6 Must-Know Property Shifts Reshaping Singapore’s Market In 2025

January 9, 2025

Earlier in 2024, we were expecting a more subdued property market for 2025. At the time, it seemed the housing shortage had been resolved, and prices were losing momentum. But the tail end of 2024 created some surprises, with a surge of interested buyers as home loan interest rates fell. On top of that, HDB resale flats maintained their upward momentum for much longer than anticipated. Here are the key changes we now see, heading into 2025:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Key factors to watch out for in 2025:

- 1. A possible resurgence in the CCR, after 2023 cooling measures

- 2. Uncertainty over home loan interest rates

- 3. Rising concerns over prices in the resale flat market

- 4. Continued concerns over replacement property costs

- 5. Potential confusion over post-GFA harmonisation sizes

- 6. Larger unit sizes costing more

1. A possible resurgence in the CCR, after recent cooling measures

The CCR bore the brunt of the 2023 cooling measures. At the time, ABSD rates for foreigners were doubled from 30 per cent to 60 per cent. This had an outsized impact on the CCR, where affluent foreigners are more likely to purchase their residences. As we explained in our 2024 year-end review, this caused OCR and RCR condos to outpace their prime region counterparts, in terms of appreciation.

However, we note that 2025 is likely to have strong offerings in the CCR. The Collective @ One Sophia (formerly Peace Centre/Peace Mansions) got the ball rolling; but in 2025 we’ll also see Marina View. This will be the second luxury residential condo + hotel we’ll see in Singapore, next to the former Pullman Residences. Likewise, we’re expecting a new launch condo with around 680 units, on the Holland Drive GLS site, and Robertson Walk is set to become a mixed-use project with 348 units.

As we’ve mentioned a few times in the past, the cooling measures have narrowed the price gap somewhat, between the CCR and RCR. Given the combination of strong offerings and potentially lower interest rates (see below), we believe some buyers will sense an opportunity. This could offer some upgraders a shot at bridging the gap between an RCR and CCR condo in 2025, especially without affluent foreigners to compete with them.

If the upcoming launches are not priced too far from their RCR counterparts, we might see a local-led resurgence in the CCR.

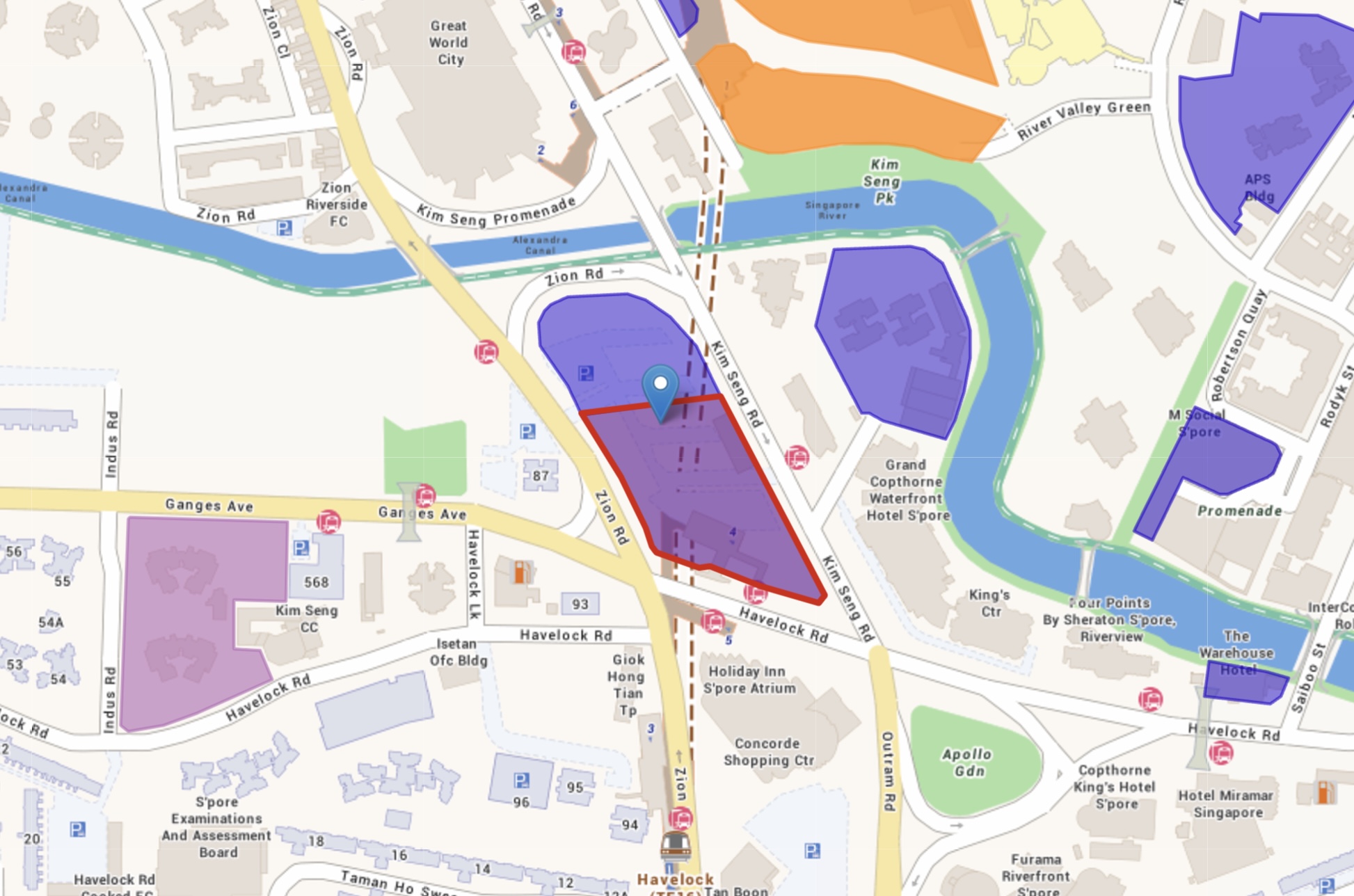

On a related note, CDL and Mitsui Fudosan obtained a $1.107 billion site in the Zion Road area; this is in District 10 and within the CCR. The plot is around 164,439 sq. ft., bringing the price to about $1,202 psf. For those keeping track, this is at a price lower than what the recently launched Orie was at. This site saw low demand because of the government’s insistence on a new model of long-stay service apartments, which have to be included in the development. So the expected development will be a mixed-use project, with a retail podium, 740 residential units, and 290 of the long stay rental units.

As this new long-stay rental model has yet to be tested, we expect a lot of attention will be on this project to see how well it fares. Done right, this could also be a boon to the recently diminished CCR.

Another CCR land parcel, also requiring the long-stay service units, was taken by Wing Tai Holdings. This also saw low demand for the same reason: no one seemed eager to be the guinea pig for the new service apartment model. But Wing Tai snagged the Rivery Valley Green land parcel at $464 million (about $1,325 psf), which is expected to yield about 380 private homes. As with the Zion Road plot, there’s going to be lots of interested observers over the market reception.

As a side note, Aurea is an almost-Prime property to keep an eye on

Aurea is a redevelopment of the legendary Golden Mile Complex, which should be up sometime in 2025. Aurea is not technically in the CCR, as it’s in District 7 (RCR). But the Ophir-Rochor Corridor may well see the centre of gravity move from the traditional CBD to this area in the decades to come. For those who want to live close to the CBD, or who want a litmus test of city fringe properties, Aurea will be closely watched.

2. Uncertainty over home loan interest rates

The drop in home loan interest rates was cited as a reason for renewed interest in 2024. However, mortgage brokers were cautious, when we asked if the trend would continue.

Singapore home loan packages that are pegged to the Singapore Overnight Rate Average (SORA) tend to move in tandem with US interest rates. From mid-to-late 2024, as the US seemed to get inflation under control, the US Federal Reserve cut interest rates. This had a knock-on effect on Singapore home loan rates, making mortgages cheaper.

The recent political turmoil in the US, however, has left 2025 looking less certain. There’s a possibility that tariffs imposed by the upcoming US administration could drive up inflation again, which in turn would force the Fed to maintain or even raise interest rates. At the time of writing, it’s expected that 2025 may see only shallow interest rate cuts, possibly just half a percentage point for the year.

How this plays out could have a significant impact on buyer demand, although not all borrowers are equally affected (e.g., borrowers who are using HDB loans are not affected by SORA).

For now, however, borrowers have been rushing to banks to refinance their home loans, as some loans dip below three per cent per annum. This is a reversal from what we saw in 2022/23, when interest rates were rising, and many borrowers rushed to lock in their rates. Now they’re looking to do the opposite (variable home loan rates are cheaper, in an environment where interest rates are set to decline).

3. Rising concerns over prices in the resale flat market

We recently mentioned that a 3-room flat at Bidadari sold for $900,000, and that some flats have reached the $1.5 million mark. We’ve been hearing since 2023 that the uptick in resale flat prices is not sustainable; but as many disgruntled home buyers will tell you, they don’t feel like there’s any slowing down.

For these buyers, we have some bad news for the coming year. The number of flats reaching MOP in 2025 is expected to only be around 7,000 units. This is a stark contrast from the bumper crop of 2020/21 when some 50,000+ flats entered the resale market. This falling number continued with ongoing demand, will make it harder for resale flat prices to dip.

In addition, we note that Plus flats have begun entering the scene. As with Prime flats, Plus housing comes with eligibility restrictions for resale buyers, a 10-year MOP, and a Subsidy Recovery (SR) clawback for the first batch of buyers. As the category isn’t retroactively applied, this could indirectly push up the prices of existing resale flats close to Plus flats, which have the same location but don’t suffer the same drawbacks.

All in all, we find it hard to see the pace slowing for resale flats in 2025 unless something changes; and some buyers may have to resign themselves to the BTO queue. As to where the money’s coming from for these flats, speculatively, the prices of condos may have risen so much, that some buyers have simply resigned themselves to a larger or better-located flat instead.

4. Continued concerns over replacement property costs

In 2024 as with 2025, we believe the challenge facing realtors will be finding sellers, not buyers. This in turn means challenges facing aspiring upgraders. We refer you to these numbers for year-end 2024, where you can see most family-sized (three-bedder) new launch condos now exceed $2.1 million, and resale counterparts can reach $1.6 million to $1.8 million.

Even with the remarkable increase in resale flat prices, it can be quite a stretch for an upgrader with, say, a 4-room flat in a run-of-the-mill location. We have come across owners of even 5-room or executive flats, who feel the $2.1 million+ mark has priced them out of new launches despite years of patient saving.

We expect this to be a drag on the en-bloc scene (besides the fact that GLS sites are being released and are preferred). Fewer people will agree to a collective sale given the price of a replacement property today. Also, those who previously bought on lower or non-existent ABSD, may be unwilling to surrender their second property. If you lose your second property in an en-bloc today, replacing it could come with 20 per cent ABSD, which might rob you of the net gains.

The unwillingness to sell, or the desire to sell for much higher, could in turn drive up prices even more.

5. Potential confusion over post-GFA harmonisation sizes

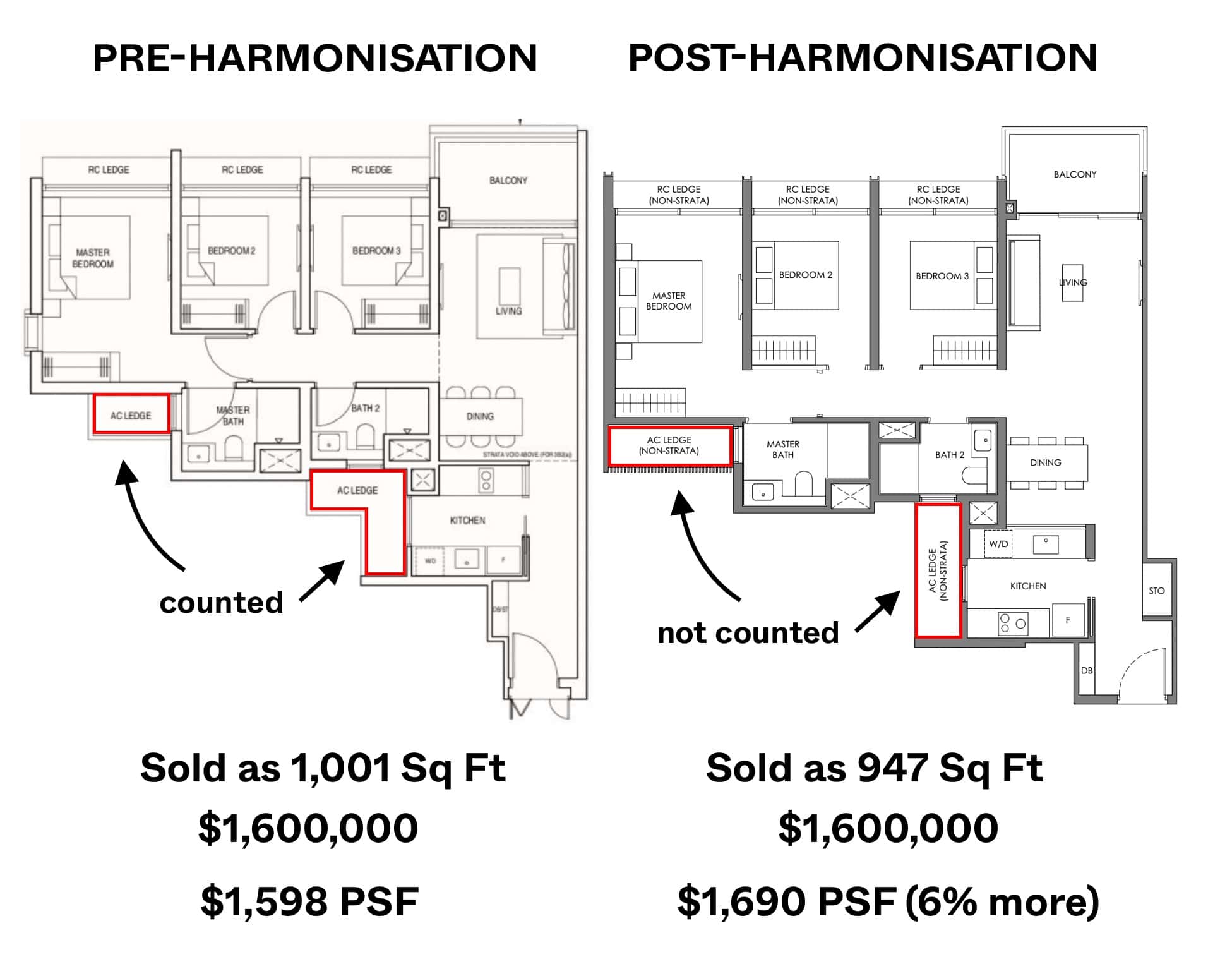

Price Per Square Foot has been used to gauge property prices for decades. So the recent GFA harmonisation exercise (detailed here) has been causing some chaos. The GFA of a unit now excludes unliveable spaces such as air-con ledges, and strata void space. But as the price of the unit hasn’t changed, this results in a higher price psf, which makes units look more expensive than they are.

For example: a unit including its air-con ledges and strata void space is 1,000 sq.ft., and is priced at $2.1 million. This is an apparent price psf of $2,100 psf.

But if we remove the air-con ledges and strata void space, to fit new GFA rules, the unit’s size is reduced to 800 sq. ft. This changes the apparent price to $2,625 psf, although the total price ($2.1 million) is still the same, as is the unit’s size (only the non-liveable spaces have been cut out).

This leads to the perception that newer condo units are much smaller and pricier than they really are. It’s also led to some confusion when comparing post-GFA harmonisation condos with older resale counterparts, which may still have their GFA measured according to the old rules. It will take some time for the message to sink in, and it could impact perceived prices this coming year.

6. Larger unit sizes costing more

This was something we highlighted in late 2024, but a trend that we will no doubt continue to see more of: bigger units costing more in terms of psf.

In short, we’ve been seeing lately that in new launches like Sora, the bigger bedroom types (like 3-bedders) cost more in $psf than the smaller 1 and 2-bedders.

Here’s a snapshot of the indicative prices at launch: 2 Bedroom units (646 sq ft onwards) start from $1.3 million ($2,012 psf), 3 Bedroom units (936 sq ft) from $2 million ($2,136 psf) and 4 Bedroom units (1,528 sq ft) from $3.05 million ($1,996 psf).

This is a trend that has played on since the pandemic, where there was increased demand for larger homes (also another reason why older HDB flats like maisonettes have higher prices). Developers have started to price that demand accordingly even in new launches, and there may be a greater focus on family-sized units in 2025. We can even see that trend in terms of facilities, where new launches like Nava Grove have facilities like an indoor kids play area – something that seems to be getting more popular in recent developments.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What property market changes are expected in Singapore in 2025?

Will the Singapore property market see a revival in the CCR in 2025?

How might home loan interest rates affect property buying in Singapore in 2025?

Are resale flat prices in Singapore expected to continue rising in 2025?

What is the impact of post-GFA harmonisation on property prices in Singapore?

Why are larger units in Singapore new launches costing more per square foot?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Singapore Property News Taking Questions: On Resale Levies and Buying Dilemmas

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments