6 Super Useful Tips To Spot An “Undervalued” Property In 2021

July 10, 2021

2021 is a bit of a conundrum, to investors and homeowners alike. While home prices are rising across the board, it’s a little painful not to take advantage of super-low interest rates; or face the prospect of prices going even higher if you wait. Even in the current high-priced environment, however, there are ways to spot an “undervalued” property in the Singapore private property market. Here’s a checklist relevant to 2021:

- Examine saturated areas first

- Work out the new launch / resale price gap

- “Worst house in the best area” strategy

- Don’t ignore new launches just because it’s a later sales phase

- For HDB properties, dodge the five-year mark

- Check out older listings, including rental listings

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

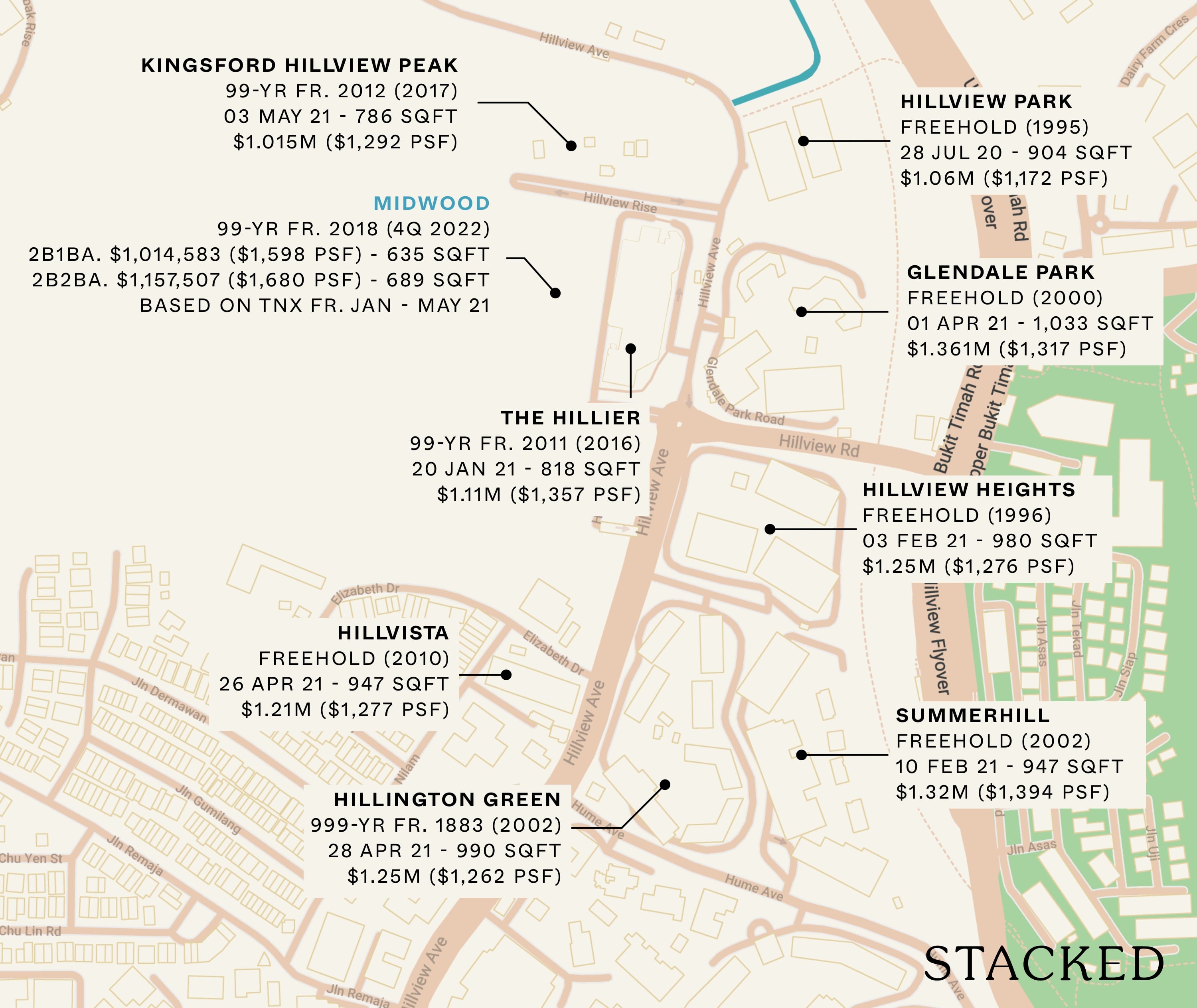

1. Examine saturated areas first

Prices tend to dip when there is a lot of supply, within a given area. This is, for example, currently the case in Holland Village, where we’ve had seven new launches in a short time.

Pick out spots where you find multiple residential properties, of different ages, within a one-kilometre radius. This won’t be detailed enough to make any final decisions, but it gives you a point from which to start.

Take, for instance, the packed area around Tanah Merah MRT station. Within 1,000 metres, you can find the following:

| Development | Average Price | Lease | TOP Date |

| Urban Vista | $1,343 | 99-years | 2016 |

| Grandeur Park Residences | $1,562 | 99-years | 2021 |

| The Tanamera | $904 | 99-years | 1994 |

| Optima @ Tanah Merah | $1,216 | 99-years | 2012 |

| East Meadows | $974 | 99-years | 2001 |

| The Glades | $1,453 | 99-years | 2017 |

As all of the above are in the same general area, there will not be a huge disparity in quality of location (barring a longer or shorter walk to the MRT). However, we can already see some interesting developments to focus on.

Grandeur Park Residences, which is four years newer than Urban Vista, comparatively isn’t priced all that much higher than The Glades.

If we’re willing to settle for older properties, we can see that East Meadows is priced only about 7.7 per cent higher than the Tanamera, although it’s newer by seven years.

From here, you can take a closer look at the properties, to note the discrepancies. For example, Grandeur Park Residences is bigger and much more crowded than Urban Vista, with 722 to 582 units; so you will be in a squeeze with more people.

The Tanamera is only 500 metres (seven minutes’ walk) to the MRT station, whereas East Meadows is further at 700 metres (eight minutes’ walk).

You can decide later if these discrepancies justify – or don’t justify – price differences.

These sorts of comparisons are tougher in areas with only a handful of developments (e.g. only J Gateway and Ivory Heights are within one kilometre of Jurong East MRT; and there’s no real comparison to make for value).

It’s best to use a tool like Street Directory as you are able to really hone in on developments that might have otherwise gone under the radar. While most people would default to Google Maps, we find that it isn’t as comprehensive in showing you the developments (and upcoming MRT stations as well).

2. Identify the new launch / resale price gap

We have a more detailed explanation of this in an earlier article. Without repeating too much of it here, the idea is to identify the price gap between a new launch and resale property in the same area (somewhat related to point 1).

Here are 3 simple steps:

- Find a resale condo with a number of new launches around it

- Look at the price gap between the new launch and resale

- If it’s a big enough gap (for that district), then it’s worth taking a closer look

The resale property that shows the biggest price gap often represents the best overall value, as you’re getting in the same location for cheaper. Do see the above link for a more detailed breakdown.

3. “Worst house in the best area” strategy

This is old real estate advice, and works best if applied in moderation.

This argument is that – if you look for a stigmatised or run-down property in a desirable location (e.g., an old flat in Bishan, or Peace Mansion in Dhoby Ghaut) – you are most likely to find an undervalued property.

There is a kernel of truth to this, such as in the aforementioned Peace Mansion. This is a condo that’s one of the oldest in the Dhoby Ghaut area (in fact, one of the oldest in Singapore, with a completion date in 1976). Here’s how it compares in price to nearby properties:

| Development | Average Price | Lease | TOP Date |

| Peace Mansion | $583.25 | 99-years | 1976 |

| Sophia Residence | $1,557 | Freehold | 2014 |

| Liv on Sophia | $72,427.87 | 99-years | 2018 |

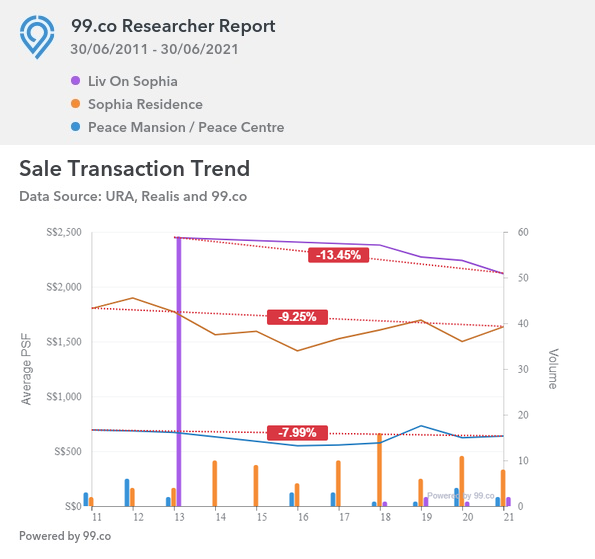

Peace Mansion is in worse shape, as you would expect than Sophia Residence and Liv on Sophia. But take a look at how its prices have moved in comparison:

On a 10-year basis, Peace Mansion has held off depreciation far better than its newer counterparts, even the freehold Sophia Residence. Prices have fallen by about eight per cent, whereas Sophia Residence has seen a drop of 9.25 per cent, and Liv on Sophia (completed quite recently in 2018) has seen a drop of 13.45 per cent.

Buyers of Peace Mansion in 2016 would have spent far less, and taken a smaller hit, than buyers of the neighbouring units; and given Peace Mansion’s gross rental yield of 3.54 per cent (2.78 per cent for Sophia Residence and 2.63 per cent for Liv on Sophia), a landlord might consider a Peace Mansion purchase to be a win.

However, be careful not to oversimplify this approach

It is not always true that the “worst” property in a neighbourhood is a value buy. A degree of common sense has to apply.

For example, Geylang is a high-demand neighbourhood that’s a 10-minute drive to the city. This does not mean a run-down, landed property in the red-light area is “undervalued”. The house would be almost impossible to resell, there would be no financing, etc.

You should always compare price movements to surrounding properties (as we have above). Just because a home is older and in a better location, doesn’t necessarily mean it will be undervalued. There’s just a better chance that it will be, compared to a new launch or a better maintained home nearby.

You also need to factor in restoration costs, for older properties. This may effectively remove any discount.

4. Don’t ignore new launches just because it’s a later sales phase

It’s generally true that, the earlier you buy, the cheaper a property will be. However, there are exceptions to this.

As we show in regular updates, there are instances where new launches have actually become cheaper rather than more expensive. Some buyers may be surprised to learn, for example, that even developments like Marina One Residences actually saw developer prices dip in later sales ($2,400 to $2,340 psf).

New launches sometimes even have fire sales on the last few units; such as we saw with 38 Jervois last year. This is quite rare though, and often due to factors like developers rushing to meet their five-year ABSD deadline.

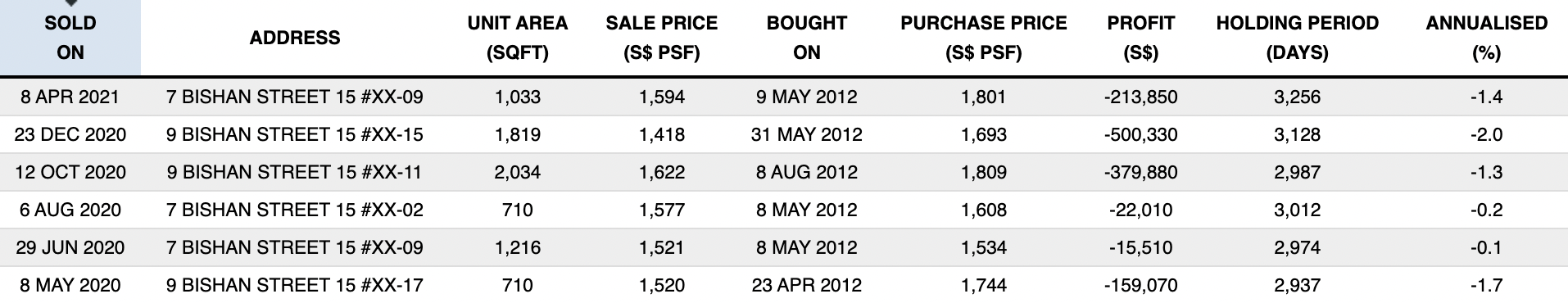

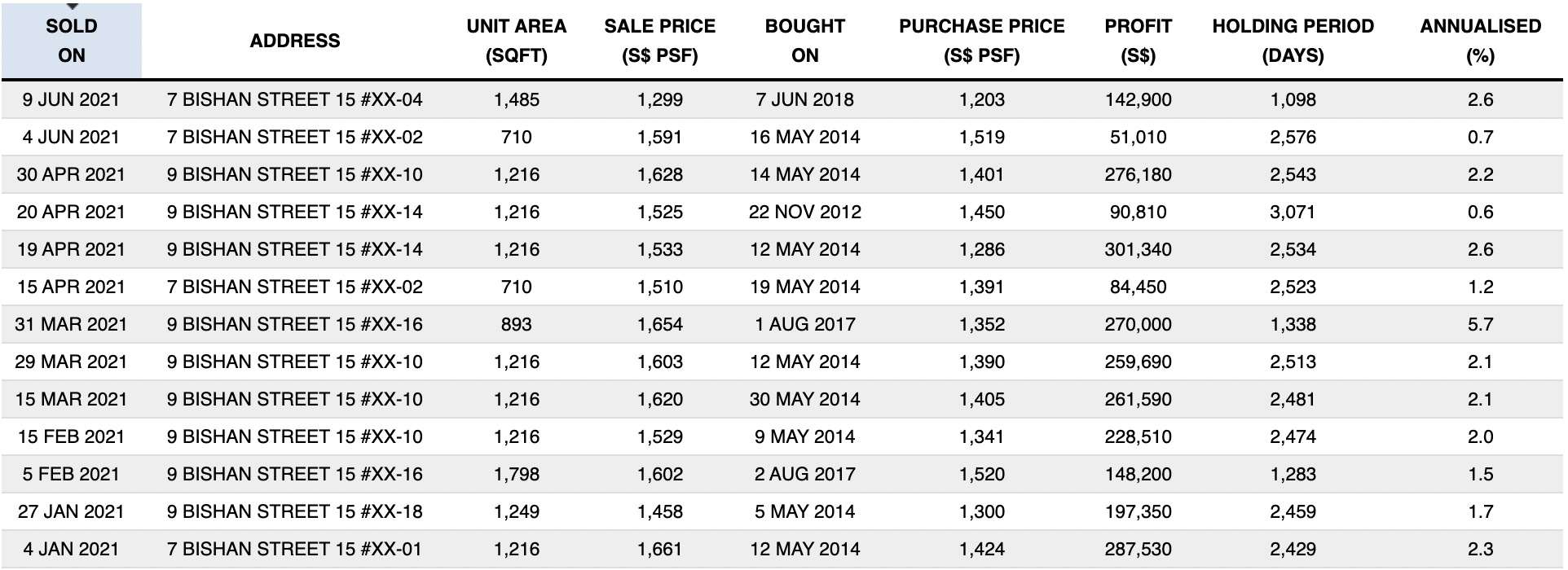

So instead of the early buyers making a profit, it would be the later buyers that would stand to gain. An example of this would be at Sky Habitat.

All those who bought in 2012 during the first few months of launch..

As compared to most who bought during the price drops in 2014. While obviously 2021 is a great time to exit, the lower purchase price does give you that buffer to play with.

5. For HDB properties, dodge the five-year mark

For reasons we’ve explained in this article, five-year old HDB flats are a perennial favourite. Because they’re already completed, new home buyers don’t need to wait for construction time.

Property Market CommentaryResale HDB: Are 5 year old HDB flats the best option for first time buyers?

by Sean GohThe eventual time to upgrade is also shorter, as the Minimum Occupancy Period (MOP) starts from the key collection and not purchase (a BTO flat might mean waiting eight to nine years to upgrade, after taking into account construction).

The lease decay is also negligible, at this stage.

Sellers of five-year old flats tend to be (1) aware of all the above (2) are often aiming for an upgrade. This prompts them to ask for higher prices, and the odds of getting an undervalued flat from them are slim to none.

The same applies to Executive Condominiums (ECs) that have just reached their five-year MOP. In fact, ECs are expected to see their biggest price surge after five years, as they’re also half-way to full privatisation.

As such, you’re least likely to spot an undervalued property in this age range; and you’re better off researching older units.

6. Check out older listings, including rental listings

If you already have a particular development in mind, do check out listings that have been around for a while. Most sellers have a given time frame in which to sell their property; as they near the time limit, they may become more amenable to negotiation.

It’s common for realtors to advise their clients to drop the price, if no one responds after about three months.

Note that home buyers should check rental listings as well. Sometimes, if a unit has been vacant for some time, the landlord might be ready to dispose of it for less.

While none of these methods guarantees you’ll find an undervalued property, they provide a good place to start looking

You may need to make regular checks for the above. Finding an undervalued property is a time-consuming activity; but we advise homeowners and investors to do it if they can. The reason is that – even if you don’t end up finding a missed gem – the process will familiarise you with existing developments and prices.

This knowledge could even help with the sale of your existing home if you’re in the process of upgrading. For more in-depth looks at specific developments, follow us on Stacked. We’ll keep you up to date on the latest trends and movements in the Singapore private property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

0 Comments