Are Mega Development Condos In Singapore Really More Profitable? Here’s What The Data Says

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

There used to be a time when home buyers frowned on mega-developments. These 1,000+ unit projects were thought to be noisy, lacking in privacy, overcrowded, etc. But as of the last few years, there’s been a huge shift in opinion: many buyers have started to associate mega developments with more lavish facilities, lower entry prices, and better room for gains.

The success of developments like Normanton Park, Parc Clematis, and Treasure at Tampines has only reinforced this perception. Even projects like Jadescape, which had a slower start, have since made headlines for their million-dollar profits. So now, it’s common to hear the claim that mega-developments perform even better than regular condos; but how true is it?

A quick explanation of the theory

A mega-development refers to projects with 1,000+ units, although it’s sometimes also used for those that come close (e.g., 900+ unit condos). A mega-dev is expected to have the following advantages:

- Better range of facilities, due to the larger land areas of these developments; this means multiple pools, tennis courts, bigger landscaped areas, etc.

- Lower maintenance costs despite the bigger facilities, because there are so many more units to split the cost

- A more competitive price point, if for no other reason than sheer scale. Treasure at Tampines exemplifies this: with over 2,200+ units, it was at a competitive price point from the very beginning

- High transaction volumes. Due to the high number of units that can potentially change hands in a single mega dev, even in just a year, the resale prices tend to be consistent and well-supported.

But does all of this translate to better performance, as some realtors have claimed? Let’s have a look:

An overall comparison between mega-developments and regular projects, since 2015

If we just did a raw, straight-up comparison, here’s what it looks like:

| Type | Average Gains (%) | Average Gains ($) | Volume |

| Mega Condo | 22.0% | $249,983 | 4,236 |

| Regular Condo | 21.6% | $254,827 | 8,643 |

| Average | 21.7% | $253,234 | 12,879 |

In this very broad sense, there doesn’t appear to be much difference between the two. Mega-developments do perform better, but the difference is almost negligible.

This isn’t detailed enough, so let’s compare the performance of different unit sizes.

How well does a small unit in a mega-development compare to one in a regular project? How well does a large unit compare? Let’s use the following definitions:

Note that we’re going by size instead of number of rooms, because our data set includes condos of very different ages. This could make such a definition misleading: condos built in the 1990s or earlier, for instance, can have “two-bedders” which are over 1,000 sq. ft., that would be a three-bedder today. Nonetheless, for your convenience, we’ve attached a quick description so you can mentally compare the sizes by today’s standards.

- Very small: Below 500 sq.f t. (small even for a one-bedder)

- Small: 500 to 800 sq. ft. (one to two-bedder units)

- Medium: 800 to 1,200 sq. ft. (three-bedder units)

- Large: 1,200 to 1,600 sq. ft. (larger three-bedders to four-bedders)

- Extra large: Above 1,600 sq. ft. (five-bedders, penthouse units)

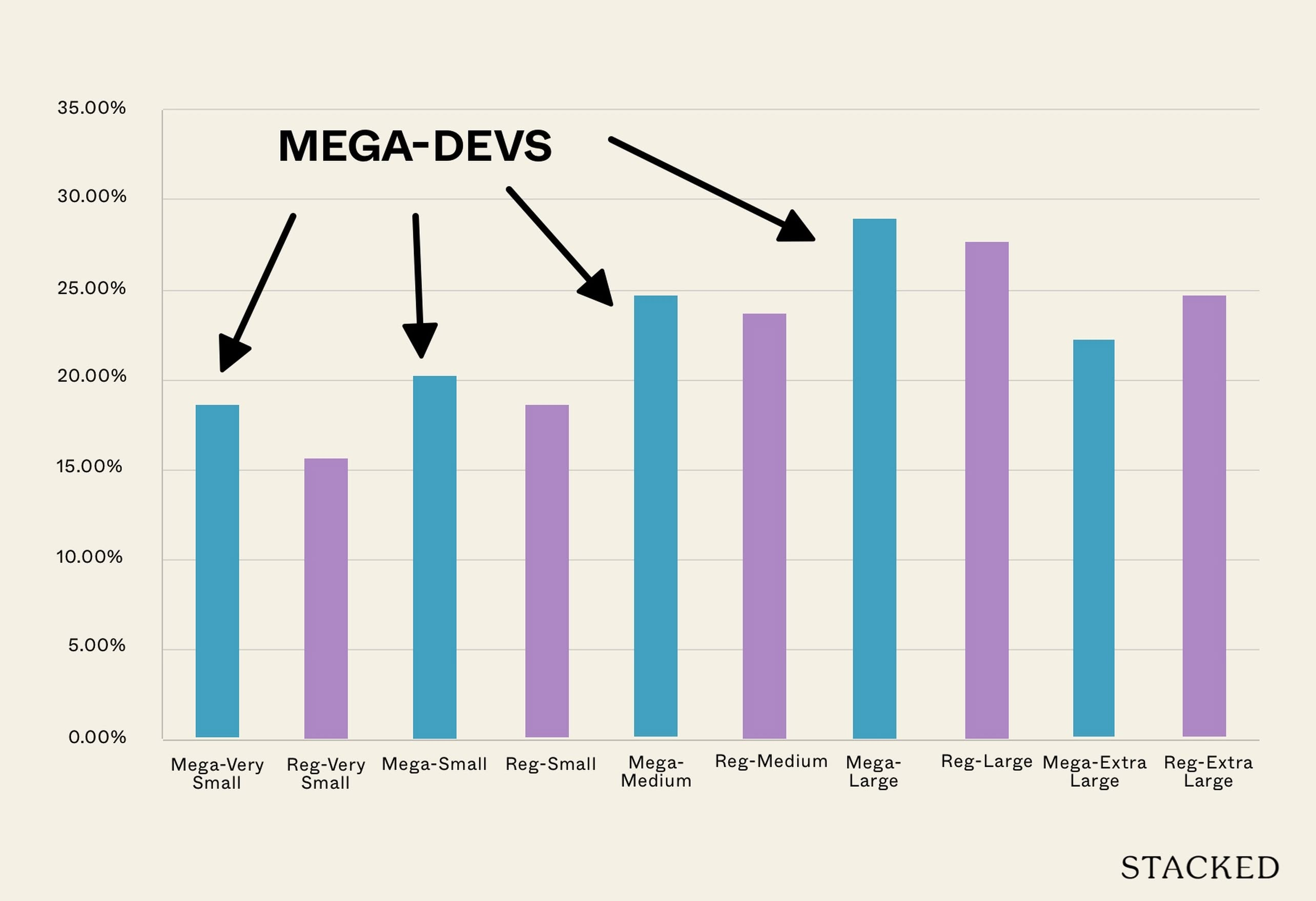

After we broke down the units by size, we then compared how they performed in a mega-development versus a regular project:

| Type | Average of % | Average of quantum | Difference in ROI |

| Mega-Very Small | 18.58% | $113,946 | 3.0% |

| Reg-Very Small | 15.61% | $106,118 | |

| Mega-Small | 20.19% | $193,792 | 1.5% |

| Reg-Small | 18.64% | $177,045 | |

| Mega-Medium | 24.62% | $313,020 | 0.9% |

| Reg-Medium | 23.75% | $295,452 | |

| Mega-Large | 28.94% | $453,292 | 1.3% |

| Reg-Large | 27.62% | $416,195 | |

| Mega-Extra Large | 22.26% | $625,783 | -2.3% |

| Reg-Extra Large | 24.58% | $485,999 |

We can see that the smaller the unit, the better the performance of the unit in a mega dev. The inverse is true for the largest units in a mega dev: at a size of above 1,600 sq. ft., the mega dev unit becomes the underperformer.

When we check for statistical significance, we can see that (1) very small, (2) small, and (3) medium categories have a p-value below 0.05*, which means the difference is unlikely to be due to chance.

So whilst it’s hard to pinpoint the exact reason, one thing is clear: the smaller units in a mega dev are the size most likely to outperform their counterparts in a regular condo; at least by a notable margin.

*The p-value is a measure of statistical significance, where anything above 0.05 could more likely be a result of chance.

Next, we looked at the transaction types.

This was to determine if, for instance, most of the benefits of mega devs come only if you bought during early sales phases.

(This is more significant to mega devs than most standard projects, as the high unit counts often mean a longer, dragged-out period of developer sales)

We looked at new to resale, new-to-sub sale, resale-to-resale, and sub sale-to resale:

| Type of sale | Average of % | Average of quantum | Volume |

| Mega New To Resale | 24.0% | $256,352 | 1,583 |

| Regular New To Resale | 21.7% | $249,020 | 3,828 |

| Mega New To Sub Sale | 20.9% | $238,874 | 2,018 |

| Regular New To Sub sale | 18.6% | $233,195 | 1,593 |

| Mega Resale To Resale | 20.4% | $280,355 | 575 |

| Regular Resale To Resale | 23.7% | $287,054 | 2,854 |

| Mega Sub Sale To Resale | 20.0% | $165,911 | 58 |

| Regular Sub Sale To Resale | 15.4% | $158,882 | 362 |

Here’s another interesting result: in all categories save one (resale-to-resale), mega devs come out ahead.

(We would take sub sale-to-resale transactions with a pinch of salt though, as those types of transactions tend to be quite rare and low in volume)

That should give us pause for thought. It implies – on the surface – that the advantages of buying a mega dev may come primarily from early developer sales. Perhaps the advantage won’t be present if you buy a resale mega dev unit, and subsequently try to sell.

But there may be another explanation

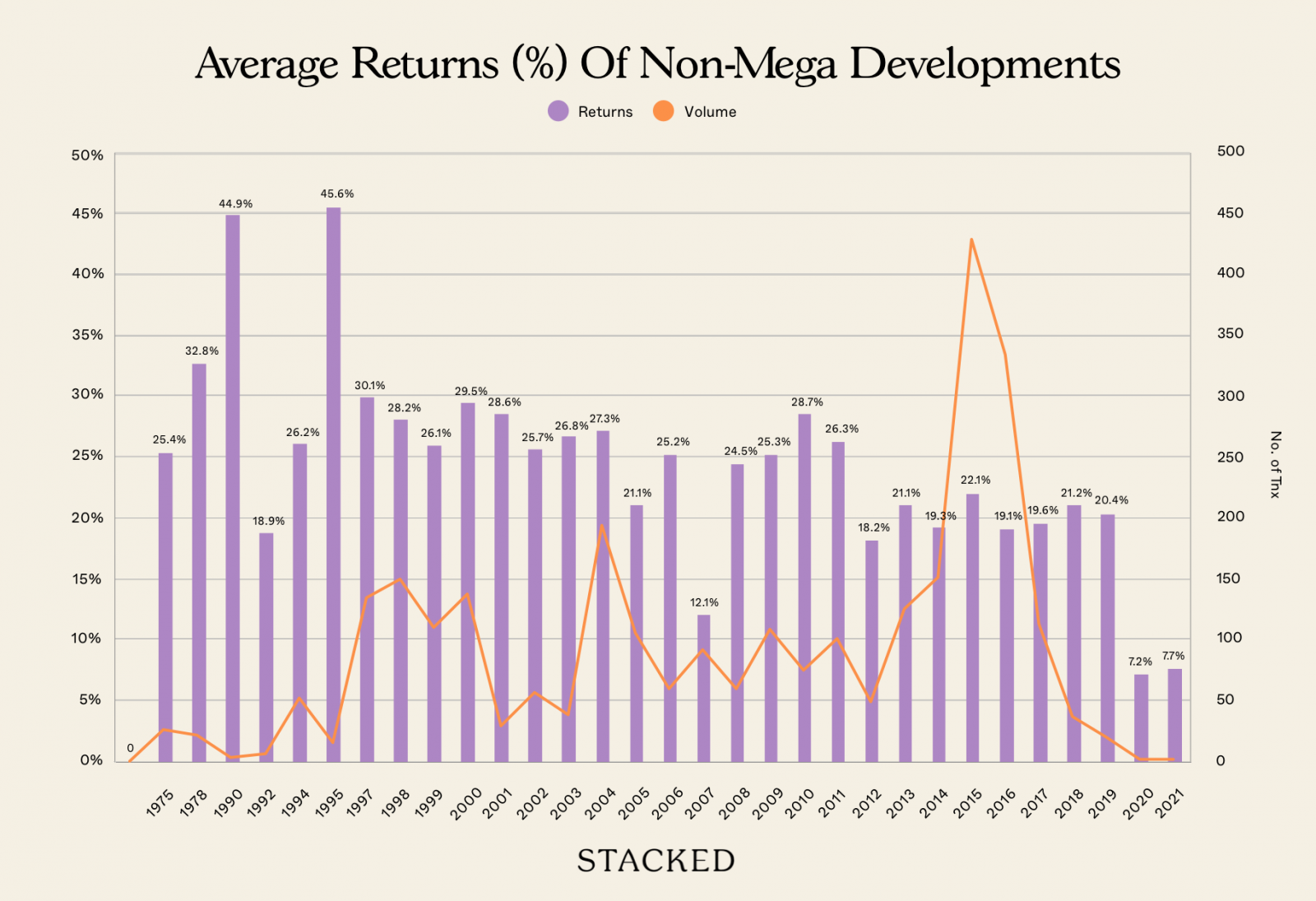

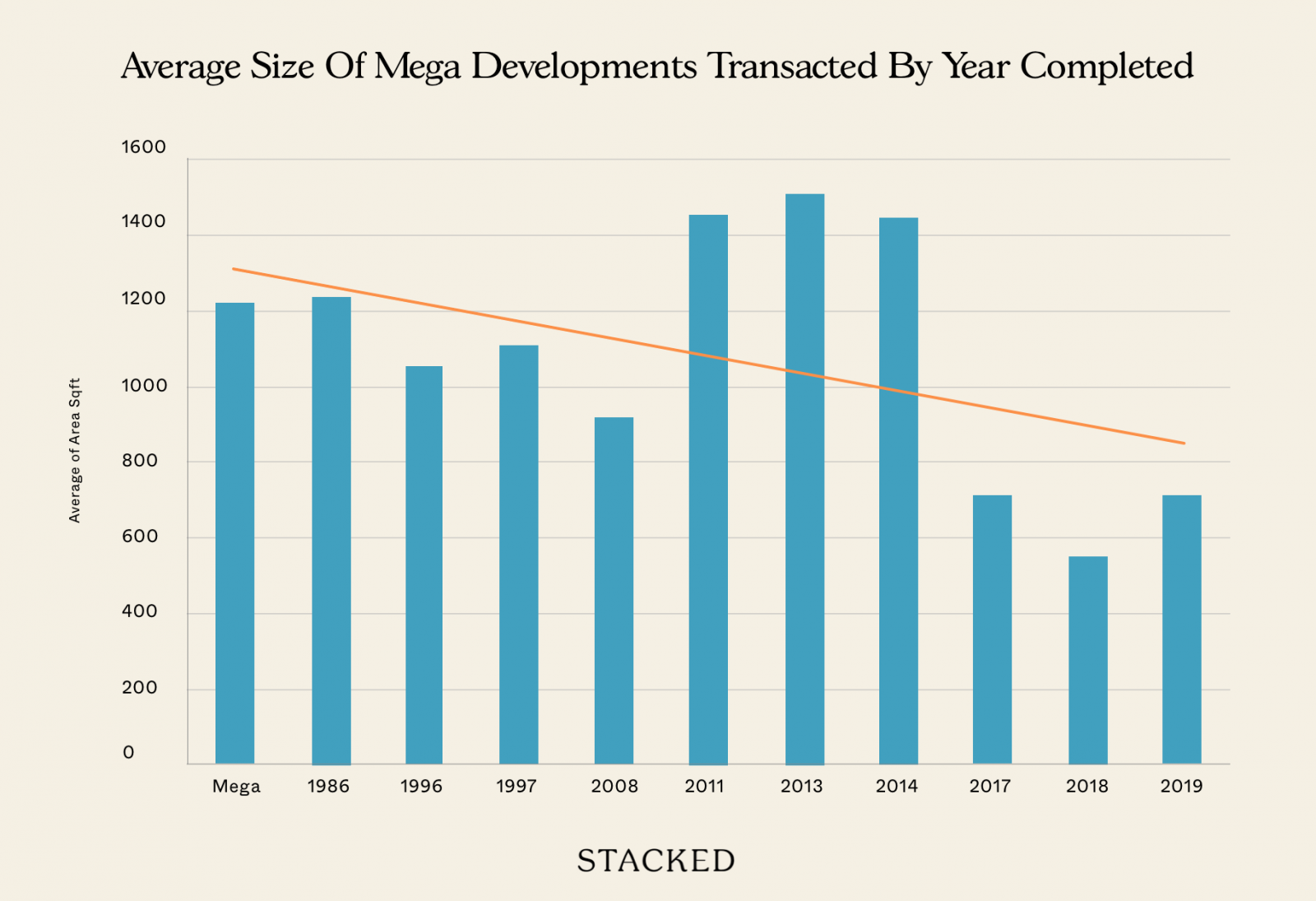

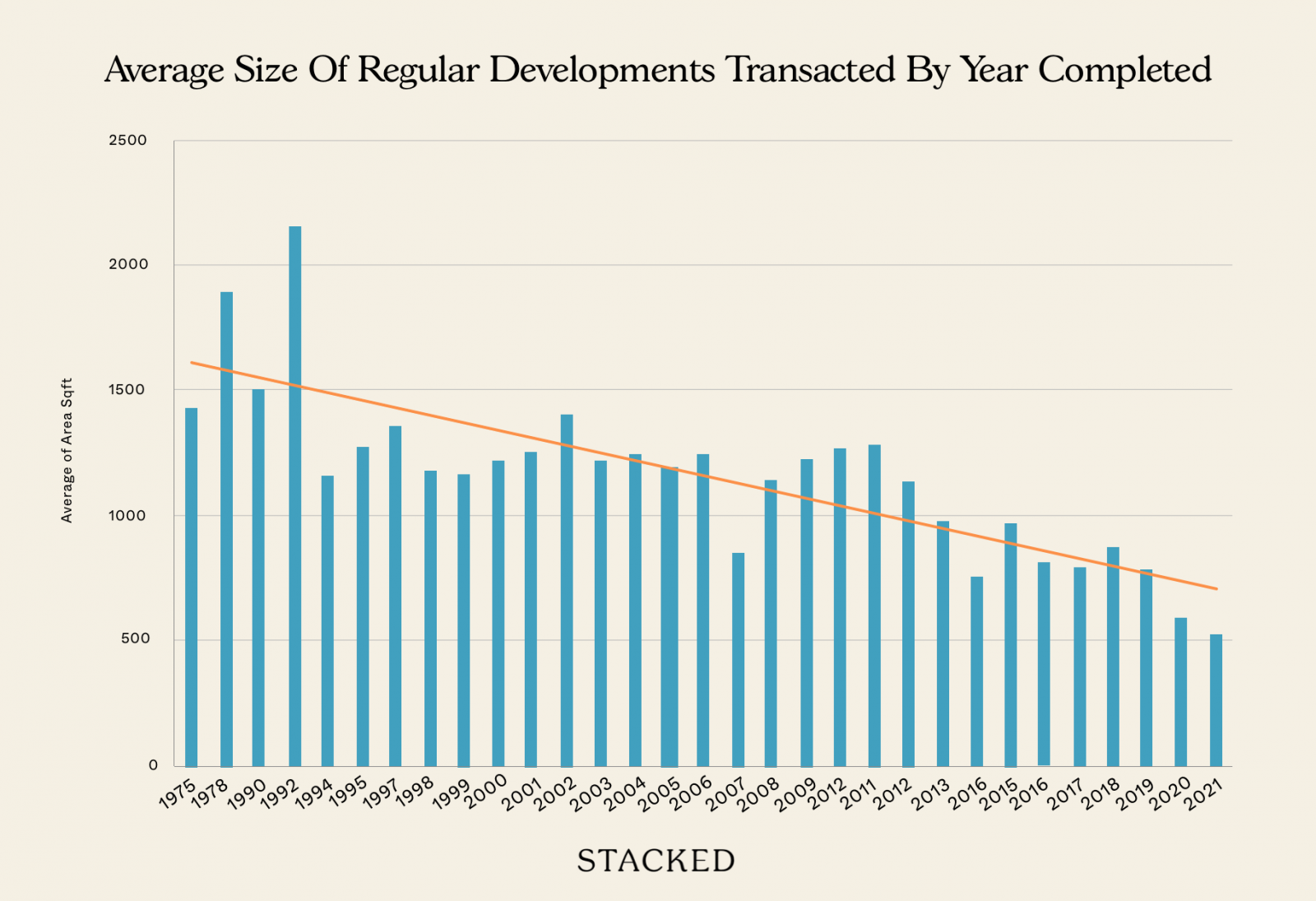

We should consider that, for resale-to-resale, we’re looking at more condos that are older. Note the completion years of the regular condos, versus their mega-development counterparts:

What’s happened here is that there’s a large number of regular older condos, which through consistent performance over time, have pulled up the overall average.

One other issue with older condos is that they’re often built much bigger. As we mentioned above, even a 1,000+ sq. ft. unit could have been considered a two-bedder back in the 1990s. This could also contribute to such older condos performing well in today’s market, where newer units tend to be much smaller.

As an interesting aside, you can also see how much our private homes have shrunk over time!

Overall though, the numbers so far show that mega-developments do tend to outperform their regular counterparts

This is still by no means universal. We cannot predict with absolute guarantee that a mega-development unit will beat a regular counterpart, or by what exact margin. What it does show, however, is that some of our previous fears may be unwarranted.

It used to be said, for instance, that mega devs face tough resale prospects because there would be many competing listings at the point of sale (and some landlords claim this is true for rental as well.) But from what we’ve observed, this hasn’t caused mega devs to underperform after all.

As for overcrowding, it may also be that the larger land spaces, and better-designed facilities today, help to make up for this.

Ultimately, it still comes down to lifestyle and preference; but numbers-wise, it’s not a lie to say mega-developments – on average – tend to outperform regular condos for now.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Editor's Pick

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Singapore Property News We Review The February 2026 BTO Launch Sites (Bukit Merah, Toa Payoh, Tampines, Sembawang)

Singapore Property News One Segment of the Singapore Property Market Is Still Climbing — Even as the Rest Slowed in 2025

Singapore Property News Why Buying Or Refinancing Your Home Makes More Sense In 2026

Latest Posts

Property Market Commentary Landed Home Sales Hit a Four-Year High — Here’s What That Could Mean for Prices in 2026

Singapore Property News A Rare Freehold Mall Is Up for Sale At $295 Million: Why the Market Is Paying Attention

On The Market Here Are The Rare HDB Flats With Unblocked Views That Hardly Come Up for Sale

Pro Where HDB Flats Continue to Hold Value Despite Ageing Leases

Property Market Commentary What A Little-Noticed URA Rule Means For Future Neighbourhoods In Singapore

Pro What Happens When a “Well-Priced” Condo Hits the Resale Market

Singapore Property News Why The Rising Number Of Property Agents In 2026 Doesn’t Tell The Full Story

New Launch Condo Analysis This New Dairy Farm Condo Starts From $998K — How the Pricing Compares

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

On The Market Here Are The Cheapest Newer 3-Bedroom Condos You Can Still Buy Under $1.7M

New Launch Condo Reviews Narra Residences Review: A New Condo in Dairy Farm Priced Close To An EC From $1,930 PSF

Property Market Commentary Why Looking at Average HDB Prices No Longer Tells the Full Story: A New Series

Singapore Property News This Latest $962 PSF Land Bid May Push Dairy Farm Homes Past $2,300 PSF — Here’s Why

On The Market Orchard Road’s Most Unlikely $250 Million Property Is Finally Up for Sale — After 20 Years

Overseas Property Investing What $940,000 Buys You in Penang Today — Inside a New Freehold Landed Estate