Here’s Why You Should Consult An Architect Before Buying A Landed Home (Don’t Make This Same $18m Mistake)

January 8, 2024

Sometimes, not being seen as a property expert is an advantage

In a recent case, a buyer’s attempt to sue a real estate agency over an $18.6 million Good Class Bungalow (GCB) didn’t go well. The issue? A drainage reserve of 278.8 sq. ft. on the property, which couldn’t be redeveloped.

(Drainage reserve is part of the land that you can’t build on, in case the government needs to build a drain there)

The buyers contended that the marketing brochure for the bungalow didn’t reflect this drainage reserve. Fast forward to the conclusion: the attempt to sue failed because the buyer’s father is the founder of a boutique property development firm. As such, it was decided that with their experience in real estate, they would have known redevelopment layouts can change, and that not the entire land area could be redeveloped.

Also, outside of the legal system and in the public eye, there’s probably a whole “they can afford a GCB, they don’t need sympathy” thing going on.

But honestly, I’ve been involved in real estate for a while, and I can’t say that this is exactly on them. I understand about redevelopment limits and land parcels and such; but I wouldn’t have guessed that the drainage area is as much as 278.8 sq. ft.; and if it is that much, I would frankly expect it to be indicated in the sales materials.

Regardless given how everything has played out, this is one big reason why getting your architect to go along with you before purchasing any landed home for redevelopment is important. Besides details such as this, you may have a better idea of if the piece of land is suitable for what you have in mind.

Speaking of wealthy people with GCBs…

Someone might be looking to slaughter, or at least violently poke, one of the sacred cows in Singapore: our devotion to creating a low tax environment.

Here’s an interesting question: ABSD aside, would we see some kind of inheritance tax in Singapore soon? This might be the thing that finally does what countless rounds of cooling measures have failed to do: kill off some of the enthusiasm for real estate.

It may also be interesting to see if the Singaporean love for freehold status remains intact. If inheritance taxes on property are high enough, perhaps more Singaporeans will be happy to settle for leasehold properties (even older ones that last only for their lifetime), and just leave other forms of inheritance to their children. Perhaps there’s a psychological answer to the “99-year timebomb” in that.

In any case, the debate also remains if an inheritance tax (as part of a broader wealth tax) would really be that effective in balancing the inequality in wealth. Some have argued that wealth transfers should be taxed more heavily than income tax, because these recipients are viewed as “better off” and they don’t have opportunity costs to give up to inherit that wealth.

More from Stacked

How Does Normanton Park’s Former “No-sale License” Matter To Buyers?

Normanton Park is shaping up to be one of the hot launches of 2021. It’s close to the One-North tech…

But with more countries that have given up wealth taxes than kept them (the recent case of Norway pushing out their billionaires because of a new wealth tax is one), there are clear issues too. Besides pushing the rich out (and their money) it’s expensive to administer, it’s “not fair” on those who have assets but are cash poor, and there’s much to be said about how not much revenue is really raised at the end of it.

Meanwhile, in other property news…

- A friend of mine bought a home recently, but some people have chided him for buying ”so late.” Seriously? Why do we act like everyone has to buy by 35? Here’s how he felt buying his first flat in his mid-forties.

- What’s likely to happen to the property market in 2024? Here’s our take.

- When was the actual best time to buy property in Singapore? Check out the prices over time.

- We look at a case study with buyers choosing The Continuum; here’s a good look at how to pick your next home.

Weekly Sales Roundup (25 December – 31 December)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WATTEN HOUSE | $14,157,000 | 4080 | $3,462 | FH |

| MIDTOWN MODERN | $4,353,000 | 1464 | $2,974 | 99 yrs (2019) |

| THE RESERVE RESIDENCES | $4,333,696 | 1625 | $2,666 | 99 yrs (2021) |

| THE LANDMARK | $3,314,880 | 1141 | $2,905 | 99 yrs (2020) |

| THE REEF AT KING’S DOCK | $3,240,040 | 1249 | $2,595 | 99 yrs (2021) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE ARDEN | $1,315,000 | 721 | $1,823 | 99 yrs (2023) |

| PICCADILLY GRAND | $1,395,000 | 624 | $2,234 | 99 yrs (2021) |

| THE LAKEGARDEN RESIDENCES | $1,419,900 | 678 | $2,094 | 99 yrs (2023) |

| THE LANDMARK | $1,436,608 | 495 | $2,901 | 99 yrs (2020) |

| PULLMAN RESIDENCES NEWTON | $1,598,000 | 463 | $3,453 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| FOUR SEASONS PARK | $12,500,000 | 3821 | $3,271 | FH |

| D’LEEDON | $7,888,888 | 4252 | $1,855 | 99 yrs (2010) |

| ST REGIS RESIDENCES SINGAPORE | $7,200,000 | 2756 | $2,613 | 999 yrs (1995) |

| THE ORANGE GROVE | $5,100,000 | 2336 | $2,183 | FH |

| BOTANIKA | $4,850,000 | 2260 | $2,146 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| EUHABITAT | $770,000 | 538 | $1,431 | 99 yrs (2010) |

| ALEXIS | $820,000 | 527 | $1,555 | FH |

| BELLA CASITA | $820,000 | 463 | $1,772 | FH |

| EIGHT RIVERSUITES | $845,000 | 441 | $1,915 | 99 yrs (2011) |

| GUILLEMARD SUITES | $845,000 | 603 | $1,402 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE MARBELLA | $3,638,000 | 1582 | $2,299 | $2,478,000 | 19 Years |

| THE ATRIA AT MEYER | $3,180,000 | 1475 | $2,156 | $2,250,000 | 19 Years |

| THE STERLING | $3,160,000 | 1518 | $2,082 | $1,903,200 | 23 Years |

| THE CENTREPOINT | $2,450,000 | 1119 | $2,189 | $1,720,000 | 22 Years |

| JERVOIS LODGE | $2,400,000 | 1216 | $1,973 | $1,140,000 | 14 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| OUE TWIN PEAKS | $2,310,000 | 1055 | $2,190 | -$525,840 | 7 Years |

| ICON | $1,060,000 | 581 | $1,824 | -$40,000 | 11 Years |

| D’LEEDON | $3,365,000 | 1679 | $2,004 | -$15,000 | 2 Months |

| KATONG REGENCY | $1,128,000 | 570 | $1,977 | $28,990 | 12 Years |

| CLEMENTIWOODS CONDOMINIUM | $850,000 | 592 | $1,436 | $50,000 | 11 Years |

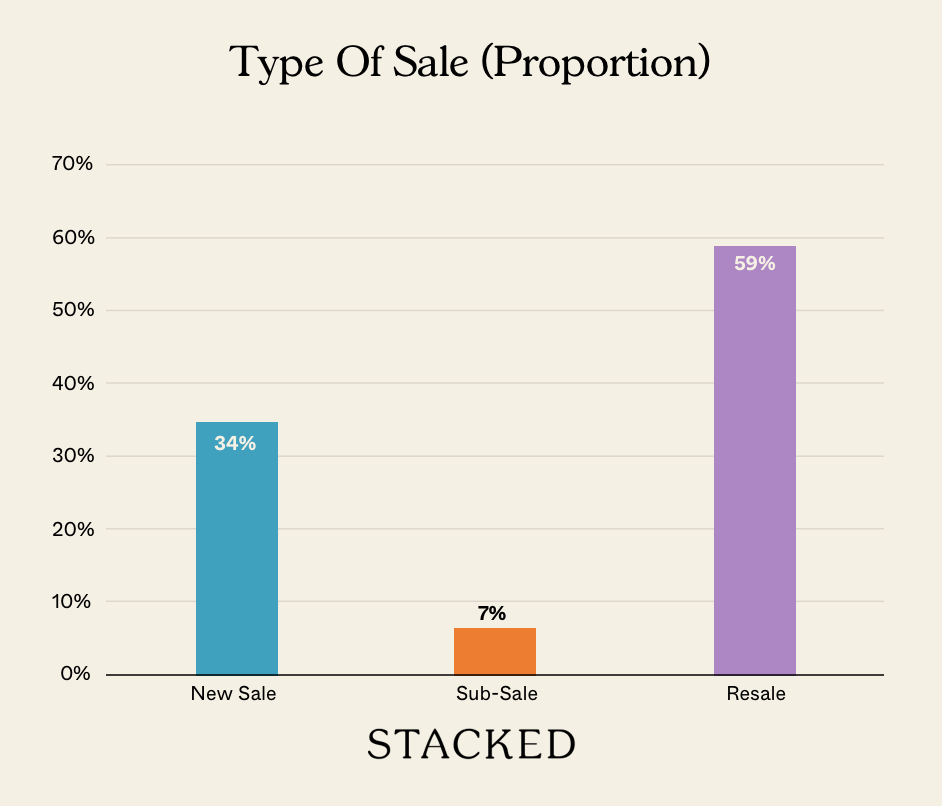

Transaction Breakdown

Follow us on Stacked for more news on the Singapore property market, and in-depth project reviews.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why should I consult an architect before buying a landed home?

What was the issue in the case of the $18.6 million bungalow?

How can drainage reserves affect property redevelopment?

Is it common for buyers to overlook details like drainage reserves when purchasing land?

Could understanding land details influence the decision to buy a property?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments