We Analysed 22 Recent HDB MOP Estates To Find Out Which Has Made The Most Money

November 12, 2019

Most investors and property agents are inclined to delve into the condominium market.

Which is understandable, to say the least. Higher prices = higher potential commissions.

And the fact that HDB flats are supposed to be ‘affordable for everyone’ means that we shouldn’t see a massive appreciation jump in any of these flats…

…or will we?

First Things First.. What On Earth Is MOP?

For those familiar with the MOP scheme, feel free to skip ahead.

For those who aren’t, it simply means that buyers of a new HDB flat can only sell their units 5 years from the initial transaction date for the flat.

More than that, it also means that you will not be able to rent out the house completely (you’ll have to occupy at least one room) during this time. Furthermore, owners who are based abroad for a considerable period during this window will not have time from that period counted toward their MOP progress.

Of course, it goes without saying that this poses quite a restriction to flat owners – most notably for residents who are looking to purchase a new home during these 5 years. Granted, there are some instances in which MOP doesn’t apply (the first that comes to mind is a one-room resale flat purchased without HDB grants), though it does entail a rather drawn-out list of black and white.

In lieu of today’s lighter topic of top recent appreciators, we’ll save everyone the effort and leave this discussion for the near future.

How will this list help me?

Now for those of us who are just starting out in life and working towards the purchase of our first flat (1st move-in tip: try not to miss the nagging), it is easy to lose track of your property’s investment value from the get-go.

Unfamiliar surroundings, random terms popping up here and there… we’ve all been through it (and made our fair share of mistakes) so we know how you feel.

If there’s one thing to remember, however, it’s to never lose sight of your property’s potential value even if you intend to settle down in the flat for a long time to come (2nd move-in tip: things change, opportunities come by).

Even for the seasoned mover, resale trends are constantly shifting and so new data is always important when it comes to any property’s potential value analysis.

That’s why we’ve decided to review 10 Punggol, 2 Yishun, 4 Sengkang, 2 Woodlands, 2 Bukit Panjang, 1 Choa Chu Kang and 1 Jurong West BTOs following their respective MOPs.

If you’re wondering why the hell this seemingly rag-tag bunch of developments, its because they are the most recent developments that have achieved MOP (we just wanted to throw in the bizarre mix for full effect…sorry).

And so jokes aside, we present to you our list of Top 22 HDB MOP estates following the latest string of MOP sales.

Let the countdown begin.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Top 22 HDB MOP Estates

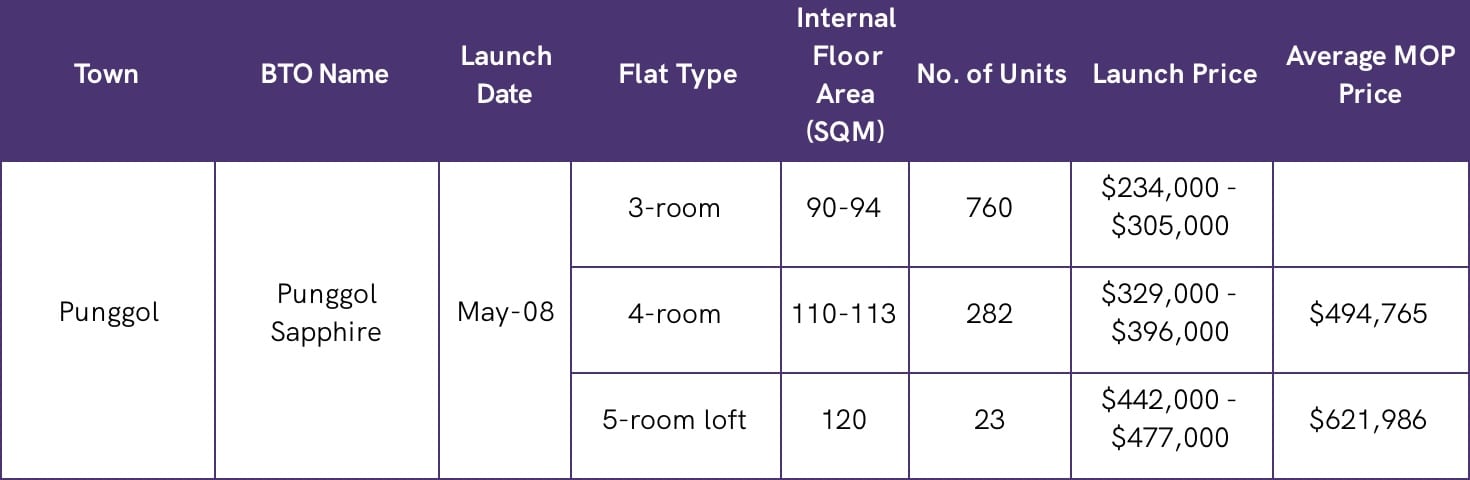

#22- Punggol Sapphire

Punggol Sapphire was launched on May 2008 and completed in May 2012.

Its 4-room units have sustained an estimated appreciation rate of 36.4% from a median $362,500 launch price to a $494,765 post HDB MOP average price.

Its 5-room loft units have sustained an estimated appreciation rate of 35.3% from a median $459,500 launch price to a $621,986 post HDB MOP average price.

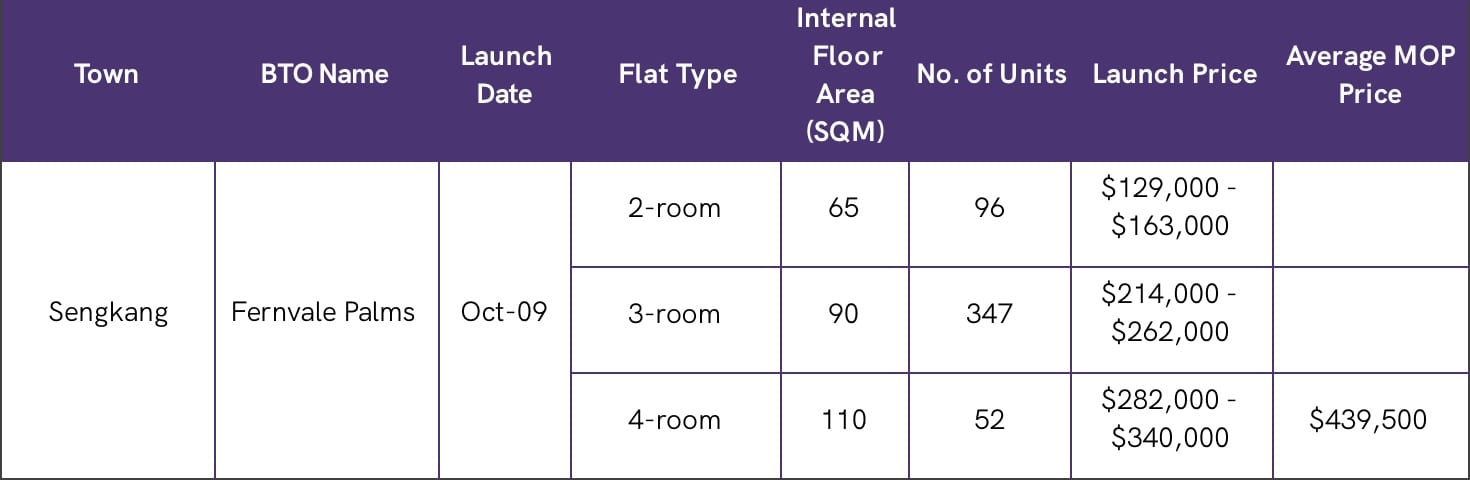

#21- Fernvale Palms

Fernvale Palms (Sengkang) was launched on October 2009 and completed in October 2013.

Its 4-room units have sustained an estimated appreciation rate of 41.3% from a median $311,000 launch price to a $439,500 post HDB MOP average price.

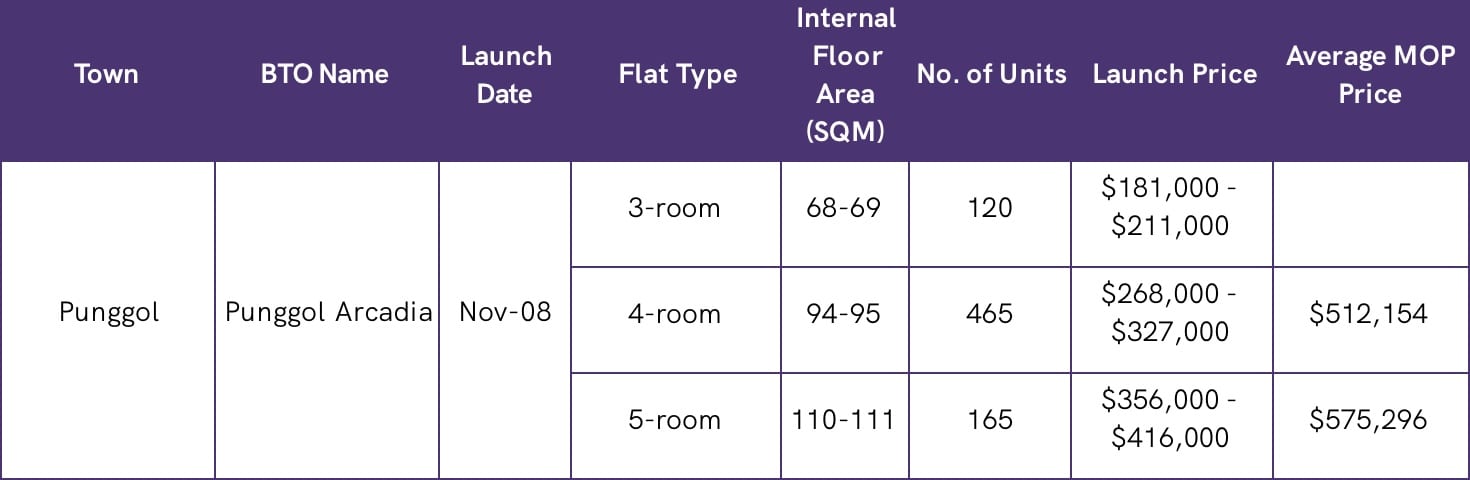

#20 – Punggol Arcadia

Punggol Arcadia was launched on November 2008 and completed in November 2011.

Its 4-room units have sustained an estimated appreciation rate of 72.1% from a median $297,500 launch price to a $512,154 post HDB MOP average price.

Its 5-room units have sustained an estimated appreciation rate of 49% from a median $386,000 launch price to a $575,296 post HDB MOP average price.

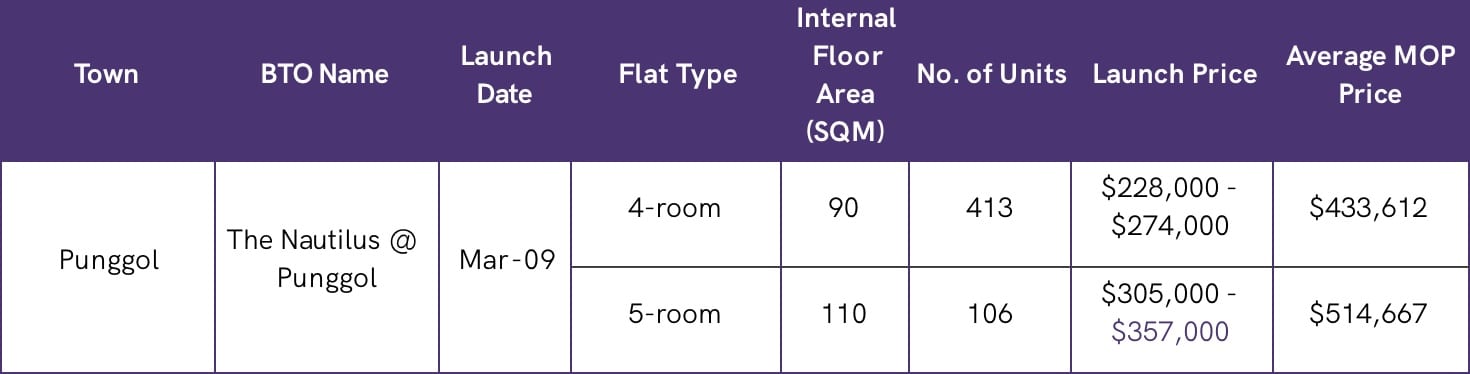

#19 – The Nautilus @ Punggol

The Nautilus @ Punggol was launched on March 2009 and completed in March 2013.

Its 4-room units have sustained an estimated appreciation rate of 72.7% from a median $251,000 launch price to a $433,612 post HDB MOP average price.

Its 5-room units have sustained an estimated appreciation rate of 55.4% from a median $331,000 launch price to a $514,667 post HDB MOP average price.

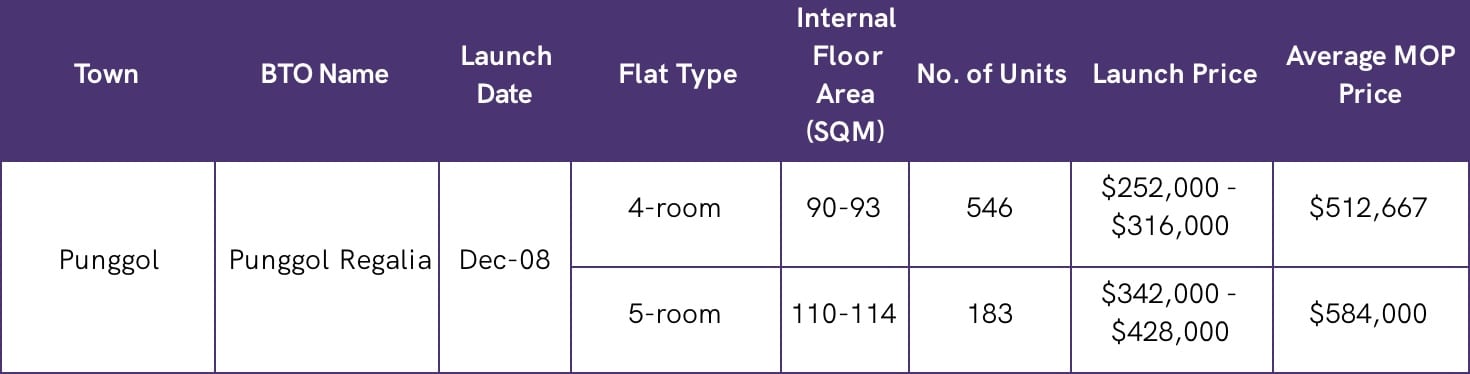

#18 – Punggol Regalia

Punggol Regalia was launched on December 2008 and completed in December 2011.

Its 4-room units have sustained an estimated appreciation rate of 80.5% from a median $284,000 launch price to a $512,667 post HDB MOP average price.

Its 5-room units have sustained an estimated appreciation rate of 51.6% from a median $385,000 launch price to a $584,000 post HDB MOP average price.

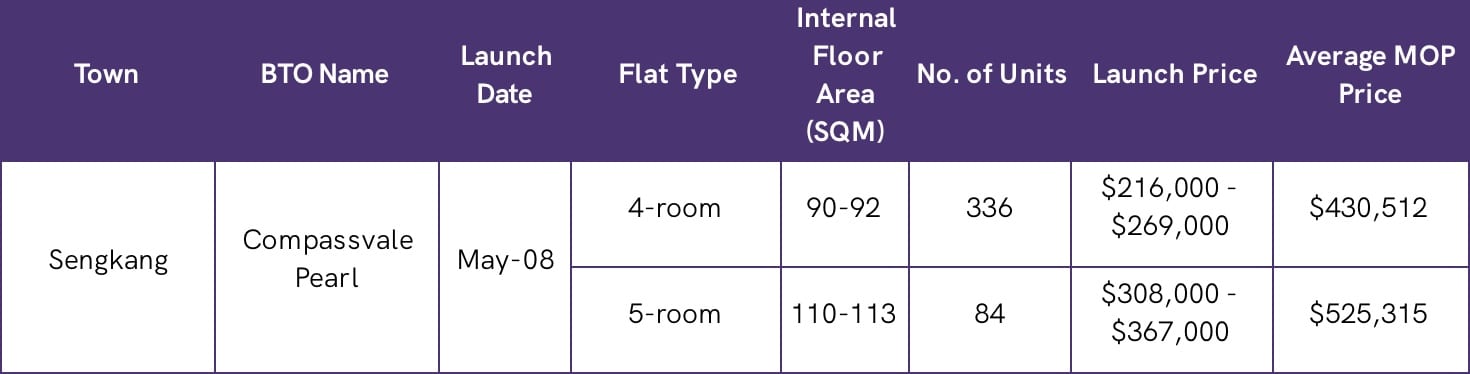

# 17 – Compassvale Pearl

Compassvale Pearl (Sengkang) was launched on May 2008 and completed in May 2010.

Its 4-room units have sustained an estimated appreciation rate of 77.5% from a median $242,500 launch price to a $430,512 post HDB MOP average price.

Its 5-room units have sustained an estimated appreciation rate of 55.6% from a median $337,500 launch price to a $525,315 post HDB MOP average price.

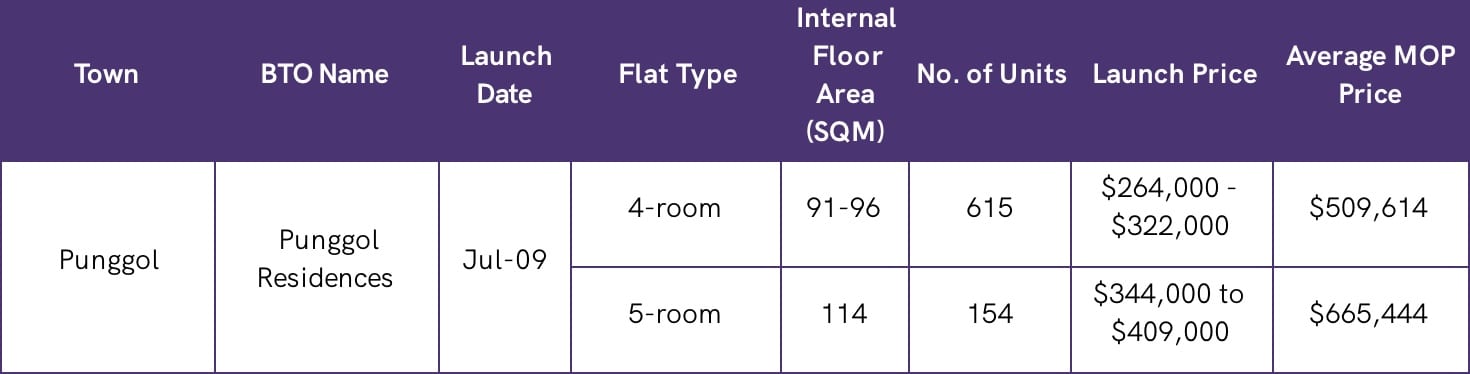

#16 – Punggol Residences

Punggol Residences was launched on July 2009 and completed in July 2013.

Its 4-room units have sustained an estimated appreciation rate of 73.9% from a median $293,000 launch price to a $509,614 post HDB MOP average price.

Its 5-room units have sustained an estimated appreciation rate of 76.7% from a median $376,500 launch price to a $665,444 post HDB MOP average price.

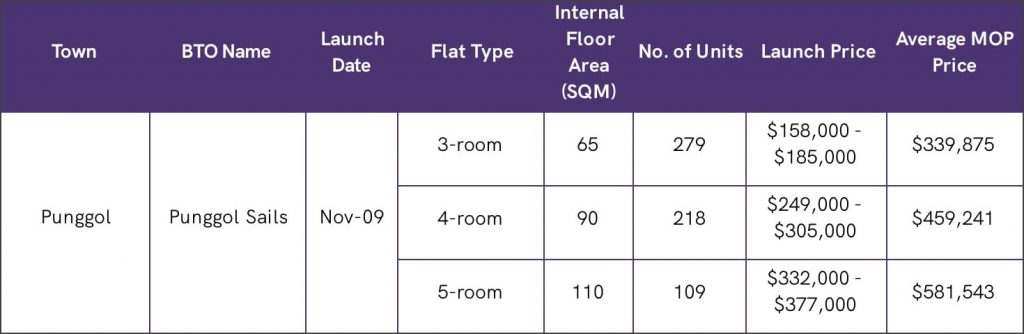

# 15 – Punggol Sails

Punggol Sails was launched on November 2009 and completed in November 2013.

Its 3-room units have sustained an estimated appreciation rate of 98.1% from a median $171,500 launch price to a $339,875 post HDB MOP average price.

Its 4-room units have sustained an estimated appreciation rate of 65.7% from a median $277,000 launch price to a $459,241 post HDB MOP average price.

Its 5-room units have sustained an estimated appreciation rate of 64% from a median $354,500 launch price to a $581,543 post HDB MOP average price.

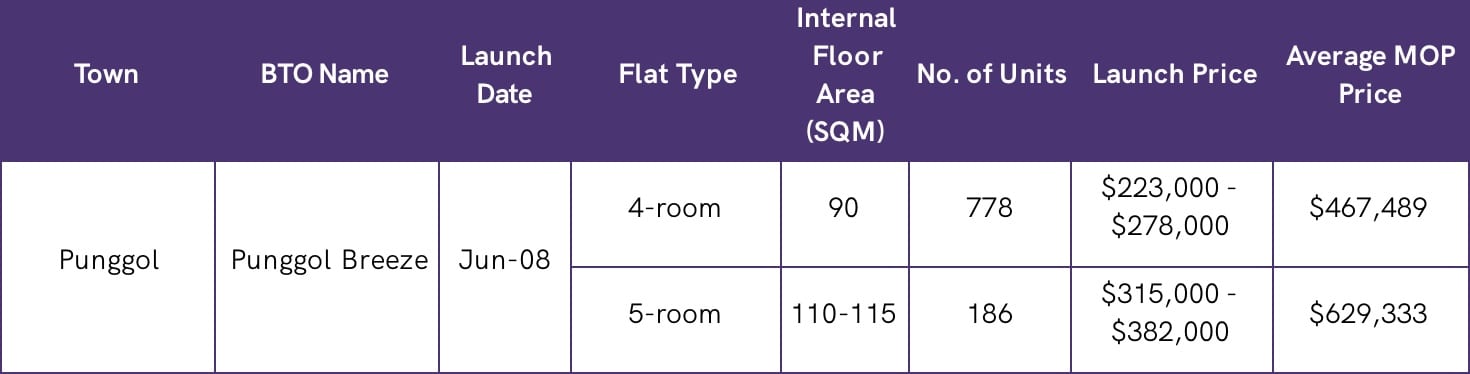

# 14 – Punggol Breeze

Punggol Breeze was launched on June 2008 and completed in June 2012.

Its 4-room units have sustained an estimated appreciation rate of 86.6% from a median $250,500 launch price to a $467,489 post HDB MOP average price.

Its 5-room units have sustained an estimated appreciation rate of 80.5% from a median $348,500 launch price to a $629,333 post HDB MOP average price.

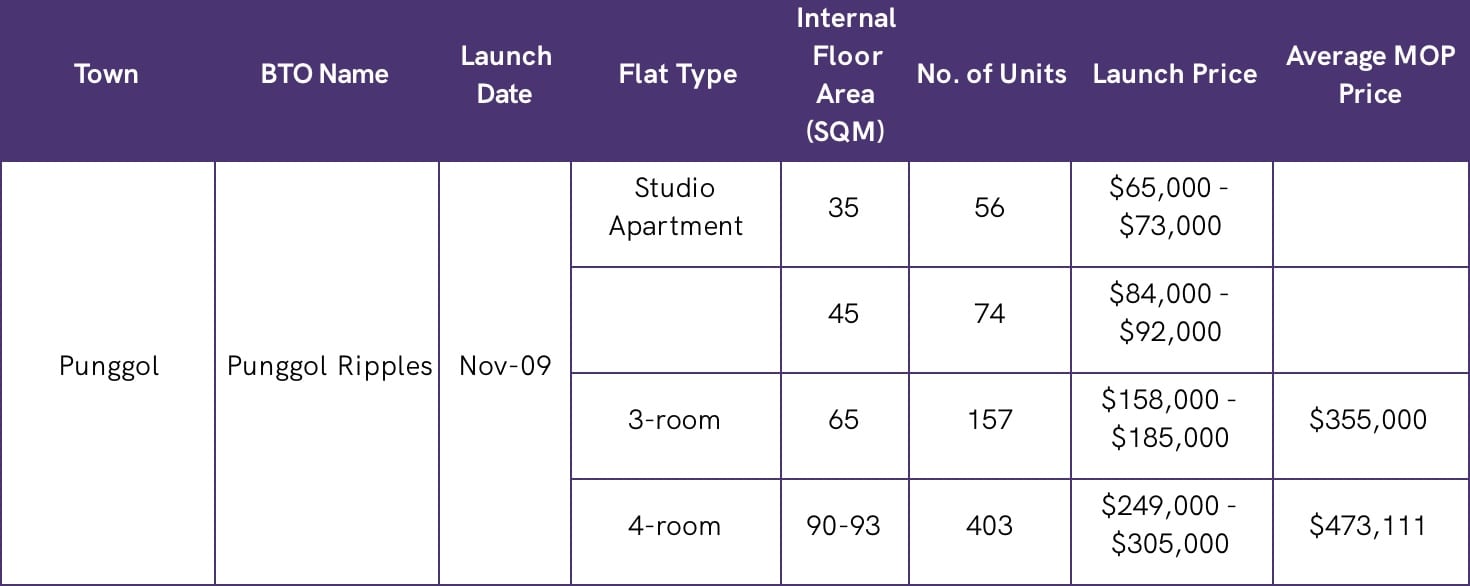

# 13 – Punggol Ripples

Punggol Ripples was launched on November 2009 and completed in November 2013.

Its 3-room units have sustained an estimated appreciation rate of 106.9% from a median $171,500 launch price to a $355,000 post HDB MOP average price.

Its 4-room units have sustained an estimated appreciation rate of 70.7% from a median $277,000 launch price to a $473,111 post HDB MOP average price.

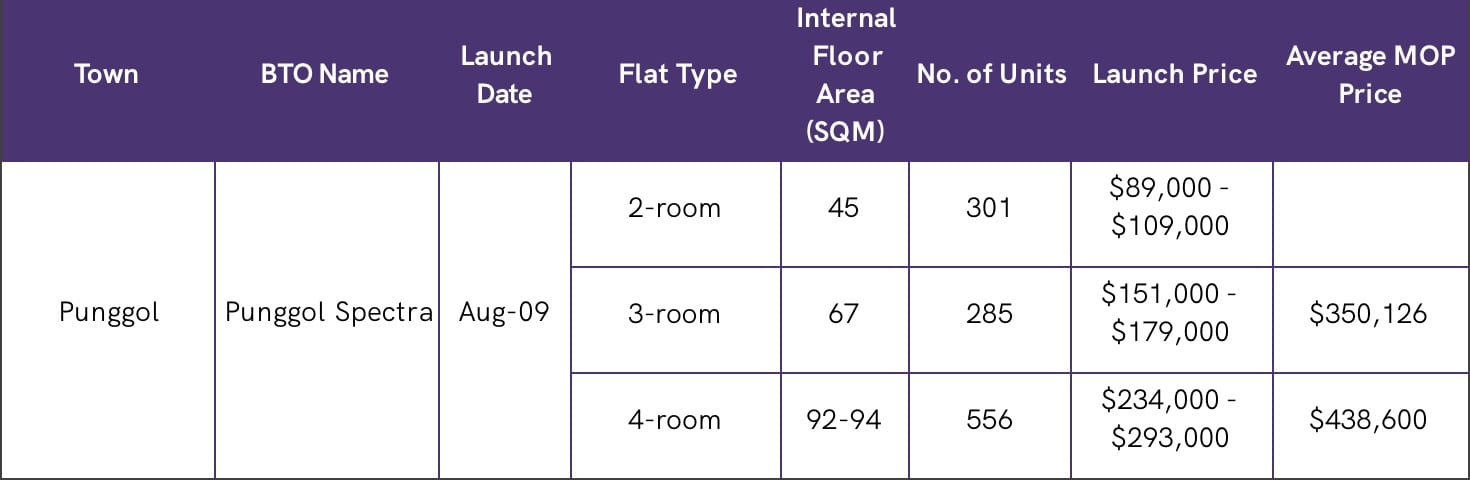

#12 – Punggol Spectra

Punggol Spectra was launched on August 2009 and completed in August 2013.

Its 3-room units have sustained an estimated appreciation rate of 112.1% from a median $165,000 launch price to a $350,126 post HDB MOP average price.

Its 4-room units have sustained an estimated appreciation rate of 66.4% from a median $263,500 launch price to a $438,600 post HDB MOP average price.

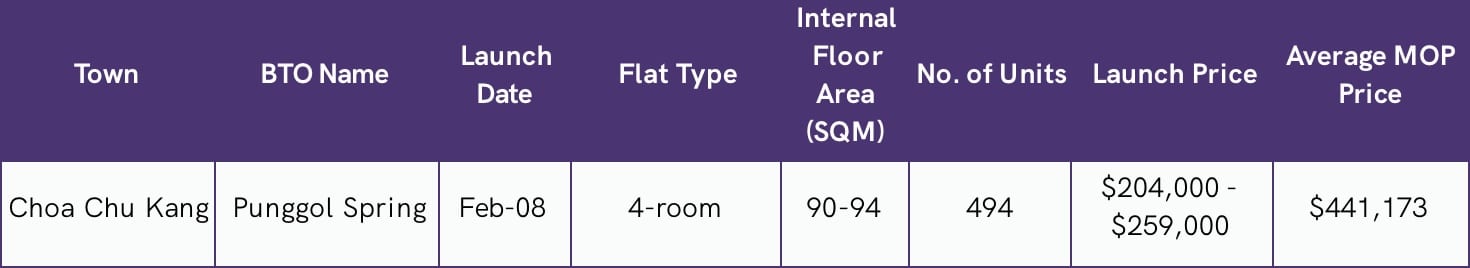

#11 – Punggol Spring

Punggol Spring was launched on February 2008 and completed in Feb 2012.

Its 4-room units have sustained an estimated appreciation rate of 90.5% from a median $231,500 launch price to a $441,173 post HDB MOP average price.

Property Market CommentaryResale Condo vs New Launch vs HDB Resale: A Case Study On Which Is The Best Option

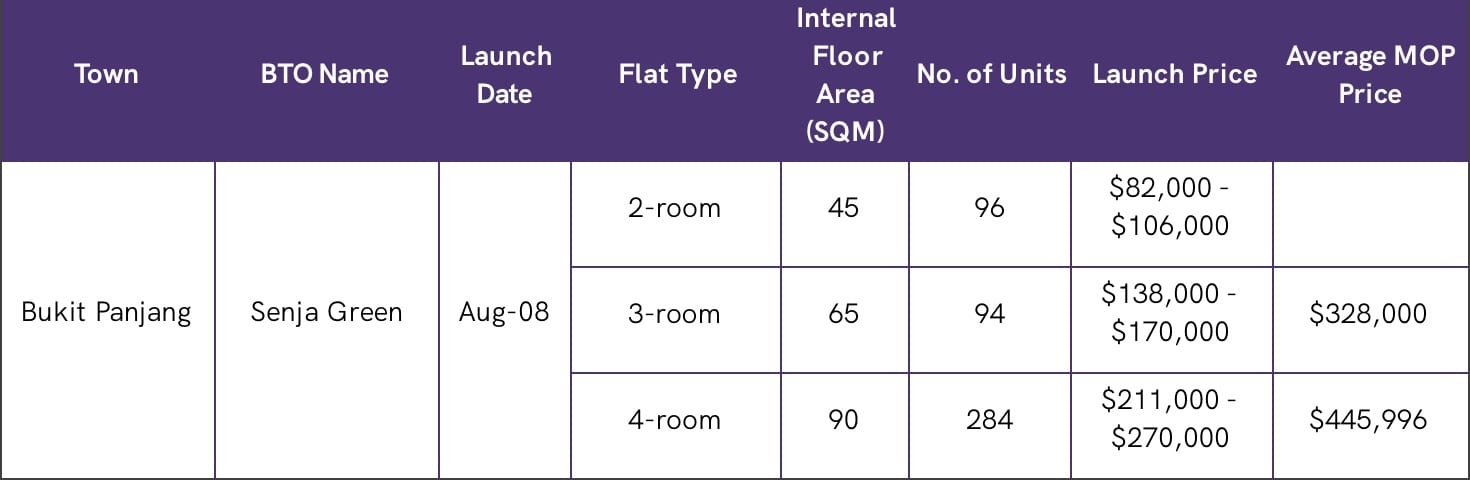

by Reuben Dhanaraj# 10 – Senja Green

Senja Green (Bukit Panjang) was launched on August 2008 and completed in August 2012.

Its 3-room units have sustained an estimated appreciation rate of 112.9% from a median $154,000 launch price to a $328,000 post HDB MOP average price.

Its 4-room units have sustained an estimated appreciation rate of 85.4% from a median $240,500 launch price to a $445,996 post HDB MOP average price.

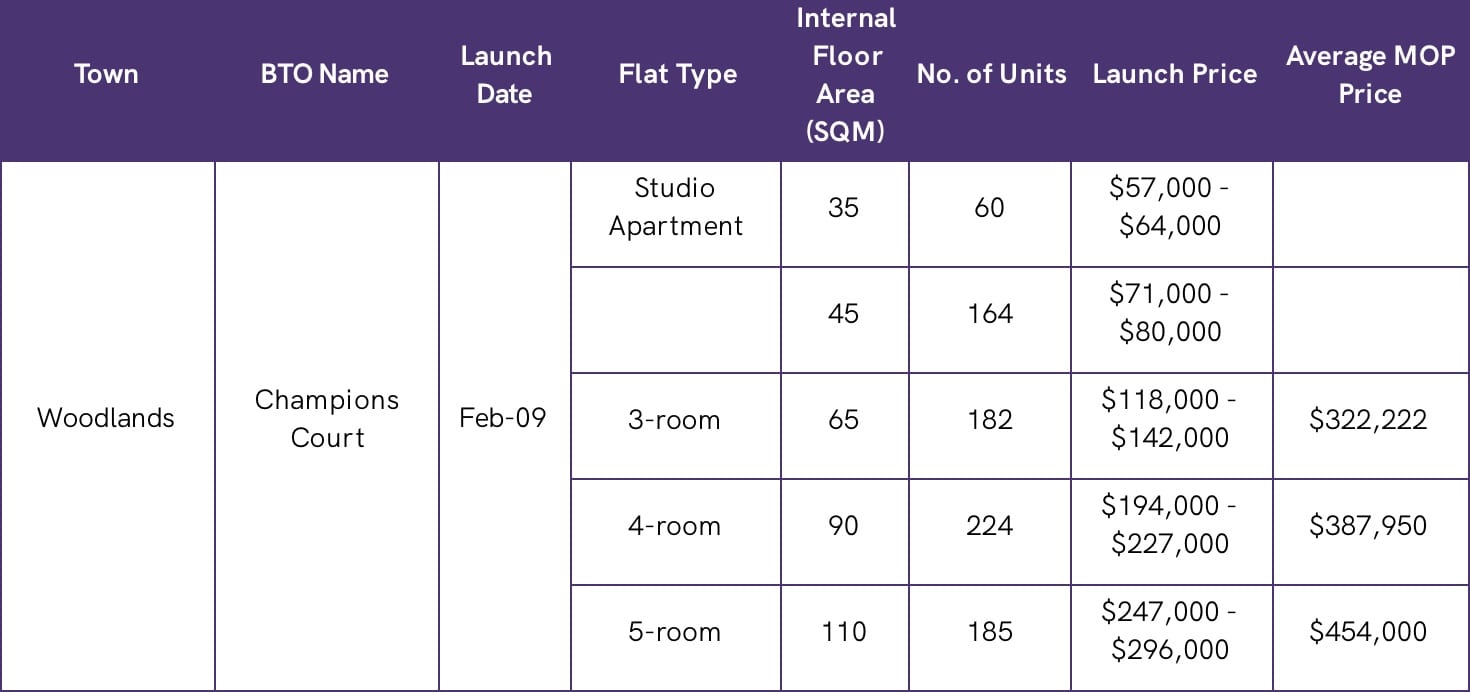

# 9 – Champions Court

Champions Court (Woodlands) was launched on February 2009 and completed in February 2013.

Its 3-room units have sustained an estimated appreciation rate of 147.8% from a median $130,000 launch price to a $322,222 post HDB MOP average price.

Its 4-room units have sustained an estimated appreciation rate of 84.2% from a median $210,500 launch price to a $387,950 post HDB MOP average price.

Its 5-room units have sustained an estimated appreciation rate of 67.2% from a median $271,500 launch price to a $454,000 post HDB MOP average price.

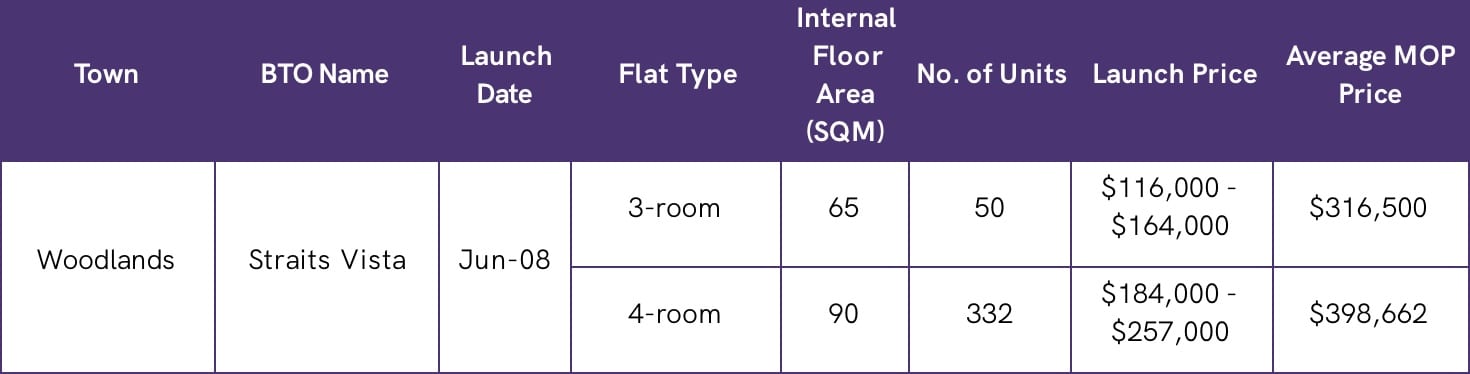

# 8 – Straits Vista

Straits Vista (Woodlands) was launched on June 2008 and completed in June 2012.

Its 3-room units have sustained an estimated appreciation rate of 126% from a median $140,000 launch price to a $316,500 post HDB MOP average price.

Its 4-room units have sustained an estimated appreciation rate of 80.7% from a median $220,500 launch price to a $398,662 post HDB MOP average price.

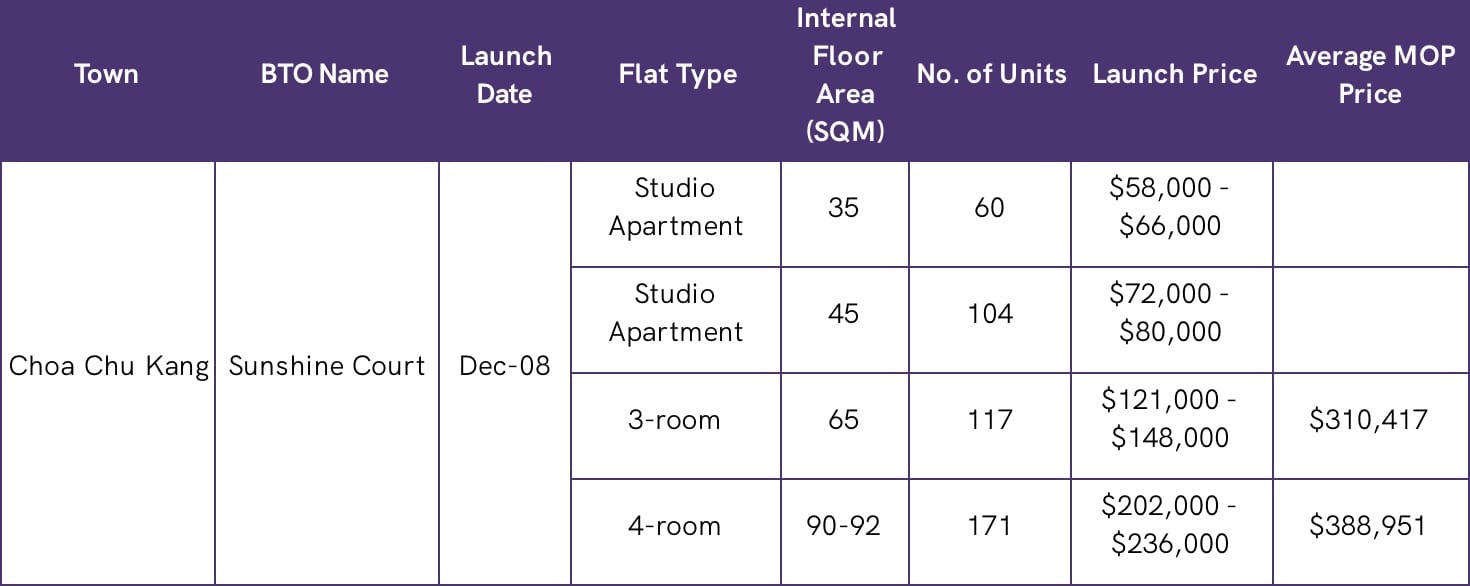

#7 – Sunshine Court

Sunshine Court (Choa Chu Kang) was launched on December 2008 and completed in December 2012.

Its 3-room units have sustained an estimated appreciation rate of 130.7% from a median $134,500 launch price to a $310,417 post HDB MOP average price.

Its 4-room units have sustained an estimated appreciation rate of 77.6% from a median $219,000 launch price to a $388,951 post HDB MOP average price.

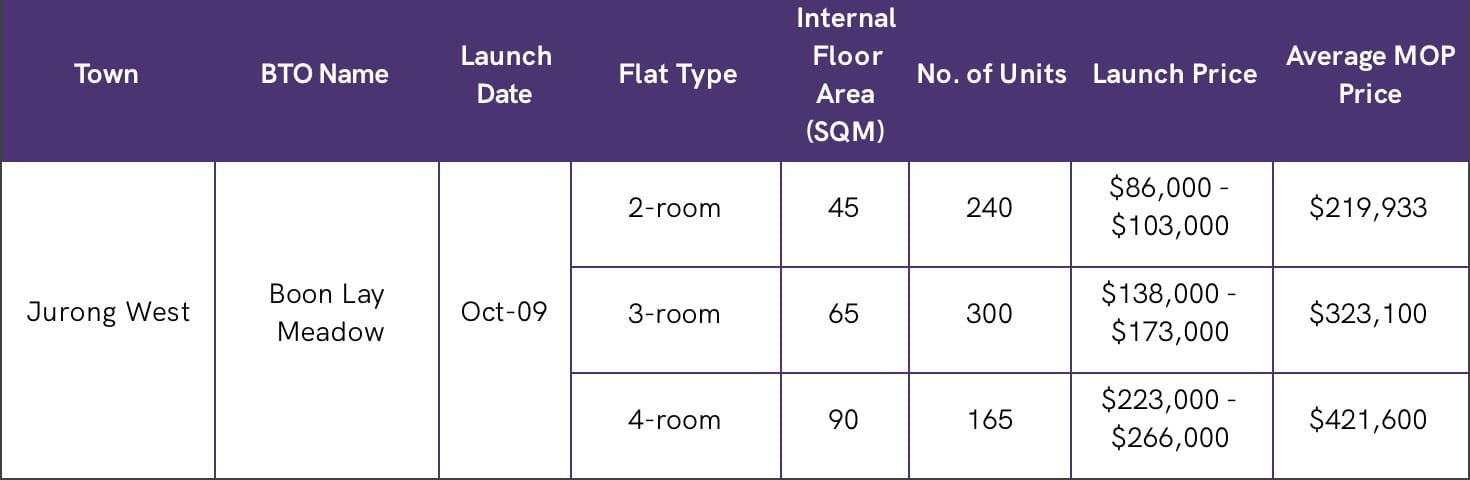

#6 – Boon Lay Meadow

Boon Lay Meadow (Jurong West) was launched on October 2009 and completed in October 2013.

Its 2-room units have sustained an estimated appreciation rate of 132.7% from a median $94,500 launch price to a $219,933 post HDB MOP average price.

Its 3-room units have sustained an estimated appreciation rate of 107.7% from a median $155,500 launch price to a $323,100 post HDB MOP average price.

Its 4-room units have sustained an estimated appreciation rate of 72.4% from a median $244,500 launch price to a $421,600 post HDB MOP average price.

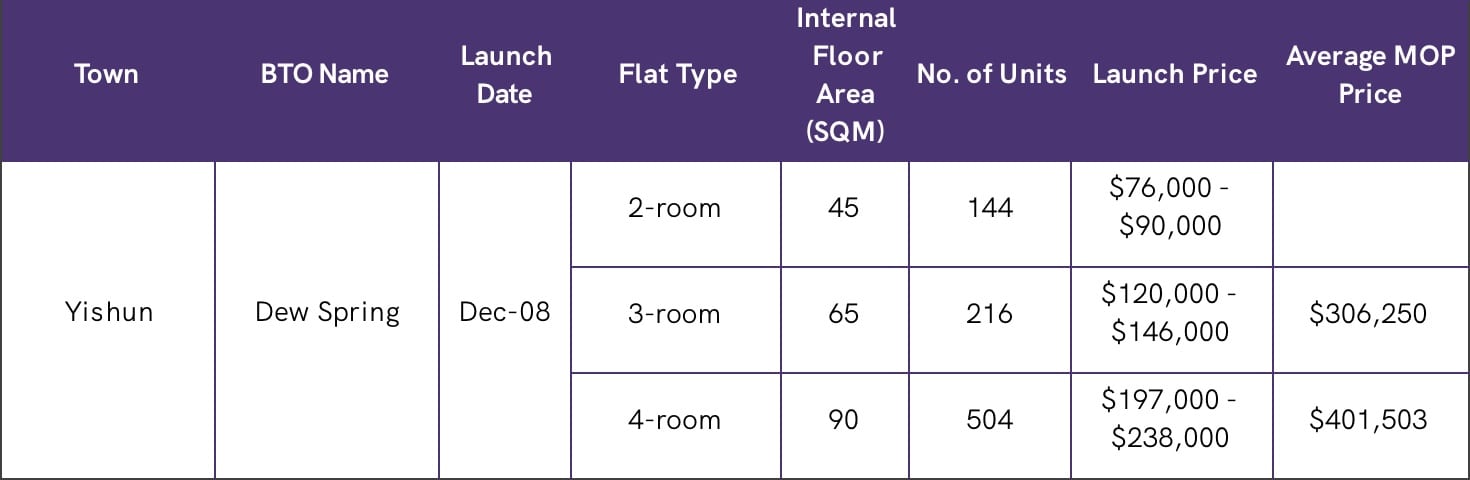

#5 – Dew Spring

Dew Spring (Yishun) was launched on December 2008 and completed in December 2012.

Its 3-room units have sustained an estimated appreciation rate of 130.2% from a median $133,000 launch price to a $306,250 post HDB MOP average price.

Its 4-room units have sustained an estimated appreciation rate of 84.5% from a median $217,500 launch price to a $401,503 post HDB MOP average price.

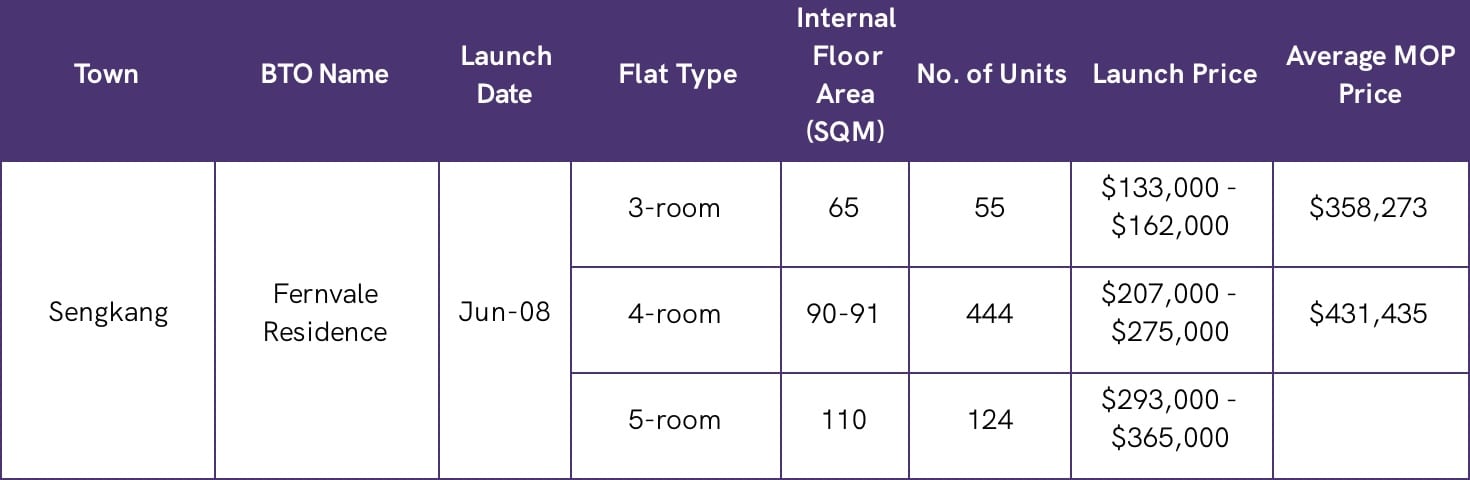

#4 – Fernvale Residence

Fernvale Residence (Sengkang) was launched on June 2008 and completed in June 2011.

Its 3-room units have sustained an estimated appreciation rate of 142.8% from a median $147,500 launch price to a $358,273 post HDB MOP average price.

Its 4-room units have sustained an estimated appreciation rate of 79% from a median $241,000 launch price to a $431,435 post HDB MOP average price.

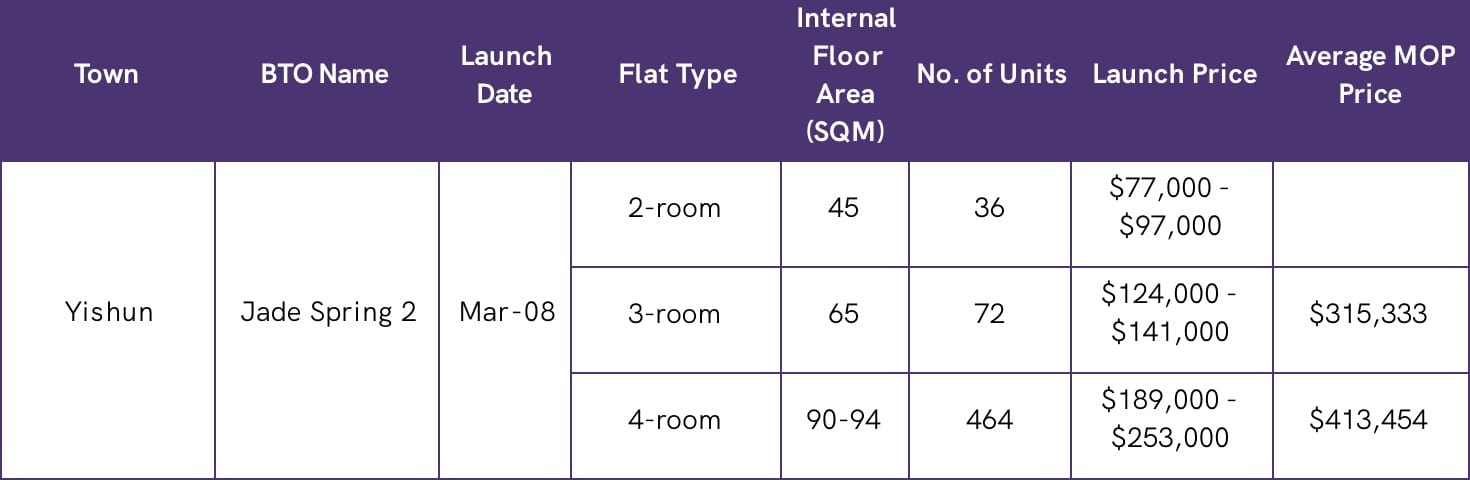

#3 – Jade Spring 2

Jade Spring 2 (Yishun) was launched on February 2008 and completed in Feb 2012.

Its 3-room units have sustained an estimated appreciation rate of 137.9% from a median $132,500 launch price to a $315,333 post HDB MOP average price.

Its 4-room units have sustained an estimated appreciation rate of 87% from a median $221,000 launch price to a $413,454 post HDB MOP average price.

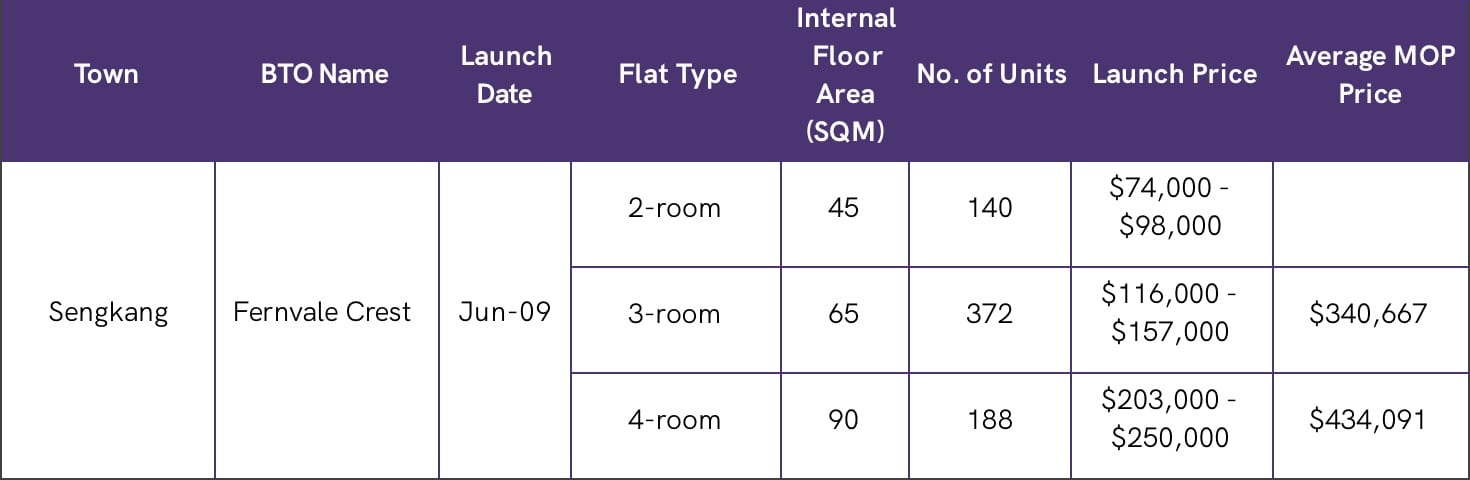

#2 – Fernvale Crest

Fernvale Crest (Sengkang) was launched on June 2009 and completed in June 2013.

Its 3-room units have sustained an estimated appreciation rate of 149.5% from a median $136,500 launch price to a $340,667 post HDB MOP average price.

Its 4-room units have sustained an estimated appreciation rate of 91.6% from a median $226,500 launch price to a $434,091 post HDB MOP average price.

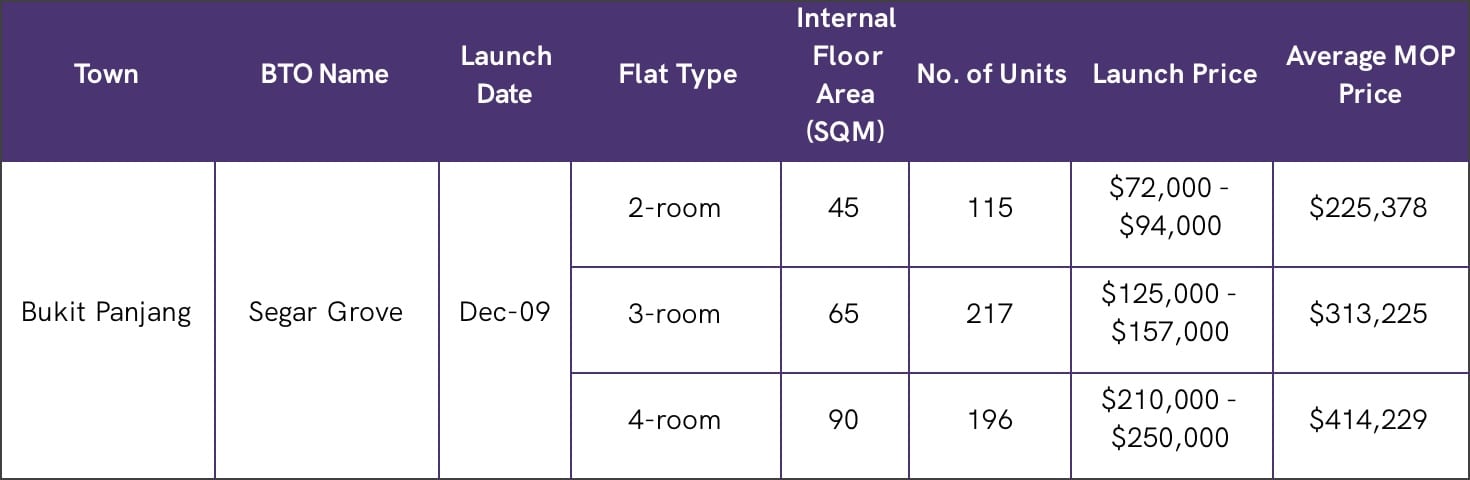

# 1 – Segar Grove

Segar Grove (Bukit Panjang) was launched on December 2009 and completed in December 2013.

Its 2-room units have sustained an estimated appreciation rate of 207.7% from a median $83,000 launch price to a $255,378 post HDB MOP average price.

Its 3-room units have sustained an estimated appreciation rate of 122.1% from a median $141,000 launch price to a $313,225 post HDB MOP average price.

Its 4-room units have sustained an estimated appreciation rate of 80% from a median $230,000 launch price to a $414,229 post HDB MOP average price.

HDB MOP Key Takeaways

| Area | Highest Average Appreciator | Average Appreciation | Number of Flats |

| Punggol | Punggol Spring – 90.5 | 72.9% | 10 |

| Woodlands | Straits Vista – 103.3% | 101.5% | 2 |

| Choa Chu Kang | Sunshine Court – 104.1% | 104.1% | 1 |

| Jurong West | Boon Lay Meadow – 104.2% | 104.2% | 1 |

| Yishun | Jade Spring 2 – 112.45% | 109.9% | 2 |

| Sengkang | Fernvale Crest – 120.55% | 84.8% | 4 |

| Bukit Panjang | Segar Grove – 124.5% | 111.8% | 2 |

As you can see, the highest average appreciator in each area is relative to its average appreciation rank on the table – save for the Sengkang area (logically speaking, an increased number of flats in said area usually skewers this trend).

The Sengkang area is relatively volatile with its highest appreciator, Fernvale Crest (120.55%) ranking 2nd and its lowest appreciator, Fernvale Palms (41.3%) ranking 21st out of the 22 developments.

We can also tell that the influx of HDB flats in the Punggol region led to lesser demand and essentially lower average appreciation across the board. In crux, no particular development did extremely well from the appreciation stat standpoint as compared to the other areas covered here.

What’s more, top appreciator Segar Grove’s 2-bedders were sold at a whopping 2.7 times more, 5 years from its initial launch.

It gives eye to a trend. A trend sounded by all the other flats in the Punggol, Woodlands, Bukit Panjang, Choa Chu Kang, Jurong West, Yishun, and Sengkang area.

Lesser roomed units are the biggest winners here.

Final Word

So why are the stats as such? And what other trends can it tell us about this new round of upcoming BTOs?

With all these figures and opportunities floating around, it is only natural for all these queries to abound.

One thing that is certain however, is that this little analysis has shown us just how much we can actually make from our BTO units if we sell them upon MOP.

Now my question to you – “Do you think this incredible trend will continue?

*For more information on the stats we use and for article requests, feel free to reach out to us at stories@stackedhomes.com. As always, we’d love to hear from you and get in touch!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What does the MOP scheme mean for HDB flat owners?

Why should I pay attention to recent HDB estate appreciation rates?

Which HDB estates have shown the highest appreciation after MOP?

Are smaller units in HDB estates more likely to appreciate in value?

How does the number of flats in an area affect its appreciation trend?

Reuben Dhanaraj

Reuben is a digital nomad gone rogue. An avid traveler, photographer and public speaker, he now resides in Singapore where he has since found a new passion in generating creative and enriching content for Stacked. Outside of work, you’ll find him either relaxing in nature or retreated to his cozy man-cave in quiet contemplation.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

3 Comments

This was when things used to be great. Now the tune has changed, people no longer can make as much from BTO. A lot of BTO buyers rode on the 07-13 growth. Sadly it’s unlikely to be the case for today’s BTO buyers.

Hi! I was wondering if something similar had been done for mature estates? Thank you!