6 Essential Factors To Think About Before Buying Your First Rental Property

September 14, 2022

Some Singaporeans are fortunate enough to have an alternative home; these range from singles who can continue living with parents, to those who whose spouses already own a property. For this advantaged group, it’s possible that their very first mortgage will be for a rental property. Here are some of the things to keep in mind, before making such a move:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Be aware of future HDB ownership restrictions

There are two things to take note of:

First, you can’t buy a private property, and then also buy and own an HDB flat – but you can do it the other way around. For example, if you buy an HDB flat and wait out the five-year Minimum Occupancy Period (MOP), you can then later buy a private property as well, and end up owning both (although you would have to pay ABSD on the private property).

If you want to avoid having to pay ABSD, there is a way around it, which is to use the Single Owner and Essential Occupier scheme. In this way, your spouse can be listed as an essential occupier instead of a co-owner. To qualify for this, you have to list one of the applicants as the single owner, and your spouse/fiance as the essential owner during the flat application.

There are implications to this, which you can read more about here.

For those who want to own both a flat and a private property, this is worth keeping in mind.

Second, if you sell a private property, you need to wait 30 months after disposing of it before you can ballot for a new flat. As such, most people who sell their condo for a flat will end up buying in the resale market, as the wait-times for a new flat are quite impractical.

Resale flats are more expensive and have less remaining lease, which may bother some home buyers.

Make sure you’re aware of these implications, before deciding on private homes for your first property.

2. In an emergency, can the rental property can double as a real home for you?

If for some reason you can’t stay in your current home, can your rental property serve as accommodation?

This is one of the reasons to be wary of very small rental units. A 490 sq. ft. shoebox unit may have a higher gross rental yield, due to the lower costs; but if you end up actually needing a roof over your head, it probably can’t accommodate your family. This is compounded by issues in point 1 (if you can’t get an HDB flat, and you also only own a one-bedder, you may find yourself in quite a jam).

It’s always preferable to pick a rental unit that can also suffice as a home, in the event things go wrong. Pay attention to the location: if your workplace is in Changi, and you pick a rental property in Jurong, this can be a major inconvenience when you’re forced to move into the rental unit.

3. Unless it’s a cash-flow positive property, the experience can be underwhelming

Keep in mind that, for the last few years, most rental properties are not cash-flow positive (although the occasional gem exists). First time landlords, who are also first-time buyers, tend to experience a lot of cognitive dissonance because of this. (That said, the rental rates increases in 2022 has probably been a positive one for many landlords).

There will be times where the rental income suffices to cover the mortgage interest, property tax, and maintenance fees; but it’s unlikely to cover all the costs, and still provide surplus income (unless your loan quantum, and hence monthly repayments, are very small).

This can be emotionally unsatisfying: consider that you’re making payments every month for a property you don’t personally enjoy. A typical example would be living with your parents in their flat, but forking out payments for your condo each month; and then realising that your tenant is enjoying the condo pool, gym, clubhouse, etc.

This is one of the reasons a lot of buyers eventually quit after the first one or two tenants, and just move into the property. But if you had considered there’s a possibility of doing that, you may have picked a very different condo (see point 2).

4. Always know the end game for the rental unit

Is your end goal to move into the rental unit, or to sell it and buy something else?

If it’s the latter, you should work out an exit strategy. Keep in mind the property market has its ups and down swings – there’s no guarantee that, when it comes time to sell and buy your first true home, you’ll be able to sell your rental unit for a good price.

More from Stacked

This New Executive Condo Is Just 5-Minutes From Tampines North MRT: Is Aurelle Of Tampines Worth A Look?

Tampines North is certainly having its moment. Hot on the heels of Parktown Residence, the upcoming launch of Aurelle of…

As such, work with your financial advisor (or whichever expert you trust) to create less optimistic projections. Consider, for instance, the impact of selling at cost: will this result in having to refund your whole CPF usage, and leave you unable to make the down payment on the next property?

If the end game is to move into the rental unit yourself, it’s usually better to buy a larger unit if you can. A three-person family could possibly squeeze into a two-bedder, but anything smaller is probably too uncomfortable.

For reference, a 4-room flat is around 83 to 95 sqm, and is liveable for most Singaporean families. You may want to aim for a unit of around this size. And anyway, a larger unit can cater to family groups as tenants, which is a definite advantage.

Do note that for rental-focused projects (usually ones with small units) it doesn’t necessarily always translate to good capital appreciation. For example, developments like The Tennery, where you can get units rented out easily, but the resale performance has not quite been fantastic. There are multiple reasons to this, of course, but another reason can be that projects geared towards rental will have investors that have lesser staying power.

If they’ve made their money from rent, they are more inclined to let go of their property – even if they have to do so at a loss.

5. Do consider the advantages of living in your rental property

Some aspiring landlords use their first property as both a home, and a rental unit. This is one way to offset some of the costs of home ownership, especially if you’re single – having one or two room mates may mitigate the burden of the entire mortgage.

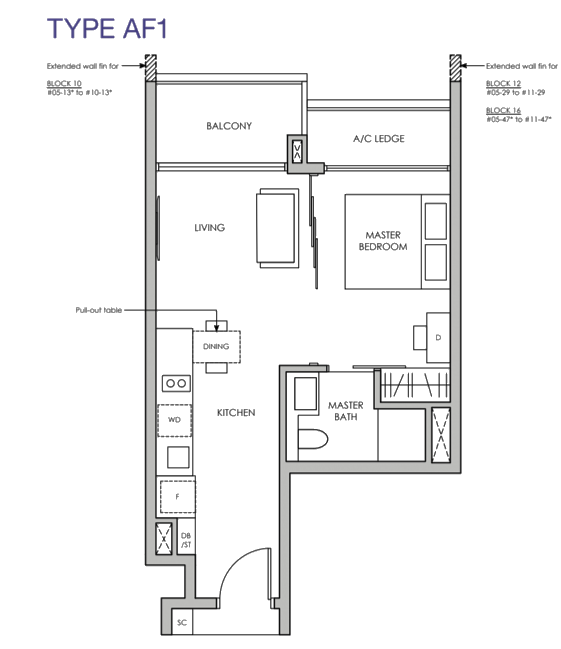

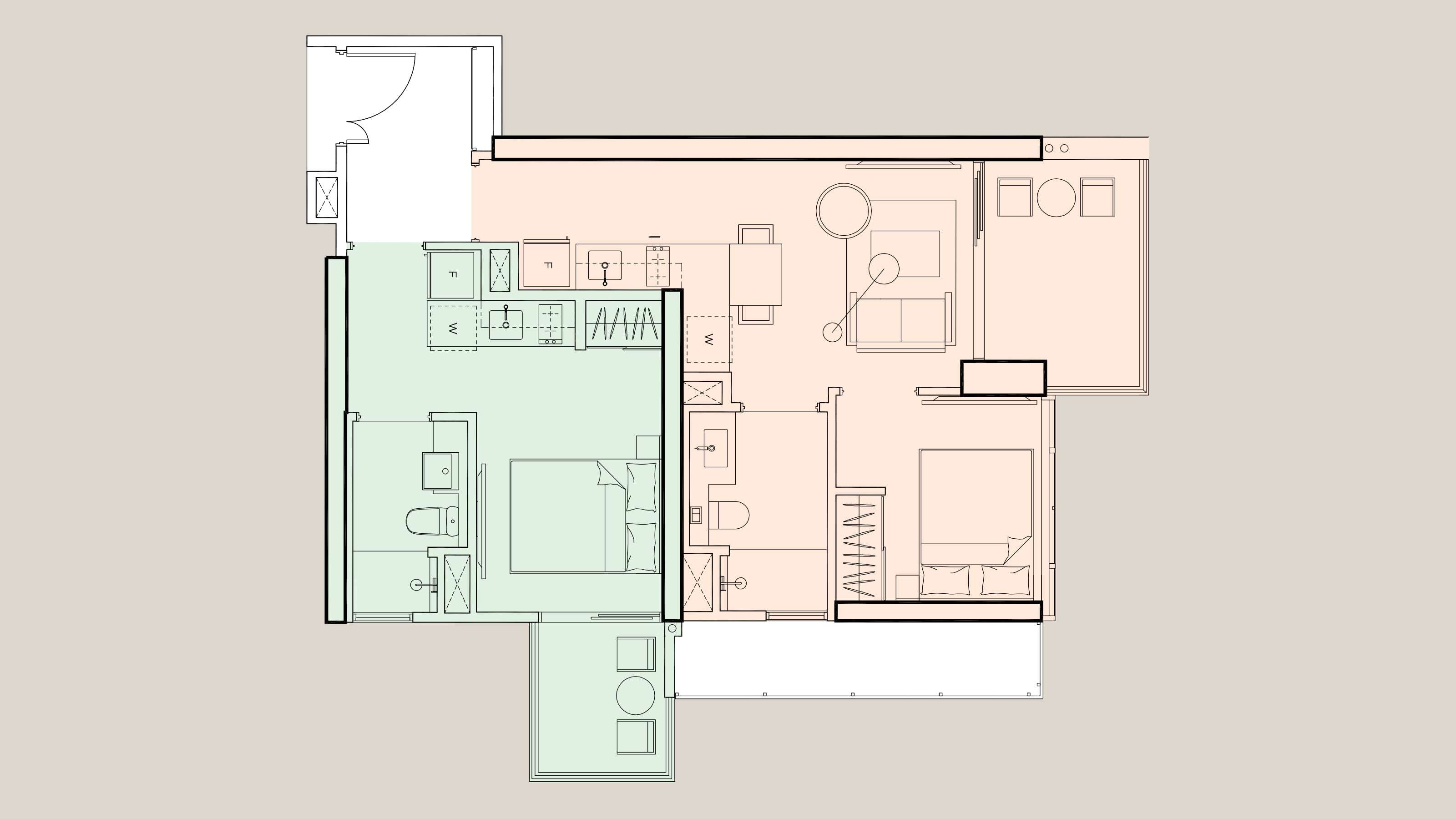

If you’re considering this approach, you may want to focus more on the floor plan. Some unit types, such as dual-key units, are ideal for this kind of arrangement – while they cost a little more, you’ll be able to maintain your privacy from your tenants.

You can also speak to an Interior Designer or contractor early on, to discuss possibilities like additional partitions.

Another advantage to this is that, as a new landlord, you may not fully grasp the ins-and-outs of manging tenants. But by living in the same property, you ensure that no one can wreck the place; and you can see first hand the issue that tenants may face.

This can also feel more satisfying, as you’re able to access facilities like a pool, gym, etc., rather than continuing to stay in your flat.

If it doesn’t work out, or you decide you want more rental income, you can still decide to move out later. So if you’re single, there’s a lot to recommend for this approach.

6. A freehold unit may not necessarily be better

Consider a leasehold rather than freehold unit, if you’re seeking better yields:

All things being even, a freehold property will typically cost around 15 to 20 per cent more than its leasehold equivalent.

On top of that, a tenant doesn’t care if the condo is leasehold or freehold – they’re not going to pay more just because it’s freehold; it’s of no benefit to them.

This means that, in terms of gross rental yield, leasehold tends to fare better than freehold. For example:

Gross rental yield is the (annual rental income)/(cost of property).

For a $1 million leasehold unit, generating $2,800 per month, the yield would be ($33,600) / ($1,000,000) = 3.36%

If we were to get a freehold version of the same unit, at $1.2 million, the yield falls to ($33,600) / ($1.2 million) = 2.8%

However, do keep in mind that this consideration only involves rental yield. If you have other requirements – such as if you want the property to be a long term investment that you’ll resell in 30 years – a freehold condo may still be the preference.

For more on picking a property for home ownership or rental, follow us on Stacked. We’ll also provide you with in-depth reviews of new and resale developments alike, so you can make a more informed decision.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What should I know about owning both an HDB flat and a private property in Singapore?

Can my rental property serve as my main home in an emergency?

Is rental property investment usually profitable in Singapore?

What should I consider about the size of my rental property if I plan to live there?

What are the benefits of living in my rental property as a landlord?

Is a freehold property always better than a leasehold one?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Editor's Pick New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

0 Comments