Investing in a rental property could be a tough call right now, due to Covid-19; but what if the condo generates enough rent to cover its loan repayments, plus more?

These days, it’s true that most condos generate just enough rental income to offset the interest and maintenance; as for more than cover the entire loan repayment, some landlords will tell you that’s a daydream. But as we’re fond of saying, exceptions always exist in Singapore’s private property market.

A search of rental transactions over the past year, compared to unit costs, revealed some condo units that are quite likely to be seeing positive cash-flow:

How did we pick the following condos?

The following is based on URA rental data over the past 12 months (for the given unit size). We’ve compared the rental rates of the units to the estimated monthly loan repayment.

(The home loan is assumed to have an interest rate of 1.3 per cent per annum, with a loan tenure of 30 years).

We then picked out the condo units where the median rental rate would exceed the loan repayment.

We then arrive at the following developments, where you’re most likely to find units with a positive cash-flow:

*We only used those with rental transactions of 5 and up in case of any outliers.

**The cash flow was calculated with just mortgage monthly repayment in mind, not taking into account other costs such as maintenance etc.

1. Central Imperial

| Unit size | Volume Of Rental Transactions | Transacted price | Median rental rate | Monthly repayment | Cashflow |

| 549 sq. ft. | 13 | $560,000 | $2,350 | $1,879.39 | + $470.61 |

Current Prices

The average price on Square Foot Research is $946 psf.

Square Foot Research gives an indicative rental rate of $3.08 to $4.73 psf for the entire development, with an average of $4.13 psf. The implied rental yield is 5.23 per cent.

Location: Geylang Lorong 14 (District 14)

Note: Within the red-light district

Developer: G28 Developments Pte. Ltd.

Lease: Freehold

TOP: 2014

Number of units: 63 units

Key highlights:

Home owners wouldn’t consider anything in Central Imperial’s location, as it’s within the red-light area of Geylang. Landlords who are more focused on the bottom line, however, will find properties here have low vacancy rates and higher than average rental yields. Note that the implied rental yield for Central Imperial is 5.23 per cent, whereas the average rental yield for a residential property is two to three per cent (or four per cent for shoebox units).

Geylang’s red light area is most notorious for vice, but it’s also a leading destination for foodies. Central Imperial is 300 metres, or four minutes’ walk, from the famous 126 Dim Sum and the accompanying food stretch.

Central Imperial is also one of the Geylang properties that benefit from URA’s rezoning in 2015: there will no longer be any zones for residential property use over a large stretch of Geylang, thus choking off future supply for this city fringe location.

Geylang is just around a 12-minute drive into the city centre; for tenants who absolutely must live near the CBD, but have tight rental budgets, properties like Central Imperial tend to be the only option.

So open-minded investors can find a lot of opportunity here; but be ready for possible financing difficulties. Some banks may not provide loans for properties within the red-light area, and you’ll probably need a mortgage specialist for help (drop us a message and we can provide that).

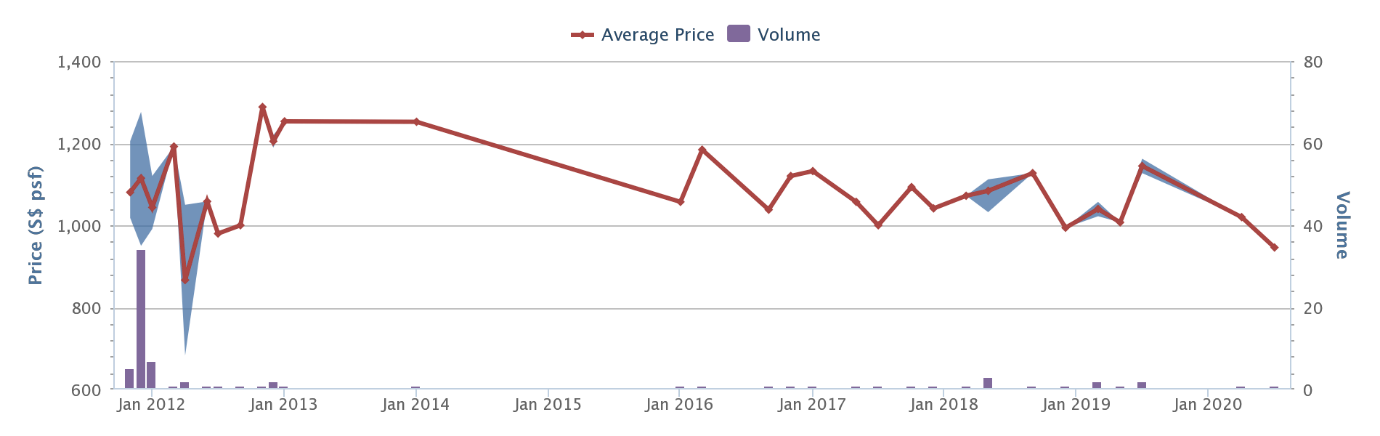

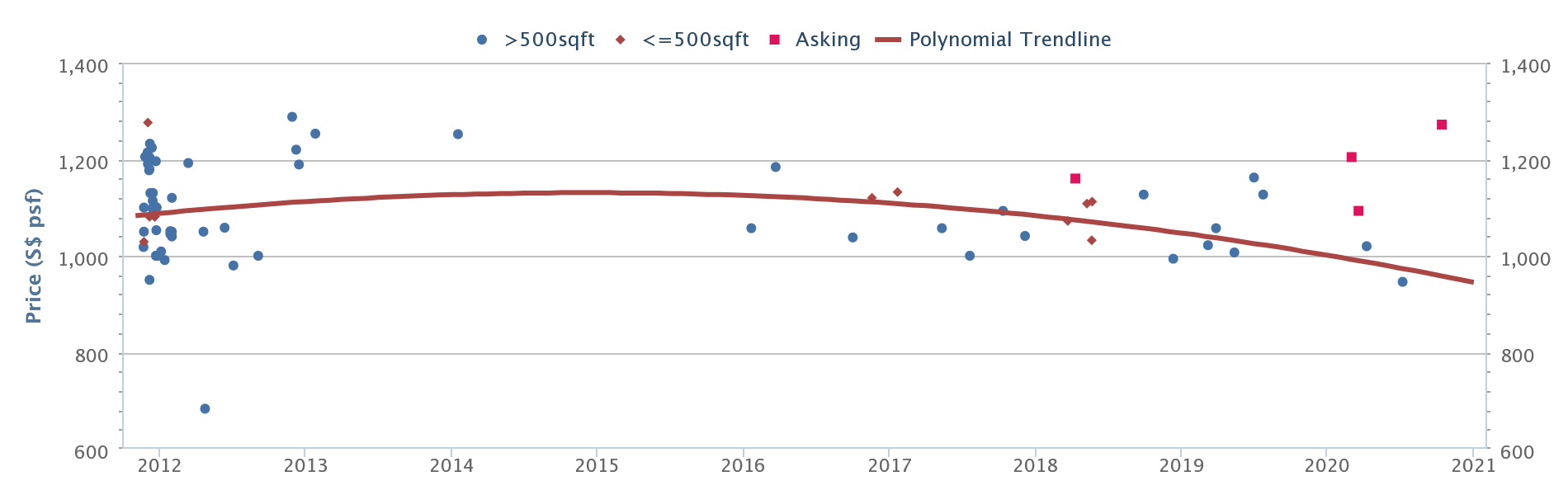

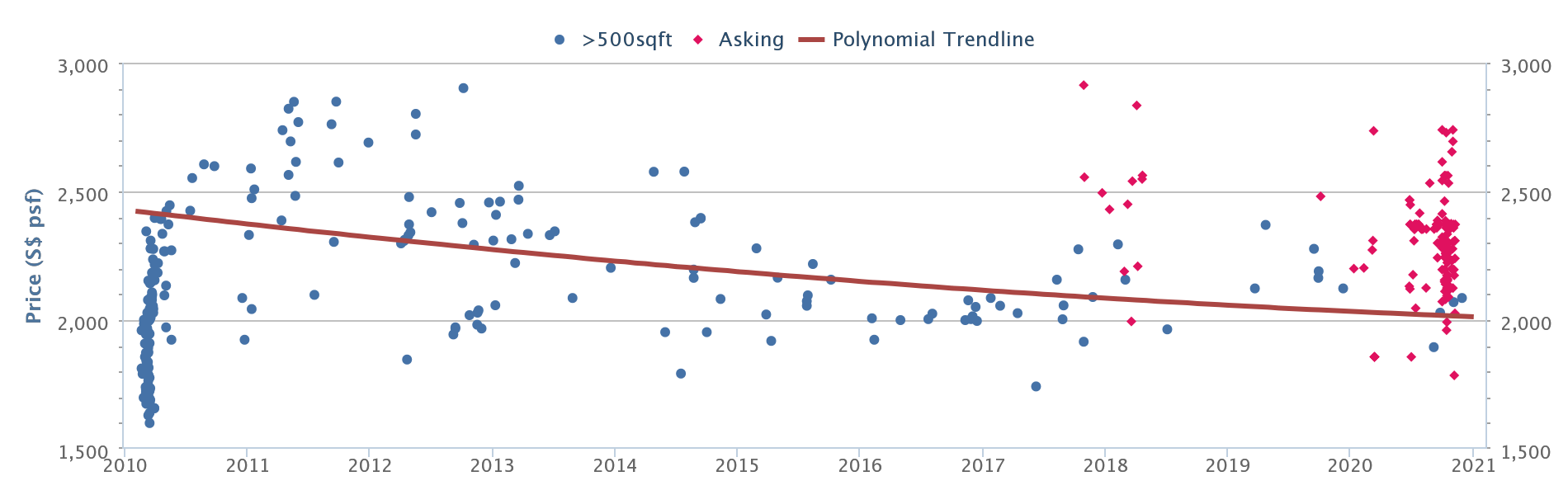

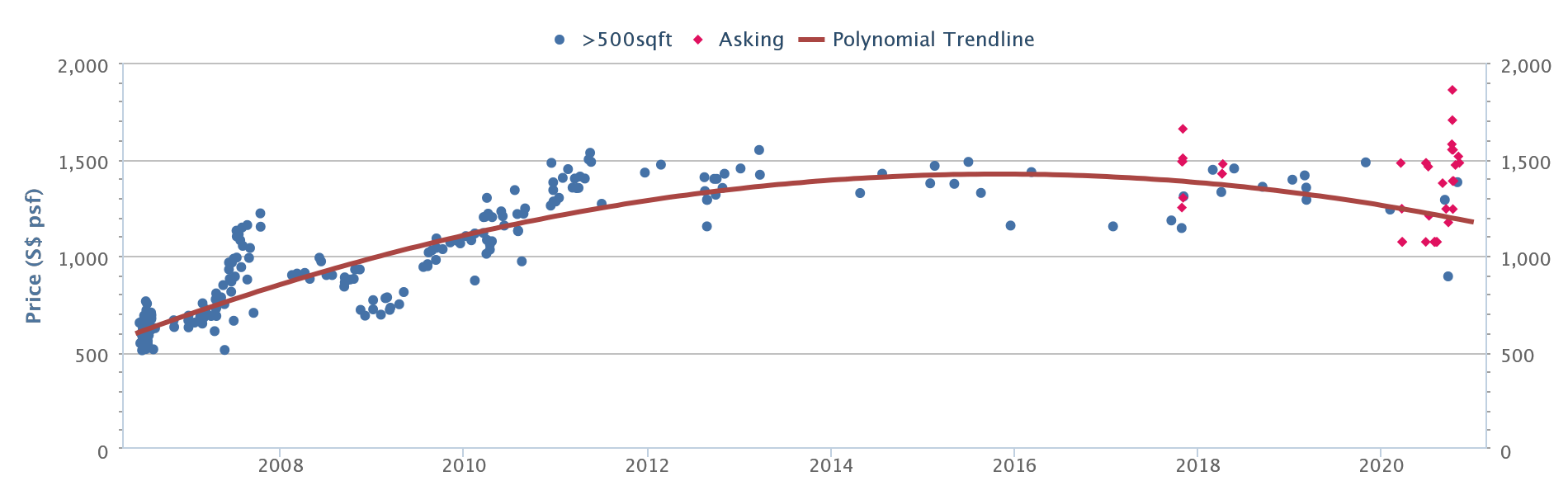

As with what we’ve mentioned in our previous article, it isn’t all sunshine and rainbows when it comes to the price trends for the property – so take note of that.

Property Advice4 Practical Ways To Use Supply And Demand For Property Research

by Sean Goh2. Meraprime

| Unit size | Volume Of Rental Transactions | Transacted price | Median rental rate | Monthly repayment | Cashflow |

| 840 sq. ft. | 10 | $1,180,000 | $4,350 | $3,960.14 | + $389.86 |

Current Prices

The indicative price range on Square Foot Research is $1,367 to $1,545 sq ft, with an average price of $1,439 psf.

Square Foot Research gives an indicative rental rate of $3.74 to $5.53 psf for the entire development, with an average of $4.47 psf. The implied rental yield is 3.73 per cent.

Location: Jalan Bukit Ho Swee (District 3, Bukit Merah)

Developer: MCL Land (Balmoral 2) Pte. Ltd.

Lease: 99-years from 2003

TOP: 2006

Number of units: 213 units

Key highlights:

What happened here was more or less a lottery win. We doubt anyone back in the early 2000’s actually predicted that Tiong Bahru – at the time a sleepy residential area – would become the icon of gentrification in Singapore.

Meraprime is surrounded by streets lined with artisanal cafes, bakeries, boutiques churning out bespoke apparel, etc. And while there are signs that hipsterisation is moving on to other areas like Joo Chiat, it has done its work of ramping up rental rates and prices.

Besides the retail and food outlets in the area, Tiong Bahru Plaza – which underwent a $90 million revamp in 2015 – is just a two-minute walk away (there’s an NTUC FairPrice here). The Tiong Bahru MRT station is also here, providing a direct line to City Hall, Bugis, and Raffles Place.

The MRT access alone would support high rental demand; but coupled with the transformation of Tiong Bahru, Mera Prime is a goldmine for landlords who bought in the early 2000’s.

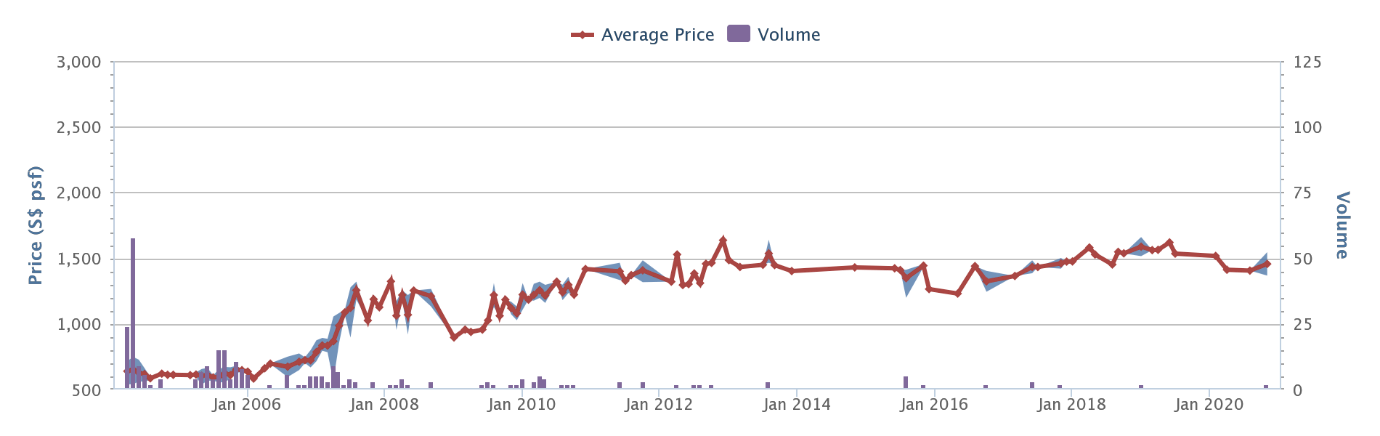

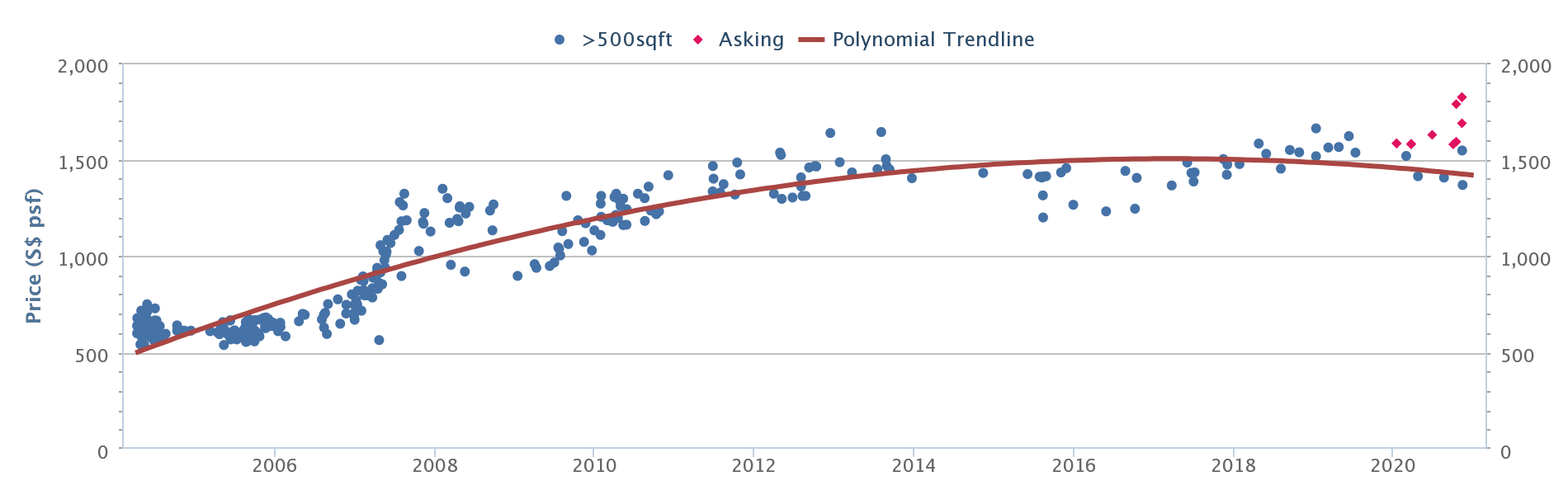

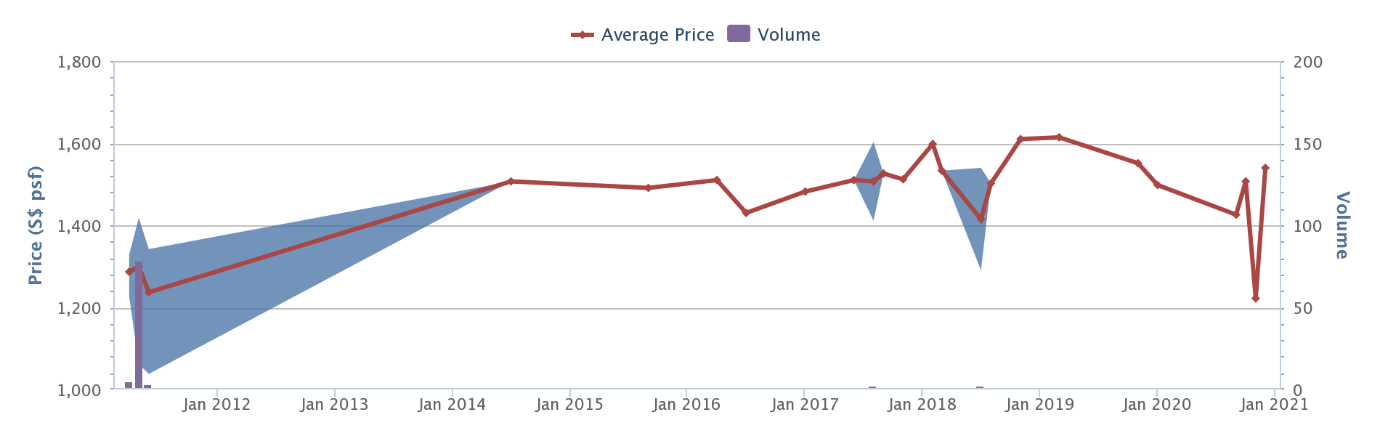

With a total of 170 profitable transactions and just 2 unprofitable ones (at current time of writing), Meraprime has done well for itself in the resale market – but prices are currently trending down slightly.

3. Altez

| Unit size | Volume Of Rental Transactions | Transacted price | Median rental rate | Monthly repayment | Cashflow |

| 527 sq. ft. | 29 | $1,070,000 | $3,900 | $3,590.97 | + $309.03 |

Current Prices

The indicative price range on Square Foot Research is $1,895 to $2,086 sq ft, with an average price of $2,020 psf.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Units Of The Week Issue #57

In light of the latest launch in District 5, One-North Eden (the first launch in 14 years to the area),…

Square Foot Research gives an indicative rental rate of $4.40 to $8.18 psf for the entire development, with an average of $6.03 psf. The implied rental yield is 3.59 per cent.

Location: Enggor Street (District 2, Downtown Core)

Developer: MCL Land (Balmoral 2) Pte. Ltd.

Lease: 99-years from 2008

TOP: 2014

Number of units: 280 units

Key highlights:

Altez is located right in the heart of the CBD, about 250 metres (four minutes’ walk) from the Tanjong Pagar MRT station. Next to it is Union Building, and just after that is Tras Street with its various cafes and eateries. Via Tras Street, you can get to the centre of Chinatown with about a 12-minute walk.

We probably don’t need to explain the rental demand, given the location.

At just $3,900 per month, this residence is a dream for single tenants who need to work within the CBD. We’d also venture that a shoebox unit at just $1.07 million is cheap, compared to other options within District 2.

That said, Altez appeals to a specific demographic. Families aren’t likely to choose this location, and it might not be ideal for owner-occupancy (unless you’re a true urbanite). Altez is well and truly “packed in” by other tall buildings, the road noise roars at rush hour, and there’s no disguising the feel of being in a concrete jungle (there isn’t even much greenery to alleviate the space).

Imagine if you had to live between the banks at Raffles Place; that’s a little what the location feels like. Nonetheless, tenants in the CBD are probably just happy to find a unit without an exorbitant price tag; and landlords seem amply rewarded.

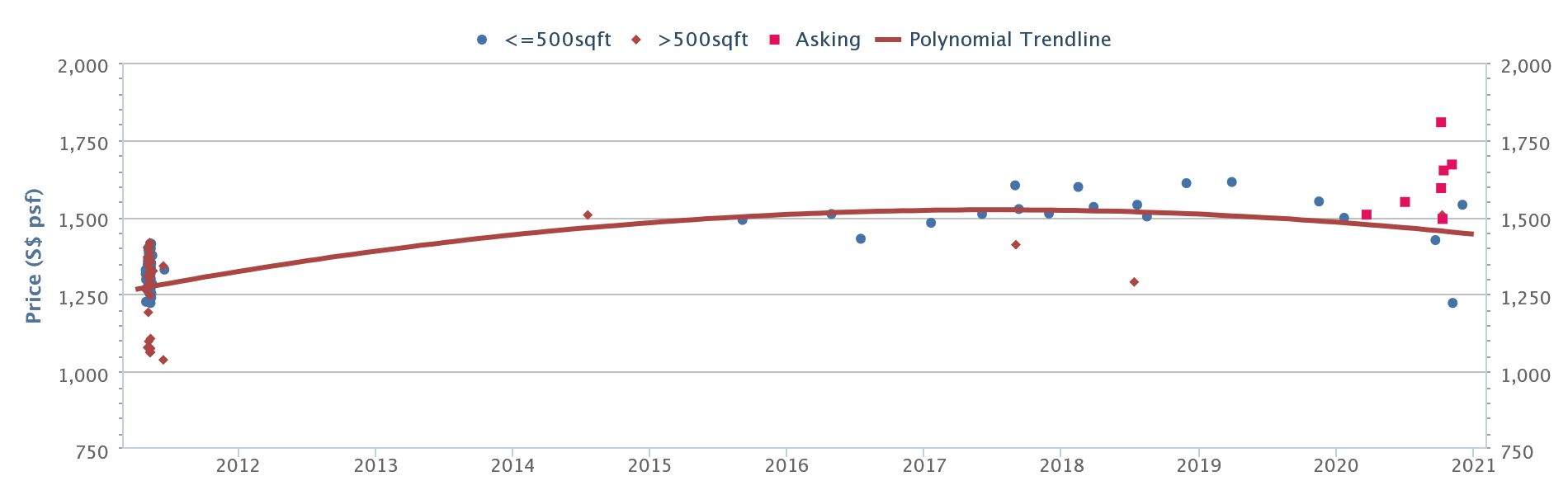

For those looking at potential appreciation as any indication, the price trend for the Altez does not make for a good picture.

4. Centra Heights

| Unit size | Volume of Rental Transactions | Transacted price | Median rental rate | Monthly repayment | Cashflow |

| 409 sq. ft. | 34 | $500,000 | $1,950 | $1,678 | + $271.98 |

Current Prices

The indicative price range on Square Foot Research is $1,222 to $1,540 sq ft, with an average price of $1,424 psf.

Square Foot Research gives an indicative rental rate of $3.29 to $4.56 psf for the entire development, with an average of $4.15 psf. The implied rental yield is 3.5 per cent.

Location: Sims Avenue (District 14, Downtown Core)

Developer: Fission Capital Pte. Ltd.

Lease: Freehold

TOP: 2014

Number of units: 90 units

Key highlights:

While it’s in Geylang, Centra Heights is not within the red-light area (the vice area is from lorongs 8 to 24. Centra Heights is closest to Lorong 35, on the other side of Sims Avenue).

Centra Heights benefits from being just 400 metres, or about six minutes’ walk, to the Aljunied MRT station. This being Geylang, there are eateries at almost every junction you turn. There’s even a steakhouse near the Aljunied MRT station (look around the same block as the coffee shop next to the train station).

There are three schools within less than 10 minutes’ walk: Geylang Methodist Primary and Secondary, and Kong Hwa High School.

Other than this, what we said about the Geylang area above (see Central Imperial) also applies: there are limited future residential options, coupled with a city fringe location; both these factors keep rental demand strong in this area. Centra Heights might also be preferred by investors who don’t want the red-light stigma, or the financing issues that may arise with it.

As an aside, $1,424 psf is an uncommonly low price for a freehold condo that’s just six years old.

Centra Heights has had 20 profitable and 1 unprofitable transaction as of the time of writing.

5. The Beacon

| Unit size | Volume of Rental Transactions | Transacted price | Median rental rate | Monthly repayment | Cashflow |

| 807 sq. ft. | 8 | $1,000,000 | $3,600 | $3,356 | + $243.95 |

Current Prices

The indicative price range on Square Foot Research is $893 to $1,381 sq ft, with an average price of $1,188 psf.

Square Foot Research gives an indicative rental rate of $2.87 to $4.47 psf for the entire development, with an average of $3.56 psf. The implied rental yield is 3.59 per cent.

Location: Cantonment Road (District 2, Downtown Core)

Developer: Cantonment Realty Pte Ltd

Lease: 99-years from 2004

TOP: 2008

Number of units: 124 units

Key highlights:

The Beacon is quite an under-the-radar property in District 2 given there are many more glitzy condos in the vicinity – especially so when its neighbour is the famous Pinnacle@Duxton.

As with most developments in the area, The Beacon stands to gain from a connectivity standpoint. It is in close walking distance to 3 different MRT stations, Outram Park (NE Line), Tanjong Pagar (EW Line), and the upcoming Cantonment (Circle Line) so you are pretty much well covered to anywhere you would like to go in Singapore.

Like the Altez, we probably don’t have to do much explaining as to why this condo would have good rental demand as the location speaks for itself – even with Covid-19 and the entire work from home situation happening.

Food options are definitely a highlight here as well, with a ton of variety to choose from in the Duxton area and the malls like 100AM and GuocoLand Tower.

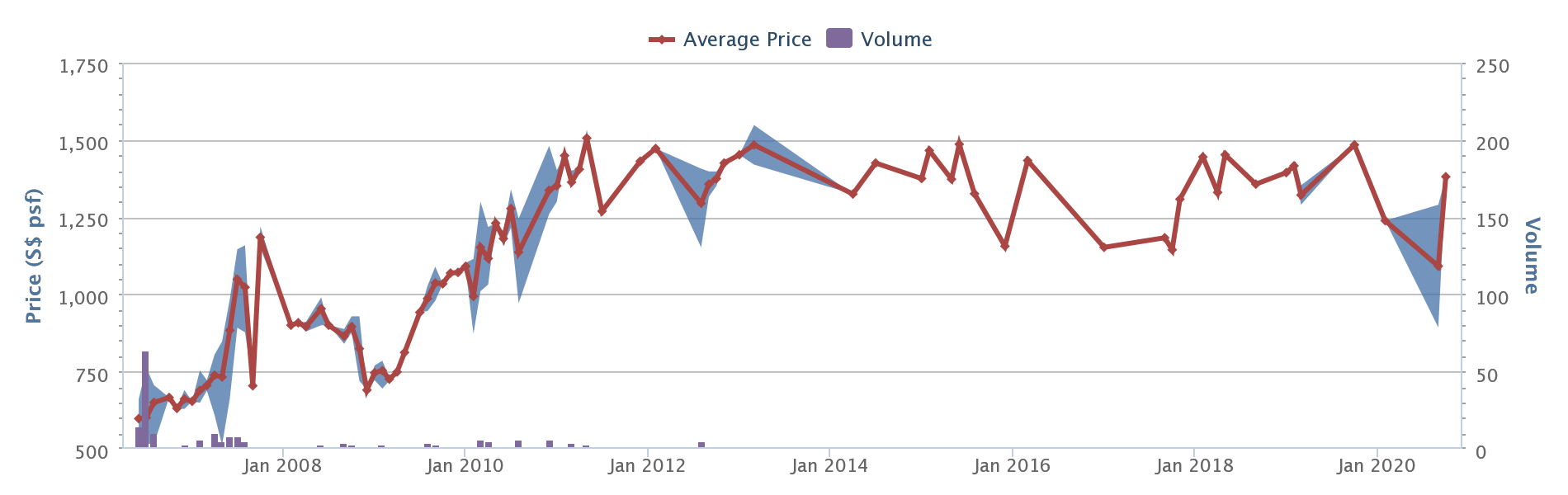

The Beacon enjoyed a good growth in prices in the earlier years, but that has slowed down as of recent years.

Next up, we’ll look for cash-flow positive properties in a specific area – drop us a comment or email if you have any other suggestions.

Finding these is a bigger challenge in prime areas, but follow us on Stacked and we’ll track them down for you. We’ll also keep you updated on the latest trends and news in the Singapore private property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are some Singapore condos that generate positive cash flow for landlords?

How was the positive cash flow determined for these Singapore condos?

What are the key factors making Central Imperial a potentially profitable rental property?

Why might Meraprime be considered a good investment despite current price trends?

What are some considerations for investing in condos like Altez and The Beacon?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Picks

Property Picks Where to Find Singapore’s Oldest HDB Flats (And What They Cost In 2025)

Property Picks Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

3 Comments

Meraprime is currently asking for 1.53mil on propertyguru – 30~% higher than transacted price that is indicated above here. Not sure how useful is it to use transacted price to derive positive (or negative) cash flow here.

What is your opinion about Wing Fong mansion. Is investing in this condo worth the risk? Is rezoning to commercial/institution a boon or bane as no body would want to set up an office space in the middle of red light area. Would the red light area be moved out of Geylang eventually especially with covid in place? Id enbloc potential good for Wing Fong as the land size is substantial ?