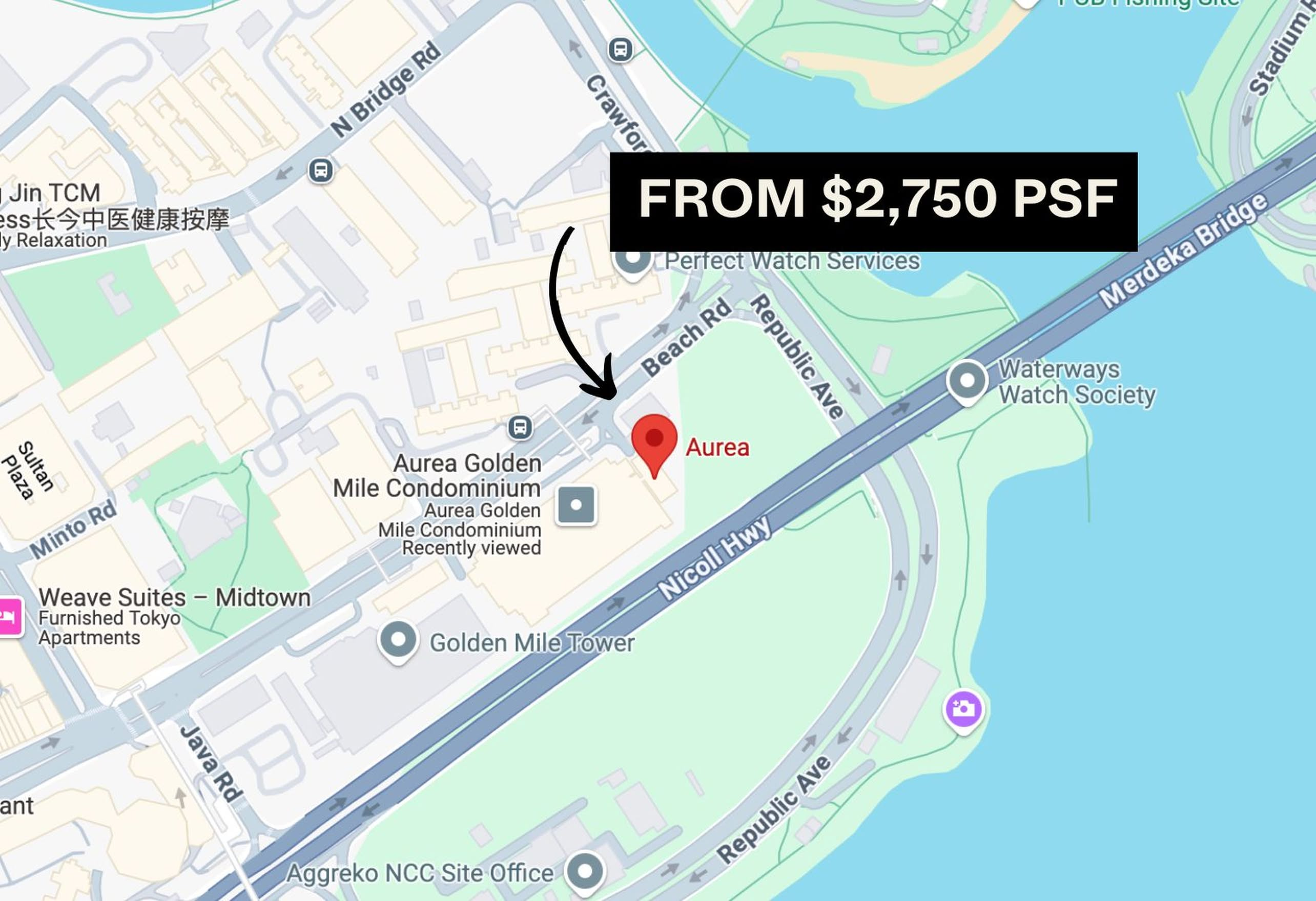

A First Look At Aurea, A Luxury Redevelopment Of Golden Mile Priced From $2,750 Psf

February 18, 2025

For a while now, critics have been all too eager to write off the Core Central Region (CCR)* as yesterday’s news. Yet as we now see in 2025, new upcoming developments suggest that even an “old dog” can bask in a new day’s sun.

Leading this potential revival is Aurea. As part of the redevelopment of the former Golden Mile Complex, this project continues the legacy of one of Singapore’s most iconic brutalist landmarks—standing in the same league as Pearl Bank Apartments and People’s Park Complex, which were all products of Singapore’s early urban transformation.

But beyond its heritage and design, what would probably interest buyers most would be the price point. As the OCR and RCR start reaching new highs in pricing, it seems that CCR prices may now be starting to look comparatively attractive.

And so with prices starting at $2,750 psf and units from $1.92 million, Aurea presents an interesting entry point into the CCR* at a time when the prime region’s market is still finding its footing.

For comparison, The Orie in Toa Payoh starts from $2,395 psf (average of $2,704 PSF), while Emerald of Katong in Tanjong Katong is priced from $2,224 psf (average of $2,637 PSF)—both in the RCR.

This pricing prompts a key question: can a CCR* project deliver a stronger value proposition relative to similar RCR developments—especially as the prime region recovers?

Let’s take a closer look.

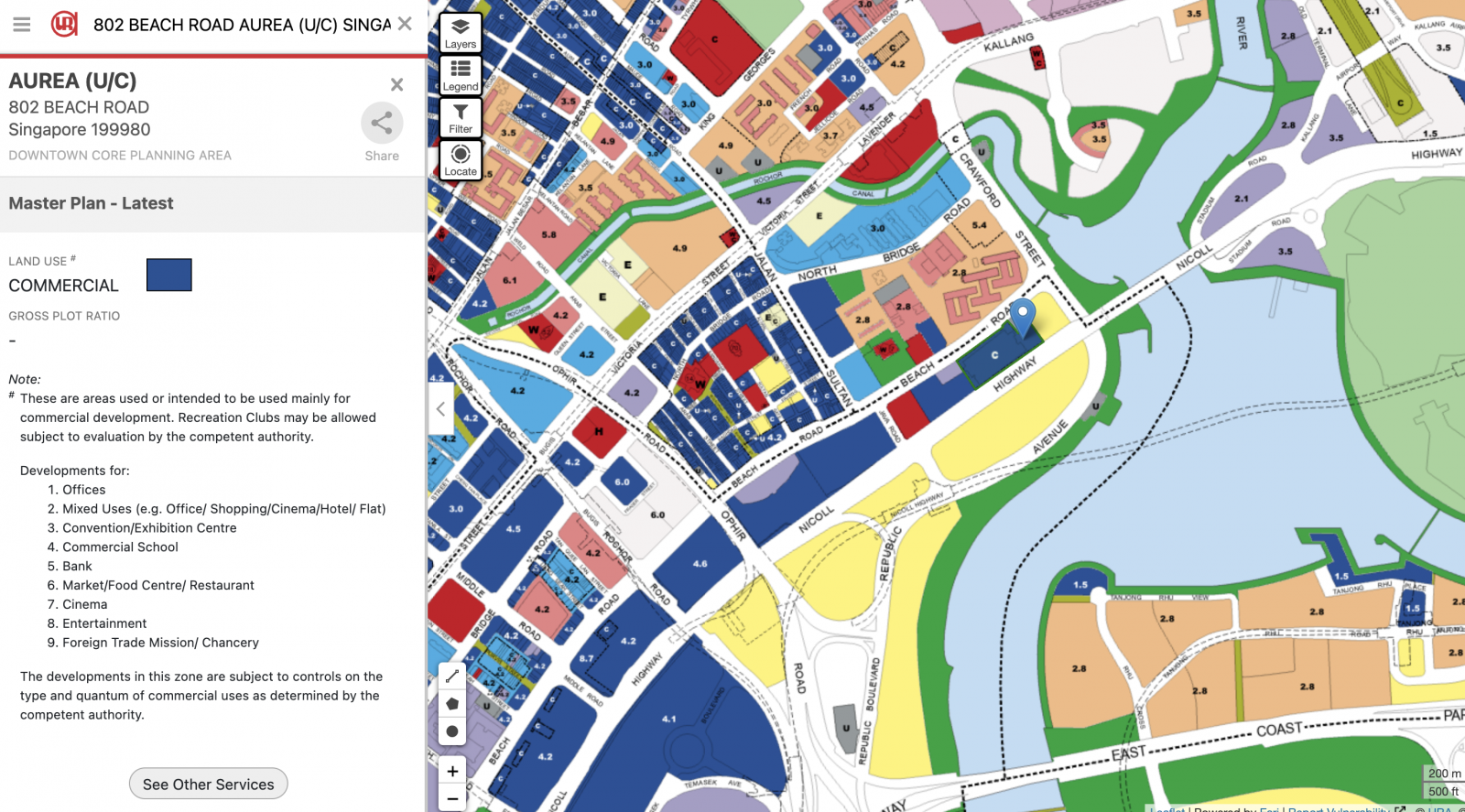

*Do note that only certain parts of District 7 are considered within the CCR, and some may argue that District 7 is technically an RCR district. But practically speaking, this project is close enough to the CCR that it’s advertised as such.

| Project Name | Aurea |

| Location | Beach Road |

| District | 7 |

| No. of Units | 188 |

| Tenure | 99-year Leasehold |

| Site Area | 144,908 square feet (including commercial components) |

| Gross Plot Ratio | 5.6 |

| Developer | JV Between Perennial Holdings and Far East Organization |

| Est. TOP | Est. 2029 |

For those driving in from Nicoll Highway, Golden Mile Complex is one of the unmistakable markers signalling the approach to the CBD. Architecturally, it’s hard to miss— it is one of Singapore’s most distinctive buildings, whether you love it or not.

A little bit of history: Golden Mile Complex was part of Singapore’s 1967 Government Land Sales (GLS) programme, which aimed to encourage private developers to take part in the city centre’s redevelopment. It was originally envisioned as a luxury development, and the team behind its design—Design Partnership (now DP Architects)—was responsible for the striking stepped terrace layout.

While it might seem like an aesthetic choice, the design was a functional response to its coastal setting, maximising sea views while naturally shading lower floors from the afternoon sun.

Of course, Golden Mile Complex has always been more than just an architectural statement. Over the years, it became known for its layered and, at times, controversial history—marked by poor maintenance, a seedy nightlife reputation, and a strong Thai community presence that made it a cultural outlier in Singapore.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A New Lease of Life – But With High Expectations

In 2021, the Golden Mile Complex was gazetted for conservation by the URA, part of a broader effort to preserve Singapore’s modernist buildings. This means its distinctive facade will remain intact, though the interiors will be completely reworked. Fittingly, DP Architects—the original designers—are again leading its transformation.

Naturally, there will be high expectations around how well they can balance heritage with modern functionality.

This time, the project is in the hands of Far East Organization, Perennial Holdings, and Sino Land, who acquired the 99-year leasehold site (13,462.3 sq ft) in 2022 for $700 million.

Unlike a straightforward residential redevelopment, the new Golden Mile Complex will be a mixed-use development, incorporating commercial, office, and medical spaces—some of which will be sold rather than leased.

Far East Organization is perhaps no stranger to projects of this nature – it previously led the revitalisation of One Holland Village, a development that, in some ways, shares similarities with Aurea.

Both projects involve integrating a new residential component with a culturally-dense estate and require a balance between preserving heritage elements, while also bringing new into the old to make the development more relevant for modern living.

The transformation will be significant for those familiar with the old Golden Mile Complex. While the facade remains, the interior will be completely gutted to make way for:

- Office spaces (available for sale)

- Medical suites (also for sale)

- Retail space, which will be managed by Perennial Holdings

From what we understand, Perennial Holdings will be overseeing the retail component of the project. While they may not be among Singapore’s largest mall operators, they do have experience managing developments like Capitol Singapore and Chinatown Point.

Early indications suggest that they are looking to bring in a supermarket and F&B tenants, but these are still tentative. It won’t be a large-scale mall, but it should cover daily conveniences—something that will be appreciated by residents and office-goers alike.

Additional changes include:

- A four-storey extension to the original structure, adding more office spaces for sale

- Green spaces replacing the open corridors, which had previously fallen into disrepair

- A new commercial branding—the commercial component will now be known as The Golden Mile

The only completely new addition to the site is a 45-storey residential tower, Aurea. While it won’t be the tallest in the area, it will certainly add a fresh element to the neighbourhood skyline.

Here’s what we know so far:

- 188 residential units

- 129 residential parking lots + 3 accessible lots (unit-to-lot ratio of 70%)

- Direct access to The Golden Mile via a link bridge

- Total site size: 144,908 square feet (including commercial and residential components)

Here’s a look at the unit mix offered:

| Unit Type | No. of Units | Approx. Unit Size (SQ FT) | Est. Maintenance Fee | % of Unit Mix |

| 2 Bedroom | 84 | 635/646/710 sq ft | $432 | 44.7% |

| 3 Bedroom | 28 | 1,001 sq ft | $432 | 14.9% |

| 4 Bedroom | 56 | 1,442/1,798 sq ft | $540/$612 | 29.8% |

| 5 Bedroom | 18 | 2,863/3,251 sq ft | $756/$828 | 9.6% |

| Penthouse | 2 | 5,608/8,816 sq ft | $1,044/$1,440 | 1% |

While 44.7% of the units are two-bedders, some buyers may also be surprised to see that there’s a good majority that are catered to the larger 3, 4, and 5-bedroom units – with sizes that are also larger than the typical new launch average. This speaks of the focus for larger families to consider the Aurea as a potential home.

It’s also worth noting that the Aurea is a pre-harmonisation project, meaning AC ledges are included in the total GFA. While this doesn’t necessarily affect liveable space, it’s something to keep in mind when comparing unit sizes across newer developments.

One factor that works in Aurea’s favour is its elevation. Residential units only start from Level 4, which means that even those on the lowest floors will enjoy partial views of the neighbourhood skyline. For units facing Nicoll Highway, the added height provides a buffer from traffic and noise—an advantage in a high-density, city-fringe setting.

More from Stacked

Analysing Forest Woods Condo at Serangoon: Did This 2016 Project Hold Up Over Time?

In this Stacked Pro breakdown:

Another feature worth mentioning is the ceiling height.

- Levels 4 to 17: 2.85m – which is relatively generous for today’s market

- Levels 18 and above: 3.02m – edging into the luxury range

This is a step up from the new norm of 2.79m from the new launches that we see today – though not unsurprising, considering Aurea’s more premium positioning.

For those seeking a full-fledged suite of condo facilities, Aurea may not be as compelling as some of the larger city-fringe projects. Space constraints mean you won’t find a tennis court or an Olympic-sized pool here, but that’s fairly standard for projects as central as these.

Facilities are spread across Levels 3, 17, and 33, offering a mix of lifestyle and leisure spaces. The upside? Even those on lower floors can enjoy elevated views from the common areas.

That said, given the location, many residents will likely already have memberships at nearby fitness clubs or prefer lifestyle offerings in the surrounding area. For a project like Aurea, the main draw has always been its location rather than extensive in-house amenities.

Aurea’s Location – A Well-Connected City-Fringe Site with Trade-Offs

Positioned along Beach Road and facing Nicoll Highway, Aurea sits in a location that offers both centrality and accessibility. It is within a six-minute walk to Nicoll Highway MRT (CCL), providing a direct link to Marina Bay, Paya Lebar, and the broader MRT network.

However, from what we understand, there is no direct sheltered path to the station, so part of the walk will be exposed—something to keep in mind for daily commuters.

Most would already be familiar with the Beach Road and Nicoll Highway area, so we won’t go too much into the obvious.

However, one key aspect to watch is the Ophir-Rochor Corridor, a district that’s quickly evolving from a quieter commercial zone into a work-live-play hub. The transformation kicked off with South Beach, followed by DUO Tower, which brought in major MNCs like Mastercard and Chevron. With Guoco Midtown and further rejuvenation plans in the pipeline, this stretch is set to become a key extension of the CBD.

For buyers, this shift could be a double-edged sword. On one hand, greater commercial activity means more amenities, offices, and lifestyle offerings. On the other, the area may feel increasingly business-centric, which could impact its appeal as a residential neighbourhood.

Trade-Offs to Consider

Beach Road has always been a fairly traffic-heavy corridor, especially during peak hours. While Nicoll Highway offers a relatively open stretch of road, congestion around Bugis and Suntec City is something to keep in mind for those sensitive to dust and noise.

Another factor to consider is the lack of primary schools within a one-kilometre radius, which could be a drawback for families with children.

For some buyers, unblocked views could be a key draw, given Aurea’s positioning. Units facing Nicoll Highway are likely to enjoy open views towards Kallang Basin and beyond, while those facing Beach Road may have to clear the surrounding HDB blocks. The exact clearance height isn’t confirmed yet, so if views are a priority, it’s worth checking in on specific unit placements before making a decision.

A bigger question mark, however, is the reserve site directly in front of Aurea. While the development currently benefits from open views, this could change depending on what eventually gets built there. Since the plot remains unzoned for now, its future use is still up in the air. For buyers who see an unblocked view as a long-term perk, it’s something to keep in mind—what looks like a clear outlook today may not necessarily stay that way in the years to come.

Relatively Affordable Entry Prices into the CCR

Beyond the unit layouts and design, pricing will be a key factor for buyers considering Aurea.

With starting prices from $2,750 PSF or $1.92 million, it offers a relatively accessible entry point into the CCR—particularly compared to recent launches like Elta, Emerald of Katong, Parktown Residences, or The Orie.

A big reason for this is its lower price per square foot (PSF) and compact unit sizes, which help to keep the overall quantum manageable.

For buyers who may have previously purchased in the RCR, this could make Aurea a more viable step up into the prime districts without stretching budgets significantly.

This shift in pricing strategy isn’t new.

Traditionally, CCR projects were associated with larger, high-quantum units catering to an affluent buyer pool—particularly foreigners. But in recent years, developers have introduced smaller, more efficient layouts to appeal to a broader segment of local buyers.

We’ve seen this play out in projects like Midtown Modern and Irwell Hill Residences, where compact units helped to lower the overall price point, making the CCR a more realistic option for those who previously might have been priced out.

That said, while Aurea’s pricing makes it more accessible, one consideration for buyers is the impact of higher ABSD rates on future resale demand. Given that the CCR has historically attracted foreign buyers, the cooling measures have undoubtedly slowed this segment of the market. This could affect long-term exit strategies, especially if foreign demand remains subdued.

However, the increasing availability of compact, lower-quantum CCR units means that more locals are entering the market—potentially shifting the typical buyer profile in the long run. With two-bedroom units at Aurea priced under $2 million, it offers an entry point that remains competitive, even without heavy reliance on foreign demand. Whether this trend continues will depend on how the CCR market evolves and how Aurea is eventually priced, but for now, it presents a case for a more attainable route into a prime district.

To get a sense of what demand may be like, let’s consider Midtown Modern, another mixed-use project in District 7:

| Contract Date | Address | Type of Sale | Unit Area (SQFT) | Type of Area | Price (S$PSF) | Price (S$) |

| 6 Dec 2024 | 18 Tan Quee Lan Street #23-XX | Sub Sale | 721 | Strata | 3,328 | 2,400,000 |

| 30 Nov 2024 | 16 Tan Quee Lan Street #30-XX | New Sale | 409 | Strata | 3,638 | 1,488,000 |

| 30 Nov 2024 | 16 Tan Quee Lan Street #27-XX | New Sale | 1,808 | Strata | 3,256 | 5,888,000 |

| 30 Nov 2024 | 18 Tan Quee Lan Street #30-XX | New Sale | 409 | Strata | 3,638 | 1,488,000 |

| 30 Nov 2024 | 18 Tan Quee Lan Street #24-XX | New Sale | 1,808 | Strata | 3,145 | 5,688,000 |

| 1 Nov 2024 | 18 Tan Quee Lan Street #30-XX | New Sale | 409 | Strata | 3,939 | 1,611,000 |

| 24 Sep 2024 | 16 Tan Quee Lan Street #07-XX | Sub Sale | 904 | Strata | 2,876 | 2,600,000 |

| 22 Sep 2024 | 16 Tan Quee Lan Street #28-XX | New Sale | 1,808 | Strata | 3,611 | 6,530,000 |

Looking at recent transactions, demand for Midtown Modern has remained strong, suggesting continued interest in homes within this part of the CCR.

While Aurea’s final indicative pricing has yet to be confirmed, its starting price of $2,750 PSF and two-bedders from $1.92 million appear competitive for the area. So, how well it stacks up against nearby launches will ultimately depend on its final pricing structure and how buyers perceive its value relative to the broader market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Cheryl Teo

Cheryl has been writing about international property investments for the past two years since she has graduated from NUS with a bachelors in Real Estate. As an avid investor herself, she mainly invests in cryptocurrency and stocks, with goals to include real estate, virtual and physical, into her portfolio in the future. Her aim as a writer at Stacked is to guide readers when it comes to real estate investments through her insights.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

0 Comments