purchase, there were fewer loan curbs. He could have gotten up to 80 per cent financing, for instance, and there was no mandated Total Debt Servicing Ratio (TDSR).

However, Andy willingly made a larger down payment, using both his cash and CPF OA funds.

The total payments made were as follows:

(These are the closest approximations to the actual figures)

| Purchase price | $921,000* |

| Down payment | $276,000 total: $150,000 (cash) + $126,000 (CPF) |

| Total home loan | $630,000 at 1.5% per annum at the time (30-year loan tenure) |

| Monthly repayment | Approx. $2,175 per month |

| Buyers Stamp Duty (BSD) | $22,230** |

| Misc Cost, legal fees, insurance etc* | $4,500 |

*As an aside, this covered around an additional $15,000 Andy had to pay in cash, as the actual valuation was $906,000. This was lower than the purchase price of $921,000.

**The BSD rate at the time of Andy’s purchase was one per cent of the first $180,000, two per cent of the next $180,000, and three per cent of the remaining amount.

With no real renovations needed, Andy had to spend only on furnishing.

“It ended up costing more than I thought it would. I spent about $25,000 to $30,000 on furnishing.”

However, Andy had few regrets, as under other circumstances he would have had to spend that much on renovations anyway.

He mentioned he did get fined a few hundred dollars, on the first day of moving in:

“Because this was my first time living in a ground-floor unit, I forgot my dog could bolt out the door in an instant. There’s no lift to block him.

And being in a new place, he was very excited; he darted out the door when I was coming in with my hands full.

He ran all the way to the swimming pool and jumped in. The kids loved it, the adults complained, and I got fined. Day one, and already a black mark.”

After Andy and his girlfriend drifted apart, he ended up renting out the condo

For a number of years now, Andy has lived with his parents while renting out the full unit.

It was in 2013 where he started renting out a room for $700 a month, which amounted to $6,300 gross income for nine months of the rental period.

From 2014 to 2016 he managed to rent it out for $3,400 a month, and in 2016 onwards because of the soft rental market – this has been reduced to $3,000 a month up till today.

Rental Proceeds

| Monthly Rent | Yearly Gross | Agent Fee | Maintenance | Net Income | |

| 2013 | $700 | $6,300 | $700 | $5,200 | $400 |

| 2014 | $3,400 | $40,800 | $3,400 | $5,200 | $32,200 |

| 2015 | $3,400 | $40,800 | $3,400 | $5,200 | $32,200 |

| 2016 | $3,400 | $40,800 | $3,400 | $5,200 | $32,200 |

| 2017 | $3,000 | $36,000 | – | $5,200 | $30,800 |

| 2018 | $3,000 | $36,000 | – | $5,200 | $30,800 |

| 2019 | $3,000 | $36,000 | – | $5,200 | $30,800 |

| 2020 | $3,000 | $36,000 | – | $5,200 | $30,800 |

| Total | $220,200 |

In 2017, Andy had a stroke of luck when Upper Changi MRT station opened. The station is located just a four-minute walk from Changi Court, thus solving the major accessibility problems.

Andy calls it a godsend, even if he waited almost 10 years from the point of purchase. He’s able to find tenants more easily now. In addition, he has two sources of tenants these days:

“The SIA training centre used to be where tenants came from, as it’s about a 10-minute walk from my condo. Some tenants were also airport workers. But increasingly, I have tenants from SUTD, as their school is only about a five-minute walk.”

Overall, Andy feels his property purchase turned out well, although he attributes it more to luck than any special insight. “I didn’t know the MRT would pop up there, I didn’t know SUTD would be there one day. And it’s nice that I got it before property prices went sky high in 2013.”

If Andy does have one regret, it’s not buying in Paya Lebar instead.

“If I knew Paya Lebar Quarter was going to happen, I would have stuck to my guns and gotten a unit there. By now I would have cashed out and made a fortune. But as they say, hindsight is always perfect; and I think what I have is far from a bad deal.”

Ultimately though, with the last similar sized unit at Changi Court selling for $1.4 million early this year, he is sitting on gross paper profits of more than $400k. And even if an en-bloc doesn’t happen in the next few years, he is more than happy to continue renting it out.

Parting advice for a first time home buyer

“Don’t forget the location and property are not the only things that change,” Andy says.

“You will also change. Your lifestyle will change, some plans may fall through, your income may not be the same a few years from now. And when changes come, your property may no longer be serving its original purpose.

So I would suggest you be versatile. Don’t make too many assumptions about how many years you’re going to live there, or that you’re going to always be a pure home owner. Pick a property that, in a pinch, can generate income – that’s why I’ll always go for larger units.”

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Homeowner Stories

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

Homeowner Stories What I Only Learned After My First Year Of Homeownership In Singapore

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

2 Comments

any recommendation for condo around district 15. the size should be around 1500 sqft or below. i want to buy it to stay. In case I upgrade to land property in the future and i plan to rent it out for rental income