4 Ways Singapore Population Trends Can Impact Home Buyers

July 16, 2021

Despite the current trend toward bigger homes, Singapore household sizes are shrinking. Chalk it up to smaller families, fewer Singaporeans having children, and an ageing population. This matters to property buyers, as homes are long-term investments; and it’s worth considering what the Singapore property market might be like, should we sell 15 or 20 years down the road. For what we right now, these are the key concerns:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How is the population changing?

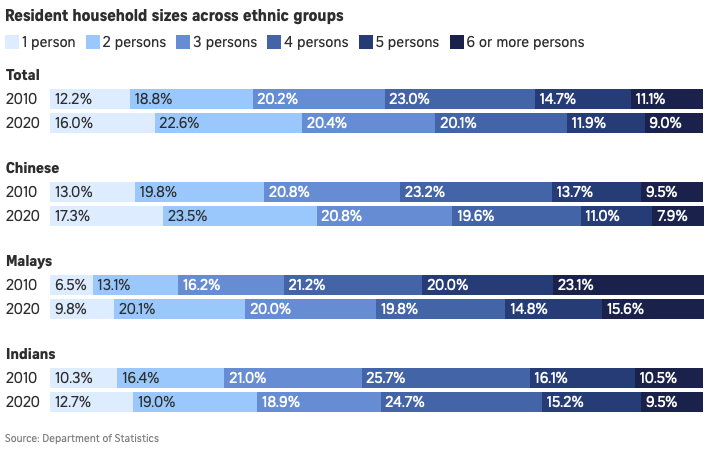

The population census this month shows that, while the number of households rose from 1.15 million to 1.37 million, average household sizes have dropped from 3.5 to 3.2. Over 60 per cent of Singapore households now have three or fewer members; and over the past decade, the population of one and two-person households grew by 3.8 per cent.

When we check SingStat, we see broadly similar data. Between 2010 and 2020, the number of Singaporeans living alone rose from 12.2 per cent to 16 per cent, while the number of lone parents rose from 6.5 per cent to 7.3 per cent.

In short, Singaporeans are broadly maintaining the same level of home ownership; but there are fewer of us living in each home. This has some worrying implications in the long term.

What are the long-term implications for the real estate market?

- We might face an oversupply of resale flats

- Smaller homes may be in demand in the future, defying the current trend

- More projects tailored for assisted living or elder-care

- Less interest in multi-storey layouts

1. We might face an oversupply of resale flats

Consider what happens when the generation of older Singaporeans pass on, and leave behind their flats:

Given our high home ownership rate (over 90 per cent at the time of writing), it seems likely that most of us – when the sad day comes – will be unable to keep the flat our parents pass down to us.

Remember that you can never own two HDB properties at the same time. If you already have a flat, and you inherit another one, you have to make a choice: you can retain either your existing flat or the inherited flat; but the other will have to be sold within six months.

If you own a private property, and you inherit a flat, then it comes down to when the flat was purchased. If the flat was purchased before 30th August 2010, you can keep both properties; but your family must live in the flat, not the private home.

If the flat was purchased on or after 30th August 2010, you will have to sell one of the properties.

So when the older generation of Singaporeans pass on, who is going to buy all their flats that most of us can’t inherit?

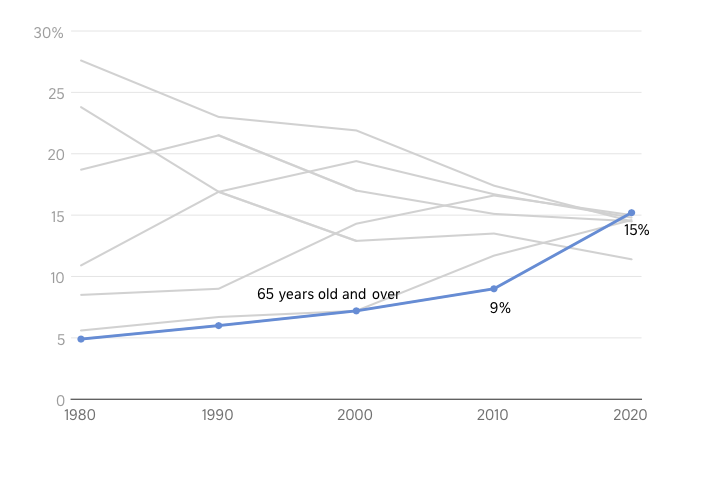

In 2020, around 15 per cent of the population are aged 65 and older, as opposed to nine per cent in 2010 (see the above links).

There’s no data on how many of them are HDB flat owners; but again, given that about 90 per cent of Singaporeans are home owners, it’s a frightening number of resale flats that could be entering the market when they pass on.

It will come down to whether there are sufficient young Singaporeans, or Permanent Residents, to buy up these resale flats (foreigners can’t own HDB flats). We can also count on some retirees who are downgrading from their private properties, to soak up some of these flats.

But that’s a narrow tightrope. Our shrinking population doesn’t inspire confidence that we’ll have enough young Singaporeans and PRs; and we don’t know there’s a crowd of retirees waiting to sell their condos and buy resale flats – that’s just hopeful speculation.

So we may need some policy tweaks in the future, perhaps regarding HDB ownership via inheritance. Alternatively, the government could buy back the inherited flats, and find some other use for the land. Whatever the case, something will have to be done.

On a practical level, young buyers today should think twice about paying high Cash Over Valuation (COV) for an old resale flat; even if it’s in a “hot” location. The old flats aren’t disappearing, but the people eligible to own them seem to be.

2. Smaller homes may be in demand in the future, defying the current trend (caused by the pandemic)

With more “empty nest” situations, we could see retirees opt for smaller homes. Already, realtors have pointed out that shoebox flats – once thought of as just investment assets – have now found a niche among retirees and older buyers. More affluent retirees sometimes “right-size” into a one-bedder condo, rather than downgrade to a resale flat.

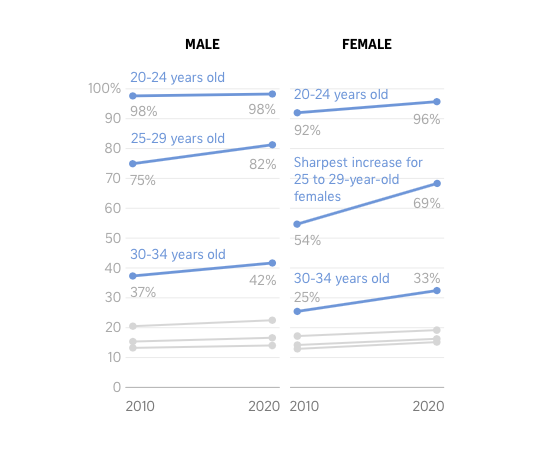

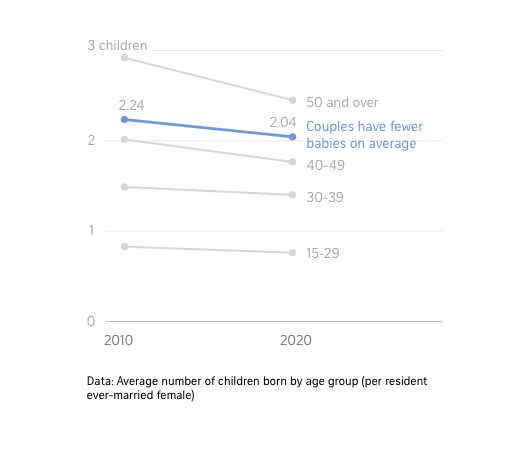

Likewise, two-bedders will appeal to couples without children – be they younger Singaporeans who have decided against parenthood, or older Singaporeans whose children have moved out.

The smaller quantum on these units will also be a huge attraction. Retirees can’t get large loans due to their age, and will want to set aside more for retirement. Single buyers, who take on the mortgage single-handedly, are probably priced out of larger homes anyway.

But clearly, the proportion of singles are rising, getting married later – and as a result having less children as well.

With regard to HDB flats, we may see more applications under the Single Singapore Citizen or Joint Singles Schemes.

This may result in a greater abundance of smaller two and three-room flats, as opposed to the popularity of four-room flats today. The more cynical will wonder if HDB might simply reduce flat sizes.

3. More projects tailored for assisted living or elder care

In the Singapore private property market, The Hillford may be on to something (with regard to home ownership, not investment).

This condo was intended for the elderly, and has a 60-year lease. As the population ages, however, we may see demand for similar developments. For pure home owners, who are already 65 or older, a full 99-year lease may just be an unnecessary expense. A shorter lease could mean access to a condo with full-suite facilities, or a good location, at a fraction of the price.

We note that Community Care Apartments, with assisted living services, did well during their pilot run in Bukit Batok. These flats have leases ranging from 15 to 35 years, and they are priced much cheaper than many nursing homes.

Property Market CommentaryHow Much Would You Save By Buying An Assisted Living HDB Flat?

by Ryan J. OngLooking ahead 20 or 30 years, we suspect the idea of a 99-year lease as a “standard” might fade. We may have a residential market where, like commercial counterparts, leases of 60 years are not uncommon.

4. Less interest in multi-storey layouts

A smaller household size means it becomes less necessary to have that second or third floor. An ageing population makes the additional floors a health risk (unless the owners are rich enough to install a lift).

Realtors on the ground have mentioned that, for owners of large multi-storey homes, one of the key reasons for downgrading is stairs. It can be rough on seniors to have to hike up and down to go between the kitchen and their room. For those who can’t afford helpers, keeping the unit clean is also a major challenge.

This doesn’t bode well for multi-storey apartments, as well as some strata-titled landed developments (again, unless a lift can be installed).

Property is a long-term investment for most of us

This might mean ignoring episodic events, like a brief uptick in resale flat prices, or a trend toward big loft apartments. Buyers intending to hold for 15 to 20 years, or longer, should keep in mind that today’s advantages could be tomorrow’s drawbacks.

For more on the situation as it unfolds, follow us on Stacked. We’ll also provide you with in-depth reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How might Singapore's aging population affect the housing market in the future?

What are the potential long-term effects of shrinking household sizes in Singapore?

Could there be an oversupply of resale flats in Singapore?

How might future housing developments change to accommodate Singapore's demographic trends?

What impact will smaller household sizes have on the design of residential buildings in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

0 Comments