Are Executive Condos Getting Too Expensive Compared To Private Condos In 2024?

December 17, 2024

Most of us understand that Executive Condominiums (ECs) should be cheaper than private condos; but the question is how much cheaper. There’s been a lot of grumbling that ECs are getting too expensive these days and that buyers may as well get private homes at this rate. It’s not a new complaint either, as we heard the same thing about Piermont Grand, which was seen by some as a dire omen – back in 2019, people decried the pricing as being absurd for the Sumang Walk location. Have ECs really risen so much in price though, that they’re nearing their private counterparts? We compared the two to see how things are faring:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Condo versus EC price gaps by unit size

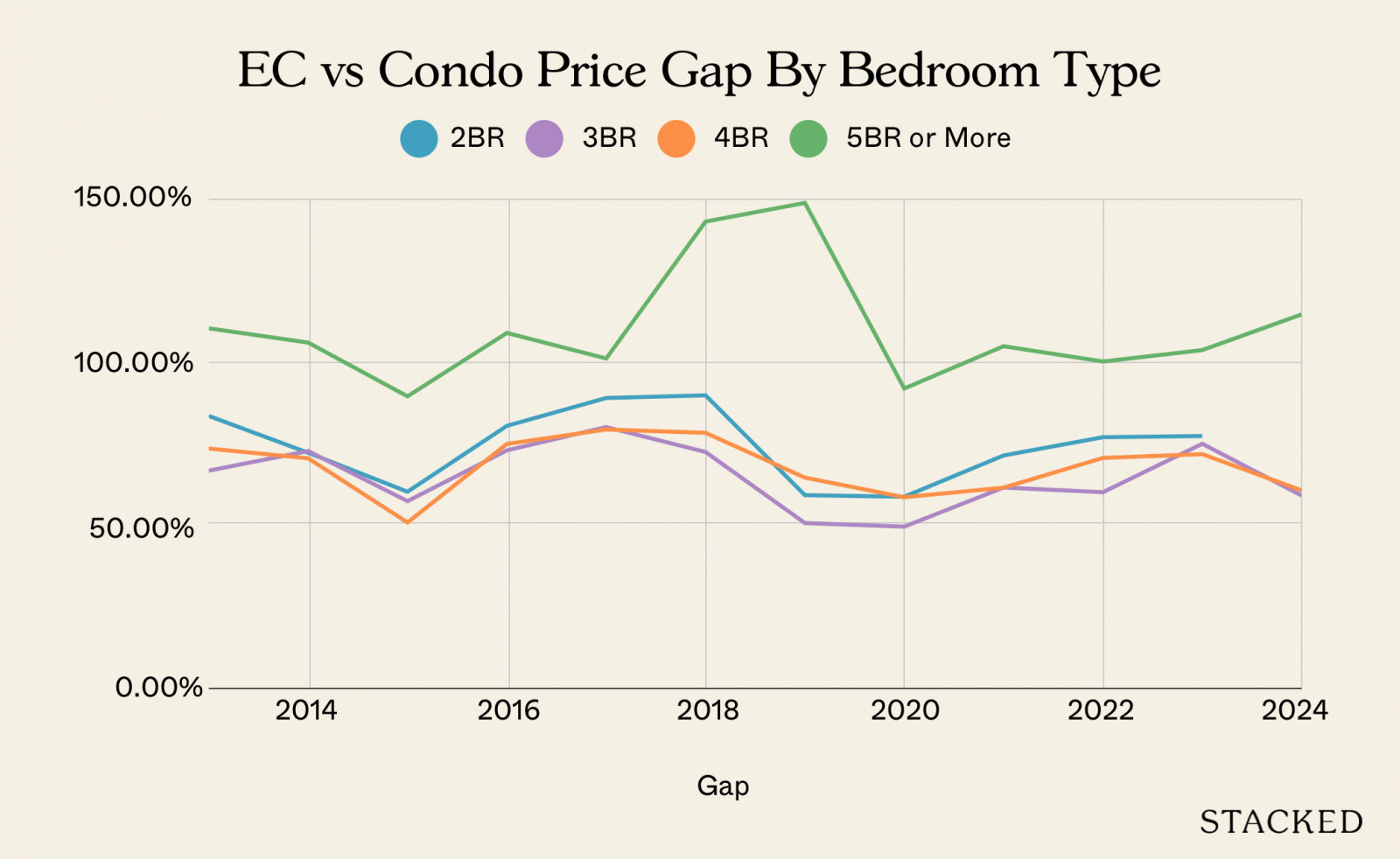

First, we compared the price gap (using new ECs) by looking at unit sizes (two-bedders, three-bedders, and so forth) over a 10-year period, going back to 2014.

Note that we only used new sale transactions here; our aim is to see if ECs, in their original sandwich-class housing nature, are getting too close to fully blown condo prices:

The immediate result that stands out is for the largest unit size: the five-bedders. With the exception of 2020, the price gap between a (new) five-bedder EC and a private condo has never dropped below 100 per cent, and the gap is a notable 114.75 per cent so far this year.

Realtors attributed this to the lack of eligibility requirements in private properties. There’s no income ceiling or Mortgage Servicing Ratio (MSR) for example, so there’s no limit on how high a penthouse or premium unit can be priced. For new ECs though, eligibility restrictions impose natural price constraints, even on the biggest and most luxurious units.

Other than the largest units, though, the price gap seems to have remained mostly at 60 to 70+ per cent across the years. However, do note that the price gap for three and four-bedroom apartments in 2024 has been lower compared to the last three years.

Looking at the price gaps based on different districts

Next, we looked at the price gap between new ECs and private condos in different districts:

District 18

| Year | Condominium | Executive Condominium | Gap |

| 2013 | $965 | $788 | 23% |

| 2014 | $1,002 | $805 | 24% |

| 2015 | $1,005 | $787 | 28% |

| 2016 | $1,024 | $784 | 31% |

| 2017 | $1,035 | No Data | |

| 2018 | $1,317 | No Data | |

| 2019 | $1,310 | No Data | |

| 2020 | $1,350 | No Data | |

| 2021 | $1,477 | $1,174 | 26% |

| 2022 | $1,716 | $1,373 | 25% |

| 2023 | $1,829 | $1,394 | 31% |

| 2024 | $1,789 | $1,541 | 16% |

More from Stacked

Why Old ECs Now Make More Sense Than Million-Dollar Flats

In 2025, we’re seeing flats transact at prices that, back in 2010, could have bought you a full-blown private condo.…

District 19

| Year | Condominium | Executive Condominium | Gap |

| 2013 | $1,166 | $758 | 54.0% |

| 2014 | $1,218 | $803 | 51.6% |

| 2015 | $1,236 | $793 | 55.8% |

| 2016 | $1,339 | $778 | 72.0% |

| 2017 | $1,337 | $832 | 60.7% |

| 2018 | $1,384 | $976 | 41.9% |

| 2019 | $1,479 | $1,096 | 34.9% |

| 2020 | $1,545 | $1,126 | 37.2% |

| 2021 | $1,654 | $1,155 | 43.2% |

| 2022 | $1,892 | $1,256 | 50.7% |

| 2023 | $2,042 | $1,351 | 51.1% |

| 2024 | $2,042 | No Data |

District 23

| Year | Condominium | Executive Condominium | Gap |

| 2013 | $1,260 | $743 | 70% |

| 2014 | $1,265 | $800 | 58% |

| 2015 | $1,197 | $787 | 52% |

| 2016 | $1,230 | $773 | 59% |

| 2017 | $1,272 | $792 | 61% |

| 2018 | $1,452 | $859 | 69% |

| 2019 | $1,508 | $918 | 64% |

| 2020 | $1,528 | $989 | 54% |

| 2021 | $1,643 | No Data | |

| 2022 | $1,674 | No Data | |

| 2023 | $2,025 | $1,475 | 37% |

| 2024 | $2,060 | $1,512 | 36% |

Unfortunately, there aren’t any conclusive patterns, as it comes down to the specifics of each Executive Condominium as it’s launched. We can see, however, that Districts 18 and 23 may have pricier ECs, with regard to the price gap versus the area’s condos.

This is likely to persist in the near future with District 18, as Aurelle of Tampines is coming up soon (probably within Q1 of the coming year). This will be one of the rare ECs that’s close to an MRT station (Tampines North), and judging from the price of the land, this would mean a higher price point. There’s yet another EC parcel – Tampines Street 95 – which could speculatively be launched in 2026. This was bought at a record $768 psf ppr, which could mean a price of between $1,500 and $1,750 psf when launched.

Meanwhile, in District 23, a narrowing of the prices could be due to Lumina Grand, which we covered in detail here. This was priced at an average $1,464 psf at launch, and is currently 87 per cent sold at the time of writing. Altura is also a notable recent presence in District 23, managing around $1,375 psf (currently 98 per cent sold); so the area’s been quite active for ECs of late.

Overall though, the pricing of ECs – relative to private counterparts – has been reasonably consistent

Again excluding the biggest and more premium units, there’s generally been a healthy price distance between ECs and private condos (specific to new sale transactions for ECs).

There were some worries about this in 2019 when Piermont Grand had an unpalatable price tag for its Sumang Walk location. Then we saw it again in 2020 when Ola kicked off one of the first “luxury EC” concepts. But perhaps the term luxury EC has been used a little too liberally; whilst they have gotten pricier, it’s not a price gap we haven’t seen before (check out 2018 above).

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are executive condos becoming as expensive as private condos in 2024?

Why are some executive condos in certain districts more expensive compared to private condos?

Has the price difference between executive condos and private condos decreased recently?

What factors contribute to the higher prices of private condos compared to ECs?

Are luxury executive condos becoming more common or expensive?

What is the future outlook for executive condo prices in specific districts?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

0 Comments