12 Reasons To Be Happy (Or Scared) About The Singapore Property Market In 2023

December 21, 2022

2022 was a wild ride for the property market, and for the world in general. From a new war in Europe, to record-high interest rates, to new cooling measures. There are definitely some bumps ahead in the coming year, but there’s always a silver lining too. Here’s what we think most property buyers (and sellers) will like or hate about 2023:

Table Of Contents

- The possible upsides of 2023

- 1. Prices may moderate for resale flat buyers

- 2. Strong rental prospects, carrying on from 2022

- 3. Continued ramp-up of BTO supply

- 4. Some condos are nearing their ABSD deadline

- 5. A reaction to recent cooling measures may set in, which helps on the buyer front

- 6. A move towards more of a buyer’s market

- Possible downsides of the 2023 property market

- 1. Higher interest rates

- 2. Higher GST

- 3. Not as many new launches as most would prefer

- 4. Even HDB upgraders may be priced out of new launches

- 5. We may not have felt the full effects of the European war yet

- 6. More ultra-rich foreign buyers coming in

The possible upsides of 2023

- Prices may moderate for resale flat buyers

- Strong rental prospects, carrying on from 2022

- Continued ramp-up of BTO supply

- Some condos are nearing their ABSD deadline

- A reaction to recent cooling measures may set in, which helps on the buyer front

- A move towards more of a buyer’s market

1. Prices may moderate for resale flat buyers

This is due to the wait-out period, imposed during the September 2022 cooling measures. With some exceptions*, anyone disposing of private property must now wait 15 months, before they’re eligible to buy a resale flat.

(For BTO flats, it’s a longstanding rule that you need to wait 30 months after selling a private property before you can apply).

Before the cooling measure, we saw a record-number of flats transacting at $1 million or more. This was because right-sizers were selling at a market peak, and could easily afford the rising Cash Over Valuation (COV), or the premium on executive flats, Maisonettes, DBSS units, etc.

With the wait-out period in place, alongside the other cooling measures (e.g., the higher MSR and TDSR floor rates), and more BTO supply upcoming in 2023, resale flat prices may lose some momentum.

At present, however, there’s no way to know the exact number of people impacted by the wait-out period; so it’s still hard to estimate its precise significance.

*An exception is made for Singaporeans aged 55 and older, who are buying a 4-room or smaller resale flat.

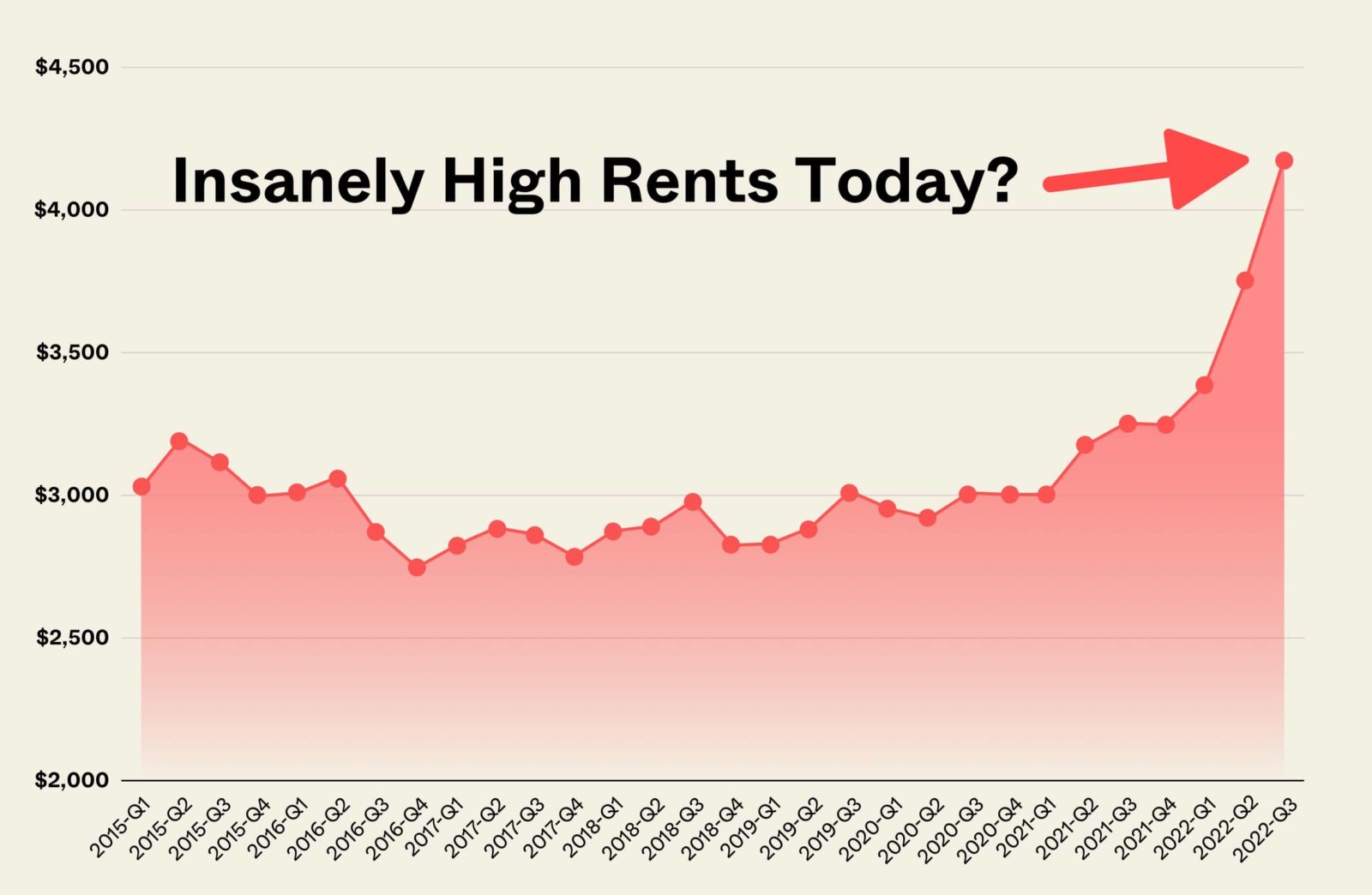

2. Strong rental prospects, carrying on from 2022

From word on the ground, 2023 is set to be a good year for landlords, with momentum carrying on from the previous year. We covered the reasons extensively in this earlier article (for HDB), and also in this post (for condos).

The main reason is Covid-19 trailing off, and the return of foreign workers at all levels – from S-Pass holders (who usually rent flats) to E-pass holders (who usually rent condos). There is also the extra S-Pass for higher foreign worker quotas (although the conditions to be met are only restricted to less than 1 per cent of all registered business entities).

Also, for the first time in many years, landlords are seeing stronger demand from local tenants. This is related to the surge in housing transaction volumes: more people are looking for temporary accommodation while their new home is being built – and a few others just need their own space right now, for purposes like Work From Home jobs.

Landlords will likely see fewer vacancies in 2023, and tenants may have little choice but to accept higher rental rates.

As a further bonus, realtors told us landlords may slightly be less affected by the increase in home loan rates. As one realtor pointed out, landlords can claim the interest portion of their mortgage as a tax deduction.

On the other hand, this could also be moderated by the number of completed new launches that will come onboard in 2023 (see point 6 for more).

Editor's Pick“Buy Now Before Property Prices Rise” 5 Facts You Must Know Before Making A FOMO Property Purchase

by Ryan J. Ong3. Continued ramp-up of BTO supply

About another 23,000 flats are expected in 2023, to meet surging demand. At present, we’re expecting 2,900 to 3,900 new flats in towns including Kallang, Queenstown, Whampoa, and Tengah. While these won’t immediately soak up resale demand, it’s at least a promise that the flat shortage won’t last forever.

HDB has further said that, if necessary, they’re prepared to launch up to 100,000 flats in total between 2021 to 2025, subject to monitored demand.

4. Some condos are nearing their ABSD deadline

2022 should be the very end of the last tranche of en-bloc redevelopments, dating back to 2017. There is a five-year cycle, as this is how long developers are given to complete and sell all remaining units.

For those that haven’t yet sold out, developers will be eager to move units as they creep closer to their ABSD deadline. This can sometimes (no promises!) result in lower-priced units, even for later buyers. We’ve highlighted 66 potential developments where the ABSD deadline is starting to loom.

Realtors said that, while developers are usually loathed to lower the price in later phases, it may become necessary due to the new cooling measures, and concerns over spiking home loan rates.

5. A reaction to recent cooling measures may set in, which helps on the buyer front

Historically, buyers have reacted to cooling measures with a wait-and-see attitude; no one wants to buy a property just weeks before home values start to plummet.

If this usual reaction takes place, it may represent a lucky break for home buyers, who have faced climbing private property prices for almost all of 2022. While prices will still rise, they may do so at a slower pace.

However, we should note there’s a difference from other cooling measures in 2023. Earlier periods of cooling measures didn’t coincide with a housing shortage; but as of late 2022, unsold residential properties were at their lowest number in around 15 years.

It’s possible that this limited supply could help to maintain prices. But speaking of which..

6. A move towards more of a buyer’s market

This was a difficult one to place, as a move toward a buyer’s market would also mean a slow end of it being a seller’s market. You definitely won’t see this immediately, as it will take time to moderate the high prices that sellers are currently asking for.

Besides the high-interest rate environment, there’s also the increase of BTO supply and a large supply of completed new launches that will come on the market in 2023. This is expected to go some way to help with the high rental market, but we may see a bit of an impasse in terms of initial volume as sellers may have unrealistic selling prices in this environment.

Most of the mega launches that you’ve seen in 2019/20 will be completed in 2023, and this will no doubt have positive bearings for buyers looking for a ready home to move into next year. Here are some of the biggest launches:

More from Stacked

How High Will Singapore Property Prices Get In 2025? Here’s What AI Predicts

Everything is being overtaken by AI, including - some have claimed - the jobs of analysts and realtors. But how…

| Project | Units | District |

| Treasure at Tampines | 2,203 | 18 |

| Parc Clematis | 1,468 | 5 |

| The Florence Residences | 1,410 | 19 |

| Avenue South Residence | 1,074 | 3 |

| Piermont Grand | 820 | 19 |

| Sengkang Grand Residences | 680 | 19 |

| Leedon Green | 638 | 10 |

| Ola | 548 | 19 |

| Parc Canberra | 496 | 27 |

Possible downsides of the 2023 property market

- Higher interest rates

- Higher GST

- Not as many new launches as most would prefer

- Even HDB upgraders may be priced out of new launches

- We may not have felt the full effects of the European war yet

- More ultra-rich foreign buyers coming in

1. Higher interest rates

2023 will be a defining moment, as Singapore’s property market isn’t used to such a high-interest environment. Since the Global Financial Crisis in 2008/9, we’ve been used to home loan rates of two per cent per annum or lower. Up till now, our home loan interest has been below the guaranteed CPF rate.

There’s a possibility that pricier home loans, coupled with higher stamp duties, might take the shine off the property as an investment. At the very least, the higher rates mean fewer people may qualify for home loans, without a much higher cash outlay.

High-interest rates are also a concern for developers. This affects them in two ways:

First, developers need to consider if they can sell the whole project within five years, even with buyers weighed down by higher interest and loan curbs.

Developers seem to be playing it cautiously, and that may explain why we’ve yet to see any “en-bloc fever” to replenish their depleted land banks.

The second factor involves financing for the developers themselves. Higher loan rates also mean it’s more expensive for developers to borrow, and property development is an industry that tends to involve a lot of upfront costs and leveraging. These sorts of costs may ultimately be transferred to buyers.

2. Higher GST

This isn’t strictly about the property market alone, just a reminder that you need to pay GST for property agent services. The GST is going up to eight per cent on 1st January 2023 and will rise by another one per cent in 2024.

Where this has more impact, however, is in the realm of commercial property. While the commercial property has been spared from ABSD, it’s still subject to GST. We doubt a one per cent increase will make any investor reconsider their decision, but it’s not something everyone will be too happy about.

3. Not as many new launches as most would prefer

Based on feedback from realtors, the number of new launches for 2023 is rather modest (especially compared to the previous few years), considering the diminishing inventory and high demand.

There are an estimated close to 40 new launches, with two new Executive Condominiums (ECs). However, unlike previous years, there’s only one 1,000+ unit mega-development; this is expected to be at a site in Dunman Road.

There are just three more large developments (700+ units) expected, being The Continuum, The Reserve Residences, and a site at Marina View. Overall, expectations are for around 11,000 new units.

This is far from recent years, when developers were confident enough to launch massive projects like Treasure at Tampines, Normanton Park, Parc Clematis, etc. It’s unfortunate, as now is the time we need such large projects.

4. Even HDB upgraders may be priced out of new launches

The pace of rising prices is expected to slow in 2023, if for no reason besides the September cooling measures and higher loan rates. But there’s almost no chance that new launches can see significant price drops, given the costs developers face.

Higher Land Betterment Charges, an ABSD increased to 40 per cent (five per cent non-remissible), and property agent commissions of five per cent are all driving up costs; and developer margins are too narrow to allow for many discounts.

Prices charged by contractors also rose significantly during Covid; and as with most such situations, the end of Covid hasn’t seen prices go back to normal. Rather, the market has adapted to the higher price point, further eating into developer margins.

As we concluded in 2022, a price of about $2,000 psf, even for suburban condos, appears to be the norm going forward. This is out of budget for many HDB upgraders, who will likely turn to the resale market in 2023.

From word on the ground, agents have mentioned that the upcoming Seneca Residence may be one of the last properties below $2,000 psf.

5. We may not have felt the full effects of the European war yet

It’s a little early to declare there’s no fallout from the Russia-Ukraine crisis, as winter is the crucial point for the EU. If fuel prices end up surging, developers – like many other businesses – will end up feeling the pinch.

This will cause logistical disruptions (e.g., the rising cost of trucks to deliver materials, higher prices of imported goods, and so forth), and developers are hard-pressed to plan for this in the coming year. This may be factored into the pricing of the next few launches, which in turn impacts buyers.

6. More ultra-rich foreign buyers coming in

To be fair, this could also be seen as a positive, depending on which side of the fence you sit on.

We’ve done a more comprehensive overview here on the rise of the centi-millionaire, but in short, the increase in the number of family offices, and the stability of the Singapore property market are some of the reasons why the ultra-rich have been flocking here.

Besides the instability from China, there has also been further attraction from Taiwan, and you can also see evidence of it from the ground from Sentosa Golf Clubs now costing a crazy high of $840,000, to private VIP clubs with a minimum fee of $50,000 coming up as well.

Overall, 2023 is one of the most uncertain years we’ve faced

It feels a little unfair that coming out of an unpredictable global pandemic, we’re now faced with massive geopolitical disruptions, and there is again a lack of certainty. But buyers and sellers should focus on what they do know:

The US has been hawkish with rate hikes, and these are expected to rise in 2023, as long as US inflation remains high. For the coming year, prudence may be the most viable strategy. Even if prices are rising, buyers shouldn’t feel rushed to buy just because “it could be more expensive next month,” or any other such sales pitch.

Buy or sell based on your financial situation, not on where you think the market is. And for more updates in the year ahead, follow us on Stacked. We’ll provide you with in-depth reviews of new and resale properties alike, so you can smart decisions in a volatile year.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the main reasons to be optimistic about Singapore's property market in 2023?

How might higher interest rates affect property buyers and developers in Singapore in 2023?

Why are there concerns about the number of new property launches in Singapore for 2023?

In what ways could the European war impact Singapore's property market in 2023?

What is the significance of the increasing number of ultra-rich foreign buyers in Singapore's property market?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Singapore Property News Why Housing Took A Back Seat In Budget 2026

Latest Posts

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

2 Comments

The Singapore property market in 2023 brings a mix of optimism and caution. Factors like economic recovery and increased demand for housing signal positivity. Look here https://www.matchoffice.sg/lease/offices/suntec-city and find interesting options for commercial property. However, concerns arise from potential interest rate hikes and global uncertainties. Prospective buyers and investors should navigate wisely, considering both opportunities and challenges in this dynamic real estate landscape.

Your article helped me a lot, is there any more related content? Thanks!