Are Larger Condo Units A Better Investment? Comparing Profits Of One, Two, and Three Bedroom Units

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

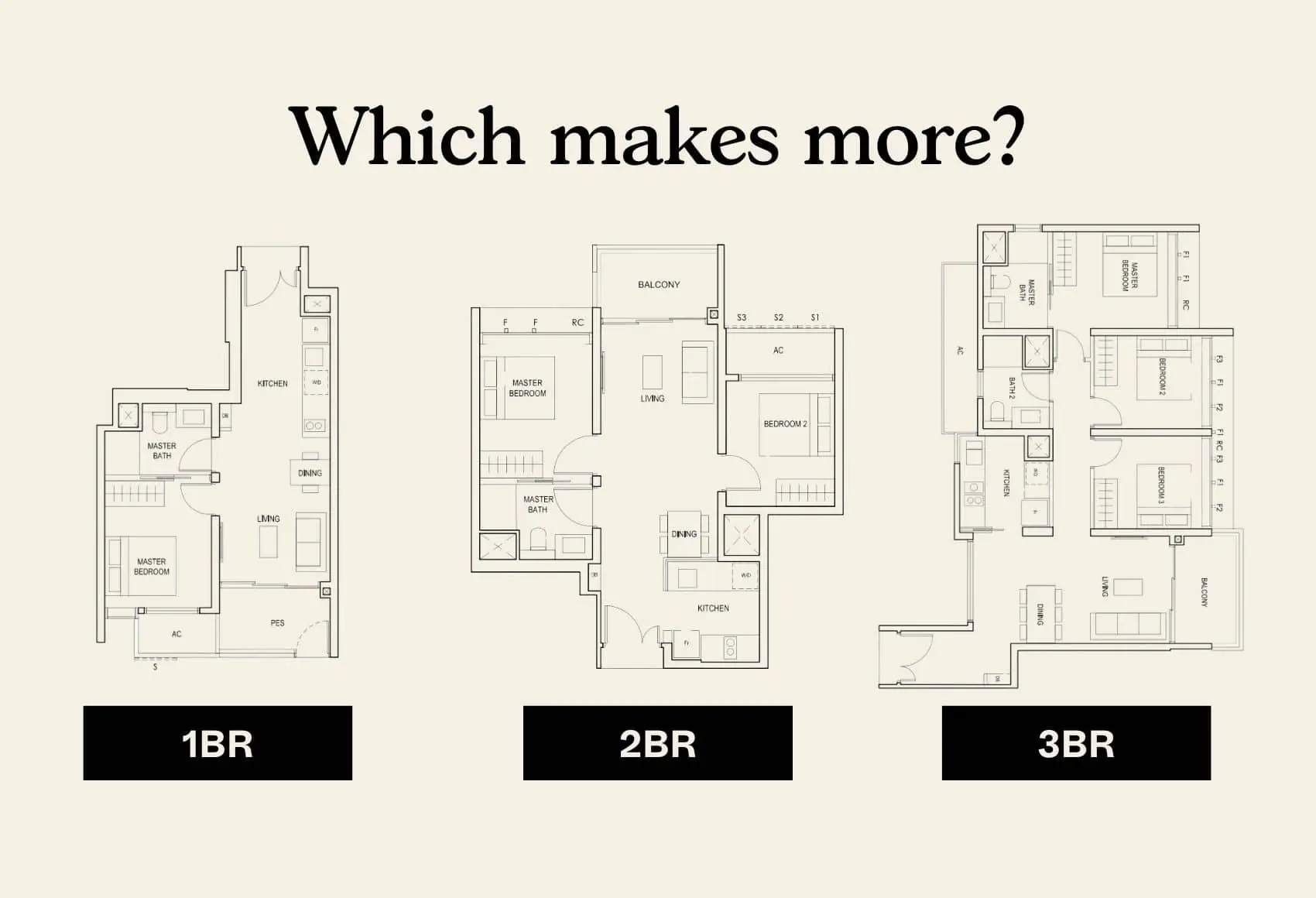

Some property buyers swear by family-sized units (i.e., three-bedders or bigger), whereas others believe in low quantum one and two-bedders. But as far as returns go, which of these unit sizes is actually better for investment? It’s worth a look since the property market has changed a lot, from the shoebox craze in the 2010s to the growing preference for larger homes in the past decade:

A broad overview of performance

For this study, we compared 65 projects and a total of 2,321 transactions. These 65 projects were considered as we had bedroom information readily available. Considering they were launched within the past decade and had sufficient transactions for our analysis, we decided to use this dataset.

The earliest of these transactions was in Martin Modern in 2017, so we’re only looking at transactions that occurred within the past five to six years as anything before that would be subject to different environments (cooling measures, etc). We only looked at transactions that were from new launch to resale, or new launch to sub sale, as the other transaction types (e.g., sub sale to resale, or resale to resale) only made up 10 transactions, which is too low a volume to consider.

| Bedrooms | Avg. Profit ($) | Avg. Profit (%) | Avg Annualised (%) | Avg. Holding Period | No. of Buy/Sell Tnx |

| 1 | $120,787 | 16.0% | 3.7% | 4.1 | 575 |

| 2 | $213,483 | 19.1% | 4.6% | 4.0 | 1,100 |

| 3 | $367,224 | 24.3% | 5.8% | 3.9 | 646 |

This is largely in line with expectations. Larger units tended to see a higher return, with three-bedders having an ROI that’s almost 50 per cent more than one-bedders; and whilst three-bedders have a shorter holding period, it’s not by a significant margin.

From the opinions of realtors, which we’ve pointed out in many articles, this is due to the majority of condo buyers being HDB upgraders. As upgraders are almost always family units, they don’t have much use for small one and two-bedders.

But are the results the same across different regions?

One of the theories you might hear is that, in the CCR, one-bedders can do much better than in the OCR. This is on the basis that more singles, as well as more investors who want to rent to single expats, are more interested in CCR.

So to see if there’s any real difference based on region, we took a look at how these unit sizes perform in the CCR, RCR, and OCR:

| Bedroom | segment | Avg. Profit ($) | Avg. Profit (%) | Avg Annualised (%) | Avg. Holding Period | No. of Buy/Sell Tnx |

| 1 | CCR | $97,624 | 7.5% | 2.0% | 3.4 | 12 |

| RCR | $146,924 | 16.7% | 3.9% | 4.1 | 158 | |

| OCR | $111,277 | 16.0% | 3.7% | 4.1 | 405 | |

| 2 | CCR | $166,576 | 9.8% | 2.4% | 4.0 | 48 |

| RCR | $244,253 | 19.6% | 4.7% | 3.9 | 491 | |

| OCR | $190,566 | 19.4% | 4.6% | 4.0 | 561 | |

| 3 | CCR | $456,174 | 17.7% | 3.7% | 4.4 | 42 |

| RCR | $409,946 | 24.5% | 6.0% | 3.8 | 203 | |

| OCR | $336,281 | 24.9% | 6.0% | 3.9 | 401 |

More from Stacked

Inside 2023’s Biggest Condo Launch: Everything You Need to Know About Grand Dunman

It's been a while since we've had two new condos launching on the very same weekend - Grand Dunman (near…

Clearly, the theory doesn’t hold up. Notice that all the unit sizes, even the one and two-bedders, actually perform better in the OCR than in the CCR. Besides this, the pattern is consistent with the broad overview: the three bedders still perform best, followed by two-bedders and one-bedders.

As an aside, do note that performance between the OCR and RCR is very close; this may be worth keeping in mind when you come across statements like “shoeboxes in the OCR are the worst.” Percentage-wise, the results here suggest they’re no better or worse than RCR shoeboxes.

(But that being said, the RCR does have a higher average profit in absolute numbers)

Next, we look at a breakdown based on specific projects:

| Project | 1BR | 2BR | 3BR |

| AFFINITY AT SERANGOON | 3.1% | 3.5% | 4.2% |

| AMBER PARK | 3.0% | 2.9% | 3.6% |

| AVENUE SOUTH RESIDENCE | 4.0% | 3.3% | 4.6% |

| FORETT AT BUKIT TIMAH | 0.7% | 5.4% | 7.1% |

| FOURTH AVENUE RESIDENCES | 1.1% | 2.7% | 4.1% |

| JADESCAPE | 4.5% | 5.4% | 6.2% |

| KENT RIDGE HILL RESIDENCES | 3.5% | 2.8% | 3.1% |

| KOPAR AT NEWTON | 3.0% | 3.1% | 4.1% |

| MAYFAIR GARDENS | 2.1% | 2.0% | 2.6% |

| MAYFAIR MODERN | 4.5% | 2.1% | 3.5% |

| MIDWOOD | 6.6% | 5.5% | 5.8% |

| PARC CLEMATIS | 5.0% | 5.7% | 7.6% |

| PARC ESTA | 4.1% | 5.9% | 7.3% |

| PARC KOMO | 2.9% | 4.4% | 4.3% |

| PARK COLONIAL | 3.6% | 3.5% | 5.1% |

| PENROSE | 3.0% | 6.4% | 8.3% |

| RIVERFRONT RESIDENCES | 3.8% | 4.2% | 5.7% |

| SENGKANG GRAND RESIDENCES | 2.7% | 4.0% | 5.0% |

| SKY EVERTON | 2.6% | 1.1% | 3.0% |

| STIRLING RESIDENCES | 4.6% | 4.9% | 6.2% |

| THE FLORENCE RESIDENCES | 3.6% | 4.6% | 5.6% |

| THE JOVELL | 4.4% | 4.1% | 5.1% |

| THE LINQ @ BEAUTY WORLD | 6.8% | 9.3% | 7.9% |

| THE TAPESTRY | 2.4% | 3.4% | 5.2% |

| TREASURE AT TAMPINES | 4.3% | 4.7% | 6.3% |

| WHISTLER GRAND | 5.2% | 6.3% | 7.7% |

The same pattern still shows, with three-bedders generally outperforming smaller counterparts in most projects. There is the occasional exception though, such as The Linq @ Beauty World, where two bedders saw a higher ROI (9.3 per cent) versus three-bedders (7.9 per cent); but this irregularity could be an outlier, as there was only a single transaction for each of the one and three-bedder units there.

The advantage of one or two-bedders may be in rental yields rather than resale

For the above, we have looked only at profits upon resale. We haven’t taken into account any additional gains from rental.

For smaller units, rental yields tend to be higher, because of the lower quantum. (e.g. a $900,000 shoebox unit, rented out at $2,800 per month, would give you a gross rental yield of 3.7 per cent. A $1.8 million three-bedder unit, rented out at $4,500, has a gross yield of about three per cent.)

After you add rental gains to the equation, it’s still possible for a one or two-bedder to ultimately outperform a larger counterpart. However, this is immaterial to an owner-occupier or owner-investor, who has no intention to rent out the unit; so if you fall into such a category, you’re better off getting a bigger unit if you can.

Also, several realtors have expressed that – profits aside – three-bedders or larger units are generally quicker to sell. When it comes to resale, it’s a much smaller group of buyers (some retirees, lifelong singles, and other investors) who would consider a one or two-bedder.

The ubiquitous 4-room flat is about 960 to 1,000 sq. ft., and this is the size that most Singaporeans consider to be sufficient for a family. This is about the size of a three-bedder, among condos built since the 2010s.

For more on the Singapore private property market, as well as reviews of new and resale condos alike, follow us on Stacked. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Investment Insights

Property Investment Insights New Launch vs Resale Condos in District 9: Which Bedroom Types Offer Better Value Today?

Property Investment Insights Why The Interlace Condo Underperformed—Despite Its Massive Land Size And Large Units

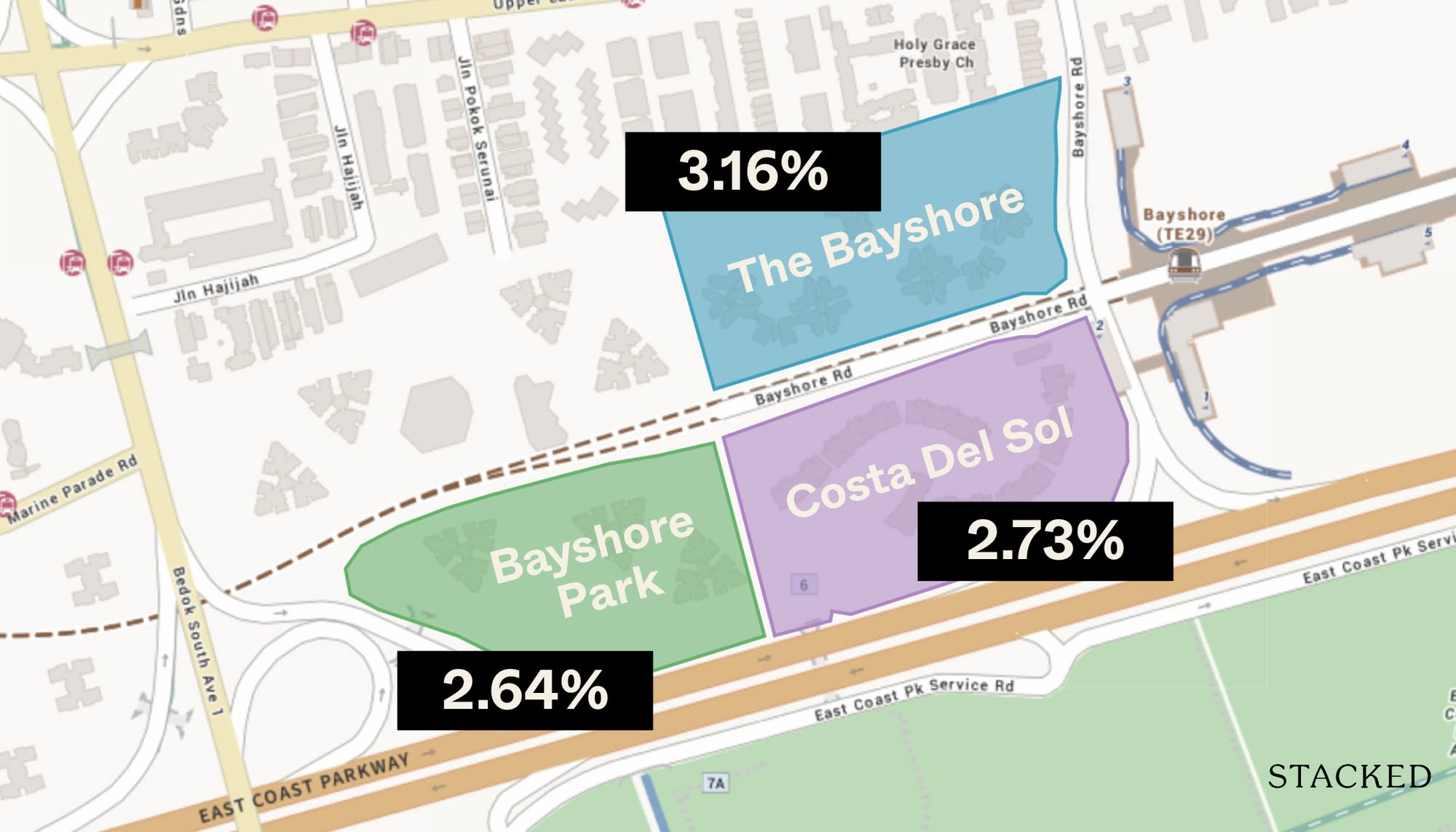

Property Investment Insights 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Property Investment Insights 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Latest Posts

Overseas Property Investing 4 Hidden Risks To Avoid When Buying Property In Malaysia (A Guide For Singaporeans)

Homeowner Stories I Bought a Freehold Property in Singapore and Regret It — Here’s the Big Mistake I Made

Landed Home Tours We Toured A Rare Part Of Singapore Where Terrace Houses Are Bigger Than The Semi-Detached Units

Singapore Property News What Buyers Overlook When Purchasing Older Condos (Until It’s Too Late)

Property Market Commentary 5 Ways Housing Shapes Singapore’s National Identity

On The Market 5 Attractive Freehold Condos With Private Pools (Under $2M)

New Launch Condo Analysis Springleaf Residence Pricing Review: How It Compares To Nearby Resale And New Launches

New Launch Condo Reviews Springleaf Residence Review: A 941 Mega-Development Near The MRT From $1,995 Psf

Property Market Commentary 4 Condo Layouts And Features Buyers Are Moving Away From in 2025

Editor's Pick Summer Suites Condo Review: A Freehold Johor Bahru Condo Near The RTS Link

Editor's Pick Over 900 Units Sold in One Weekend: The Surprising Lessons From River Green, Promenade Peak & Canberra Crescent

Singapore Property News Is Property Decoupling To Avoid ABSD Now Illegal?

Editor's Pick I Visited Freehold Terraces, Semi-Ds, and Detached Homes in the East Ranging from $2.5 Million to $11 Million

Singapore Property News How Condo Buying In Singapore Became A Game Of Luck

Editor's Pick Springleaf Residence Launches From $878K — Is This 941-Unit Mega Development Worth It?