Unraveling The Mystery Behind These 3 Highly Unprofitable District 9 Condos

September 14, 2020

With the high costs of property in Singapore, we all want to buy a condo whose value stands the test of time.

Unfortunately, good unit appreciation potentials aren’t always fulfilled.

Take Urban Vista for instance. A beautiful development situated within immediate proximity of the Tanah Merah MRT station, with the East Coast Park just beyond that. One wouldn’t expect a drastic depreciation in value here.

OUE Twin Peaks, in the same vein, rises proudly over the glitzy Orchard precinct (our place of emphasis today) – a twist of iconic architecture tinged with key centrality.

Yet if you were to look at its complete resale transactions list, you’d notice 23 unprofitable transactions to its name.. with just 2 profitable transactions to date!

So why is this the case?

Well, there are a number of reasons to account for.

In today’s piece, we single out some possible factors that could have led to these underappreciated transactions – so that future buyers too, can keep an eye out for these key red flags on their next property purchase.

Quick Note Before We Begin:

We chose these 3 condos mainly on the pretext of location (i.e. D9 CCR developments), as well as the staggering impact/number of unprofitable transactions that line their individual data sheets.

Given that the key overarching ‘depreciation-related factors’ for these 3 central condos are somewhat identical, I’ll do my best to dive into a number of differing ‘small-scale’ factors along the way to keep things fresh.

Regarding order of content, we’ll briefly introduce the condos in this list before asserting the larger overall factors for depreciation amongst the developments. Following which, we’ll then dive into the ‘pettier’ depreciation-related factors that differ from condo to condo.

We end off with some key takeaways and parting thoughts.

HELIOS RESIDENCES

In no particular order, we begin with this freehold development along Cairnhill Circle.

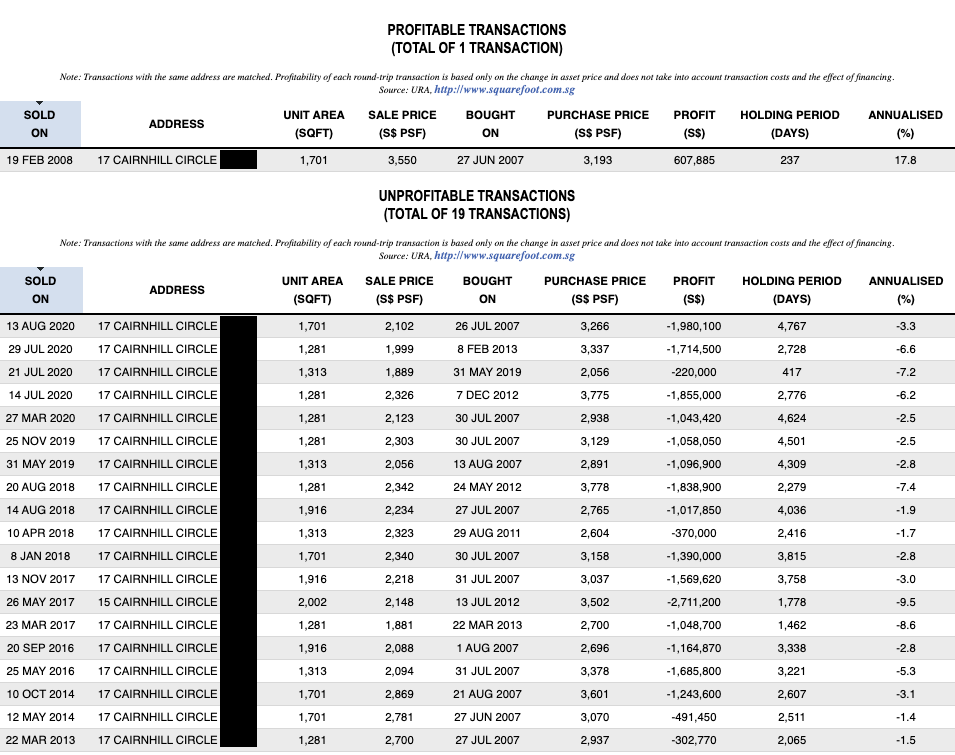

Looking at its past resale transactions, this is what we observe:

As of 14 September 2020, there are a stunning 19 unprofitable to 1 profitable resale unit transaction.

Looking at the transaction price differences, we observe the biggest (-$2.7m) loss for a unit that was purchased in July 2012 and later sold in May 2017 – just as the en bloc phase was beginning to heat up.

We also see an increased number of (5) unprofitable resale transactions here in 2020 even before the year’s end.

OUE TWIN PEAKS

Our next condo is just a 15-minute walk away from Helio Residences.

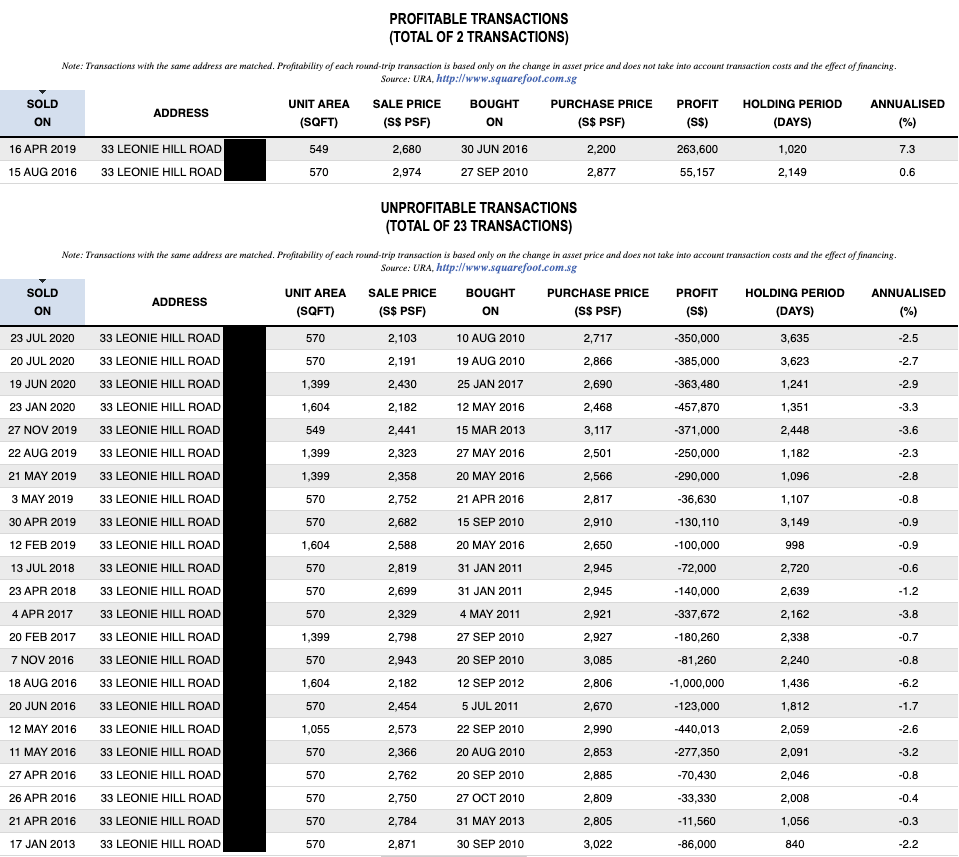

Regarding its resale transactions, this is what we observe:

Despite the increased number of unprofitable transactions here, we see that the average resale net losses here don’t amount to as much as the aforementioned Helios Residences.

Condo ReviewsOUE Twin Peaks Review: If A Luxury Brand Built A Condo This Would Be It

by Reuben DhanarajThe biggest loss here amounts to $1m, and it comes from a unit that was bought in September 2012 and later sold in August 2016. The loss here is more than twofold the cost of the subsequent ‘runner-up’ (unprofitable) transaction.

THE LAURELS

Our final CCR development on this list brings us to The Laurels.

Located along Cairnhill Road, this freehold condo has seen a mix of both worlds in its transaction department.

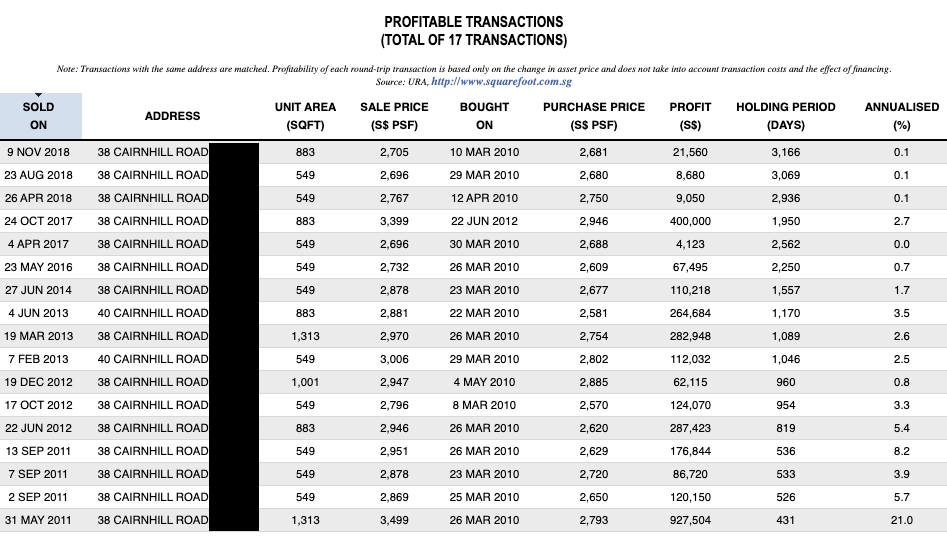

Here are the figures:

On one end, we observe a much higher number of profitable transactions here than in the previous two condos. The highest gain comes from a unit bought in March 2010 and sold a year later in May 2011 for almost a $1m net profit (note that the time of purchase was right in tandem with the 2010 SSD introduction).

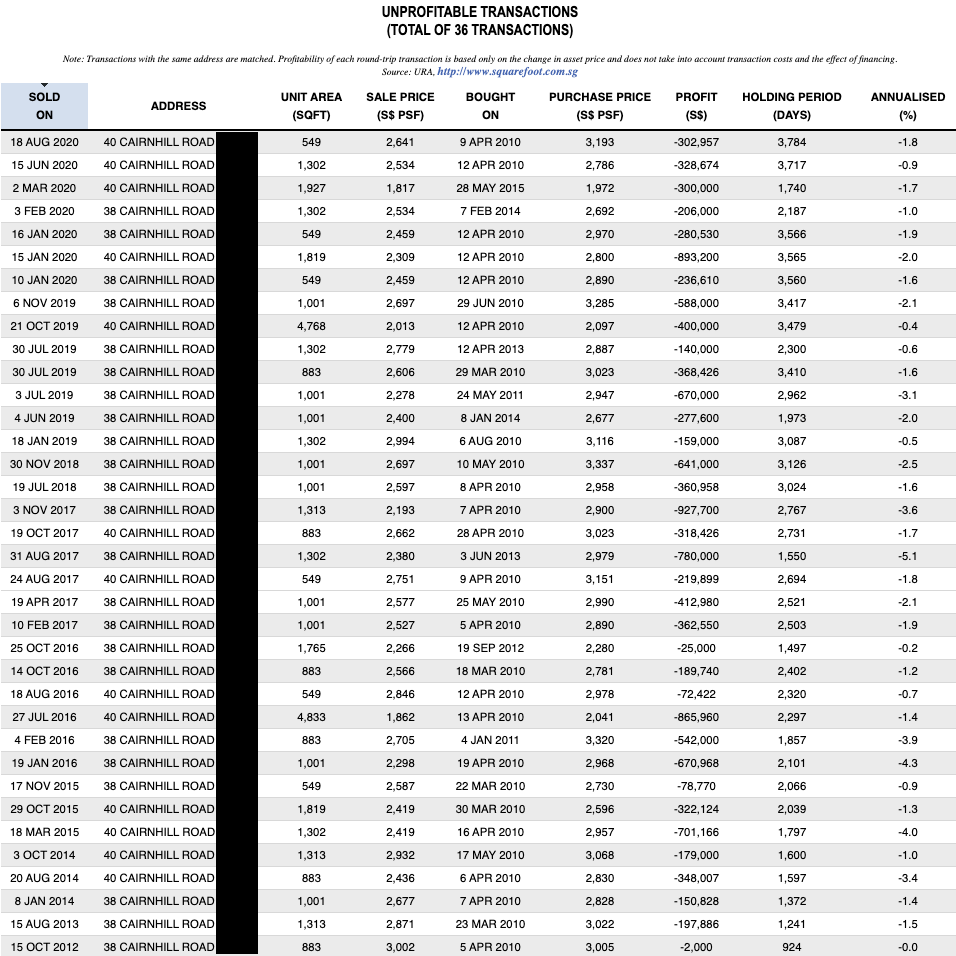

On the other hand (and perhaps rather poignantly), we see that the number of unprofitable transactions in The Laurels actually tops that of all the other condos in this list.

There are a number of hefty losses, with the biggest one coming from a unit that was bought in April 2010 and sold in November 2017. The loss accounted for almost $1m.

So what went wrong with these Condos?

- Introduction of Cooling Measures

- Dip in Foreigner Buying Power

- Intensified competition/increased opportunities for potential buyers

Looking at transaction dates, we realise that a majority of the units that later made hefty losses were also bought before the cooling measures in 2013 and sold some years later.

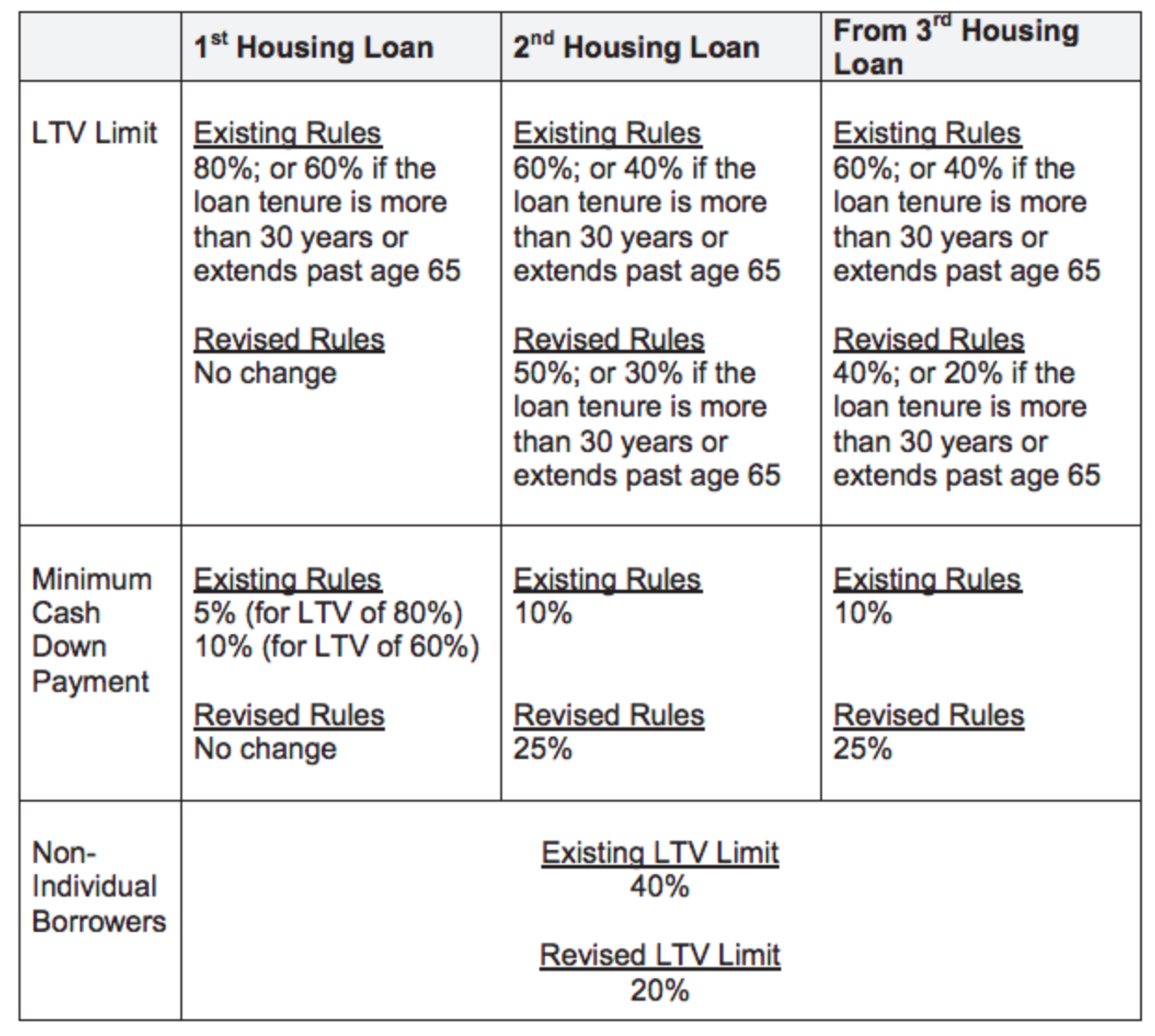

To set some context, these were the LTV amendments for 2013:

The new 2013 TDSR implementations also dictated that only 60% of one’s monthly salary would be recognised for a loan scheme extending over 30 years – including his/her other debt obligations (which essentially put an end to many previous high-end condo unit purchase practices where buyers would take massive loans stretching past 30 years).

What’s more, a further 30% loan recognition haircut of variable incomes (ie. commissions/rental yields), as well as the newly introduced 3.5-4.5% interest ‘stress tests’ basically meant that people could not borrow as much as they were previously doing to pay for their homes.

The result?

A drastic drop in eligible buyers with sufficient buying power who could still pay these exorbitant prices for units in the aforementioned developments.

And for those unfamiliar with ABSD history, these were the amendments made in 2013:

| Singapore Citizens | Permanent Residents | Foreigners | Companies | |

| Purchase of 1st property | NIL | 5% | 15% | 15% |

| Purchase of 2nd property | 7% | 10% | 15% | 15% |

| Purchase of 3rd & subsequent properties | 10% | 10% | 15% | 15% |

After a further glance at buyer demographics, we realised that in the case of Helios Residences and The Laurels, a majority of buyers fall under a combination of ‘foreigners’ and ‘companies’ (50.6% and 49% respectively), with the total similar makeup for OUE Twin Peaks amounting to 32.3%.

Foreigners were not only impacted by loan cuts, they were now imposed with additional taxes too, resulting in the complete inability of many (previously eligible) buyers to match unit prices here.

Hence the massive restructuring of asking prices and subsequently underappreciated sales.

Fast forward to 2020 and we see even stricter revisions to the LTV, ABSD and TDSR measures, further constricting loan-related buying power for many formerly eligible buyers.

Another point worth noting is the number of condos rising up in the D9 area in recent times.

With over 300 condos in the vicinity, there is no shortage of ‘alternatives’ that higher-end buyers can revert to if there are certain nuances that they do not appreciate in a particular development.

Let’s now have a look at how these ‘nuances’ differ amongst our 3 D9 condos today.

Helios Residences

Helios Residences was (at launch – and subsequently between 2011 and 2013) the most expensive condo in this list during the peak of the property market price index – it is now the ‘most affordable’ of the 3.

Through the years we see the gradual decline in demand, and hence price points for units here.

And it’s really no wonder with newer condos popping up in the immediate vicinity (Cairnhill 9 comes to mind).

In other words, Helios Residences is no longer the new kid on the block with any incredible USPs that really sets it apart from surrounding competition.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

This New Freehold CBD Condo Starts From $1.29M — Here’s How the Pricing Compares

The development of Newport Residences marks some firsts for a new luxury residential project in the CBD. It's a redevelopment…

What’s more, for those looking for more affordable options, there are also a number of older (more spacious) condo units in the area.

Before we move on to the next condo, let’s also talk about unit make-up.

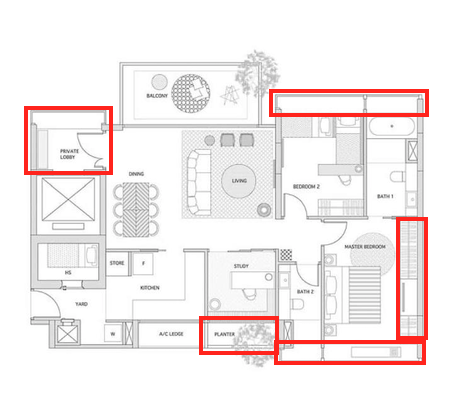

This is a 2-bedroom + Study unit at Helios Residences.

Notice the massive bay windows and planter?

Admittedly, some might prefer them in bigger units, but the truth is that these extra ‘space-wranglers’ often serve as a bane to smaller-unit owners looking to maximise unit space.

Let’s not forget that we’re also paying for these spaces after all!

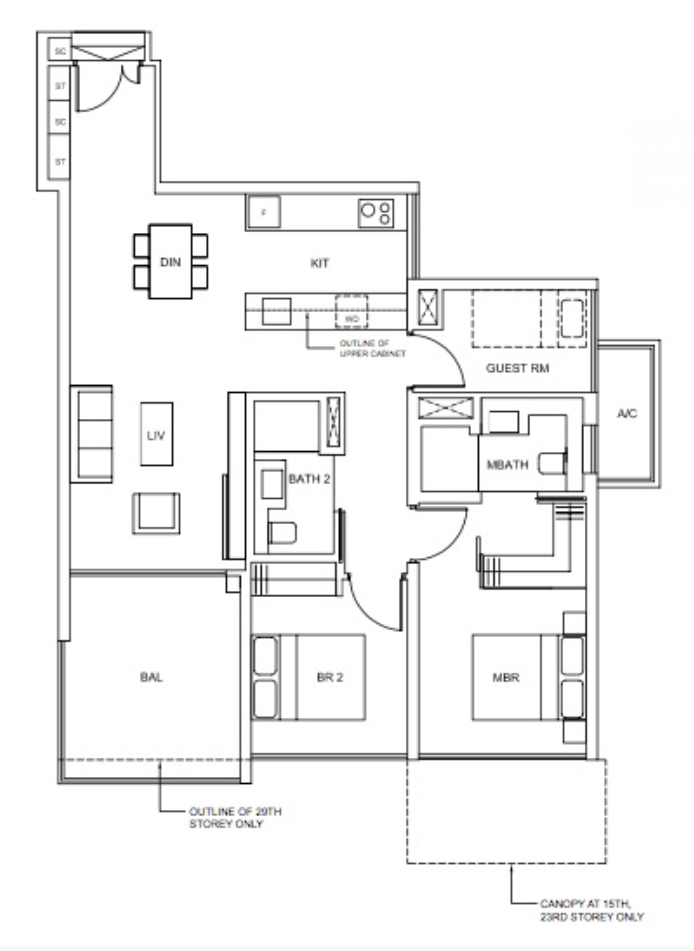

Here’s an alternate example of a 2-bedroom + Guest unit at the 2016 TOP-ed Cairnhill 9 (500m down the road):

Note the lack of bay windows and planter space.

Moving on to our final point, it is also clear that Covid-19 has had its effects with 5 fire-sale transactions made here in 2020 even before the year’s end.

While we cannot speculate on the financial reasons behind these latest sales (one of which would include fear of further deprecation), it’s safe to say that the hefty, drawn-out depreciation rates of these units have forced some unfortunate owners’ hands to resort to selling their units at major losses.

OUE Twin Peaks

Our next condo is a 99-year leasehold amongst a number of Freehold district neighbours along Leonie Road – a point in itself when ascertaining fall in pricings for units here.

It was also marketed as a luxury high-end condo in the heart of Orchard – and with incredible architecture and ornaments scattered around the condo’s grounds, it’s safe to say that the developers have fulfilled their end of the bargain (for our in-depth of the place, click here).

But as the tenure begins to deplete and the initial luxury ‘wow-factor’ fades/is replaced by surrounding luxury projects, so too does the value of these developments.

Some might even go on to say that you’re basically paying an unreturnable sum for ‘peak-year livability’.

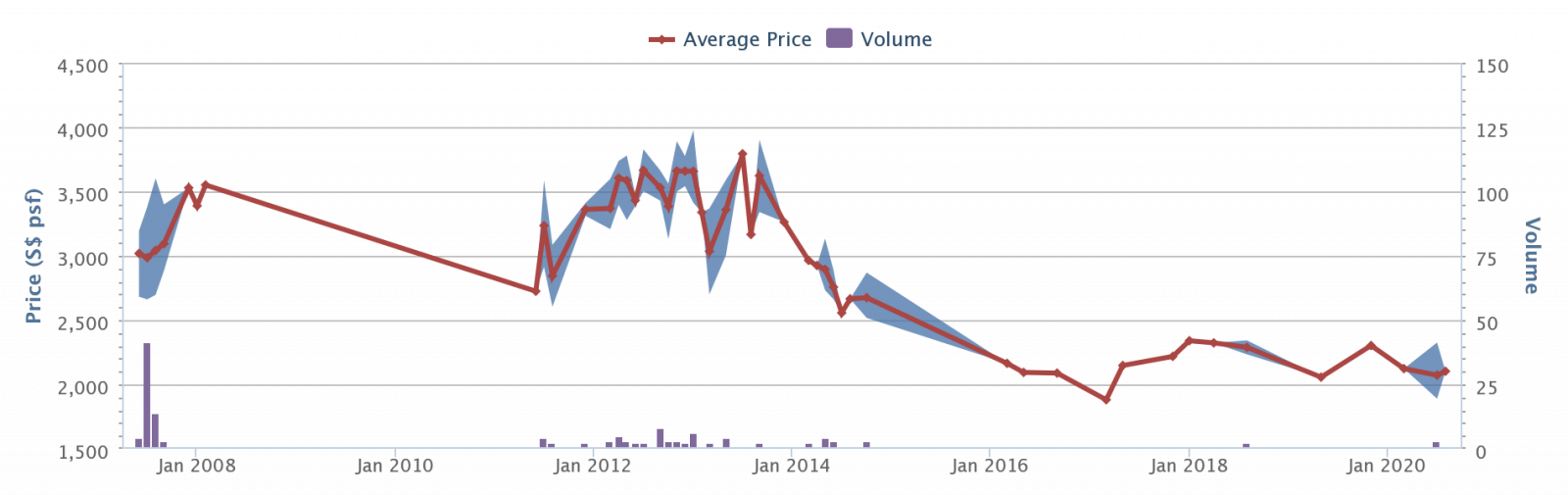

Another key factor for the decline in prices were the initial deferred payment schemes, followed by the more ‘desperate’ discounts that the developers pushed out in order to avoid being hit by almost $43m-worth of ABSD/QC charges (in the first year) some 4 years back.

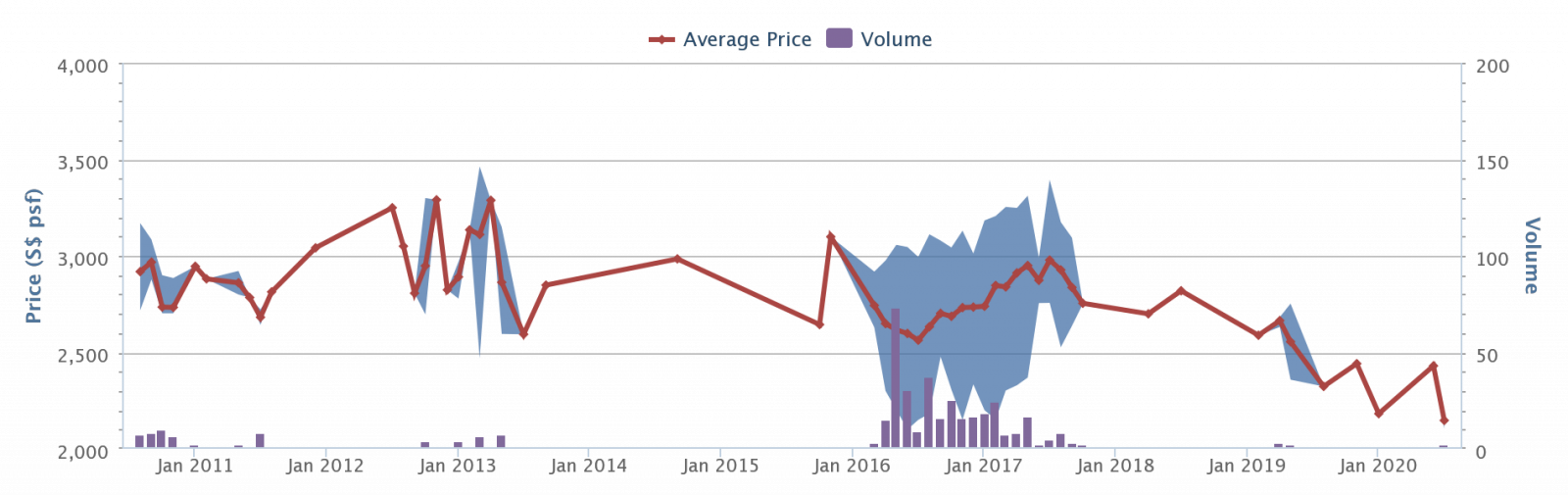

Notice the point in 2016 where unit transactions increased and prices dipped? That’s the point where the discounts came in.

Unsurprisingly, the downward momentum combined with a variety of aforementioned factors meant that unit price points never subsequently recovered to their former glory days.

A final point worth noting for OUE Twin Peaks revolves around its immediate location.

If you fire up google maps, you’ll notice that OUE is actually a 10-minute walk away from Orchard Road. With the premium that one was initially paying for a unit here, you could easily buy into a D9 condo on the cusp, or even in the shopping belt itself.

In the same vein, surrounding condos in the Leonie Road area never really lept off the ground in terms of appreciation.

The Laurels

Beyond the initial 3 overarching factors that we mentioned earlier, our final condo proves to be quite an interesting one.

Now one of the unorthodox (but admittedly efficient) ways of finding the ins-and-outs of a resale condo is to fire up a good old Google review search.

From the comments on The Laurels, we were able to find out a number of things.

Firstly – there were a number of residents unhappy with below-average unit/condo maintenance.

Based on comments of past and current homeowners, we realise that both time and the committee hasn’t been too kind/zealous about the project.

Issues like dirty swimming pools, rampant mosquitoes and leaking pipes are said to plague a number of residents here.

(And as if it isn’t already hard enough to deal with the existing cooling measures and poor property market sentiments!)

From this, we realise that the importance of condo/unit maintenance when looking at securing high resale prices should never go under prioritised.

Ok, quick question before we go on.

If you were a buyer looking to purchase a unit here, would this little comment cause you to halt discussions immediately?

Probably not.

But the comment would definitely leave a lasting impression personally – which could then lead to overly-zealous inspections and a subsequently age-old self-fulfilling prophecy. An issue which might have not surfaced had you never seen the comment.

It also brings up my following point about bad press.

Through this little example, we see how just one bad comment can skew the credibility of a condo even if it might not be true.

Intriguingly, all the other google reviews speak very highly of the place – though that initial subconscious reputational damage has already been done.

One final point to note stems from the unit configurations here.

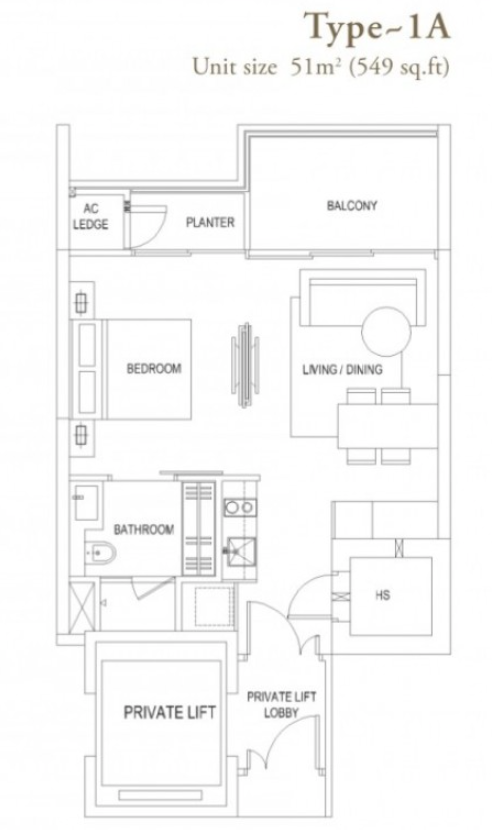

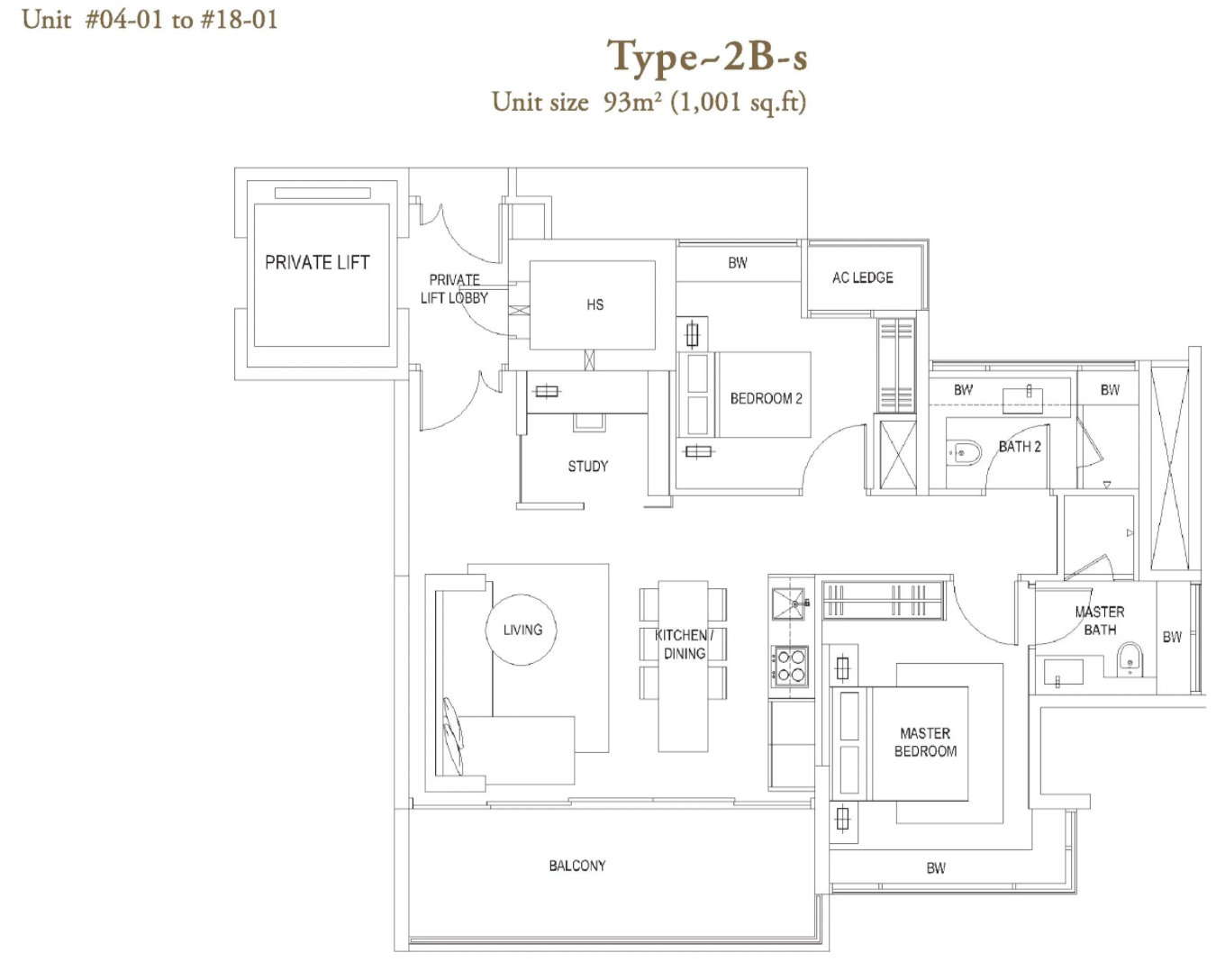

Similar to Helios Residences, there seems to be an issue with inefficient space across unit types. Here are some examples:

Notice how there’s an inclusion of a HS (household shelter), private lift, bw (bay windows), planters and balconies across all units?

For larger unit spaces the impact of these implementations is often negligible – and at certain points, even welcome.

However, if you were living in a 549 square foot 1-bedder (of which there are 45 out of 229 units), it just means that you have much less ‘liveable’ space to contend with.

And again, there are a ton of other condos in the area to choose from. Newer condos that are offering more affordable units with bigger room for ‘livability’.

Key Takeaways from Today

So what are some of the points that we can take away from our respective case studies today?

1.) Firstly depreciation yields are often affected by a plethora of factors both big and small – though it often coincides with neighbouring competition and current property market price sentiments.

2.) Secondly, units with poorer layouts (ie. smaller, less livable spaces) tend to do badly upon resale.

3.) Thirdly, unit and condo maintenance is very important. Issues like unaddressed unit finishing issues, poorly upkept facilities and even unit noise pollution can be very telling. In other words, the MCST have an important role to play in a condo’s future appreciation.

4.) Fourth, the condo’s image in the public eye is more important than you think – especially with the advent of technology in this age where bad news spreads like wildfire.

As always, feel free to reach out at stories@stackedhomes.com or leave a comment down below should you have any pressing questions!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why do some condos in District 9 experience unprofitable resale transactions?

How did Singapore’s cooling measures impact condo prices in District 9?

What role does condo maintenance play in property value and resale?

Why has OUE Twin Peaks experienced more unprofitable sales compared to other condos?

What should buyers consider about unit layouts and space when purchasing condos in District 9?

Reuben Dhanaraj

Reuben is a digital nomad gone rogue. An avid traveler, photographer and public speaker, he now resides in Singapore where he has since found a new passion in generating creative and enriching content for Stacked. Outside of work, you’ll find him either relaxing in nature or retreated to his cozy man-cave in quiet contemplation.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Latest Posts

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Singapore Property News You Can Now Buy Part Of A $300M Singapore Bungalow — But You Can’t Live In It

0 Comments