5 Surprising HDB Estates With Declining Prices In 2023

July 26, 2023

As the dust of the post-Covid phase begins to settle, the narrative surrounding the HDB resale flat market appears to be changing. It is true that prices have surged to unprecedented heights, in part fueled by a growing demand for larger homes, and also due to the BTO supply over the last few years. However, a closer look at recent data suggests a moderating trend in HDB resale prices across various regions in Singapore.

In the second quarter of 2023, resale flat volumes fell by 4.6% year on year, marking the lowest level in three years since Q3 2020. While resale prices did see an uptick of 1.4% from the previous quarter, this growth rate is notably less than the 2022 average quarterly increase of 2.5%. It is evident that the rate of increase in prices is slowing, suggesting a potentially cooling market.

Additionally, price trends varied across different flat sizes and regions, revealing a nuanced market landscape. For instance, median prices of five-room and four-room flats rose by 1.9% and 1.5%, respectively. Conversely, three-room flat prices have seen a dip of 0.5%. According to Christine Sun, Senior Vice-President of Research and Analytics at OrangeTee & Tie, some parts of Singapore have seen more modest price increases, while others have even experienced decreases in certain flat sizes.

As a matter of fact, 2023 has painted a more diverse and complex picture of the market, where select estates across are beginning to show signs of slowing growth and even occasional price drops. This could usher in new considerations for both buyers and sellers in the HDB resale market. Here’s what we’ve found after looking at the data.

Many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

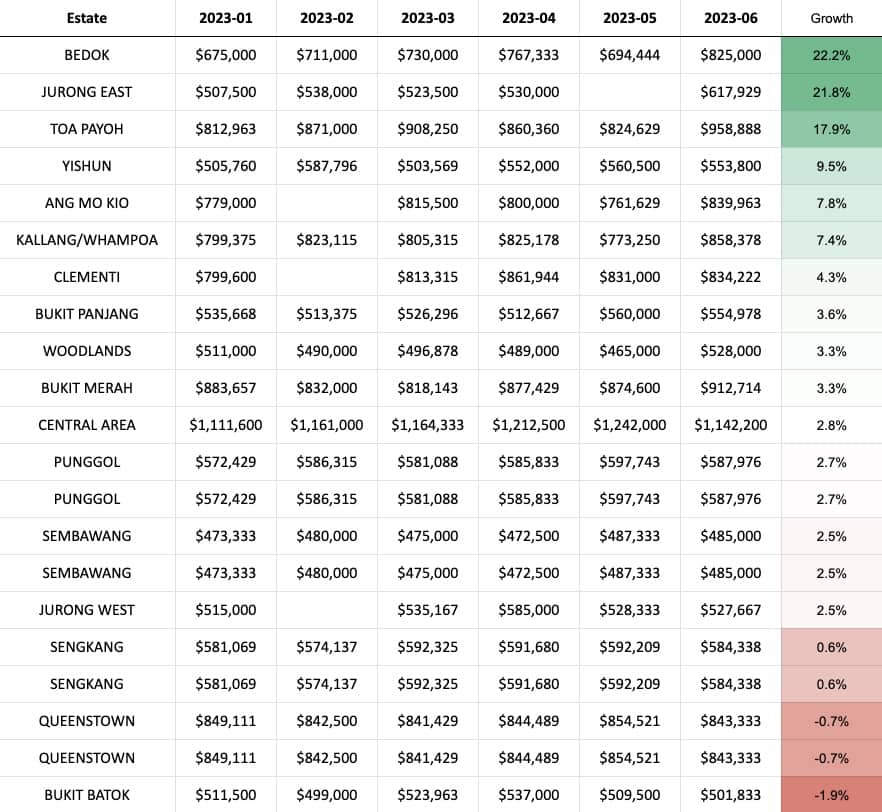

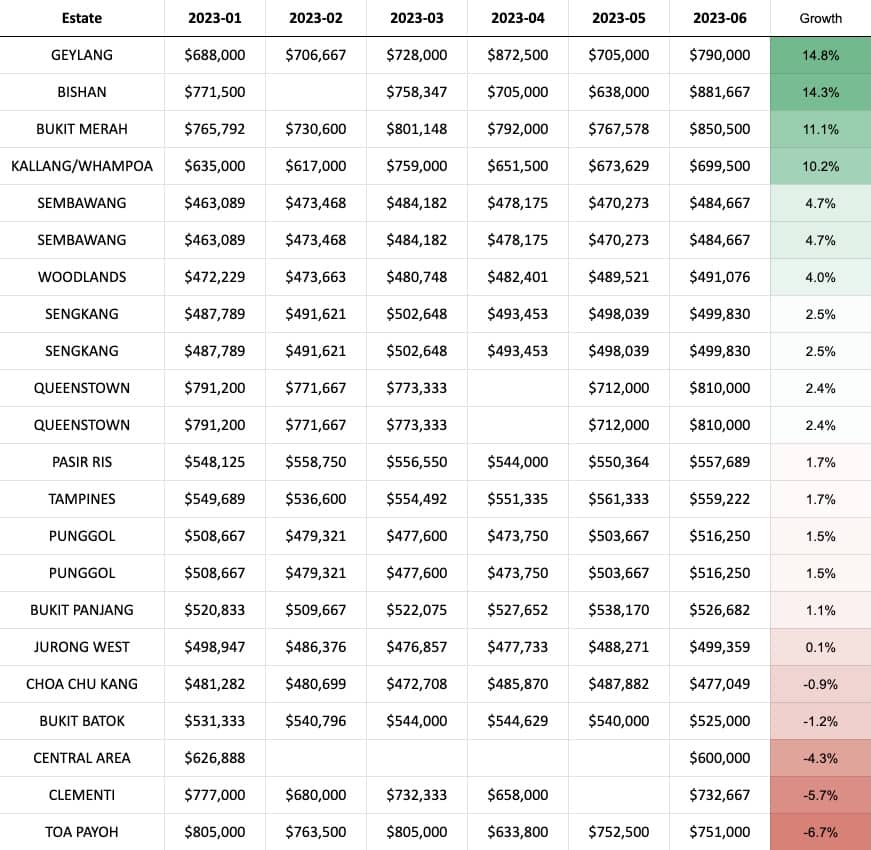

HDB Towns that have seen slower price growth or even price dips:

4-Room Flat

| Estate | 2023-01 | 2023-02 | 2023-03 | 2023-04 | 2023-05 | 2023-06 | Growth |

| GEYLANG | $548,282 | $578,573 | $631,054 | $632,017 | $670,955 | $677,316 | 23.5% |

| JURONG EAST | $473,046 | $472,089 | $477,605 | $475,048 | $492,000 | $535,982 | 13.3% |

| CLEMENTI | $646,642 | $577,668 | $737,471 | $649,056 | $668,520 | $724,717 | 12.1% |

| KALLANG/WHAMPOA | $738,027 | $689,485 | $728,642 | $712,122 | $776,966 | $795,993 | 7.9% |

| TOA PAYOH | $730,841 | $773,702 | $715,391 | $681,113 | $732,189 | $772,913 | 5.8% |

| MARINE PARADE | $534,000 | $635,000 | $570,000 | $592,500 | $549,500 | $560,000 | 4.9% |

| SERANGOON | $575,941 | $638,429 | $602,667 | $613,931 | $564,042 | $601,698 | 4.5% |

| SEMBAWANG | $529,590 | $536,171 | $532,005 | $545,733 | $539,646 | $550,510 | 4.0% |

| YISHUN | $476,447 | $495,930 | $485,701 | $490,951 | $499,934 | $495,041 | 3.9% |

| PUNGGOL | $581,327 | $577,477 | $581,044 | $586,843 | $594,642 | $598,962 | 3.0% |

| BEDOK | $530,855 | $541,883 | $559,174 | $586,894 | $596,934 | $544,532 | 2.6% |

| TAMPINES | $560,718 | $553,381 | $581,856 | $565,605 | $573,932 | $570,658 | 1.8% |

| WOODLANDS | $493,154 | $483,412 | $492,740 | $486,956 | $477,120 | $501,120 | 1.6% |

| BUKIT MERAH | $814,112 | $728,917 | $777,576 | $780,164 | $790,077 | $822,483 | 1.0% |

| BUKIT BATOK | $591,632 | $589,693 | $593,359 | $579,073 | $583,568 | $597,169 | 0.9% |

| PASIR RIS | $540,273 | $562,717 | $547,450 | $558,034 | $560,500 | $543,495 | 0.6% |

| JURONG WEST | $494,087 | $482,145 | $488,519 | $486,628 | $484,494 | $496,711 | 0.5% |

| BUKIT PANJANG | $515,832 | $499,694 | $510,059 | $508,778 | $519,351 | $517,176 | 0.3% |

| HOUGANG | $532,403 | $520,016 | $539,307 | $530,291 | $531,225 | $533,533 | 0.2% |

| SENGKANG | $557,218 | $548,694 | $573,612 | $569,425 | $569,341 | $557,771 | 0.1% |

| BISHAN | $680,563 | $684,914 | $677,238 | $699,523 | $697,941 | $679,526 | -0.2% |

| CHOA CHU KANG | $499,757 | $498,762 | $485,475 | $490,456 | $507,217 | $495,501 | -0.9% |

| QUEENSTOWN | $823,768 | $855,427 | $859,500 | $842,259 | $838,508 | $809,278 | -1.8% |

| CENTRAL AREA | $946,861 | $789,841 | $884,429 | $1,026,000 | $849,625 | $888,700 | -6.1% |

| ANG MO KIO | $696,370 | $612,620 | $665,562 | $600,060 | $634,607 | $641,146 | -7.9% |

Some observations on resale prices today

- Geylang rise in prices is due to flat age

- Sembawang may be seeing a rise due to its younger population

- Woodlands prices may have factored in the Woodlands North Coast project

- Queenstown has surprisingly avoided big price increases

1. Geylang rise in prices is due to flat age

With a 23.5 per cent growth in price, Geylang tops the list of price increases over the first 6 months of the year in 2023.

But a deeper look into the data showed that this wasn’t due to any MOP flats in 2023, but because of the proportion of older flats that were sold in January, as compared to the later months.

Newer flats in Circuit Road that cost $800k and above accounted for more transactions towards the later half of the first year – which skewed the data. As such, it was important for us to break down the numbers by age group instead (see below), to get a better sense of the overall prices.

2. Sembawang may be seeing a rise due to its younger population

Some realtors pointed out that Sembawang rivals Sengkang and Punggol for the youngest overall population in Singapore. A check shows that this information is a bit old (dating back to 2018) though, and we haven’t been able to find a more recent update. But back then more than half the population of Sembawang (54 per cent) were below the age of 40.

Nonetheless, observations on the ground suggest the realtors are right. Even walking a few blocks will reveal a mind-boggling number of preschools and childcare centres, and it would explain the numbers.

Younger couples in urgent need of a home gravitate toward affordable flats, in less mature estates. This would explain the beeline formed for Sembawang resale flats, in the post-Covid period.

That aside, there are big general upgrades to Sembawang in the area of Canberra, where Canberra MRT station and Canberra Hub (a combined sports hub and community hub) are now up and running.

3. Woodlands prices may have factored in the Woodlands North Coast project

You can check out more about the Woodlands North Coast project here. This will be part of Woodlands’ transformation into the regional centre of the north, and it will bring universities, start-ups, large corporations, etc., all into a single cluster. This will include the usual dining, retail, recreation, etc. to support the move.

We’ve mentioned in prior articles that, once the North Coast project is up, we’ll likely see the end of Woodlands as one of the cheapest housing areas. As such, we’re not too surprised to see prices have risen here; and it’s possible that sellers have begun to factor the upcoming developments into their HDB prices.

This is likely to still go up further, particularly for flats located near the North Coast project (although some may end up losing their waterfront view to this same project).

4. Queenstown has surprisingly avoided big price increases

This isn’t to say that Queenstown is cheap. It’s still pricey and desirable, but the price increases have been somewhat lacklustre; not something one would associate with a longstanding HDB hot spot.

One realtor pointed out that this was true even for BTO flats. During the November 2022 BTO launch, the Queenstown sites (some of which were PLH sites) saw a muted response, with Kallang/Whampoa seemingly stealing the limelight.

Another realtor noted that Queenstown, like Bishan, has been among the most expensive flats for over a decade. Compared to young towns such as Punggol, Sengkang, and Sembawang, there’s less room for prices to appreciate further.

What if we look at price increases by age instead?

To do this, we’ll break up HDBs by the following bands:

- 0 – 9 years old

- 10 – 19 years old

- 20 – 29 years old

- 30 – 39 years old

- 40 years old and above

Given the number of age bands, we’ll only focus on 4-room flats.

0 – 9 year old HDBs

10 – 19 year old HDBs

20 – 29 year old HDBs

30 – 39 years old HDB

HDBs 40 years old and older

Some observations on appreciation by age:

- Non-mature estates generally lead in price appreciation

- Singaporeans seem to care very little about lease decay

- Yishun may be one of the most underrated HDB towns

1. Non-mature estates generally lead in price appreciation

This corresponds to what our realtor mentioned about Queenstown above. The older flats seem to have less room to appreciate because the town is as developed as it’s going to get (barring future revolutions like all-underground transport networks or increases in plot ratio).

So while non-mature areas may be cheaper in sheer quantum, their prices may also be accelerating faster.

With areas like Sembawang, Sengkang, Pasir Ris, etc. there’s still room for major upgrades. More train stations, malls, recreational centres, etc. Something like a mall or MRT station popping up nearby provides an opportunity for bigger jumps in price.

Buying in a non-mature area is getting in on the ground floor; almost like an early-bird discount for the earlier inconveniences to live there.

2. Singaporeans seem to care very little about lease decay

Some people are derisive of the possibility that 40 or 50+year old flats can still appreciate. But just look at the numbers above: clearly that’s wrong.

Not one single HDB town has seen overall prices go down, for 40+ year old flats. Out of all the realtors we spoke to who made such transactions (i.e., older flats over the past three years), not one of them had made or seen a single losing transaction.

As you probably already know, this is likely due to the effects of the pandemic, where there was an increase in demand for larger flats. This was also due to people wanting to move straight away, or not wanting to wait for the delays in BTO flats.

That said, this could change in the coming decades though, when we start to see VERS (we haven’t seen a single such exercise yet). Any failure to get the requisite 80 per cent approval will, once and for all, doom certain flats to reach a value of $0.

We may re-evaluate our outlook toward older flats, after the first few times that happens.

3. Yishun may be one of the most underrated HDB towns

Yishun residents may have the last laugh here.

Yishun is the constant butt of jokes and memes (e.g., being in a Stranger Things trailer, having a whole website tracking weird events there, getting called names like “the Florida of Singapore”, etc.) but look at the price appreciation.

Yishun performed best for 10-to-19-year-old flats, as well as 40+ year old flats.

It’s also a bit of an open secret that Yishun is not really “non-mature.” As most Yishun residents will tell you, its amenities are on par with mature towns like Bedok or Hougang.

Keep in mind Yishun is nothing like Tengah or Sengkang, where things are just getting started. Yishun is roughly as old as Bishan. This town dates to the 1980s, and has around 30+ years of constant development behind it.

For more on price movements in the Singapore property market, public or private, follow us on Stacked. We’ll also provide you with trends and homeowner stories from across Singapore.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Which HDB estates have experienced slower price growth or price drops in 2023?

Why did Geylang flats see a big increase in prices in 2023?

How might upcoming developments like the Woodlands North Coast project affect property prices?

Is Yishun a good place to buy HDB flats based on recent price trends?

Do older flats in Singapore still appreciate in value despite lease decay concerns?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

0 Comments