“Buy Now Before Property Prices Rise” 5 Facts You Must Know Before Making A FOMO Property Purchase

August 4, 2021

Pasir Ris 8 seems to have kicked the proverbial hornet’s nest, with the developer raising prices on some units from $1,400 psf to around $2,000 psf. Now, we’re seeing a slew of text messages claiming that you’d “better buy now”, because developments X, Y, and Z are all about to follow suit. However, this is a dramatised misrepresentation of what’s happening. Here’s what you need to realise, before you feel rushed into securing the Option:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Fact 1: Pasir Ris 8 is not a good bellwether for rising prices

Contrary to some narratives, Pasir Ris 8 has not inspired rising prices; nor is it an accurate reflection of the new launch market. It’s very much an outlier.

While prices are rising, developers are just following a routine pattern of starting off sales at lower prices, and then raising them if the units are moving well. This has been the norm in the Singapore private property market for decades.

(The only time prices go down in later sales phases is when the units are not selling well).

Price increments across new launches have been nowhere near as dramatic as the almost 42.8 per cent price spikes in Pasir Ris 8. If anything, the headlines have been overly too focused on the $2,000 psf mark, when the average selling psf was actually only around $1,600ish.

For example, the following condos are said to have raised prices:

- Ki Residences: 4%

- Coastline: Around 2-3%

- Florence Residences: Around 1-2%

- Normanton Park: 2% + $5,000 for 2 Bed, $5,000 for the rest

- Penrose: 2%

- Midwood: ~

However, these increases have been gradual and expected. For example:

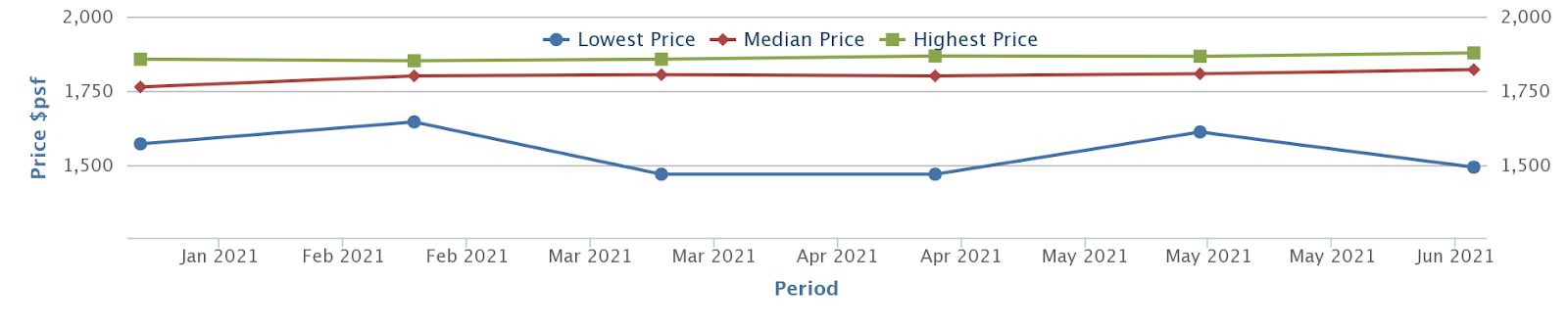

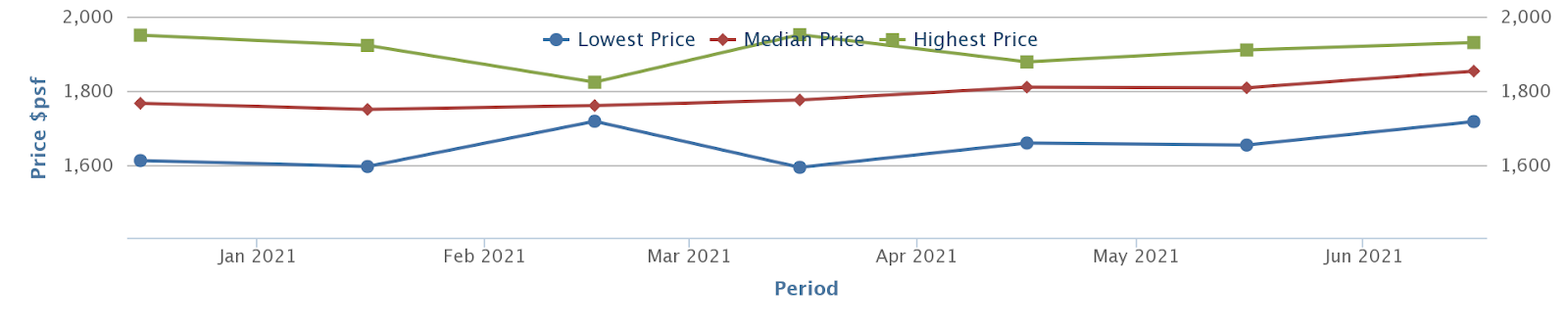

Normanton Park saw median prices of $1,763 psf in January, and this has since risen to $1,821 psf; around a 3.3 per cent increase.

Ki Residences saw a median price of $1,766 psf, and was up to $1,853 psf in June; about a 4.9 per cent increase.

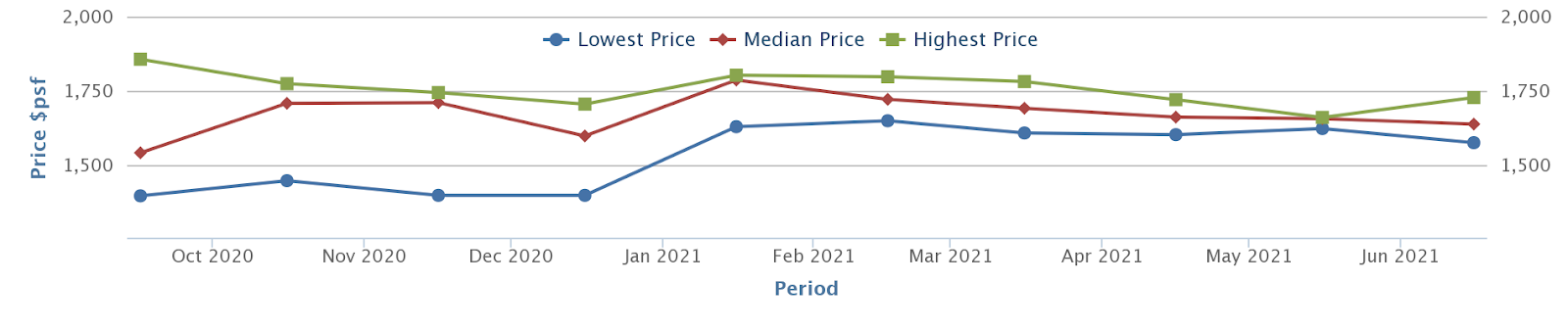

Penrose opened with loss leaders, and a median price of $1,541 psf in October last year. Even so, prices are only up around 6.3 per cent, to $1,638 psf.

As such, we think it’s a bit over the top to claim that developers are now scrambling to raise prices, because Pasir Ris 8 has lit some sort of match under the real estate market.

Buyers are not likely to end up paying 40+ per cent more for a unit in a few months, if they don’t put down the cheque right away.

Fact 2: You are not guaranteed to “hit the jackpot” by buying early right now

It is true that early buyers of Pasir Ris 8 did well for themselves, as the price increases meant paper gains for them. If you buy a unit at $1.16 million today, and the price becomes $1.65 million by 8 pm, that’s definitely a good entry point for you.

But while situations like these do happen from time to time, remember that not all early purchases are surefire successes.

As we’ve described in an earlier article, situations like the ABSD deadline – or sales that suddenly taper off – can result in late-phase discounts.

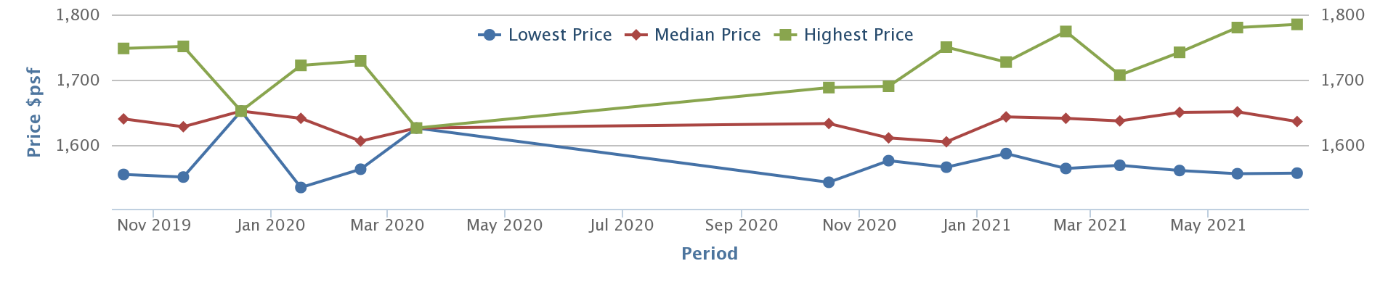

In fact, Midwood, one of the condos currently touted as raising prices, has actually seen prices dip slightly since launch:

Median prices were at $1,640 psf in November 2019, and were at $1,636 psf in June this year. Even if price increments were to happen, we feel the price will be broadly similar to what earlier buyers paid.

Property Market Commentary5 Unpopular, Slow-Selling New Launch Condos In 2021: What’s Going Wrong?

by Ryan J. OngAs such, you should still be focused on fundamentals like location, the URA Master Plan, etc. if looking for gains. Counting on the developer to raise prices later is speculative – it’s nice when it happens, but it’s not something to hinge your investment strategy on.

Fact 3: Over-leveraging is more dangerous than being priced out

Let’s say you decide to wait, and you ultimately get priced out of a new launch. That’s disappointing to be sure. But consider the alternative: what if you rush to buy, and barely scrape through with the loan and down payment?

If you have zero life savings or CPF after the down payment – and the home loan chews up 60 per cent of your monthly income (the allowable maximum) – you’re walking a financial tightrope. All it takes is for one co-borrower to see a drop in income, or a dual-income family to become single-income, to render the home unaffordable.

Remember that, if you’re forced to sell between the first to third year, you will have to pay the Sellers Stamp Duty (SSD). In addition, the property is unlikely to appreciate so fast that you can cover the cost of the Buyers Stamp Duty (BSD), renovations, legal fees, etc. if you sell on short notice. This is without considering the impact on your family as well, such as if you have to relocate somewhere further from your child’s school.

The Singapore private property market rewards long-term investment. If you over-leverage, you could be struggling with the loan for at least five years. The stress and risk are far worse than just being priced out, and having to wait a while longer.

Fact 4: The rationalisations behind FOMO buying are based on extreme extrapolations

While there are many convincing-looking charts of rising property prices, do consider that “it’s more expensive later” is not a good reason to buy anything now.

Due to simple inflation, almost everything you can buy now will be “more expensive” later; from your home, to your car, to your socks. If you’re taking it from an investment perspective, bear in mind that – while property prices “always rise over time” – the same can be said of most other assets too (equities also tend to “rise over time”, as do many commodities).

Also, if you track the narratives to push sales, you’ll note that there’s always an excuse why you should buy now. Before Pasir Ris 8, for instance, the push to buy was for fear of new cooling measures; a situation that’s fast becoming a self-fulfilling prophecy.

Before the risk of new cooling measures, the push to buy was from the flood of HDB upgraders entering the market, and so forth.

To be clear, we’re not saying all these narratives are somehow untrue – just that there’s an incentive to exaggerate these narratives, to disproportional levels.

Fact 5: We haven’t seen the full impact of Covid-19 yet

There is some degree of disconnect between Singaporean home buyers, and the wider economic situation. Thanks to CPF contributions, many of us have substantial savings to buy a home, even in times when the economy contracts (this is why home prices don’t always move in tandem with GDP).

These sizeable CPF savings can contribute to the illusion of affordability, especially if we service the loan with our Ordinary Account (OA). However, homebuyers shouldn’t lose sight of affordability. Covid-19 is still far from over, and we should buy with contingencies (e.g., how long can you service the home loan, if a co-owner loses their income)? As we mentioned above, being over-leveraged is worse than being priced out.

The danger is that sometimes, it may not look as if we’re taking on too big a loan, because we assume our jobs or businesses will be unaffected. The pandemic isn’t even over yet, so that’s a dangerous presumption.

Investors, likewise, need to consider the state of the rental market. With Covid-19 not yet fully played out, we don’t know when foreign tenants will be returning; and even if they will return in previous numbers. This could make some new launch one and two-bedders unattractive from a pure rental perspective; and it’s irrelevant that they could “cost more later”. Of course, this is looking at things with a less than rosy perspective, but sometimes it is good to err on the side of caution.

These concerns should outweigh the risk of having to pay a bit more later. Besides, if Covid-19 does tank the economy, and you held on to your cash, you’d be well placed to seize real estate opportunities.

Prices have been rising over the past year, but don’t let that drive you into panicked buying

Remember that the examples you’re given – in any sales pitch – tend to be the most extreme examples in the market.

Focus price changes in the specific development(s) you’re interested in, and don’t take outliers like Pasir Ris 8 as a reflection of the wider market. Above all, buy based on your personal financial situation, and your needs – not simply because you’re panicked into thinking you’ll be priced out in a few months.

For a detailed consultation, reach out to us at Stacked, and we can provide additional clarity on your buying decision. You can also follow us for detailed condo reviews, and news on Singapore’s private property market trends.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

6 Comments

Raising average prices in new launch is misleading. Typically, it’s the lowest psf or lower levels unit that sells first, and higher psf/higher level units that sells later. Hence average prices will move up.

The world is still very much in turmoil, splashing out on a brand new condo at historical peak prices is just a recipe for disaster (for the gullible buyers, that is).

Given the number of new Condo launches + the number of units being built, it appears there will be an *oversupply* situation in the near future. I have lived in SG for less than 3 years, so I may be wrong. Thoughts?