4 Key Factors That Could Impact The EC Market In 2022

February 27, 2022

With prices hitting new peaks since 2021, first-time homebuyers are at a bit of a loss; this is especially true for the sandwiched demographic, who are slightly above the HDB income ceiling. Executive Condominiums (ECs) seem a natural choice here – but what can we expect from EC prices in this volatile year?

Update 05 March 2022: Edited the EC income ceiling to the correct figure.

Table Of Contents

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

New EC launches in 2022

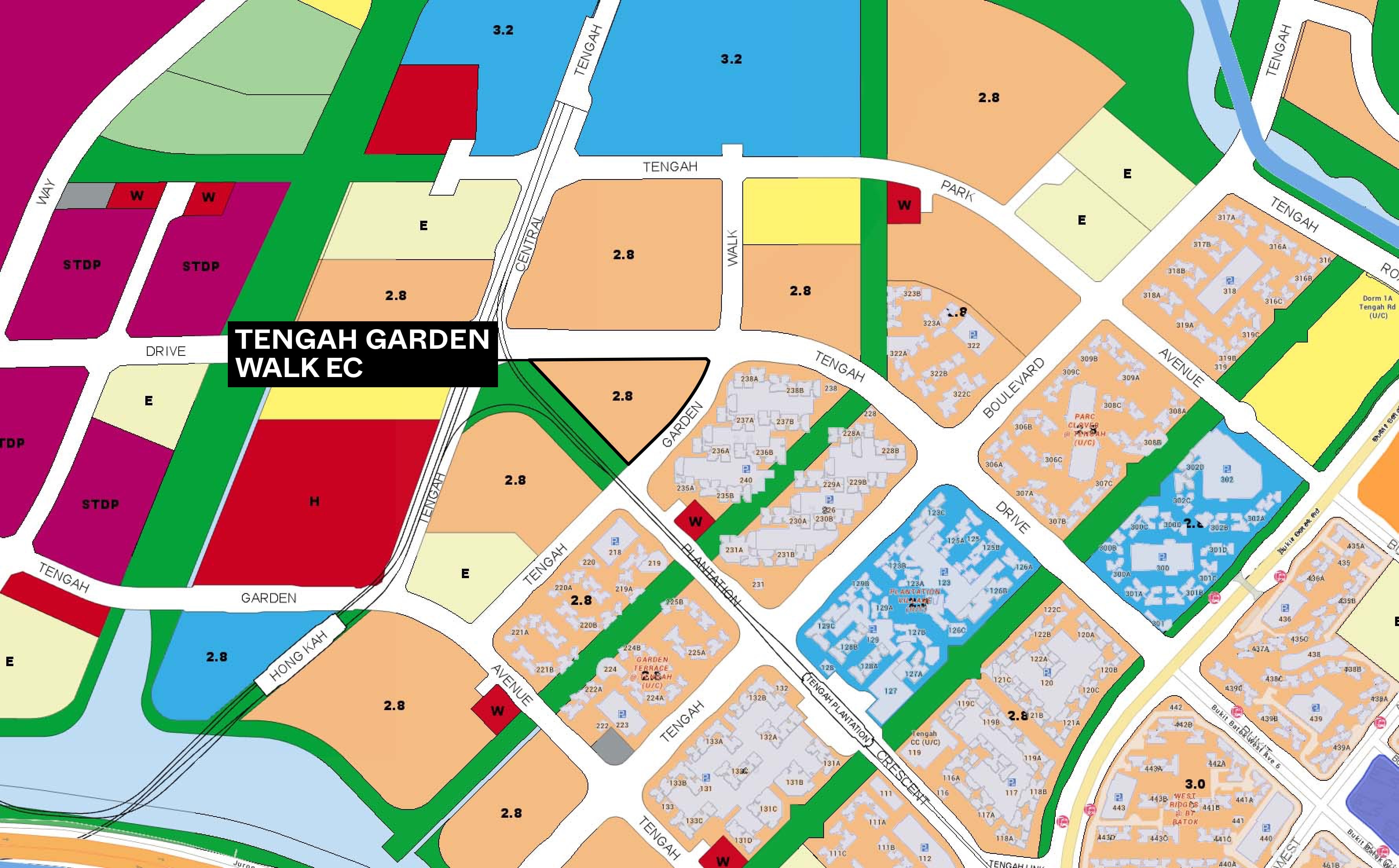

We’re certain of at least two ECs that will launch this year: North Gaia at Yishun Avenue 9, and Tengah Garden Residences at Tengah Garden Walk.

Both are about equally sized where units are concerned. North Gaia is estimated at 617 units, and Tengah Garden Residences is roundabout 620 units. This makes for around 1,200 potential new homes in the EC segment.

There are two other land plots for ECs right now: Tampines Street 62 (Parcel A), and Bukit Batok West Ave. 8, but we haven’t heard much about these locations of late. For more details, you can view our overview here.

Key factors impacting EC demand

- ECs are unscathed by new cooling measures

- Full privatisation is less of a selling point

- Rising prices might push buyers to an EC alternative

- Older, privatised ECs look very attractive next to resale flats

1. ECs are unscathed by new cooling measures

The new cooling measures introduced three key elements:

- Reduction in maximum Loan To Value (LTV) ratio for HDB loans

- A lower Total Debt Servicing Ratio (TDSR)

- Higher Additional Buyers Stamp Duty (ABSD)

All three of these are largely irrelevant, to first-time buyers or upgraders going for an EC.

There is no HDB loan for an EC anyway, and bank loan limits have remained unchanged. As for the lower TDSR, buyers of ECs need to meet two debt limitations: the Mortgage Servicing Ratio (MSR), as well as the Total Debt Servicing Ratio (TDSR).

The MSR caps the borrowers’ home loan to 30 per cent of their monthly income. The TDSR is now capped at 55 per cent of monthly income (inclusive of other loans).

This means that, other than a few borrowers who are heavily in debt, almost everyone within the MSR will more than be within the TDSR as well.

ABSD has risen to 17 per cent for the second home, even for Singapore citizens. But for those still owning a single home, ABSD is only an issue if they’re upgrading, and choose to buy a private property before selling their previous flat. In these cases, you normally need to pay the ABSD on the new home, before applying for remission later.

When you’re moving from one HDB property to another, however (e.g., moving to a larger resale flat, or moving to an EC), you don’t need to pay this upfront ABSD.

As such, upgrading to an EC is much more accessible than upgrading to a private condo, for those who absolutely must buy before they sell.

2. Full privatisation is less of a selling point

ECs are fully privatised after 10 years, and no longer count as HDB properties. In the past, ECs were often expected to see an increase in value when this happens. However, this opinion needs to be revised in light of recent cooling measures.

The main impact of full privatisation is that non-locals can now buy the EC units as well. Also, it’s possible for investors to purchase the EC unit as a second or subsequent property, as a rental asset (they can’t do this before privatisation, as no one can own two HDB properties at once).

However, consider who is most affected by the recent rise in ABSD: foreigners now pay 30 per cent ABSD, whilst ABSD is up to 17 per cent for the second home, and 25 per cent for the third (for Singapore citizens).

These buyers may be reluctant to step in at this point, making full privatisation less impactful to EC owners; although we will add that the lack of eligibility requirements (e.g., singles are free to buy, no ethnic quota) still make a meaningful difference.

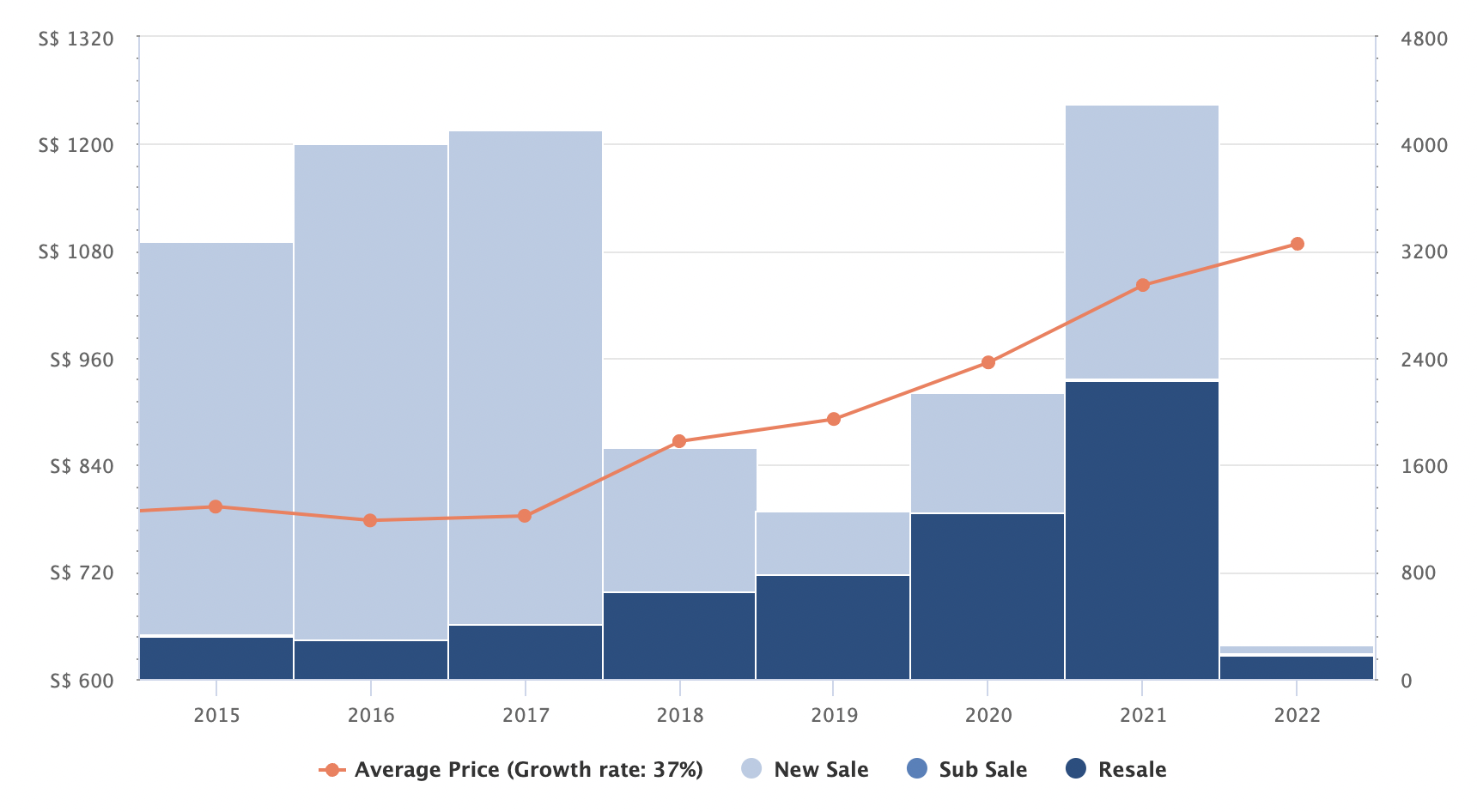

3. Rising prices might push buyers to an EC alternative

At the time of writing, most EC prices were somewhere in the range of $1,080 to $1,100 psf. New condo prices, however, averaged about $1,755 to $1,800 psf, with many new launches crossing the $2,000+ psf mark.

Given the high prices of private condos in 2022, it’s expected that sandwiched Singaporeans will need ECs more than ever.

Property Market Commentary4 Reasons Why HDB Upgraders Prefer Executive Condos To Private Condos

by Ryan J. OngThis is particularly true of those who are just above the income ceiling for a regular HDB flat ($14,000 per month).

For example, if your combined income is $15,000 per month, conventional guidelines suggest your home should cost no more than $900,000 (prudence advocates a home that costs no more than five times your annual income).

But at $1,755 to $1,800 psf, the average family-sized condo unit (around 1,100 sq. ft.) is likely to see a quantum of around $1.9 million.

As such, sandwiched Singaporeans are likely to gravitate toward the upcoming new ECs – if they can wait out the construction – or start looking for resale ECs. This leads us to our next point:

4. Older, privatised ECs may start to look attractive next to pricey resale flats

Resale flat prices are at record highs, of around $508 to $512 psf islandwide. At this point, the price gap between resale flats and ECs may well tip buyers toward the latter. To demonstrate the point:

Consider the price of Woodsvale EC, which in December 2021 saw a 1,292 sq. ft. unit sell for around $719.80 psf (about $930,000).

| Date | Project | Price | Size (sqft) | $PSF |

| 5-Jul-21 | Woodsvale | $888,000 | 1,313 | $676 |

| 12-Jul-21 | Woodsvale | $872,000 | 1,313 | $664 |

| 15-Jul-21 | Woodsvale | $868,000 | 1,227 | $707 |

| 21-Jul-21 | Woodsvale | $873,000 | 1,313 | $665 |

| 23-Jul-21 | Woodsvale | $905,000 | 1,313 | $689 |

| 26-Aug-21 | Woodsvale | $960,000 | 1,281 | $749 |

| 13-Sep-21 | Woodsvale | $842,000 | 1,227 | $686 |

| 20-Sep-21 | Woodsvale | $855,000 | 1,292 | $662 |

| 5-Oct-21 | Woodsvale | $950,000 | 1,313 | $723 |

| 21-Oct-21 | Woodsvale | $860,888 | 1,227 | $702 |

| 3-Nov-21 | Woodsvale | $875,000 | 1,238 | $707 |

| 3-Nov-21 | Woodsvale | $960,000 | 1,292 | $743 |

| 5-Nov-21 | Woodsvale | $970,000 | 1,313 | $739 |

| 22-Nov-21 | Woodsvale | $915,000 | 1,292 | $708 |

| 24-Nov-21 | Woodsvale | $915,000 | 1,292 | $708 |

| 3-Dec-21 | Woodsvale | $950,000 | 1,313 | $723 |

| 10-Dec-21 | Woodsvale | $930,000 | 1,356 | $686 |

| 31-Dec-21 | Woodsvale | $930,000 | 1,292 | $720 |

Just next door, you can find Executive Maisonettes/Apartments about 1,500+ sq. ft. going for between $565,000 – $800,000 with a median price of $665,000 (based on Feb 21 – Jan 22 data). This equates to around $438 psf on average.

| Date | Flat Type | Price | Size (sqft) | $PSF |

| 2021-05 | HDB Executive Apartment | $658,000 | 1,539 | $427 |

| 2021-07 | HDB Executive Maisonette | $642,888 | 1,550 | $415 |

| 2021-09 | HDB Executive Maisonette | $800,000 | 1,518 | $527 |

| 2021-09 | HDB Executive Maisonette | $665,000 | 1,518 | $438 |

| 2022-02 | HDB Executive Apartment | $690,000 | 1,518 | $455 |

| 2021-02 | HDB Executive Apartment | $565,000 | 1,539 | $367 |

| 2021-04 | HDB Executive Maisonette | $580,000 | 1,550 | $374 |

| 2021-06 | HDB Executive Apartment | $622,000 | 1,507 | $413 |

| 2021-06 | HDB Executive Maisonette | $685,000 | 1,550 | $442 |

| 2021-06 | HDB Executive Maisonette | $650,000 | 1,518 | $428 |

| 2021-07 | HDB Executive Apartment | $620,000 | 1,507 | $411 |

| 2021-09 | HDB Executive Maisonette | $720,000 | 1,518 | $474 |

| 2021-09 | HDB Executive Apartment | $680,000 | 1,539 | $442 |

| 2021-10 | HDB Executive Apartment | $665,000 | 1,518 | $438 |

| 2021-11 | HDB Executive Maisonette | $700,000 | 1,550 | $452 |

| 2021-12 | HDB Executive Apartment | $702,000 | 1,518 | $463 |

Let’s also consider Chestervale EC located in Bukit Panjang. In Jan 2022, a 1,432 sq. ft. unit exchanged hands for $1,118,888 ($782 psf). Here are some transactions since July 2021:

| Date | Bukit Panjang Projects | Price | Size (sqft) | $PSF |

| 16-Jul-21 | Chestervale | $880,000 | 1,259 | $699 |

| 21-Jul-21 | Chestervale | $1,010,000 | 1,464 | $690 |

| 3-Aug-21 | Chestervale | $895,000 | 1,259 | $711 |

| 30-Aug-21 | Chestervale | $1,093,800 | 1,442 | $758 |

| 18-Nov-21 | Chestervale | $1,150,000 | 1,410 | $816 |

| 4-Jan-22 | Chestervale | $1,100,000 | 1,528 | $720 |

| 13-Jan-22 | Chestervale | $1,118,888 | 1,432 | $782 |

Just within a 200-metre distance, at Block 239 Bukit Panjang Ring Road, there are HDB Executive Flats selling for around $660,000; the most recent was in October 2021, when a 1,572 sq. ft. unit transacted at about $413.49 psf (about $650,000).

| Date | Type | Price | Size (sqft) | $PSF |

| 2021-07 | Executive Apartment | $638,000 | 1,539 | $414 |

| 2021-10 | Executive Maisonette | $690,000 | 1,572 | $439 |

| 2021-05 | HDB Executive Maisonette | $660,000 | 1,572 | $420 |

| 2021-05 | HDB Executive Maisonette | $638,000 | 1,572 | $406 |

| 2021-07 | HDB Executive Maisonette | $645,000 | 1,572 | $410 |

| 2021-08 | HDB Executive Maisonette | $668,888 | 1,572 | $426 |

| 2021-09 | HDB Executive Maisonette | $660,000 | 1,615 | $409 |

| 2021-10 | HDB Executive Maisonette | $650,000 | 1,572 | $414 |

Our last example points to The Floravale, located in Jurong West. A 1,238 sq. ft. unit transacted for $950,000 in December 2021 ($767 psf).

| Date | Price | Size (sqft) | $PSF |

| 12-Jul-21 | $885,000 | 1,313 | $674 |

| 14-Jul-21 | $958,000 | 1,324 | $724 |

| 16-Jul-21 | $972,000 | 1,324 | $734 |

| 27-Jul-21 | $940,000 | 1,249 | $753 |

| 10-Aug-21 | $988,000 | 1,410 | $701 |

| 11-Aug-21 | $885,000 | 1,238 | $715 |

| 17-Aug-21 | $990,000 | 1,324 | $748 |

| 1-Sep-21 | $845,000 | 1,238 | $683 |

| 10-Sep-21 | $860,000 | 1,335 | $644 |

| 22-Sep-21 | $985,000 | 1,324 | $744 |

| 1-Oct-21 | $993,998 | 1,324 | $751 |

| 6-Oct-21 | $980,000 | 1,238 | $792 |

| 11-Oct-21 | $1,005,000 | 1,324 | $759 |

| 19-Oct-21 | $950,000 | 1,238 | $767 |

| 3-Dec-21 | $980,000 | 1,399 | $700 |

| 10-Dec-21 | $975,000 | 1,249 | $781 |

| 17-Dec-21 | $1,000,000 | 1,238 | $808 |

| 23-Dec-21 | $950,000 | 1,238 | $767 |

Located south of The Floravale are blocks 859 – 862 Jurong West Street 81 where you can find Executive flats for $590,000 – $698,000.

| Date | Type | Price | Size (sqft) | $PSF |

| 2021-04 | Executive Apartment | $638,888 | 1,539 | $415 |

| 2021-05 | Executive Maisonette | $590,000 | 1,572 | $375 |

| 2021-06 | Executive Apartment | $630,000 | 1,528 | $412 |

| 2021-08 | Executive Maisonette | $698,000 | 1,593 | $438 |

| 2021-09 | Executive Apartment | $620,000 | 1,518 | $409 |

| 2021-10 | Executive Apartment | $600,000 | 1,561 | $384 |

| 2021-11 | Executive Maisonette | $615,000 | 1,572 | $391 |

| 2022-01 | Executive Apartment | $640,000 | 1,539 | $416 |

Granted, the EC is still much more expensive. But for buyers who have an income just above the ceiling for BTO flats (ECs have an income ceiling of $16,000), the price gap could start looking more and more justified: the executive flats are older, have no common facilities, and will never be privatised or have the potential for an en-bloc.

As older resale flats continue to creep up in price – as they have for 19 straight months now – some buyers are invariably going to look at the resale flat/resale EC price gap, and wonder if perhaps the EC is a better prospect; especially if they have hopes of upgrading again later.

While the decision is ultimately based on location, we do suggest that buyers looking for resale flats also take a peek at any resale ECs that may be nearby. You may find the price gap isn’t as big as many assume.

For more on the situation as it unfolds, follow us on Stacked. We’ll also provide you with in-depth reviews of new and resale properties alike, so you can make an informed property purchase.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How do new cooling measures affect EC buyers in Singapore?

Why is full privatisation of ECs less of a selling point in 2022?

Are EC prices expected to rise compared to private condos in 2022?

How do resale ECs compare in price to resale flats in Singapore?

What factors might make older, privatised ECs more appealing in 2022?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

3 Comments

Hi, EC income ceiling should be $16,000? (currently shown as $21,000 in the article)

Income ceiling should increase. $16,0000 is too low