Are Resale Executive Condos No Longer “Affordable” Compared To Condos In 2024? Here’s The Surprising Answer

October 30, 2024

Executive Condominiums (ECs) are intended as a stepping stone between HDB housing and private condos; a sort of “sandwich class housing” if you will. So when these ECs go on the secondary market, a common assumption is that they’ll still be cheaper than a regular condo – something that has been true for many years. However, the price gap has narrowed over time, and there have been some interesting observations with recent transactions. Here’s what to consider:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A quick rundown on ECs

For those who are not clear about the difference, ECs are built and sold by private developers. However, they count as HDB properties, with the usual HDB eligibility requirements, for the first 10 years; after that, they’re fully private (which also means they can be sold en bloc to developers). The five-year Minimum Occupancy Period (MOP) only applies to the first batch of EC buyers: after the MOP, subsequent buyers can sell whenever they like (subject to the usual three-year Sellers Stamp Duty).

For some of the most affordable resale ECs of late, check out this earlier article.

Examining the EC and private condo price gap

While we could do this on an island-wide basis, that wouldn’t be useful. Too many factors, from age to location, would distort the overall picture. So rather than look at averages across Singapore, let’s look at two key locations for ECs: Sembawang and Woodlands.

To be blunt, it’s fringe areas like these that tend to see EC launches. These two neighbourhoods have a good range of ECs, with fully private condos nearby to compare.

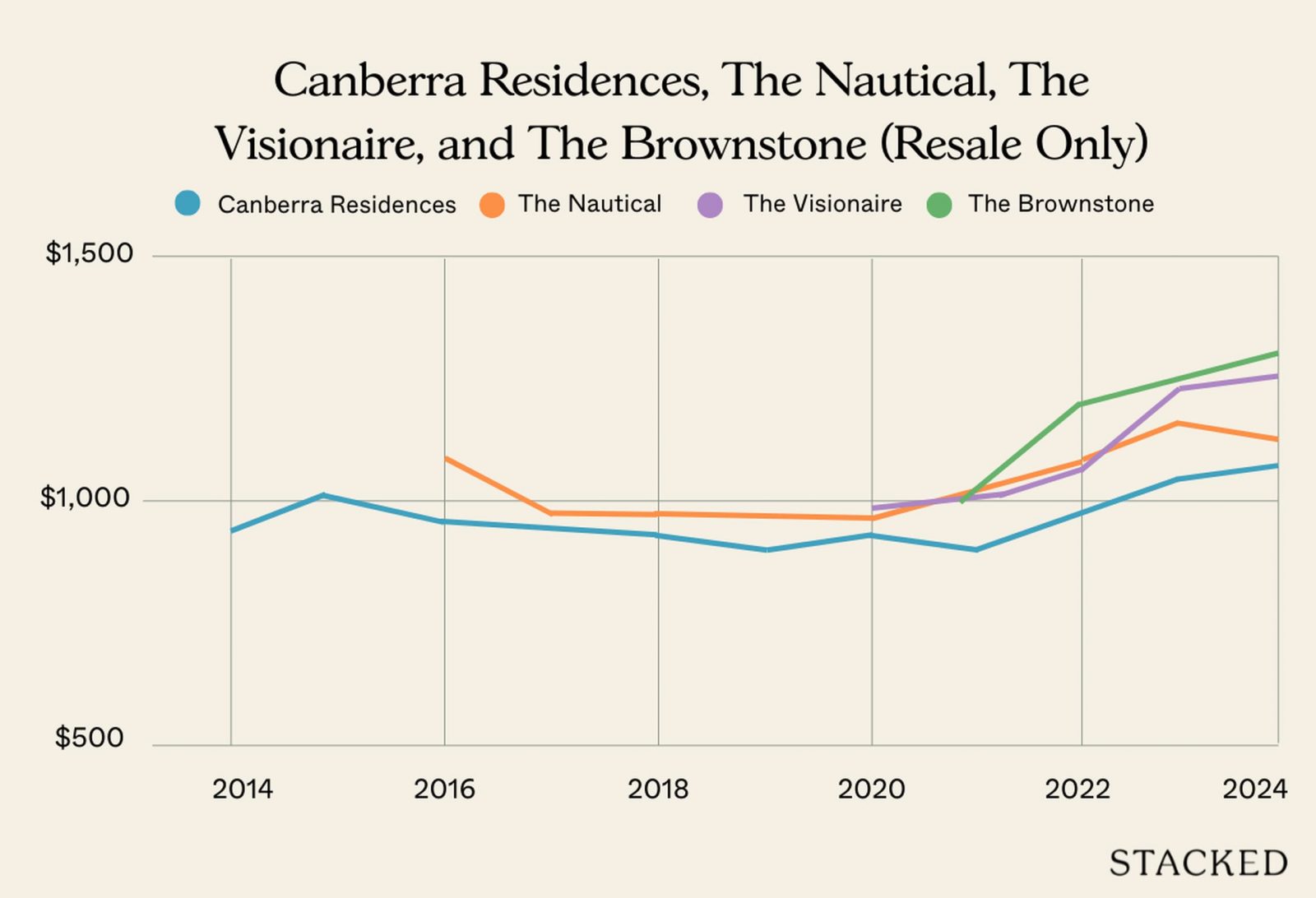

We’ll start with The Visionaire and The Brownstone, both of which are ECs close to Canberra MRT station.

Both ECs are only around a year apart in age (lease start dates are in 2014 and 2015 respectively). They also have neighbouring projects that are fully private, and which also happen to range between three to five years old – these are Canberra Residences and The Nautical.

| All sales | |||||

| Sembawang | Condo | Condo | Executive Condo | Executive Condo | |

| Year | CANBERRA RESIDENCES | THE NAUTICAL | THE VISIONAIRE | THE BROWNSTONE | |

| 2011 | $819 | ||||

| 2012 | $787 | $882 | |||

| 2013 | $750 | $845 | |||

| 2014 | $1,028 | ||||

| 2015 | $1,024 | $1,173 | $813 | ||

| 2016 | $916 | $1,059 | $810 | $830 | |

| 2017 | $886 | $967 | $815 | $825 | |

| 2018 | $873 | $979 | $943 | $868 | |

| 2019 | $839 | $969 | |||

| 2020 | $883 | $959 | $980 | ||

| 2021 | $900 | $1,044 | $1,014 | $1,017 | |

| 2022 | $1,002 | $1,117 | $1,083 | $1,274 | |

| 2023 | $1,104 | $1,267 | $1,319 | $1,326 | |

| 2024 | $1,117 | $1,173 | $1,358 | $1,386 | |

Note that at the point of launch, the average prices at Visionaire and Brownstone would have been around $800+ psf after subsidies. This was about 10 to 20 per cent lower than private counterparts at The Nautical or The Brownstone. Following this, the ECs and private condos somewhat maintained their price gap…right up till 2021.

Between 2022 to 2024, the prices of Visionaire and Brownstone surged to $1,300+ psf, actually overtaking Canberra Residences and Nautical. This reverses the situation of the projects at launch: the ECs are now the ones transacting at 20 per cent higher than their neighbouring private condos.

It’s unlikely to just be due to age differences: Nautical and Canberra Residences were completed in 2015 and 2013 respectively, and this is too small an age gap to justify the 20 per cent price gap. So we can conclusively say that, in the context of these Canberra region condos, the EC prices have caught up to their private counterparts.

Next, let’s look at a situation in Woodlands

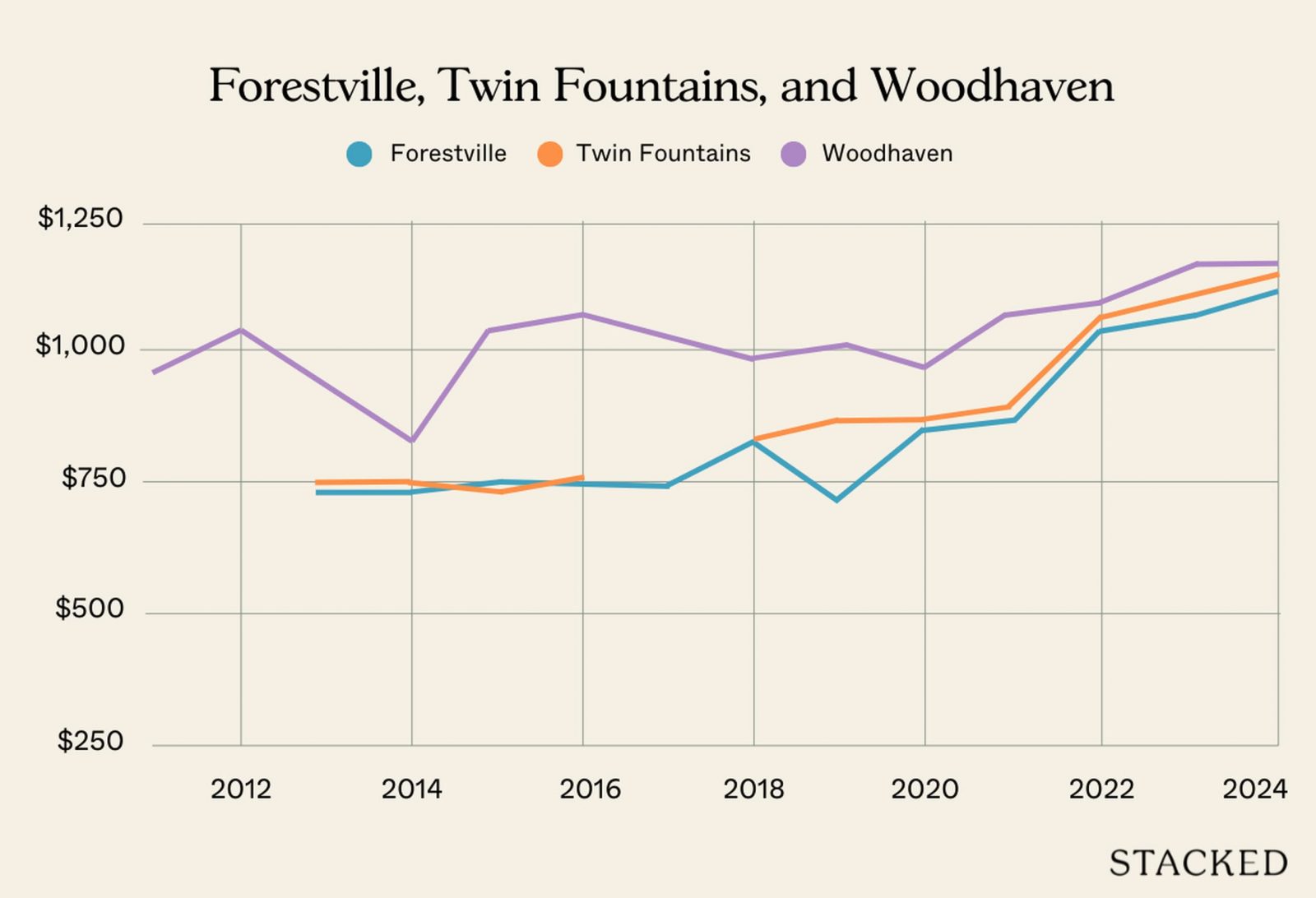

For the Woodlands area, we’re going to compare the ECs Forestville and Twin Fountains to Woodhaven, a fully private condo. While there are many ECs in Woodlands, these three provide the best overall point of comparison, being close in age and distance:

More from Stacked

Investing In A Property With A Friend/Family? Here’s How To Choose Between Joint Tenancy And Tenancy-in-common

Perhaps you’ve bought a property with a sibling or friend, instead of your spouse. Or maybe you have aspirations toward…

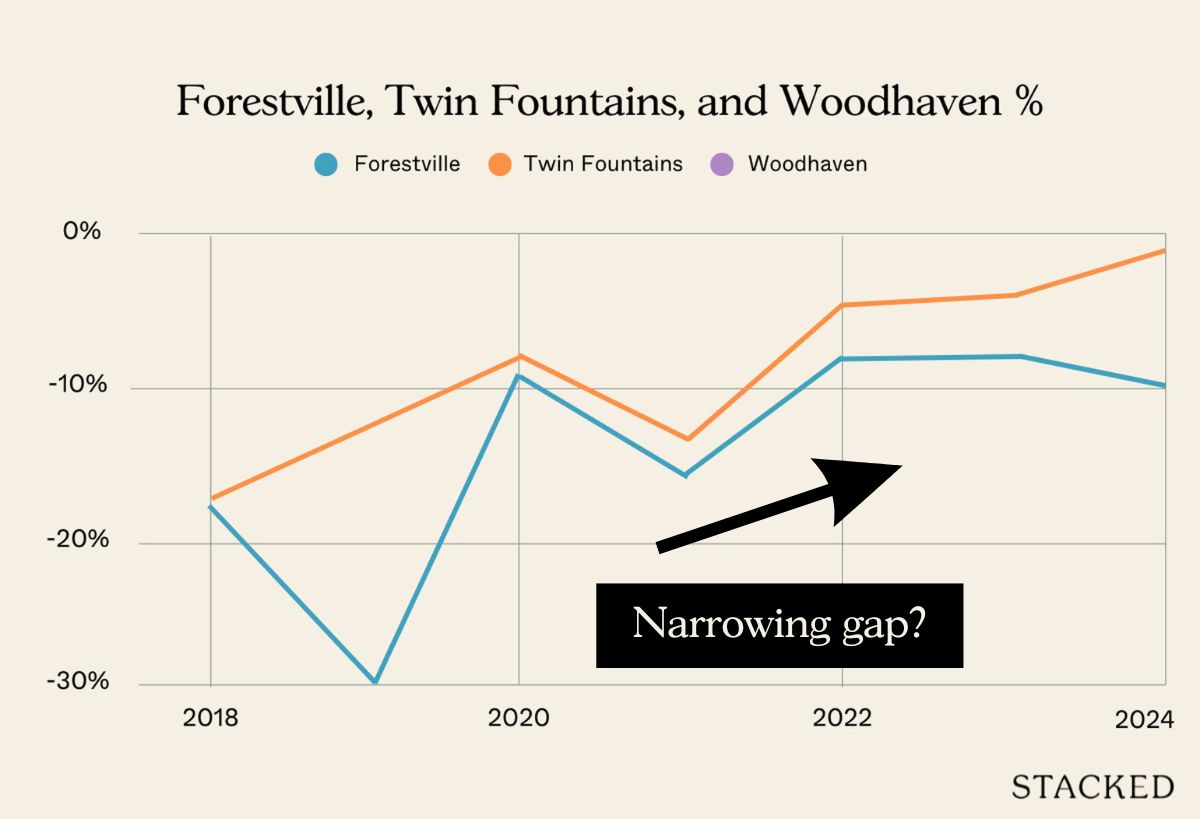

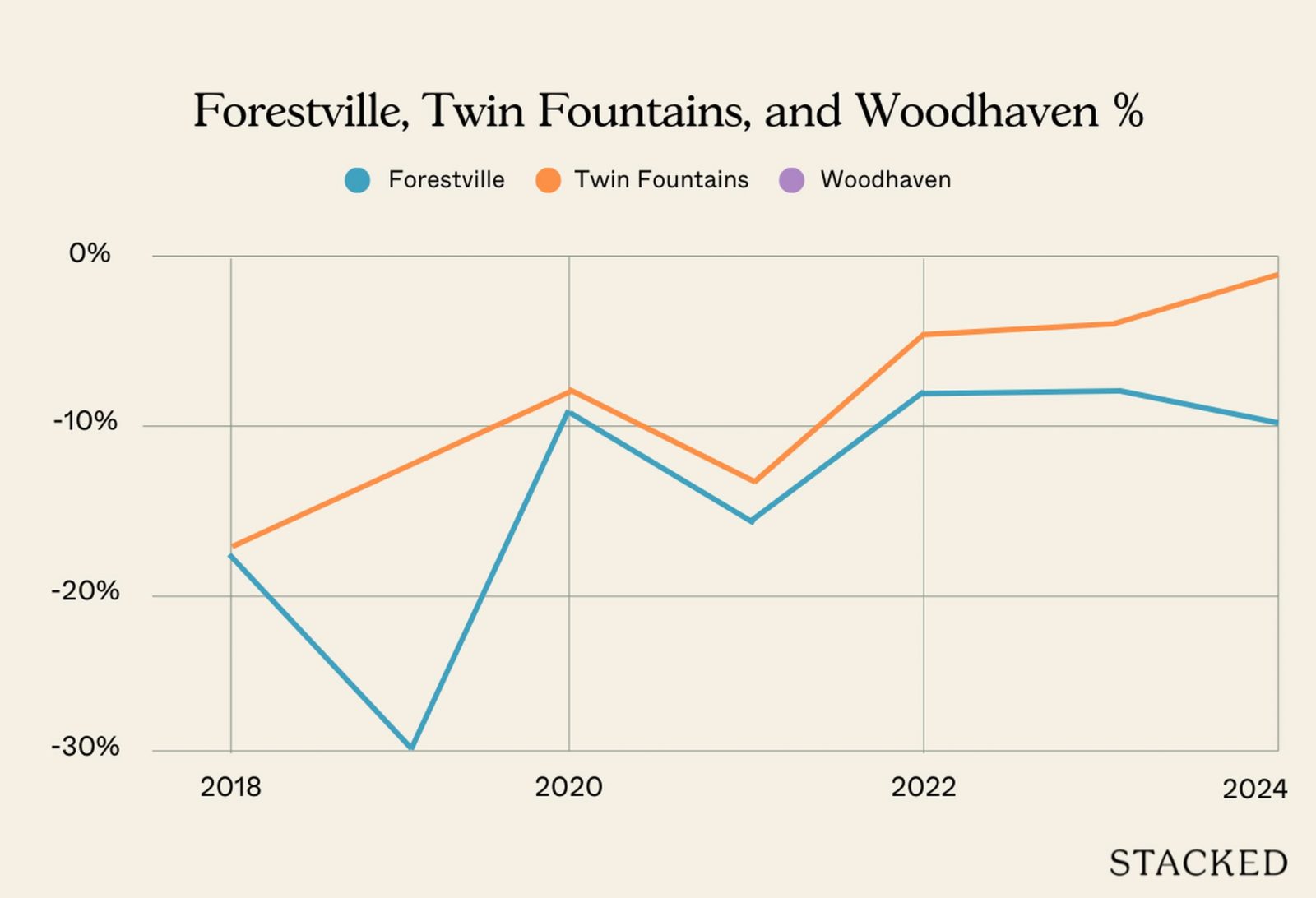

We see a similar pattern to Canberra, in that the ECs here had starting prices of around 20 per cent lower than Woodhaven. After Forestville and Twin Fountains met their MOP, they went up for resale at prices of about $800+ psf, compared to Woodhaven’s $989 psf. That’s in line with expectations, but look at how the price gap between the ECs and Woodhaven has progressed since:

| Year | FORESTVILLE | TWIN FOUNTAINS | WOODHAVEN |

| 2015 | $1,064 | ||

| 2016 | $1,070 | ||

| 2017 | $724 | $1,020 | |

| 2018 | $817 | $820 | $989 |

| 2019 | $705 | $888 | $1,010 |

| 2020 | $878 | $896 | $969 |

| 2021 | $903 | $936 | $1,071 |

| 2022 | $1,037 | $1,069 | $1,114 |

| 2023 | $1,107 | $1,160 | $1,191 |

| 2024 | $1,136 | $1,233 | $1,247 |

| ROI (18 – 24) | 5.70% | 7.00% | 3.90% |

Again, we see a dramatic turn right after Covid. Prior to 2020, the ECs had a sizeable price gap of 30 per cent for Forestville, and 12 per cent for Twin Fountains. But between 2022 to 2024, this dwindled to almost nothing: Forestville is now just nine per cent cheaper on average (in price psf), while the price difference between Twin Fountains and Woodhaven is negligible.

This may be due in part to the new Thomson East Coast Line, which has reduced prior accessibility issues for the ECs. However, it could just as easily be argued that Woodhaven – having more convenient access to Causeway Point and Woodlands MRT, should more than compensate for this factor.

Another plausible reason could be the supply of private condos in these areas, which would be on the lower side as compared to other more central regions. As such, when the demand is higher, we can see how the EC prices can match.

Whatever the reasons, the gap is definitely narrowing; and perhaps like Canberra, we may even see the ECs match or overtake their private counterparts.

Admittedly, picking out two segments in the north is not representative of all the data and warrants more study.

But it does show how a common assumption – that resale ECs are always cheaper than resale condos – may not hold true in specific areas. In this sense, the data that’s often presented (i.e., islandwide data comparing averages between hundreds of projects) may not be an accurate representation: some buyers may be shocked to learn that the EC they’re eyeing is, ultimately, not that much cheaper than its private neighbour.

Also, ECs no longer need to cross a 10-year mark to have fully unlocked their value. While an EC is still an HDB property at the five-year mark (i.e., right after MOP), this may be immaterial: being fully privatised simply means the EC can be sold en-bloc or bought by foreigners. But foreigners don’t typically buy ECs, and are even less likely to do so at the current 60 per cent ABSD rate. Likewise, developers aren’t half as enthusiastic about en-bloc deals as we saw in the 2010s.

As such, an EC can see a significant jump in value right after MOP; even if they’re only halfway to privatisation.

Assuming similar advantages in location and quality, this may tip some buyers toward the EC rather than the private market.

Third, from the opinions of some realtors, it’s related to the lower differentiation between the ECs and private condos. It used to be that ECs were almost always far from train lines, for example; but the construction of more MRT stations and lines have made some ECs just as convenient as private counterparts.

(Remember the EC scheme predates even the North East Line, which was only ready in 2003, or the Circle Line, which was fully operational in 2011; many ECs over the years have seen their accessibility greatly improved.)

If we also consider their quality, layout, facilities, etc. to be comparable to private counterparts, then the differentiation between the two might have faded considerably. And if so, that might also make new launch ECs a more attractive proposition going forward.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments